Writing a resume for a Mortgage Loan Closer position can be tricky, as the job requires specific knowledge and a certain skill set. The role involves coordinating the closing of loans with buyers, sellers, title companies, real estate agents, and other stakeholders involved in the process. To be successful in the position, it is important to have a resume that shows your knowledge and experience. In this blog post, you will find a comprehensive guide on how to write a standout resume for a Mortgage Loan Closer and also several examples of well-written resumes that can be used as a reference. With this guide and the provided examples, you will be able to craft a resume that will get you the job you’re after.

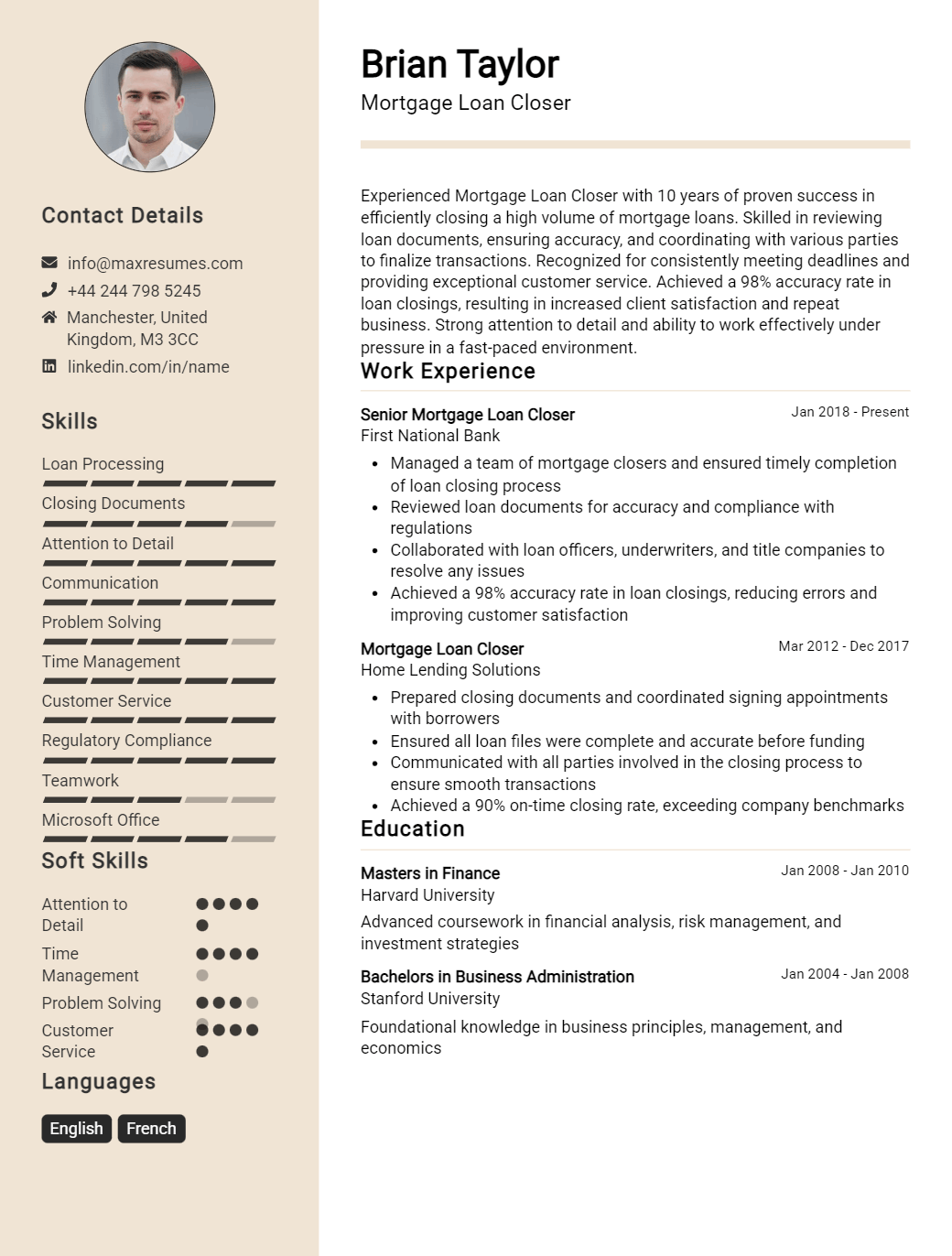

Mortgage Loan Closer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Loan Closer Resume Examples

John Doe

Mortgage Loan Closer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly motivated and experienced Mortgage Loan Closer with an advanced understanding of real estate industry regulations, mortgage products, loan documentation and closing processes. Possess the ability to review and analyze loan data, and perform due diligence to ensure accuracy. Skilled in dealing with customers, working in complex and rapidly changing environments and managing a high volume of transactions.

Core Skills:

- Real Estate Industry Regulations

- Mortgage Products

- Loan Documentation

- Closing Processes

- Data Analysis

- Customer Service

- Complex Problem Solving

- Time Management

- Compliance

Professional Experience:

Mortgage Loan Closer, First National Bank, 2019- Present

- Review loan data and documentation to ensure accuracy and validity.

- Assist loan officers in the collection of documents needed to process loan applications.

- Initiate and review loan closing documents in preparation for closing.

- Conduct pre- closing quality control reviews and clear any issues that are revealed.

- Coordinate with title companies, attorneys and lenders for loan documents.

- Maintain loan files with accurate and up- to- date information.

Education:

Bachelor of Science in Business Administration, University of Maryland, 2018

Mortgage Loan Closer Resume Examples Resume with No Experience

Organized and detail- oriented Mortgage Loan Closer with a proven track record of success in mortgage loan closing. Possess a comprehensive knowledge of loan policies and procedures, as well as strong customer service skills. Able to work well independently or as part of a team, with excellent time management and communication skills.

Skills:

- Knowledge of loan policies and procedures

- Ability to work independently and as part of a team

- Time management and organizational skills

- Excellent communication and interpersonal skills

- Customer service and administrative expertise

- Accuracy and attention to detail

Responsibilities:

- Prepare loan application documents, such as title insurance, deed of trust, and closing disclosure

- Review loan documents for accuracy

- Communicate with borrowers, lenders, real estate agents, and other parties during the closing process

- Answer borrower questions and provide loan details

- Finalize and deliver documents to closing agents

- Follow up with borrowers to ensure loan closing is successful

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Loan Closer Resume Examples Resume with 2 Years of Experience

Motivated Mortgage Loan Closer with 2 years of experience in the financial services industry. Known for excellent customer service, strong problem- solving skills, and organizational abilities. Achieved success in numerous roles and have an extensive working knowledge of mortgage closings and the loan origination process. Proven track record of meeting deadlines, providing excellent customer service, and managing complex projects with ease.

Core Skills:

- Mortgage Closing: Loan origination, compliance, document preparation and review, funding, and title review.

- Customer Service: Greeting customers, responding to inquiries, and providing detailed information about products and services.

- Organizational Skills: Streamlining processes, managing multiple tasks and deadlines, and resolving customer issues.

- Problem Solving: Identifying the root cause of issues and creating solutions.

- Communication: Maintaining effective communication with clients, lenders, real estate agents, and other stakeholders.

Responsibilities:

- Verified loan and title documentation to ensure accuracy and compliance with state and federal laws and regulations.

- Assisted customers throughout the closing process, providing detailed information and answering all questions.

- Provided training and technical assistance to lenders, real estate agents, and other stakeholders.

- Managed the loan pipeline and tracked progress of individual closings.

- Maintained excellent customer service and worked with other departments to resolve customer issues.

- Assisted in preparing closing documents and closing statements.

- Reviewed loan documents to ensure accuracy and completeness.

- Negotiated terms with lenders and other stakeholders to ensure the best deal for the customer.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Loan Closer Resume Examples Resume with 5 Years of Experience

Highly skilled Mortgage Loan Closer with 5 years of experience in the financial services industry. Skilled in closing mortgage loans, processing loan applications, and verifying loan documents for accuracy. A team- player with excellent communication and problem- solving skills, adept at multi- tasking, and able to work independently in a fast- paced environment.

Core Skills:

- Experienced in closing mortgage loans

- Knowledgeable in loan processing and loan document verification

- Strong communication and problem- solving skills

- Ability to multi- task and work independently in a fast- paced environment

Responsibilities:

- Review and verify mortgage loan documents for accuracy and completeness

- Prepare closing documents, instructions, and other paperwork

- Ensure that all closing conditions are met before closing a mortgage loan

- Establish and manage loan servicing accounts

- Monitor loan modifications and ensure that all relevant documents are complete and accurate

- Answer customer inquiries, resolve customer issues, and provide excellent customer service

- Communicate with internal and external customers regarding any changes to the loan terms

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Loan Closer Resume Examples Resume with 7 Years of Experience

I am an experienced Mortgage Loan Closer with 7 years of experience in the banking and financial services sector. I am adept at handling all aspects of loan closing, from legal and regulatory compliance checks, to coordinating with lenders, underwriters and attorneys to ensure a smooth closing process. I have strong knowledge of closing documents and a strong track record of ensuring accuracy and compliance with all applicable rules and regulations. My attention to detail and excellent organizational skills have enabled me to consistently deliver high- quality work in a timely manner.

Core Skills:

- Loan Closing

- Regulatory Compliance

- Loan Documentation

- Closing Documents

- Risk Management

- Data Analysis

- Problem Solving

- Customer Service

- Communication

Responsibilities:

- Collaborate with lenders, underwriters, and attorneys to ensure a smooth closing process.

- Prepare closing documents and ensure accuracy and compliance with all applicable rules and regulations.

- Maintain records and track loan documents to ensure accuracy and adherence to industry standards.

- Analyze loan applications and credit reports to ensure accuracy and compliance with industry standards.

- Evaluate loan closing risks and ensure that appropriate risk mitigation strategies are in place.

- Prepare and review closing instructions to ensure accuracy and completeness.

- Answer questions from customers and stakeholders about loan closing process and documents.

- Resolve any discrepancies that arise during the closing process.

- Coordinate with lenders, underwriters and attorneys throughout the closing process.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Loan Closer Resume Examples Resume with 10 Years of Experience

A dedicated and experienced Mortgage Loan Closer with 10 years of progressive experience in closing mortgages, providing closing services, loan origination and processing. A professional with a commitment to customer service and a strong record of success in the closing of residential and commercial mortgage loans in a fast- paced and ever- changing environment. Possessing superior problem solving, organizational and communication skills.

Core Skills:

- Mortgage loan closing services

- Loan origination and processing

- Underwriting and analyzing loan applications

- Loan documentation preparation

- Ensuring all loan closing adhere to federal and state regulations

- Examining title reports to ensure accuracy

- Excellent customer service

- Strong problem solving abilities

Responsibilities:

- Conducted loan origination, processing, and underwriting functions while ensuring all loans meet company, investor and regulatory standards.

- Prepared loan documentation, ensuring all documents are accurate and complete.

- Reviewed title reports and ensured all loan closing documents adhere to federal and state regulations.

- Resolved customer inquiries and loan processing issues in a timely and effective manner.

- Utilized strong problem- solving skills to identify and resolve customer issues.

- Provided excellent customer service to ensure customer satisfaction.

- Followed up with customers to ensure all loan closing documents were complete and accurate.

- Collaborated with other departments to ensure the timely and successful completion of loan closings.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Loan Closer Resume Examples Resume with 15 Years of Experience

Experienced Mortgage Loan Closer with 15 years of success in providing accurate and timely closing documents to ensure the loan process is complete and compliant. Proven ability to build trusting relationships with clients and lenders, while adhering to all banking regulations and procedures. A dedicated and detail- oriented professional with exceptional problem- solving and multitasking skills.

Core Skills:

- Client Relations

- Attention to Detail

- Closing Documents

- Banking Regulations

- Problem Solving

- Communication

- Time Management

Responsibilities:

- Prepare and review closing documents for accuracy.

- Verify all documents meet bank’s requirements.

- Facilitate closing process and provide closing services.

- Ensure loans are properly funded and recorded.

- Maintain and update loan files, processing documents and closing procedures.

- Respond to client inquiries and requests in a timely manner.

- Monitor loan quality and compliance to banking regulations.

- Collaborate with lenders, attorneys, and other parties to ensure closing process is complete.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Loan Closer Resume Examples resume?

A mortgage loan closer is a professional who ensures that the mortgage loan documents necessary for finalizing the loan transaction are successfully prepared, collected, and closed. This position requires a certain level of expertise and knowledge, so it is important to ensure that your resume is tailored to highlight the key qualifications relevant to the job. Here are some examples of what to include in a mortgage loan closer resume:

- Education: List any relevant education or certifications such as a bachelor’s degree in business, finance, or accounting, or a certification in mortgage loan closing.

- Experience: Include in-depth detail of your experience in the mortgage loan closing industry. This could include a list of the types of loans you have closed, the number of transactions completed, and the duration of your employment.

- Knowledge: Demonstrate your knowledge of mortgage loan documents and procedures. Describe any relevant training or experience that you have that is related to the closing process.

- Skills: Detail your ability to effectively manage multiple loan closings at once. Highlight any software or computer skills that may be relevant to the job.

- Customer Service: Demonstrate your ability to provide exceptional customer service by listing any previous customer service experience or training.

- Interpersonal Skills: Describe your ability to communicate effectively in a professional setting.

By including all of these key elements in your resume, you can ensure that you are putting your best foot forward and giving yourself the best chance of landing the job.

What is a good summary for a Mortgage Loan Closer Resume Examples resume?

A mortgage loan closer resume should highlight the individual’s experience in the financial industry, as well as their ability to manage complex tasks and deadlines. A good summary for a mortgage loan closer resume should include the individual’s experience in the banking industry, as well as their ability to analyze financial documents and process loan applications. This summary should also include the individual’s skills in communication, problem-solving and attention to detail. Furthermore, the summary should emphasize the individual’s ability to work in a fast-paced and ever-changing environment and their ability to ensure accurate and timely results.

What is a good objective for a Mortgage Loan Closer Resume Examples resume?

A good objective for a Mortgage Loan Closer resume should focus on the skills, experience, and qualifications necessary to excel in the position. Here are some example objectives that can be used when writing a Mortgage Loan Closer resume:

- To leverage my 5+ years of experience closing residential and commercial mortgage loan transactions to benefit the organization

- To use my knowledge of loan origination, underwriting, and closing procedures to ensure timely and accurate closings

- To utilize my expertise in federal, state, and local regulations to ensure compliance in all transactions

- To employ my excellent customer service and communication skills to build relationships with clients and lenders

- To contribute to the organization’s success by achieving all goals and objectives set for loan closings

How do you list Mortgage Loan Closer Resume Examples skills on a resume?

When listing Mortgage Loan Closer resume examples skills on a resume, it’s important to emphasize those that demonstrate your understanding of the key responsibility of the job. A successful Mortgage Loan Closer is organized, knowledgeable on loan processes and regulations, and has excellent customer service and communication skills.

Here are some skills to consider including on a Mortgage Loan Closer resume:

- Knowledge of loan closing procedures and regulations

- Ability to maintain accurate and detailed records

- Exemplary customer service skills

- Excellent communication and negotiation skills

- Well-developed problem-solving and analytical skills

- Proficient in the use of loan processing software

- Ability to work effectively with a wide range of customers

- Ability to remain calm and professional under pressure

- Proven ability to prioritize tasks and meet deadlines

- Ability to work independently and within a team environment

What skills should I put on my resume for Mortgage Loan Closer Resume Examples?

•Whether you are just starting out in the mortgage industry or have been in the business for a while, it is important to make sure that you showcase the right skills on your resume when applying for a loan closer role.

When crafting your resume, be sure to emphasize the following key skills:

- Ability to review and understand loan documents: As a loan closer, you will be responsible for reviewing and understanding loan documents to ensure all details are accurate and that all necessary documents are in order.

- Knowledge of loan closing procedures: You should have an understanding of closing procedures and the ability to accurately prepare closing documents such as closing statements and loan agreements.

- Attention to detail: As a loan closer, you will be responsible for ensuring that all documents are accurate and complete. You should possess excellent attention to detail to ensure all details are correct.

- Communication skills: You will need to be able to effectively communicate with loan officers, customers, and other stakeholders throughout the loan closing process. Excellent communication skills are a must.

- Time management: You will need to be able to prioritize tasks and efficiently manage your time to ensure that all loan closings are completed in a timely manner.

By highlighting the right skills on your resume, you can demonstrate to potential employers that you are the right fit for the job. Good luck!

Key takeaways for an Mortgage Loan Closer Resume Examples resume

When writing a resume for a mortgage loan closer, it is important to highlight skills and qualifications that demonstrate your knowledge of the industry. A mortgage loan closer is a professional who helps borrowers and lenders complete the loan closing process. As such, a mortgage loan closer’s resume should demonstrate the borrower’s knowledge of loan terms, regulations, and other factors that affect loan closings.

When writing a mortgage loan closer resume, it is important to include details about your experience with the loan closing process. This can include the types of loans you’ve closed, the lender’s you’ve worked with, and any additional closing-related certifications you may have. Additionally, be sure to detail any relevant software programs you’ve used, such as those used to create closing documents and follow up on loan status.

In addition to your experience and qualifications, your resume should also emphasize any specialized skills you possess. This could include your ability to analyze loan applications, credit reports, and appraisals, as well as your ability to communicate effectively with clients and other stakeholders throughout the loan process.

Finally, be sure to include a comprehensive list of key takeaways from your mortgage loan closer resume. This could include highlights of your experience, such as the number of loan closings you’ve completed or any advanced certifications you possess. It should also include the types of loan terms and regulations you’re familiar with, as well as any additional skills you possess that could be useful in the role.

By emphasizing your knowledge, experience, and skills, you can create a compelling resume that will help you stand out from the competition. By following these key takeaways, you can ensure that your resume is as effective as possible in helping you land the job of your dreams.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder