A resume for an AML Analyst position is a critical tool for success in the job search process. It helps employers quickly identify candidates who are qualified for the job. A well-written and formatted AML Analyst resume should highlight the most relevant skills and experiences that you possess that make you the ideal candidate for the job. This comprehensive guide will provide useful tips and examples for crafting an impressive AML Analyst resume. It will also help you understand what employers are looking for in a candidate and how to best position yourself to be selected for a job interview.

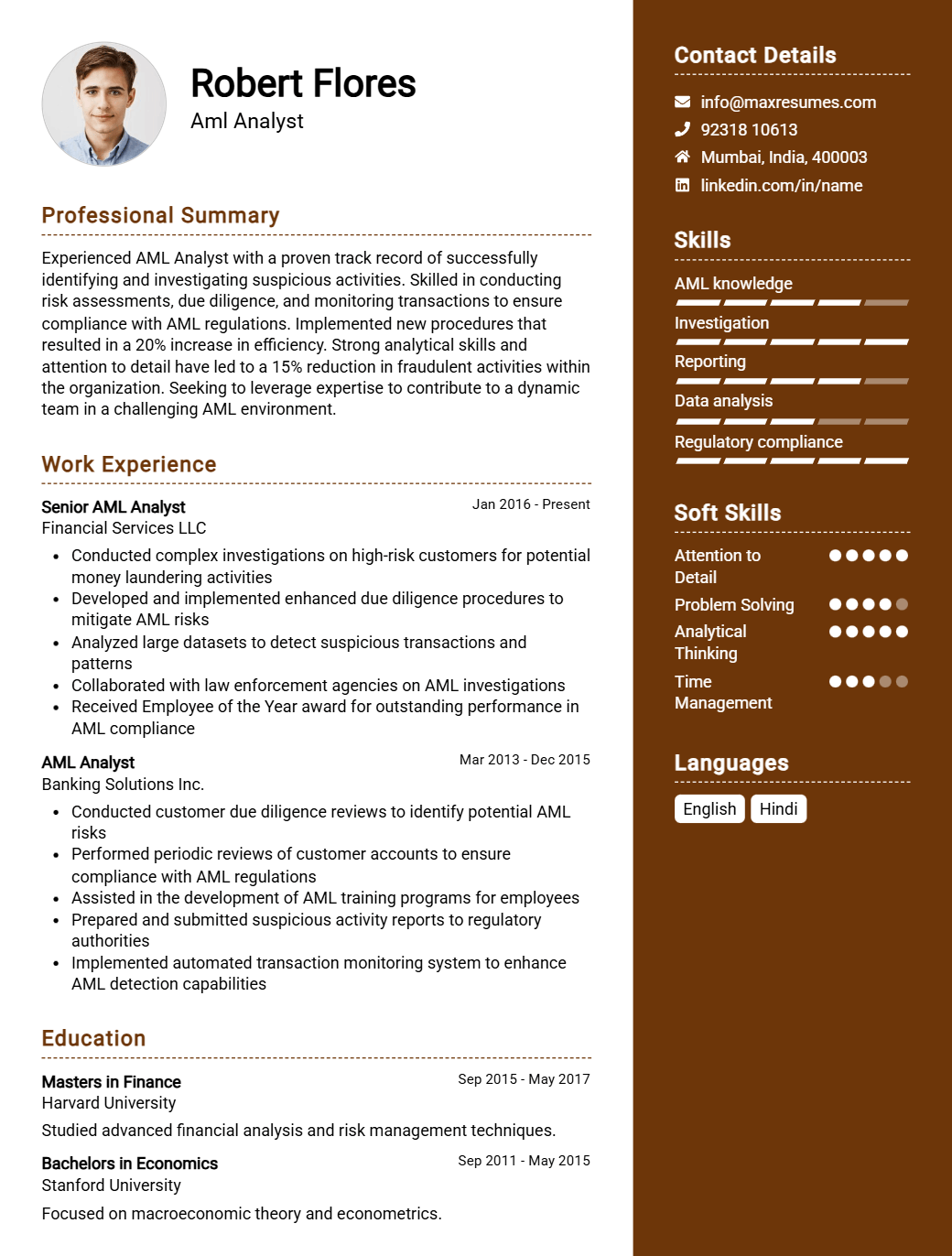

Aml Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

AML Analyst Resume Examples

John Doe

AML Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A motivated and experienced AML Analyst with a passion for financial compliance and regulations. Highly knowledgeable in both domestic and international banking regulations and laws that govern the financial industry. Excellent track record in the successful identification and resolution of suspicious activity, as well as the implementation of successful compliance measures.

Core Skills

- Strong knowledge of the Bank Secrecy Act (BSA) and its associated regulations

- Proficient in AML/BSA investigative techniques and processes

- Highly detail- oriented and organized

- Excellent problem- solving and analytical skills

- Proficient in multiple financial software applications

- Advanced knowledge of fraud detection and prevention

- Strong understanding of KYC and enhanced due diligence procedures

- Excellent written and verbal communication skills

Professional Experience

AML Analyst, ABC Bank, 2018- Present

- Analyze customer transactions to detect suspicious activity and prepare detailed reports

- Monitor customer accounts for any suspicious or unusual activity

- Conduct research on customer backgrounds and activities including KYC checks

- Analyze customer information to accurately assess risk

- Conduct training sessions and educate staff on banking regulations and compliance

- Assist in the development of new AML policies and procedures

- Conduct AML/BSA audits and reviews

- Develop and maintain relationships with law enforcement and regulatory agencies

Education

Bachelor of Science in Finance, University of XYZ, 2016- 2018

AML Analyst Resume with No Experience

Recent college graduate with a degree in Business Administration and a passion for data analysis and financial operations. Seeking to leverage my analytical skills and knowledge of financial software and systems to help support the AML Analyst team.

Skills:

- Proficient in Microsoft Office Suite, including Excel, Access and PowerPoint

- Knowledge of financial software and systems

- Strong analytical and problem- solving skills

- Excellent communication and interpersonal skills

- Ability to work effectively in a team environment

Responsibilities:

- Assist in the development and implementation of AML compliance processes and procedures

- Monitor accounts for suspicious activity and investigate any discrepancies

- Conduct audits to ensure compliance with AML regulations

- Provide recommendations for improvement of existing policies and procedures

- Assist with customer onboarding and KYC processes

- Conduct research and analysis of customer data and records

Experience

0 Years

Level

Junior

Education

Bachelor’s

AML Analyst Resume with 2 Years of Experience

A highly motivated and self- directed analyst with two years of experience in Asset Management and Lending (AML). Demonstrated success in analyzing financial information and identifying compliance risks. Experienced in developing and executing AML compliance policies and procedures. Strong analytical and problem- solving skills, with a commitment to accuracy and excellent customer service.

Core Skills:

- Financial Analysis

- AML Compliance

- Risk Analysis

- Regulatory Compliance

- Process Improvement

- Problem Solving

- Report Writing

- Investigative Analysis

Responsibilities:

- Conducted financial analysis to identify non- compliance or suspicious activities in accordance with applicable AML regulations.

- Created and implemented AML compliance policies and procedures to ensure compliance with applicable regulations.

- Developed and maintained AML filter parameters and monitoring scenarios to identify suspicious activity.

- Analyzed and reported on regulatory developments to ensure AML compliance.

- Assessed customer risk profiles and monitored customer activities for potential AML compliance issues.

- Investigated suspicious activity and drafted reports outlining the findings.

- Developed and implemented process improvements to enhance operational efficiency and reduce costs.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

AML Analyst Resume with 5 Years of Experience

A highly accomplished and detail- oriented AML Analyst with 5 years of professional experience in conducting financial crime investigations and developing money laundering policies. Possesses expertise in analyzing financial transactions and detecting signs of suspicious activity. Experienced in managing and analyzing high- volume data, identifying potential risks and implementing effective solutions. Possesses excellent research, analytical and problem- solving skills, and the ability to communicate effectively with stakeholders and colleagues.

Core Skills:

- Advanced knowledge of KYC, AML, and Fraud Analytics

- Ability to identify, investigate, and report suspicious activity

- Knowledge of financial crime regulations, compliance policies and procedures

- Proficient in using various investigation tools, including Excel

- Excellent communication and writing skills

Responsibilities:

- Identified and investigated suspicious financial transactions using transaction monitoring and data analysis tools

- Performed KYC (Know Your Customer) reviews to ensure compliance with AML regulations

- Researched and identified activities potentially associated with money laundering

- Developed and implemented policies to detect and prevent money laundering and other financial crimes

- Drafted reports to senior management on suspicious activity, money laundering cases, and risk assessments

- Assisted in developing and maintaining internal control processes and procedures

- Conducted financial crime investigations and analysis to detect money laundering and fraud

- Analyzed large amounts of data to detect anomalies, trends and irregularities

- Reviewed new and existing customer accounts for compliance with AML law and regulations

Experience

5+ Years

Level

Senior

Education

Bachelor’s

AML Analyst Resume with 7 Years of Experience

I am an experienced and professional AML (Anti- Money Laundering) Analyst, with more than 7 years of expertise in the financial industry. My experience includes handling complex client transactions, identifying and investigating suspicious activities, enabling the smooth functioning of financial systems, and ensuring compliance with AML regulations. I possess excellent analytical, technical, and communication skills, which have enabled me to provide complete assistance to financial institutions on various aspects of AML, KYC, and Regulatory Compliance. I also have a deep understanding of the systems and procedures for preventing, detecting, and tracking financial terrorist activities.

Core Skills:

- Strong Analytical Skills

- Excellent Knowledge of AML and KYC Regulations

- Highly Experienced in Anti- Money Laundering Investigations

- Proficient in Regulatory Compliance

- In- depth Understanding of Financial Systems

- Good Understanding of Financial Terrorist Activities

- Proficient in Risk Assessment and Risk Analysis

Responsibilities:

- Monitoring and analyzing financial transactions for suspicious activities

- Ensuring compliance with Anti- Money Laundering (AML) regulations and Know Your Customer (KYC) procedures

- Conducting investigations into suspicious activities and reporting findings to the senior management

- Developing and maintaining a database of customer information and transaction records

- Providing customer support on AML and KYC compliance issues

- Identifying and analyzing financial risks and threats, and developing strategies to mitigate them

- Assisting in the implementation of AML and KYC compliance policies and procedures

- Performing periodic reviews of customer accounts to ensure compliance with AML regulations

- Providing training on financial regulations and fraud prevention to staff members.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

AML Analyst Resume Resume with 10 Years of Experience

Highly experienced AML Analyst with 10 years of experience in the financial services industry. Adept at monitoring customer accounts to detect unusual activity, performing customer risk assessments, and ensuring compliance with all applicable laws and regulations. Possesses excellent analytical skills, a keen eye for detail, and the ability to work well under pressure.

Core Skills:

- Experienced in Anti- Money Laundering (AML)

- Able to identify and assess customer risk

- Excellent analytical, problem- solving and organizational skills

- Knowledge of financial instruments and transaction types

- Proficient in using MS Office and AML software

- Strong written and verbal communication skills

- Able to work independently and as part of a team

Responsibilities:

- Monitor customer accounts to detect any unusual or suspicious activity

- Perform customer risk assessments to identify any potential money laundering or other fraudulent activities

- Analyze customer transactions and make recommendations for further investigation

- Ensure compliance with all applicable laws and regulations, including the Bank Secrecy Act, PATRIOT Act, and OFAC regulations

- Assist with customer due diligence and customer onboarding process

- Review customer documentation for accuracy and completeness

- Generate reports and provide them to senior management

- Maintain detailed records and prepare regular status updates on compliance activities

- Participate in internal and external audits, as required

Experience

10+ Years

Level

Senior Manager

Education

Master’s

AML Analyst Resume Resume with 15 Years of Experience

A highly experienced AML Analyst with over 15 years of professional experience in the banking and financial services industries, adept at detecting and managing financial crime risks through a range of techniques, including periodic reviews and customer profiling. Experienced with compliance, risk management, and data analysis, with a sound knowledge of relevant regulations and best practices in the banking and financial services sector. Proven track record of success in identifying suspicious activity, conducting timely investigations and collaborating with the relevant stakeholders to mitigate potential risks.

Core Skills:

- Extensive knowledge of banking and financial services industry regulations, procedures and best practices

- Experienced in developing and implementing AML compliance standards and procedures

- Proficient in the use of software applications to analyze large sets of data, identify anomalies and detect suspicious activity

- Excellent written and verbal communication skills

- Ability to identify potential risks and take appropriate action

- Highly organized with attention to detail

- Proven track record of success in customer profiling

Responsibilities:

- Conduct customer due diligence and periodic reviews to identify suspicious activity

- Develop and implement AML compliance strategies and procedures

- Monitor customer accounts for any suspicious activity and escalate as needed

- Collaborate with stakeholders such as law enforcement, regulators, and other financial institutions to ensure compliance with regulations

- Keep abreast of current developments in the banking and financial services industry

- Analyze customer data to identify suspicious activity, including money laundering and terrorist financing

- Prepare reports and documents for internal and external review

- Provide guidance and support to colleagues on AML related topics

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a AML Analyst Resume resume?

A resume for a AML Analyst should contain information that outlines the individual’s qualifications, experience, and any special training related to the position. When creating a resume for an AML Analyst position, there are certain key elements that should be included.- Education: Be sure to include any degrees, certifications, or educational courses related to the position of AML Analyst. This can include a degree in finance, economics, accounting, or a related field.

- Experience: Include any relevant experience in the financial industry as a AML Analyst. This should include any past roles and responsibilities related to AML compliance.

- Knowledge: This should include any specialized knowledge related to AML compliance that the individual has acquired. This could include an understanding of banking regulations, anti-money laundering legislation, or other AML related topics.

- Technical Skills: Include any technical skills related to AML compliance that the individual possesses. This can include software proficiency, familiarity with databases, or any other technical skills related to the position.

- Communication Skills: Outline any communication skills that the individual possesses that are relevant to the position. This can include abilities to effectively collaborate with colleagues and customers, as well as the ability to present data and information in a clear manner.

By including these elements in an AML Analyst resume, the individual will be able to demonstrate their qualifications for the position and make themselves a more attractive candidate for employment.

What is a good summary for a AML Analyst Resume resume?

A good summary for an Anti-Money Laundering (AML) Analyst Resume should highlight the candidate’s expertise in AML compliance and regulations. It should also mention the candidate’s experience in conducting AML investigations, analyzing suspicious activities, and performing risk assessments. The summary should also include the candidate’s ability to work collaboratively with team members, as well as their knowledge of banking and financial systems. Finally, the summary should emphasize any special qualifications the candidate has, such as certifications and other relevant training.

What is a good objective for a AML Analyst Resume resume?

A well-constructed objective for an AML Analyst Resume should clearly communicate the candidate’s professional goals and qualifications. A good objective for an AML Analyst Resume should focus on the following points:

- Increase proficiency in identifying suspicious financial activities and complying with AML regulations

- Utilize financial software to analyze and monitor financial transactions

- Develop and implement AML procedures and policies

- Monitor customer accounts to detect suspicious activities

- Participate in audits to ensure compliance with AML regulations

- Create and manage financial reports and documents

- Liaise with internal and external stakeholders to ensure timely and accurate completion of AML tasks

- Remain up-to-date with the latest AML regulations

- Enhance AML process efficiency and effectiveness through innovative solutions.

How do you list AML Analyst Resume skills on a resume?

When listing AML Analyst skills on a resume, you should focus not only on the technical capabilities and experience that are directly related to the role, but also the personal qualities that will make you stand out from other applicants. Below are some skills and qualifications that are beneficial to highlight in an AML Analyst resume:

- In-depth understanding and knowledge of AML regulations and laws

- Expertise in AML/KYC systems and applications

- Proficiency in financial analysis and data analysis

- Strong ability to detect suspicious financial transactions and patterns

- Excellent communication and problem-solving skills

- Ability to work independently and in a team

- Experience with AML compliance processes and procedures

- High attention to detail and accuracy

- Ability to identify areas of risk and take decisive action to address them

- Ability to manage multiple projects and prioritize tasks

What skills should I put on my resume for AML Analyst Resume?

When applying for a role as an anti-money laundering (AML) analyst, it’s important to make sure that your qualifications are highlighted on your resume. Your resume should include a combination of skills and experiences that demonstrate your knowledge of banking regulations and financial crime prevention. Here are some of the key skills employers will be looking for when reviewing your AML analyst resume:

- Thorough knowledge of banking regulations and financial crime prevention

- Familiarity with anti-money laundering laws, regulations, and procedures

- Strong analytical and problem-solving skills

- Ability to interpret and analyze financial data

- Excellent interpersonal and communication skills

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint, etc.)

- Ability to identify suspicious activities

- Ability to develop and maintain relationships with clients

- Strong organizational and time management skills

- Ability to work independently and as part of a team

By showcasing these skills and qualifications on your resume, you’ll demonstrate to employers that you’re the ideal candidate for the role of an AML analyst.

Key takeaways for an AML Analyst Resume resume

An Anti-Money Laundering (AML) Analyst resume is a vital component of an AML Analyst’s job search. While it is important to include information about education, experience, and certifications, it is also important to include certain key takeaways that will help the resume stand out from the competition. Here are the key takeaways for an AML Analyst resume:

- Put your experience in the spotlight. Make sure that you highlight the experience you have with AML compliance and financial crime prevention. Ensure that you include any specific software or systems you have worked with, as well as any specialized roles you have performed.

- Show off your hard skills. As an AML Analyst, you will need to demonstrate your knowledge of various AML regulations, financial instruments, and risk management practices. List any specialized courses or certifications that you have completed that relate to AML and financial crime.

- Demonstrate your aptitude for data analysis. As an AML Analyst, you will need to be able to analyze large amounts of data to identify suspicious activity. Make sure to include any data analysis tools, such as Excel and SQL, that you are proficient in.

- Show off your soft skills. As an AML Analyst, you need to have excellent communication and problem-solving skills. Make sure to include any additional soft skills, such as customer service and collaboration, that are necessary for your role.

By following these key takeaways, you can create an AML Analyst resume that will make you stand out from the competition. Make sure to highlight your experience, knowledge, and skills to give potential employers an accurate representation of how you can contribute to their team.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder