Writing a resume as a teller can be a daunting task, but with the right knowledge and guidance, it can be an effective way to showcase your skills and experience for potential employers. This article provides an in-depth guide to writing a teller resume, with examples of real resumes that have landed successful job seekers interviews. You will learn how to present your education, experience, and skills in the most attractive light, as well as tips for selecting the best format and style for your resume. With these tools and tips, you’ll be able to write an effective teller resume that will help you stand out from other candidates and get the job you want.

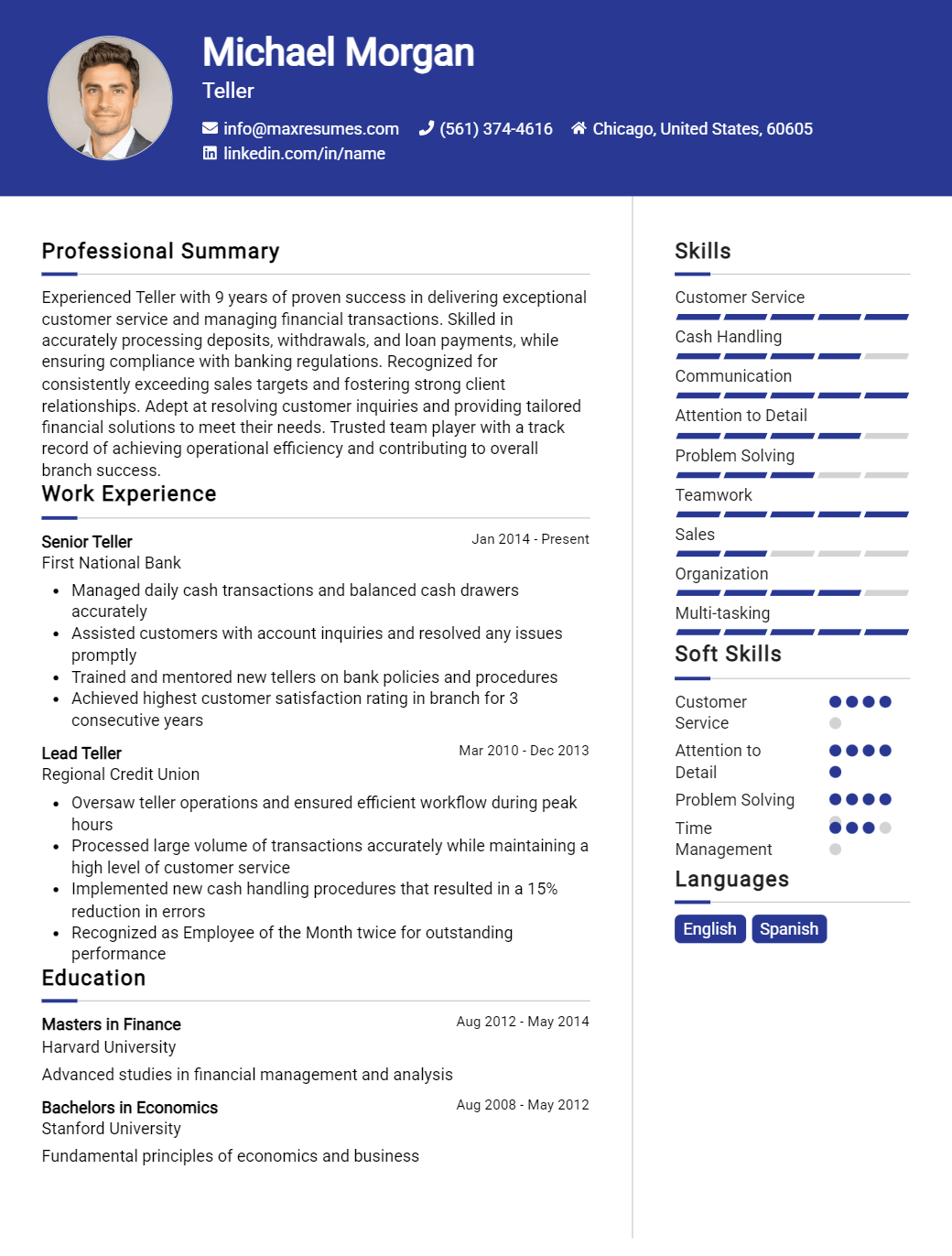

Teller Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Teller Resume Examples

John Doe

Teller

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced and results- oriented Teller with a demonstrated track record of success in providing friendly and knowledgeable customer service. Over the past 4 years, I have developed a strong understanding of banking products, services and regulations, and I have an excellent ability to quickly build positive relationships with customers. I am highly organized and self- motivated, with attention to detail and a commitment to accuracy and customer satisfaction.

Core Skills:

- Proficient in banking operations, products, and services

- Excellent customer service and communication skills

- Skilled in cash handling, reconciliation, and deposits

- Ability to identify customer needs and provide appropriate solutions

- Highly organized and self- motivated

- Knowledge of banking regulations

Professional Experience:

Bank Teller, ABC Bank, 2019 – Present

- Assisted customers with account management, deposits, and loan applications

- Built and maintained strong customer relationships

- Processed transactions accurately and efficiently

- Balanced the cash drawer at the beginning and end of the day

- Investigated and resolved customer complaints

- Ensured compliance with all bank policies and regulations

Bank Teller, XYZ Bank, 2016 – 2019

- Greeted customers and accurately answered inquiries

- Performed transactions including deposits, withdrawals, foreign currency exchange, and account transfers

- Processed loan payments, cheques, and cash advances

- Handled all cash accurately and securely

- Executed daily teller reports

- Contacted customers regarding account discrepancies

Education:

Bachelor of Science in Business Administration, ABC University, 2016

Teller Resume Examples Resume with No Experience

Recent college graduate with strong customer service and interpersonal skills looking to gain experience in the banking industry as a Teller. Highly organized, detail- oriented and able to quickly learn new concepts and procedures.

Skills:

- Excellent customer service skills

- Ability to prepare and maintain accurate records

- Proficient in using computers and software applications

- Familiar with basic accounting principles

- Knowledge of basic banking regulations

- High level of accuracy and attention to detail

- Strong interpersonal and communication skills

Responsibilities:

- Greet customers, provide information, and answer inquiries

- Cash checks, accept deposits and process withdrawals

- Balance cash drawer and reconcile daily transactions

- Process wire transfers and loan payments

- Answer phone calls, take messages and transfer calls

- Verify customer information and complete required documents

- Assist customers in opening accounts and completing forms

Experience

0 Years

Level

Junior

Education

Bachelor’s

Teller Resume Examples Resume with 2 Years of Experience

A detail- oriented and organized professional with two years of experience working in a financial services environment as a Teller. Demonstrated ability to handle cash, process deposits and withdrawals, and reconcile accounts. Possesses in- depth knowledge of financial regulations ensuring compliance with all laws and regulations. Skilled in customer service, problem solving and multitasking.

Core Skills:

- Cash handling

- Customer service

- Account reconciliation

- Process deposits/withdrawals

- Problem solving

- Financial regulations

- Multi- tasking

Responsibilities:

- Process customer transactions such as deposits, withdrawals, check cashing, and loan payments accurately and efficiently.

- Balance and reconcile cash drawers daily.

- Adhere to all applicable laws and regulations, especially those concerning money laundering prevention.

- Ensure the security of all confidential customer information.

- Provide superior customer service by assisting customers with questions and transactions.

- Research and resolve customer inquiries, complaints, and discrepancies.

- Cross- sell bank products and services.

- Monitor customer accounts for suspicious activities.

- Maintain a clean, professional, and efficient work environment.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Teller Resume Examples Resume with 5 Years of Experience

Dedicated Teller with 5 years of experience in financial institutions providing high quality customer service. Demonstrated ability to accurately process banking transactions, resolve customer inquiries and problems, and ensure compliance with banking regulations. Possess excellent communication and interpersonal skills, as well as a high level of integrity and responsibility.

Core Skills:

- Strong knowledge of banking products and services

- Experience in handling customer inquiries and complaints

- Proven ability to meet sales goals

- Excellent interpersonal and communication skills

- Proven ability to process banking transactions quickly and accurately

- Proven ability to work with confidential information

- Knowledge of banking regulations and procedures

- Highly organized, detail- oriented, and efficient

Responsibilities:

- Process customer transactions, including deposits, withdrawals, loan payments, and other transactions

- Answer customer inquiries, open and close accounts, and provide account information

- Balance cash drawers and reconcile discrepancies

- Cross- sell bank services and products

- Manage customer disputes and handle customer complaints

- Monitor and enforce bank security, privacy, and fraud policies

- Ensure compliance with banking regulations and procedures

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Teller Resume Examples Resume with 7 Years of Experience

A passionate, organized, and proactive teller with 7 years of banking experience in providing superior customer service and managing client relationships. Demonstrated ability to handle financial transactions and maintain accurate records, as well as adept in identifying customer needs and providing appropriate solutions. Focused on improving customer service standards and building long- term relationships with customers. Committed to providing excellent customer service and following bank policies and procedures.

Core Skills:

- Cash handling, balancing and reconciliation

- Customer service and relationship building

- Financial operations and transactions

- Bank policies and procedures

- Data entry and record keeping

- Problem solving and conflict resolution

Responsibilities:

- Process customer deposits, withdrawals, and loan payments

- Verify customer identity and account information

- Provide assistance with account inquiries

- Resolve customer complaints and issues

- Maintain records of customer transactions

- Monitor daily bank activity and transactions

- Assist in cash balancing and reconciliation

- Provide superior customer service at all times

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Teller Resume Examples Resume with 10 Years of Experience

I am an experienced teller with over 10 years of experience in customer service and financial services. I specialize in processing customer transactions, handling large amounts of cash, and providing excellent customer service. I have a detailed understanding of banking procedures and regulations and an in- depth knowledge of financial services. As a teller, I am dedicated to providing high- quality service and helping customers with their banking needs.

Core Skills:

- Cash Handling

- Financial Services

- Customer Service

- Banking Procedures and Regulations

- Transaction Processing

- Problem Solving

Responsibilities:

- Greet customers and answer inquiries

- Open and close accounts

- Process financial transactions

- Provide accurate information about services and products

- Balance cash drawers and generate reports

- Monitor customer transactions to detect suspicious activities

- Follow security procedures and protect confidential information

- Explain banking policies and procedures

- Maintain up- to- date knowledge of financial services

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Teller Resume Examples Resume with 15 Years of Experience

An experienced and highly motivated professional Teller with 15 years of experience in providing customer service, managing customer accounts, and handling cash transactions. Proficient in using computer systems to process customer requests and maintain records. Possesses excellent communication, interpersonal, and problem- solving skills. Adept at working under pressure in a fast- paced environment.

Core Skills:

- Cash Handling

- Customer Service

- Account Management

- Data Entry

- Ability to Work Under Pressure

- Computer Proficiency

- Problem- solving

Responsibilities:

- Greet customers and provide them with assistance

- Verify customer identity and account information

- Handle customers’ deposits and withdrawals

- Process customer transactions accurately and efficiently

- Provide customer service and respond to customer inquiries

- Maintain daily records of customer transactions

- Balance and reconcile cash drawers

- Detect suspicious activity and report to higher authorities

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Teller Resume Examples resume?

A teller resume is an important tool for jobseekers in the banking or financial services industry. It should be tailored to the job position you are applying for and should include all relevant information about your education, experience, and skills. Here are a few tips on what should be included in a teller resume.

- Summary: include a brief statement about yourself, highlighting any relevant skills and experience that make you an ideal candidate for the job.\ Education: list any educational qualifications or certifications you have attained, such as a banking or finance degree.

- Experience: include any prior banking or customer service experience you have held, including job titles and responsibilities.

- Skills: list any specialized skills relevant to the position, such as money handling, sales techniques, or familiarity with banking software.

- References: it is common practice to include references on a teller resume. It is important to include contact information for at least two professional references who can vouch for your work ethic, skills, and qualifications.

Overall, a well-crafted teller resume can help you stand out from the competition and land the job you want. Be sure to include all relevant information about your education, experience, and skills, and make sure to highlight whatever makes you unique and sets you apart from other applicants.

What is a good summary for a Teller Resume Examples resume?

A well-written Teller Resume Examples resume should include a clear and concise summary of qualifications and experience that highlight the candidate’s ability to provide excellent customer service and support financial operations. It should include key accomplishments, such as increasing deposit volumes, improving cash flow management, or resolving customer complaints. Candidates should demonstrate their understanding of banking policies and regulations, their technical aptitude, and their ability to meet and exceed customer expectations. The summary should also include specific examples of the candidate’s interpersonal, organizational, and problem-solving skills. Ultimately, a good summary should clearly demonstrate why the candidate is the best choice for the role.

What is a good objective for a Teller Resume Examples resume?

A teller’s resume should demonstrate a wide range of responsibilities and qualifications. An effective objective should emphasize customer service, communication, mathematical, and organizational skills. When writing an objective for a teller resume, consider the following example:

- To obtain a challenging position as a teller, utilizing strong customer service, communication and organizational skills to provide excellent service to customers.

- To use my knowledge of banking services and procedures to effectively process customer transactions, answer customer inquiries, and refer customers to appropriate channels.

- To enhance my experience in the banking industry with an opportunity to work as a teller, thereby contributing to the growth of the organization through efficient and accurate customer service.

- Seeking a position as a teller to utilize my customer service, communication and problem solving skills to promote customer satisfaction and optimize customer experience.

- To apply my knowledge of banking policies and procedures in providing excellent customer service and serving as a representative of the organization.

- To leverage my financial knowledge and customer service skills in a teller role, thereby driving customer loyalty and satisfaction.

How do you list Teller Resume Examples skills on a resume?

When creating a Teller resume, you want to incorporate skills that demonstrate your ability to work with customers, handle money, and provide excellent customer service. Here are some examples of skills that can be listed on a Teller resume:

- Cash handling: Demonstrate your ability to handle both cash and checks, including counting, balancing, and accurately recording cash transactions.

- Customer service: Showcase your customer service skills, including effective communication and problem-solving.

- Product knowledge: Demonstrate your knowledge of the bank’s products and services and your ability to provide information accurately and in a timely manner.

- Computer literacy: Show your proficiency in using computers, software programs, and other technology related to bank transactions.

- Compliance: Demonstrate your understanding of banking regulations and your ability to follow procedures and protocols.

- Mathematics: Showcase your ability to accurately calculate deposits, withdrawals, and other math-related tasks.

- Organizational skills: Demonstrate your ability to prioritize tasks, provide efficient service, and maintain a clean and organized workspace.

- Attention to detail: Showcase your attention to detail and accuracy in performing tasks such as inputting customer information into a computer system.

What skills should I put on my resume for Teller Resume Examples?

Having the right skills on a resume for a Teller position are essential for making a great impression. As Tellers are responsible for handling customer transactions, being proficient in customer service and basic computer skills are important. Below are some skills to consider for your Teller resume:

- Cash Handling: Demonstrating experience with managing cash and deposits, as well as having the ability to count large amounts of money efficiently.

- Customer Service: Showcasing the ability to provide friendly and helpful customer service, as well as having the ability to handle difficult customer requests.

- Computer Skills: Being proficient in computers and banking software, as well as having the ability to learn new systems quickly.

- Multi-Tasking: Demonstrating the ability to handle multiple tasks at once and being able to prioritize tasks in an efficient manner.

- Attention to Detail: Showcasing the ability to accurately process transactions with a high degree of accuracy and diligence.

- Communication: Showcasing the ability to communicate clearly and effectively with both customers and colleagues.

- Problem-Solving: Demonstrating the ability to troubleshoot customer issues and suggest the best solution.

Having the right skills on a Teller resume will help you stand out from the competition and increase your chances of landing the job. Be sure to showcase your skills in a professional and concise manner to make the most impact.

Key takeaways for an Teller Resume Examples resume

A teller resume is an important tool for anyone looking to enter the banking industry. It can be used to show off your experience, skills, and qualifications to potential employers. A well-crafted resume is the key to getting an interview and securing a job in any profession. Here are some key takeaways for writing a teller resume that will help you stand out from the competition:

- Highlight Your Experience: One of the most important things to remember when writing your resume is to highlight your experience in the banking industry. Employers will want to know what types of roles you’ve held in the past and how long you’ve been working in the field. Include any additional certifications or training you’ve received, such as a Bank Teller Certification.

- Showcase Your Skills: Another key element of a teller resume is to showcase your skills in the field. This can include things such as the ability to handle money, customer service, and the ability to work with different computer systems. Be sure to list any relevant skills you’ve acquired over the years and how you’ve used them in the past.

- Utilize Keywords: Many employers use applicant tracking systems (ATS) to search for candidates. A resume that incorporates relevant keywords related to the position is more likely to be noticed. Make sure to include words such as “teller”, “cashier”, “client service”, and “banking” throughout your resume to make sure it makes it through the ATS.

- Stress Your Qualifications: It’s not enough to just list your experience and skills. You need to stress why you’re the best candidate for the position. Include any awards or special recognition you’ve received in the past and explain how they made you an outstanding teller.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder