A commission analyst resume is a critical document for anyone looking to stand out from other applicants and secure a job in this highly competitive field. Writing a successful resume requires a great deal of research, thought, and creativity. Knowing which skills and experiences to emphasize and what details to include can be a daunting process. That’s why it’s important to have a handy guide that can help you craft a strong and effective resume. This guide will provide you with all the information you need to create a commission analyst resume that stands out from the competition. We’ll walk through the essential components of a good resume, provide examples of commission analyst resumes, and offer useful tips on how to make your resume shine.

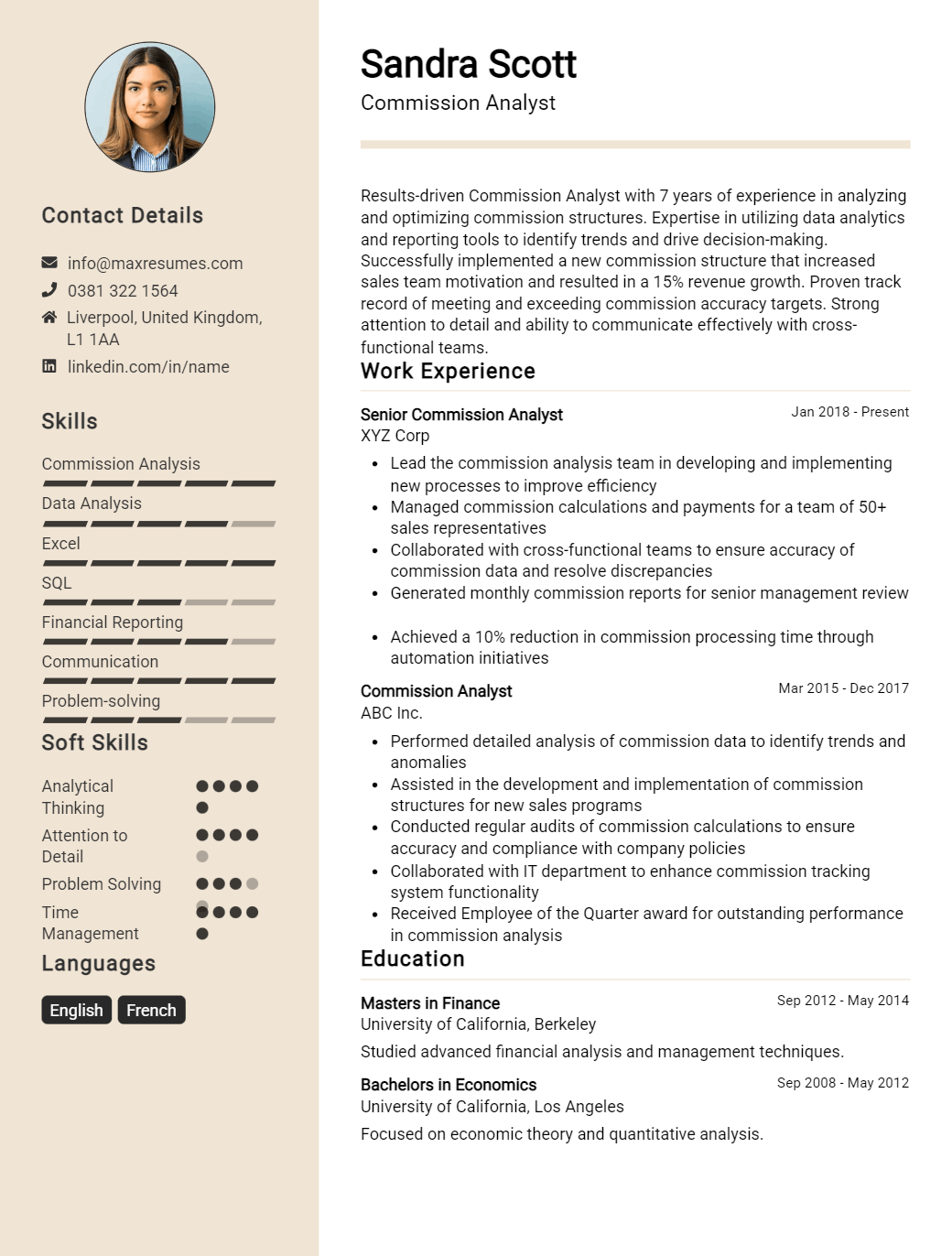

Commission Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Commission Analyst Resume Examples

John Doe

Commission Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a Commission Analyst with over 5 years of experience in the banking industry. I have extensive knowledge of financial regulations and bank policies, as well as a strong understanding of financial positions and trends. I have a proven track record of accurately analyzing commissions, helping to reduce costs, and improving profitability. My experience includes developing highly effective commission plans, performing competitive analysis, and recommending changes to optimize commission structure. I am also highly organized and have excellent communication skills.

Core Skills:

- Commission Analysis

- Financial Regulations & Bank Policies

- Competitive Analysis

- Commission Plan Development

- Cost Reduction Strategies

- Profitability Optimization

- Excellent Communication Skills

- Highly Organized

Professional Experience:

Commission Analyst, Bank XYZ – Los Angeles, CA

- Developed commission plans to ensure compliance with regulatory requirements and organizational policies.

- Analyzed commissions and suggested changes to optimize cost effectiveness and profitability.

- Performed competitive analysis and benchmarking against other financial institutions.

- Implemented cost reduction strategies to improve overall profitability and increase market share.

- Developed reports and presented findings to senior management.

Commission Analyst, Bank ABC – New York, NY

- Conducted research and provided analysis of commission trends and market dynamics.

- Created and maintained databases of financial and commission data.

- Collaborated with finance and legal departments to ensure compliance with regulations.

- Developed strategies to improve commission processes and optimize costs.

- Advised senior management on commission structures and opportunities.

Education:

Bachelor of Science in Business Administration, California State University, Los Angeles, CA

Commission Analyst Resume with No Experience

Recent college graduate with a B.A. in Business Management, eager to apply my knowledge and skills to a commission analyst role. Demonstrated strong analytical and problem- solving abilities and the ability to work independently or collaboratively. Proven ability to learn quickly and adapt to new concepts.

Skills:

- Analytical Skills

- Organizational Skills

- Interpersonal Skills

- Mathematics

- Computer Skills

- Communication Skills

Responsibilities:

- Develop and maintain a detailed understanding of the company’s commission structure

- Utilize analytical skills to analyze and report on commission- related data

- Create and maintain commission reports for internal and external stakeholders

- Monitor commission performance and make recommendations for improvements

- Research and develop commission structures for new products

- Reach out to sales representatives and provide guidance on commission structures and strategies

- Collaborate with internal teams to ensure the accuracy and integrity of commission data

Experience

0 Years

Level

Junior

Education

Bachelor’s

Commission Analyst Resume with 2 Years of Experience

A highly motivated professional with two years of experience as a Commission Analyst. Possess a Bachelor’s degree in Business Administration and outstanding skills in data analysis and problem- solving. Adept in creating and analyzing commission structures, researching customer data, and monitoring and analyzing sales trends. Experienced in using commission and incentive software. Proven record of success in meeting and exceeding goals.

Core Skills:

- Data Analysis

- Commission Structures

- Problem- Solving

- Analyzing Sales Trends

- Customer Data Research

- Commission and Incentive Software

- Goal Setting and Achievement

Responsibilities:

- Developed and implemented commission plans for all sales staff.

- Conducted periodic analysis to ensure commission calculations were correct.

- Created customized commission plans for high- performing sales staff.

- Monitored sales trends and gathered customer data to identify potential sales opportunities.

- Communicated commission plans and policies to sales staff.

- Utilized commission and incentive software to track sales performance and commission payments.

- Researched industry trends and customer feedback to improve the effectiveness of commission plans.

- Created reports and presentations to convey insights and strategies to senior management.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Commission Analyst Resume with 5 Years of Experience

Highly motivated and detail- oriented Commission Analyst with 5 years of experience in financial planning and analysis, budgeting and forecasting, client management and commission calculation. Proven ability to develop and implement effective commission plans that maximize company revenues and boost customer and employee satisfaction. Experienced in providing advice and guidance to teams on how to maximize commission earnings and create effective strategies to achieve desired outcomes.

Core Skills:

- Financial Planning & Analysis

- Budgeting & Forecasting

- Client Management

- Commission Calculation

- Customer Service

- Strategic Planning

- Problem- Solving

- Excellent Communication Skills

Responsibilities:

- Calculated and tracked sales commissions for all sales team members, ensuring accuracy of commissions and proper payment to sales team.

- Developed and implemented commission plans that maximized company revenues while also increasing customer satisfaction.

- Provided advice and guidance to sales teams on how to maximize commission earnings.

- Conducted financial planning, budgeting, and forecasting analyses to assist in the development of commission plans.

- Developed and maintained relationships with clients to ensure satisfaction with commission plans and services.

- Resolved customer complaints and escalated issues to the appropriate personnel for resolution.

- Generated reports and assisted with account reconciliation for clients.

- Developed and implemented strategies to achieve desired outcomes when planning and calculating commissions.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Commission Analyst Resume with 7 Years of Experience

A well- organized and detail- oriented Commission Analyst with 7 years of professional experience providing financial solutions to clients. Proven track record of working with commission structures, customer relationships, and customer data. Skilled in analyzing market trends and customer data to identify customer needs and develop strategies to meet those needs. Experienced in preparing detailed reports and summarizing financial data for senior management. Possess excellent organizational, customer service, and communication skills.

Core Skills:

- Commission Structures

- Customer Relationships

- Customer Data Analysis

- Financial Data Analysis

- Market Trends Analysis

- Data Reporting

- Organizational Skills

- Customer Service

- Communication Skills

Responsibilities:

- Analyze customer data and market trends to identify customer needs and develop strategies to meet those needs

- Develop commission structures to maximize customer satisfaction and profitability

- Prepare detailed reports and summaries to be presented to senior management

- Manage customer relationships and record customer data

- Monitor and analyze customer trends and preferences to ensure customer satisfaction

- Provide customer service and respond to inquiries and requests in a timely manner

- Collaborate with other departments to ensure customer needs and expectations are met

- Ensure compliance with industry regulations and company policies and procedures

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Commission Analyst Resume with 10 Years of Experience

A highly experienced Commission Analyst with 10 years of experience in the financial services industry. Skilled in analyzing and optimizing commission payment processes, implementing commission tracking systems, and conducting financial analysis. Possess an in- depth knowledge of financial regulations and a strong understanding of customer service. A team player with excellent communication and organizational skills, who is able to work independently and as part of a larger team.

Core Skills:

- Financial Analysis

- Commission Payment Processes

- Commission Tracking System

- Financial Regulations

- Customer Service

- Excellent Communication Skills

- Organizational Skills

- Team Player

Responsibilities:

- Analyzing and optimizing commission payment processes.

- Developing and implementing commission tracking systems.

- Creating reports for management on commission payments and data.

- Monitoring commission payments to ensure accuracy and compliance.

- Assisting in the development of financial policies and procedures.

- Investigating discrepancies related to commission payments.

- Coordinating with internal and external stakeholders for commission payment information.

- Evaluating financial statements and data for accuracy.

- Providing customer service and support to clients.

- Ensuring compliance with applicable regulations related to commission payments.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Commission Analyst Resume with 15 Years of Experience

A highly experienced Commission Analyst with 15 years of experience working in a variety of corporate and financial environments. Expert in commission calculations, incentive structures, and financial reporting. Possesses excellent communication skills, attention to detail, and the ability to work independently and with a team. Strong understanding of financial principles and the ability to work with large amounts of data with accuracy and efficiency.

Core Skills:

- Commission Calculations

- Incentive Structures

- Financial Reporting

- Data Analysis

- Communication

- Aptitude for Numbers

- Teamwork

- Problem- solving

Responsibilities:

- Analyze sales data to calculate commissions and incentives

- Assist with the development of commission plans

- Monitor monthly sales and commission reports

- Assist with reconciliation and payment processes

- Maintains accurate records of individual and team performance

- Prepare and review financial statements

- Identify discrepancies and investigate inconsistencies

- Suggest improvements for efficiency and accuracy of commission calculations

- Develop and implement guidance for commission processes and procedures

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Commission Analyst resume?

A Commission Analyst is a financial professional who evaluates and monitors commission plans, as well as other related incentives, to ensure they are in compliance and properly administered. Those who specialize in this profession are in high demand by organizations looking to ensure their commission plans are up-to-date and profitable. When creating a resume for a Commission Analyst position, the following should be included:

- Professional Summary: An introductory statement that summarizes your relevant professional experience and qualifications.

- Work Experience: A comprehensive list of your past commission analyst positions, including any related responsibilities, such as developing commission plans, building financial models, and providing administrative support.

- Education: Any educational background related to commission analysis, such as a degree in finance, accounting, business administration, or economics.

- Technical Skills: Technical skills related to commission analysis, such as proficiency in spreadsheet software, experience working with commission automation platforms, knowledge of incentive plan compliance requirements, and familiarity with incentive compensation management (ICM) software.

- Soft Skills: Soft skills that are important for success in this role, such as excellent problem-solving abilities, strong communication skills, the ability to work under pressure, and the ability to work with a variety of stakeholders.

- Certifications: Any certifications related to commission analysis that you have obtained, such as a Certified Commission Analyst designation.

By including all of these elements in your Commission Analyst resume, you’ll be able to demonstrate to potential employers that you have the skills and experience necessary to be successful in this role.

What is a good summary for a Commission Analyst resume?

A Commission Analyst resume should include a summary that outlines the professional’s experience in analyzing commissions, determining commission rates, and recommending changes to commission structures. The summary should also demonstrate the individual’s ability to work with a variety of stakeholders, analyze data, and develop strategies for improving commission structures. Additionally, the summary should highlight the individual’s communication and problem-solving skills. Finally, the summary should include any specialized training or certifications in commission analysis.

What is a good objective for a Commission Analyst resume?

A Commission Analyst is a professional who is responsible for analyzing and calculating commission data, along with providing reporting and analysis to stakeholders. This position requires a detailed understanding of commission metrics, as well as the ability to work accurately and meet deadlines.

When writing a resume for a Commission Analyst role, it is important to have a well-written objective that outlines your goals and qualifications. Here are some good objectives for a Commission Analyst resume:

- To leverage my strong analytical and research abilities to effectively analyze commission related data and create meaningful reports.

- To use my excellent organizational, communication and problem-solving skills to ensure timely delivery of commission related data.

- To utilize my knowledge of commission metrics and reporting standards to provide accurate and detailed reporting of commission data.

- To contribute my expertise in commission-related analysis to increase the efficiency and accuracy of the commission process.

- To utilize my knowledge of commission analysis and calculations to provide insightful recommendations and analysis for stakeholders.

How do you list Commission Analyst skills on a resume?

A Commission Analyst plays a critical role in business by helping to optimize sales performance and streamline the sales process. This position requires a combination of technical and interpersonal skills. When crafting your resume, you will want to highlight the most relevant skills to catch the eye of potential employers.

Here are some key Commission Analyst skills to consider listing on your resume:

- Sales Analysis: Commission Analysts need to be able to interpret data from sales processes and use them to identify opportunities for improvement. This includes developing and monitoring sales KPIs, analyzing performance reports, and making insightful recommendations to management.

- Relationship Management: Commission Analysts need to be able to build and maintain relationships with stakeholders and sales staff. This includes understanding the needs of all parties involved and using communication to resolve conflicts and ensure a steady flow of sales.

- Business Acumen: Commission Analysts need to have a strong understanding of the sales process, as well as a general knowledge of the business. This includes familiarity with the company’s products, services, and pricing structure.

- System Knowledge: Commission Analysts need to have an understanding of the software used to manage sales and commissions. This includes proficiency with spreadsheets, data analysis programs, and other commission management tools.

- Problem-Solving: Commission Analysts need to be adept at problem-solving and troubleshooting. This includes being able to diagnose issues in the sales process, troubleshoot hardware and software systems, and develop creative solutions to maximize efficiency.

With the right combination of technical and interpersonal skills, you can be an ideal candidate for a Commission Analyst role. By making sure that these skills are listed on your resume, you can make sure that you stand out to potential employers.

What skills should I put on my resume for Commission Analyst?

When applying for a Commission Analyst position, it’s important to ensure that your resume showcases the right skills. Commission Analysts need to demonstrate a variety of both technical and soft skills to be successful in the role. Here are some of the key skills that should be included on your resume when applying for any Commission Analyst role:

- Analytical Thinking: Commission Analysts need to have excellent analytical and problem-solving skills. They need to be able to quickly analyze data, draw insights, and develop solutions in a timely manner.

- Financial Analysis: Commission Analysts need to have a strong understanding of financial analysis and data analysis. They must be able to understand financial statements, identify trends, and use data to determine the most effective commission structure.

- Attention to Detail: Commission Analysts need to pay close attention to detail in order to ensure accuracy when it comes to commission calculations.

- Communication Skills: Commission Analysts need to be able to communicate complex concepts in a clear and concise manner. They need to be able to explain their decisions and recommendations to stakeholders in a way that is easy to understand.

- Interpersonal Skills: Commission Analysts need to be able to work with a variety of internal and external stakeholders, so strong interpersonal skills are essential. They need to be able to collaborate with a wide range of people and build relationships with both clients and colleagues.

- Time Management: Commission Analysts need to have excellent time management skills in order to meet deadlines and stay organized. They need to be able to prioritize tasks and manage their time effectively.

Key takeaways for an Commission Analyst resume

Being an Commission Analyst requires you to have a comprehensive understanding of the payment process, as well as the skills and experience needed to succeed in the role. Writing a resume for a Commission Analyst position requires you to highlight the qualifications and experience that are most relevant to the job. Here are some key takeaways you should include in your resume when applying for a Commission Analyst role:

- Demonstrate your knowledge of the payment process: To be a successful Commission Analyst, you need to be familiar with the payment process. This includes understanding how to process payments, review documents, and reconcile accounts. You should clearly demonstrate your knowledge of the payment process and any relevant experience in your resume.

- Showcase your analytical skills: Commission Analysts are responsible for analyzing data and making decisions based on their findings. You should emphasize your analytical and problem-solving skills to show that you have the knowledge and experience to succeed in the role.

- Highlight your experience with financial software: Commission Analysts often need to use financial software to track and review payments. You should emphasize any experience you have with financial software in your resume.

- Demonstrate your ability to work with stakeholders: Commission Analysts need to be able to work with a variety of stakeholders, such as customers, vendors, and colleagues. Showcase your interpersonal and communication skills to demonstrate that you can effectively collaborate with others in the role.

These are just a few key takeaways to consider when writing your Commission Analyst resume. Be sure to include any relevant qualifications and experience that are essential to the position. With the right qualifications and experience, you can demonstrate to employers that you are the right fit for the role.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder