Finding the perfect job can be a daunting task. It takes skill, research, and dedication to land that great job that you’ve been dreaming of. To help you in your job search, we’ve compiled a resume writing guide for those seeking the role of a mortgage loan processor. In this guide, you’ll find resume examples and tips to help you create an effective resume and stand out from the competition.

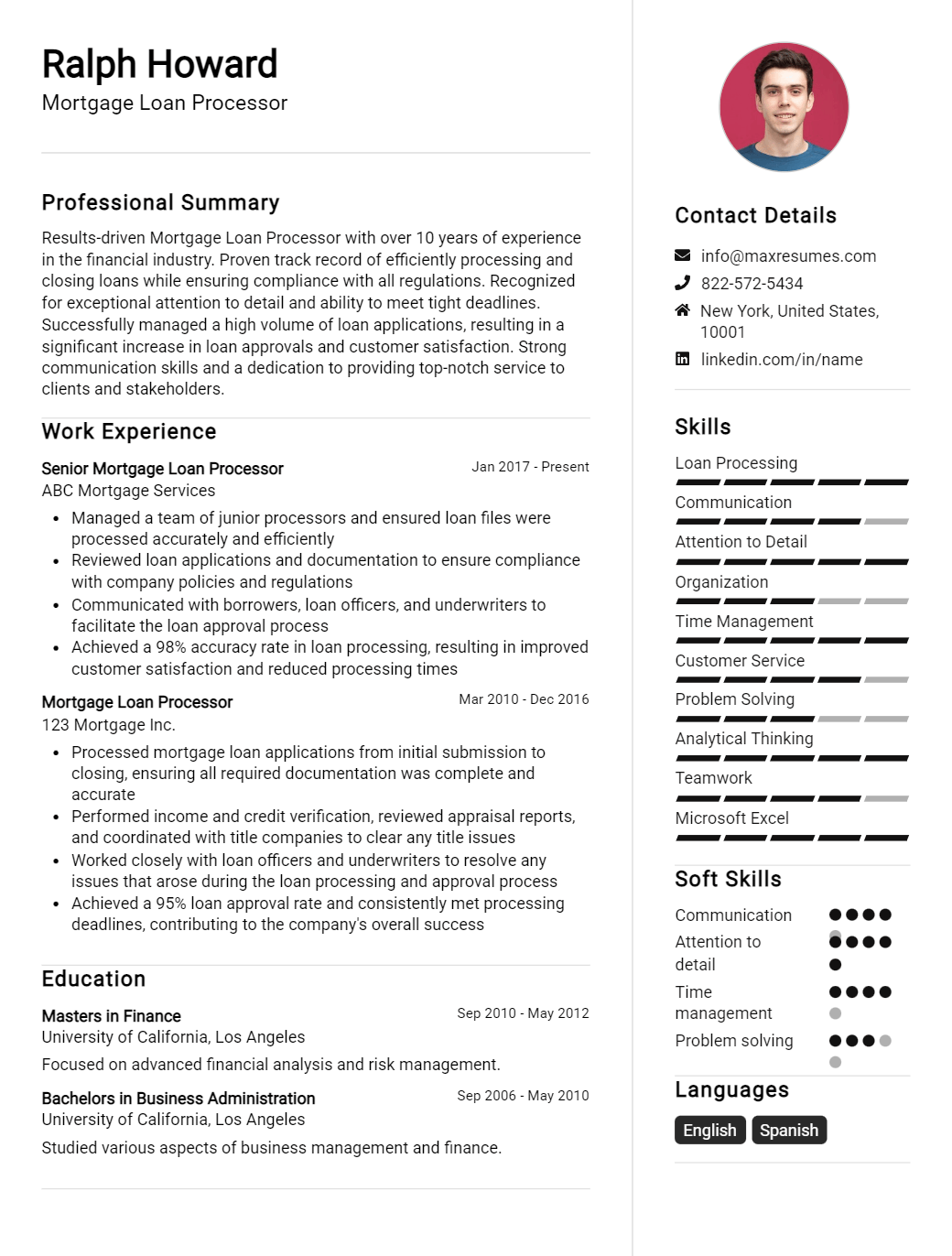

Mortgage Loan Processor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Loan Processor Resume Examples

John Doe

Mortgage Loan Processor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Experienced Mortgage Loan Processor with 5 years of experience in the financial services industry. Skilled at communicating with clients and professionals, managing loan documents and providing support to Loan Officers. Experienced in reviewing and analyzing applicant’s financial information to assess creditworthiness and calculate income. Seeking to leverage extensive knowledge and experience to take on a new challenge in a Mortgage Loan Processor role.

Core Skills:

- Experienced in reviewing and analyzing loan applications

- Skilled in loan management, document preparation and client communication

- Knowledge of loan processing systems and procedures

- Proficient in Microsoft Office Suite and loan origination software

- Ability to analyze credit reports and calculate income

- Excellent customer service and problem- solving skills

Professional Experience:

Mortgage Loan Processor, XYZ Financial Group, Long Beach, CA

- Reviewed and analyzed loan applications to ensure accuracy and compliance with mortgage underwriting guidelines and regulations

- Prepared and recorded loan documents such as promissory notes, deeds of trust and mortgage documents

- Verified and calculated income, credit history, assets and liabilities to qualify applicants for loan approval

- Managed customer inquiries and provided customer service support to loan applicants

- Processed loan applications and kept updated records of loan documents

- Prepared loan packages for submission to underwriters and handled loan documentation

Education:

Bachelor of Science, Finance, University of California, Long Beach, CA

Mortgage Loan Processor Resume Examples Resume with No Experience

- Recent college graduate with strong academic background.

- Detail- oriented and organized with excellent problem- solving skills.

- Strong analytical, organizational, and communication skills.

Skills:

- Knowledge of mortgage loan processing and related regulations.

- Proficiency in Microsoft Office (Outlook, Word, Excel, and PowerPoint).

- Ability to identify and interpret financial statements.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

- Ability to prioritize and manage multiple tasks.

Responsibilities

- Process mortgage loan applications and documents.

- Review and verify loan documents for accuracy and completeness.

- Communicate with lenders and borrowers to obtain missing documents and information.

- Review loan terms and conditions.

- Compile loan closing documents.

- Ensure compliance with state and federal regulations.

- Produce reports and analysis of loan data.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Loan Processor Resume Examples Resume with 2 Years of Experience

An experienced and highly motivated Mortgage Loan Processor with 2 years of experience in the financial services field. Possesses an in- depth understanding of the industry regulations, loan underwriting processes and customer service procedures. Demonstrates excellent communication, problem solving and organizational skills to ensure successful loan processing in a timely manner.

Core Skills:

- Experienced in loan processing and customer service

- Knowledgeable in applicable mortgage loan regulations

- Expertise in loan underwriting and conforming to loan programs

- Proficient in loan origination systems (LOS) and Electronic Document Interchange (EDI) systems

- Proven ability to work efficiently under pressure and meet deadlines

- Excellent interpersonal and communication skills

- Strong problem solving and organizational abilities

Responsibilities:

- Processed loan applications by verifying and entering data into the loan origination system (LOS)

- Analyzed and prepared loan packages to meet all underwriting requirements

- Ensured accuracy in loan documents, such as title reports, appraisals, verifications, credit reports, and other required documents

- Handled customer inquiries and provided customer service in a professional and timely manner

- Determined eligibility for loan applications according to established guidelines

- Developed and maintained good working relationships with loan officers, brokers, underwriters, and other staff members

- Maintained up- to- date knowledge of loan processing procedures, policies, and regulations

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Loan Processor Resume Examples Resume with 5 Years of Experience

Experienced mortgage loan processor with over 5 years of experience in providing customers with quality services to meet their mortgage loan requirements. Skilled in communicating effectively with clients, understanding loan qualification criteria and analyzing loan credit files. Ability to assess loan applications and make accurate decisions to ensure compliance with federal and state regulations. Proficient in Microsoft Office, with outstanding organizational and time- management skills.

Core Skills:

- Cash Management

- Mortgage Loan Processing

- Financial Analysis

- Loan Documentation

- Credit Policies

- Government Regulations

- Customer Service

- Organizational Skills

Responsibilities:

- Analyze loan credit files for accuracy and completeness

- Verify financial information and loan eligibility

- Calculate income, assets and liabilities to evaluate loan approval

- Prepare loan documents, including credit reports, income statements and title searches

- Follow up with customers to obtain additional information when needed

- Communicate loan decisions to customers and explain the conditions for loan approval

- Ensure compliance with federal and state regulations

- Review and resolve loan issues and discrepancies

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Loan Processor Resume Examples Resume with 7 Years of Experience

A seasoned mortgage loan processor with 7 years of experience in the banking and finance industry. Experienced in loan origination, loan servicing, underwriting and audit, credit analysis and risk assessment. Skilled in customer relations, data entry, and compliance processes. Adept at working independently and as part of a team to ensure the smooth functioning of all loan processes. Able to develop strong relationships with clients, business partners and colleagues.

Core Skills:

- Loan processing

- Credit analysis

- Risk assessment

- Underwriting

- Loan origination

- Customer service

- Data entry

- Compliance

- Interpersonal skills

Responsibilities:

- Process mortgage loan applications and disbursements, including data entry and verification.

- Review loan applications and financial information to ensure they meet loan requirements.

- Utilize underwriting software to assess creditworthiness, evaluate credit history and verify income.

- Analyze financial documents and loan information to assess risk levels.

- Prepare loan documents, including contracts and agreements.

- Communicate with banking personnel and customers to resolve issues and maintain relationships.

- Comply with laws and regulations, ensuring all documents are filed and stored correctly.

- Process loan payments and updates to loan records.

- Prepare reports and maintain loan records to ensure accuracy and compliance.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Loan Processor Resume Examples Resume with 10 Years of Experience

I am an experienced Mortgage Loan Processor with 10 years of experience in financial services. Throughout the years, I have acquired extensive knowledge and understanding of the mortgage process, customer service, and loan origination systems. My expertise lies in analyzing financial documents, gathering client information, and verifying loan eligibility. I have a strong work ethic, excellent communication skills, and management experience. My attention to detail, problem- solving abilities, and creative solutions have enabled me to provide customers with the highest level of service.

Core Skills:

- Loan Origination Systems

- Financial Statement Analysis

- Knowledge of Mortgage Lending Regulations and Guidelines

- Client Relationship Management

- Problem Solving and Analytical Skills

- Verifying Loan Eligibility

- Effective Communication Skills

- Attention to Detail

- Customer Service

Responsibilities:

- Analyze and verify documents related to customer income, assets, debts, and credit

- Prepare loan documents and disclosures to ensure compliance

- Communicate with real estate agents, customers, and lenders regarding loan details

- Review and process loan applications, making sure they meet company and government standards

- Monitor and review mortgage applications, ensuring timely completion

- Communicate with escrow and title companies to ensure closing requirements are met

- Provide customer service and answer any questions or concerns regarding the loan process

- Ensure accuracy of customer information and loan documents

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Loan Processor Resume Examples Resume with 15 Years of Experience

An experienced Mortgage Loan Processor with over 15 years of expertise in the financial services industry. Proven ability to develop relationships with customers, lenders and brokers and handle administrative details of mortgage loan processing, including document review and preparation. Possesses excellent communication and interpersonal skills, with a strong commitment to customer service and satisfaction.

Core Skills:

- Strong organizational and time management skills

- Proficiency in MS Office suite

- Excellent customer service skills

- Superior communication, both verbal and written

- Ability to multitask in a fast- paced environment

- Knowledge of banking regulations, compliance and risk assessment

- Underwriting experience

Responsibilities:

- Gathering and verifying loan documentation and accurately entering data into loan origination systems

- Developing and maintaining relationships with customers, lenders and brokers

- Analyzing loan applications and credit reports

- Evaluating and verifying income, assets, liabilities and creditworthiness

- Reviewing and approving loan applications

- Ordering appraisals, payoffs and other required documents

- Analyzing credit reports and appraisals to ensure accuracy and completeness

- Ensuring compliance with company policies and procedures as well as federal and state regulations

- Completing loan packages for submission to underwriting

- Assisting with loan closing activities, including packaging and funding

- Conducting post- closing quality assurance reviews

- Monitoring loan status and responding to customer inquiries in a timely manner

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Loan Processor Resume Examples resume?

When applying for a mortgage loan processor position, it is important to have a resume that stands out from other candidates. Your resume should showcase your skills and experience to employers, while also highlighting your qualifications and achievements. To ensure that you create a strong and effective resume, here are some key elements to include:

- Professional Summary: Include a brief summary of your overall experience and qualifications, as well as any certifications or specializations you possess.

- Education: Detail your educational background, including any degrees or certificates that are relevant to the position you are applying for.

- Work Experience: List your previous positions in a chronological order, including dates of employment, job titles, and company names. Highlight your duties and accomplishments in each role and explain how they relate to your current job goals.

- Technical Skills: Demonstrate your knowledge of mortgage loan processing software, including your proficiency in Microsoft Office or other programs.

- Communication Skills: Showcase your communication and interpersonal skills by providing examples of how you provided excellent customer service or solved difficult customer problems.

- Awards and Recognition: Include any awards, honors, or recognition that you have received for your work.

By including these elements in your resume, you can demonstrate to potential employers your knowledge and experience and stand out from the competition.

What is a good summary for a Mortgage Loan Processor Resume Examples resume?

A Mortgage Loan Processor Resume Examples resume should be concise and to the point. It should focus on the applicant’s experience in the mortgage industry, as well as any qualifications and certifications they may have. The resume should also highlight any successful mortgage-related projects they have completed. Additionally, the resume should show evidence of an applicant’s ability to communicate effectively with clients, prioritize tasks, and handle multiple projects simultaneously. Finally, the resume should indicate the applicant’s knowledge of mortgage loan processing procedures, financial terminology, and state and federal laws and regulations.

What is a good objective for a Mortgage Loan Processor Resume Examples resume?

A mortgage loan processor resume should be tailored to the job description of the desired position. A good objective should focus on the key skills and experience needed to be successful in the role. Here are some examples of good objectives for a mortgage loan processor resume:

- Acquire extensive knowledge and understanding of the loan origination process, including underwriting and closing procedures

- Utilize strong organizational and communication skills to efficiently collect and review all required loan documentation

- Utilize cutting-edge technology to accurately process loan applications in accordance with government and industry standards

- Demonstrate proficiency in the areas of customer service, problem-solving, and team leadership

- Utilize technical skills to ensure accuracy in the loan origination process and compliance with state and federal regulations

- Maintain accurate and up-to-date records for all loan transactions

How do you list Mortgage Loan Processor Resume Examples skills on a resume?

When it comes to listing your skills on your Mortgage Loan Processor Resume, you want to show potential employers that you’re a great fit for the job. Employers are looking for candidates who have the experience and credentials to successfully process mortgage loans, so it’s important to include the right skills on your resume. Here are some of the essential skills to include on your resume:

- Knowledge of mortgage industry standards, regulations, and procedures: You should have a deep knowledge of the entire mortgage loan process, from pre-qualifying borrowers to closing the loan.

- Strong math skills: Mortgage loan processors must be able to interpret financial documents and perform complex calculations.

- Excellent communication skills: You must be able to communicate clearly and concisely with lenders, borrowers, and other stakeholders.

- High attention to detail: Mortgage loan processors must be able to review documents quickly and thoroughly to ensure accuracy.

- Time management skills: You must be able to manage multiple tasks at once and work efficiently under pressure.

- Problem-solving ability: Mortgage loan processors must be able to troubleshoot problems and find solutions when issues arise.

- Computer literacy: You should be comfortable working with computer software and databases.

These are just some of the skills that employers expect to see on a mortgage loan processor resume. By including these skills on your resume, you’ll be able to show potential employers that you’re the right candidate for the job.

What skills should I put on my resume for Mortgage Loan Processor Resume Examples?

bulletA mortgage loan processor’s resume should include a number of key qualifications and skills to be competitive in the job market. It’s important to emphasize the skills that make you a strong candidate for the position and showcase your ability to handle a variety of tasks. Here are some skills to consider putting on your mortgage loan processor resume examples:

- Knowledge of mortgage loan processing and closing procedures: A mortgage loan processor should have an understanding of the loan processing and closing process and be able to effectively manage the process. This includes understanding the different types of loans, the documents that need to be processed, and any state and federal regulations related to mortgage loan processing.

- Excellent customer service skills: A mortgage loan processor should have strong customer service skills to ensure that customers are satisfied throughout the process. This includes being able to answer questions and provide guidance to customers in a timely and professional manner.

- Attention to detail: A mortgage loan processor will be responsible for processing a variety of documents. This requires a high level of detail-oriented work to ensure accuracy and compliance with applicable laws and regulations.

- Analytical skills: A mortgage loan processor must be able to analyze the data and documents associated with a loan in order to determine if a loan is eligible for approval.

- Computer proficiency: A mortgage loan processor should have strong computer skills to be able to use relevant software programs, such as loan origination systems or processing programs.

- Time-management skills: A mortgage loan processor must be able to manage a high volume of loans in a timely manner. This includes the ability to juggle multiple tasks and prioritize work in order to meet deadlines.

By including these skills on your mortgage loan processor resume examples, you’ll be well-positioned to land the job.

Key takeaways for an Mortgage Loan Processor Resume Examples resume

A mortgage loan processor’s resume should focus on their skills and experience in the mortgage loan industry. When crafting a resume for this role, there are a few key takeaways that need to be highlighted.

First and foremost, it’s important to showcase your knowledge of the entire mortgage loan process. This includes a thorough understanding of the application process, loan qualification procedures, loan processing techniques, and loan closing process. Additionally, it’s important to demonstrate an ability to interpret and analyze financial documents, as well as to be able to effectively communicate with both lenders and borrowers.

In addition, mortgage loan processors also need to be highly organized and proficient in different software applications. Demonstrating an ability to accurately enter relevant data and manage loan files is key to excelling in this role.

Finally, having a working knowledge of the different federal, state, and local regulations that apply to the mortgage loan industry will set you apart from the competition. Showcasing an understanding of the Fair Housing Act and Equal Credit Opportunity Act is especially important.

By highlighting these key takeaways in a resume, a mortgage loan processor can demonstrate their qualifications and skill set to potential employers.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder