As a senior teller, you’re in a unique position where you’re responsible for both providing top-notch customer service and managing the teller line effectively. Your resume should highlight your ability to effectively handle customer interactions, support other team members, and manage administrative tasks. To create a successful resume, it’s important to include all the necessary information and use the right format. This article will provide examples of senior teller resumes and offer a comprehensive guide to help you create your own.

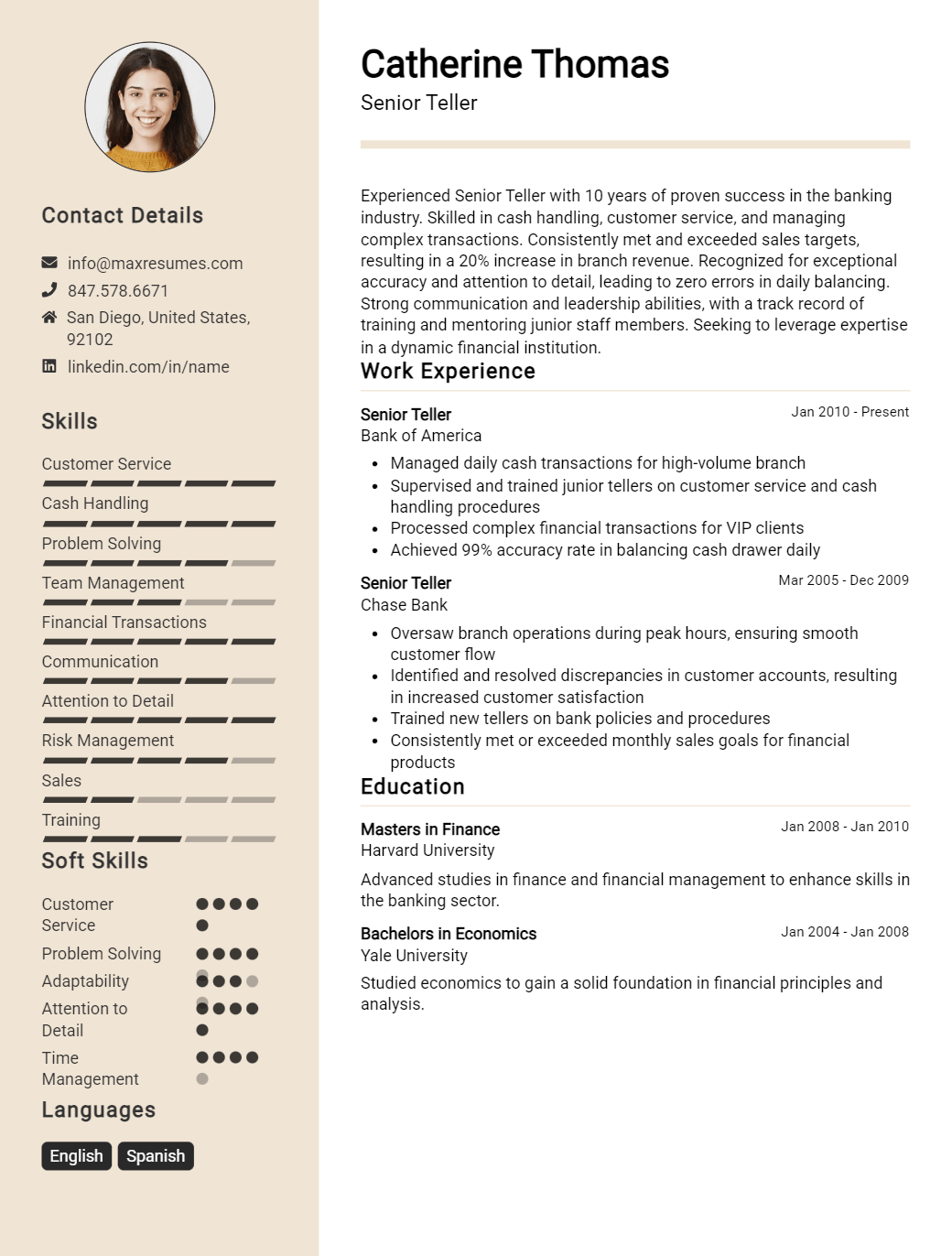

Senior Teller Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Senior Teller Resume Examples

John Doe

Senior Teller

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Motivated Senior Teller with 5+ years of customer service experience in the banking industry. Proven track record of exceeding goals, delivering exceptional customer service, and ensuring completion of daily tasks. Skilled in providing financial advice and guidance to customers regarding accounts, loans, and investments. Demonstrated ability to remain calm and composed in high pressure situations.

Core Skills:

- Excellent customer service

- Strong verbal and written communication

- Attention to detail

- Financial advice and guidance

- Problem- solving

- Knowledge of banking regulations

- Cash handling

Professional Experience:

Senior Teller, ABC Bank, Miami, FL

January 2016 – Present

- Processing deposits, withdrawals, loan payments, and other banking transactions

- Offering financial advice and guidance to customers regarding accounts, loans, and investments

- Ensuring that all customer transactions are accurate and compliant with banking regulations

- Assisting customers with account problems and inquiries

- Performing daily customer service tasks, such as balance inquiries and account maintenance

- Maintaining accurate records of customer transactions

Teller, ABC Bank, Miami, FL

August 2012 – December 2015

- Processing deposits, withdrawals, loan payments, and other banking transactions

- Providing customer service to assist customers with account problems and inquiries

- Verifying accuracy of customer transactions and ensuring compliance with banking regulations

- Balancing cash drawers daily and reporting any discrepancies

- Performing daily customer service tasks, such as balance inquiries and account maintenance

Education:

Bachelor of Science in Business Administration, Florida State University, Miami, FL

August 2008 – May 2012

Senior Teller Resume Examples Resume with No Experience

- Recent college graduate with a Bachelor’s degree in Business Administration and a passion for customer service.

- Dedicated individual with a strong work ethic, excellent communication skills and the ability to work well independently or as part of a team.

- Strong problem- solving skills with the ability to think quickly and take the initiative to provide exceptional service.

Skills:

- Customer Service: Extremely comfortable interacting with customers and providing excellent service.

- Organizational Skills: Ability to multitask and prioritize tasks while maintaining accuracy.

- Computer Literacy: Experienced in working with computer systems, databases and software.

- Cash Handling: Comfortable working with large amounts of cash and able to accurately count and balance the cash drawer.

Responsibilities:

- Greet each customer in a friendly and inviting manner.

- Process customer transactions accurately, efficiently, and in a timely manner.

- Provide answers to customer inquiries and explain procedures.

- Monitor and balance the cash drawer ensuring accuracy and accountability.

- Identify opportunities to cross- sell bank products and services.

- Follow all safety regulations and procedures to protect the customer, employees, and the bank.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Senior Teller Resume Examples Resume with 2 Years of Experience

A highly motivated, results- oriented professional with 2 years of experience as a Senior Teller. Highly skilled in customer service, cash handling, and managing the daily operations of a banking facility. Experienced in accurately and efficiently completing financial transactions, detecting and preventing fraudulent activity, and providing excellent customer service.

Core Skills:

- Cash handling

- Financial transactions

- Customer service

- Fraud prevention

- Bank operations

- Data entry

Responsibilities:

- Handling customer transactions accurately and efficiently

- Detecting and preventing fraudulent activity

- Monitoring cash levels and making necessary adjustments

- Assisting customers with their banking needs

- Managing the daily operations of the bank

- Complying with all applicable banking regulations

- Maintaining customer data in a secure and confidential manner

- Assisting with training of new tellers

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Senior Teller Resume Examples Resume with 5 Years of Experience

A highly experienced Senior Teller with over 5 years of experience in all aspects of banking operations, customer service, and sales. Possesses excellent communication, interpersonal, and problem- solving skills. Possesses deep knowledge of banking products and services, including loans and mortgages. Experienced in providing excellent customer service, identifying and assessing customer needs, and resolving customer issues. Experienced in developing and implementing customer service plans to ensure customer satisfaction.

Core Skills:

- Cash and check handling

- Accounts management

- Customer service

- Cross- selling

- Financial product knowledge

- Processing deposits and withdrawals

- Sales experience

- Strong communication skills

- Problem- solving

- Interpersonal skills

Responsibilities:

- Open and close customer accounts and process transactions.

- Promote and cross- sell bank products and services.

- Educate customers on products and services.

- Verify customer identity and complete Know Your Customer (KYC) compliance checks.

- Accurately process deposits, withdrawals, cash advances, loan payments, and other transactions.

- Answer customer inquiries and resolve customer complaints.

- Balance cash drawer daily and provide reports.

- Process foreign exchange transactions.

- Follow all bank policies and procedures.

- Maintain a safe, secure, and comfortable environment for customers.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Senior Teller Resume Examples Resume with 7 Years of Experience

An experienced, reliable and organized Senior Teller with 7 years of experience in customer service and cash handling, and a proven track record of delivering excellent customer service. I have a comprehensive understanding of financial services, banking, and other related business operations. Possessing excellent communication and problem- solving skills, as well as a strong background in customer service and cash handling, I strive to exceed expectations and provide an exceptional customer experience.

Core Skills:

- Cash handling

- Customer service

- Financial services

- Problem- solving

- Communication

- Banking operations

Responsibilities:

- Greet customers and answer inquiries regarding financial services

- Process transactions quickly and accurately

- Ensure compliance with regulations and policies

- Investigate and resolve customer complaints in a timely manner

- Support cash operations and adhere to cash management policies and procedures

- Maintain accurate documentation of customer accounts

- Assist with the development and training of junior staff

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Senior Teller Resume Examples Resume with 10 Years of Experience

Highly experienced Senior Teller with 10 years of experience in cash management and customer service. Skilled in providing financial advice, processing transactions, and developing strong relationships with customers. Proven success in maintaining accuracy and security, while providing excellent customer service and upselling products. Adept at working in a fast- paced environment and able to handle various customer inquiries and requests.

Core Skills:

- Cash Management

- Record Keeping

- Sales

- Customer Service

- Financial Advice

- Interpersonal Skills

- Problem Solving

- Transaction Processing

Responsibilities:

- Manage banking transactions such as deposits, withdrawals, and transfers

- Balance cash drawers and reconcile discrepancies

- Assist customers with banking inquiries and product knowledge

- Cross- sell financial products and services

- Assist in training and coaching of new tellers

- Take initiative to identify customer needs and offer solutions

- Collaborate with other departments and personnel to ensure customer satisfaction

- Maintain confidentiality of sensitive customer information

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Senior Teller Resume Examples Resume with 15 Years of Experience

A senior teller with 15 years of experience in the banking industry. Adept at providing excellent customer service, problem solving, and successfully balancing registers. Possesses a thorough knowledge of banking regulations and procedures and has a proven ability to work well in a team.

Core Skills:

- Excellent customer service

- Strong problem solving skills

- Ability to balance registers

- Knowledge of banking regulations and procedures

- Ability to work in a team

Responsibilities:

- Provided excellent customer service to all types of clients

- Calculated accurate transaction amounts for a variety of financial products including check cashing, deposits, and withdrawals

- Accurately balanced registers on a daily basis

- Assisted customers with account inquiries

- Followed all banking regulations and procedures

- Processed loans and credit card applications

- Assisted with opening and closing procedures

- Communicated with other bank staff regarding customer needs and inquiries

- Developed strong working relationships with customers

- Collaborated with team members to provide the best service to customers

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Senior Teller Resume Examples resume?

A Senior Teller Resume should focus on highlighting the specialized experience and knowledge acquired over the course of their tenure in banking.

It should be clear, concise, and include all relevant information about the individual’s work history and competencies.

Here are some key resume components that should be included in a Senior Teller Resume:

- Professional Summary: A brief overview of the Senior Teller’s qualifications and experience.

- Education: The formal education that has been completed, such as a degree or certification.

- Skills: Any specialized skills or knowledge the Senior Teller has acquired throughout their career.

- Work Experience: A list of the Senior Teller’s previous employers and job titles, as well as any volunteer work they may have done.

- Professional Accomplishments: Any awards or recognitions received while employed as a Senior Teller.

- References: Contact information for former employers who can comment on the Senior Teller’s abilities.

What is a good summary for a Senior Teller Resume Examples resume?

A Senior Teller resume should showcase a successful career in banking, with a proven track record of customer service, cash management, and financial transactions. The summary section should highlight the jobseeker’s expertise in customer service, their understanding of bank policies and procedures, their proficiency in cash and financial transactions, and their ability to work in a team environment. It should also demonstrate their ability to identify and resolve customer issues and their ability to maintain and enforce security protocols. In addition, the summary should mention any experience in training bank staff or participating in programs to improve customer relations and satisfaction. This summary should be tailored to the position, emphasizing the jobseeker’s unique experience and qualifications.

What is a good objective for a Senior Teller Resume Examples resume?

A Senior Teller is responsible for providing exceptional customer service, maintaining a safe and secure environment, and ensuring the efficient operations of the banking institution. Having a strong objective statement on your resume can make a positive impression on potential employers and help you stand out from the competition. Here are some example objectives for a Senior Teller resume:

- To obtain a Senior Teller position with ABC Bank where I can utilize my customer service and banking experience.

- Seeking a Senior Teller position with XYZ Bank to leverage my excellent customer service and banking knowledge.

- To secure a Senior Teller role at a reputable financial institution and apply my strong customer service and banking skills.

- To work as a Senior Teller at a successful banking institution and contribute my strong customer service and banking experience.

- To utilize my experience in banking and customer service to gain a Senior Teller position with a reputable financial institution.

How do you list Senior Teller Resume Examples skills on a resume?

When you’re applying for a senior teller position, employers will want to see a strong resume that demonstrates your skills, qualifications, and experience.

Your resume should include a combination of hard and soft skills that are tailored to the position. Here’s a list of skills to include on your senior teller resume:

- Cash handling: As a senior teller, you should have advanced skills in handling large sums of money efficiently and accurately.

- Customer service: Senior tellers provide excellent customer service and help clients with financial transactions.

- Banking regulations: You should have a thorough knowledge of banking regulations and be able to adhere to them.

- Computer skills: Senior tellers must be competent in computer skills, such as operating a computer system and software programs.

- Math and problem-solving: Senior tellers must be able to solve complex problems with accuracy and speed.

- Leadership: You should be able to lead and motivate a junior teller team, as well as manage daily operations.

- Communication: Excellent communication and interpersonal skills are essential for a senior teller. You should be able to effectively communicate with customers.

Include these skills on your resume, and you’ll be sure to impress potential employers. Good luck!

What skills should I put on my resume for Senior Teller Resume Examples?

When crafting a Senior Teller resume, it’s important to include the right skills that will make you stand out from other applicants. Highlighting the right skills on your resume can help employers quickly understand that you have the qualifications and experience needed to be an effective Senior Teller. To help you get started, here are some of the key skills you should include on your Senior Teller resume:

- Cash Handling: Senior Tellers must have advanced cash handling experience and skills. Be sure to include your knowledge of handling cash transactions, balancing cash drawers, and managing daily deposits and withdrawals.

- Problem Solving: Senior Tellers will be expected to handle customer issues in a timely and professional manner. Include any past experience you have resolving customer complaints and inquiries.

- Customer Service: Perhaps the most important skill for this role is providing excellent customer service. Highlight any experience you have dealing with customers directly, as well as any customer service training you may have completed.

- Time Management: Senior Tellers must be able to manage their time effectively while working in a fast-paced environment. Showcase any time management skills you have such as working independently, multitasking, and meeting tight deadlines.

- Teamwork: Senior Tellers must be able to collaborate and communicate effectively with their colleagues. Include any experience you have working on teams and helping to motivate and inspire team members.

- Data Entry: Senior Tellers must be able to accurately and quickly enter data into the bank’s system. Highlight any data entry experience you have and include any certifications or software programs you’re familiar with.

Including these skills on your Senior Teller resume will help you stand out from the competition. Good luck!

Key takeaways for an Senior Teller Resume Examples resume

A senior teller resume is a critical document for job seekers looking to secure a position in the banking industry. As a senior teller, you are responsible for managing customer accounts, performing deposits and withdrawals, and providing customer service. Your resume should highlight your experience and skill set in order to make a positive impression on potential employers. Here are some key takeaways for a senior teller resume examples:

- Detail Your Experience: One of the most important aspects of a senior teller resume is to include specific details of past positions held. Make sure to list your job titles, the banks you have worked for, and the responsibilities you have taken on. This information will help potential employers to better understand the level of experience you have in the banking industry.

- Highlight Your Skills: Your resume should also include a section detailing the skills that you have acquired throughout your career in the banking industry. These skills should be relevant to the position you are applying for and they should include communication, customer service, financial analysis, problem-solving, and any other skills that may be relevant.

- Include Education: Be sure to include any relevant education on your resume. This will show potential employers that you are capable of learning and applying new skills in the banking industry.

- Include Certifications: List any certifications or training courses related to the banking industry that you have taken. This will demonstrate to potential employers that you are dedicated to the field and have taken steps towards advancing your career in the banking sector.

- Include Awards/Achievements: If you have been recognized for your work in the banking industry, be sure to list this on your resume. This will showcase your commitment and dedication to the field.

By following these key takeaways for a senior teller resume examples, you can create an effective resume that will help you stand out to potential employers. Good luck in your job search!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder