Having a resume that stands out is the key to getting noticed in the competitive job market; especially in the finance industry. To get the attention of potential employers in the finance industry, you will need a well-crafted resume that stands out. The best way to do this is to create a resume that highlights your qualifications as a Certified Financial Planner (CFP). A CFP resume should be tailored to the position you are applying for, so it is important to understand what is required for the role. This guide will provide you with tips and examples on how to write an effective CFP resume.

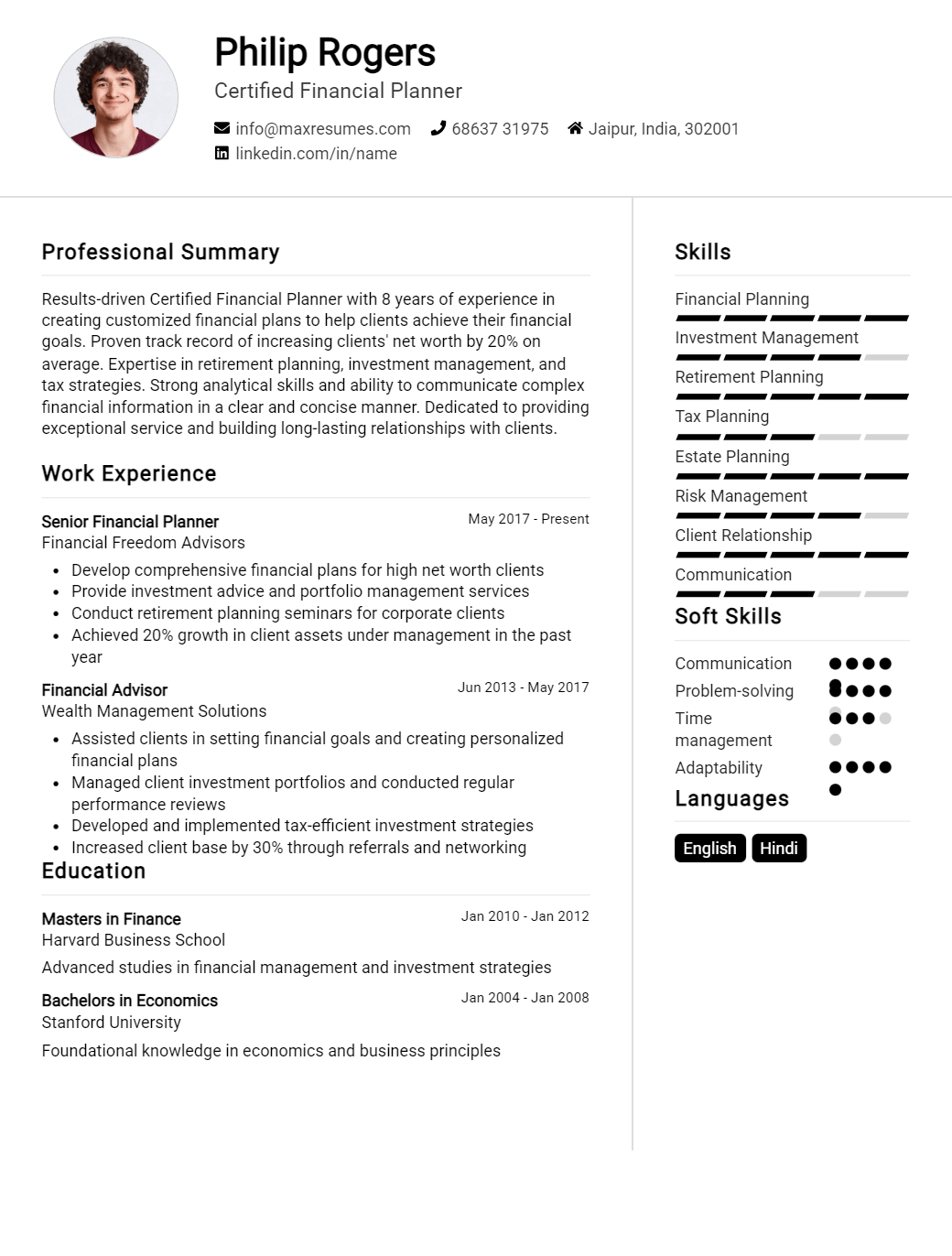

Certified Financial Planner Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Certified Financial Planner Resume Examples

John Doe

Certified Financial Planner

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A Certified Financial Planner with 10+ years of experience in the financial services industry who specializes in financial planning, investments, risk management, and retirement planning. Possesses a professional certification from the Certified Financial Planner Board of Standards and has extensive knowledge in developing and evaluating portfolios, asset allocation, and estate planning. Adept at building strong relationships with clients, providing tailored financial advice, and understanding their needs and goals.

Core Skills:

- Financial Planning

- Investment Management

- Risk Management

- Retirement Planning

- Asset Allocation

- Portfolio Development

- Estate Planning

- Strong Client Relationships

- Expertise in Regulatory Compliance

- Problem Solving

- Data Analysis

Professional Experience:

Financial Planner, ABC Bank – San Francisco, CA

- Provided tailored financial advice to clients on a wide range of topics including investments, retirement, estate planning, and risk management

- Developed and evaluated portfolios, monitored progress and provided regular updates

- Built strong relationships with clients, identified their needs and goals and provided solutions to meet their objectives

- Reviewed and amended financial plans in accordance with clients’ changing needs and goals

- Informed clients of regulatory changes and new investment opportunities

Education:

Certified Financial Planner, CFP Board of Standards – San Francisco, CA

Bachelor of Science in Finance, University of California – San Francisco, CA

Certified Financial Planner Resume with No Experience

Recent college graduate with a degree in finance, passionate about helping others reach their financial goals. Experienced in researching, analyzing and interpreting financial data. Driven to help clients develop financial plans that meet their individual needs.

Skills

- Financial Analysis

- Investment Strategies

- Tax Planning

- Risk Management

- Business Development

- Strategic Planning

- Accounting Principles

- Financial Modeling

- Data Analysis

Responsibilities

- Develop financial plans that meet the individual needs of clients

- Analyze data and interpret financial information

- Develop investment strategies for clients

- Identify and manage risks associated with investments

- Assist clients in developing financial goals

- Research and recommend appropriate financial products

- Provide ongoing support and guidance to clients

- Ensure compliance with applicable laws and regulations

Experience

0 Years

Level

Junior

Education

Bachelor’s

Certified Financial Planner Resume with 2 Years of Experience

Certified Financial Planner with 2 years of experience providing financial advice to individuals and small businesses. Skilled in creating customized financial plans, setting and monitoring financial goals, and providing advice on retirement planning and investments. Experienced in analyzing financial data and making recommendations for creating long- term financial security. Committed to providing quality customer service and ensuring clients’ financial goals are met.

Core Skills

- Investment Advice

- Tax Planning

- Retirement Planning

- Financial Analysis

- Budgeting

- Risk Assessment

- Data Analysis

- Financial Goal Setting

Responsibilities

- Analyzed financial data and identified potential risks and opportunities.

- Developed comprehensive financial plans, tailored to meet individual or small business needs.

- Reviewed current financial strategies and investment portfolios to ensure goals and objectives are met.

- Developed strategies to minimize taxes and maximize returns.

- Recommended investment products, such as stocks, bonds, mutual funds and ETFs.

- Monitored investments and advised clients on portfolio adjustments when necessary.

- Tracked economic and market trends to identify potential growth opportunities.

- Provided guidance on retirement planning, insurance and estate planning.

- Educated clients on financial concepts, investment plans, and tax planning.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Certified Financial Planner Resume with 5 Years of Experience

An experienced and highly- skilled Certified Financial Planner with over 5 years of experience in the financial services industry. Possesses a comprehensive understanding of financial planning and investment strategies. Highly proficient in analyzing complex financial data and developing sound financial plans that meet clients’ long- term objectives. Possesses excellent communication and problem- solving skills and is passionate about helping clients make sound financial decisions.

Core Skills:

- Financial Planning & Investment Advisory

- Asset Allocation & Portfolio Management

- Retirement & Estate Planning

- Risk Management

- Tax Planning & Compliance

- Client Relationship Management

- Budgeting & Cash Flow Management

- Regulatory Compliance

- Financial Analysis & Modelling

Responsibilities:

- Develop tailored financial plans that meet the individual needs of clients

- Analyze and interpret complex financial data

- Offer advice on investments, estate planning and retirement strategies

- Create detailed investment portfolios to meet clients’ objectives

- Monitor market conditions and recommend suitable asset allocations

- Ensure compliance with applicable laws and regulations

- Maintain strong relationships with clients and provide professional advice

- Assist clients with budgeting, cash flow management and debt consolidation

- Educate clients on financial products and services

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Certified Financial Planner Resume with 7 Years of Experience

Highly- skilled Financial Planner with 7 years of professional experience in the financial services industry. Successfully consults on, designs and implements comprehensive financial plans for clients from all walks of life. Proven ability to identify the client’s financial needs and to develop clear, precise and targeted financial strategies to ensure their financial security. Expert in financial planning, wealth management, investments, retirement planning and insurance.

Core Skills:

- Wealth Management

- Retirement Planning

- Investment Strategies

- Financial Analysis

- Risk Management

- Tax Planning

- Financial Modeling

- Budgeting

- Cash Flow Management

- Client Relationship Management

Responsibilities:

- Guided clients in the development of financial strategies and plans

- Developed financial strategies to meet client’s goals and objectives

- Provided investment advice and strategies to clients

- Created and implemented financial plans to maximize the client’s wealth

- Analyzed clients’ financial data to determine their financial goals and objectives

- Researched and evaluated potential investments for clients

- Developed and maintained client relationships

- Provided timely and accurate information on financial markets

- Developed and monitored budgets for clients

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Certified Financial Planner Resume with 10 Years of Experience

A Certified Financial Planner with 10 years of experience with a strong background in providing financial planning advice to a wide range of clients. Experienced in preparing comprehensive financial plans, conducting financial analysis, and developing strategies to help individuals and businesses achieve their short and long- term financial goals. Possessing excellent communication, organizational, and problem- solving skills.

Core Skills:

- Financial planning

- Financial analysis

- Risk management

- Portfolio management

- Investment strategies

- Asset Allocation

- Tax planning

- Business planning

- Strategic planning

- Cash flow management

Responsibilities:

- Identifying needs of clients and developing financial plans to meet their goals

- Researching and recommending suitable investments, including stocks, bonds, mutual funds and other securities

- Monitoring and adjusting client portfolios as needed

- Developing strategies and plans to reduce financial risk

- Providing guidance on retirement, estate, and tax planning

- Analyzing and interpreting financial data to identify trends and opportunities

- Developing financial models and forecasting financial performance

- Providing financial advice on insurance and investment products

- Preparing presentations and reports to present to clients and management

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Certified Financial Planner Resume with 15 Years of Experience

A highly experienced Certified Financial Planner with 15 years of helping clients make informed decisions about their financial future. Expertise in asset allocation, investment portfolio management, trust and estate planning, retirement planning, and insurance planning. Proven ability to help clients reach their long- term financial objectives. Skilled in identifying potential financial opportunities and risks and recommending viable solutions.

Core Skills:

- Financial Planning

- Investment Management

- Estate Planning

- Retirement Planning

- Risk Management

- Tax Planning

- Financial Analysis

- Client Relations

- Negotiation

Responsibilities:

- Developing and implementing tailored financial plans for clients

- Identifying potential financial opportunities and risks

- Analyzing clients’ current financial status

- Creating investment portfolios and asset allocation strategies

- Assisting clients with trust and estate planning

- Educating clients on retirement planning and insurance options

- Advising clients on risk management and tax planning strategies

- Negotiating with financial institutions and brokers

- Maintaining client relationships and delivering exceptional service

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Certified Financial Planner resume?

When preparing your resume for a Certified Financial Planner position, there are certain components that need to be included to demonstrate your skills and qualifications. Here are some key elements of a Certified Financial Planner resume that should be included:

- Professional Summary: Summarize your experience, qualifications, and skills in the financial planning field.

- Education and Certifications: List any certification, education, or training you have received related to financial planning.

- Work Experience: Describe any relevant experience you have had in the financial planning field.

- Skills: Include relevant skills such as financial analysis, portfolio management, risk analysis, financial modeling, and investments.

- Awards and Recognitions: Highlight any awards or recognitions you have received for your work in the financial planning field.

- Professional References: Include the names and contact information of previous supervisors or colleagues that can provide a reference for your work in the financial planning field.

By including these key components in your Certified Financial Planner resume, you will be able to showcase your experience and qualifications to potential employers.

What is a good summary for a Certified Financial Planner resume?

A Certified Financial Planner resume should highlight an applicant’s expertise and experience in financial planning and advice. It should include details of the applicant’s education, certifications, and experience. It should also highlight their ability to develop and implement financial plans and strategies that are tailored to their client’s individual needs. The resume should also demonstrate the applicant’s knowledge in areas such as retirement planning, estate planning, investments, insurance, and taxation. The summary should demonstrate the applicant’s commitment to helping their clients achieve their financial goals, as well as their dedication to continuing their education in the field.

What is a good objective for a Certified Financial Planner resume?

When constructing a resume, it is important to write an objective that outlines the job you are seeking, the qualifications you have, and the skills you possess that make you a prime candidate for the position. Certified Financial Planners (CFPs) have a specialized skill set that can benefit many organizations, so a well-crafted objective can help employers quickly identify the value you can bring to their team.

A good objective for a Certified Financial Planner resume should include the following key points:

- Highlight your CFP designation, as well as any additional certifications.

- Showcase any experience you have in financial planning, portfolio management, retirement planning, or related fields.

- Include a brief description of your skills, such as budgeting, forecasting, taxation, and financial analysis.

- Mention any relevant education or professional development courses that you have completed.

- Highlight any awards or recognition you have received for your work in the financial services industry.

By including these key points in your objective statement, employers will get a clear picture of the value and expertise you can bring to their organization. A well-crafted objective can help you stand out from the crowd and get your resume noticed.

How do you list Certified Financial Planner skills on a resume?

When crafting a resume, it is important to include all relevant skills to give potential employers a full picture of your qualifications. For those looking to specialize in financial planning, it is especially important to highlight any Certified Financial Planner (CFP) credentials.

Including CFP skills on a resume requires a few simple steps, which can help your application stand out from the competition. Here’s how to do it:

- Start by highlighting your CFP credential prominently in your summary statement or professional profile. This should be a quick and easy way for employers to see that you have the certification.

- Include a section dedicated to your CFP skills. This should include a brief description of the scope of your skills and an overview of the areas of expertise you possess.

- Create a bulleted list of your key CFP skills. This should include both technical and soft skills, such as financial analysis, portfolio management, tax planning, risk management, financial coaching, and communication.

- Make sure to include any specializations you possess, such as retirement planning, estate planning, or investment advice.

- Consider including any relevant industry experience or education related to financial planning.

By following these steps, you can showcase your Certified Financial Planner credentials and make sure potential employers are aware of the value you can bring to their organization.

What skills should I put on my resume for Certified Financial Planner?

A Certified Financial Planner (CFP) is a professional responsible for helping individuals or businesses manage their financial well-being. They must have the correct qualifications and experience to provide relevant advice and assistance. When creating a resume for a Certified Financial Planner position, it is important to highlight the different types of skills and knowledge that you have. Here are some of the skills and abilities that should be highlighted on your resume:

- Knowledge of Financial Planning Principles: As a Certified Financial Planner, you will need to have a thorough understanding of the principles of financial planning, such as investment strategies, retirement planning, and tax planning.

- Financial Analysis Skills: A Certified Financial Planner must be able to analyze financial statements and other financial documents in order to provide accurate advice and guidance on how best to manage finances.

- Communication Skills: A Certified Financial Planner must be able to communicate financial concepts to their clients in a clear and understandable way.

- Problem-Solving Skills: A Certified Financial Planner must be able to identify potential problems or issues and devise solutions to them.

- Time Management Skills: A Certified Financial Planner must be able to effectively manage their time and the time of their clients in order to provide the best service possible.

- Research Skills: A Certified Financial Planner must be able to research and find the best investments, insurance policies, and other financial products for their clients.

By highlighting these skills and abilities on your resume, you will be able to show potential employers that you have the qualifications and experience necessary to be an effective Certified Financial Planner.

Key takeaways for an Certified Financial Planner resume

Certified Financial Planners (CFPs) are highly sought after professionals in the finance industry. They are responsible for managing the financial planning and investments of individuals, families, and businesses. In order to stand out to potential employers, it is important to have a comprehensive and well-crafted resume that highlights your qualifications and experience. Here are some key takeaways for a CFP resume:

- Highlight your certifications: Make sure to include all of your certifications and credentials, including any professional licenses you may have.

- Showcase your experience: List your past jobs, experience, and responsibilities in detail. This will demonstrate to potential employers your knowledge and understanding of the financial planning industry.

- Be specific: When describing your experience and job duties, make sure to provide specific examples of how you used your skills to help clients reach their financial goals.

- Demonstrate your knowledge: Include a section on skills and knowledge. This will showcase to potential employers the depth of your understanding of financial planning principles and practices.

- Include references: Include references from past employers, colleagues, or clients. This will further demonstrate your qualifications and reliability.

Following these tips can help to ensure your CFP resume stands out from the others and showcases your qualifications and experience in the best light. With a strong and comprehensive CFP resume, you can successfully land the job that you’ve been dreaming of.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder