Having a great resume is the first step towards finding a new job as a mortgage processor. It’s important to understand what a mortgage processor does and how to highlight your skills and experience if you want to stand out from the competition. This guide will provide you with a comprehensive look at what a mortgage processor does and how to create a resume that will get you noticed. We will provide you with examples of resumes to help shape your own, as well as tips and advice on what to include. By the end of this guide, you will have the knowledge and skills needed to create a resume that will help you take the next step in your career.

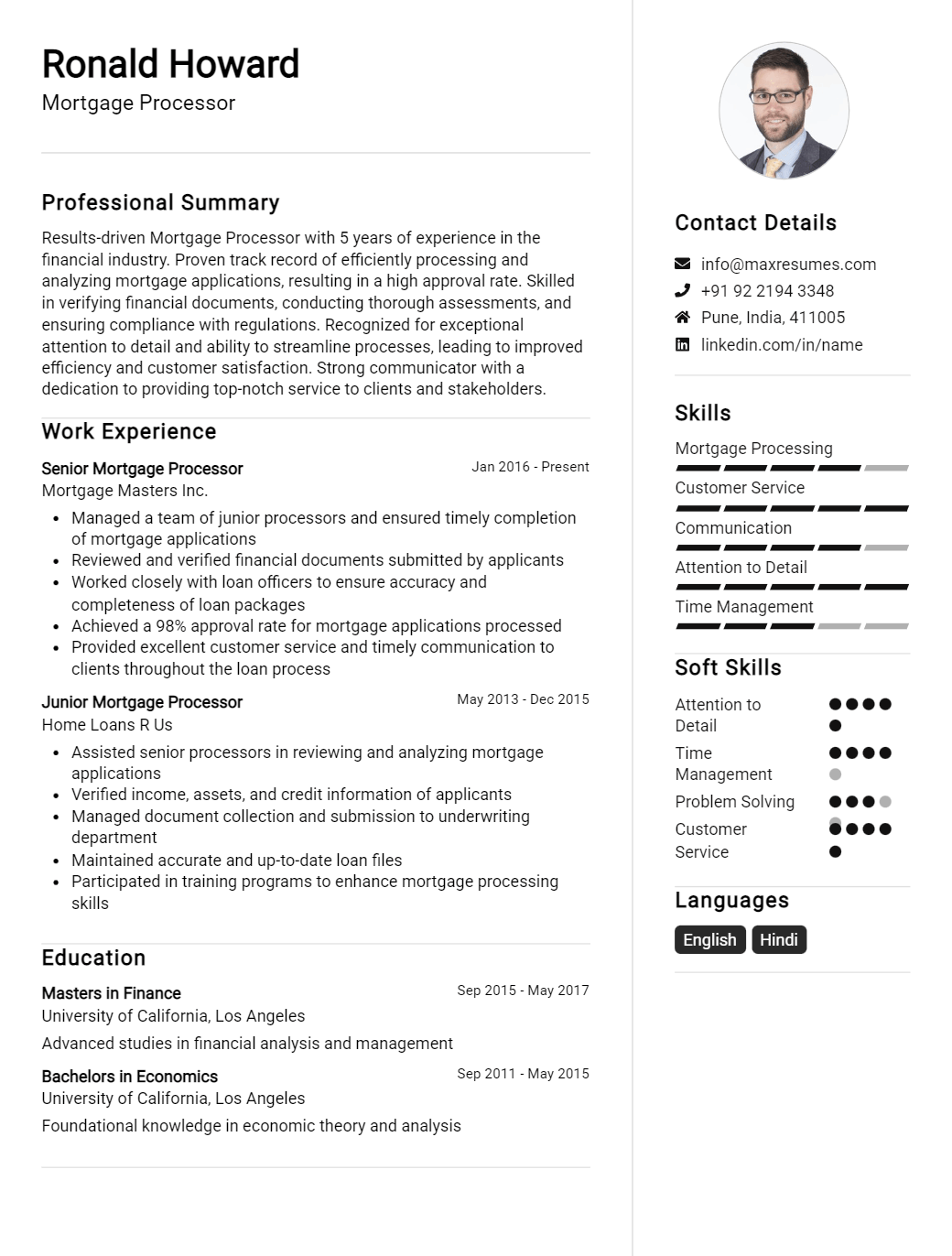

Mortgage Processor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Processor Resume Examples

John Doe

Mortgage Processor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced and motivated Mortgage Processor with 10 years of extensive knowledge in the mortgage industry. I am well- versed in loan origination processes and federal/state regulations and am confident that I could provide an effective and efficient loan processing assistance to any organization. I have excellent customer service, communication, and organizational skills. My experience also includes working closely with appraisers, lenders, and realtors to ensure that all loan documentation is accurate and complete.

Core Skills:

- Excellent customer service and communication skills

- Knowledge of federal/state regulations

- Loan origination processes and procedures

- Loan underwriting, processing, and closing

- Mortgage loan documents and records

- Appraisal and credit report review

- Computer proficiency (Microsoft Office, Adobe Acrobat, etc.)

Professional Experience:

Mortgage Processor, XYZ Mortgage Corporation, 2019- Present

- Process loan applications from start to finish, including gathering initial documents, underwriting, and closing

- Review and evaluate loan applications and supporting documents for compliance with program requirements

- Interact with customers and other stakeholders on a regular basis to resolve any issues

- Prepare and submit loan documents to lenders for funding

- Maintain accurate and detailed records of loan applications

- Monitor and review credit reports, appraisals, and other documents for accuracy

Mortgage Loan Processor, ABC Mortgage Company, 2015- 2019

- Assisted loan officers, appraisers, and lenders in the loan application process

- Reviewed and analyzed loan documents for accuracy and completeness

- Processed and compiled loan information to meet the pre- determined standards

- Facilitated loan closings and funded loan applications

- Responded to customer inquiries and requests in a timely manner

Education:

Bachelor of Science, Business Administration, University of XYZ, 2013

Mortgage Processor Resume Examples Resume with No Experience

Recent college graduate with strong organizational and research skills. Seeking an entry- level position as a Mortgage Processor to utilize my passion for helping individuals achieve their financial goals.

Skills:

- Excellent communication and customer service skills

- Proficient in MS Office Suite and basic computer applications

- Strong interpersonal and problem- solving skills

- Ability to work independently or with a team

- Attention to detail and accuracy

- Ability to maintain confidential information

- Knowledge of banking and mortgage loan processing

Responsibilities

- Gather and verify documents from clients, including bank statements, tax returns, credit reports, and proof of income

- Review loan applications for accuracy and completeness

- Contact applicants and lenders to obtain additional information and documents

- Ensure accuracy and completeness of loan documents

- Verify loan documents for accuracy and legal compliance

- Enter loan data into the computer system

- Monitor the progress of loan applications and make adjustments as required

- Work collaboratively with other departments to ensure timely loan processing

- Communicate status updates to clients and lenders

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Processor Resume Examples Resume with 2 Years of Experience

Diligent and organized mortgage processor with two years of experience in the mortgage industry. Skilled at accurately gathering and reviewing loan application documents. A team player with excellent communication and customer service skills who takes pride in delivering top- notch customer satisfaction.

Core Skills:

- In- depth knowledge of mortgage banking regulations

- Proven ability to review and process loan applications

- Proficient in using mortgage loan origination software

- Ability to work in a fast- paced and team- oriented environment

- Experience preparing and submitting loan packages for approval

- Excellent data entry and record- keeping skills

- Proficient in Microsoft Office Suite

Responsibilities:

- Gather and review loan application documents and verify accuracy

- Analyze documents such as income tax, bank statements, and credit reports

- Calculate income, credit scores, and debt ratios

- Communicate with customers, loan officers, and underwriters to resolve discrepancies

- Prepare and submit loan packages to lenders and investors

- Enter loan data into loan origination systems and update status of loan applications in a timely manner

- Monitor daily loan activity and ensure that all documents needed for the loan have been received and reviewed

- Maintain accurate and up- to- date loan files

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Processor Resume Examples Resume with 5 Years of Experience

An experienced mortgage processor with over 5 years in the industry, specializing in timely and accurate loan processing with excellent customer service. Skilled in collecting, verifying, and analyzing information to ensure accuracy when underwriting loans. Adept at utilizing the latest mortgage industry technologies to stay up- to- date on industry compliance standards and ensure efficient processing.

Core Skills:

- Loan Processing

- Underwriting

- Loan Origination

- Data Entry

- Customer Service

- Compliance

- Problem Solving

- Analytical Skills

Responsibilities:

- Verifying and collecting borrower information

- Processing income and asset documentation

- Analyzing the borrower’s credit profile

- Assigning loan application numbers, entering data into loan origination software

- Ensuring accuracy of loan applications

- Securing signature and notarizations on documents

- Cross- checking loan documentation for accuracy

- Reviewing loan files for compliance with lending regulations

- Maintaining records of documents and communications

- Providing excellent customer service throughout the loan process

- Generating loan status reports

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Processor Resume Examples Resume with 7 Years of Experience

Experienced Mortgage Processor with 7 years of experience in the financial services industry. Skilled in loan origination, knowledge of loan origination systems, and loan processing. Adept at analyzing borrower’s credit and financial information, providing customer service to borrowers and loan officers, and ensuring accurate and timely loan processing. Strong understanding of Fannie Mae and Freddie Mac underwriting guidelines and applicable regulatory and compliance requirements.

Core Skills:

Loan Origination

Customer Service

Loan Processing

Loan Documentation

Underwriting Guidelines

Credit Analysis

Financial Analysis

Regulatory Compliance

Responsibilities:

- Review loan applications for accuracy and completeness.

- Analyze borrower’s credit and financial information to determine loan eligibility.

- Respond to borrower and loan officer inquiries regarding loan status and/or documents needed.

- Verify loan documents for accuracy, completeness and compliance with lender’s underwriting guidelines.

- Provide support to loan officers in the origination and processing of loans.

- Provide customer service to borrowers and loan officers.

- Ensure accurate and timely loan processing.

- Maintain up- to- date knowledge of Fannie Mae and Freddie Mac underwriting guidelines and applicable regulatory and compliance requirements.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Processor Resume Examples Resume with 10 Years of Experience

Highly organized and motivated Mortgage Processor with 10+ years of experience in the financial industry. Adept at managing loan documents and ensuring accuracy of information. Proven ability to develop and maintain strong relationships with customers, lenders, and investors. Possesses a keen eye for detail and excellent time management skills. Utilizes technology to streamline processes and improve accuracy.

Core Skills:

- Data Entry

- Loan Documentation

- Regulatory Compliance

- Risk Management

- Customer Service

- Time Management

- Problem Solving

- Communication

Responsibilities:

- Review loan applications and assess credit risk

- Obtain, review, and verify all supporting documents necessary for loan approval

- Analyze financial information and assess potential risks

- Analyze loan documents to ensure accuracy and completeness

- Communicate with lenders and investors to ensure compliance with regulations

- Ensure loan documents and disclosures are up- to- date and in compliance with all applicable laws

- Develop and maintain relationships with customers, lenders, and investors

- Determine loan eligibility and decide whether to approve or deny loan requests

- Monitor loan progress and coordinate closings

- Handle customer complaints and issues in a timely and efficient manner

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Processor Resume Examples Resume with 15 Years of Experience

A highly experienced Mortgage Processor with 15 years of experience in mitigating risk, optimizing customer service, and ensuring compliance with all applicable regulations in the mortgage industry. Skilled in mortgage document verification, loan setup and closing, and customer service. A strong communicator with excellent problem- solving, customer service, and organizational skills. Dedicated to providing clients with the best mortgage experience possible, while adhering to all industry guidelines.

Core Skills:

- Mortgage document verification

- Loan setup and closing

- Risk mitigation

- Customer service

- Problem- solving

- Organizational skills

- Industry guidelines

Responsibilities:

- Verify mortgage documents for accuracy and completeness

- Set up loans for closing, including calculating loan origination fees and points

- Negotiate loan terms and conditions with lenders

- Ensure compliance with all laws and regulations governing mortgage lending

- Work closely with loan officers and other staff to ensure smooth and timely completion of loan process

- Provide assistance to customers throughout the loan process

- Maintain records and reports of all loan activity

- Identify and address any potential risks associated with loan origination and closing

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Processor Resume Examples resume?

A Mortgage Processor Resume Examples is a great way for applicants to showcase their experience and abilities in preparing and submitting loan applications for approval. It is important for applicants to be familiar with the industry and know what should be included in a Mortgage Processor Resume Examples. Here are some of the key elements that should be included:

- Professional Summary: A concise overview of your professional experience and qualifications.

- Industry Knowledge: A comprehensive understanding of the mortgage industry, including the common terms, products, regulations, and more.

- Loan Application Preparation: A history of preparing complete and accurate loan applications, as well as reviewing and ensuring accuracy of loan documents.

- Loan Submission: Experience submitting loan packages through the most appropriate channels, such as directly to lenders or through automated underwriting systems.

- Communication: Excellent communication and interpersonal skills, both written and verbal, necessary for interacting with clients, lenders, and other stakeholders.

- Problem Solving: A history of troubleshooting loan application issues to ensure timely and accurate submission.

- Organizational Skills: The ability to prioritize workload and manage multiple tasks while ensuring accuracy.

- Computer Literacy: Knowledge of loan origination software and other computer programs used in the mortgage industry.

These are just some of the key elements that should be included in a Mortgage Processor Resume Examples. Applicants should ensure that they highlight their experience and qualifications in order to demonstrate their value to potential employers.

What is a good summary for a Mortgage Processor Resume Examples resume?

A mortgage processor resume should be written to demonstrate a job seeker’s ability to efficiently process mortgage applications. The resume should include a summary of qualifications, emphasizing a candidate’s experience in the finance industry and their aptitude for managing customer documents and data. The resume should also highlight any relevant customer service or sales experience, as well as any specialized training or certifications related to mortgage processing. The resume should further include any relevant experience in loan origination or underwriting, as well as any knowledge of state and federal regulations. Finally, the resume should demonstrate a commitment to customer satisfaction and consistently meeting deadlines.

What is a good objective for a Mortgage Processor Resume Examples resume?

A mortgage processor resume should have an objective that focuses on the applicant’s ability to efficiently process loan applications and prepare them for submission. Here is an example of a good objective for a mortgage processor resume:

- Process loan applications and documents efficiently for easy submission

- Ensure accuracy and compliance with federal and state regulations

- Thoroughly review documents for accuracy and completeness

- Collaborate with lenders and other departments to ensure timely processing of loans

- Remain up to date on industry trends and new regulations

- Ability to handle multiple tasks simultaneously and meet deadlines

How do you list Mortgage Processor Resume Examples skills on a resume?

A Mortgage Processor is responsible for processing mortgage applications and ensuring that they meet regulatory and organizational requirements. In order to demonstrate your expertise, you will need to list your skills on your resume. Here are some examples of skills to consider including on your Mortgage Processor Resume:

- Knowledge of mortgage loan documentation, including understanding of mortgage loan underwriting guidelines

- Familiarity with federal regulations, including the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA)

- Ability to review and analyze credit reports, income documentation, and other required documents

- Computer savvy with experience in mortgage processing software, loan origination systems, and other applications

- Excellent customer service skills for communicating with clients, lenders, and other industry professionals

- Proficiency in multitasking and managing multiple files at the same time

- Well-versed in mathematical calculations, including the ability to accurately calculate a borrower’s debt-to-income ratio

- Attention to detail and a commitment to accuracy when processing mortgage applications

- Ability to work independently and as part of a team to ensure timely processing of loans

What skills should I put on my resume for Mortgage Processor Resume Examples?

A mortgage processor is a professional who handles the paperwork and financial details of a mortgage loan application. They’re responsible for ensuring that loan documents and information is accurate and up-to-date, as well as meeting deadlines for the loan processing process. To be successful in the field, it’s important to have a strong understanding of the mortgage industry, as well as excellent organizational and interpersonal skills. Here’s a look at some of the skills to list on your resume for a mortgage processor role.

-Excellent customer service: Being able to provide quality customer service to clients is essential in a mortgage processing role. This includes answering questions, providing helpful guidance, and making sure to address any concerns.

-Knowledge of loan processing: The mortgage processor needs to have a thorough understanding of loan processing and the necessary paperwork involved. This includes gathering documents, verifying accuracy, and staying up-to-date on any changes in the industry.

-Strong attention to detail: A mortgage processor needs to have a sharp eye for detail, as they’ll need to go through documents and paperwork with accuracy. This includes making sure that all information is accurate and up-to-date, as well as catching any potential errors.

-Organizational skills: An effective mortgage processor needs to be highly organized in order to manage multiple loan applications at once. This includes managing timelines and ensuring that deadlines are met.

-Interpersonal skills: Having strong interpersonal skills is important for a mortgage processor, as they’ll be working with a variety of people in the loan processing process. This includes being able to effectively communicate with lenders, borrowers, and other services related to the loan application.

-Time management: Being able to manage time and meet deadlines is crucial in the mortgage processing role. This means being able to prioritize tasks, remain focused on the task at hand, and stay organized throughout the loan processing process.

Key takeaways for an Mortgage Processor Resume Examples resume

If you are a mortgage processor looking to put together a resume, there are several key takeaways that you should consider. Taking the time to consider these tips can help your resume stand out and increase your chances of landing the job.

- Highlight your experience with industry-specific software. As a mortgage processor, it is essential that you are familiar with the software and systems used in the mortgage industry. Showcase your experience by referencing the software and systems you have used, as well as any specialized training you have completed.

- Emphasize any customer service experience you have. Mortgage processors have an important role in helping to build relationships between customers and lenders. Make sure to highlight any customer service experience you have that demonstrates your ability to interact with clients and create positive relationships.

- Demonstrate your attention to detail. A major part of a mortgage processor’s job is ensuring accuracy and paying attention to the small details. Make sure to mention any experience you have that showcases your attention to detail and accuracy.

- Provide examples of any successful projects. If you have been involved in any successful projects that you are proud of, outline them in your resume. This will help to show potential employers that you are a capable and experienced mortgage processor.

By keeping these key takeaways in mind, you can create an effective mortgage processor resume that will increase your chances of getting the job. Take the time to highlight your experience, customer service skills, attention to detail, and successful projects so you can create the strongest resume possible.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder