Writing a resume as a mortgage consultant can be a daunting task, especially with the ever-changing mortgage industry standards. To ease the stress of resume writing, this guide will detail what should be included in a mortgage consultant resume, best practices for writing a resume, and examples of resumes for mortgage consultants. By following this guide and reviewing the sample mortgage consultant resumes provided, you can craft a resume that will help you stand out from the competition and land your dream mortgage consultant job.

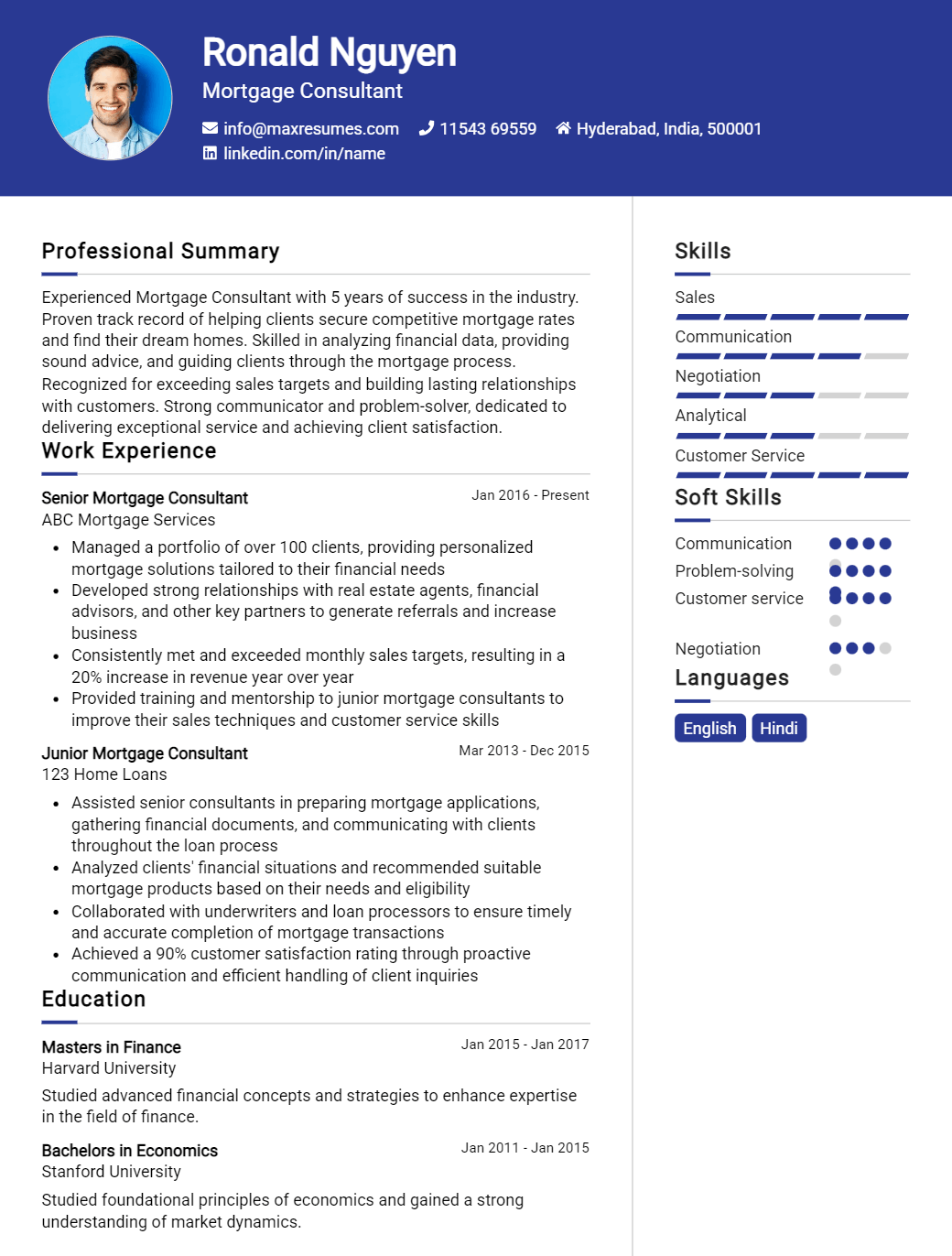

Mortgage Consultant Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Consultant Resume Examples

John Doe

Mortgage Consultant

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly motivated and results- oriented mortgage consultant with extensive experience in helping customers secure financing and realize their dreams of property ownership. I have extensive knowledge of the loan origination process, including all the financial and legal aspects involved in the process. My exceptional customer- service skills have enabled me to create highly successful relationships with clients and maintain a high rate of customer satisfaction. I am reliable and committed to providing excellent customer service and solutions to complex loan scenarios.

Core Skills:

- Proven track record of success in loan origination and processing

- Comprehensive understanding of the mortgage industry

- Exceptional customer service skills

- Excellent oral and written communication skills

- Ability to assess client needs and provide appropriate solutions

- Ability to work independently and collaboratively in teams

- Proficient with Microsoft Office Suite and loan origination software

Professional Experience:

Mortgage Consultant, ABC Financial Corporation, 2019- Present

- Originate, process, and close various mortgage loans for customers

- Analyze customer credit profiles, income, and assets to determine eligibility and affordability of mortgages

- Manage the loan origination process from start to finish, ensuring compliance with all legal requirements

- Provide customers with comprehensive advice and guidance throughout the loan process

- Develop and maintain relationships with various lenders to obtain loan products and services

- Review loan applications and verify the accuracy of all documents

Education:

Bachelor of Science in Finance, ABC University, 2017

Mortgage Consultant Resume Examples Resume with No Experience

- Recent graduate with an educational background in business and finance and a commitment to providing exceptional customer service.

- Ambitious and highly motivated to work with clients in order to provide them with the best mortgage solutions and advice.

- Well versed in financial terminology, concepts and products and dedicated to delivering solutions that meet customer needs.

Skills:

- Knowledge of mortgage and lending products

- Familiar with various mortgage programs such as FHA, VA, and USDA

- Excellent communication and customer service skills

- Strong problem- solving and analytical skills

- Ability to work independently and in teams

- Proficient in MS Word, Excel, and PowerPoint

Responsibilities

- Analyze financial documents and credit history to assess customer eligibility for a loan

- Negotiate with lending institutions to secure the best terms and conditions for customers

- Develop and maintain relationships with customers and other industry professionals

- Explain the terms and conditions of loan programs to customers

- Stay abreast of the mortgage market to identify new opportunities

- Follow industry regulations and best practices to ensure compliance

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Consultant Resume Examples Resume with 2 Years of Experience

Dynamic mortgage professional with 2 years of experience in customer service, sales, mortgage origination, and loan processing. High degree of expertise in customer relations, problem solving, and financial analysis. Proven record of providing customers with excellent customer service and guidance to facilitate loan closings.

Core Skills:

- Customer Service: Highly skilled in understanding customer needs and providing excellent customer service.

- Sales: Experienced in sales techniques and strategies to provide clients with the best loan options.

- Mortgage Origination: Experienced in creating financial plans for clients, originating loans, and closing documents.

- Loan Processing: Experienced in successfully processing mortgage loan applications.

- Financial Analysis: Proficient in analyzing financial data and making effective decisions.

Responsibilities:

- Provided high- level customer service to ensure customer satisfaction

- Assisted clients with completing loan applications and collecting necessary documents

- Processed loan applications and reviewed credit reports to ensure accuracy

- Conducted interviews with clients to review and discuss loan options

- Analyzed financial data to ensure accuracy and compliance with loan requirements

- Prepared loan closing documents and submitted loan information to underwriters

- Monitored loan progress to ensure timely closings and customer satisfaction

- Researched loan programs and products to provide customers with the best loan option

- Processed mortgage loan payments and coordinated payments with lenders

- Resolved customer service issues in a timely and professional manner.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Consultant Resume Examples Resume with 5 Years of Experience

A motivated and experienced Mortgage Consultant with 5 years of experience and a strong foundation in client relations and sales. Highly skilled in gathering and analyzing financial data, conducting on- site underwriting inspections, and processing loan applications. Committed to providing customers with effective and satisfactory mortgage solutions.

Core Skills:

- Excellent customer service and communication skills

- Knowledge of underwriting regulations and procedures

- Proficient in using Microsoft Office Suite, loan origination software, and various databases

- Strong multitasking and organizational abilities

- Ability to work collaboratively in a team environment

Responsibilities:

- Assessing financial information and credit history to determine loan eligibility

- Negotiating competitive loan terms and taking into consideration customer needs

- Pre- screening and submitting loan applications on behalf of clients

- Maintaining regular contact with clients throughout the loan process

- Educating clients on the different types of loan options available

- Performing financial analysis and providing risk assessment on loan applications

- Ensuring compliance with regulations and laws governing mortgage lending

- Maintaining current knowledge of mortgage industry trends, regulations, and procedures

- Providing support and advice to customers on loan- related matters

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Consultant Resume Examples Resume with 7 Years of Experience

I am a highly effective mortgage consultant with 7 years of experience in the financial services industry. I have built a successful career helping clients navigate the home loan process, providing expert advice and guidance to ensure the best outcome for all parties. I have extensive knowledge of loan products, including FHA, VA, USDA, and conventional loans, and an outstanding understanding of regulatory and legal requirements. I have excellent communication and problem- solving skills and always strive to provide an exceptional client experience. I am a motivated self- starter, able to work independently and as part of a team.

Core Skills:

- Loan origination

- Compliance with banking regulations

- Mortgage processing

- Analyzing credit and financial documents

- Negotiating loan terms

- Building client relationships

- Risk analysis

- Problem- solving

Responsibilities:

- Identifying the financial needs and objectives of clients

- Evaluating the income, assets, and credit history of loan applicants

- Calculating the total cost of mortgage products and services

- Working with lenders to ensure compliance with all state and federal laws

- Assisting clients in understanding and completing loan applications

- Providing professional advice and guidance on loan products and features

- Negotiating loan terms with lenders

- Processing loan documents and closing the loan

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Consultant Resume Examples Resume with 10 Years of Experience

Dynamic and experienced Mortgage Consultant with 10 years of experience in the financial services industry. Highly skilled in loan origination, underwriting, and approval processes. Adept at building relationships with customers and lenders, and staying abreast of changes to loan guidelines and regulations. Dedicated to finding the best loan terms and solutions to suit customer needs and helping them achieve their financial goals.

Core Skills:

- Loan Origination

- Underwriting

- Loan Approval Processes

- Relationship Building

- Financial Analysis

- Regulatory Compliance

- Problem Solving

- Risk Assessment

- Customer Service

- Time Management

Responsibilities:

- Analyzing customer financial information and lending criteria to identify suitable loan products for customers

- Assessing various loan products to determine their suitability for customer needs

- Obtaining loan application documents and verifying them for accuracy and completeness

- Reviewing loan applications and supporting documents and verifying that they meet lender guidelines

- Establishing relationships with lenders and ensuring an understanding of loan guidelines

- Keeping abreast of loan market trends and changes to financial regulations and loan requirements

- Negotiating loan terms with lenders and customers to ensure the best rates and loan products

- Assisting customers in understanding the loan application and approval processes

- Proactively managing customer expectations throughout the loan approval process

- Responding to customer inquiries and addressing any concerns in a timely manner

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Consultant Resume Examples Resume with 15 Years of Experience

Highly motivated and results- oriented Mortgage Consultant with 15 years of experience in the mortgage banking industry. Expert in loan origination, loan processing and closing services. Possesses a comprehensive understanding of mortgage banking policies and procedures, with an eye for detail and a knack for problem solving. Experienced in providing exceptional customer service, review of loan documents and loan analysis. Skilled in underwriting, loan structuring and financial analysis of loan applications.

Core Skills:

- Loan Origination

- Loan Processing

- Loan Closing

- Mortgage Banking Policies and Procedures

- Customer Service

- Loan Document Review

- Loan Analysis

- Underwriting

- Loan Structuring

- Financial Analysis

Responsibilities:

- Interact with customers to understand their financial needs and develop loan solutions to meet their requirements

- Provide customers with information about loan products and services

- Analyze financial data to determine creditworthiness or eligibility for loan program

- Review loan applications for accuracy and completeness

- Underwrite loan applications and determine loan terms

- Prepare loan documents, such as promissory notes, mortgages and other related loan documents

- Verify loan documents, such as title documents, appraisals, income and employment documents

- Structure loan packages, negotiate rates and terms and arrange for closing

- Monitor loan progress and ensure compliance with federal and state regulations

- Resolve loan issues by working closely with customers and other related parties

- Update loan system with changes in customer information, loan status and other relevant information

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Consultant Resume Examples resume?

When looking for a job in mortgage consultation, it is important to make sure your resume is up to date, professional, and tailored to the position you are applying for. The following sections should be included in a mortgage consultant resume examples to ensure you have the best chance of getting the job:

- Personal Information: Include your name, address, contact information, and a professional headshot if appropriate.

- Summary: Summarize your career goals and qualifications, including certifications and degrees.

- Work Experience: List past work experience in the mortgage industry, including positions held and accomplishments achieved.

- Professional Skills: Outline any specialized skills or knowledge related to the mortgage industry, such as loan origination, mortgage underwriting, or financial analysis.

- Education: Provide information about any relevant educational degrees or certifications.

- Awards and Achievements: Highlight any awards or recognition you have received in the mortgage industry.

- References: Provide at least two professional references that can speak to your qualifications.

Following these tips for creating a strong mortgage consultant resume examples can help you stand out from the competition and make a great first impression. Good luck with your job search!

What is a good summary for a Mortgage Consultant Resume Examples resume?

A Mortgage Consultant Resume Examples resume should provide a comprehensive summary of the applicant’s experience, qualifications, and expertise in the mortgage industry. This should include information regarding prior positions in the mortgage sector, specific mortgage-related qualifications, and any awards or recognition the applicant has received. The summary should also include key areas of expertise, such as loan negotiation, loan origination, and customer service. Finally, the summary should provide evidence of the applicant’s passion for the mortgage industry, as well as their commitment to providing the highest customer service. These details will ensure that potential employers have a clear understanding of the applicant’s skill set and experience level.

What is a good objective for a Mortgage Consultant Resume Examples resume?

A Mortgage Consultant Resume Examples resume should have an objective that effectively communicates the candidate’s qualifications and experience for the job. The objective should be brief and clearly articulate the applicant’s career goals.

When considering what to include in your objective, consider the following:

- Demonstrate a thorough knowledge of the mortgage industry and the loan process

- Maintain an up-to-date understanding of mortgage rates, products, and eligibility criteria

- Advise clients on the best type of mortgage loan for their specific needs

- Identify and resolve any potential problems that may arise during the loan process

- Keep accurate records of all loan documents and ensure compliance with federal and state regulations

- Develop and maintain relationships with business partners and lenders

- Assist clients in securing the most favorable terms and conditions for their loans

- Provide clients with timely updates on the progress of their loans and any changes in interest rates

How do you list Mortgage Consultant Resume Examples skills on a resume?

When writing a resume as a Mortgage Consultant, it’s important to list your skills and qualifications accurately and effectively. Your resume should be tailored to showcase your unique set of skills and experience. Here are some examples of skills you can list on your resume:

- Financial and Budgeting Knowledge: A Mortgage Consultant must have an in-depth knowledge of financial and budgeting practices, including budgeting, cash flow, and financial analysis.

- Attention to Detail: You must be able to read and analyze financial documents and contracts, so it is important to have a keen eye for detail.

- Analytical Skills: You must be able to interpret a customer’s financial information and create a loan package that meets their needs.

- Negotiation Skills: You must be able to negotiate with lenders to get the best terms for your customers.

- Client Relations: You must be able to maintain a positive relationship with clients, and be able to explain complex financial concepts in a way that is easy to understand.

- Compliance Knowledge: You must be able to understand and follow laws and regulations related to the mortgage industry.

- Communication Skills: You must be able to communicate effectively, both verbally and in writing, with clients and lenders.

- Time Management Skills: You must be able to work efficiently and effectively to meet deadlines and stay on top of customer requests.

What skills should I put on my resume for Mortgage Consultant Resume Examples?

A successful Mortgage Consultant is someone who can apply knowledge of loan products, the local market, and legal regulations to close deals effectively. When writing your resume for this type of job, be sure to include skills such as:

- Understanding of the mortgage loan process, including origination, processing, underwriting, and closing

- Knowledge of loan products, including FHA, VA, and Conventional loans

- Ability to explain loan terms and conditions to clients

- Ability to analyze financial statements and credit reports

- Strong negotiation and problem-solving skills

- Ability to build strong relationships with clients and referral sources

- Excellent customer service and communication skills

- Proficient with loan origination systems and software

- Understanding of state and federal lending regulations

- Ability to remain organized and detail-oriented throughout the loan process

Having a comprehensive skills section on your resume is an important part of showcasing your qualifications as a Mortgage Consultant. Highlighting your skills and accomplishments in a way that stands out to potential employers will help you stand out in the competitive job market.

Key takeaways for an Mortgage Consultant Resume Examples resume

Are you a talented mortgage consultant looking for a new job? Writing a resume can be intimidating, but with the right strategy and tips, you can create an effective and professional resume to help you stand out from the competition. Here are some key takeaways to consider when crafting your mortgage consultant resume:

- Focus on Your Quantifiable Accomplishments: When it comes to the mortgage industry, it’s all about the numbers. Make sure you highlight the various mortgage activities you’ve been successful in, such as amount of loans closed, average loan size, success rate, customer satisfaction scores, etc. Any quantifiable accomplishments you can mention will be a big boost to your resume.

- Include Relevant Professional Experience: It’s important to include any relevant professional experience you have in the mortgage industry, even if it’s not directly related to consulting. Demonstrating that you’ve worked in the industry in various capacities will be beneficial.

- Highlight Your Industry Knowledge: The mortgage industry is always evolving, so it’s important to demonstrate your understanding of the changes in the industry. Include any certifications or training sessions you’ve taken to stay up to date on industry trends and news.

- Demonstrate Your Communication Skills: As a mortgage consultant you need to be a good communicator. Include any experience you have working with customers, responding to inquiries, and negotiating terms.

- Showcase Your Interpersonal Skills: As a mortgage consultant you need to have the ability to build relationships. Showcase any experience you have working with lenders, attorneys, and other stakeholders in the mortgage industry.

By using these key takeaways to craft your resume, you can create a professional and effective resume that will help you stand out from the competition. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder