Are you looking to become a certified credit investigator? If so, it’s important to have a resume that stands out and showcases your experience, qualifications, and skills. Writing a resume for a credit investigator can be daunting, especially if you don’t have much experience in the field. Fortunately, this guide will provide you with a comprehensive overview of the resume writing process and provide you with examples of how to craft a successful credit investigator resume. Whether you’re a recent college graduate or an experienced professional, this guide will provide you with the tips and advice you need to make your resume stand out from the competition.

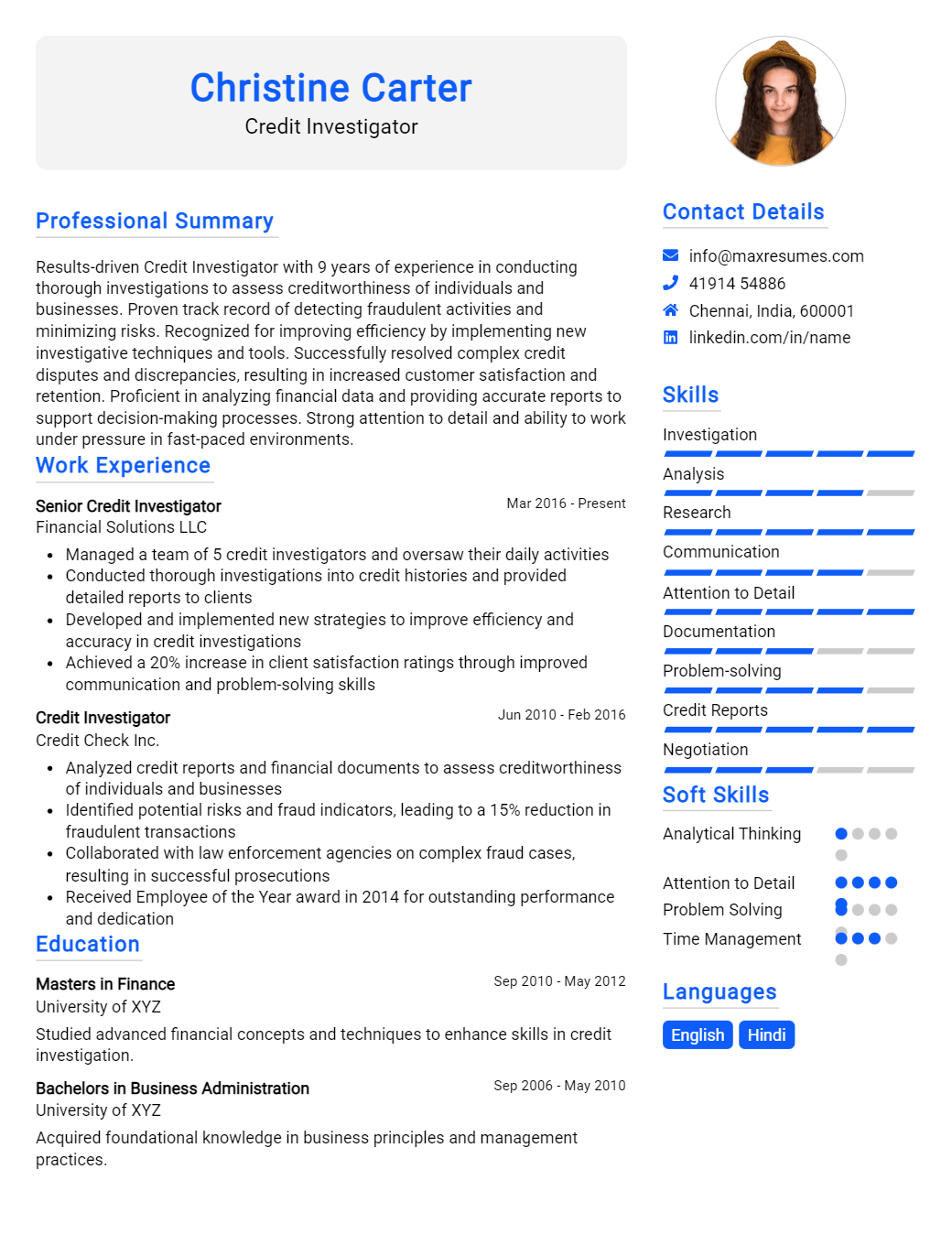

Credit Investigator Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Investigator Resume Examples

John Doe

Credit Investigator

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

An experienced and knowledgeable Credit Investigator with 10+ years of expertise in efficiently investigating credit applications, reviewing credit history and loan files and managing credit verification processes. Highly skilled in evaluating financial information, analyzing data and financial statements and providing accurate and timely credit reports. Adept in developing strong relationships with clients, customer service, and utilizing various tools, technologies and software to streamline processes.

Core Skills:

- Credit Investigation

- Loan Applications

- Credit History Analysis

- Financial Analysis

- Data Entry

- Credit Reports

- Risk Assessment

- Problem Solving

- Client Relationships

- Software Proficiency

Professional Experience:

Credit Investigator, ABC Credit Agency, 2016- Present

- Conduct background investigations and analyze credit histories to determine creditworthiness of customers

- Review loan applications, credit reports, financial documents and other creditworthiness related information

- Enter data accurately and timely into the system to ensure accuracy and completeness of credit files

- Assess credit risk and approve or decline loan applications based on creditworthiness

- Provide detailed and timely written credit reports to clients

- Research and analyze financial records and provide appropriate recommendations

- Develop and maintain strong relationships with clients and provide excellent customer service

Education:

Bachelor of Science in Finance, University of XYZ, 2014

Credit Investigator Resume with No Experience

- Recent college graduate with excellent communication and research skills looking for an entry- level position as a Credit Investigator.

Skills

- Strong communication skills

- Strong problem- solving abilities

- Knowledge of local, state, and federal laws and regulations

- Organizational and time management skills

- Ability to analyze financial documents

- Proficient in Microsoft Office Suite

Responsibilities

- Conduct in- depth interviews with clients to understand their financial situation

- Analyze financial documents and credit reports

- Gather financial information from various sources

- Review existing credit accounts and payment history

- Provide recommendations on creditworthiness of clients

- Manage and update case files

- Verify income statements and other financial documents

- Prepare and submit reports on findings to management.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Investigator Resume with 2 Years of Experience

A highly disciplined and dynamic professional with two years of experience as a Credit Investigator. Possesses an eye for detail and a flair for analyzing data, allowing for efficient assessment of creditworthiness and reliability of customers. Experienced in analyzing financial statements, loan applications, credit references, and other customer sources. Possesses excellent problem- solving skills, communication skills and the ability to work independently as well as in a team.

Core Skills

- Credit Analysis

- Financial Statement Analysis

- Loan Application Analysis

- Data Entry

- Regulatory Compliance

- Data Analysis

- Risk Assessment

- Customer Service

- Negotiation

Responsibilities

- Conduct investigations, gather and analyze data, and synthesize information to assess creditworthiness and reliability of customers

- Perform financial statement analysis, loan application analysis, credit reference analysis, and other customer sources

- Analyze risk factors and perform risk assessments on potential customers

- Monitor customer accounts to ensure that credit terms are met and payment is received in a timely fashion

- Ensure compliance with regulatory requirements for credit inquiries and loan applications

- Interact with customers to understand their financial needs and provide advice

- Negotiate credit terms and repayment plans with customers

- Maintain accurate records of customer data and account activities

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Investigator Resume with 5 Years of Experience

Highly experienced credit investigator with 5+ years of expertise in the financial services industry. Experience includes conducting financial and background checks, performing comprehensive reviews of consumer credit portfolios, and working closely with departments, legal counsel, and other stakeholders for successful credit portfolio management. Possess excellent analytical and problem- solving skills with the ability to exercise sound judgment and make difficult decisions.

Core Skills:

- Financial Analysis

- Risk Management

- Credit Portfolio Management

- Regulatory Review & Compliance

- Documentation & Reporting

- Data Analysis & Interpretation

- Negotiation & Problem Solving

Responsibilities:

- Conducted financial and background checks of credit applicants

- Performed comprehensive reviews of consumer credit portfolios

- Analyzed credit reports to identify risk and ensure compliance with regulations

- Developed and monitored credit policies, procedures, and requirements

- Developed and maintained good relationships with customers and internal departments

- Resolved any discrepancies or issues related to credit portfolio management

- Developed procedures for credit portfolio management and reported to management

- Coordinated with legal counsel to obtain records and resolve any legal issues

- Ensured compliance with state, federal, and other applicable laws and regulations

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Investigator Resume with 7 Years of Experience

Highly- motivated Credit Investigator with 7 years of experience in conducting detailed investigations and research into the backgrounds of existing and prospective customers. Adept at analysis of credit reports, financial statements and other documents, developing investigations plans and strategies, and implementing loss prevention programs. Proven excellent communication and interpersonal skills, as well as strong problem solving and decision- making abilities.

Core Skills:

- Credit Analysis

- Financial Statements Analysis

- Loan Negotiations

- Report Writing

- Investigation Strategies

- Loss Prevention

- Client Relationship Management

Responsibilities:

- Conducted detailed investigations and research into the backgrounds of existing and prospective customers.

- Analyzed credit reports, financial statements, and other documents.

- Developed investigations plans and strategies.

- Negotiated loan terms.

- Wrote reports on credit investigation findings.

- Implemented loss prevention programs.

- Managed client relationships.

- Assisted in the collection of overdue accounts.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Investigator Resume with 10 Years of Experience

I am a professional Credit Investigator with 10 years of experience in conducting detailed investigations into the financial backgrounds and credit histories of individuals and businesses. I have extensive knowledge of the legal regulations, policies, and procedures related to investigating credit. I am highly detail- oriented with excellent organizational and communication skills. I am highly motivated and have the necessary skills to understand, investigate and resolve complex financial issues.

Core Skills:

- Extensive knowledge of financial regulations and policies

- Strong interpersonal and negotiation skills

- Ability to remain organized and maintain a high level of accuracy

- Proficient in gathering and analyzing data

- Experienced in using various investigation tools

- Excellent written and verbal communication

- Ability to work collaboratively with teams

Responsibilities:

- Interviewing clients to obtain financial information

- Examining financial records and documents

- Conducting detailed investigations into a customer’s credit history

- Analyzing data to identify patterns and inconsistencies

- Verifying the accuracy of submitted financial documents

- Providing recommendations on credit decisions

- Ensuring compliance with legal and regulatory requirements

- Developing and maintaining positive relationships with clients and partners

- Providing reports and updates to management on progress

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Investigator Resume with 15 Years of Experience

With more than 15 years of experience as a Credit Investigator, I have a deep understanding of credit and banking procedures and regulations. I have a proven ability to analyze financial data, make sound decisions, and ensure compliance. I am a highly organized, proactive, and detail- oriented individual who excels at researching, investigating, and resolving complex financial matters. I am passionate about contributing to the success of an organization by ensuring compliance with laws and regulations and protecting its assets.

Core Skills:

- Financial analysis and decision- making

- Credit and banking procedures

- Risk assessment

- Research and investigation

- Problem solving

- Compliance management

- Laws and regulations

- Professional communication

- Organizational skills

Responsibilities:

- Conduct credit investigations and reviews

- Collect and analyze financial data

- Make sound decisions based on research

- Ensure compliance with applicable laws and regulations

- Provide detailed reports and recommendations

- Maintain accurate records and documentation

- Carry out due diligence and background checks

- Identify and assess risk factors

- Resolve financial disputes

- Provide expert advice and guidance on credit issues and related matters

- Investigate suspicious activities and report non- compliance

- Develop and implement strategies to manage risk and protect assets

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Investigator resume?

A Credit Investigator resume should include all pertinent information that highlights the experience and qualifications necessary to be successful in the role. While the specific format and content of a resume can vary depending on individual job requirements, the following components should be included:

- Contact Information: Provide your full name, address, phone number, and email address.

- Summary: A brief summary of your qualifications and experience.

- Education: Any relevant degrees or certifications that are applicable to credit investigation.

- Experience: Provide a list of the past positions you’ve held and any achievement from those positions.

- Special Skills: Include any relevant skills such as knowledge of legal and financial regulations, analytical abilities, and experience with researching and preparing reports.

- Certifications: If applicable, include certifications related to credit investigation such as Certified Credit Analyst (CCA).

- Awards & Accomplishments: Include any awards or achievements that are related to credit investigation.

By including all of these components, a Credit Investigator resume should be comprehensive enough to demonstrate a jobseeker’s qualifications and experience. The resume should be tailored to the specific role and highlight the skills and qualifications that make you the best candidate for the job.

What is a good summary for a Credit Investigator resume?

A Credit Investigator resume should concisely summarize a candidate’s education, experience, and qualifications in the field of credit investigations. It should highlight any specializations or certifications that the candidate may have, as well as any experience that is particularly relevant to the position. Additionally, a Credit Investigator resume should demonstrate the candidate’s familiarity with relevant laws, regulations, and procedures. The summary should also emphasize the candidate’s communication skills and ability to work independently or as part of a team. Ultimately, the summary should be tailored to the specific role the candidate is applying for and should demonstrate the individual’s commitment to the field of credit investigations.

What is a good objective for a Credit Investigator resume?

A Credit Investigator resume should emphasize a candidate’s ability to analyze creditworthiness, assess risk, and uncover fraudulent activities. An effective objective for a Credit Investigator resume should demonstrate a proven ability to conduct investigations and research into the credit records of individuals and businesses.

Here are some examples of objectives for a Credit Investigator resume:

- To obtain the position of Credit Investigator where I can use my investigative skills and knowledge of credit regulations to protect financial institutions from risk

- Seeking a Credit Investigator position to use my experience in financial analysis, background investigations, and data analysis to identify and prevent fraud

- Dedicated and experienced Credit Investigator looking for a position to work with financial institutions to research, monitor, and assess credit risk

- Looking to leverage my experience and knowledge of credit regulations to obtain a Credit Investigator position.

A successful Credit Investigator should be detail-oriented and able to provide accurate financial and credit analysis. These important qualities should be highlighted in a Credit Investigator resume objective.

How do you list Credit Investigator skills on a resume?

When you are applying for a Credit Investigator role, it is important to highlight your relevant skills in your resume. To help you showcase your qualifications and make your resume stand out, here is how you can list your Credit Investigator skills:

- Knowledge of credit scoring and credit rating systems: Demonstrate your understanding of the concept of credit scoring, including what goes into the credit score calculation and how credit ratings are determined.

- Ability to assess financial data: Highlight your experience in gathering, analyzing, and interpreting financial information and documents related to credit requests.

- Investigative skills: Showcase your ability to verify information and investigate various records, such as credit histories, financial statements, and employment records.

- Strong communication skills: Demonstrate your ability to effectively communicate with customers, colleagues, and other stakeholders to explain credit decisions and resolve disputes.

- Attention to detail: Show that you are capable of carefully reviewing credit applications to identify inconsistencies and evaluating the creditworthiness of applicants.

- Decision-making skills: Demonstrate your capacity to make timely and informed decisions when evaluating credit applications.

By listing these Credit Investigator skills on your resume, you will be able to show potential employers that you are qualified and have the necessary skills to become a successful Credit Investigator.

What skills should I put on my resume for Credit Investigator?

Writing a resume for a Credit Investigator position can be challenging without the right set of skills. Employers will be looking for the right skills to ensure their organization is getting the best candidate for the job. To help you secure the position, here are some of the top skills you should include on your resume:

- Analytical Thinking: Credit Investigators need to be able to synthesize large amounts of data and draw up accurate conclusions. Showcase your strong analytical thinking skills by discussing how you’ve used data to identify trends in past projects.

- Communication: Credit Investigators need to be able to effectively communicate with customers and stakeholders during the investigation process. Include examples of strong written and verbal communication skills on your resume.

- Negotiation: This role requires excellent negotiation skills to ensure the best outcome for your organization. Prove you’re an ace negotiator by providing examples of successful negotiations.

- Research: Credit Investigators must be able to conduct thorough research in order to make informed decisions. Demonstrate your research skills by describing the methods you used to develop a project or complete an investigation.

- Problem-solving: Credit Investigators must be able to think quickly and effectively solve problems. Show off your problem-solving abilities by describing how you’ve solved difficult challenges in the past.

- Regulatory Compliance: Credit Investigators must be able to remain compliant with the relevant regulations and laws. Highlight your knowledge of the relevant regulations and discuss any courses you’ve taken to stay up-to-date.

These are just some of the skills you should include on your resume when applying for a Credit Investigator position. Make sure to tailor your resume to the specific job to showcase your qualifications and abilities.

Key takeaways for an Credit Investigator resume

A credit investigator resume is a vital piece of paperwork that can help you land the job of your dreams. As such, it’s important to make sure your resume is up to date and in top shape. To help, here are some key takeaways to consider when crafting your credit investigator resume.

- Focus on Experience: When creating a credit investigator resume, it’s important to focus on relevant experience. This means you should include any jobs or internships that you have completed in the past, and make sure to highlight any successes and accomplishments that you achieved during those positions. Additionally, be sure to mention any specialized training or certifications that you have received in the credit investigation field.

- Include Relevant Skills: While credit investigation is a highly technical field, there are a number of soft skills that are also important to mention. These skills include communication, problem-solving, and an eye for detail. Be sure to include any related skills and experiences that you have to show employers that you are a well-rounded candidate.

- Make it Visually Appealing: A great resume should not only be filled with relevant information, but also be visually pleasing. Be sure to use a clean and organized layout, use professional fonts, and choose appropriate font sizes and colors. Additionally, consider including a headline or summary at the top of your resume that quickly and succinctly states your qualifications.

By keeping these key takeaways in mind, you can create a credit investigator resume that is sure to get the attention of employers. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder