Writing a resume for a credit analyst position can seem daunting, but with the right format, focus and content you can craft an effective and compelling document. This guide will provide you with useful tips and advice on how to write a credit analyst resume that stands out from the competition. You will learn how to highlight your most relevant skills and qualifications, and learn how to use resume best practices to create an effective and professional document. Read on to learn how to create a resume that will help you land the credit analyst job you’re applying for.

Credit Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Analyst Resume Examples

John Doe

Credit Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly motivated Credit Analyst with a diverse background in financial analysis, business operations and customer service. Proven ability to assess risk and make sound financial decisions. With experience in the financial services industry, I have acquired strong problem- solving and decision making skills, as well as excellent communication and customer service skills. I am eager to apply these skills in a new role as a Credit Analyst.

Core Skills:

- Financial Risk Analysis

- Credit Risk Assessment

- Loan Servicing

- Financial Modeling

- Data Analysis

- Customer Service

- Problem Solving

Professional Experience:

Credit Analyst, ABC Bank – Jan 2020 to Present

- Evaluate and analyze loan requests from borrowers, ensuring that all requirements are met.

- Perform credit checks and analyze financial documents to assess risk and determine creditworthiness.

- Prepare reports for management, summarizing creditworthiness and risk factors.

- Advise and recommend loan terms and conditions to minimize credit risk.

- Monitor and review existing loan accounts for potential issues.

Credit Associate, XYZ Bank – Jan 2018 to Dec 2019

- Assisted in the preparation of loan documents and credit applications.

- Reviewed and evaluated loan applications for creditworthiness.

- Obtained and examined financial statements, credit reports and other documents.

- Monitored loan repayment status and ensured all payments were made on time.

- Provided customer service to borrowers and resolved any issues or questions.

Education:

Bachelor of Science in Business Administration, ABC University – 2017

Credit Analyst Resume with No Experience

Recent college graduate with a degree in accounting and finance, seeking to leverage my excellent problem solving and analytical skills to become a successful credit analyst. I am highly motivated, organized, and detail- oriented with a passion for the financial services industry.

Skills

- Strong attention to detail

- Analytical and problem- solving skills

- Exceptional communication skills

- Proficient in Microsoft Office and financial software

- Ability to analyze financial statements and credit reports

- Knowledge of banking and lending regulations

Responsibilities

- Review credit applications and financial statements

- Analyze financial risk of customers

- Develop and implement credit policies and procedures

- Ensure compliance with banking and lending regulations

- Prepare credit reports and recommendations

- Monitor account activity and investigate any discrepancies

- Identify areas of risk and suggest appropriate solutions

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Analyst Resume with 2 Years of Experience

A highly organized and detail- oriented Credit Analyst with 2 years of experience in conducting credit assessments and analysis. Experienced in assessing financial documents, studying customer backgrounds and making informed recommendations for credit decisions. Skilled in preparing credit package summaries, analyzing credit trends and identifying areas of risk. Adept at working with project teams to maintain accurate records and develop efficient procedures.

Core Skills:

- Financial Analysis

- Credit Assessments

- Client Relations

- Credit Recommendations

- Problem Solving

- Team Collaboration

- Data Management

- Risk Assessment

Responsibilities:

- Conducted credit assessments and analysis to evaluate creditworthiness of potential customers.

- Reviewed financial documents such as credit reports, bank statements, and tax returns.

- Verified customer backgrounds and identified areas of risk.

- Developed credit policies and procedures and monitored credit performance.

- Prepared credit package summaries for account managers.

- Analyzed credit trends and identified areas of financial risk.

- Collaborated with project teams to develop and maintain efficient processes for credit management.

- Maintained accurate records, tracked credit activities and communicated results.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Analyst Resume with 5 Years of Experience

Hardworking and diligent Credit Analyst with 5 years of experience in providing financial services and analysis to clients in a timely and accurate manner. Possess excellent analytical, problem solving, and communication skills, as well as the ability to develop and evaluate credit options for clients and businesses. Experienced in managing and analyzing credit risk, performing credit investigations, and providing financial forecasting and analysis. Highly motivated to ensure all clients receive the highest quality of financial services.

Core Skills:

- Risk Management

- Financial Analysis

- Credit Investigations

- Credit Risk Analysis

- Financial Forecasting

- Documentation

- Problem Solving

- Communication

- Time Management

Responsibilities:

- Analyze financial documents such as debt structure, business plans, and cash flow statements in order to evaluate creditworthiness of clients

- Develop and evaluate credit options for clients and businesses

- Manage and analyze credit risk for clients by analyzing financial information

- Maintain and update internal credit reports to ensure accuracy

- Analyze financial trends and provide various financial forecasts for clients

- Investigate credit applications, review credit histories, and approve or deny credit applications

- Resolve credit disputes and work with clients to arrange payment plans

- Prepare detailed credit reports and updates to provide clients with accurate financial information

Experience

5+ Years

Level

Senior

Education

Bachelor’s

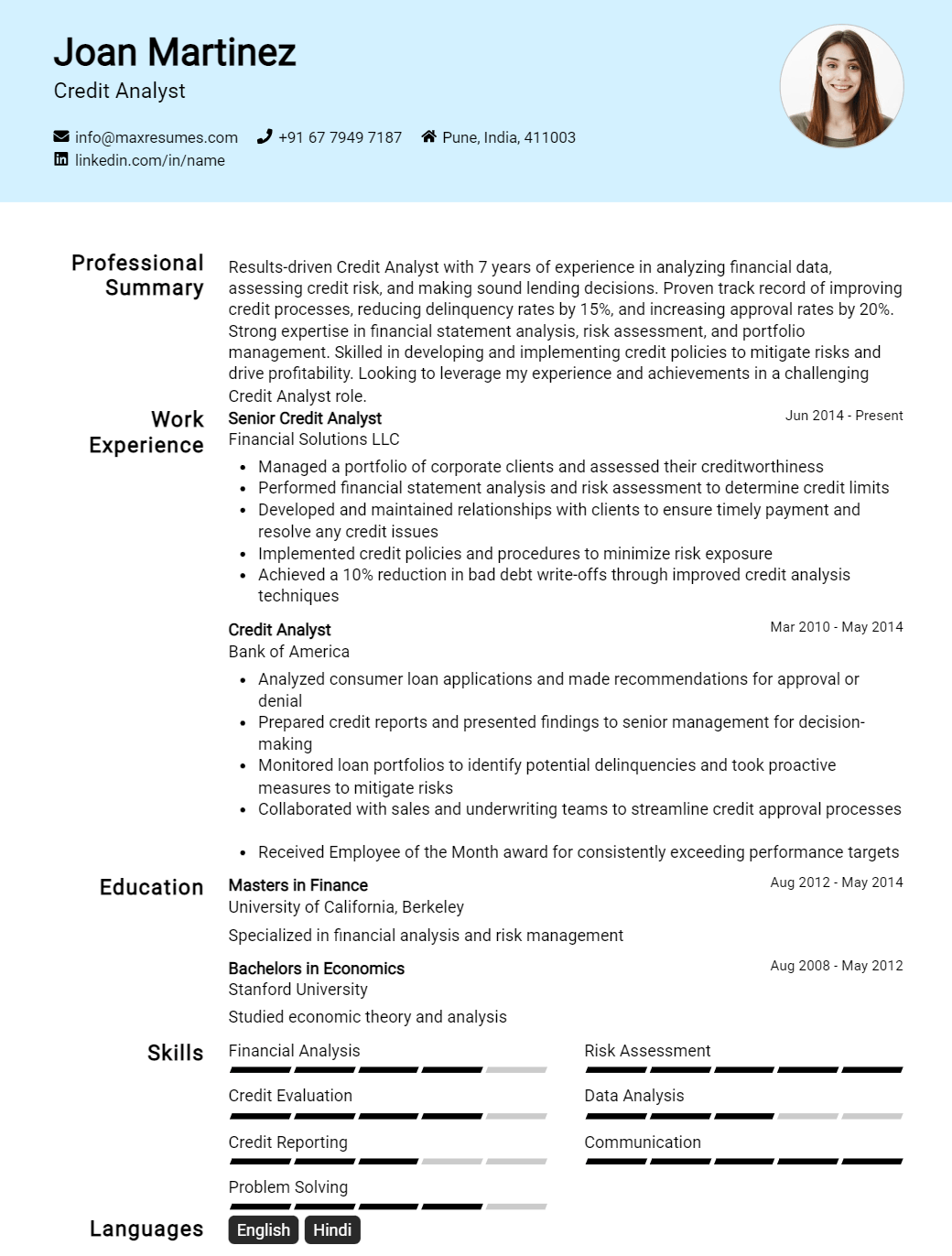

Credit Analyst Resume with 7 Years of Experience

Dynamic and highly motivated credit analyst with 7 years of experience in the financial industry. Skilled in analyzing financial statements to assess creditworthiness of borrowers, creating credit reports, and developing credit ratings. Proven ability to conduct financial analysis and develop risk evaluation strategies. Adept at managing banking relationships and negotiating loan terms. Possesses excellent interpersonal and communication skills.

Core Skills:

- Financial analysis

- Credit worthiness assessment

- Credit report creation

- Risk evaluation strategies

- Banking relationships management

- Loan negotiations

- Interpersonal and communication skills

Responsibilities:

- Developed comprehensive credit reports of commercial and consumer customers using financial statements and third- party credit information

- Analyzed financial statements to assess creditworthiness of borrowers and determine appropriate credit limits

- Evaluated customer’s credit application to identify risk factors and accurately assess credit risk

- Created credit ratings to determine the level of risk associated with each customer

- Developed risk evaluation strategies to minimize the risk associated with lending

- Negotiated loan terms and managed banking relationships with customers

- Provided guidance to customers on financial matters to build strong credit relationships

- Maintained accurate records of customer data and updated credit information on a regular basis

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Analyst Resume with 10 Years of Experience

A highly experienced Credit Analyst with 10 years of experience in evaluating creditworthiness, analyzing financial data, and determining credit risk. Possess a detailed knowledge of credit risk management and banking regulations. Skilled in leading credit risk assessment and leveraging financial statement analysis to identify any potential risks. Proactive in managing customer relations, ensuring customer satisfaction through strong customer service and good communication.

Core Skills:

- Credit Risk Analysis

- Financial Statement Analysis

- Risk Mitigation

- Banking Regulations

- Customer Relationship Management

- Credit Estimation

- Credit Authorization

Responsibilities:

- Analyze relevant financial information, such as credit references, related to customers and businesses applying for credit.

- Carry out risk assessment of clients to determine their creditworthiness.

- Monitor existing accounts for changes in credit risk.

- Provide credit recommendations and decisions based on credit risk findings.

- Work with customers to resolve credit issues, negotiate payment plans, and ensure customer satisfaction.

- Develop and maintain a comprehensive knowledge of banking regulations and credit policies.

- Propose and implement credit risk mitigation strategies.

- Perform loan analysis and review credit agreements.

- Provide guidance to customers on how to improve credit scores.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Analyst Resume with 15 Years of Experience

Highly analytical and detail- oriented credit analyst with over 15 years of experience in the banking and finance industry. Skilled in assessing the financial and creditworthiness of clients, maintaining and monitoring portfolios, and analyzing market trends. Experienced in developing financial models and forecasts, risk management, and portfolio optimization. Adept in utilizing financial analysis software and maintaining relationships with clients.

Core Skills:

- Financial Analysis & Modeling

- Credit Risk Analysis

- Portfolio Management

- Financial Forecasting

- Market Analysis

- Account Reconciliation

- Data Collection & Analysis

- Credit Portfolio Optimization

- Software Proficiency

- Financial Reporting & Presentation

Responsibilities:

- Assessed the financial backgrounds, credit worthiness, and liquidity of borrowers and investors to determine eligibility for financing.

- Conducted financial analysis and developed financial models to assess credit risk and forecast potential returns.

- Developed risk management and portfolio optimization strategies to ensure valuations and investment returns remain within acceptable risk profile.

- Monitored and updated portfolio performance to identify key trends, outliers, and correlations.

- Collected data and prepared regular reports on financial performance and creditworthiness for internal and external stakeholders.

- Developed and maintained strong professional relationships with customers and external partners.

- Analyzed market trends to identify opportunities and issue early warnings of potential risks.

- Reconciled accounts to ensure accuracy of financial statements and transactions.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Analyst resume?

Having a well-crafted resume for your Credit Analyst position is essential for getting an interview. Your resume should draw attention to your qualifications, relevant experience, and accomplishments to make a good impression on hiring managers.

When creating your resume for a Credit Analyst role, here are some of the important details to include:

- Education: List your education qualifications, including the name of your degree and the institution where you attended.

- Work Experience: Include your current and past positions in reverse chronological order. Note the years of employment, the name of your employer, and a brief description of your job duties and accomplishments.

- Technical Skills: List any technical skills that you possess that are related to the Credit Analyst role such as accounting software or data analysis.

- Analytical Skills: Showcase your analytical skills with examples of how you have used them to solve problems.

- Communication Skills: Highlight your communication skills and demonstrate how you have used them to explain complex concepts or resolve issues.

- Interpersonal Skills: Describe your ability to work with diverse teams and how you have used those skills to collaborate effectively.

- Leadership: If you have any prior leadership experience, make sure to mention it on your resume.

By including all of these details, you can create a resume that will stand out from the competition and help you get closer to your dream Credit Analyst role.

What is a good summary for a Credit Analyst resume?

A good summary for a credit analyst resume should highlight the individual’s knowledge of both financial and credit analysis principles, as well as their ability to interpret complex data and identify patterns and potential issues. The summary should also include a brief description of the individual’s experience, such as the type of credit analysis performed and the industries in which the individual has worked. Additionally, the summary should detail the individual’s problem-solving skills, organizational skills, and communication abilities. Finally, the summary should highlight the individual’s dedication to staying up to date with industry trends and best practices.

What is a good objective for a Credit Analyst resume?

A Credit Analyst is responsible for the evaluation and approval of loan applications. They must analyze financial documents to determine a borrower’s creditworthiness and ability to repay loans. An effective Credit Analyst resume should demonstrate a thorough understanding of financial regulations, lending policies, and credit risk management. A good objective for a Credit Analyst resume should emphasize these qualities as well as any related experience and educational qualifications.

Some potential objectives for a Credit Analyst resume include:

- To leverage my knowledge of financial regulations and risk management strategies to assess credit risk and evaluate loan applications.

- To provide superior credit analysis and risk management services, utilizing my expertise in financial regulations and lending policies.

- To use my financial analysis skills and knowledge of credit risk management to make informed decisions in determining creditworthiness.

- To work collaboratively with a team of credit analysts to review and evaluate loan applications and creditworthiness.

- To utilize my Bachelor’s degree in Economics and experience in credit analysis to effectively assess and approve loan applications.

- To use my strong analytical, organizational, and problem solving skills to effectively evaluate loan applications and assess risk.

By emphasizing qualifications, experience, and knowledge in a Credit Analyst resume objective, applicants can make a strong impression and demonstrate why they are a good fit for the position.

How do you list Credit Analyst skills on a resume?

When crafting a resume for a Credit Analyst role, listing the right skills can be a critical factor in gaining a prospective employer’s attention. As a Credit Analyst, you must demonstrate your ability to review and analyze financial data, make sound decisions, and offer guidance on risk management.

When listing your skills on a resume, you should include both soft and hard skills that are relevant for the position. Here are some skills you should include when crafting a resume for a Credit Analyst position:

- Financial data analysis: Ability to analyze financial data, review credit requests, and make sound decisions based on the information provided.

- Risk management: Ability to evaluate and manage risk associated with credit requests.

- Attention to detail: Ability to review and analyze financial data accurately and thoroughly.

- Decision-making: Proficiency in making sound decisions regarding credit requests based on financial data.

- Interpersonal communication: Ability to effectively communicate with customers, lenders, and other stakeholders.

- Problem-solving: Ability to identify and resolve issues related to credit requests.

- Time management: Ability to manage multiple tasks and prioritize efficiently.

By demonstrating these skills on your resume, you can show prospective employers your qualifications and abilities as a Credit Analyst. Being able to showcase your technical and interpersonal skills can help you stand out and increase your chances of being hired for the role.

What skills should I put on my resume for Credit Analyst?

When applying for a Credit Analyst role, it is important to showcase the necessary skills and experience on your resume. Showing that you have the right skills and qualifications will help you stand out as a candidate. Below are some of the skills employers may look for on a Credit Analyst’s resume:

- Credit Analysis: A Credit Analyst should have experience researching and analyzing credit reports, financial documents, and loan applications. They should also be familiar with credit scoring systems and the ability to make sound credit decisions.

- Financial Acumen: A Credit Analyst should have a solid understanding of financial concepts and principles, such as financial statements, budgeting, cash flow analysis, accounting, and financial reporting.

- Problem Solving: Credit Analysts must have excellent problem-solving skills in order to identify fraudulent activity and develop creative solutions for credit-related issues.

- Communication: Credit Analysts must have strong communication skills in order to effectively communicate with clients and lenders. They must also be able to explain complicated financial information in a clear and concise manner.

- Time Management: Credit Analysts must have excellent time management skills to stay organized and prioritize tasks in order to meet deadlines.

- Attention to Detail: Credit Analysts must be detail-oriented to accurately assess credit information and identify inconsistencies.

By including these skills on your resume, you can demonstrate that you have the qualifications and experience to excel in a Credit Analyst role.

Key takeaways for an Credit Analyst resume

If you’re looking to break into the world of finance as a credit analyst, having a strong resume is key. Your resume should not only showcase your qualifications, but also demonstrate your ability to analyze financial data and make sound decisions. Below are some key takeaways for creating the perfect credit analyst resume.

- Highlight Key Skills: When crafting your resume, make sure to highlight any knowledge, experience, or skills that make you an ideal candidate for a credit analyst position. This could include any experience working with financial statements and data, analyzing risk, or developing financial plans.

- Demonstrate Your Qualifications: To make yourself stand out from the competition, be sure to detail your qualifications such as any relevant certifications or education. If you have any experience working in the banking or finance industry, be sure to include this as well to further demonstrate your expertise.

- Showcase Your Achievements: If you have any examples of past successes or projects you were involved in, include these in your credit analyst resume. This could include any financial decisions you helped to make or any risk assessment strategies you implemented.

- Use the Appropriate Format: Make sure to use a professional and organized format when crafting your credit analyst resume. This includes using a clear and concise heading, objective statement, and section titles. Also, be sure to tailor your resume to the job you’re applying for and include relevant keywords to ensure it gets noticed by recruiters.

By following these tips, you will be able to create a strong resume that will make you stand out from the competition and help you land the credit analyst job of your dreams.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder