Having a well-crafted resume is essential for any professional looking to land their dream job, especially in the competitive field of corporate tax accounting. A resume that is well-written and reflects the qualities and experiences you bring to the role can be a powerful weapon in your job search arsenal. To help you write an effective resume, this guide will provide tips on how to write a corporate tax accountant resume, along with a few examples of how it should look. From how to structure the document, to what types of skills and experiences to include, this guide will walk you through the process of creating a resume that will get you noticed by potential employers.

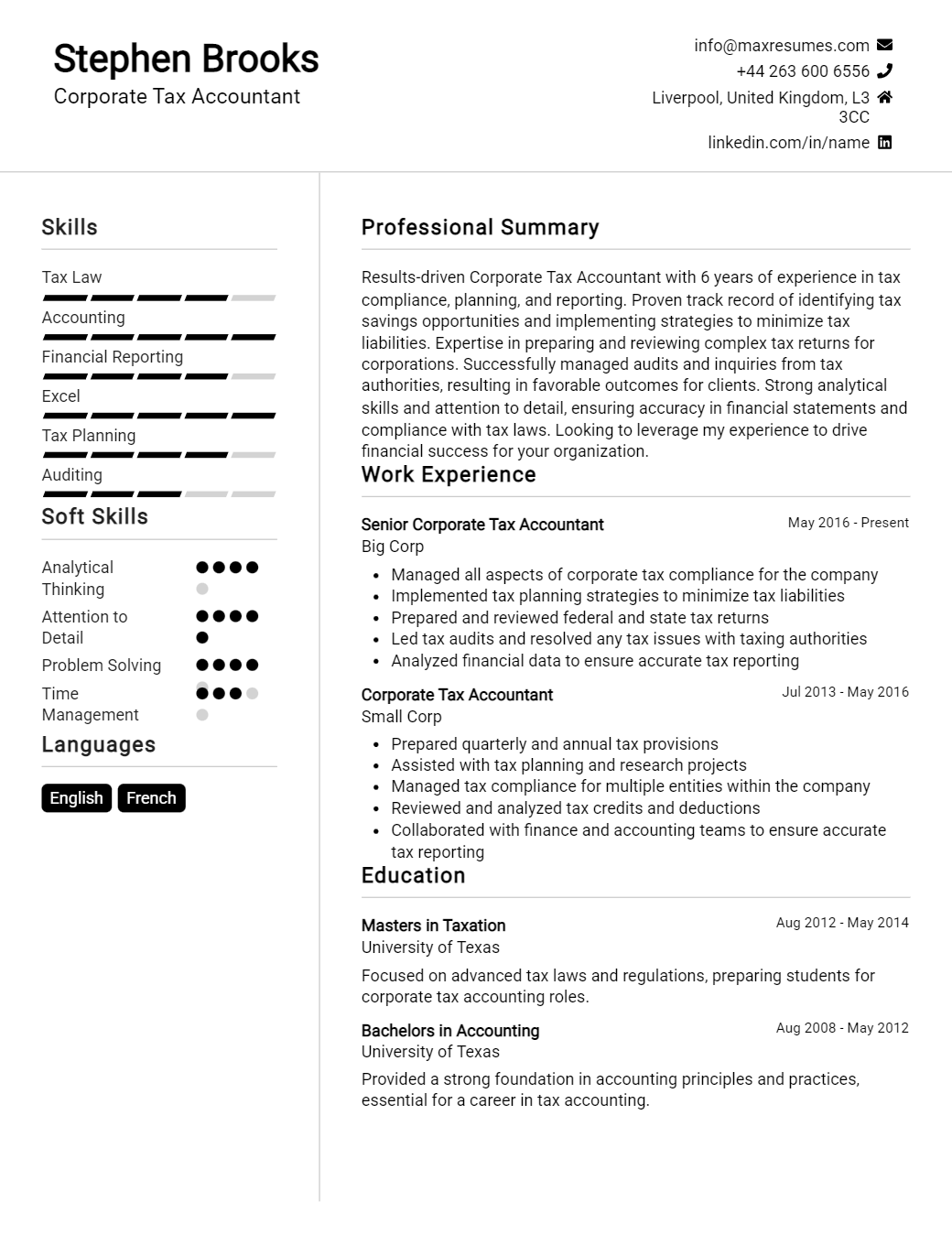

Corporate Tax Accountant Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Corporate Tax Accountant Resume Examples

John Doe

Corporate Tax Accountant

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a Corporate Tax Accountant with 10+ years of experience in a range of tax reporting and compliance services. I have extensive knowledge of tax laws and regulations and possess strong project planning and management skills. I have an in- depth understanding of corporate structuring and taxation strategies, and I have experience working with global and domestic companies. I have a proven track record of successfully managing tax planning and filing deadlines, and I am able to handle complex tax projects with ease.

Core Skills:

- In- depth knowledge of corporate tax laws and regulations

- Tax planning and reporting

- Proficient with tax software and filing systems

- Project management and effective time management

- Technical writing, analysis, and problem solving

- Strong organizational and communication skills

- Able to work independently and in a team

Professional Experience:

Tax Accountant, ABC Company – New York, NY

- Prepared and filed quarterly and annual corporate tax returns

- Assisted in the evaluation of state and federal tax legislation and its impact on the company’s financial statements

- Developed and implemented a comprehensive tax planning strategy

- Documented tax information and financial transactions for auditing purposes

- Advised management on relevant tax issues

- Researched and resolved complex tax issues

Tax Manager, XYZ Company – Los Angeles, CA

- Oversaw and managed the corporate tax compliance process

- Prepared tax returns and tax provisions

- Analyzed and reviewed financial statements and other financial data

- Prepared and submitted various reports to government agencies

- Participated in tax audits and negotiations with tax authorities

- Provided technical tax advice and counsel to clients

Education:

Bachelor of Science in Accounting, University of Texas – Austin, Texas

Certified Public Accountant

Corporate Tax Accountant Resume with No Experience

Recent accounting graduate with an eagerness to learn and an understanding of financial regulations and corporate tax strategies. I am looking to develop my skills and abilities as a corporate tax accountant and to contribute to a company that values hard work and dedication to excellence.

Skills

- Strong analytical and problem- solving skills

- Excellent communication and interpersonal skills

- Proficient in Microsoft Office Suite

- Knowledge of accounting software and databases

- Ability to identify and address compliance issues

- Ability to research and interpret tax laws and regulations

Responsibilities

- Assist in the preparation of tax returns for corporations

- Assist in the review of financial documents

- Analyze financial transactions and records for compliance with applicable tax laws

- Identify and address tax- related issues

- Maintain accurate records of all tax documents

- Research tax legislation and interpret new tax regulations

- Provide feedback to management on potential tax- related risks and opportunities

- Stay up to date with changes in tax regulations and laws

Experience

0 Years

Level

Junior

Education

Bachelor’s

Corporate Tax Accountant Resume with 2 Years of Experience

An experienced Corporate Tax Accountant with 2+ years of experience in preparing tax returns and financial statements, performing analysis and audits, and providing financial guidance to clients. Possesses extensive knowledge of tax regulations, laws, and accounting principles; excellent organizational, communication, and problem solving skills.

Core Skills:

- Tax Preparation

- Financial Statements

- Analysis

- Auditing

- Tax Regulations

- Problem Solving

- Communication

Responsibilities:

- Preparation of corporate tax returns and financial statements in accordance with IRS regulations

- Identification and analysis of tax implications of transactions

- Research of federal and state tax laws, regulations, and guidelines

- Auditing of financial statements for accuracy and compliance with tax regulations

- Provision of financial guidance to clients on tax related matters

- Maintenance of records and files to ensure compliance with IRS regulations

- Preparation of reports and presentations to management on tax related matters

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Corporate Tax Accountant Resume with 5 Years of Experience

An experienced and knowledgeable tax accountant with five years in the field. Possesses expertise in the field of taxation and has an in- depth understanding of the federal and state tax codes. Has a proven track record of accuracy and efficiency in preparing, reviewing, and managing individual and corporate tax returns. Skilled in tax research and planning, and able to provide valuable insight and advice to clients regarding tax- related matters.

Core Skills:

- Knowledgeable in federal and state tax codes

- Tax research and planning

- Preparation, review, and management of individual and corporate tax returns

- Accuracy and efficiency in record keeping

- Client communications and consultation

- Ability to work independently and meet deadlines

Responsibilities:

- Calculate taxes owed and prepare tax returns, ensuring compliance with payment, reporting and other tax requirements

- Research and analyze tax legislation to determine the most beneficial tax strategies for clients

- Prepare monthly, quarterly and annual financial reports for clients

- Manage the preparation of complex tax returns, including those for corporations and other business entities

- Develop tax plans and strategies to minimize tax liabilities

- Respond to inquiries from clients and the Internal Revenue Service (IRS)

- Prepare and maintain records of financial transactions

- Monitor changes in tax law and regulations and ensure compliance

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Corporate Tax Accountant Resume with 7 Years of Experience

A results- driven corporate tax accountant with 7 years of experience in working with public and private sector clients. Demonstrated ability to analyze financial data, prepare and file tax returns, and provide guidance on tax issues. Proficient in working with accounting software and financial systems. Track record of providing accurate and timely financial reports to clients.

Core Skills:

- Public and private sector tax expertise

- Financial reporting and analysis

- Tax return preparation and filing

- Accounting software proficiency

- Excellent organizational skills

Responsibilities:

- Conducted tax planning, research and analysis to optimize the tax benefits for corporate clients

- Prepared and filed accurate and timely corporate tax returns

- Managed the corporate tax accounting processes and systems

- Provided guidance on complex tax issues to clients

- Reviewed and analyzed financial data to ensure accuracy and compliance with tax regulations

- Ensured the accurate and timely reporting of financial information to clients

- Assisted with the development and implementation of new accounting systems and processes

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Corporate Tax Accountant Resume with 10 Years of Experience

An experienced Corporate Tax Accountant with 10 years of experience in providing tax planning and preparation services, financial reporting, and consulting to both public and private companies. Proven ability to research complex tax issues and interpret and apply the most relevant tax law to identify and generate tax savings opportunities. Possesses strong communication, problem- solving and interpersonal skills in providing tax advice to clients.

Core Skills:

- Tax Planning and Preparation

- Financial Reporting

- Tax Research and Analysis

- Tax Law Interpretation

- Interpersonal and Communication Skills

- Problem- Solving

- Consulting

Responsibilities:

- Prepare US and international corporate tax filings

- Identify and implement tax savings strategies

- Prepare financial statements and related schedules

- Research complex tax issues and interpret and apply related tax law

- Provide tax advice and assistance to clients

- Ensure compliance with regulations, laws and policies

- Review and recommend tax planning strategies

- Perform ad- hoc analysis and other duties as needed

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Corporate Tax Accountant Resume with 15 Years of Experience

Highly experienced Corporate Tax Accountant with 15 years of experience in the finance industry. Skilled in all areas of accounting, including tax preparation, internal auditing and financial reporting. Proficient in analyzing data and implementing financial strategies to maximize profitability. Excellent understanding of tax codes and regulations, as well as establishing successful client relationships.

Core Skills:

- Accurate and timely financial reporting

- Strategic tax planning

- Thorough knowledge of relevant laws and regulations

- Tax return preparation

- Auditing and budgeting

- Analyzing data, trends and projections

- Interpreting and implementing complex tax regulations

- Developing efficient filing systems

- Excellent problem- solving and communication skills

Responsibilities:

- Prepare and review tax returns and ensure accurate and timely filing of returns

- Analyze financial data and develop financial strategies to maximize profitability

- Review and ensure compliance with all federal and state regulations

- Assist with internal and external audits, as needed

- Prepare and review financial statements and budgets

- Monitor and analyze tax trends and changes in regulations

- Monitor accounts and reconcile discrepancies

- Manage client relationships and respond to client inquiries

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Corporate Tax Accountant resume?

When writing a corporate tax accountant resume, it is important to highlight your key technical and professional qualifications. A well-written resume should include the following information:

- Education: List the highest degree or diploma you have completed, as well as any relevant certificates or professional designations.

- Experience: Include any relevant prior experience in the corporate tax field, such as working with businesses to plan, prepare and file their taxes.

- Skills: List any technical skills related to corporate tax, such as knowledge of accounting principles, corporate tax regulations and tax preparation software.

- Specializations: If you have experience in a specialized area of corporate tax, such as international taxation or transfer pricing, be sure to include these details.

- Awards and Recognition: If you have received any awards or recognition for your work, list them here.

- Professional Memberships or Affiliations: If you are part of any professional organizations, list them here.

- Personal Attributes: Include any personal attributes that make you unique, such as excellent communication and problem-solving skills, or the ability to work well in a team environment.

What is a good summary for a Corporate Tax Accountant resume?

A Corporate Tax Accountant is responsible for ensuring that all taxes for a company are accurately and efficiently filed. A strong Corporate Tax Accountant resume should demonstrate a candidate’s knowledge of tax laws and procedures, as well as their experience in dealing with complex financial and tax matters.

The summary statement in a Corporate Tax Accountant resume should highlight the applicant’s years of experience in the field and the technical skills they possess. It should also showcase their ability to stay current with changes in the tax regulatory environment and to collaborate with other professionals. An ideal summary statement will include a combination of the following:

- Proven experience in preparing corporate tax returns and executing tax strategies

- Thorough knowledge of tax laws and regulations

- Ability to interpret financial statements and audit reports for tax preparation

- Proficiency in using tax software and financial systems

- Excellent problem-solving and critical thinking skills

- Strong communication and interpersonal skills

- Ability to work independently or as part of a team

What is a good objective for a Corporate Tax Accountant resume?

A Corporate Tax Accountant is responsible for tax preparation and filing, analyzing financial records, and maintaining accurate financial information. It is important to have an objective on each resume in order to clearly explain to potential employers what you are looking for in a position. Here are some good objectives for a Corporate Tax Accountant resume:

- To secure a challenging and rewarding role as a Corporate Tax Accountant where I can utilize my knowledge in accounting and taxation to contribute to the success of the organization.

- To obtain a responsible Corporate Tax Accountant position in a professional environment, to utilize my experience in financial analysis, accounting, and tax compliance.

- To obtain a position as a Corporate Tax Accountant where I can apply my technical knowledge and expertise in the preparation and filing of taxes.

- To become a Corporate Tax Accountant, using my experience and expertise in financial analysis and compliance, to help the organization achieve its goals.

- To obtain a position as a Corporate Tax Accountant utilizing my knowledge and experience in taxation, financial statement preparation, and financial planning.

How do you list Corporate Tax Accountant skills on a resume?

Your Corporate Tax Accountant resume should illustrate the hard and soft skills that make you unique and suitable for the position. A comprehensive resume showcases your technical and analytical skills, as well as the ability to handle confidential and sensitive data. Here are some skills to consider when listing your skills on a Corporate Tax Accountant resume:

- Excellent numeracy and analytical skills: Corporate Tax Accountants must be able to interpret and analyze tax data in order to prepare accurate reports, file returns, and identify potential savings.

- Strong attention to detail: Corporate Tax Accountants must have a high level of accuracy and thoroughness to ensure that all financial records and documents are accurate and complete.

- Advanced knowledge of tax laws and regulations: A thorough understanding of federal and state tax laws and regulations is essential for Corporate Tax Accountants.

- Excellent communication and interpersonal skills: Corporate Tax Accountants must be able to effectively communicate and work with clients, colleagues, and other stakeholders.

- Proficient with financial software: Corporate Tax Accountants must be skilled in using financial software such as QuickBooks and TurboTax, in order to efficiently and accurately prepare returns and reports.

- Ability to work independently: Corporate Tax Accountants must be able to independently manage their workload and prioritize tasks in order to meet deadlines.

What skills should I put on my resume for Corporate Tax Accountant?

As a Corporate Tax Accountant, employers will expect you to have the right qualifications, certifications, and skills to be successful in the role. When crafting your resume, make sure you include the following skills to be sure you stand out from the competition.

- Professional Certification: Employers want to know that you are qualified to work as a Corporate Tax Accountant. Include any professional certifications you hold, such as Certified Public Accountant (CPA), Certified Internal Auditor (CIA), or Chartered Tax Professional (CTP).

- Tax Compliance Knowledge: Corporate Tax Accountants must understand the complexities of federal, state, and local tax laws and regulations. Make sure your resume reflects your knowledge of tax compliance and how to accurately prepare and file tax returns.

- Expertise in Tax Preparation Software: Many Corporate Tax Accountants use tax preparation software to help them accurately prepare and file tax returns. Be sure to mention any experience you have with popular tax preparation software, such as Intuit’s TurboTax, TaxAct, and TaxSlayer.

- Accounting Knowledge: As a Corporate Tax Accountant, you will be expected to know the basics of accounting, such as bookkeeping, financial reporting, and internal controls. Demonstrate to employers that you have a good understanding of accounting concepts and processes.

- Research and Analytical Skills: Corporate Tax Accountants must be able to research tax laws and regulations, analyze financial data, and draw conclusions from the data. Include any research and analytical skills you have in order to show employers you have the ability to identify trends and make decisions based on the data.

- Strong Communication Skills: Corporate Tax Accountants must be able to communicate effectively with clients and other stakeholders. Make sure you mention any communication skills you have, such as verbal and written communication, active listening, and problem-solving.

Key takeaways for an Corporate Tax Accountant resume

When it comes to writing a resume as a corporate tax accountant, there are certain key takeaways that you need to consider to make sure it stands out from the rest. As a corporate tax accountant, it’s important that you demonstrate your understanding of the tax system, as well as your ability to think strategically to make sure companies pay the right amount of taxes. Here are some key takeaways to consider when writing your resume:

- Highlight Your Technical Knowledge: It’s important to demonstrate your understanding of tax law and regulations on your resume. Make sure to highlight any courses you took in tax law or accounting, as well as any certifications or experience you have in this field. Showcasing your technical knowledge will make you more attractive to potential employers.

- Show Your Strategic Thinking Skills: Corporate tax accountants must be able to think strategically when it comes to minimizing a company’s tax obligations. You should demonstrate your problem-solving skills and ability to think of creative solutions to tax problems. This can include any successes you have had in minimizing a company’s tax payments.

- Demonstrate Your Research Abilities: Tax law is constantly changing and evolving, so it’s important to show potential employers that you can stay on top of the latest changes. Demonstrate your researching ability by showcasing any reports or articles you have written related to tax law.

- Showcase Your Organizational Skills: One of the key skills of any corporate tax accountant is their ability to organize and analyze data. Showcase any times you have used software such as Excel to create efficient reports. This will demonstrate your ability to take raw data and turn it into useful information.

By following these key takeaways, you can create the perfect resume for a corporate tax accountant. Make sure to highlight your technical knowledge, strategic thinking skills, research abilities, and organizational skills to make sure you stand out from the competition.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder