Are you looking for tips on how to write a professional, standout credit coordinator resume? You’ve come to the right place! This blog post provides a step-by-step guide to writing a credit coordinator resume, including tips on what to include, what to omit, and examples of strong resumes for inspiration. Writing a resume can be a daunting task, but following these steps and best practices can help you create a polished and effective document that will get you noticed by employers.

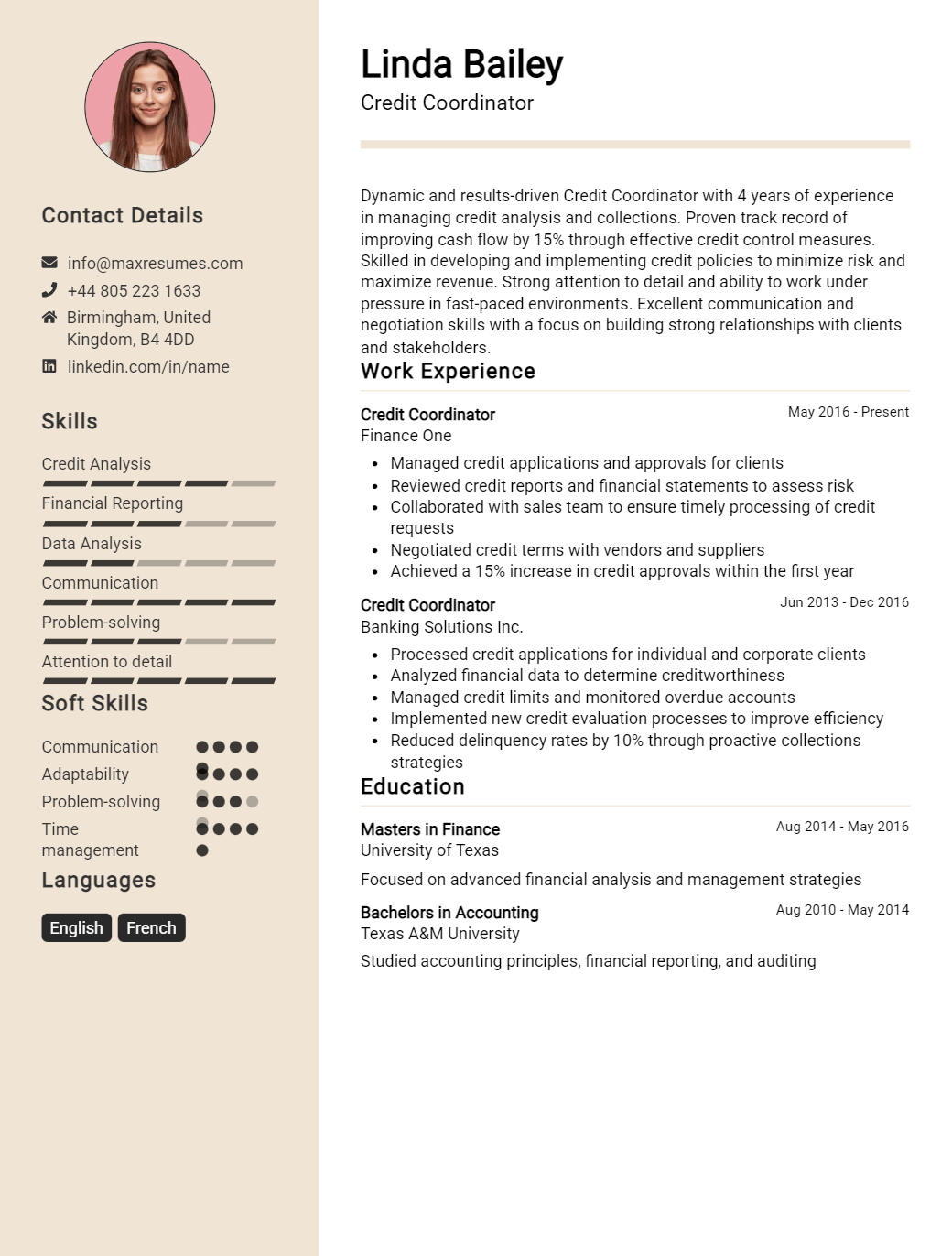

Credit Coordinator Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Coordinator Resume Examples

John Doe

Credit Coordinator

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Credit Coordinator with over eight years of experience in the banking and finance industry. My core skills include risk assessment and analysis, credit processing, loan and portfolio management, and financial analysis. I am also highly knowledgeable in banking laws, regulations, and procedures. My professional experience includes working in various banking and finance organizations, helping to process credit applications, assess risk, and manage loan and portfolio portfolios. My educational background includes a Bachelor’s degree in Business Administration and Accounting and I am currently working towards obtaining a Master’s of Business Administration.

Core Skills:

- Risk Assessment and Analysis

- Credit Processing

- Loan and Portfolio Management

- Financial Analysis

- Banking Laws and Regulations

- Banking Procedures

- Excel and Database Management

Professional Experience:

- Credit Coordinator, Bank of America, Chicago, IL (2015 – Present)

- Processed and approved credit applications based on credit risk analysis

- Managed loan and portfolio portfolios

- Ensured compliance with banking laws and regulations

- Assisted customers in understanding their credit options

- Credit Officer, Chase Bank, Los Angeles, CA (2012 – 2015)

- Analyzed credit risk of loan and portfolio portfolios

- Processed credit applications

- Supervised credit processing team

- Collaborated with legal department to ensure compliance with banking laws and regulations

Education:

- Bachelor of Business Administration and Accounting, University of California, Los Angeles, CA

- Master of Business Administration (in progress), University of California, Los Angeles, CA

Credit Coordinator Resume with No Experience

Hardworking and detail- oriented individual with a desire to enter the credit coordinator field. Passionate about utilizing strong organizational and multitasking abilities to ensure credit- related objectives are met.

Skills

- Strong time management and multitasking abilities

- Excellent organizational and communication skills

- Knowledge of credit policies and procedures

- Proficient in Microsoft Office Suite

- Ability to work independently and in a team

- Detail- oriented and analytical

Responsibilities

- Process customer applications for credit

- Monitor credit limits and provide support to customers

- Analyze credit reports and financial statements to make credit decisions

- Maintain customer accounts and update credit information

- Negotiate payment arrangements with customers

- Track and monitor customers’ payment trends and activity

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Coordinator Resume with 2 Years of Experience

Highly organized and detail- oriented Credit Coordinator with two years of experience managing credit accounts, maintaining client relations, and resolving customer complaints. Adept in overseeing and tracking accounts receivable, implementing credit policies and procedures, and maintaining accurate records. An effective communicator with excellent problem- solving skills and the ability to prioritize tasks and meet deadlines.

Core Skills:

- Account Management

- Credit Policies & Procedures

- Customer Service

- Client Relations

- Record Keeping

- Conflict Resolution

- Problem Solving

- Time Management

- Communication

Responsibilities:

- Managed credit accounts for clients, ensuring timely payments and resolving any discrepancies

- Implemented credit policies and procedures for all accounts

- Oversaw accounts receivable and maintained accurate financial records

- Monitored and tracked customer credit payments and balances

- Developed positive relationships with clients by providing exceptional customer service

- Resolved customer complaints in a timely and professional manner

- Analyzed current credit policies and recommended improvements when needed

- Ensured compliance with all regulatory standards and regulations

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Coordinator Resume with 5 Years of Experience

I am an experienced Credit Coordinator with 5 years of professional experience in credit analysis and loan processing. I am highly knowledgeable of banking regulations, policies and procedures when it comes to lending. I have strong organizational, problem- solving, and communication skills to ensure the accuracy and timely completion of the loan processing cycle. I have a proven ability to work well within a team, and individually, to ensure that all customer needs are met.

Core Skills:

- Credit Analysis

- Loan Processing

- Banking Regulations and Procedures

- Problem Solving

- Communication

- Teamwork

- Time Management

- Accuracy

- Attention to Detail

Responsibilities:

- Analyzing credit risk and approving or denying loan requests

- Processing loan applications and documents

- Ensuring accuracy and compliance with banking regulations

- Interacting with customers to ensure loan needs are met

- Managing the loan processing cycle from start to finish

- Maintaining customer records and loan data

- Resolving discrepancies and problems

- Working with the loan management team to ensure customer satisfaction

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Coordinator Resume with 7 Years of Experience

Highly organized and detail- oriented Credit Coordinator with 7 years of experience in credit, collections, and risk analysis. Proven track record of establishing and maintaining successful customer relationships while carrying out accurate and timely assessments. Possess excellent interpersonal, communication, and problem- solving skills. Strong leadership skills with the ability to effectively delegate tasks and prioritize workload.

Core Skills:

- Credit & Collections

- Risk Analysis

- Account Management

- Customer Relationships

- Interpersonal & Communication Skills

- Leadership & Delegation

- Organization & Time Management

Responsibilities:

- Analyzing and monitoring customer credit worthiness and risk of default

- Preparing credit reviews and authorizing credit limits exceeding $100,000

- Processing customer payments, invoicing and adjustments

- Developing strong relationships with customers and responding to inquiries in a timely manner

- Maintaining accurate and up- to- date records of customer payment history

- Generating monthly reports for management and tracking customer credit status

- Identifying and recommending process improvements to streamline workflow and maximize efficiency

- Assisting with inventory and supply chain management

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Coordinator Resume with 10 Years of Experience

Highly motivated Credit Coordinator with over 10 years of experience coordinating customer accounts and loan processing. Proven ability to effectively manage customer accounts and ensure customer satisfaction. Excellent knowledge of federal and state laws, regulations, and policies governing loan processing. Adept at working with both large and small organizations to build trust- based customer relationships.

Core Skills:

- Customer Relations

- Compliance

- Loan Processing

- Account Management

- Data Analysis

- Report Writing

- Problem- solving

- Communication

- Negotiation

Responsibilities:

- Responsible for processing loan applications received from customers.

- Evaluate credit worthiness and determine terms and conditions of loan.

- Gather and analyze customer financial data and credit history.

- Develop credit scoring systems for loan underwriting.

- Contact customers to verify credit information.

- Review loan documents for accuracy and completeness.

- Ensure compliance with federal and state laws, regulations, and policies.

- Work directly with customers to build trust- based relationships.

- Maintain accurate and up- to- date records of customer accounts.

- Monitor customer accounts and payment histories.

- Generate loan and repayment reports.

- Resolve customer service issues in a timely and professional manner.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Coordinator Resume with 15 Years of Experience

Highly experienced Credit Coordinator with 15 years in the field and a wealth of knowledge in corporate accounting, customer service, and financial reporting. Possess excellent problem solving and analytical skills, as well as strong interpersonal, communication, and organizational abilities. Skilled at reconciling accounts, ensuring accuracy of ledger entries, and providing financial analysis in order to maintain efficient and effective financial operations.

Core Skills:

- Account Reconciliation

- Financial Analysis

- Reporting

- Customer Service

- Accounting

- Interpersonal Communication

- Organizational Abilities

- Ledger Entries

Responsibilities:

- Reconciled accounts using auditing and balancing to ensure accuracy of ledger entries

- Provided financial analysis to senior managers in order to ensure efficient and effective financial operations

- Prepared monthly reports for management to review and verify accuracy

- Assisted in the preparation of annual budget and forecasts

- Conducted credit checks and reviews for customers in order to mitigate financial risk

- Provided excellent customer service, responding in a timely and professional manner

- Prepared and entered ledger entries to ensure acc

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Coordinator resume?

When applying for a Credit Coordinator role, your resume should clearly demonstrate your strong financial skills as well as your ability to provide administrative support for a credit team.

Here are some of the qualifications employers look for when hiring a Credit Coordinator:

- Extensive knowledge of accounting principles, financial analysis, credit risk management and credit underwriting.

- Superior communication and negotiation skills.

- Ability to manage multiple projects and prioritize tasks.

- Strong analytical and problem-solving skills.

- Proficiency in Microsoft Office applications and other credit software programs.

- Ability to work independently and take initiative.

- Excellent organizational skills.

- Ability to handle confidential information with discretion.

- Detail-oriented and able to work under tight deadlines.

Your resume should also include a list of any relevant coursework, certifications, or internships related to the position. If you have any prior experience working in a credit coordinator role, it is important to highlight this experience too. Lastly, be sure to showcase your knowledge of applicable laws, regulations and industry best practices.

What is a good summary for a Credit Coordinator resume?

A good summary for a Credit Coordinator resume should highlight the applicant’s experience and skills in managing customer accounts, analyzing credit reports, and handling customer complaints. The summary should include a mention of the applicant’s knowledge of banking regulations, credit regulations, and debt collection procedures, as well as their ability to process payments and close accounts. Additionally, the summary should emphasize the applicant’s strong communication and interpersonal skills, as well as their ability to work independently and manage multiple tasks. The summary should give employers an overview of the applicant’s qualifications and demonstrate why they are the ideal candidate for the position.

What is a good objective for a Credit Coordinator resume?

A Credit Coordinator is responsible for the financial administration of a company’s credit accounts. They manage related processes, such as credit review, collections, payment tracking, and credit limit adjustments. When creating a resume, it is important to have a clear and concise objective statement that outlines your experience and qualifications. Here are some good objectives for a Credit Coordinator resume:

- A highly motivated and organized professional with 5 years of experience in credit management, collections, and financial reporting seeking a Credit Coordinator position with ABC Company.

- Results-driven professional with a Bachelor’s Degree in Accounting and a proven track record of success in developing and implementing effective credit policies looking to join XYZ Company in a Credit Coordinator role.

- To obtain a Credit Coordinator role with a reputable organization that will allow me to utilize my expertise in financial operations and credit analysis to develop and manage successful credit strategies.

- Top-performing Credit Coordinator with 7+ years of experience in collections, credit analysis, and risk management seeking to leverage my skills and knowledge to join a progressive organization.

- Seeking an opportunity to work as a Credit Coordinator with a high-growth organization to apply my experience in credit analysis, financial reporting, and collections.

By creating a clear and concise objective statement, you can effectively showcase the skills and qualifications you possess to potential employers. Additionally, you can demonstrate your knowledge of the role and the company you are applying to.

How do you list Credit Coordinator skills on a resume?

When creating a resume for a Credit Coordinator position, it is important to include skills that show you are qualified for the job. Here are some key skills to include that will demonstrate your competency and expertise in the role:

- Credit Analysis: Show that you have experience analyzing the credit history of customers or clients and evaluating risk associated with their accounts.

- Account Management: Show that you are adept at managing customer accounts, including tracking payments and providing customer service.

- Financial Recordkeeping: Demonstrate your ability to keep detailed and accurate financial records, such as bank statements and invoices.

- Regulatory Compliance: Show that you understand the legal and regulatory compliance requirements related to credit and financial management.

- Problem Solving: Demonstrate your ability to identify and solve problems related to customer accounts and payments.

- Strong Communication Skills: Demonstrate your ability to clearly communicate with customers, vendors, and colleagues in both written and verbal form.

By including these skills in your resume, you will be able to show that you have the qualifications and expertise necessary to be a successful Credit Coordinator.

What skills should I put on my resume for Credit Coordinator?

As a Credit Coordinator, your resume should showcase both your technical and customer service skills. Your role is to coordinate the credit process for a company, so employers will want to see that you have the abilities to both process and track credit applications. Here are some key skills to include on your resume:

- Credit analysis: As a Credit Coordinator, you must have the ability to analyze a customer’s credit history in order to determine their creditworthiness. This includes evaluating the customer’s financial stability and capacity to pay, as well as their past payment performance.

- Account management: You must be able to manage customer accounts, including setting up new credit accounts, monitoring existing accounts, and updating customer information.

- Financial statements: The ability to read, analyze, and interpret financial statements is an important skill for a Credit Coordinator. You should be able to understand a customer’s financial records in order to make an accurate credit decision.

- Risk management: You must be able to determine and manage the credit risk associated with a customer, taking into account their financial stability, payment history, and past credit experiences.

- Customer service: As a Credit Coordinator, you need to be able to provide excellent customer service. You should possess strong communication and interpersonal skills in order to effectively interact with customers and resolve issues.

- Computer skills: Proficiency in Microsoft Office Suite and other customer relationship management (CRM) software is important for a Credit Coordinator. You should be able to use these programs to process credit applications and manage customer accounts.

Including these skills on your resume will demonstrate to employers your qualifications for a Credit Coordinator position and help you stand out in the job market.

Key takeaways for an Credit Coordinator resume

Writing an effective and impressive resume as a Credit Coordinator is important for getting your foot in the door with hiring managers in the finance industry. Here are some key takeaways to keep in mind when writing your resume:

- Highlight your credit experience: As a Credit Coordinator, you need to make sure that your resume contains information about your previous credit and banking experience. Include your job title, the number of years you have worked in the field, and any accomplishments you achieved while in that role.

- Highlight your communication skills: As a Credit Coordinator, you need to be able to effectively communicate with clients, lenders, and other financial professionals. Make sure your resume reflects your ability to communicate and negotiate with clients.

- Detail your knowledge: Make sure to include details about your knowledge of banking and credit regulations and procedures. Highlight any specific specialized skills or certifications you have that are related to credit.

- Showcase your management skills: As a Credit Coordinator, you must be able to manage multiple clients and lenders at once. Make sure to include information about your ability to manage and coordinate multiple projects at once.

- Highlight your technical skills: As a Credit Coordinator, having knowledge of financial software and spreadsheets is a must. Make sure to include examples of your technical skills and any certifications or awards you have received in the area of financial software.

By incorporating these five key takeaways into your Credit Coordinator resume, you can ensure that you stand out from the competition and show potential employers that you have the skills and experience necessary to be successful in the role.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder