A well-crafted resume is an important tool for getting your career off the ground. Having a good resume can increase your chances of being hired for an entry-level position in a mortgage specialist role. This guide will provide sample resumes and tips to help you write an effective resume for a mortgage specialist position. You will learn the basics of resume writing, including how to structure your resume, what to include, and the key points you should emphasize. We will also provide helpful examples of mortgage specialist resume sections to help you get started. With the help of this guide, you can create a professional resume that will make a great first impression and help you get the job you want.

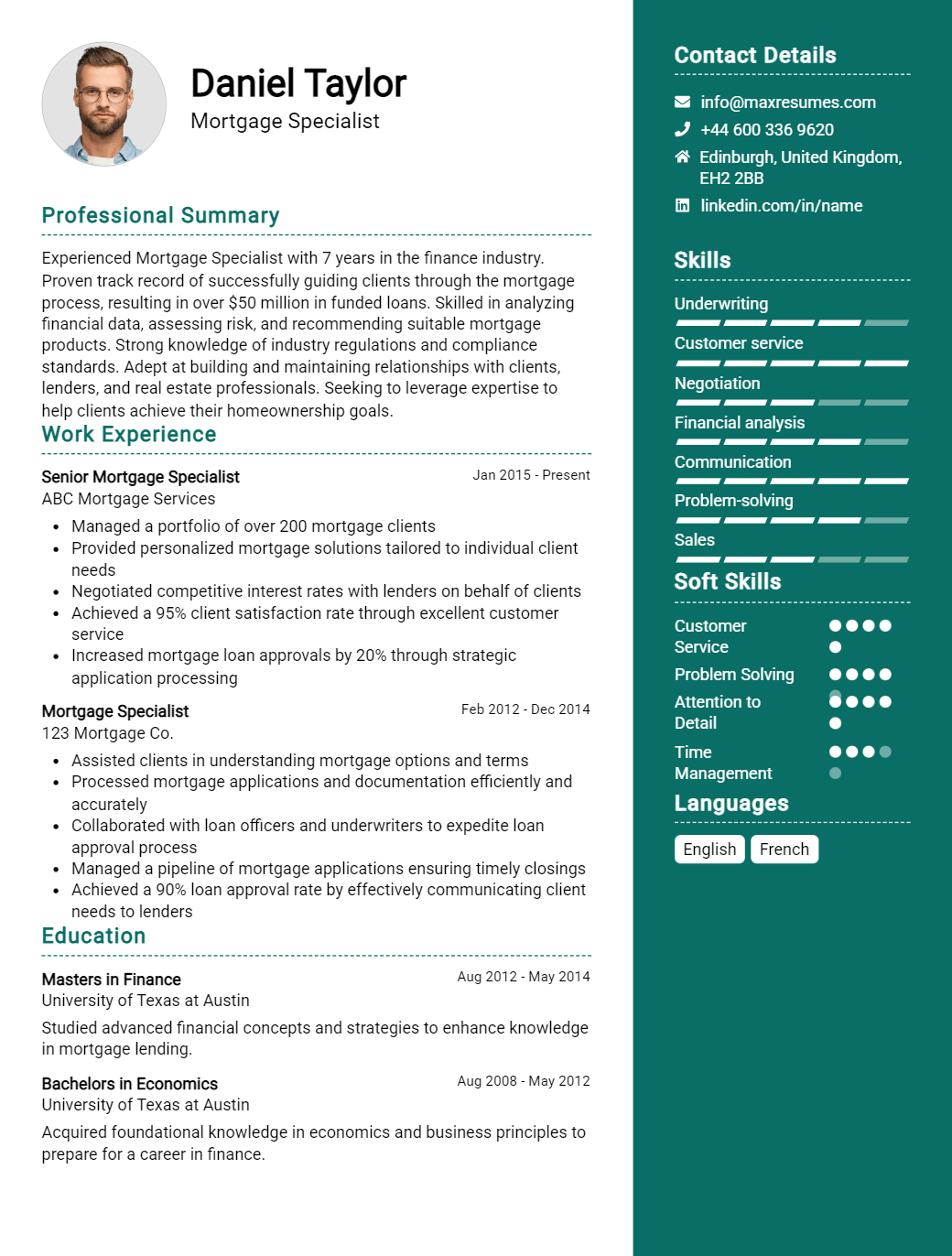

Mortgage Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Specialist Resume Examples

John Doe

Mortgage Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a self- motivated and results- oriented mortgage specialist with over 5 years of experience in handling mortgage loan applications, processing documents, and evaluating credit worthiness. I have a strong eye for detail and excellent customer service skills. My professional experience includes working with loan originations, underwriting, loan closings, and customer relations. I am also adept at using loan origination systems, Excel, and other mortgage software. I am highly knowledgeable about lending regulations and local markets, and I pride myself on my ability to help borrowers find the best financing solutions.

Core Skills:

- Loan Origination Systems

- Mortgage Software

- Credit Analysis

- Loan Closings

- Regulatory Compliance

- Underwriting

- Excel

- Customer Relations

Professional Experience:

Mortgage Specialist, ABC Financial Services, 2018 – Present

- Originate mortgage loans, analyze creditworthiness, and process loan documents.

- Oversee loan closings and handle customer inquiries.

- Research local markets and stay updated on loan regulation changes.

- Utilize loan origination systems and mortgage software.

Mortgage Loan Officer, XYZ Bank, 2016 – 2018

- Processed loan applications and evaluated credit histories.

- Reviewed loan documentation and determined creditworthiness.

- Assisted customers with loan requests and answered inquiries.

- Educated customers on products and services available.

Education:

Bachelor of Arts in Finance, University of Michigan, 2014- 2016

Associate of Arts in Business Management, College of DuPage, 2012- 2014

Mortgage Specialist Resume Examples Resume with No Experience

A hardworking and motivated individual with a passion for helping customers select the best mortgage product for their needs. Looking to leverage my knowledge of the mortgage market and keen customer service skills to become a Mortgage Specialist.

Skills:

- Ability to understand and explain complex mortgage products and terms to customers

- Excellent understanding of the mortgage market and current loan rates

- Strong communication and interpersonal skills

- Good organizational and time management skills

- Proficient in Microsoft Office Suite

Responsibilities

- Assist customers in selecting the best financial products for their needs

- Research the mortgage market for current rates on loan products

- Maintain accurate records of customer interactions and application status

- Develop customer relationships by providing excellent customer service

- Answer customer inquiries regarding loan products and terms

- Assist customers through the entire loan application process

- Ensure all customer information is accurate and up to date

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Specialist Resume Examples Resume with 2 Years of Experience

Dedicated Mortgage Specialist with two years of experience in the field of loan origination. Proven track record of accurate and efficient loan processing; adept at securing maximum loan qualification for clients. Possesses sound knowledge of applicable laws and regulations and excellent communication and customer service skills.

Core Skills:

- Loan origination

- Loan processing

- Document analysis

- Risk analysis

- Customer service

- Knowledge of applicable laws and regulations

- Interpersonal communication

- Negotiation

Responsibilities:

- Assisted clients in determining their eligibility for various loan products

- Collected financial information and documents to assess the risk associated with the loan

- Reviewed loan applications to ensure accuracy and completeness

- Negotiated loan terms with lenders to secure the best rate for clients

- Drafted loan contracts and other pertinent documents

- Interacted with clients in answering questions and providing guidance

- Followed up with credit agencies and other parties to obtain documents

- Assisted in resolving any discrepancies with the loan application

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Specialist Resume Examples Resume with 5 Years of Experience

A highly motivated and driven Mortgage Specialist with 5 years of experience in the financial services industry. I have a track record of success in providing excellent customer service in a fast- paced environment. My expertise comprises of a comprehensive knowledge of loan origination, underwriting, and funding procedures. I am also well- versed in conducting credit and background checks, verifying documents, and ensuring compliance with federal and state regulations. I possess strong organizational skills and the ability to work independently or collaboratively, as needed.

Core Skills:

- Customer Care

- Loan Origination

- Underwriting

- Funding Procedures

- Credit Checks

- Document Verification

- Regulatory Compliance

Responsibilities:

- Assisted in originating, underwriting, and funding mortgage loans according to organization and industry standards.

- Verified customer data by reviewing credit reports, tax returns, and other documents.

- Evaluated customer creditworthiness and loan applications.

- Monitored loan status throughout the entire process.

- Met with customers and provided guidance on loan options and strategies.

- Maintained accurate records and documentation of customer interactions.

- Reconciled discrepancies regarding documents, payments, and other loan information.

- Ensured compliance with federal and state regulations.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Specialist Resume Examples Resume with 7 Years of Experience

A highly organized and detail- oriented mortgage specialist with 7 years of experience in providing comprehensive mortgage services. Proven track record of ensuring accuracy and timeliness of loan closing. Skilled in conducting thorough research and analysis of loan inquiries, qualifying borrowers and offering sound financial advice. Excellent communication, problem- solving and customer service skills.

Core Skills:

- Mortgage Processing

- Loan Closing

- Credit Analysis

- Financial Advice

- Documentation Preparation

- Loan Packaging

- Risk Assessment

- Escrow Management

- Regulations Compliance

Responsibilities:

- Review and evaluate loan applications for accuracy and completeness

- Analyze credit and income documents to ensure borrower data meet the bank’s standards

- Assess loan risk and potential profitability

- Calculate loan payments, interest rates and repayment terms

- Negotiate terms and conditions of loan agreements

- Ensure loan documents and records are accurate, complete and compliant with financial regulations

- Obtain and verify necessary documents prior to loan closing

- Monitor and track loan processing progress

- Maintain communication with borrowers, underwriters and other financial professionals

- Provide technical advice and guidance on loan programs and regulations

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Specialist Resume Examples Resume with 10 Years of Experience

Results- driven Mortgage Specialist with 10 years of experience in the financial services sector. Proven track record of providing outstanding customer service, accurate mortgage application processing, and market analysis. A self- motivated professional with strong communication and interpersonal skills, who is comfortable working behind- the- scenes or in a client- facing capacity.

Core Skills

- Finance & banking knowledge

- Mortgage processing expertise

- Analytical & problem- solving abilities

- Data entry & record keeping

- Advanced MS Office skills

- Professional customer service

- Market research & analysis

Responsibilities

- Review and analyze customer financial information to determine eligibility for mortgage products.

- Check and verify customer credit and financial documents for accuracy.

- Assist customers in filling out and completing mortgage applications.

- Collaborate with professionals from other departments to ensure accurate and timely processing of applications.

- Monitor market trends and current regulations to stay informed of industry changes.

- Follow up with customers to ensure satisfaction and address any issues.

- Maintain accurate records of customer interactions and transactions.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Specialist Resume Examples Resume with 15 Years of Experience

A skilled Mortgage Specialist with over 15 years of experience in providing superior customer service and financial advice to borrowers seeking all types of mortgage loans. Possesses an in- depth understanding of all current mortgage products, loan processing and closing procedures, and lending policies. Outstanding ability to gather and analyze financial data to determine loan eligibility and accurately assess risk. Highly organized, efficient, and proactive with a commitment to accuracy and detail.

Core Skills:

- Knowledgeable in all aspects of mortgage loan processing

- Excellent customer service, communication, and organizational skills

- Proficiency in financial software, MS Office Suite, and loan origination systems

- Highly organized and detail- oriented

- Strong analytical and problem- solving skills

- Ability to work independently and as part of a team

Responsibilities:

- Gathering and verifying information from loan applicants

- Educating loan applicants on loan options

- Comparing and analyzing loan applications and credit reports

- Submitting loan applications to lenders

- Evaluating loan repayment history to determine loan eligibility

- Negotiating loan terms and interest rates with lenders

- Monitoring loan approval process to ensure timely closing

- Updating and maintaining customer records

- Providing customer support and post- closing assistance

- Ensuring compliance with all banking and lending regulations

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Specialist Resume Examples resume?

A mortgage specialist resume should include the following:

- Contact Information: This should include your name and contact information such as your address, phone number, and email address.

- Summary of Qualifications: This should provide a brief overview of your qualifications, experience, and accomplishments as a mortgage specialist.

- Education and Certifications: Include any relevant educational qualifications, such as degrees in finance, accounting, or real estate, as well as any certifications you may have obtained.

- Work Experience: List any previous jobs as a mortgage specialist, highlighting the skills and knowledge you gained in each position.

- Technical Skills: List any technical or computer skills you possess that are relevant to the role of a mortgage specialist.

- Professional Organizations: If you are a member of any professional organizations or associations, include those in your resume.

- Professional References: List three to five professional references who can vouch for your experience and skills.

What is a good summary for a Mortgage Specialist Resume Examples resume?

A mortgage specialist resume should emphasize a candidate’s experience with mortgage products, including loan origination and underwriting. The resume should also highlight a candidate’s knowledge of the mortgage industry, including its regulations and requirements. Other important skills for a mortgage specialist resume include excellent customer service skills, strong problem-solving abilities, and knowledge of financial and loan processing software. It is important to include a summary statement that quickly summarizes a candidate’s key qualifications, such as their experience, knowledge, and abilities. The summary statement should also include any certifications a candidate may have, such as a Certified Mortgage Banker (CMB) designation. By highlighting a candidate’s qualifications in a concise summary statement, potential employers can quickly get an overview of the candidate and decide if they are the right fit for the job.

What is a good objective for a Mortgage Specialist Resume Examples resume?

A mortgage specialist is a key player in the mortgage industry, helping borrowers secure the best loan for their needs. A mortgage specialist must have a thorough understanding of the loan process, regulations, and current market trends. A strong resume objective is vital for a mortgage specialist to stand out against other candidates and get an interview.

When writing your resume objective, it is important to highlight your relevant experience and qualifications. Here are a few examples of resume objectives for mortgage specialists:

-A highly motivated and organized mortgage specialist with 5 years of experience in the financial services industry, looking to leverage my skills to secure a position at ABC Bank.

-A results-driven mortgage specialist with 10 years of experience and a focus on customer satisfaction, seeking to join XYZ Bank and help build strong relationships with clients.

-A highly knowledgeable and detail-oriented mortgage specialist with a passion for helping people, eager to join ACB Mortgage to support loan origination and underwriting.

-An experienced mortgage specialist with a strong background in loan processing, seeking a position with DEF Mortgage to help borrowers navigate the home buying process.

How do you list Mortgage Specialist Resume Examples skills on a resume?

When writing a resume for a Mortgage Specialist position, it’s important to include the skills and experience that are most relevant to the job. Listing the right skills will help employers quickly identify the best candidate for the role. Here are some key skills that can be included on a Mortgage Specialist resume:

-Financial Analysis: Ability to assess financial information and data, understand risk factors, and make sound judgments.

-Customer Service: Demonstrated experience providing excellent customer service to clients and colleagues.

-Regulatory Knowledge: Understanding of relevant legislation and regulations related to the mortgage industry.

-Communication: Proven ability to listen to client needs and explain complex financial concepts in simple terms.

-Problem-Solving: Strong problem-solving skills to identify solutions to client-related issues.

-Organizational Skills: Ability to manage multiple tasks and prioritize workload for maximum efficiency.

-Computer Proficiency: Proficient in the use of mortgage software, database systems, and other business applications.

What skills should I put on my resume for Mortgage Specialist Resume Examples?

bulletA mortgage specialist is a financial professional who helps clients with the process of obtaining a mortgage loan. The mortgage specialist is responsible for analyzing a client’s financial information, such as income and expenses, to determine their ability to qualify for a loan. A resume for a mortgage specialist position should include certain skills and qualifications that demonstrate the applicant’s knowledge and expertise in the mortgage industry.

When writing your resume, consider including the following skills:

- Knowledge of the mortgage industry: A mortgage specialist should have a thorough understanding of the mortgage process, including the various types of loans available and the requirements for approval.

- Attention to detail: Mortgage specialists must be able to accurately review financial documents and paperwork to ensure that all requirements are being met.

- Analytical skills: Mortgage specialists must have the ability to analyze the client’s financial information and identify areas of potential risk.

- Customer service: A mortgage specialist should be able to provide excellent customer service, including responding promptly to customer inquiries and concerns.

- Computer skills: Mortgage specialists must be comfortable using computer programs and software to process loan applications and manage customer data.

By including these skills on your resume, you can demonstrate to potential employers that you are well-versed in the mortgage industry and have the necessary skills to succeed in the position.

Key takeaways for an Mortgage Specialist Resume Examples resume

When writing a resume, a mortgage specialist should highlight their expertise in finance and their knowledge of mortgage products and services. To make your resume stand out, here are some key takeaways for a mortgage specialist resume example:

- Highlight your proficiency in mortgage-related industries. As a mortgage specialist, your expertise should be prominently featured on your resume. Include any certifications or education you have in the field, as well as any job or volunteer experience related to mortgages.

- Showcase your ability to understand complex topics. Since mortgages involve a lot of financial technicalities, it’s essential to demonstrate your ability to understand and communicate complicated topics. Include any projects or initiatives that required you to analyze and interpret large amounts of data.

- Demonstrate your customer service skills. Working with customers is a large part of the job, so showcasing your ability to provide excellent customer service is key. Include any customer service awards, as well as any training or workshops you have taken regarding customer service.

- Emphasize your problem-solving skills. Mortgage specialists often need to troubleshoot and solve issues that arise, so it’s important to demonstrate your problem-solving capabilities. Include any projects or initiatives that required you to find solutions to complex problems.

- Highlight your ability to work independently. As a mortgage specialist, you need to be able to handle tasks independently. Showcase your ability to take initiative and work without supervision by including any projects or initiatives that required independent work.

By following these key takeaways, you’ll be able to create a compelling resume that showcases your skills and expertise as a mortgage specialist.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder