Writing a comprehensive resume as an AML Investigator can be a daunting task, especially when a lot is at stake. As the job market continues to become more competitive, it is important for job seekers to stand out from the crowd and present their qualifications in an effective way. This guide aims to provide insightful tips and examples of resumes for AML Investigators that can help you create an impressive resume and make a lasting impression on potential employers.

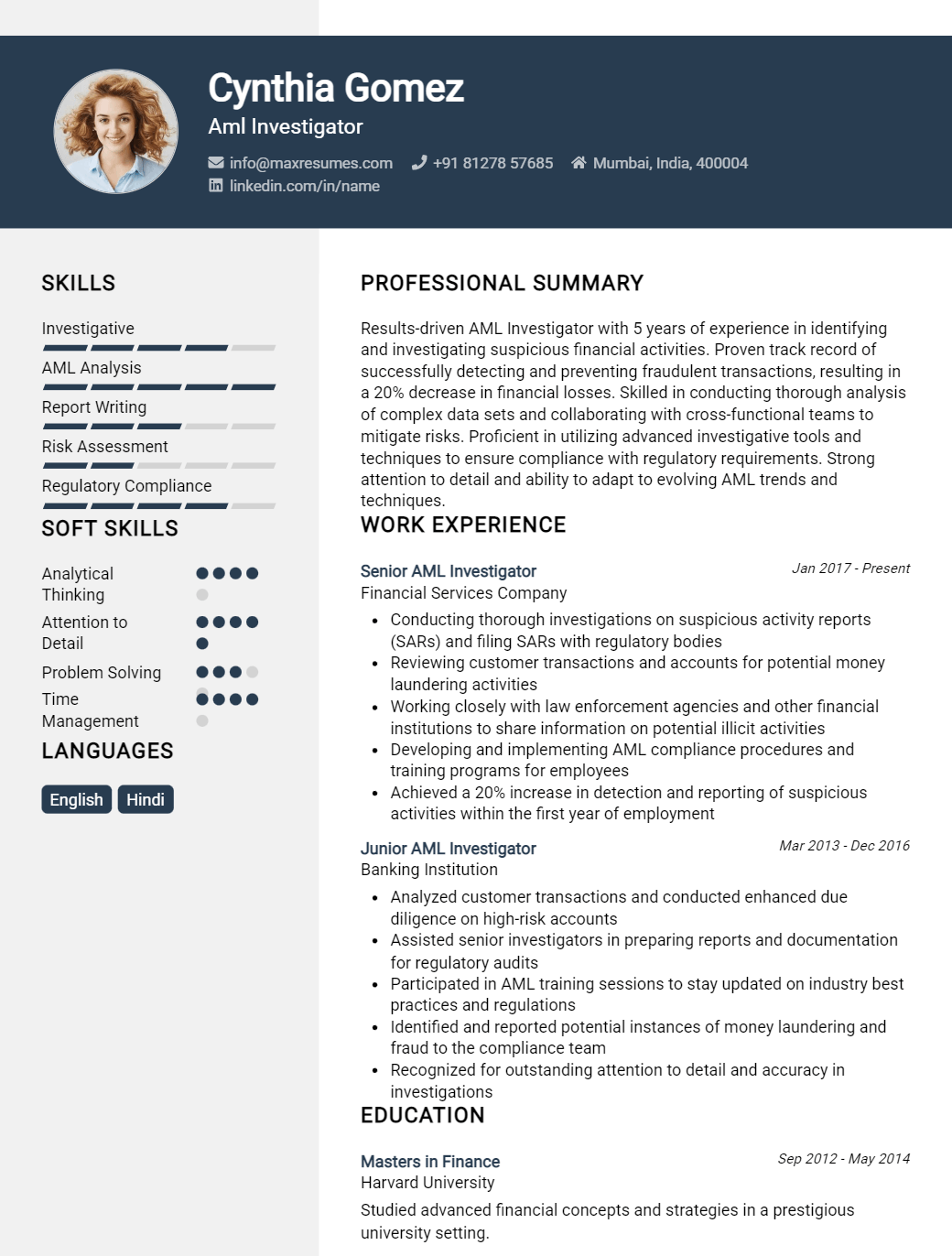

Aml Investigator Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

AML Investigator Resume Examples

John Doe

AML Investigator

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly experienced AML Investigator with 6+ years in the financial services industry. I am a results- driven, detail- oriented and organized individual who is well- versed in KYC/AML procedures, financial regulations and statutory requirements. My extensive knowledge in conducting investigations using data analysis and financial intelligence, combined with superb communication, problem solving and customer service skills, enables me to consistently get the job done.

Core Skills:

- Strong knowledge of KYC/AML regulations

- Financial intelligence and data analysis

- Excellent communication and problem solving skills

- Superior organizational and customer service skills

- Proficient in Microsoft Office applications

Professional Experience:

AML Investigator, ABC Bank – May 2015 – Present

- Conducted investigations using data analysis and financial intelligence

- Investigated suspicious customer accounts and transactions

- Reviewed customer KYC information and identified discrepancies

- Monitored customer accounts and approved/denied transactions

- Reported any suspicious activities to management

- Developed and implemented AML policies and procedures

- Provided AML training to new staff

Education:

Bachelor of Commerce, ABC University – 2011

AML Investigator Resume with No Experience

Recent college graduate with a degree in criminal justice looking to gain experience as an AML investigator. Possess strong research and investigative aptitude, excellent problem solving and communication skills, and a thorough understanding of the principles of criminal and corporate law.

Skills

- Strong research, investigative and analytical skills

- Excellent problem solving and communication skills

- Knowledge of criminal and corporate law

- Proficient in Microsoft Office applications

- Ability to work independently and with a team

Responsibilities

- Conduct investigations into suspicious transactions and activities

- Collect and analyze financial data to identify suspicious activity

- Perform due diligence on clients and financial transactions

- Research and analyze customer’s financial backgrounds

- Develop detailed reports of findings and recommendations

- Collaborate with law enforcement and other regulatory agencies

Experience

0 Years

Level

Junior

Education

Bachelor’s

AML Investigator Resume with 2 Years of Experience

A highly experienced AML Investigator with two years of experience researching and executing financial transactions, adhering to AML regulations and preventing money laundering activities. Experienced in conducting due diligence, analyzing suspicious transactions & activities and using financial and legal databases to verify documentation. Possesses strong problem- solving & analytical skills and the ability to work independently or as part of a team.

Core Skills:

- In- depth knowledge of applicable AML regulations

- Ability to conduct due diligence, research and analysis

- Expertise in maintaining and updating financial databases

- Strong problem- solving and analytical skills

- Excellent written and verbal communication skills

Responsibilities:

- Review and analyze financial transactions for potential money laundering activities

- Monitor customer accounts for suspicious activities and document findings

- Investigate suspicious cases using various financial and legal databases

- Prepare reports of findings and recommendations for action

- Maintain and update financial databases with current information

- Participate in team meetings and strategy sessions to stay abreast of news and regulations

- Develop and implement policies and procedures to ensure compliance with AML regulations

Experience

2+ Years

Level

Junior

Education

Bachelor’s

AML Investigator Resume with 5 Years of Experience

I am a talented and experienced AML Investigator with 5+ years in the field. I have extensive experience with financial investigations and identity verification, as well as extensive knowledge of banking regulations, compliance and financial processes. I am also adept at risk assessment and reporting, and I have a keen eye for suspicious activity. I am well- versed in AML- related technologies and software and have a demonstrated ability to collaborate and work effectively with internal and external stakeholders.

Core Skills:

- AML/KYC Investigation

- Financial Investigation

- Risk Assessment and Reporting

- Identity Verification

- Banking Regulations, Compliance and Processes

- AML- related Technology and Software

- Collaboration and Stakeholder Management

Responsibilities:

- Conduct KYC/AML investigations and provide investigative findings

- Analyze financial records for evidence of suspicious activity

- Identify and investigate potential suspicious activity and money laundering cases

- Verify customer identity and analyze risk related to customer account activities

- Monitor customer accounts for suspicious activity and ensure compliance with regulatory requirements

- Ensure accuracy and completeness of customer information in accordance with applicable laws and regulations

- Analyze customer accounts for potential risks and facilitate the implementation of corrective measures

- Develop and maintain relationships with customers, internal and external stakeholders to ensure proper AML compliance

- Provide recommendations on AML/KYC matters to management and other stakeholders

Experience

5+ Years

Level

Senior

Education

Bachelor’s

AML Investigator Resume with 7 Years of Experience

A highly organized, detail- oriented professional with 7 years of experience as an AML Investigator. Possess an in- depth knowledge of developing and implementing various AML compliance programs, risk assessments, and monitoring to detect and report suspicious activities. Adept in reviewing customer profiles, using various investigative techniques, analyzing large volumes of data, and preparing reports. Skilled at conducting investigations and interacting with financial institutions. Possess excellent communication, problem- solving, and organizational skills.

Core Skills:

- AML Compliance Programs

- Risk Assessments

- Suspicious Activity Monitoring

- Customer Profiles

- Investigative Techniques

- Data Analysis

- Report Preparation

- Financial Institution Interaction

- Communication

- Problem- Solving

- Organizational Skills

Responsibilities:

- Developed and implemented AML compliance programs to adhere to regulatory requirements.

- Carried out risk assessments to identify potential issues and develop strategies to mitigate risks.

- Monitored suspicious activities to detect and report any suspicious activities.

- Evaluated customer profiles to identify possible financial crime and money laundering activities.

- Applied various investigative techniques such as open- source research, document analysis, and interview techniques.

- Analyzed large volumes of data and information to validate findings and detect money laundering.

- Prepared reports to document the investigation results and provide recommendations.

- Coordinated with financial institutions and other relevant parties to obtain necessary information.

- Liaised with legal, financial, and compliance teams to address any compliance Gap.

- Assisted in developing and conducting training programs to improve team members’ understanding of AML requirements.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

AML Investigator Resume with 10 Years of Experience

A highly experienced AML Investigator with a ten year career across various financial institutions, including banks and investment firms. A dedicated and thorough professional, with a comprehensive understanding of internal control systems and international regulations related to Anti- Money Laundering. Track record of successful investigations, leading to the identification and prevention of criminal activities. Demonstrated experience in the areas of risk mitigation, investigations, and transaction monitoring.

Core Skills:

- Advanced knowledge of Anti- Money Laundering laws and regulations

- Strong investigative and analytical skills

- Proficient in the use of MS Office Suite and investigative research techniques

- Excellent written and verbal communication abilities

- Exceptional time management and organizational skills

Responsibilities:

- Conducting comprehensive investigations into suspicious activity and financial crimes

- Monitoring transactions and accounts for potential money laundering

- Developing and implementing enhanced due diligence procedures

- Identifying and assessing potential money laundering risks

- Reviewing and analyzing customer information

- Collaborating with other departments to ensure compliance with internal and external regulations

- Preparing reports for upper management on investigations, findings, and recommendations

Experience

10+ Years

Level

Senior Manager

Education

Master’s

AML Investigator Resume with 15 Years of Experience

I am an AML Investigator with 15 years of experience in the banking sector. I have strong knowledge of global AML regulations, including the US Patriot Act, KYC, and the Banking Secrecy Act. I have a thorough understanding of the financial services industry, with a particular focus on money laundering, fraud, and compliance. I have a proven track record of conducting complex investigations, identifying and mitigating potential money laundering risks, and implementing compliance programs and policies to ensure that financial institutions adhere to AML requirements.

Core Skills:

- Extensive experience in global AML regulations

- Strong knowledge of financial services industry

- Proficiency in conducting complex investigations

- Ability to identify and mitigate money laundering risks

- Familiarity with implementation of compliance programs

- Excellent communication and interpersonal skills

- Proficient in Microsoft Office Suite

Responsibilities:

- Performing detailed investigations into suspicious activities and transactions

- Assessing customer information and documentation to identify money laundering risks

- Analyzing transaction records and other relevant data to detect potential money laundering activities

- Conducting periodic reviews of customer accounts to ensure compliance with AML regulations

- Assisting in the development and implementation of AML policies and procedures

- Maintaining accurate records of investigations and monitoring activities

- Providing training and guidance to staff on AML regulations and requirements

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a AML Investigator resume?

A resume for a AML Investigator should include information about their experience and qualifications in order to demonstrate their knowledge of the anti-money laundering industry. The resume should also include information about their ability to analyze and investigate money laundering activities and to make corresponding recommendations.

Here is what should be included in an AML Investigator resume:

- Extensive experience in the fields of financial crime, fraud and anti-money laundering

- Experienced in using various transaction monitoring and investigation systems

- Ability to use data analysis techniques to identify suspicious activities and recommend appropriate action

- Strong knowledge of AML regulations and laws

- Skilled in developing and implementing AML policies and procedures

- Ability to work independently and as a team member

- Excellent verbal and written communication skills

- Ability to maintain confidentiality and abide by regulations

- A bachelor’s degree in finance, economics, accounting or a related field

What is a good summary for a AML Investigator resume?

A good summary for an AML Investigator resume should showcase your experience in financial crime investigations, regulatory compliance and anti-money laundering (AML) matters. Your summary should also demonstrate your solid knowledge of banking regulations, such as the Bank Secrecy Act, and your strong research and analytical skills. Additionally, you should highlight your ability to quickly identify and report suspicious activity to the appropriate authorities. Finally, you should also emphasize your excellent investigative and communication skills, which are critical for successful investigations.

What is a good objective for a AML Investigator resume?

A good objective for an Anti-Money Laundering (AML) Investigator resume should demonstrate the applicant’s qualifications and commitment to enforcing AML regulations. It should also highlight the individual’s experience with financial crimes, their research and analytical abilities, and their dedication to ensuring compliance with the relevant laws and regulations.

Objective

Seeking a position as an AML Investigator to use my investigative, research, and analytical abilities to help ensure compliance with AML regulations.

Qualifications

- Demonstrated experience investigating financial crimes, including money laundering and fraud

- Skilled in conducting research and analyzing financial transactions

- Adept at analyzing complex financial documents and identifying suspicious activity

- Proven ability to work effectively with law enforcement, regulators, and other relevant bodies

- Familiarity with relevant laws and regulations governing anti-money laundering activities

- Excellent communication skills and problem-solving abilities

- Highly organized and detail-oriented

How do you list AML Investigator skills on a resume?

- A successful Anti-Money Laundering (AML) Investigator will have a well-rounded skillset that includes both technical and investigative proficiencies.

- Education and qualifications such as a degree in finance, accounting, or a related field may be required.

- Knowledge of the latest AML regulations is essential, as well as understanding the laws and regulations pertaining to money laundering and terrorist financing.

- Demonstrated experience in conducting audits, investigations, and reviews of financial transactions.

- Ability to effectively use industry specific investigative software, databases, and other technological tools.

- Good research and analytical skills to identify suspicious activities and transactions.

- Strong interpersonal and communication skills to interact with internal and external stakeholders.

- Excellent problem-solving and critical thinking skills.

- Ability to work autonomously and collaboratively in a team environment.

- Detail-oriented with an aptitude for accuracy and precision.

What skills should I put on my resume for AML Investigator?

Being an AML (Anti-Money Laundering) Investigator requires a combination of both hard and soft skills. It is important to emphasize these key skills on your resume to give potential employers an understanding of your professional abilities.

Here are some of the top skills to consider including on your resume when applying for an AML Investigator position:

- Risk Management: AML Investigators must be able to identify and assess risks, take appropriate measures to reduce exposure, and understand how to mitigate the threat of money laundering.

- Data Analysis: It is essential to be able to interpret and analyze data in order to identify suspicious activity and patterns. Investigator must also be able to accurately document their findings.

- Interpersonal Skills: AML Investigators must have strong communication and interpersonal skills in order to effectively interact with banks, stakeholders, and clients.

- Regulatory Compliance: AML Investigators need to be familiar with the relevant regulations and laws in order to ensure that all procedures are being followed.

- Investigative Techniques: AML Investigators must possess strong investigative techniques, such as being able to uncover evidence and build a case.

- Organizational Skills: AML Investigators need to be able to organize and manage large amounts of data and information.

- Attention to Detail: AML Investigators must pay close attention to detail in order to identify and investigate any suspicious activity or patterns.

By emphasizing these skills on your resume, you’ll demonstrate to potential employers that you are well-suited for the role of an AML Investigator.

Key takeaways for an AML Investigator resume

If you’re looking for a job as an AML Investigator, there are a few key things you need to include in your resume that will make you stand out from the competition. Here are the key takeaways for an AML Investigator resume:

- Demonstrate your experience. Make sure your resume shows your experience in AML investigations, including any relevant certifications, such as CFE or CAMS. Showcase any achievements you have made in the field, such as successful investigations conducted or AML-related crimes prosecuted.

- Highlight critical skills. An AML Investigator should have a range of technical and interpersonal skills, such as knowledge of Anti-Money Laundering laws, investigative techniques, and financial analysis. Make sure to emphasize these skills on your resume to make it stand out.

- Showcase your education. While experience is important, make sure to include information on any education you have related to AML investigations, such as a degree in finance or criminal justice.

- Demonstrate strong communication skills. AML Investigators need to be able to clearly communicate their findings to employers, clients, and law enforcement, so make sure to emphasize your ability to write reports, present findings, and build relationships.

Including these key elements on your resume will make you stand out from the competition and help you land the job of your dreams. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder