A Universal Banker is an important role in banking. It requires great customer service, financial literacy, and the ability to use various banking systems. Crafting a strong resume that showcases your qualifications is key to standing out from other applicants and landing the job. This guide will provide you with examples of resume writing to help you create a powerful and effective resume that will get you noticed by potential employers. With this guide, you’ll learn best practices for highlighting your experience and skills and creating an overall professional resume.

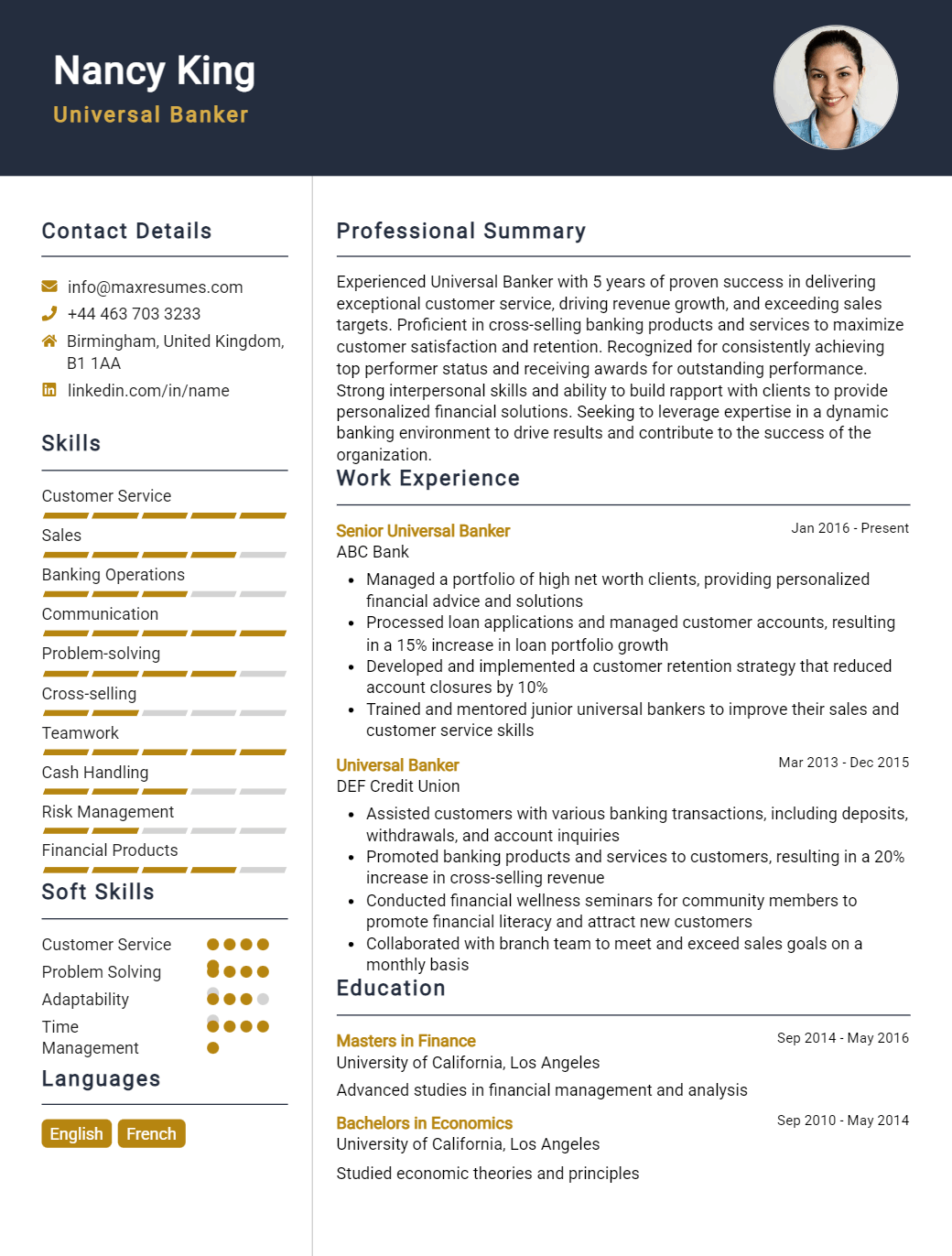

Universal Banker Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Universal Banker Resume Examples

John Doe

Universal Banker

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Universal Banker with 6 years of experience in customer service, sales, and banking operations. I have a comprehensive understanding of banking products, services and regulations, as well as the ability to handle multiple tasks in a fast- paced environment. I have a proven track record of success in building relationships with customers and learning their needs in order to provide tailored solutions. My strong organizational and problem- solving skills, exceptional communication and customer service skills, and ability to work independently or with a team make me an ideal candidate for a Universal Banker role.

Core Skills:

- Ability to build relationships with customers

- Knowledge of banking products, services, and regulations

- Ability to analyze customer needs and provide tailored solutions

- Exceptional communication and customer service skills

- Proven track record of success meeting sales goals

- Highly organized and capable of multi- tasking

- Ability to work independently or in teams

Professional Experience:

American Bank – Universal Banker (2015 – 2020)

- Greeted customers, assessed their needs, and responded to inquiries related to banking services

- Offered clients tailored solutions based on their financial goals

- Processed new accounts, loans and other transactions

- Executed sales activities to meet monthly goals and build customer loyalty

- Developed financial plans and provided guidance to clients

- Ensured compliance with banking regulations and procedures

Education:

B.S. Business Administration | San Diego State University | 2012- 2015

Universal Banker Resume Examples Resume with No Experience

Recent college graduate with a Bachelor’s degree in Business Administration seeking an entry- level Universal Banker role. Possesses excellent communication and customer service skills, as well as an eagerness to learn and develop in the banking industry.

Skills:

- Customer Service: Experienced in dealing with clients in a professional and friendly manner

- Financial Knowledge: Good understanding of basic banking procedures and regulations

- Computer Literacy: Proficient in Microsoft Office Suite and other banking software

- Organization: Able to manage multiple tasks and prioritize tasks efficiently

- Time Management: Able to meet tight deadlines and manage time efficiently

Responsibilites

- Provide customers with information about banking products and services

- Process customer deposits and withdrawals

- Analyze customer financial needs and recommend appropriate banking solutions

- Assist customers with filling out paperwork for loan applications

- Maintain accurate customer records and account balances

- Perform regular account maintenance tasks such as reconciling accounts and processing account transfers

- Adhere to bank policies and procedures when dealing with customers

Experience

0 Years

Level

Junior

Education

Bachelor’s

Universal Banker Resume Examples Resume with 2 Years of Experience

A highly motivated and enthusiastic Universal Banker with 2 years of experience in providing excellent customer service and financial management expertise. Possesses an in- depth knowledge of banking regulations, procedures and products. Proven ability to communicate effectively and develop strong relationships with customers. Experienced in handling customer inquiries, resolving customer issues and providing financial advice.

Core Skills:

- Excellent customer service skills

- Knowledge of banking regulations and procedures

- Strong communication and interpersonal skills

- Problem- solving and conflict resolution

- Organizational and time management skills

- Cash handling and banking operations

- Computer literacy

- Financial analysis and reporting

Responsibilities:

- Providing exceptional customer service and resolving customer inquiries

- Assisting customers with various banking products and services

- Performing financial transactions such as withdrawals, deposits, transfers etc.

- Handling cash deposits, withdrawals and balancing the teller drawer

- Analyzing customer financial needs and providing advice on banking products and services

- Following policies and procedures to ensure the security of customer transactions

- Maintaining confidentiality of customer records and information

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Universal Banker Resume Examples Resume with 5 Years of Experience

Hard- working and enthusiastic Universal Banker with 5 years of experience in providing excellent customer service and support to banking customers. Possesses excellent communication skills, is able to quickly understand customer needs, and is adept at using banking software and technology. Proven ability to manage customer relationships, handle financial transactions, and meet customer expectations. Excellent organizational and problem- solving skills, as well as knowledge of financial instruments, regulations, and banking products.

Core Skills:

- Customer Service

- Financial Transactions

- Relationship Management

- Banking Software

- Regulations and Laws

- Financial Instruments

- Problem- Solving

- Organizational Skills

- Technology

Responsibilities:

- Providing excellent customer service and support.

- Answering customer inquiries and resolving customer issues.

- Cross- selling banking products to customers.

- Processing customer deposits, withdrawals, and other banking transactions.

- Assisting with loan applications, credit card and account openings.

- Recommending banking products and services.

- Verifying customer information and updating records.

- Ensuring compliance with banking regulations and laws.

- Reconciling discrepancies and resolving discrepancies.

- Maintaining customer relationships and helping customers meet their financial goals.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Universal Banker Resume Examples Resume with 7 Years of Experience

A highly motivated and customer- oriented individual with seven years of experience in the banking industry. Experienced in helping customers with their banking needs, resolving customer complaints, opening accounts, and providing excellent customer service. Possesses excellent communication, organization, and problem- solving skills.

Core Skills:

- Customer Service

- Problem Solving

- Communication

- Organizational Skills

- Computer Literacy

- Regulatory Compliance

- Sales Processing

Responsibilities:

- Greet customers and provide assistance with banking services

- Answer customer inquiries and resolve any issues

- Maintain customer records and ensure accuracy and security

- Open new accounts and ensure accuracy of paperwork

- Adhere to banking regulations and compliance standards

- Process transactions including deposits, withdrawals, and transfers

- Assist customers with loan and mortgage applications

- Conduct daily sales activities to meet sales goals

- Cross- sell products and services to customers

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Universal Banker Resume Examples Resume with 10 Years of Experience

Dynamic and motivated Universal Banker with 10 years of experience in the banking industry. Adept at customer service, legal and regulatory compliance, and handling cash and credit transactions. Highly organized with the ability to meet customer needs in a timely manner. Eager to apply skills and experience to help customers gain access to financial products and services.

Core Skills:

- Customer service

- Cash handling

- Credit processing

- Problem solving

- Financial product knowledge

- Regulatory compliance

- Knowledge of banking operations

Responsibilities:

- Managing customer accounts and tracking customer transactions

- Providing guidance to customers on appropriate financial products and services

- Recommending appropriate financial products and services to customers

- Ensuring compliance with all applicable laws and regulations

- Performing clerical duties, such as filing customer paperwork

- Verifying customer identity to ensure accuracy of customer transactions

- Assisting customers with setting up new accounts and transactions

- Processing customer deposits, withdrawals, and payments

- Troubleshooting customer banking issues and resolving customer disputes

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Universal Banker Resume Examples Resume with 15 Years of Experience

Highly motivated and knowledgeable Universal Banker with 15 years of experience providing exceptional customer service and financial advice. Proven success in developing long- term relationships with clients while helping to grow and monitor individual financial portfolios. Skilled in assessing customer needs and providing tailored solutions. Fully compliant with all banking regulations and committed to upholding the highest standards of customer service.

Core Skills:

- Proven ability to identify and address customer needs

- Strong knowledge of banking regulations, products and services

- Exceptional interpersonal and communication skills

- Skilled in handling customer inquiries and complaints

- Highly organized and detail- oriented

- Ability to process loan applications and other banking transactions

- Proficient in using banking software and computer operations

Responsibilities:

- Providing quality customer service and financial advice

- Assessing customer needs and providing tailored solutions

- Processing loan applications and other banking transactions

- Handling customer inquiries and complaints

- Educating customers on banking products and services

- Preparing account documents and maintaining accurate records

- Following up with customers to ensure satisfaction

- Researching and resolving customer account issues

- Identifying opportunities to cross- sell products and services

- Updating customer information in banking system

- Monitoring customer accounts and ensuring compliance with regulations

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Universal Banker Resume Examples resume?

A Universal Banker resume should include all of the necessary qualifications and experiences for the job, as well as demonstrate an individual’s ability to provide customer service in a banking environment. Here are some examples of what should be included in a Universal Banker resume:

- Professional Summary: A brief statement outlining the individual’s qualifications, such as degree in finance or economics, related experience and a commitment to delivering exceptional customer service.

- Skill Highlights: A list of relevant skills and experiences such as cash handling, loan processing, customer relations and sales.

- Education: A list of educational accomplishments such as technical certifications or degrees in finance or economics.

- Professional Experience: A list of relevant job experiences, such as customer service in a banking environment, loan processing, cash handling and sales.

- Additional Experience: Any additional experiences that demonstrate professional growth or customer service capabilities.

- Awards and Achievements: Any awards or recognitions received for outstanding customer service or other achievements.

- References: A list of professional references.

What is a good summary for a Universal Banker Resume Examples resume?

A Universal Banker resume example should highlight the candidate’s experience in areas such as customer service, financial operations, sales, and banking. It should also emphasize their ability to manage the complex financial products of a bank. A good summary for a Universal Banker Resume should include the candidate’s skills in providing excellent customer service, understanding banking regulations, and strong communication and problem-solving skills. It should also indicate the candidate’s ability to work in a team and their ability to multitask. Finally, a good summary should showcase the candidate’s enthusiasm and commitment to providing excellent customer service and financial support.

What is a good objective for a Universal Banker Resume Examples resume?

A universal banker is a financial professional who specializes in a variety of banking services. Therefore, a great objective for a universal banker resume should be specific and highlight the skills, knowledge, and experience the applicant can bring to the table. Here are some examples of good objectives for a universal banker resume:

- To utilize my 5+ years of experience in banking operations, customer service, and financial analysis to provide exceptional service to customers at ABC Bank.

- Seeking to leverage my extensive knowledge of loan and deposit products to help maximize customer satisfaction at ABC Bank.

- Seeking a position as a Universal Banker at ABC Bank to use my background in financial services to help drive growth and profits.

- To bring my ability to develop strong customer relationships and deliver outstanding service to ABC Bank as a Universal Banker.

- Looking to apply my knowledge of banking regulations and financial analysis to contribute to the success of ABC Bank as a Universal Banker.

How do you list Universal Banker Resume Examples skills on a resume?

When crafting a Universal Banker resume, it’s important to emphasize the skills needed for this multifaceted role. As a Universal Banker, you need to demonstrate a range of skills, ranging from customer service and sales to operations and financial services. To help you showcase your skills and make a great impression, here’s how to list Universal Banker resume examples skills on a resume:

- Excellent customer service skills: As a Universal Banker, you’re expected to provide exemplary customer service to both external and internal customers. Demonstrate your customer service skills on your resume by listing the specific duties you’ve performed, such as assisting customers with transactions, resolving customer complaints, and providing excellent customer service.

- Strong sales and marketing skills: Universal Bankers need to be knowledgeable and experienced in sales and marketing. List any sales and marketing projects you’ve completed, such as designing marketing materials, creating and managing customer databases, and developing sales strategies.

- Knowledge of banking regulations: To successfully work as a Universal Banker, you must be knowledgeable about banking regulations. Be sure to list any banking certifications you have and describe how you’ve used your knowledge of banking regulations in your work.

- Proficiency in financial services: As a Universal Banker, you need to be proficient in many financial services, such as loans, insurance, and investments. List the financial services you’re knowledgeable in and describe any experience you have in these services.

- Problem-solving and organizational skills: As a Universal Banker, you need to be able to solve problems quickly and efficiently. List any problem-solving techniques you’ve used in your work and any related successes you’ve had. Additionally, Universal Bankers must be organized and detail-oriented to manage customer accounts and transactions. Describe your organizational skills and any experience you have in managing customer accounts

What skills should I put on my resume for Universal Banker Resume Examples?

When writing a resume for a Universal Banker position, it is important to highlight the skills you possess that will prove beneficial for the job. Depending on the institution, a Universal Banker may be expected to provide customer service, process payments, handle cash, and more. Here is a list of the top skills you should include on your resume for a Universal Banker position:

- Cash Handling: Universal Bankers need to have experience and proficiency in handling various forms of cash, such as coins and currency. They should be able to count and manage cash accurately and efficiently.

- Customer Service: Excellent customer service skills are essential for a successful Universal Banker. This includes the ability to answer customer questions, handle customer complaints, and maintain a professional and courteous demeanor.

- Sales: As a Universal Banker, you may be expected to upsell and cross-sell products and services. It is important that you demonstrate your ability and experience in sales.

- Financial Knowledge: Universal Bankers need to have a basic understanding of financial products, such as loans, credit cards, and other offerings.

- Computer Skills: Universal Bankers need to have proficiency in computer systems, databases, and other technology platforms.

- Problem-Solving: Universal Bankers may be exposed to a variety of complex customer issues. It is important that you demonstrate your ability to quickly and accurately assess problems and come up with solutions.

By including these key skills on your resume, you will be able to demonstrate your qualifications and experience, and set yourself up for success.

Key takeaways for an Universal Banker Resume Examples resume

The key to writing a standout resume for a universal banker position is focusing on the skills and experience most important for that role. It is essential to include a comprehensive list of banking-related experiences and qualifications, but you also want to highlight the ways you stand out from the competition. Here are some of the key takeaways for writing a successful universal banker resume:

- Highlight Your Knowledge of Banking: As a universal banker, you have the ability to manage the customer’s entire financial experience. This means you should make sure to highlight your extensive knowledge of banking, including the different types of products and services you are familiar with. Be sure to include any certifications or industry-specific qualifications you may have.

- Demonstrate Your Professionalism: The banking industry is a highly competitive field, and customer service is a key aspect of the job. You must demonstrate on your resume that you have excellent interpersonal and customer service skills. Include any customer service experience you may have and emphasize any awards or recognition you have received for your professionalism.

- Showcase Your Ability to Multi-Task: Universal bankers must be able to work in a fast-paced environment and handle a variety of tasks at once. Make sure your resume includes any experiences you have had that demonstrate your ability to multi-task and manage multiple customer requests.

- Demonstrate Your Technical Skills: Technology is a major component of the banking industry, and many banks are investing heavily in digital solutions for their customers. Be sure to include any technical skills you have, such as knowledge of computer software, coding languages, or related experience.

By following these key takeaways for a universal banker resume, you can ensure your resume stands out from the competition and gives you the best chance of landing the job. With the right financial services experience and the ability to multi-task, your resume can make you the ideal candidate for any banking position.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder