Your resume is often the first impression you make on potential employers, so it’s important to make the right impression. As a mortgage underwriter, you have a unique set of skills and experiences that can separate you from the competition. Knowing how to properly highlight your experiences and qualifications is essential to getting noticed by recruiters and hiring managers. This guide will provide you with useful tips and mortgage underwriter resume examples to help you craft the perfect resume.

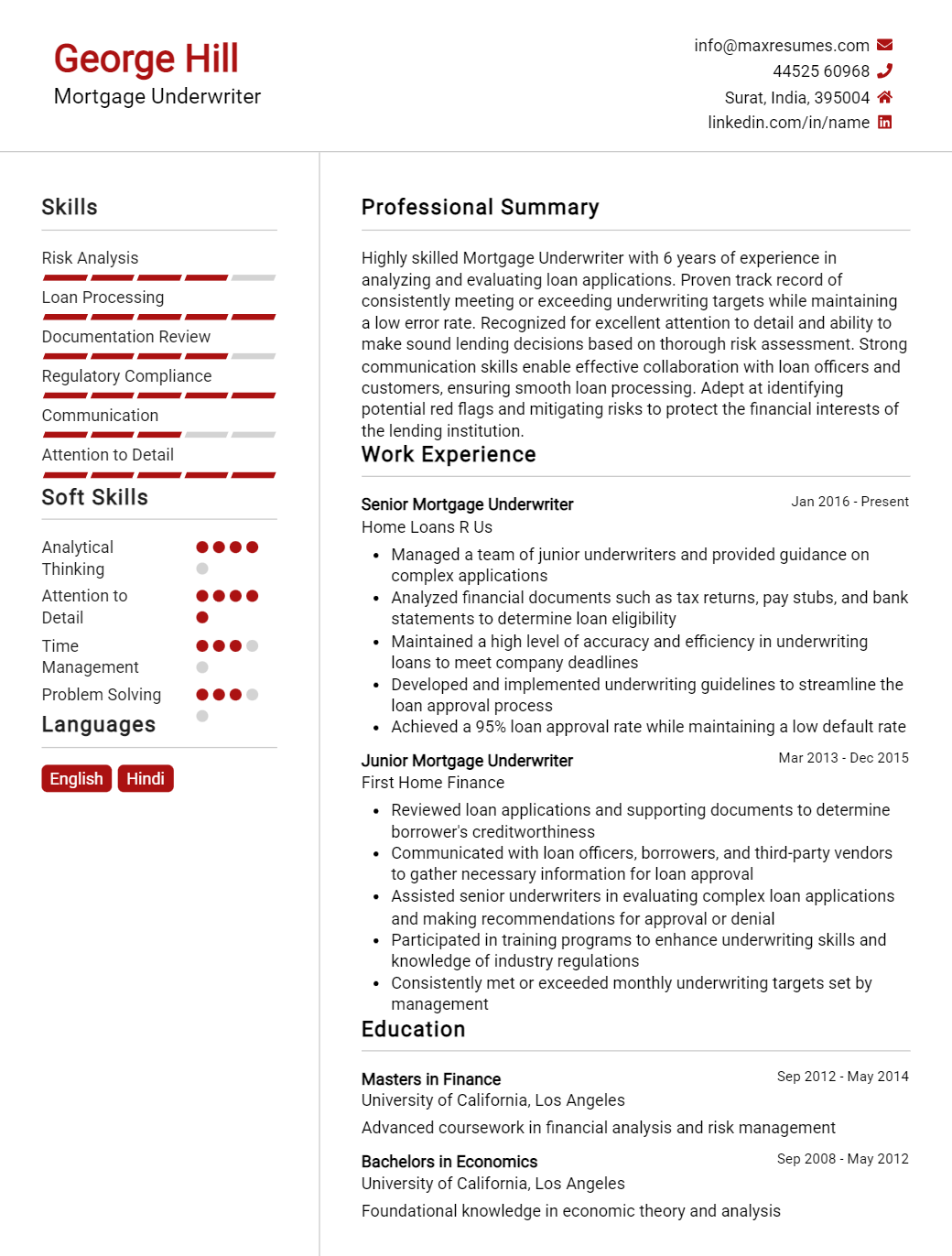

Mortgage Underwriter Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Underwriter Resume Examples

John Doe

Mortgage Underwriter

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Dynamic and highly organized Mortgage Underwriter with 9+ years of experience in the finance sector. Proven track record of success in reviewing hundreds of complex loan applications and assessing their financial risks, while consistently adhering to underwriting guidelines. Artist of mitigating risk and maximizing opportunity to ensure a profitable return for the bank and clients.

Core Skills:

- Strong understanding of underwriting guidelines and regulations

- Excellent analytical and problem- solving skills

- High degree of accuracy and attention to detail

- Excellent communication and customer service skills

- Ability to build relationships with clients

- Proficient in loan origination and management software

Professional Experience:

Mortgage Underwriter, ABC Bank, November 2011 – Present

- Review loan applications, assess financial risks and ensure they meet underwriting guidelines

- Perform a complete analysis of borrower’s credit profile, income, assets and property characteristics

- Analyze credit reports, tax returns, financial statements and income verification documents

- Review special circumstances cases and make underwriting decisions

- Collaborate with loan originators and assist them in completing the loan process

- Deliver superior customer service by responding promptly to customer inquiries

Education:

Bachelor of Business Administration in Banking & Finance, University of Toronto, 2010

Mortgage Underwriter Resume Examples Resume with No Experience

Motivated and organized Mortgage Underwriter with a passion for understanding the complexities of the mortgage industry. Experienced in underwriting loans and ensuring the accuracy and legality of loan documents. Possesses strong communication skills and the ability to maintain relationships with all stakeholders.

Skills:

- Strong knowledge of mortgage lending regulations

- Proficient in loan origination software

- Excellent communication and interpersonal skills

- Strong problem- solving and analytical skills

- Solid customer service and presentation skills

Responsibilities:

- Review loan applications to ensure accuracy, completeness and compliance with lending regulations

- Analyze loan documents for accuracy and completeness, including income verification and credit reports

- Conduct loan review and title examinations to ensure all documents are in order and meet the standards of the lender

- Verify borrower assets and liabilities and ensure compliance with the institution’s loan policies and procedures

- Issue loan approval and denial decisions based on the data provided

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Underwriter Resume Examples Resume with 2 Years of Experience

Experienced mortgage underwriter with over two years of experience in the financial services industry. Strong analytical skills with the ability to examine and interpret financial documents. Possesses excellent communication and customer service skills to effectively work with clients and colleagues. Skilled at quickly recognizing unusual or potentially fraudulent transactions and making decisions that are in compliance with company policies.

Core Skills:

- Analytical Skills

- Financial Document Interpretation

- Customer Service

- Risk Analysis

- Loan Underwriting

- Software Proficiency

- Regulatory Compliance

- Decision Making

- Time Management

Responsibilities:

- Analyze financial documents and credit reports for loan applicants.

- Review loan documents for accuracy and completeness.

- Verify that the loan meets all required criteria and is in compliance with company regulations.

- Examine transactions for any potentially fraudulent activity.

- Make decisions to approve or deny loan applications.

- Document all loan related decisions and processes.

- Provide advice and training to loan officers and other staff.

- Monitor loan portfolios for risk analysis and compliance.

- Keep up to date with changing regulations and policies.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Underwriter Resume Examples Resume with 5 Years of Experience

An experienced mortgage underwriter with 5 years of experience in evaluating and approving loan applications with a focus on compliance and risk management. Possesses strong communication and organizational skills and experience working with multiple loan origination systems. Highly knowledgeable in FHA, VA and Conventional loan guidelines and federal regulations. Demonstrated ability to perform timely and accurate underwriting analysis.

Core Skills:

- Risk Management

- Underwriting and loan analysis

- Federal regulations and guidelines

- Loan origination systems

- Document review

- Customer service

- Communication

- Organization

Responsibilities:

- Analyzing loan applications and accompanying documents for completeness, accuracy and compliance with all relevant regulations and guidelines

- Verifying applicant’s employment, income, assets, credit scores and other financial data

- Assessing property value and market conditions

- Making sound, responsible underwriting decisions within set risk limits

- Developing, recommending and providing solutions to underwriting conditions

- Maintaining detailed records of loan underwriting activities

- Responding to customer inquiries regarding loan status and underwriting decisions

- Working with other departments to resolve underwriting issues and ensure timely closing of loans

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Underwriter Resume Examples Resume with 7 Years of Experience

Highly motivated Mortgage Underwriter with 7+ years of experience analyzing and approving mortgage applications for clients. Possesses a deep understanding of the entire mortgage underwriting process and has a proven track record of handling complex transactions. Experienced in verifying and assessing financial data, validating income, and providing loan approval recommendations. Possesses excellent interpersonal and communication skills, with the ability to explain complex financial data and regulations in simple terms.

Core Skills:

- Proficient in analyzing credit and loan applications

- Skilled in appraising and assessing loan risk

- Solid knowledge of mortgage underwriting guidelines and regulations

- Experience in using automated underwriting systems

- Effective communication and interpersonal skills

- Strong attention to detail and problem- solving orientation

- Ability to handle multiple tasks and prioritize workloads

- Knowledge of lending and real estate markets

Responsibilities:

- Analyzing credit and loan applications and determining loan eligibility based on applicable underwriting guidelines

- Assessing loan risks and validating income and asset documents

- Examining borrowers’ financial information to verify and assess their creditworthiness

- Determining loan value and maximum loan amount

- Performing detailed reviews of loan documentation for accuracy and completeness

- Reviewing credit reports and verifying income and asset statements

- Recommending loan approval or denial based on assessment results

- Monitoring industry and market trends to maintain current industry knowledge

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Underwriter Resume Examples Resume with 10 Years of Experience

Experienced Mortgage Underwriter with 10 years of experience in the financial industry. Skilled in evaluating and processing loan applications for residential mortgages, managing loan documents, and preparing loan packages for final submission. Proven ability to work collaboratively with diverse teams, assess risk, and manage multiple projects at once. Adapts easily to new regulations and technologies to stay up to date with the ever- changing mortgage industry.

Core Skills:

- Risk assessment

- Regulatory compliance

- Loan application processing

- Loan document management

- Loan package preparation

- Data analysis

- Time management

- Communication

- Organizational skills

Responsibilities:

- Evaluate loan applications for residential mortgages and determine borrower’s creditworthiness

- Ensure loan applications are in compliance with relevant regulations and standards

- Analyze financial documents and credit reports for accuracy

- Manage loan documents, including title documents, credit reports, appraisals, and other necessary paperwork

- Collaborate with loan officers, processors, and other team members to review applications and ensure compliance

- Prepare loan packages for final submission, ensuring all documents are included and up to date

- Conduct periodic loan reviews to assess risk and ensure compliance

- Update loan files with new information, as needed

- Provide valuable feedback to loan officers and other team members

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Underwriter Resume Examples Resume with 15 Years of Experience

A highly experienced and skilled Mortgage Underwriter with 15 years of experience in the financial services industry. Adept at researching and analyzing loan applications, evaluating financial information, and ensuring compliance with banking regulations. Committed to providing outstanding customer service and delivering quality results. Possesses excellent communication, organizational, problem- solving, and customer service skills.

Core Skills:

- Mortgage Underwriting

- Credit Analysis

- Loan Structuring

- Regulatory Compliance

- Financial Services

- Problem- Solving

- Customer Service

Responsibilities:

- Review loan applications and supporting documentation for accuracy and completion.

- Assess creditworthiness and evaluate loan risk for residential and commercial mortgage loans.

- Analyze financial information such as credit reports, income statements, balance sheets and assets.

- Ensure that loan application packages are in compliance with banking regulations.

- Respond to questions and inquiries from borrowers and loan officers.

- Verify and document information such as income, assets, and liabilities.

- Monitor loan processing, underwriting and closing activities.

- Develop underwriting standards and procedures to ensure accuracy, quality, and compliance.

- Generate timely and accurate underwriting decisions and communicate them to customers.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Underwriter Resume Examples resume?

A mortgage underwriter is an important financial professional in the mortgage lending industry. As such, it is critical that a mortgage underwriter has a resume that stands out. Here are some tips to make sure that your mortgage underwriter resume examples is up to par and will get you noticed:

- Highlight your experience: Make sure to include any and all experience with mortgage underwriting in your resume. Include job titles, dates of employment, and responsibilities.

- List relevant skills: Mortgage underwriters need to be skilled in risk assessment, credit analysis, and financial regulations. Make sure to list any relevant skills that you possess.

- Mention certifications: If you have any certifications related to mortgage underwriting, make sure to include them on your resume.

- Include education: Include any educational background relevant to mortgage underwriting, such as a degree in finance.

- Emphasize your strengths: Don’t forget to showcase the strengths that make you an ideal candidate for a mortgage underwriting job.

- Use a professional format: Make sure to use a professional, easy to read format when writing your resume.

Follow these tips and you’ll be sure to stand out from the competition and get the attention of your potential employer. Good luck!

What is a good summary for a Mortgage Underwriter Resume Examples resume?

A mortgage underwriter resume should showcase an individual’s experience analyzing loan applications and making credit decisions. It should highlight the applicant’s ability to assess risk, review documentation, and issue final credit decisions. It should also demonstrate the applicant’s knowledge and understanding of mortgage regulations, policies, and guidelines. Furthermore, the resume should demonstrate the individual’s experience in communication, problem solving and customer satisfaction. Additionally, the resume should demonstrate technical skills and expertise such as computer software programs and financial analysis. The summary should include the applicant’s years of experience in a mortgage underwriter role, and the full range of skills and knowledge that the individual will bring to the organization.

What is a good objective for a Mortgage Underwriter Resume Examples resume?

A Mortgage Underwriter Resume should clearly and effectively communicate the applicant’s qualifications, skills, and experience necessary for success in the position. A powerful objective statement is essential to achieving this goal. Here are some good objectives for a Mortgage Underwriter Resume:

- To utilize my thorough knowledge of mortgage underwriting and risk assessment to secure a position as a Mortgage Underwriter

- To apply my four years of banking and finance experience to become a successful Mortgage Underwriter

- To leverage my expertise in credit analysis, loan review, and financial management to become a successful Mortgage Underwriter

- To secure a Mortgage Underwriter role with a reputable firm that allows me to utilize my strong analytical and problem-solving skills

- To leverage my strong interpersonal and communication skills to become an effective and successful Mortgage Underwriter

- To utilize my expertise in loan origination and processing to successfully become a Mortgage Underwriter

How do you list Mortgage Underwriter Resume Examples skills on a resume?

bulletA mortgage underwriter plays a crucial role in the loan approval process. They use their expertise to assess a customer’s financial status, creditworthiness, and capacity to repay a loan. When listing your mortgage underwriter resume skills, it’s important to highlight your knowledge of the loan process and financial documents, your customer service skills, and your ability to make difficult decisions. Here are some examples of skills to list on your mortgage underwriter resume:

-Analytical Thinking: Mortgage underwriters must be able to analyze loan applications and financial documents to determine customer’s creditworthiness.

-Risk Analysis: A mortgage underwriter must be able to assess the risk of a loan and make a final decision on whether or not to approve the loan.

-Financial Knowledge: Mortgage underwriters need to be familiar with the financial industry and understand how interest rates and other factors affect a loan’s profitability.

-Customer Service: Mortgage underwriters must have strong customer service skills to build relationships with customers.

-Decision Making: Mortgage underwriters must be able to make difficult decisions in a timely manner.

-Computer Skills: Mortgage underwriters must be proficient in computer programs such as Microsoft Word and Excel.

By highlighting your mortgage underwriter resume skills, you will demonstrate to potential employers that you have the skills and qualifications necessary to be successful in this highly-skilled position.

What skills should I put on my resume for Mortgage Underwriter Resume Examples?

. When writing your resume for a mortgage underwriter position, it’s important to showcase your qualifications and skills that make you the best candidate for the job. To ensure your resume is as strong as possible, here are some of the top skills to include:

- Analytical Ability: Mortgage underwriters must be able to analyze financial documents and make accurate assessments. Demonstrate your analytical ability by highlighting any relevant experience in data assessment, financial analysis, or other related fields.

- Attention to Detail: Mortgage underwriters must be detail-oriented in order to accurately assess loan applications and ensure compliance with regulations. Showcase your attention to detail by highlighting past experience that required a high level of accuracy and precision.

- Knowledge of Regulations and Standards: As a mortgage underwriter, you must be up-to-date on all relevant regulations and standards. Provide examples of your knowledge in this area, such as any certifications you’ve achieved or industry-related courses you’ve taken.

- Communication Skills: Mortgage underwriters must have excellent communication skills in order to clearly explain loan programs and decisions to customers. Highlight your communication skills by showing examples of any past customer service or communication roles you’ve had.

- Decision-Making: Mortgage underwriters must be able to make quick, accurate decisions when approving or rejecting loan applications. Detail any past experience that required you to make important decisions, such as any managerial or supervisory roles you’ve had.

Key takeaways for an Mortgage Underwriter Resume Examples resume

When creating a resume as a mortgage underwriter, there are certain key points to consider to make sure you stand out from the competition. Here are some key takeaways to help you create an effective resume:

- Highlight Your Education: Make sure to showcase your educational background in your resume. This is an important factor to emphasize when applying for a mortgage underwriter role. Include any relevant certifications or degrees you have in relation to finance or banking.

- Emphasize Experience: When applying for a mortgage underwriting role, it is important to showcase any relevant experience you have. This can include underwriting experience from other loan types, such as auto and personal loans, or from working in a financial institution.

- Showcase Problem-Solving Abilities: As a mortgage underwriter, you need to be able to analyze and assess hundreds of loan applications. Therefore, it is essential to demonstrate your problem-solving and critical thinking skills. You can do this by highlighting any complex cases or challenges you have overcome in the past.

- Demonstrate Technical Knowledge: Mortgage underwriting requires a certain technical knowledge to review and approve loan applications. Make sure to showcase any technical skills or knowledge you have, such as knowledge of automated underwriting systems (AUS) or credit scoring systems.

- Showcase Your Soft Skills: Mortgage underwriting is a customer-facing position, so it is important to demonstrate your customer service skills. Highlight any customer service experience you have, such as dealing with difficult customers or helping them understand the loan process.

By following these key takeaways, you can create an effective and eye-catching resume for a mortgage underwriter role.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder