When you are a senior loan processor, you are responsible for making sure that all loan applications and other financial documents are handled correctly. You must also be able to provide sound advice to the loan applicants and guide them through the loan process. With such a demanding job, you need to make sure your resume is up-to-date and has all the essential information needed to showcase your skills and experience. This guide will provide you with some useful tips and resume examples to help you create the perfect resume for your senior loan processor role.

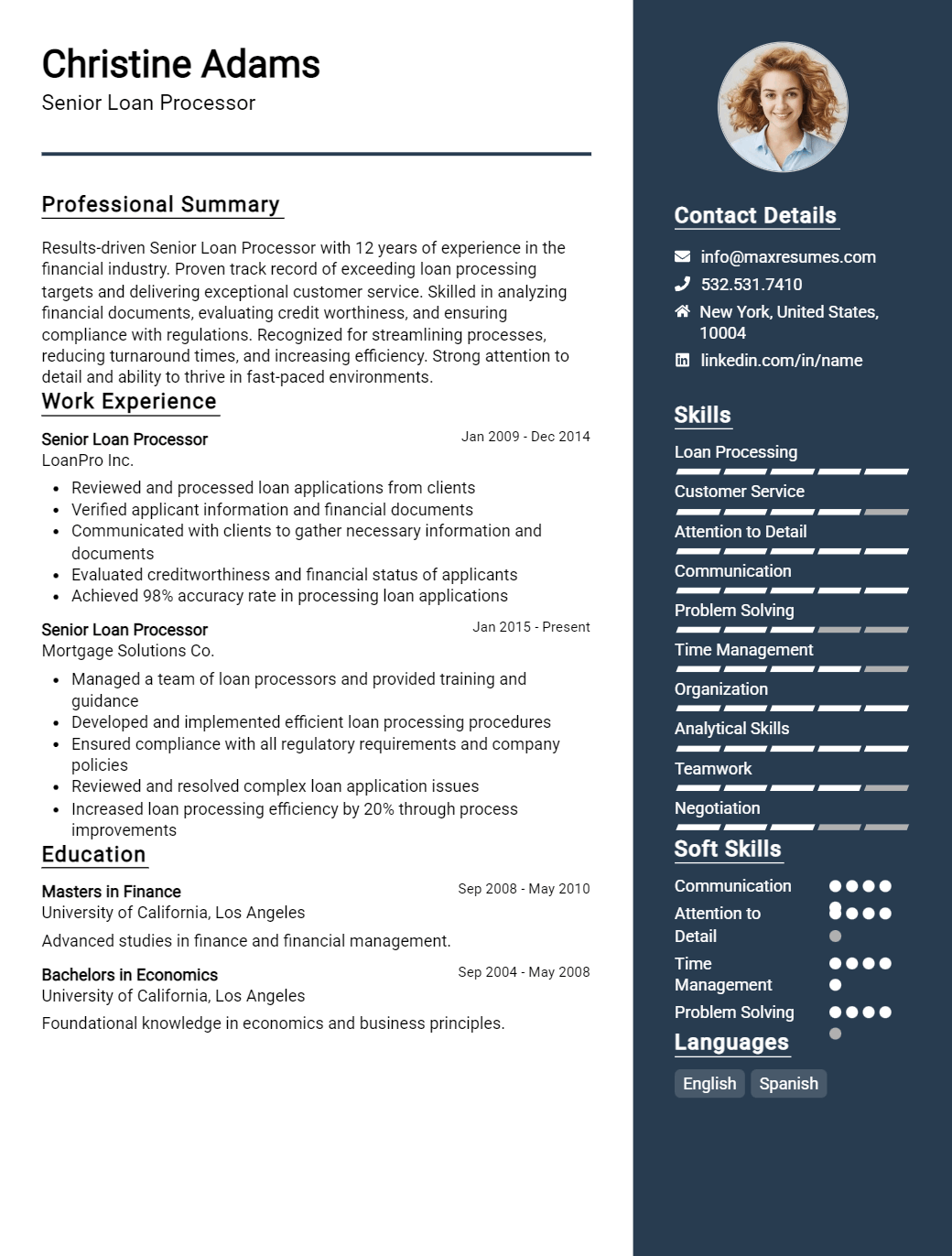

Senior Loan Processor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Senior Loan Processor Resume Examples

John Doe

Senior Loan Processor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Hardworking Senior Loan Processor with 8+ years of experience in the financial industry. Demonstrated expertise in loan origination and underwriting, client relations, and risk analysis. Proven record of meeting client requirements and delivering quality results in a fast- paced environment. Highly detail- oriented, organized, and highly efficient. Possess a Bachelor’s Degree in Business Administration and a Certified Loan Processor designation.

Core Skills:

- Loan origination and underwriting

- Analyzing and reviewing loan applications

- Database management

- Client relations

- Risk analysis

- Microsoft Office Suite (Word, Excel, Powerpoint, Outlook)

- Excellent verbal and written communication skills

Professional Experience:

- Senior Loan Processor, ABC Financial Services, 2014- Present

- Execute loan origination and underwriting processes

- Monitor loan applications for accuracy, completeness, and conformity with regulations

- Analyze credit reports and financial documentation

- Maintain databases and loan files

- Establish and maintain positive relations with clients

- Generate and review loan documents

- Perform risk analysis to ensure loan quality

Education:

- Bachelor’s Degree in Business Administration, XYZ University, 2010

- Certified Loan Processor, American Bankers Association, 2012

Senior Loan Processor Resume Examples Resume with No Experience

Recent college graduate with a Bachelor of Science degree in Business Administration. Strong organizational and communication skills. Highly motivated and eager to enter the loan processing field

Skills:

- Strong knowledge of loan processing and underwriting practices

- Excellent customer service and problem- solving skills

- Proficiency in Microsoft Office Suite (Word, Excel, PowerPoint)

- High level of accuracy and attention to detail

- Ability to work in a fast- paced environment

Responsibilities

- Assisted with the processing and closing of loan documents

- Sat with customers to review and discuss loan terms and conditions

- Compiled and evaluated loan applicants’ financial information

- Reviewed and verified loan documents for accuracy

- Answered customer inquiries and provided loan guidance

- Assisted with loan preparation, including gathering documents, calculating payments and verifying accuracy of information

Experience

0 Years

Level

Junior

Education

Bachelor’s

Senior Loan Processor Resume Examples Resume with 2 Years of Experience

Highly motivated Senior Loan Processor with two years of experience in the mortgage industry. Excellent communication, organizational, and problem- solving skills. Demonstrated ability to meet deadlines, handle competing demands, and manage multiple projects. Experienced in ensuring loan documents comply with all legal requirements while providing excellent customer service.

Core Skills:

- Document Preparation

- Regulatory Compliance

- Data Entry

- Loan Processing

- Problem Solving

- Time Management

- Customer Service

Responsibilities:

- Assessed loan applications for accuracy and completeness, verifying income, credit histories, and other documents in accordance with bank policies.

- Analyzed financial data, credit reports, and collateral evaluation reports to determine creditworthiness of applicants and to recommend approval or denial of loan applications.

- Ordered and evaluated third- party documents such as title insurance, appraisals, and other types of loan documentation.

- Compiled financial statements and other documents, researched variances, and verified accuracy of calculations.

- Prepared and maintained various reports, including loan status and default summary reports.

- Performed file audits, monitored delinquent accounts and generated reports to ensure quality control standards are met.

- Analyzed credit bureau reports and bank statements to verify accuracy and completeness of information.

- Established and maintained positive relationships with co- workers, customers, clients, and members of management.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Senior Loan Processor Resume Examples Resume with 5 Years of Experience

A highly motivated and organized Senior Loan Processor with 5 years of experience working in the finance sector. Proven track record of processing loans efficiently and accurately. Possesses excellent communication and interpersonal skills, enabling successful interactions with customers, loan officers, and other financial professionals. Highly proficient in loan processing software, loan origination systems, and other finance tools.

Core Skills:

- Loan Processing

- Loan Origination Systems

- Loan Documentation

- Financial Software

- Customer Service

- Interpersonal Skills

- Problem- Solving

- Time Management

Responsibilities:

- Review loan applications for completeness and accuracy

- Verify and analyze financial data, such as income, assets, and credit scores

- Collect and review supporting documents such as tax returns, pay stubs, and bank statements

- Ensure loan documents are in compliance with state and federal regulations

- Obtain relevant information from customers to complete loan applications

- Communicate with loan officers to ensure timely completion of loan processing

- Coordinate with other departments to ensure timely completion of loans

- Maintain accurate records of all loan processing activities

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Senior Loan Processor Resume Examples Resume with 7 Years of Experience

Highly motivated and experienced Senior Loan Processor with 7 years of experience in the mortgage industry. Excellent communication, customer service, and organizational skills. Able to review loan documents and ensure compliance with applicable banking regulations. Skilled in managing personnel, maintaining loan files, and preparing loan packages. Possess expertise in loan origination and processing, loan underwriting, and data entry. Committed to providing a high level of customer satisfaction and ensuring accuracy and efficiency when processing loan applications.

Core Skills:

- Loan origination and processing

- Loan underwriting

- Customer service

- Data entry

- Organizational skills

- Personnel management

- Compliance with banking regulations

- Loan file maintenance

- High level of customer satisfaction

Responsibilities:

- Review loan documents and application materials to ensure accuracy and compliance with banking regulations

- Verify income, assets, and credit reports to determine loan eligibility

- Prepare loan packages and prepare associated documentation

- Enter loan data into loan origination system

- Interface with loan servicers, underwriters, and other stakeholders to ensure timely completion of loan processing

- Maintain and update loan files and records

- Provide customer service by handling customer inquiries and resolving customer issues

- Monitor loan status and ensure timely completion of loan processing

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Senior Loan Processor Resume Examples Resume with 10 Years of Experience

Highly experienced senior loan processor with 10+ years of experience in the banking and financial services industry. Proven success in providing assistance to customers in securing loans for products and services such as mortgage and auto financing. Demonstrated ability to cultivate strong relationships with customers and provide high quality customer service. Highly organized and detail- oriented, with a strong aptitude for quickly and accurately processing loan applications.

Core Skills:

- Knowledge of loan processing procedures and guidelines

- Ability to analyze customer financial documents

- Attention to detail and accuracy

- Strong customer service and communication skills

- Proficient in Microsoft Office Suite

- Experience with loan origination systems

- Familiarity with loan regulations and compliance

Responsibilities:

- Review loan applications and accompanying documents to ensure accuracy and completeness

- Verify customer information and obtain additional documents if necessary

- Calculate customer debt- to- income ratios and credit scores

- Submit loan applications and documents to underwriting for review

- Respond to customer inquiries and provide customer service

- Track loan status and follow up on pending applications

- Review final loan documents for accuracy and completeness

- Reconcile loan files and ensure compliance with all applicable regulations

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Senior Loan Processor Resume Examples Resume with 15 Years of Experience

I am an experienced Senior Loan Processor with 15 years of experience in the financial services industry. I have extensive knowledge of loan origination, loan evaluation processes and closing processes. I am highly organized with excellent communication and problem- solving skills. I am motivated and proactive in efficiently managing loan processing for residential and commercial mortgages. I am a team player and always strive to deliver the highest level of customer service.

Core Skills:

- Highly organized

- Excellent communication skills

- Problem- solving skills

- Knowledge of loan origination, loan evaluation, and closing processes

- Proactive

- Customer service- oriented

Responsibilities:

- Evaluate loan applications to ensure accuracy and completeness

- Analyze financial data and credit reports to determine loan eligibility

- Prepare loan documents and submit them to lenders for approval

- Communicate with lenders, borrowers, and attorneys to ensure timely processing of loan applications

- Manage the loan servicer’s accounts to keep track of payments

- Ensure compliance with all relevant regulations and laws

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Senior Loan Processor Resume Examples resume?

A Senior Loan Processor Resume Examples resume should include the following information:

-Objective: The objective should be concise and clearly outline the candidate’s experience and qualifications for the position.

-Education: Include all relevant educational qualifications, such as relevant degrees and certifications.

-Skills: Include any loan processing and related skills such as loan system knowledge, customer service, data entry, and financial analysis.

-Experience: Include a list of relevant job experience and accomplishments, such as loan processing, data entry, customer service, and financial analysis.

-References: Include at least two references with contact information.

-Additional: Include any additional relevant information such as certifications, awards, and professional affiliations.

What is a good summary for a Senior Loan Processor Resume Examples resume?

A senior loan processor resume should provide a concise and compelling summary of the loan processor’s qualifications, skills, and experience. It should also detail the individual’s ability to work quickly and efficiently in a fast-paced environment, as well as their expertise in financial products, banking regulations, and customer service. The resume should demonstrate the loan processor’s knowledge of loan policies, procedures, and protocols, as well as their proficiency in loan processing software and other industry-related programs. Additionally, the resume should include any relevant certifications, licenses, and other qualifications the individual has earned. Lastly, it should highlight any special projects, awards, or accomplishments that demonstrate the loan processor’s expertise in the field.

What is a good objective for a Senior Loan Processor Resume Examples resume?

A senior loan processor resume is an important document used to highlight your experience and skills. It is the first contact point between you and potential employers, so it is essential to make sure that your resume is up-to-date and showcases your abilities.

A good objective for a senior loan processor resume should focus on your qualifications, skills, and ambition. It should be tailored to each job you apply for in order to stand out from the competition.

Here are some examples of objectives for a senior loan processor resume:

- Demonstrate excellent customer service and communication skills to process loan applications in a timely and efficient manner.

- Leverage extensive experience in loan processing, customer relations, and problem-solving to help clients secure the best loan options.

- Utilize strong organizational and time-management skills to ensure loan applications are processed accurately and promptly.

- Proactively collaborate with lenders, brokers, and banks to ensure seamless loan processing.

- Acquire thorough knowledge of loan products to provide quality recommendations to clients.

- Utilize superior financial analysis and contract review skills to identify changes or inaccuracies.

- Continually stay up-to-date on regulations and policies to ensure compliance with loan processing procedures.

How do you list Senior Loan Processor Resume Examples skills on a resume?

bulletA Senior Loan Processor is responsible for evaluating, verifying, and processing loan applications quickly and accurately. A Senior Loan Processor’s resume should showcase their ability to accurately review borrower information, ensure accuracy and compliance with lending guidelines, and evaluate creditworthiness.

When writing a resume for a Senior Loan Processor position, you’ll want to highlight your experience with loan processing software, customer service, and attention to detail.

Here are some examples of Senior Loan Processor skills to include on a resume:

- Knowledge of loan processing software (such as LoanBeam, Floify, and LoanPro)

- Familiarity with credit and lending guidelines

- Excellent customer service and communication

- Ability to manage multiple loan applications simultaneously

- Proficiency with Microsoft Office

- Proven organizational and time-management skills

- Attention to detail and accuracy

- Experience with data entry and verification

- Capacity to identify and solve problems quickly

- Knowledge of relevant industry regulations

What skills should I put on my resume for Senior Loan Processor Resume Examples?

Writing a resume can be a daunting task, especially if you’re applying for a senior loan processor position. You want to make sure you highlight your skills and experience that demonstrate your ability to handle the responsibilities of the job. Here are some skills to consider adding to your resume when you’re applying for a senior loan processor position:

- Knowledge of Loan Processing: As a senior loan processor, you should have a deep understanding of the loan processing process. This includes knowledge of federal and state regulations, loan origination systems, and loan processing techniques.

- Computer Skills: Being able to effectively use computers and related technology is essential for a senior loan processor position. You should make sure to list your computer skills, including knowledge of software programs such as Microsoft Office, QuickBooks, and loan origination systems.

- Analytical Skills: Being able to analyze numbers, documents, and other data is important. Senior loan processors need to be able to quickly review loan applications and financial documents to determine if they are eligible for a loan.

- Communication Skills: Loan processing requires a high degree of communication between the processor, borrower, lender, and other parties involved in the transaction. You should highlight your ability to communicate effectively with all parties.

- Problem-Solving Skills: As a senior loan processor, it’s important to be able to think quickly on your feet and solve any problems that arise in the process. You should highlight your problem-solving skills and any experience you have in quickly resolving conflicts and issues.

- Attention to Detail: Loan processing involves a great deal of attention to detail. You should demonstrate your ability to pay attention to even the smallest details and ensure accuracy in your work.

- Customer Service Skills: As a senior loan processor, you will be working with customers frequently. You should be able to provide excellent customer service and demonstrate your ability to handle customer inquiries and concerns.

By adding

Key takeaways for an Senior Loan Processor Resume Examples resume

As a Senior Loan Processor, your resume needs to be eye-catching and informative. Here are the key takeaways for creating the perfect Senior Loan Processor resume:

1) Demonstrate Your Experience: Include a detailed list of your past job titles and responsibilities. This will show employers that you are experienced in the field and have a strong understanding of the loan processing process.

2) Highlight Your Skills: Showcase the skills that you have acquired throughout your career such as loan origination, underwriting, loan administration, customer service, and problem-solving. Use concrete examples to illustrate how you have used these skills to effectively solve problems or provide excellent customer service.

3) Showcase Your Professional Achievements: Include your educational qualifications, certifications, and awards to prove to employers that you are a reliable and competent employee.

4) Tailor Your Resume: Use keywords to tailor your resume to the specific job that you are applying for. This will ensure that your resume has the best chance of standing out from the competition.

By following these key takeaways, you can create a polished and professional resume that will get you noticed. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder