Are you looking for a way to make your resume stand out among the other commercial credit analyst applicants? A great resume can help you get noticed for the right reasons, but crafting one that captures the attention of a potential employer can be a difficult task. By following our comprehensive commercial credit analyst resume writing guide, you’ll be able to create a resume that showcases your skills, experience, and qualifications and make your job search easier. We’ll provide helpful tips and examples to ensure that you make the best impression with your resume.

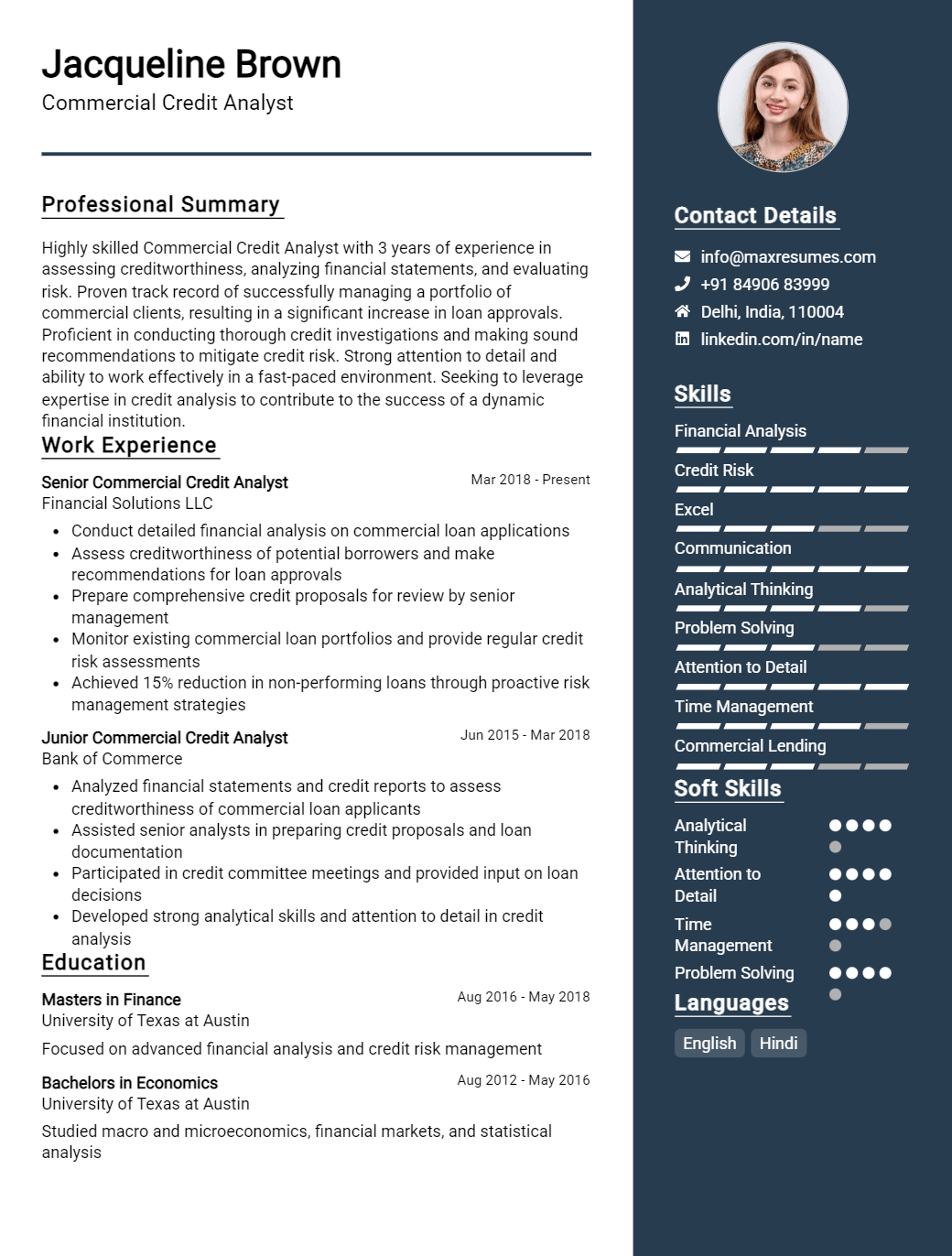

Commercial Credit Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Commercial Credit Analyst Resume Examples

John Doe

Commercial Credit Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly motivated Commercial Credit Analyst with over 5 years of experience in the financial industry. Possesses a strong ability to analyze credit trends and make sound financial decisions. Excellent communication and interpersonal skills that enable easy interactions with customers, lenders and colleagues. Proven experience in risk assessment, client relations, and financial analysis.

Core Skills:

- Risk assessment

- Financial analysis

- Client relations

- Credit analysis

- Report preparation

- Credit documentation

- Problem solving

- Decision making

- Regulatory compliance

Professional Experience:

Credit Analyst, BB Financial Group, 2015 – 2020

- Developed processes to properly evaluate financial information from potential customers and make informed decisions on their credit worthiness.

- Compiled financial data from multiple sources and created reports to review credit trends.

- Conducted credit risk assessment for customers including those for large commercial entities.

- Developed credit policies and procedures to comply with applicable regulations.

- Established and maintained relationships with clients and lenders.

Education:

Bachelor of Science in Finance, University of California, Los Angeles, 2011- 2015

Commercial Credit Analyst Resume with No Experience

Recent college graduate with excellent communication, analytical, and problem solving skills. Passionate about learning and eager to contribute in a credit analyst role.

Skills

- Strong communication skills

- Data analysis

- Attention to detail

- Organizational skills

- Computer proficiency

- Ability to work independently

- Analytical skills

Responsibilities

- Analyze financial data to assess risk for loan applicants

- Research credit histories and industry trends to assess loan applicants

- Evaluate credit reports and provide recommendations

- Produce detailed reports on credit risk assessments

- Monitor loan performance, identify problems, and advise on corrective action

- Maintain accurate records of credit analysis

- Frequent collaboration with other departments to assess creditworthiness

Experience

0 Years

Level

Junior

Education

Bachelor’s

Commercial Credit Analyst Resume with 2 Years of Experience

Highly organized and motivated Commercial Credit Analyst with 2 years of experience in financial analysis, customer service, and customer relationship management. Possesses a Bachelor’s Degree in Business Administration and a wealth of knowledge in financial markets, bank compliance, and risk management. Demonstrates a track record of providing insightful analysis and recommendations in order to drive profitability and growth through risk- adjusted returns. Experienced in developing customer relationships and building customer loyalty.

Core Skills:

- Financial Analysis

- Customer Relationship Management

- Bank Compliance

- Risk Management

- Strategic Planning

- Data Analysis

- Customer Service

Responsibilities:

- Perform credit analysis on customers and evaluate financial statements

- Monitor customer accounts and provide recommendations for improving efficiencies

- Assess potential risks and provide solutions to mitigate risk

- Develop customer relationships and build customer loyalty

- Analyze customer data and make recommendations to drive profitability and growth

- Prepare reports and presentations for management on credit analysis and risk assessment

- Provide support to team members in all aspects of the loan process

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Commercial Credit Analyst Resume with 5 Years of Experience

Highly motivated and results- driven Commercial Credit Analyst with 5 years of experience in financial analysis, credit assessment and risk management. Adept at conducting financial analysis, evaluating balance sheets and creating financial models to inform credit decisions. Proven ability to assess credit risk, develop credit strategies and identify potential concerns with customers.Extensive knowledge of banking regulations, financial instruments and credit assessment.

Core Skills:

- Financial Analysis

- Credit Assessment

- Risk Management

- Banking Regulations

- Credit Strategies

- Data Analysis

- Financial Modeling

Responsibilities:

- Conduct credit analysis of financial statements, cash flow and other financial documents.

- Review credit policy, credit risk assessments and credit limits.

- Identify and assess potential credit risks and their implications.

- Analyze customer data, trends and financial performance to identify potential credit concerns.

- Develop credit strategies to mitigate credit risk.

- Collaborate with internal stakeholders to ensure compliance with banking regulations.

- Develop financial models to inform credit decisions.

- Monitor customer’s credit portfolio and respond to credit issues.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Commercial Credit Analyst Resume with 7 Years of Experience

Highly experienced and motivated Commercial Credit Analyst with 7 years of working experience in the banking sector. Possess detailed knowledge of all different aspects of credit and financial analysis. Possess excellent analytical skills and the ability to accurately assess and control credit risk, formulate strategies geared towards minimizing risk and maximizing returns. Highly organized and punctual individual who is able to work under tight deadlines and adjust to changing work environments.

Core Skills:

- Financial Analysis

- Credit Risk Analysis

- Portfolio Management

- Understanding of Banking and Financial Regulations

- Credit Rating Modeling

- Preparation of Reports

- Financial Statement Analysis

- Credit Scoring

Responsibilities:

- Analyzed financial statements, credit reports and other relevant documents to determine the creditworthiness of borrowers.

- Developed credit risk models to assess and monitor clients’ risk profiles and creditworthiness.

- Developed and implemented credit scoring methods to evaluate new clients and identify potential risks to the bank.

- Performed analysis of current and potential portfolios to evaluate credit risk and identify opportunities for mitigation.

- Monitored existing client accounts to ensure timely payments and assess risk of default.

- Ensured compliance with all internal and external regulations and standards.

- Prepared detailed reports for senior management on the performance of the credit portfolio.

- Assisted in the preparation of loan documents and credit agreements.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Commercial Credit Analyst Resume with 10 Years of Experience

Highly organized and detail- oriented Commercial Credit Analyst with 10 years of experience in the financial services industry. Adept in financial analysis, credit risk assessment, portfolio management, and client relations. Able to independently evaluate credit applications, create comprehensive financial analysis reports, and develop strategies to reduce credit risks. Possesses excellent communication and problem- solving skills and is committed to providing high- quality customer service.

Core Skills:

- Credit Risk Assessment

- Financial Analysis

- Portfolio Management

- Client Relations

- Regulatory Compliance

- Risk Management

- Documentation Preparation

- Report Writing

- Problem- Solving

- Communication

Responsibilities:

- Analyzed financial statements and credit applications to evaluate creditworthiness of individuals and businesses

- Assessed risk of potential and existing commercial customers

- Developed strategies to reduce credit risks and maintain portfolio quality

- Maintained a portfolio of commercial clients and provided ongoing financial analysis

- Coordinated with lenders, attorneys and other external parties to resolve credit disputes

- Monitored regulatory compliance and updated processes to maintain compliance

- Prepared detailed credit reports and analysis for senior management

- Collaborated with other departments to ensure customer satisfaction and manage customer requests

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Commercial Credit Analyst Resume with 15 Years of Experience

Experienced Commercial Credit Analyst with 15 years of experience in the banking industry. Possessing strong evaluation and analysis skills with the ability to assess and make recommendations on commercial credit applications. Gaining substantial experience in commercial credit process, underwriting, and analysis. Proven record of successfully handling a variety of commercial credit transactions.

Core Skills:

- Commercial Credit Process

- Credit Analysis & Underwriting

- Risk & Portfolio Analysis

- Financial Modeling & Forecasting

- Financial Statement Analysis

- Risk Mitigation Strategies

- Adherence to Regulatory & Compliance Requirements

- Loan Portfolio Management

- Strong Negotiating Skills

- Excellent Communication Skills

Responsibilities:

- Analyze financial and credit documents to assess the creditworthiness of commercial loan applicants

- Perform a detailed analysis of financial statements and credit reports to assess the risk of granting loans

- Develop financial models to forecast loan repayment and review credit policies and procedures for compliance

- Carry out complex financial analysis to identify and evaluate loan opportunities

- Ensure compliance with all relevant regulatory and legal requirements

- Make recommendations on loan amounts, terms, and conditions

- Negotiate loan contracts, terms, and conditions

- Monitor and assess credit risk in the loan portfolio

- Manage, coordinate, and report on loan performance

- Keep track of credit trends and performance in the industry

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Commercial Credit Analyst resume?

A Commercial Credit Analyst is a specialized position within the banking and finance industry responsible for assessing the creditworthiness of prospective borrowers. A Commercial Credit Analyst Resume should showcase the candidate’s financial acumen and ability to quickly assess risk versus reward.

- Relevant educational background and certifications: A Commercial Credit Analyst should showcase relevant educational credentials and certifications, such as a Bachelor’s degree in accounting, finance, or business, as well as certificates from professional organizations such as the Association of Credit and Collection Professionals.

- Professional experience: A Commercial Credit Analyst should highlight their experience in the banking and finance industry, whether working as a Credit Analyst, Loan Officer, or in another related role. They should list their duties in these roles, as well as any successful projects or achievements.

- Analytical skills: A Commercial Credit Analyst should highlight their analytical skills, including their ability to quickly assess a borrower’s financial situation and determine risk versus reward. They should also list any financial software or programs they are proficient in using.

- Communication skills: A Commercial Credit Analyst should demonstrate excellent communication skills and the ability to work with a variety of stakeholders. They should list any prior experience in customer service or client relations, as well as their ability to explain complex financial topics in a straightforward way.

- Technical skills: Depending on the position, a Commercial Credit Analyst may need to demonstrate proficiency in a variety of technical skills. These can include anything from advanced spreadsheet software, such as Excel, to computer programming languages, such as Python or Java.

By including these items in their resume, a Commercial Credit Analyst should be able to demonstrate their qualifications for the position and showcase their abilities to potential employers.

What is a good summary for a Commercial Credit Analyst resume?

A commercial credit analyst is responsible for assessing and managing credit risk for businesses. The ideal candidate for this position must have a strong background in financial analysis, risk management, and customer service. A good summary for a commercial credit analyst resume should highlight relevant experience, education, and professional accomplishments. It should also demonstrate a background in financial analysis, risk management, credit underwriting, and customer service. Additionally, a well-crafted summary should show the applicant’s ability to successfully evaluate credit applications, organize and analyze financial statements, and develop customer relationships. With a comprehensive summary, the applicant will be well-positioned to stand out among the competition.

What is a good objective for a Commercial Credit Analyst resume?

A Commercial Credit Analyst is responsible for evaluating creditworthiness of potential customers, analyzing financial data, and recommending credit lines and risk assessment strategies. A good objective for a Commercial Credit Analyst resume should focus on the types of skills and experiences that make the applicant an ideal candidate for the position. Here are some examples of what a strong objective should include:

- Demonstrated track record of accurately interpreting financial data to inform credit decisions

- Extensive knowledge of credit and risk assessment techniques

- Proven ability to analyze loan applications and manage customer credit portfolios

- Strong understanding of financial regulations and compliance

- Excellent communication, negotiation, and problem-solving skills

- Experience with risk modeling and portfolio management tools

- Ability to work effectively with teams and independently in a fast-paced environment

How do you list Commercial Credit Analyst skills on a resume?

A Commercial Credit Analyst is a professional who is responsible for assessing and analyzing the financial standing of businesses seeking credit. When applying for a position as a Commercial Credit Analyst, it is important to demonstrate to potential employers the skills you possess and how they are applicable to the job.

The following are examples of the skills you may want to include on your resume when applying for a position as a Commercial Credit Analyst:

- Financial Risk Analysis: The ability to evaluate and analyze financial risk in order to make informed decisions.

- Quantitative Analysis: The ability to interpret and analyze numerical data to assess creditworthiness.

- Credit Assessment: The ability to analyze and assess credit information in order to make necessary decisions.

- Loan and Account Management: The ability to manage loan accounts and ensure payments are made in a timely fashion.

- Regulatory Compliance: The ability to ensure that all lending transactions comply with applicable laws and regulations.

- Negotiation: The ability to negotiate terms and conditions in order to secure beneficial loan agreements.

In addition to the skills listed above, it is also important to demonstrate other necessary qualifications such as knowledge of banking regulations and procedures, organizational skills, and excellent communication and interpersonal skills. By showcasing the skills you possess and how they are applicable to the position of a Commercial Credit Analyst, you will be able to set yourself apart from other applicants and increase your chances of landing the job.

What skills should I put on my resume for Commercial Credit Analyst?

Writing a resume can be a daunting task, especially when you’re trying to feature the right skills to show that you’re the ideal candidate for a Commercial Credit Analyst position.

In this position, employers are looking for someone with a background in credit analysis and finance. Ultimately, you should strive to showcase the skills that demonstrate your ability to make informed decisions about a company’s financial standing. Here are some of the essential skills you should include on your resume for a Commercial Credit Analyst role:

- Financial Analysis: As a Commercial Credit Analyst, you will be responsible for analyzing a company’s financial records to determine its creditworthiness. Be sure to highlight your experience with financial analysis and how you can use it to make informed decisions.

- Risk Assessment: This role requires you to assess the risk associated with granting credit to a potential customer. Showcase your skills in evaluating and understanding financial risk in order to make sound credit decisions.

- Problem-Solving: As a Commercial Credit Analyst, you need to be able to think critically and come up with creative solutions to complex financial problems. Showcase any experience you have with solving complicated problems or navigating difficult financial situations.

- Attention to Detail: Success in this role requires an eye for detail when it comes to analyzing financial data. Make sure to highlight any experience you have with carefully examining financial records and ensuring accuracy.

- Knowledge of Regulations: This role requires an understanding of the various laws and regulations related to granting credit. Make sure to feature any knowledge or experience you have with the relevant rules and regulations.

By emphasizing these skills on your resume, you can demonstrate to potential employers that you’re the ideal candidate for a Commercial Credit Analyst role.

Key takeaways for an Commercial Credit Analyst resume

When applying for a position as a Commercial Credit Analyst, it is important to make sure that your resume showcases your skills and experience. Here are some key takeaways to keep in mind when crafting an effective resume for this role:

- Demonstrate a strong knowledge base. As a Commercial Credit Analyst, you are responsible for assessing customer creditworthiness and developing financial strategies to support the company’s credit policies. To showcase your knowledge of this field, make sure to include relevant coursework, certifications, and other financial or accounting certifications on your resume.

- Highlight your financial expertise. As a Commercial Credit Analyst, you need to have a thorough understanding of financial statements, market trends, and risk management. Include any financial-related experience you have on your resume, such as working as an accountant or developing financial models.

- Emphasize your analytical skills. As a Commercial Credit Analyst, you must be able to assess creditworthiness and develop financial strategies. To demonstrate your analytical skills, list any software programs or tools that you are proficient in, such as financial statement analysis software or spreadsheet programs.

- Showcase your communication skills. As a Commercial Credit Analyst, you must be able to work with a variety of stakeholders, including customers, lenders, and other financial professionals. List any customer service or interpersonal skills on your resume to indicate your ability to effectively communicate with others.

By following the tips outlined above, you can create an effective resume for a Commercial Credit Analyst position that will help you stand out from the competition. Make sure to showcase your knowledge, financial expertise, analytical skills, and communication skills to demonstrate why you are the ideal candidate for the job.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder