Writing a resume for a Credit and Collection Manager position can be challenging. You need to demonstrate both financial acumen and leadership skills to potential employers without relying on jargon and industry-specific buzzwords. The role of a Credit and Collections Manager is a varied and multi-faceted one which includes collecting payments from customers, managing accounts receivables, handling disputes and writing reports. Crafting a resume that accurately reflects your experience and expertise is essential if you want to maximize your chances of landing the job. In this guide, we provide a detailed overview of how to compose a compelling resume for a Credit and Collections Manager, along with helpful tips and examples to make sure your resume stands out above the rest.

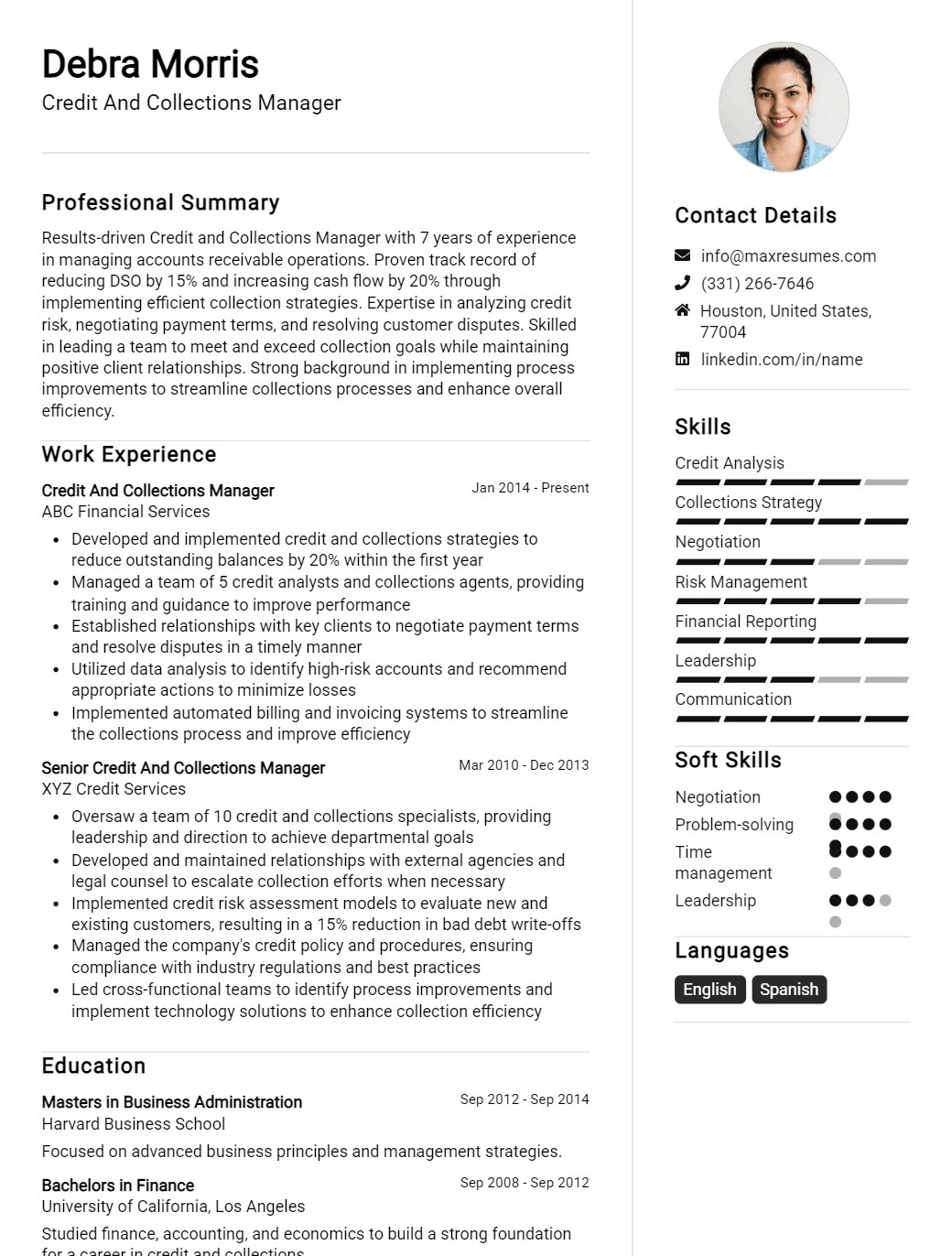

Credit And Collections Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit And Collections Manager Resume Examples

John Doe

Credit And Collections Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Credit and Collections Manager, with over 10 years of experience in customer credit and collections. My expertise lies in developing and implementing credit policies, maintaining customer relationships, and effectively managing the collection process. I am highly organized and detailed oriented, and I have an excellent track record of meeting targets and maintaining customer accounts. I have a strong understanding of collections law and regulations, and I am well- versed in customer service.

Core Skills:

- Excellent customer service

- Proficient in collections law and regulations

- Proven record of meeting targets

- Ability to maintain customer accounts

- Ability to implement credit policies

- Strong customer relationship management

Professional Experience:

Credit and Collections Manager – ABC Company, 2015- 2020

- Developed credit policies and maintained customer relationships

- Managed collection activities and monitored results

- Ensured compliance with collection laws and regulations

- Negotiated payment terms and worked with customers to resolve disputes

- Prepared and maintained accurate financial records

- Analyzed customer creditworthiness and financial data

Education:

Bachelor of Business Administration, ABC University, 2011

Credit And Collections Manager Resume with No Experience

Credit and Collections Manager with no experience, looking to start a challenging career in the financial industry. Possess excellent communication and multitasking skills, along with a keen knowledge of accounting and financial analysis. Seeking to utilize my skills and knowledge to make innovative contributions to the success of the organization.

Skills

- Accounting principles

- Financial analysis

- Credit analysis

- Strong written and verbal communication

- Multitasking

- Computer proficiency

- Problem- solving

Responsiblities

- Developing and implementing policies and procedures for credit and collections

- Evaluating credit risk on new customers and existing accounts

- Analyzing financial statements and credit reports to determine creditworthiness

- Establishing credit limits and payment terms

- Negotiating payment terms and plans with customers

- Resolving billing disputes

- Pursuing debt collection activities

- Maintaining up- to- date account records

- Analyzing and reporting on the status of accounts receivable

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit And Collections Manager Resume with 2 Years of Experience

A highly motivated and results- driven Credit and Collections Manager with 2 years of experience in managing and improving credit and collection processes. Proven ability to successfully build and maintain relationships with customers and internal stakeholders. Possesses excellent analytical and problem- solving skills. Demonstrated experience in developing and implementing new strategies and approaches to eliminate customer debt and maximize customer retention.

Core Skills:

- Credit and Collections Management

- Problem Solving

- Relationship Building

- Analytical Skills

- Business Development

- Strategic Planning

- Financial Reporting

Responsibilities:

- Monitor customer accounts and ensure timely payments of invoices.

- Evaluate customer credit risk, manage customer credit limits and set up payment plans.

- Develop and manage customer payment schedules and statements.

- Negotiate with customers to find solutions for debt repayment.

- Investigate past due accounts, analyze customer accounts and prepare debt collection reports.

- Liaise with customers to resolve disputed accounts.

- Prepare and distribute monthly financial and collection reports.

- Develop and implement new strategies and approaches to eliminate customer debt and maximize customer retention.

- Track customer payment patterns and identify potential areas of risk.

- Communicate and collaborate with internal stakeholders to ensure customer account information is accurate and up to date.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit And Collections Manager Resume with 5 Years of Experience

Highly- motivated Credit and Collections Manager with 5 years of experience in leading and managing accounts receivables and collections operations. Adept at creating and implementing strategies to reduce delinquency, manage the bad debt portfolio, and increase cash flow. Possess strong problem solving and decision making skills, and the ability to develop and maintain strong relationships with clients, vendors and colleagues.

Core Skills:

- Analytical and critical thinking

- Organizational and time management

- Knowledge of legal regulations and compliance

- Strong written and verbal communication

- Financial reporting and budgeting

- Customer service and negotiation

- Microsoft Office Suite

Responsibilities:

- Managed day- to- day accounts receivables and collections activities

- Assisted in setting credit and collection policies and procedures

- Developed strategies to reduce delinquent accounts and bad debt

- Reviewed customer accounts and set payment terms

- Ensured timely collections and adherence to payment terms

- Monitored customer credit limits and updated credit information

- Investigated disputes and negotiated with customers for payment terms

- Prepared and submitted regular reports to senior management

- Collected payments, reviewed outstanding debt and updated records accordingly

- Prepared collection strategies and dealt with the legal department on escalations

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit And Collections Manager Resume with 7 Years of Experience

Highly experienced and knowledgeable Credit and Collections Manager with 7 years of experience in managing the daily operational activities of a credit and collections team. Proven ability to improve customer collection rates and reduce delinquency, while providing excellent customer service. Skilled in developing and implementing customer policies and procedures, creating credit limit reviews, and completing credit investigations. Experienced in utilizing specialized software to assist with invoice processing, collection calls, and other tasks.

Core Skills:

- Credit and collections management

- Customer service

- Customer policies and procedures

- Credit limit reviews

- Credit investigations

- Invoice processing

- Software proficiency

- Collection calls

- Data entry

Responsibilities:

- Managed daily operations of a credit and collections team

- Developed and implemented customer policies and procedures

- Created credit limit reviews and completed credit investigations

- Utilized specialized software to assist with invoice processing, collection calls, and other tasks

- Ensured customer satisfaction and compliance with customer policies and procedures

- Processed customer payments and monitored customer accounts

- Analyzed customer payment trends and developed effective strategies to reduce delinquency

- Provided training and guidance to credit and collections team members

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit And Collections Manager Resume with 10 Years of Experience

A highly motivated and driven Credit and Collections Manager with 10 years of experience in overseeing all facets of the credit granting and collection processes, including developing and maintaining policies and procedures, providing customer service, performing analysis, and managing collection staff. Proven ability to build relationships with customers and efficiently manage accounts while driving a successful and profitable portfolio. Adept at accurately assessing creditworthiness, determining and granting credit limits, preparing reports and conducting customer account reviews, and maintaining productive relationships with all stakeholders.

Core Skills:

- Proven ability to drive successful collections while building and maintaining customer relationships

- Creditworthiness analysis and determining credit limits

- Expert knowledge of all applicable federal, state, and local laws governing credit and collections

- Exemplary customer service and problem- solving skills

- Highly organized and detail- oriented with superior analytical skills

- Proficient in Microsoft Office Suite, SAP, and other Collection & Credit tracking systems

- Excellent project management, time management and communication skills

Responsibilities:

- Develop and implement credit policies, procedures and systems for granting credit and collections

- Ensure creditworthiness of customers through financial analysis, credit checks, and reviewing customer accounts

- Monitor customer accounts and credit limits and adjust credit lines as needed

- Facilitate collections by contacting customers and negotiating payment terms

- Investigate and resolve customer disputes and discrepancies

- Track and report collection activities and aging of accounts

- Review customer accounts and prepare periodic reports

- Develop and manage performance goals and metrics for collection staff

- Ensure compliance with all applicable federal, state, and local laws

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit And Collections Manager Resume with 15 Years of Experience

An experienced and results- driven Credit and Collections Manager with 15 years of experience managing accounts receivable, credit and collections for companies in the retail and health care industries. Proven track record of reducing bad debt write- offs, increasing collections, and improving customer satisfaction. Possesses a keen eye for detail and excellent problem solving skills. A strong leader with the ability to motivate and mentor large teams.

Core Skills:

- Account Reconciliation

- Proactive Credit Management

- Debt Negotiation

- Risk Analysis

- Claims Resolution

- Computerized Credit Systems

- Audit Preparation

- Financial Reporting

- Collection Management

- Billing and Invoicing

- Accounts Receivables

- Compliance

Responsibilities:

- Develop and manage accounts receivable, credit and collections policies and procedures

- Ensure that customer accounts are reconciled, invoices are accurate, and all payments due are collected on time

- Establish credit limits for new and existing customers

- Manage a team of credit and collections clerks to ensure tasks are completed in a timely manner

- Analyze customer payment trends to identify and minimize bad debt write- offs

- Manage collection accounts, conduct credit investigations, and resolve customer complaints

- Negotiate payment arrangements with delinquent customers

- Perform risk assessment and financial analysis of customers

- Ensure compliance with federal and state laws and regulations

- Monitor customer accounts for changes in credit status

- Track and report aged receivables and other relevant financial data

- Prepare monthly financial reports and audit documents

- Provide support to other departments including sales, customer service, and accounts payable

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit And Collections Manager resume?

As a Credit And Collection Manager, your resume should clearly demonstrate your knowledge of credit and collection policies in order to secure a position in this field. A Credit And Collection Manager Resume should highlight your extensive experience in collections, credit policies, and management. It should also demonstrate the ability to maximize cash flow, reduce bad debts, and manage invoice processing.

Here are some key points to include in your Credit And Collection Manager Resume:

- Professional experience: Include any credit and collections experience that you have acquired throughout your career. Make sure to list your company names and the dates of employment.

- Core competencies: Demonstrate your knowledge in credit and collection policies as well as any other relevant skills, such as customer service and problem solving.

- Education: List any relevant educational background such as a degree or certification in accounting or business.

- Achievements: Include any successful projects or initiatives that you have worked on in the past.

- Computer software skills: Demonstrate any experience you have with relevant software programs, such as Microsoft Excel or QuickBooks.

- Analytical skills: Demonstrate your ability to analyze data and make informed decisions.

- Interpersonal skills: Demonstrate your ability to negotiate and communicate effectively with customers.

By including these key points in your resume, you will be well on your way to securing a position as a Credit And Collection Manager.

What is a good summary for a Credit And Collections Manager resume?

A Credit and Collections Manager oversees the collection of accounts receivable and credit processes. They are responsible for monitoring the customer’s accounts to ensure timely payments, minimizing the risk of bad debts and ensuring compliance with credit policies. A successful resume for this position should showcase a combination of strong analytical and organizational skills as well as customer service orientation. It should also demonstrate knowledge of accounts receivable principles and standard accounting practices. The summary section of a Credit and Collections Manager’s resume should emphasize the candidate’s abilities to analyze customer creditworthiness, maintain accurate record-keeping and collections processes and resolve customer disputes. It should also describe the candidate’s ability to remain organized and prioritize tasks when dealing with multiple accounts.

What is a good objective for a Credit And Collections Manager resume?

Tips For Writing A Credit And Collections Manager Resume Objective

Writing a resume objective can be a challenge, especially if you are applying for a Credit and Collections Manager position. However, having a clear understanding of the job and a well-crafted objective can give you the edge you need to land the job. Here are some tips to help you write a great objective for a Credit and Collections Manager resume.

- Start off with a few words describing why you’re interested in the position. For example, “Experienced Credit and Collections Manager seeking to utilize my knowledge and skills in managing and developing high-performance teams.”

- Describe the qualifications and skills you possess that make you a great fit for the role. Focus on the ones that are essential for a Credit and Collections Manager position, such as knowledge of accounting principles, excellent communication skills, and the ability to manage and coordinate the activities of a credit and collections department.

- Showcase your achievements in the field of credit and collections. If you have any experiences or certifications that make you more qualified for the position, be sure to mention them.

- Show your ability to work in teams. As a Credit and Collections Manager, you are expected to work effectively with other members of the finance team.

- Highlight your ability to manage and lead teams. As a Credit and Collections Manager, you will be responsible for overseeing the activities of the credit and collections team.

By including these elements in your resume objective, you can demonstrate your qualifications and skills as a Credit and Collections Manager. With the right objective, you can be sure to stand out from the competition and land the job you want.

How do you list Credit And Collections Manager skills on a resume?

When building a resume, ensuring that your skills are accurately listed to potential employers is essential. If you are applying for the role of a Credit and Collections Manager, you should make sure to highlight all of the key skills they will be looking for in a candidate. Here’s how to list these skills on your resume:

- Strong background in financial services: Credit and Collections Managers need to have a solid understanding of financial services and the associated laws. Demonstrate your knowledge of the industry by highlighting any relevant experience and qualifications you may have.

- Attention to detail: Credit and Collections Managers need to ensure accuracy when dealing with customer accounts. Display your attention to detail by listing any specific examples of successful projects or tasks you have completed.

- Superior organizational skills: This role requires a high level of organization in order to properly manage customer accounts. Showcase your organizational skills by detailing any systems you have implemented or outlining any special processes you have designed for managing customer accounts.

- Excellent communication skills: It is important for Credit and Collections Managers to have strong communication skills in order to effectively negotiate with customers to resolve debt issues. List any experience you have working with customers, such as customer service or sales, to demonstrate your ability in this area.

- Ability to multitask: Credit and Collections Managers need to be able to manage multiple accounts and tasks simultaneously. Highlight any past experience working in a fast-paced work environment or handling multiple accounts to show that you have the skills needed to manage multiple tasks.

What skills should I put on my resume for Credit And Collections Manager?

As a Credit and Collections Manager, you must possess many skills that demonstrate an aptitude for the job and make you stand out in the job market. This section of your resume should highlight your qualifications and experience to ensure your prospective employers are aware of your expertise.

When composing your resume for this role, consider including the following skills:

- Credit and Collections Management: You should have a proven ability to manage credit and collections processes, such as credit limits, collections, and credit worthiness.

- Negotiation: You should be an excellent negotiator who can handle difficult conversations with customers and debtors.

- Analytical Skills: You should have the ability to analyze and interpret financial data, including credit reports, budgets, and accounts receivable.

- Customer Service: You should have excellent customer service skills to deal with customer inquiries and disputes.

- Financial Analysis: You should be able to analyze financial data to make informed decisions.

- Problem Solving: You should be able to identify problems, find solutions, and make recommendations.

- Organizational Skills: You should be able to prioritize tasks, keep organized records, and manage multiple deadlines.

- Microsoft Office: You should be proficient in Microsoft Office, including Excel and Word.

By including these skills on your resume, you will show prospective employers that you are a qualified and experienced Credit and Collections Manager.

Key takeaways for an Credit And Collections Manager resume

When it comes to a successful credit and collections manager resume, there are a few key takeaways to keep in mind. These takeaways can help you to ensure that your resume is well-crafted, stands out from the competition, and is tailored to the job you’re applying for.

First and foremost, you should focus on highlighting your experience in managing credit and collections. For example, your resume should emphasize any successes you’ve had in managing accounts receivable, credit approvals, and collections. It should also focus on how you successfully resolved any customer disputes and how you leveraged technology to streamline processes.

In addition to highlighting your experience, you should also make sure to include any certifications or awards you’ve achieved. This could include certifications from the International Association of Credit and Collections Professionals, awards from the Credit and Collections Association, or any other relevant awards or certifications that you’ve earned.

Finally, you should make sure to emphasize any risk management or analytics skills you possess. This could include knowledge of financial analysis, as well as knowledge of data collection and analysis.

By following these key takeaways, you can ensure that your credit and collections manager resume is well-crafted, stands out from the competition, and is tailored to the job you’re applying for.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder