Are you looking to become a credit controller? A credit controller is responsible for managing a company’s credit and collections activities, ensuring that customers pay invoices accurately and on time. To succeed in this profession, you will need an effective resume that highlights your experience and accomplishments. In this blog post, we will provide an in-depth guide on how to write an effective credit controller resume and provide several examples for you to use as a reference.

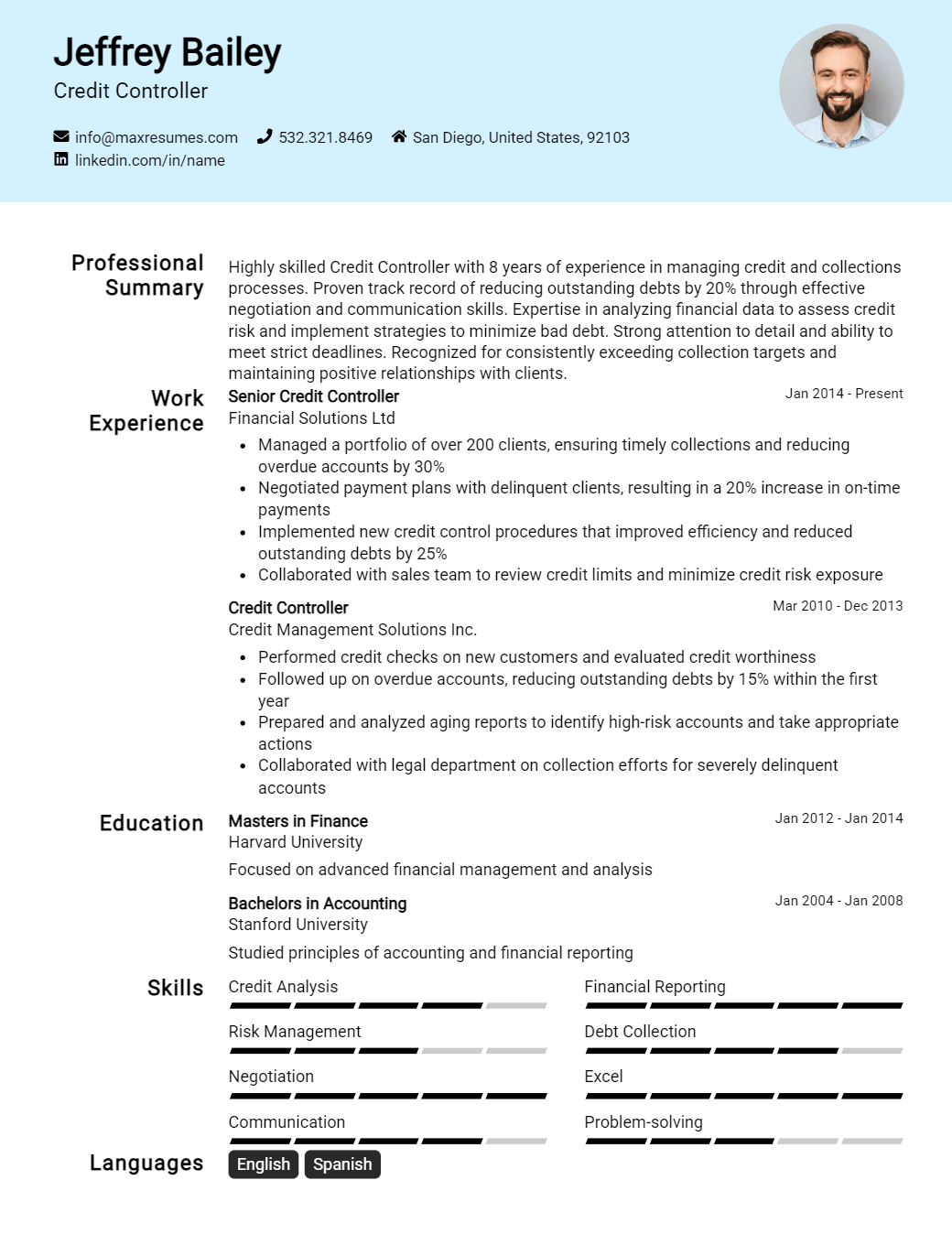

Credit Controller Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Controller Resume Examples

John Doe

Credit Controller

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly experienced and motivated Credit Controller with over 10 years of progressive experience in analyzing credit risks and providing support to customers in financial matters. Possesses comprehensive knowledge of accounting and financial operations, as well as customer service and collection processes. Experienced in managing and implementing customer credit guidelines, monitoring credit limits and customer accounts, and developing strategies for debt collection. Proven ability to develop and maintain successful customer relationships, reduce customer debt, and maximize profitability.

Core Skills:

- Extensive knowledge of credit and collections processes

- Proficient in accounting and financial operations

- Excellent customer service, communication and negotiation skills

- Proficient in Microsoft Office Suite

- Strong organizational and problem- solving skills

- Ability to manage multiple tasks and prioritize effectively

Professional Experience:

- Credit Controller, ABC Company, March 2014 – Present

- Managed customer credit accounts, monitored customer credit limits and customer accounts, and developed strategies for debt collection.

- Processed customer payments, reviewed customer accounts and credit records, and identified and resolved issues.

- Developed and maintained successful customer relationships, as well as assisted customers with any financial matters.

- Created and implemented customer credit guidelines and monitored customer credit applications.

- Researched and resolved customer inquiries and complaints in a timely manner.

Education:

- Bachelor of Science in Accounting, University of XYZ, 2008 – 2012

Credit Controller Resume with No Experience

Recent finance graduate with a Bachelor’s Degree in Business Administration Passionate and hard- working individual with strong organizational and communication skills, and a commitment to customer satisfaction. Proficient in Microsoft Office Suite and quick to learn new software

Skills

- Excellent problem solving and conflict resolution capabilities

- Strong analytical skills and attention to detail

- Ability to work as part of a team, as well as independently

- Ability to multitask and prioritize tasks

- Excellent customer service skills

Responsibilities

- Ensuring timely payment of account invoices

- Maintaining accurate records of all account transactions

- Following up on past due accounts

- Handling customer inquiries and complaints

- Collaborating with sales team to ensure customer satisfaction

- Analyzing financial data to identify potential issues and areas of improvement

- Assisting other team members with credit control duties as needed

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Controller Resume with 2 Years of Experience

Highly organized and detail- oriented Credit Controller with two years of experience in the banking industry. Proven track record of collecting delinquent payments and reducing outstanding balances by implementing effective procedures and systems. Skilled at negotiating with customers to resolve problematic accounts and improve customer relations. Possess strong knowledge of credit and collections laws and regulations.

Core Skills:

- Excellent communication and interpersonal skills

- Highly organized with strong attention to detail

- Proficient in the use of Microsoft Office Suite

- Knowledge of relevant credit and collections laws and regulations

- Ability to analyze customer financials

- Skilled at negotiating with customers

- Able to assess customer financials and determine credit eligibility

Responsibilities:

- Reviewed and processed new credit applications and customer accounts

- Analyzed customer financials to determine credit eligibility

- Compiled and maintained customer credit files

- Processed credit card payments and reconciled accounts

- Investigated customer payment histories and credit ratings

- Contacted customers to resolve delinquent accounts and discussed payment options

- Negotiated with customers to reach payment arrangements

- Provided customer service and resolved customer inquiries

- Assisted with the preparation of financial statements

- Complied with all relevant laws and regulations

- Reported customer credit activity to the credit bureau

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Controller Resume with 5 Years of Experience

I am a credit controller professional with 5 years of experience. I specialize in managing accounts receivable, monitoring credit limits, and handling customer disputes. I have extensive knowledge of financial systems, accounting software, and collections practices. I am familiar with applicable laws and regulations and am organized, detail- oriented, and adept at problem- solving. My passion is to maintain the financial health of businesses.

Core Skills:

- Accounts Receivable Management

- Credit Limit Monitoring

- Customer Dispute Handling

- Financial System Knowledge

- Accounting Software Knowledge

- Collections Practices Knowledge

- Applicable Laws and Regulations Knowledge

- Organizational and Detail- Oriented

- Problem- Solving

Responsibilities:

- Maintaining accurate accounts receivable records

- Processing and reconciling customer payments

- Performing financial analysis and reporting

- Ensuring that credit limits are respected

- Responding to customer inquiries and disputes

- Performing credit checks and assessing credit risks

- Managing collection efforts

- Ensuring compliance with applicable regulations

- Investigating and resolving discrepancies

- Maintaining customer relationships

- Developing and implementing policies and procedures

- Managing accounts receivable staff

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Controller Resume with 7 Years of Experience

I am an experienced Credit Controller with over 7 years of experience in managing and controlling credit accounts. I have a proven track record for providing excellent customer service, as well as developing and maintaining strong customer relationships. I am able to understand customer requirements and advise customers on the best payment solutions. My experience also includes assessing customer creditworthiness and determining the amount of credit to be extended. My outstanding communication and organisational skills enable me to work effectively and efficiently, while my ability to work under pressure ensures all deadlines are met.

Core Skills:

- Credit control & debt recovery

- Customer service

- Risk management & credit analysis

- Financial statements & balance sheet analysis

- Negotiation & dispute resolution

- Cash flow forecasting & budgeting

- Microsoft Office Suite & accounting software

Responsibilities:

- Monitor customer accounts and review credit limits

- Collect overdue payments and maintain customer records

- Contact customers by telephone, email and letters to collect payments

- Handle customer queries, disputes and negotiations

- Assess customer creditworthiness and financial capacity

- Prepare and submit weekly and monthly reports

- Monitor payments to ensure that customers adhere to payment terms

- Assist in the preparation of financial statements and budgeting

- Liaise with internal and external stakeholders to ensure smooth credit operations

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Controller Resume with 10 Years of Experience

Experienced Credit Controller with more than 10 years of experience in managing customer accounts, resolving payment discrepancies, and maintaining customer relations. Skilled in accurately calculating customer accounts, developing payment plans for delinquent customers, and utilizing collection tools. Proven ability to be highly organized, detail- oriented, and deliver strong customer service.

Core Skills:

- Account reconciliation

- Payment collection

- Credit control

- Invoicing

- Accounts receivable

- Customer relations

- Risk analysis

- Collection tools

- Data entry

Responsibilities:

- Resolve customer payment discrepancies and take necessary action to ensure customer account accuracy.

- Manage customer accounts, including issuing invoices, setting up payment plans, and providing customer service.

- Analyze customer accounts and payment records to identify at- risk accounts and take appropriate action.

- Prepare detailed collection reports and present findings to senior management.

- Maintain customer files and records in accordance with company policies and procedures.

- Monitor customer accounts for timely payments and alert management to potential issues.

- Process customer payments and ensure that all payments are accurately recorded.

- Develop and maintain successful relationships with customers to ensure customer satisfaction.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Controller Resume with 15 Years of Experience

A highly organized and results- oriented Credit Controller with 15 years of professional experience in the finance sector. Proven track record in managing cash flow, customer accounts, dispute resolution and customer collections. A customer- focused individual, with excellent communication and negotiation skills. Possessing a sharp eye for detail, with the ability to work under pressure and to tight deadlines. Dedicated to providing high- quality customer service and achieving the best possible outcome for the organization.

Core Skills:

- Account Reconciliation

- Credit Management

- Risk Management

- Cash Flow Analysis

- Financial Reporting

- Data Entry

- Dispute Resolution

- Customer Service

- Negotiation

Responsibilities:

- Ensuring the accounts receivable ledger remained up to date and accurate

- Liaising with customers to resolve disputed invoices

- Developing and maintaining strong relationships with customers

- Maximizing customer collections while maintaining customer satisfaction

- Monitoring credit limits and preparing credit reports

- Providing financial analysis on customer accounts and risk

- Performing regular reconciliation of accounts and reporting discrepancies

- Monitoring cash flow and ensuring payments to creditors were made on time

- Identifying opportunities to reduce financial risk and improving profits

- Preparing invoices and chasing late payments

- Preparing monthly financial reports and budgets for senior management.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Controller resume?

A credit controller’s job is to manage the customer accounts and ensure that the debtors have paid their accounts and that the creditors have received their payments. When applying for a credit controller position, it is important to prepare an effective resume that highlights your relevant experience and qualifications. Here is what should be included in a credit controller resume:

- Professional summary – this should offer a quick overview of your qualifications and experience in the field.

- Education – include details of any relevant education, such as an accounting or finance degree.

- Work history – list all the relevant work experience in chronological order. Include the name of the company, the position held and the duration of the job.

- Technical skills – highlight any computer or software skills that you possess that are related to the job. This includes knowledge of accounting software, spreadsheets, databases, and customer relationship management systems.

- Analytical skills – emphasize your ability to analyze financial statements, identify trends and make predictions.

- Ability to multitask – emphasize your ability to manage multiple projects at once and prioritize tasks.

- Communication skills – highlight your ability to communicate effectively with customers and colleagues.

- Interpersonal skills – emphasize your ability to work collaboratively and build relationships.

- Attention to detail – emphasize your ability to work accurately and efficiently.

- Problem-solving skills – demonstrate your ability to identify and solve complex problems.

By including these elements in your resume, you will be able to demonstrate your qualifications and experience as a credit controller to potential employers.

What is a good summary for a Credit Controller resume?

A Credit Controller resume should include a brief summary of your experience and accomplishments. It should highlight any expertise you have in business operations, financial analysis and customer service. Your summary should also include any skills or accomplishments you have related to managing accounts receivable and accounts payable, as well as any training or certifications you possess. Be sure to include any relevant experience you have in leading teams, developing strategies and implementing controls. An effective Credit Controller resume summary will demonstrate your knowledge, experience and commitment to the profession.

What is a good objective for a Credit Controller resume?

A credit controller is responsible for managing a company’s accounts receivable ledger, which includes issuing invoices, overseeing payments, and resolving unpaid accounts. With a strong objective on their resume, a credit controller can set themselves apart from other applicants and demonstrate to potential employers their commitment to the position.

A good objective for a credit controller resume should include the following:

- Demonstrate commitment to increasing efficiency, accuracy, and accountability in the accounts receivable process

- Utilize excellent communication and problem-solving skills to build trusting relationships with customers

- Effectively manage multiple accounts and prioritize appropriately to ensure timely payments

- Work with the accounting team to maintain accurate and consistent records of customer payments

- Develop creative solutions to reduce outstanding debt and increase customer satisfaction

- Develop and implement comprehensive strategies to manage accounts receivable and maximize cash flow

How do you list Credit Controller skills on a resume?

When it comes to putting together a job-winning resume for a career as a credit controller, it is important to make sure you highlight the skills and experiences that are necessary for the job. In particular, you should emphasize the skills that make you an effective credit controller, such as organization, financial analysis, and communication. Here is how to list credit controller skills on a resume:

- Organizational skills: As a credit controller, you need to be able to keep track of billing statements, invoices, and other financial documents. Make sure to include any organizational skills that you possess, such as the ability to manage multiple projects at once and maintain accurate records.

- Financial analysis: Credit controllers must have the ability to analyze financial information and make informed decisions based on that data. Make sure to highlight your ability to read and interpret financial statements, analyze trends, and evaluate creditworthiness.

- Communication: Effective communication skills are essential for credit controllers, who must often interact with customers and other parties. Be sure to emphasize your ability to communicate clearly and professionally, both verbally and in writing.

- Problem-solving: Credit controllers must be able to resolve disputes and other problems quickly and efficiently. Highlight your ability to develop creative solutions, identify issues, and take the initiative to resolve conflicts.

- Negotiation skills: Credit controllers are often required to negotiate payment terms with customers. Make sure to emphasize any experience you have in this area, such as the ability to negotiate effectively and resolve payment disputes.

By making sure to emphasize these key credit controller skills on your resume, you can help ensure that you stand out from the competition and increase your chances of getting the job.

What skills should I put on my resume for Credit Controller?

A Credit Controller is a professional responsible for managing an organization’s credit risk, tracking debtors, and issuing credit to customers. As such, it is important to include relevant skills on your resume when applying for a role in this field. Here are some of the key skills employers look for in Credit Controller resumes:

- Strong Analytical Skills: Credit Controllers must be able to understand and analyze financial data, such as credit reports and ledgers. They should be adept at interpreting financial information, such as budgeting and cash flow statements, to identify potential risks and areas of opportunity.

- Risk Management: Credit Controllers need to be knowledgeable about risk management and able to identify potential financial risks. They should be able to evaluate companies’ creditworthiness, understand credit risk exposure, and develop strategies to manage those risks.

- Attention to Detail: Credit Controllers must be highly detail-oriented, as they are responsible for ensuring that all financial documents and transactions are accurate. They should be able to review and verify financial information to ensure accuracy.

- Communication Skills: Credit Controllers must be able to effectively communicate with customers, vendors, and other stakeholders. They should have excellent verbal and written communication skills and be able to clearly explain financial concepts to non-financial individuals.

- Organizational Skills: Credit Controllers need to be organized in order to manage their workloads and keep track of deadlines. They should be able to multitask and prioritize tasks to meet deadlines and keep operations running smoothly.

- Interpersonal Skills: Credit Controllers should have strong interpersonal skills and the ability to build and maintain positive relationships with customers and vendors. They should also be able to handle customer disputes and negotiate payment terms.

Key takeaways for an Credit Controller resume

Writing a resume for the role of a credit controller can be a daunting task – but it doesn’t have to be. Here are some key takeaways that you should keep in mind when crafting a resume for this important role:

- Demonstrate Your Experience: Credit controllers need to have a deep understanding of financial systems, processes and policies in order to effectively manage all aspects of credit control. Make sure to list any previous experience that you have in this field, as well as any relevant certifications or qualifications.

- Showcase Your Skills: Credit controllers need to have strong analytical and problem-solving skills in order to be successful in their role. Make sure to highlight any skills that you have that demonstrate these abilities.

- Show Your Attention to Detail: Credit controllers need to be extremely detail-oriented in order to ensure that all credit control activities are conducted accurately and in a timely manner. Make sure to demonstrate the level of attention to detail that you bring to the role in your resume.

- Demonstrate Your Ability to Manage Clients: Credit controllers need to be able to effectively manage client relationships. Make sure to showcase any previous experience in this area as well as any customer service skills that you have.

- Highlight Your Knowledge of Regulatory Requirements: Credit controllers need to be familiar with applicable regulations in order to ensure compliance. Make sure to showcase any knowledge of relevant laws and regulations that you possess.

Following these tips will help you craft an effective and compelling resume for the role of credit controller. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder