Writing a resume for a credit administrator role is a critical part of the job search process. A resume is one of the most important tools when looking for a job, as it serves as a first impression of your skills and qualifications for the position. Therefore, it is essential to make sure that your resume is tailored to the role you are applying for and stands out from the crowd. This guide will provide tips and examples on how to write a successful credit administrator resume that will increase your chances of getting hired.

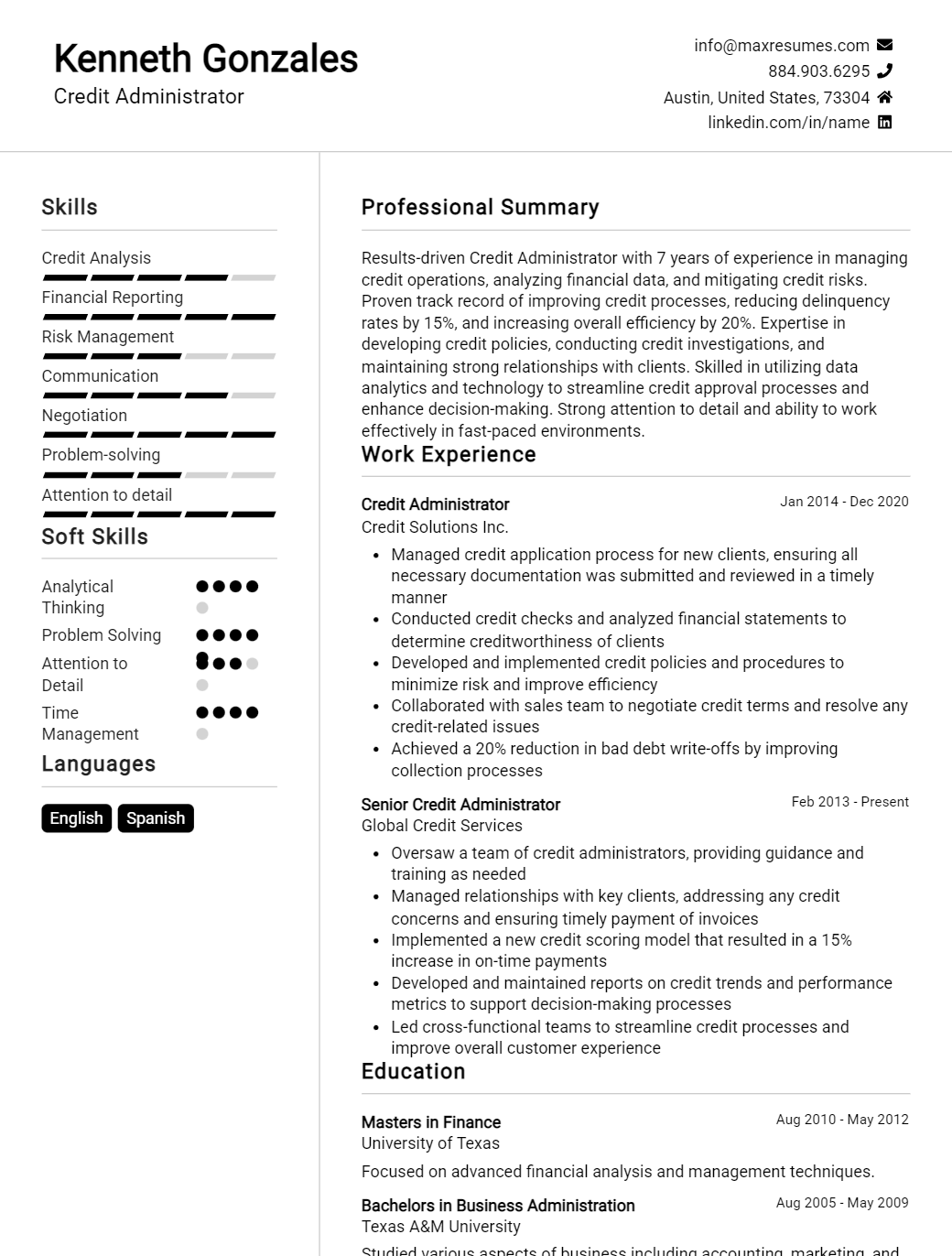

Credit Administrator Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Administrator Resume Examples

John Doe

Credit Administrator

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a Credit Administrator with five years of experience in the financial industry. I am a highly motivated and organized professional with excellent communication skills. I am experienced in managing a large portfolio of credit accounts, developing credit policies and procedures, and monitoring cash flow and credit risk. With a proven ability to analyze financial data, identify discrepancies and develop financial plans, I am a reliable asset to any organization.

Core Skills:

- Financial Data Analysis

- Project Management

- Credit Risk Management

- Cash Flow Management

- Credit Policies and Procedures

- Written and Verbal Communication

- Interpersonal Relations

Professional Experience:

Credit Administrator, ABC Bank, 2016 – Present

- Develop credit policies and procedures for the bank and manage credit risk.

- Analyze financial data and identify discrepancies to ensure accuracy.

- Monitor cash flow and develop financial plans and budgets.

- Manage a large portfolio of credit accounts and communicate with clients.

- Resolve customer complaints and disputes in a timely and effective manner.

Financial Analyst, XYZ Credit Union, 2015 – 2016

- Generated monthly, quarterly and annual financial reports.

- Assisted in the development of financial policies and procedures.

- Tracked and monitored accounts receivable.

- Developed financial models to analyze financial data.

Education:

Bachelor of Science in Finance, ABC University, 2015

Certified Credit Administrator, XYZ Institute, 2016

Credit Administrator Resume with No Experience

Highly motivated individual with a strong background in customer service and problem- solving skills. Seeking to become a Credit Administrator to utilize my organizational and communication abilities to help streamline the credit process.

Skills:

- Excellent customer service and problem- solving skills

- Detail- oriented and organized

- Ability to multi- task effectively

- Proficient in Microsoft Office Suite

- Reliable and dependable

Responsibilities:

- Process and review customer credit applications

- Collect and analyze customer financial information

- Verify customer identity and credit history

- Monitor customer accounts for payment discrepancies

- Communicate with customers regarding payment and credit terms

- Investigate credit issues with customers and banking institutions

- Manage customer credit limits and provide recommendations

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Administrator Resume with 2 Years of Experience

I am an experienced Credit Administrator with over two years of industry experience. I have a knack for effectively managing client accounts, processing payments and coordinating credit status for vendors. I am highly organized, detail- oriented and have strong analytical and problem- solving capabilities. I am an effective communicator who is able to build relationships with clients and vendors alike.

Core Skills:

- Account Management

- Credit Status Coordination

- Payment Processing

- Data Entry

- Analytical Skills

- Problem- solving Skills

- Communication Skills

Responsibilities:

- Maintained and managed client accounts

- Processed payments in a timely and accurate manner

- Coordinated credit status with vendors and clients

- Performed data entry tasks

- Monitored account balances and payment trends

- Resolved discrepancies with vendors

- Developed and maintained relationships with clients and vendors

- Analyzed and evaluated financial documents

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Administrator Resume with 5 Years of Experience

Highly experienced Credit Administrator with 5 years of experience managing the credit portfolios of clients. Proven track record of successful credit negotiations and collection within the banking and financial services industry. Expert in credit analysis and assessment of financial reports. Possesses an in- depth knowledge of the credit markets and able to create financial plans to reduce credit risk. Adept at reviewing and auditing customer records, as well as preparing and presenting credit reports.

Core Skills:

- Credit analysis

- Financial planning

- Credit negotiations

- Financial reporting

- Customer service

- Credit risk assessment

- Auditing

- Collection strategies

Responsibilities:

- Managed the credit portfolio of the bank’s clients

- Analyzed the creditworthiness of potential borrowers

- Assessed financial statements and credit reports of clients

- Negotiated credit terms and limits with clients

- Created financial plans to reduce credit risk

- Reviewed and audited customer records

- Prepared and presented monthly credit reports

- Developed collection strategies to recover delinquent payments

- Monitored customer credit activity to ensure compliance with terms and conditions

- Provided customer service to clients regarding credit inquiries and disputes

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Administrator Resume with 7 Years of Experience

Highly organized and motivated Credit Administrator with 7 years of experience in finance and credit management. Thorough knowledge of financial analysis, credit policies and procedures, and banking industry regulations. Excellent problem- solving and communication skills, works well with clients, staff, and management. Experienced in leading and managing credit departments, with a proven track record of implementing new strategies and processes to increase efficiency and improve overall credit risk.

Core Skills:

- Financial Analysis & Reporting

- Credit Risk Management

- Credit Policy & Procedure Development

- Regulatory Compliance

- Loan & Account Administration

- Credit & Collections Management

- Credit Investigations & Due Diligence

- Conflict Resolution & Negotiation

Responsibilities:

- Managed a team of credit analysts and staff, responsible for daily operations, training, and performance management.

- Developed and implemented credit policies and procedures to ensure compliance with banking regulations.

- Performed credit reviews and risk assessments for new and existing customers.

- Advised customers on loan and account opening, including documentation requirements and applicable fees.

- Reviewed customer financial statements and credit reports to assess creditworthiness.

- Monitored customer accounts for signs of delinquency or default and took corrective action as needed.

- Negotiated payment plans and restructured existing loans to improve customer creditworthiness.

- Conducted investigations into customer credit issues and provided recommendations to management.

- Reconciled customer accounts and prepared financial reports for senior management.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Administrator Resume with 10 Years of Experience

A highly motivated and experienced Credit Administrator with 10 years of experience in financial institutions. Proven track record in managing financial risks, assessing loan applications, and ensuring accurate data entry. Possesses strong knowledge in credit policies, regulations, and compliance, as well as excellent interpersonal and communication skills. Committed to providing and assisting with credit activities that are ethically sound and in compliance with relevant laws and regulations.

Core Skills:

- Financial Risk Assessment

- Credit Policies & Regulations

- Data Entry & Verification

- Interpersonal & Communication Skills

- Compliance & Regulations

- Decision Making

- Problem Solving

- Time Management

Responsibilities:

- Assisting in the assessment of loan applications

- Verifying and entering data into databases

- Ensuring compliance with relevant laws and regulations

- Assisting in the preparation of credit reports and analysis

- Monitoring credit activities and identifying risks

- Developing and implementing credit policies and procedures

- Evaluating credit reports and financial statements

- Resolving customer queries and complaints

- Liaising with other departments to ensure efficient credit processes

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Administrator Resume with 15 Years of Experience

A highly organized and efficient Credit Administrator with 15 years of experience in credit and risk management. Skilled at managing credit risks while providing solutions to complex financial issues. Has a proven track record of accurately assessing loan applications, monitoring account activity, and meeting strict deadlines. Possesses excellent communication and problem- solving skills, combined with the ability to collaborate with colleagues and clients.

Core Skills:

- Credit Risk Management

- Loan Application Assessment

- Account Monitoring

- Time Management

- Financial Analysis

- Record Keeping

- Data Analysis

- Communication

- Problem Solving

Responsibilities:

- Assess loan applications and risk factors, and set credit limits for customers

- Evaluate customer financial statements, credit reports, and other documents to determine credit decision

- Monitor customer accounts, record payment activity, and prepare monthly statements

- Follow up on past due accounts and collect payments in accordance with credit policies

- Analyze customer financial data to determine the ability to meet financial obligations

- Develop and implement credit policies and procedures to minimize risk

- Perform financial analysis utilizing electronic spreadsheets and other software

- Maintain accurate records, including customer information and credit data

- Collaborate with colleagues and customers to resolve issues related to credit

- Respond to customer inquiries, update account information, and provide credit counseling services

- Develop and maintain relationships with clients, lenders, and other financial institutions

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Administrator resume?

A Credit Administrator is responsible for overseeing the credit process and ensuring that proper credit accounts are established. A well-crafted resume can help you land a position in this important field. There are several key elements that should be included in a Credit Administrator resume.

- Professional Summary: Summarize your professional experience and qualifications. Include your years of experience, key areas of expertise, and any professional certifications you have earned.

- Education: List all relevant degrees and certifications. Be sure to include any courses or trainings related to credit administration.

- Work Experience: Include details about previous positions held in credit administration. Describe the scope of your duties and list any special projects or accomplishments.

- Skills: Outline the specific skills related to credit administration that you have developed. This may include knowledge of credit processes, risk management, and accounting principles.

- Achievements: List any awards or recognition you have received for your work in credit administration.

- Professional Affiliations: Include any professional organizations or associations you are a part of that are related to credit administration.

By ensuring that these key elements are included in your Credit Administrator resume, you will be better positioned to secure a position in this challenging field.

What is a good summary for a Credit Administrator resume?

A Credit Administrator resume should include a concise summary that highlights the applicant’s skills, qualifications, and experience in the credit field. This summary should demonstrate the applicant’s ability to manage the various aspects of credit services, such as loan processing, loan underwriting, and credit portfolio monitoring. The summary should also showcase the applicant’s knowledge in areas such as credit analysis, banking regulations, credit risk management, and financial reporting. This summary should also include any relevant certifications or training in the credit field. Additionally, the summary should reflect the applicant’s problem-solving, analytical, and organizational skills. Finally, the summary should clearly state the applicant’s career goals and how they plan to achieve them.

What is a good objective for a Credit Administrator resume?

A Credit Administrator resume should always include a clear and targeted objective statement. This statement should be tailored to the job that you are applying for and should highlight your skills and experience as they relate to the job. A good objective should be short, concise, and to the point.

Here are a few examples of good objectives for a Credit Administrator resume:

- To obtain a Credit Administrator position utilizing my financial background and expertise in credit administration.

- To obtain a Credit Administrator position in a fast-paced, high-volume environment that offers growth potential and challenges.

- Seeking a Credit Administrator position where I can use my knowledge and experience to ensure the accurate and efficient processing of credit applications.

- To secure a Credit Administrator position in a company that requires a highly organized and detail-oriented professional.

- To acquire a Credit Administrator position in order to utilize my financial management and customer service skills.

How do you list Credit Administrator skills on a resume?

A Credit Administrator is responsible for managing, tracking, and analyzing an organization’s credit activity. They must have strong organizational and communication skills, as well as analytical and problem-solving abilities. When listing Credit Administrator skills on a resume, it is important to highlight the abilities that make you qualified for the role. Here are some skills to consider including:

- Credit Risk Analysis: The ability to identify and manage credit risks, and to evaluate creditworthiness of potential customers.

- Financial Analysis: The ability to gather and analyze financial data to determine creditworthiness and make credit decisions.

- Communication: The capacity to work and communicate effectively with others to explain credit terms, resolve disputes, and ensure customer satisfaction.

- Documentation: The ability to create and maintain accurate and detailed credit-related documents.

- Regulatory Compliance: The capacity to adhere to laws and regulations related to credit and lending.

- Problem-Solving: The ability to identify and resolve credit-related issues quickly and efficiently.

- Negotiation: The capacity to negotiate terms of credit while protecting company interests.

- Organization: The ability to effectively organize and prioritize tasks related to credit management.

What skills should I put on my resume for Credit Administrator?

As a Credit Administrator, you will be responsible for overseeing the credit and collection operations of a company. Your resume should reflect your skills and experience in this role. Here are some skills you should consider including on your resume:

- Credit Analysis: Demonstrate your ability to review customer credit applications and assess risk levels.

- Accounts Receivable: Showcase your knowledge of the accounts receivable process, including tracking payments and accounting for collections.

- Collection Strategies: Highlight your understanding of different collection strategies, such as negotiation, arbitration, and legal action.

- Financial Reporting: Showcase your ability to prepare monthly and annual financial reports for upper management.

- Risk Management: Demonstrate your skills in managing risk, such as setting credit limits and monitoring customer activity.

- Customer Service: Demonstrate your ability to efficiently and effectively resolve customer inquiries and complaints.

- Data Analysis: Showcase your ability to analyze financial data and make informed decisions based on the results.

By including the above skills on your resume, you can demonstrate to employers that you are an experienced and competent Credit Administrator.

Key takeaways for an Credit Administrator resume

When crafting a resume for a Credit Administrator position, there are some key takeaways to keep in mind. A Credit Administrator is responsible for initiating, processing, and managing credit approvals. This position requires a high degree of accuracy and attention to detail.

To ensure that your Credit Administrator resume stands out, here are some key points to consider:

- Highlight relevant work experience: Make sure to include any prior experience in Credit Administration or related fields, such as Accounting or Finance. Include job titles, a description of duties, and the length of time in each role.

- Detail your knowledge of credit processes: Demonstrate your understanding of the credit process and any related systems, such as credit scoring algorithms.

- Showcase your ability to collaborate: Credit Administrators must be able to work effectively with a variety of internal and external stakeholders. Showcase your interpersonal and communication skills, as well as your ability to work in a team environment.

- Include related certifications: If you have any certifications related to Credit Administration, such as a Certified Credit Professional (CCP) designation, make sure to include these on your resume.

- Quantify your accomplishments: When listing accomplishments, try to include metrics and numbers whenever possible. This is an effective way to demonstrate your impact and value to a potential employer.

By keeping these takeaways in mind, you will be able to create a Credit Administrator resume that stands out and gives you the best chance of landing an interview.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder