When it comes to debt collectors, resume writing is an essential part of getting hired for the position. A debt collector’s resume needs to stand out and highlight their experience, skills, and expertise in the field. Writing a resume for a debt collector requires a great level of detail, as employers will want to know all about the applicant’s experience, qualifications, and achievements. In this guide, we will provide helpful tips on how to write a resume for a debt collector and provide you with examples of well-crafted resumes to help you create your own.

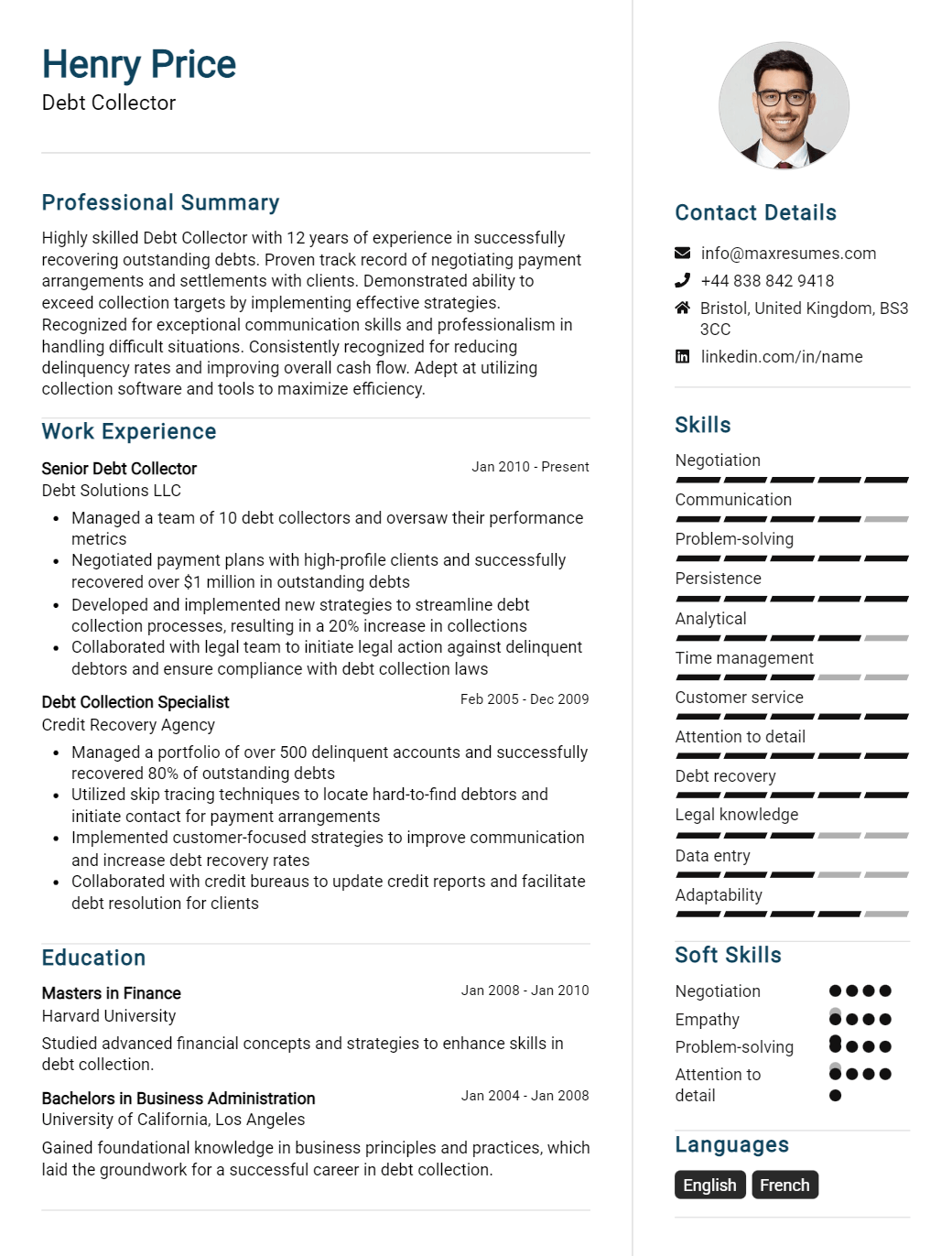

Debt Collector Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Debt Collector Resume Examples

John Doe

Debt Collector

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

An experienced and knowledgeable debt collector with 10+ years of experience in resolving outstanding debts. Excellent record in collecting overdue payments while maintaining a strong relationship with clients. Detail- oriented and confident in talking to customers and communicating payment plans.

Core Skills:

- Customer Service

- Debt Collection

- Data Entry

- Organizational

- Communication

- Negotiation

Professional Experience:

Debt Collector, XYZ Corporation – New York, NY

November 2009 – Present

- Handle collections of debts from customers and clients

- Conduct customer negotiations to come to an agreement on payment options

- Gather necessary information and documents from customers

- Establish payment plans for customers

- Maintain records of all incoming and outgoing payments

- Prepare reports and documentation for all activities

Debt Collector, ABC LTD – New York, NY

December 2006 – October 2009

- Reviewed customer accounts and provided payment options

- Communicated with debtors via phone and email to resolve debts

- Negotiated terms and payment methods with debtors

- Ensured all necessary documents were collected

- Reviewed customer credit reports and provided payment options

Education:

Bachelor of Arts in Business Administration, University of New York, New York, NY, 2005

Diploma in Accounting and Finance, New York School of Business, New York, NY, 2002

Debt Collector Resume with No Experience

Highly organized and detail- oriented individual looking to start a career in debt collection. Possesses strong verbal and written communication skills, and the ability to stay composed and professional under pressure. Committed to helping organizations recover outstanding payments ethically.

Core Skills

- Advanced knowledge of legal and financial regulations related to debt collection

- Excellent organization and time- management capabilities

- Proven track record of working with customers to find agreeable solutions

- Strong verbal and written communication skills

- Able to stay composed and professional under pressure

Responsibilities

- Conduct effective debt collection in an efficient and ethical manner

- Negotiate payment plans and settlements with customers

- Handle administrative tasks related to debt collection

- Manage customer payment records

- Keep up- to- date with legal and financial regulations related to debt collection

Experience

0 Years

Level

Junior

Education

Bachelor’s

Debt Collector Resume with 2 Years of Experience

A responsible and results- oriented debt collector with 2 years of hands- on experience in reaching out to debtors for successful payments. Proven ability to negotiate and collect payments from delinquent debtors in a timely manner. Highly skilled in tactfully communicating with clients and handling customer service related queries. Adept at performing audits and executing account reconciliations.

Core Skills:

- Strong communication and negotiation skills

- Ability to build rapport with debtors

- Competent in customer service

- Analytical and problem- solving skills

- Proficient in Microsoft Office

- Thorough knowledge of debt collection laws

- Excellent time management skills

Responsibilities:

- Contacting debtors on a daily basis to discuss debt repayment plan

- Collecting payments from debtors in a timely manner

- Negotiating payment plans and setting up payment arrangements

- Auditing accounts and executing reconciliations

- Maintaining accurate records of payments and collection activities

- Providing outstanding customer service while handling queries

- Keeping up to date with debt collection laws and regulations

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Debt Collector Resume with 5 Years of Experience

Experienced debt collector with five years of experience in the collection industry. Adept at managing debt collection accounts, developing and implementing collection processes, and maintaining positive customer relationships. Solid understanding of the Fair Debt Collection Practices Act and the ability to remain compliant while collecting outstanding debts. Dedicated to helping clients find effective ways to recover delinquent balances and reduce the financial burden on the debtor.

Core Skills:

- Account Management

- Debt Collection Processes

- Negotiations

- Customer Service

- Conflict Resolution

- Data Analysis

- Fair Debt Collection Practices Act (FDCPA)

- Legal Compliance

Responsibilities:

- Managing and collecting delinquent accounts

- Developing and implementing effective debt collection processes

- Negotiating with debtors to resolve outstanding balances

- Analyzing data to identify areas for improvement

- Maintaining positive relationships with customers and creditors

- Tracking and reporting on collection efforts

- Complying with state and federal regulations concerning debt collection

- Reviewing accounts for accuracy and resolving discrepancies

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Debt Collector Resume with 7 Years of Experience

A dedicated and results driven debt collector with 7 years of experience in the accounts receivable field. Proven ability to provide exceptional customer service while collecting on past due accounts and reducing delinquency. Committed to providing customers with an understanding and excellence in customer service to ensure payment resolution.

Core Skills:

- Excellent customer service and communication skills

- Knowledgeable in debt collection laws

- Ability to multi- task, prioritize and manage multiple accounts

- Thorough understanding of accounting principles

- Proficient in Microsoft Office and accounting software

- Excellent problem- solving and negotiation skills

Responsibilities:

- Contact customers by telephone to collect on overdue debt and negotiate payment plans

- Maintain current records of customer accounts and payment details

- Provide customers with detailed information regarding their accounts

- Prepare and send past due notices and letters to customers

- Resolve complex customer issues related to payment and account status

- Investigate and respond to customer complaints and disputes

- Analyze customer accounts to identify payment irregularities and trends

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Debt Collector Resume with 10 Years of Experience

Experienced and organized Debt Collector with 10 years of experience in handling collections and negotiations in a variety of industries. Adept at utilizing various collection tactics and methods to secure timely payments from clients. Possesses excellent problem- solving and communication skills to effectively negotiate and convince delinquent accounts. Committed to excellent customer service and creating positive relationships with customers.

Core Skills:

- In- depth knowledge of the collections process

- Excellent problem- solving and negotiation skills

- Certified Professional Collector (CPC)

- Skilled in documentation and record- keeping

- Proficient with computer software and collections systems

- Experienced in reviewing credit reports

- Ability to handle a large volume of customers and accounts

- Comfortable working with deadlines and under pressure

Responsibilities:

- Contacted clients and reminded them of payment due

- Followed up on overdue payments and negotiated payment terms

- Reviewed credit reports and other financial documentation

- Reconciled customer accounts and resolved discrepancies

- Analyzed customer financial records to determine settlement options

- Evaluated customer payment plans and set up repayment arrangements

- Monitored and updated accounts on collection software

- Negotiated settlements and answered customer inquiries

- Filed legal documents and represented the company in court proceedings.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Debt Collector Resume with 15 Years of Experience

A highly experienced and knowledgeable Debt Collector with 15 years of experience in debt collection and customer relations. Possesses an in- depth understanding of the debt collection process, and has a proven track record of successful debt recovery efforts. Proven ability to effectively manage customer relations and build constructive relationships with customers. Skilled in utilizing a variety of collection methods, including negotiation and legal action, to ensure debt collection goals are met.

Core Skills:

- Skilled in debt collection process, customer relations and relationship building

- Proven ability to successfully recover debt

- Experience in negotiation and legal action for debt collection

- In- depth knowledge of applicable laws, regulations, and procedures

- Excellent interpersonal, written and verbal communication skills

- Proficient in using MS Office applications and debt collection software

Responsibilities:

- Contact debtors to negotiate payment and set up payment plans

- Maintain accurate records of debtors and payment status

- Follow up and ensure payment is received

- Determine customer financial status and ability to pay

- Make necessary legal filings to collect on delinquent accounts

- Monitor accounts regularly and communicate with debtors

- Keep abreast of current collection laws and regulations

- Handle customer inquiries and disputes in a professional manner

- Prepare and submit detailed collection reports

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Debt Collector resume?

A Debt Collector resume should include all pertinent information related to the job you’re applying for. Here are some key points to include:

- Contact Information: Make sure your contact information is accurate and up-to-date. Include your name, phone number, email address, and the city/state you live in.

- Professional Summary: Write a brief overview of your experience as a debt collector. This should include your skills and abilities, years of experience, and any certifications or special training you have related to the job.

- Work Experience: Include any relevant debt collection experience you have. List job titles, employers, start and end dates, and a brief description of your duties and responsibilities.

- Education: Include the educational institutions you’ve attended and the degrees you’ve received.

- Skills: List any special skills you have related to debt collecting. This could include knowledge of relevant laws and regulations, computer skills, customer service skills, etc.

- Relevant Certifications: If you have any certifications related to debt collection, list them here.

- References: Include at least two professional references.

By including all this information in your resume, employers will be able to gain a better understanding of your skills and qualifications. Good luck!

What is a good summary for a Debt Collector resume?

A Debt Collector resume should include an effective summary that outlines the qualifications and experience of the individual. The summary should briefly explain key qualifications, such as experience in customer service, communication, and problem solving. It should also highlight any specialties in collections, such as skip tracing, working with legal departments, or experience in the banking industry. A good summary should also demonstrate the candidate’s enthusiasm for the job and their dedication to helping customers resolve their debts. Finally, the summary should demonstrate the candidate’s ability to multitask and prioritize, as well as their ability to maintain a positive attitude and professional demeanor.

What is a good objective for a Debt Collector resume?

A debt collector resume should include a clear objective that is tailored to the particular position you are seeking.

An effective objective should demonstrate your ability to professionally collect debts, while maintaining a respectful and professional relationship with the debtor.

Here are some good objectives for a debt collector resume:

- To use my previous experience in debt collection to positively impact the company by achieving collection targets and maintaining a good relationship with debtors.

- To apply my negotiation and problem-solving skills as a debt collector to recover debts in a professional and respectful manner.

- Seeking a debt collection position to apply my knowledge of legal regulations and industry standards to successfully recover debts.

- To contribute to the company’s success in debt collection by utilizing my strong communication and organizational skills.

- To utilize my experience in debt collection and customer service to maintain a respectful and professional relationship between debtors and the company.

- To apply my financial analysis and debt collection skills to help the company in achieving its financial goals.

How do you list Debt Collector skills on a resume?

When job-seekers are writing a resume, it is important to include skills related to the job they are applying for, even if they don’t have direct experience. For those looking to apply for a position as a debt collector, here are some key skills to consider listing on a resume:

- Ability to negotiate settlements and payment plans: Debt collectors must have strong negotiation skills in order to develop and maintain payment plans with debtors.

- Knowledge of relevant laws and regulations: Debt collectors must be familiar with the laws and regulations governing debt collection in their area, including the Fair Debt Collection Practices Act (FDCPA).

- Excellent customer service skills: Debt collectors must be able to establish a positive rapport with debtors and demonstrate strong customer service skills when interacting with them.

- Strong communication skills: Debt collectors must be able to effectively communicate with debtors via telephone and in writing.

- Good organizational and time management skills: Debt collectors must be able to keep track of multiple cases at once and manage their time efficiently.

- Analytical and problem-solving skills: Debt collectors must be able to quickly assess a situation and develop solutions to resolve it.

By including these skills in a resume, job-seekers can demonstrate to potential employers that they have the qualifications necessary to successfully perform the job of a debt collector.

What skills should I put on my resume for Debt Collector?

If you are applying for a job as a debt collector, there are several key skills that you should include on your resume. Debt collectors must have strong customer service and communication skills, along with being able to remain calm and professional even in difficult situations. Here are some of the top skills to include on your resume:

- Excellent communication skills: Debt collectors must be able to communicate with customers in a polite and professional manner, while also being assertive and persistent in asking for payment.

- Attention to detail: Debt collectors must be detail-oriented and able to keep accurate records of all customer payments and interactions.

- Problem-solving skills: In many cases, debt collectors must be able to resolve customer disputes or issues quickly and efficiently.

- Negotiation skills: Debt collectors must be able to negotiate payment plans or other solutions with customers.

- Knowledge of relevant laws and regulations: Debt collectors must have a thorough understanding of applicable laws and regulations related to debt collection.

- Time management: Debt collectors must be able to manage their time effectively and efficiently in order to collect payments in a timely manner.

By including these skills on your resume, you can demonstrate that you have the qualifications to be a successful debt collector.

Key takeaways for an Debt Collector resume

If you are a debt collector looking to make a great impression on hiring managers, your resume should be tailored to reflect your expertise in the field. Here are some key takeaways that should be included in a debt collector resume:

- Highlight Your Experience: Your resume should provide a comprehensive overview of the debt collection experience you have, such as the types of accounts you have worked with and the collection techniques you’ve used.

- Show Your Results: Include information about how effective you have been as a debt collector. For example, provide details about how much money you have recovered on behalf of your clients.

- Demonstrate Your Interpersonal Skills: Debt collectors need to be able to communicate with people in an effective and professional manner. Include any experience you have in customer service and any special training you have received.

- Showcase Your Technical Skills: Many debt collection tasks are now done electronically, so be sure to list any relevant computer skills you have, such as proficiency with debt collection software.

- Speak to Your Professionalism and Reliability: Employers look for debt collectors who are reliable and trustworthy. Make sure you list any awards or certifications you have received that demonstrate your professionalism.

By including these key takeaways, you can make sure your debt collector resume stands out to hiring managers and gives them a good idea of your capabilities.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder