Writing a resume can be a challenging task, especially if you are applying for a job as a credit counselor. After all, you are likely competing with many other applicants who also have impressive backgrounds and qualifications. However, with the right guidance and resources, you can create an outstanding credit counselor resume that will help you stand out from the competition. In this blog post, we will provide you with a comprehensive guide on how to write a great credit counselor resume. We will cover topics such as the importance of tailoring your resume to the job, how to highlight your relevant experience, and provide resume writing examples of successful credit counselors.

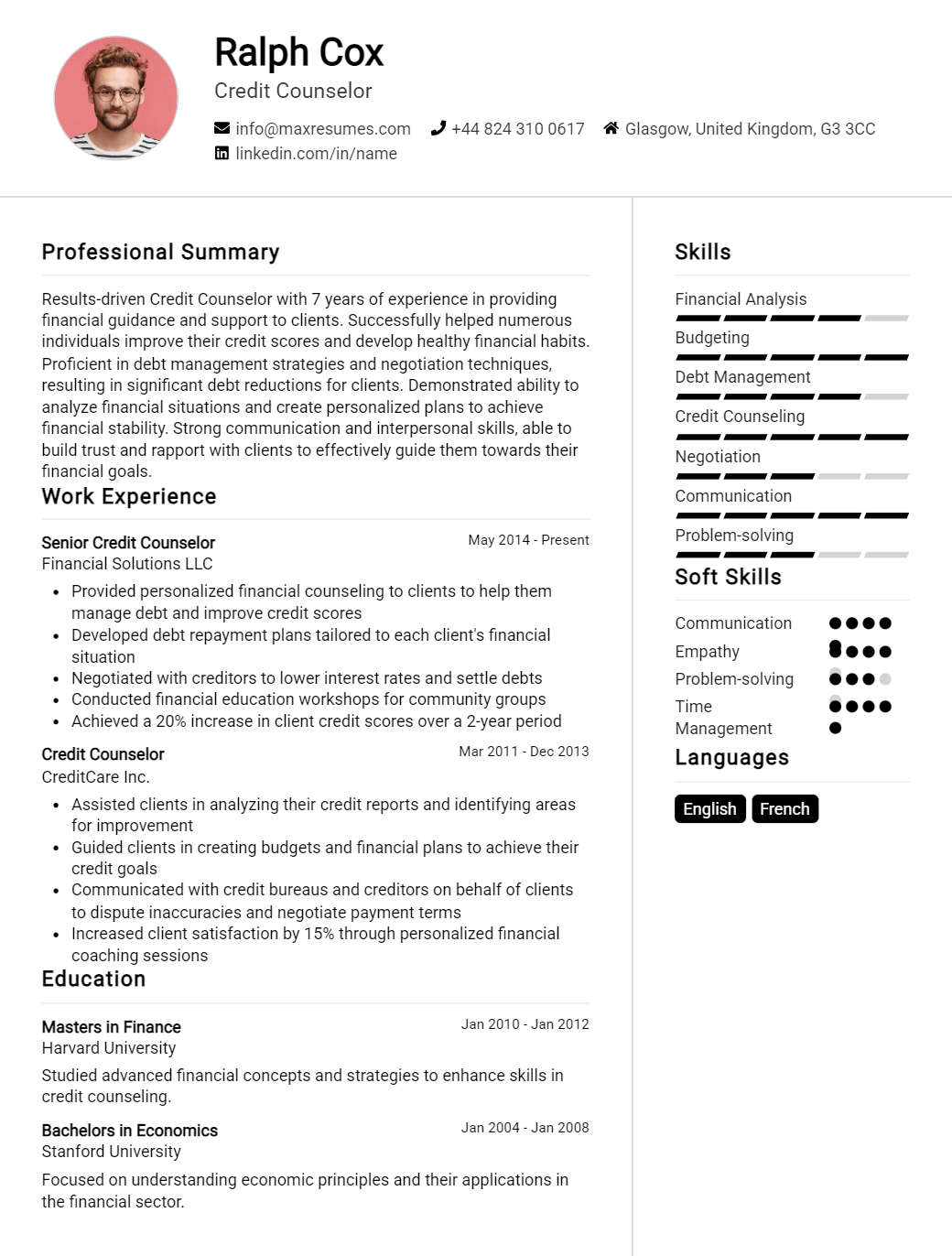

Credit Counselor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Counselor Resume Examples

John Doe

Credit Counselor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly experienced and detail- oriented Credit Counselor with over 10 years of experience in financial service industry. Skilled in working with clients to identify and address personal financial issues, such as budgeting, debt management, and credit repair. Excellent communication and interpersonal skills, which allows for a strong rapport with clients. Experienced in providing assistance in developing and implementing debt management plans, negotiating with creditors, and providing financial education.

Core Skills:

- Financial Services

- Debt Management

- Credit Repair

- Credit Counseling

- Budgeting

- Negotiation

- Interpersonal Communication

- Analytical Thinking

- Problem- Solving

Professional Experience:

Credit Counselor

- Provided credit counseling services to clients with financial problems

- Evaluated financial status and developed financial plans to help clients regain control of their finances

- Negotiated with creditors to reduce debt and payment amounts

- Educated clients on budgeting and other financial matters

- Analyzed client budget statistics to identify areas for improvement

- Assisted clients in setting up repayment plans and maintaining financial records

Credit Services Manager

- Managed the credit counseling services department

- Developed and implemented programs to help clients manage their finances

- Ensured compliance with industry standards and regulations

- Monitored progress of clients to assess effectiveness of counseling

- Provided guidance and support to staff members

- Trained new employees on credit counseling procedures

Education:

Bachelor of Business Administration

University of Texas at Austin, TX

May 2005

Credit Counselor Resume with No Experience

Detail- oriented individual with a passion for helping others in financial matters. Seeking a position as a Credit Counselor to use my communication and organizational skills to help individuals make sound financial decisions.

Skills

- Exceptional interpersonal and communication skills.

- Strong organizational and problem- solving abilities.

- Knowledgeable in financial concepts.

- Computer proficient in MS Office, accounting and database software.

Responsibilities

- Provide comprehensive guidance to individuals on how to manage debt and credit.

- Assess clients’ financial situations, develop and implement debt repayment plans.

- Assist individuals in finding ways to save money, create and adhere to budgets.

- Identify resources available to clients such as government programs, debt consolidation and other financial vehicles.

- Liaise with creditors to obtain account information, negotiate payment terms, and resolve disputes.

- Monitor client’s progress and modify payment plans as necessary.

- Maintain accurate records of all counseling sessions and client information.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Counselor Resume with 2 Years of Experience

Highly motivated and experienced Credit Counselor with two years of hands- on experience in developing and delivering comprehensive financial education and counseling to individuals, households, and small businesses. Highly skilled in providing clients with counseling services to help them take control of their financial lives by creating customized action plans to help them improve their financial well- being and reach their goals. Proven track record of success in successfully maintaining relationships with clients and providing them with sound financial advice.

Core Skills:

- Proven ability to develop and deliver comprehensive financial education and counseling

- Excellent interpersonal, communication, and problem solving skills

- Highly skilled in working with clients to create customized action plans

- Proficient in maintaining relationships with clients

- Strong knowledge of financial principles, budgeting, and financial counseling

- Ability to provide sound financial advice to clients

Responsibilities:

- Conduct initial assessment of client’s financial situation and develop a customized action plan

- Establish and maintain relationships with clients to ensure successful financial counseling

- Provide education and counseling on budgeting, debt management, and credit report review

- Assist clients in developing and utilizing financial tools to achieve their goals

- Partner with other organizations to provide additional support to clients

- Monitor client progress and provide ongoing counseling and support

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Counselor Resume with 5 Years of Experience

A highly motivated and organized professional with 5 years of experience as a Credit Counselor. Experienced in assisting clients with financial planning, budget management, debt consolidation, and credit counseling. Possesses excellent communication, problem- solving, and negotiation skills. Committed to providing quality support and assistance to clients, ensuring the best outcome.

Core Skills:

- Financial Planning

- Budget Management

- Debt Consolidation

- Credit Counseling

- Communication

- Problem- Solving

- Negotiation

- Client Support

Responsibilities:

- Assisted clients with financial planning, budget management, debt consolidation, and credit counseling

- Provided clients with quality support and assistance

- Developed customized solutions to fit the individual needs of clients

- Researched and recommended financial services and products to meet clients’ needs

- Monitored clients’ financial progress and advised them on any necessary changes

- Developed and maintained professional relationships with clients

- Managed and updated documentation and records

- Communicated with clients and creditors to negotiate repayment arrangements

- Assisted clients with the preparation of financial statements

- Educated clients on financial matters and important financial decisions

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Counselor Resume with 7 Years of Experience

A seasoned and results- oriented Credit Counselor with 7 years of experience in financial management, budgeting, and credit counseling. Proven expertise in crisis intervention, collaboration with courts and bankruptcy trustees, and dispute resolution. Adept at managing multiple tasks and working in a fast- paced environment while meeting all deadlines. Excellent communication and problem- solving skills, with exemplary customer service and a strong commitment to treating clients with integrity, respect, and professionalism.

Core Skills:

- Financial Management

- Budgeting

- Crisis Intervention

- Dispute Resolution

- Customer Service

- Communication

- Problem Solving

- Time Management

- Teamwork

Responsibilities:

- Provided clients with resources and advice on debt management and budgeting strategies

- Implemented credit counseling services to ensure clients’ financial stability

- Negotiated with creditors and banks to restructure payments according to clients’ financial capacities

- Educated clients on bankruptcy, credit repair, and other financial services

- Assisted clients with creating and managing personal budgets to help them make sound financial decisions

- Monitored client’s progress and provided guidance on how to improve credit scores

- Assisted clients in making payments, filing documents, and reaching debt payment agreements

- Collaborated with court systems and bankruptcy trustees to ensure process compliance

- Investigated and resolved disputes between creditors and clients

- Developed and implemented programs to help clients with debt reduction and financial literacy.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Counselor Resume with 10 Years of Experience

A highly experienced Credit Counselor, with 10 years in the field of consumer affairs. Possessing a strong background in consumer credit and financial planning, I am a confident and organized individual, with excellent problem- solving and communication skills. I am passionate about helping individuals and families manage their finances, and I strive to provide clear, concise and individualized advice. My focus is on helping clients gain financial control and build a brighter financial future.

Core Skills:

- Client Counselling

- Debt Management

- Financial Planning

- Credit Score Analysis

- Credit Report Analysis

- Credit Score Improvement

- Budget and Debt Management

- Excellent Communication

- Problem Solving

- Strong Analytical Skills

Responsibilities:

- Provide individualized financial and credit counselling to clients

- Conduct comprehensive financial and credit analysis to assess client needs and develop strategies

- Educate clients on the importance of budgeting and debt management

- Develop and implement strategies to improve credit scores and manage debt

- Advise clients on financial products and services

- Assist clients in the filing and management of bankruptcy proceedings

- Prepare and review financial statements

- Negotiate payment plans and settlements with creditors

- Monitor credit developments and advise clients on new regulations

- Ensure compliance with credit and consumer law.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Counselor Resume with 15 Years of Experience

Highly experienced Credit Counselor with 15 years of comprehensive experience in financial management, credit advice, and debt counseling. Proven track record of providing personalized and timely counseling to individuals and businesses on credit- related matters. Possesses strong knowledge of local, state, and federal laws and regulations related to credit, debt management, and consumer credit protection. Skilled in assessing a client’s financial situation, formulating a plan of action, and providing guidance to improve the client’s credit score.

Core Skills:

- Financial Analysis

- Credit & Debt Management

- Loan Origination & Processes

- Debt Negotiations

- Budget Management

- Credit Risk Analysis

- Client Relations

- Regulatory Compliance

Responsibilities:

- Counsel clients on their credit and debt matters, evaluating their current credit situation and formulating a plan to improve their credit score and reduce debt.

- Advise clients of their rights and responsibilities under the Fair Credit Reporting Act and Consumer Credit Protection Act.

- Develop and maintain close relationships with clients to ensure timely communication and follow up on credit and debt management.

- Conduct financial analysis to determine the best course of action for a client’s financial situation.

- Negotiate with creditors to reduce or eliminate interest and late fees.

- Analyze credit reports, credit score, and credit risk profiles.

- Advise clients on budget management and other financial strategies to improve their financial health.

- Ensure compliance with all local, state, and federal laws and regulations.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Counselor resume?

When writing a resume for a credit counselor position, the goal is to highlight the skills and experiences that make you an ideal candidate for the role. Your resume should emphasize your understanding of debt management, credit repair, and financial literacy. It should also showcase your ability to provide compassionate guidance to others.

Here are some key elements to consider when crafting a credit counselor resume:

- Education: Include any relevant education as it relates to credit counseling, such as a degree in finance, economics, or accounting. Be sure to list any certification programs you have completed in debt management or credit counseling.

- Professional Experience: Include any previous credit counseling jobs. Detail your specific roles and responsibilities, such as managing client finances, providing budget and debt management advice, or helping clients establish payment plans. Demonstrate any successes or positive outcomes associated with your past positions.

- Technical Skills: Showcase any technical skills you have acquired through training or experience, such as proficiency in QuickBooks or Microsoft Excel.

- Problem-Solving Skills: Being a credit counselor requires excellent problem-solving skills. Detail any experiences that showcase your ability to assess situations and develop effective solutions.

- Communication Skills: Stress your ability to communicate effectively and compassionately with clients. Consider highlighting any experience you have working with clients from diverse backgrounds or with particular needs.

- Interpersonal Skills: Being a credit counselor requires the ability to build trust and motivate clients to take action. Detail any experiences that demonstrate your ability to work with people and handle emotionally charged situations.

By emphasizing the relevant skills and experiences listed above, you can create a powerful resume that will help you stand out from other applicants and land the credit counseling job you desire.

What is a good summary for a Credit Counselor resume?

A credit counselor resume should provide a brief, yet clear summary of the candidate’s qualifications and experience. This summary should highlight the individual’s skills in financial management and credit counseling, as well as any relevant education or certifications. It should also describe the individual’s work history and list any unique accomplishments that demonstrate their ability to help individuals with their financial affairs. Finally, it should include any special training or seminars in which the candidate has participated, as well as any awards or honors that may have been earned in this field. By creating a clear and concise summary, a credit counselor’s resume can help applicants stand out from the competition and be more likely to receive an interview.

What is a good objective for a Credit Counselor resume?

In the ever-changing world of finance and credit, having a strong resume is essential for success as a Credit Counselor. A good objective on a Credit Counselor resume should demonstrate the applicant’s knowledge of financial management, ability to provide quality customer service, and passion for helping people achieve financial stability. Here are some objectives to consider when writing a Credit Counselor resume:

- Provide quality customer service to individuals seeking credit counseling and debt management

- Utilize in-depth knowledge of financial management to develop creative strategies for clients

- Facilitate individual financial development through effective debt repayment strategies

- Educate clients on the importance of personal financial responsibility

- Help clients develop a comprehensive financial plan to achieve long-term goals

- Develop strong relationships with clients to ensure their satisfaction

- Utilize problem-solving skills to resolve complex financial challenges

- Assist clients in understanding the importance of credit and its role in their financial future

- Maintain professional standards of ethics and integrity in all interactions with clients

How do you list Credit Counselor skills on a resume?

When writing a resume, it is important to make sure you accurately list all the skills you have related to any job you have applied for. If you have experience as a Credit Counselor, you will want to make sure you list all the skills you have in this area to give potential employers a clear understanding of the qualifications you possess. Here are some skills you may want to include when listing your Credit Counselor experience on a resume:

- Creating Financial Plans: Credit Counselors help individuals and families develop and maintain financial plans that can reduce debt and improve credit scores.

- Negotiation: Credit Counselors must communicate with creditors on behalf of their clients and use negotiation skills to obtain reduced payments, interest rates, and fees.

- Conflict Resolution: Credit Counselors work to help their clients resolve conflicts with creditors, providing support and solutions to help them move forward.

- Collection Strategies: Credit Counselors must stay up-to-date on the latest collection strategies to help their clients avoid legal action from creditors.

- Advising: Credit Counselors must be able to advise their clients on how to make responsible financial decisions, such as budgeting, saving, and avoiding unnecessary debt.

- Communication: Good communication skills are essential for Credit Counselors to effectively convey the financial options available to their clients.

- Computer Skills: Credit Counselors must be proficient with computers to access, analyze, and update financial information for their clients.

By including these skills on your resume, you will demonstrate to employers that you have the qualifications necessary to provide effective Credit Counseling services.

What skills should I put on my resume for Credit Counselor?

As a Credit Counselor, your resume should demonstrate problem-solving, communication, and customer service skills. Here are a few skills to consider that will help you stand out from the crowd:

- Knowledge of Credit Resources: A successful Credit Counselor has a comprehensive understanding of credit products and services, such as credit bureaus, creditors, debt collectors, and other financial institutions.

- Budgeting and Financial Planning: You should have the ability to analyze a customer’s budget and help them understand how to manage their finances so they can meet their financial goals.

- Conflict Resolution: As a Credit Counselor, you’ll need to be able to listen to customers, understand their needs and concerns, and help them come up with a solution that works for them.

- Interpersonal and Communication Skills: Credit Counselors must be able to communicate effectively with customers and other professionals in order to provide them with the best advice possible.

- Strong Organizational Skills: Credit Counselors must be able to prioritize tasks and work efficiently in order to meet their customers’ needs.

- Problem-Solving: You must be able to analyze a customer’s financial situation and come up with creative solutions to help them achieve their goals.

By highlighting these skills on your resume, you’ll show potential employers that you have the qualifications to excel in the Credit Counselor profession.

Key takeaways for an Credit Counselor resume

In many ways, a Credit Counselor resume must accomplish two key tasks: it must show that the job seeker is qualified to work in the field and that they can handle the difficult tasks associated with this position. To ensure your resume stands out and successfully highlights your qualifications, there are some key takeaways you should keep in mind.

First, it is essential that you include a summary of any relevant education and/or certifications you have obtained. Credit Counselors must be knowledgeable about a variety of financial topics, so any certifications or other forms of education may set your resume apart from other applicants.

Next, you should emphasize any experiences you have had in the field of credit counseling. This could include any volunteer positions, internships, or even full-time jobs. If you have any special knowledge or skills related to credit counseling, highlight these as well.

Finally, it is important to provide evidence of any successes you have had in this field. For example, if you have worked as a Credit Counselor before, include any statistics or figures that demonstrate how successful you were in your role. Showcasing your successes will help employers to see your potential and value as a Credit Counselor.

By following these key takeaways, you can create an effective Credit Counselor resume that will help you stand out from the competition. Remember to include information about your education, experiences, and successes in the field, and you will be sure to make a strong impression on employers.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder