Writing a resume for a job that focuses on relationships and customer service can be a challenging task. As a relationship banker, you should be able to demonstrate your ability to develop relationships with clients and your incredible customer service skills. Crafting a well-crafted resume is a great way to show off your skills and stand out from the competition. This guide will provide you with some great tips and examples on how to write a relationship banker resume that will get you noticed.

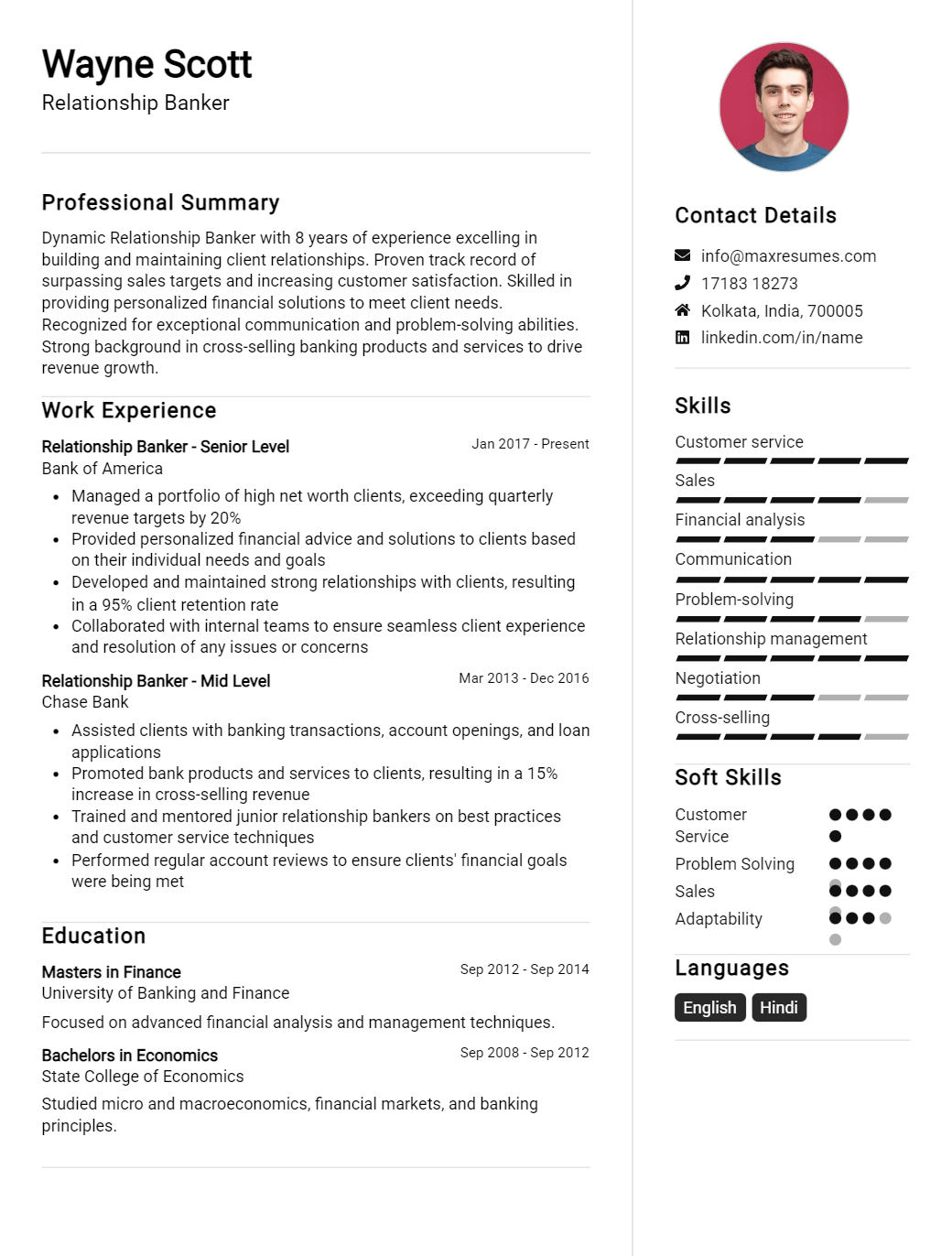

Relationship Banker Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Relationship Banker Resume Examples

John Doe

Relationship Banker

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly motivated Relationship Banker with over 8 years of experience in financial services, offering excellent customer service skills, and decision- making abilities. Proven track record in sales, customer service, relationship management, and financial analysis. Proficient in building relationships and ensuring customer satisfaction.

Core Skills:

- Customer Service

- Problem- solving

- Relationship Management

- Financial Analysis

- Sales

- Organizational

- Leadership

- Project Management

Professional Experience:

Wells Fargo, San Francisco, CA

Relationship Banker, 2016- Present

- Establish and maintain customer relationships

- Provide financial advice and guidance to customers

- Process transactions and handle inquiries

- Develop and execute sales strategies

- Assist with loan applications and customer assessments

Bank of America, San Francisco, CA

Relationship Banker, 2008- 2016

- Greeted customers and assisted with their financial needs

- Provided exceptional customer service to existing and new customers

- Managed customer accounts and developed strong relationships

- Analyzed financial statements and conducted risk assessments

- Advised customers on investment opportunities

Education:

University of California, San Francisco, CA

Bachelor of Science in Business Administration, 2008

Relationship Banker Resume Examples Resume with No Experience

Recent college graduate looking to begin a career in the banking sector as a Relationship Banker. Possess strong communication and customer service skills, with basic knowledge of financial products and services. Self- motivated and eager to learn and grow in the banking industry.

Skills:

- Good communication and customer service skills

- Ability to work with a diverse customer base

- Basic knowledge of financial products and services

- Organizational and time- management skills

- Computer proficiency, including Microsoft Office

- Team- oriented work ethic

Responsibilities

- Provide excellent customer service while performing daily banking transactions

- Maintain up- to- date knowledge of financial products and services

- Build and maintain relationships with customers

- Perform financial transactions accurately and efficiently

- Identify customer needs and recommend appropriate products and services

- Ensure compliance with banking regulations and policies

Experience

0 Years

Level

Junior

Education

Bachelor’s

Relationship Banker Resume Examples Resume with 2 Years of Experience

I am a highly motivated and experienced Relationship Banker with 2 years of experience in banking and customer service. My excellent communication and interpersonal skills allow me to build strong relationships with customers and co- workers alike. I understand the importance of providing exceptional customer service and consistently strive to exceed customer expectations. I am well- versed in banking products, services and regulations and am confident in my ability to assist customers with their financial needs.

Core Skills:

- Excellent communication and interpersonal skills

- Knowledgeable in banking products, services and regulations

- Proficient in Microsoft Office Suite

- Strong customer service orientation

- Ability to effectively handle multiple tasks simultaneously

Responsibilities:

- Provided exceptional customer service and assisted customers with their financial needs

- Processed customer deposits and withdrawals, credit card applications, and loan applications

- Monitored customer accounts for fraudulent activity and reported suspicious transactions

- Conducted financial reviews with customers to identify needs and recommend solutions

- Educated customers on banking services and products and answered any questions they had

- Developed and maintained positive relationships with customers to ensure repeat business and referrals

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Relationship Banker Resume Examples Resume with 5 Years of Experience

A highly motivated and experienced Relationship Banker who is passionate about assisting customers in achieving their financial goals. With 5 years of experience in the banking industry, I have a proven track record of success in customer service and relationship management. I have a solid understanding of banking products and services, and am adept at upselling, cross- selling, and creating new relationships. My excellent communication skills, strong work ethic, and ability to solve customer problems will be a great asset to any financial institution.

Core Skills:

- Customer Service

- Relationship Management

- Relationship Building

- Product Knowledge

- Upselling

- Cross- selling

- Risk Assessment

- Financial Analysis

- Account Management

- Financial Planning

Responsibilities:

- Manage customer relationships to increase customer loyalty and satisfaction

- Provide advice and assistance to customers to help them with their financial goals

- Cross- sell and upsell banking products and services to customers

- Identify and assess customer needs, and offer solutions to meet those needs

- Provide customer service and support

- Conduct financial analysis and risk assessment to ensure customer profitability

- Analyze customer financial statements and advise on improving financial situation

- Develop and implement financial plans to meet customer needs and objectives

- Monitor customer accounts and inform customers of any changes or updates

- Handle customer complaints and inquiries in a timely and professional manner

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Relationship Banker Resume Examples Resume with 7 Years of Experience

A highly motivated and driven individual, I have 7 years of experience as a Relationship Banker. With the ability to understand customer needs, I have a proven track record of delivering successful solutions to customers. My excellent customer service skills, knowledge of banking products and services, and proficiency in banking systems have enabled me to effectively meet customer demands. Utilizing my knowledge in banking compliance and regulations, I strive to ensure that all customer transactions adhere to necessary regulations. My strong team- building and leadership abilities have enabled me to provide exceptional customer service and ensure customer satisfaction.

Core Skills:

- Customer Service

- Banking Products & Services

- Banking Systems

- Banking Regulations & Compliance

- Team- Building & Leadership

- Problem- Solving & Conflict Resolution

Responsibilities:

- Establishing and maintaining relationships with customers

- Assisting customers with deposits, withdrawals, loan applications, and other banking transactions

- Providing customers with current banking products and services

- Gathering customer financial information to offer appropriate advice

- Answering customer inquiries and resolving complaints

- Processing customer transactions and ensuring accuracy

- Identifying customer needs and offering solutions

- Educating customers on banking products and services

- Maintaining customer files and records

- Ensuring adherence to banking regulations and compliance standards

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Relationship Banker Resume Examples Resume with 10 Years of Experience

Highly motivated Relationship Banker with 10 years of experience in customer service, sales and management. Proven record of providing excellent customer service and ensuring customer satisfaction. Skilled in developing strong relationships with clients through trust, understanding, and exceptional advice. Able to recognize and convert sales opportunities, and utilize sales techniques to exceed expectations. Committed to providing the highest quality customer service, and being a trusted and reliable resource for clients.

Core Skills:

- Client Relations

- Presentation and Negotiations

- Sales Development

- Financial and Risk Management

- Strategic Planning

- Problem Solving

- Business and Credit Analysis

Responsibilities:

- Greeted customers and provided excellent customer service to ensure client satisfaction.

- Developed relationships with customers by understanding their financial needs and providing advice and solutions.

- Utilized sales techniques to identify and convert sales opportunities.

- Ensured compliance with banking regulations and procedures.

- Developed financial plans and advised customers on investments.

- Assessed customer creditworthiness and managed financial risks.

- Developed and maintained strong relationships with clients.

- Monitored market trends and identified potential new customers.

- Developed marketing strategies and implemented promotional activities to increase customer base.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Relationship Banker Resume Examples Resume with 15 Years of Experience

A highly qualified and motivated professional with 15 years of proven experience in the banking industry, seeking a Relationship Banker role to leverage my expertise in providing excellent customer service, as well as identifying and developing new business opportunities. Possessing strong problem- solving and interpersonal skills, I am successful in developing and managing relationships with customers and achieving customer satisfaction. I have demonstrated the ability to work independently and as part of a team to meet the organization’s objectives.

Core Skills:

- Ability to communicate effectively

- Exceptional customer service skills

- Knowledge of banking products and services

- Strong organizational skills

- Excellent problem- solving skills

- Ability to develop and maintain relationships

- Knowledge of banking regulations

Responsibilities:

- Manage customer portfolios, analyze customer needs and recommend banking products and services accordingly.

- Ensure customer satisfaction by resolving customer queries, complaints and discrepancies.

- Develop and maintain relationships with existing and prospective customers.

- Handle customer transactions accurately and efficiently.

- Ensure compliance with banking regulations.

- Identify and develop new business opportunities.

- Stay informed of banking products and services.

- Provide training to new staff.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Relationship Banker Resume Examples resume?

A Relationship Banker Resume Examples resume should include a work experience section detailing any relevant banking experience, as well as a skills section that highlights relevant skills such as customer service and financial analysis. When writing a resume for a relationship banker position, it is important to demonstrate an understanding of banking regulations and the ability to interact effectively with customers.

Work Experience

- List all previous banking experience, including the name of the bank, the position held and the duration of the job

- Describe any experience managing customer accounts, such as processing deposits and withdrawals, handling customer inquiries, and resolving customer disputes

- Include any experience working with loan products and processing loan applications

- Describe any experience working with investment products and providing investment advice

Skills:

- Demonstrate strong customer service skills, including active listening and problem-solving skills

- Show proficiency in financial analysis and the ability to assess risk and make sound investment decisions

- Demonstrate knowledge of banking regulations and compliance with industry standards

- Demonstrate proficiency in sales and marketing techniques

- Possess strong communication and interpersonal skills

Education:

- Include the name of your educational institution, degree and year of graduation

- List any additional certifications such as FINRA Series 7 and Series 63

- Describe any relevant coursework or internships in banking or finance

Additional Information

- Include any awards or special recognition received while working in banking

- List any additional professional development courses taken related to banking, finance or customer service

By including all of these components, a Relationship Banker Resume Examples resume will effectively demonstrate the qualifications and experience needed for a successful career in banking.

What is a good summary for a Relationship Banker Resume Examples resume?

A relationship banker resume summary should include an overview of the applicant’s experience and qualifications in the banking industry. The summary should highlight the applicant’s ability to build and maintain relationships with customers, handle customer inquiries, manage accounts, and provide exceptional customer service. The applicant should also include their knowledge of financial products, services, and regulations. Additionally, the summary should showcase the applicant’s organizational and communication skills, as well as their overall enthusiasm for the banking industry. By demonstrating their qualifications and experience, the applicant will be able to stand out from other applicants and increase their chances of getting the job.

What is a good objective for a Relationship Banker Resume Examples resume?

A Relationship Banker resume should highlight a candidate’s expertise in customer service, personal banking services, financial products, and sales. When crafting a resume objective, consider which aspects of your skills, experience, and qualifications make you the most desirable candidate for the position. A good objective should state your career goals and the value you can bring to the position.

Here are some examples of an effective objective for a Relationship Banker Resume:

- To maximize customer satisfaction by offering the highest level of customer service and providing personalized financial solutions

- To utilize my strong understanding of banking products and services to increase client engagement and maintain customer relationships

- To apply my 5+ years of banking experience to create and implement strategic financial solutions that will exceed customer expectations and goals

- To leverage my expertise in sales and financial products to increase bank revenue

- To utilize my effective communication skills to answer customer inquiries and establish a strong rapport with clients

- To utilize my knowledge of financial markets and regulations to develop and maintain industry best practices

- To provide exceptional customer service to all clients and build lasting relationships by offering superior financial advice and solutions

How do you list Relationship Banker Resume Examples skills on a resume?

When applying for a job as a Relationship Banker, you’ll need to show that you have the right skills to be successful in the role. Having an up-to-date resume with all of your relevant skills is a great way to grab the attention of employers and stand out from the competition. Here are some tips to help you list your skills on a Relationship Banker resume:

- Highlight Core Banking Skills: As a Relationship Banker, you need to have a strong understanding of core banking skills. Make sure to highlight your knowledge of banking products, services, and procedures on your resume.

- Showcase Your People Skills: Relationship Bankers need to be able to engage with customers and build relationships. Make sure to emphasize your interpersonal skills, such as communication and customer service.

- Demonstrate Your Financial Acumen: You’ll need to be able to understand financial data and help customers make the best decisions. Showcase your ability to interpret financial information and accurately assess customer needs.

- Highlight Your Negotiation Skills: As a banker, you’ll need to be able to negotiate loan terms with customers. Make sure to emphasize your negotiation skills, as well as your ability to identify potential risks.

- Showcase Your Analytical Skills: Relationship Bankers need to be able to analyze customer data and make sound decisions. Make sure to highlight your problem-solving and analytical skills on your resume.

By following these tips, you can ensure that your Relationship Banker resume stands out and captures the attention of potential employers.

What skills should I put on my resume for Relationship Banker Resume Examples?

Writing a resume for a relationship banker position is a great opportunity to highlight your customer service and sales skills. A successful relationship banker is one who is organized, pays attention to detail, and has excellent communication skills. Here are some of the skills that should be included in your resume for a relationship banker position:

- Customer Service: As a relationship banker, you’ll be providing customer service to clients, so it’s important to highlight your excellent customer service skills on your resume.

- Relationship Building: Relationship bankers are responsible for building and maintaining relationships with their clients, so it’s important to show that you can build trust with clients and make them feel valued.

- Sales Experience: Relationship bankers are responsible for selling financial products and services to clients, so it’s important to show that you have a strong track record of achieving sales goals.

- Technical Knowledge: Being able to read and understand financial documents is essential for a successful relationship banker, so be sure to showcase your knowledge of financial products and services on your resume.

- Problem-Solving: Relationship bankers need to be able to identify and solve problems quickly and efficiently, so be sure to highlight your problem-solving skills on your resume.

- Time Management: As a relationship banker, you’ll be responsible for managing multiple clients at once, so it’s important to show that you have strong time management skills.

By highlighting these skills on your resume, you’ll be able to show employers that you’re the perfect candidate for the job.

Key takeaways for an Relationship Banker Resume Examples resume

Writing a resume for a Relationship Banker position should be based on the job description for the position you are applying for. It should highlight the specific qualifications, skills, and experiences that you possess that make you a strong candidate for the job. Here are some key takeaways for a Relationship Banker resume examples:

• Lead with a strong professional summary that outlines your qualifications, skills, and experiences as a Relationship Banker.

• Highlight your experience with customer service, relationship management, and financial analysis.

• Make sure to include any relevant certifications or credentials that you possess, such as a Chartered Financial Analyst (CFA) or a Certified Financial Planner (CFP).

• Showcase your ability to manage multiple projects, teams, and clients.

• Describe any awards, honors, or special recognition that you have received.

• Detail any experience that you have with creating and implementing financial strategies.

• Include any sales or customer service experience that you have.

• Make sure to list any software or technology proficiency relevant to the industry.

• Highlight any experience that you have with risk management and compliance.

• Demonstrate your communication and customer service skills and any specialized knowledge that you have of the banking industry.

• Finally, make sure to include any additional special skills or unique qualifications that you have.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder