Are you looking to become a mortgage closer and impress potential employers? Writing a resume that effectively communicates your skills and experiences can be daunting, but it doesn’t have to be. With the right tips, advice, and examples, you can create an impressive resume that highlights your qualifications and gets you the job you want. This blog post will provide an overview of what you need to know to write an effective mortgage closer resume, including tips and examples of resumes for mortgage closers so you can create an impressive resume with confidence.

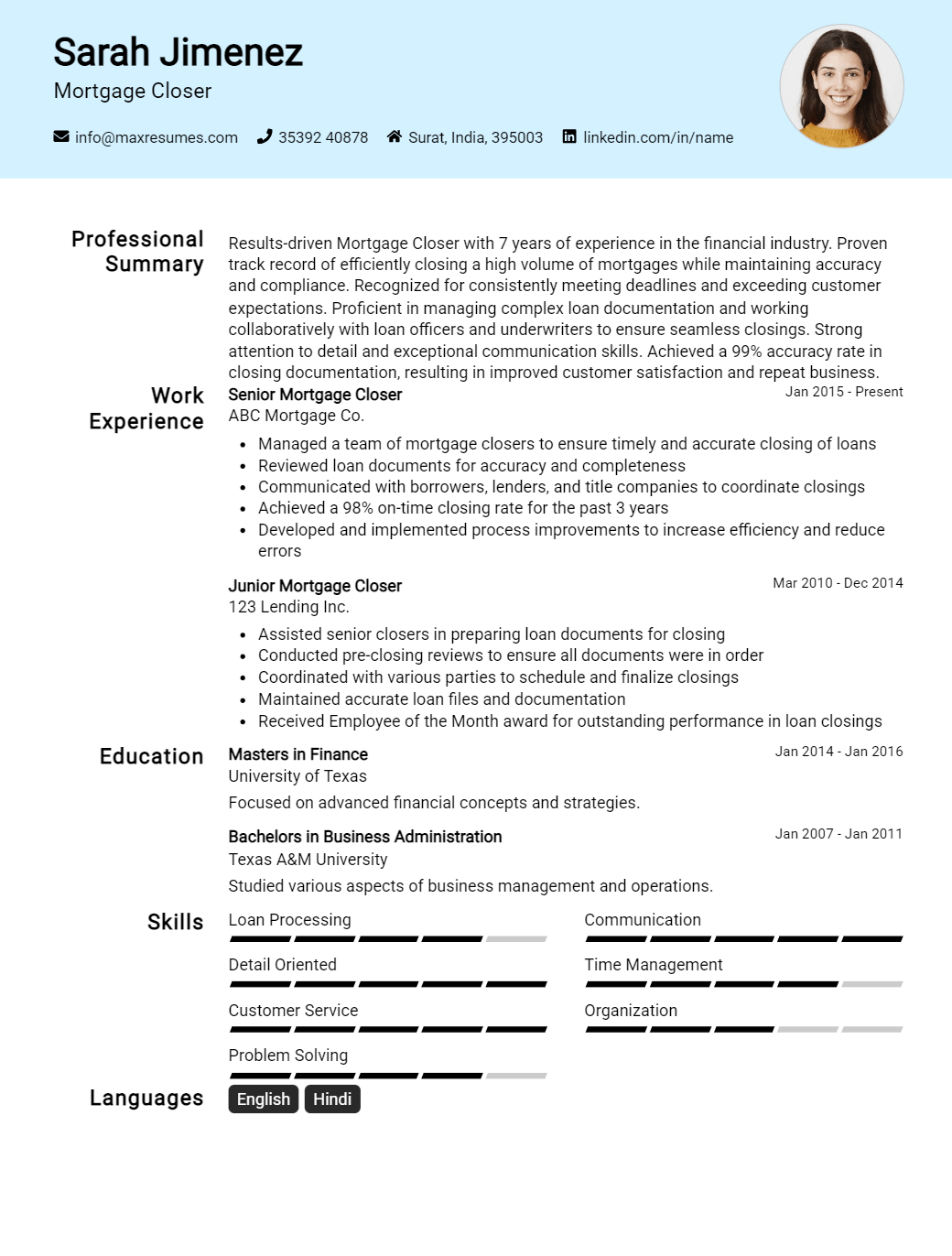

Mortgage Closer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Closer Resume Examples

John Doe

Mortgage Closer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly motivated and experienced mortgage closer with 10+ years of professional experience in closing mortgage loans for residential and commercial customers. My strong attention to detail and in- depth knowledge of the mortgage industry have proven invaluable in helping my customers throughout the process. I am confident in my ability to provide outstanding customer service and complete all mortgage closing tasks efficiently and accurately.

Core Skills:

- Knowledgeable in mortgage loan closing policies and procedures

- Excellent customer service and communication skills

- Experienced in handling escrow accounts and preparing closing documents

- Proficient in using MS Office Suite and other mortgage closing software

- Well- versed in loan processing, title examination, and loan compliance

Professional Experience:

Mortgage Closer, ABC Mortgage Corporation, 2018 – Present

- Ensure complete accuracy of closing documents prior to loan closing

- Verify accuracy of title documents and loan information

- Draft documents and obtain signatures from buyers and sellers

- Ensure compliance with applicable state and federal laws

- Prepare closing documents for submission to lenders

- Disburse loan funds and handle post- closing activities

Mortgage Loan Processor, XYZ Mortgage Company, 2015- 2018

- Assisted mortgage loan officers with the origination of loan applications

- Ensured accuracy of loan documents and applications

- Verified accuracy of employment and financial information

- Collected required documentation from borrowers

- Processed loan files and maintained loan tracking system

Education:

Bachelor of Science in Business Administration, University of California, San Diego, 2011

Mortgage Closer Resume Examples Resume with No Experience

Recent college graduate with a degree in finance and strong organizational skills. Looking to utilize knowledge of the mortgage industry to become a mortgage closer.

Skills:

- Excellent knowledge of financial principles and the mortgage industry

- Strong organizational and customer service skills

- Ability to work independently and as part of a team

- Excellent communication skills

- Ability to meet deadlines

- Proficient in Microsoft Office Suite

Responsibilities:

- Reviewing and preparing loan documents

- Organizing loan files and ensuring accuracy of documents

- Ensuring compliance with federal and state regulations

- Contacting loan applicants, brokers and lenders to resolve discrepancies

- Preparing loan closing documents and coordinating closing dates

- Reviewing closing documents for accuracy

- Sending out closing packages to lenders and borrowers

- Facilitating recording of loan documents with county agencies

- Providing post- closing customer service

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Closer Resume Examples Resume with 2 Years of Experience

Highly motivated mortgage closer with 2 years of experience in producing accurate closing documents for all types of mortgage loans, preparing closing documents for a variety of loan types, and ensuring compliance with all lending regulations. Possess extensive knowledge of mortgage industry and loan regulations and demonstrate exceptional organization, problem- solving, and communication skills.

Core Skills:

- Knowledge of mortgage closing procedures

- Proficiency with loan origination systems

- Excellent customer service skills

- Strong organizational skills

- Ability to work independently and as part of a team

- Detail- oriented and extremely accurate

- Excellent communication and interpersonal skills

- Outstanding problem- solving skills

- Knowledge of legal terminology and FHA/VA requirements

Responsibilities:

- Prepare closing documents and verify accuracy of loan closing information in accordance with state and federal regulations

- Verify accuracy of loan information prior to closing and prepare closing documents

- Generate closing documents, including Truth- in- Lending, Good Faith Estimate, and HUD- 1 settlement statement

- Conduct a thorough review of loan documents and ensure accuracy of loan information

- Ensure compliance with applicable state and federal laws and regulations

- Prepare loan closing packages and coordinate closing process with title companies, attorneys, and lenders

- Monitor and update loan status in loan origination systems

- Assist in resolving loan processing issues and discrepancies

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Closer Resume Examples Resume with 5 Years of Experience

A mortgage closer with over 5 years of experience in the mortgage industry, driven by a commitment to excellent customer service and compliance. Possess a comprehensive understanding of loan origination, processing, underwriting, closing, and post- closing procedures. Experienced in using Encompass and DocMagic software. Skilled in collaborating with loan originators and customers to ensure a smooth and efficient loan closing process.

Core Skills:

- Mortgage loan closing procedures

- Loan origination processing

- Loan underwriting and post- closing procedures

- Excellent customer service

- Encompass and DocMagic software

- Strong communication and organizational skills

Responsibilities:

- Review loan documents for accuracy and completeness prior to closing.

- Ensure all loan documents comply with applicable state and federal regulations.

- Explain loan closing process to customers in a clear and concise manner.

- Process loan closings in a timely and efficient manner.

- Handle customer inquiries and complaints in a professional manner.

- Coordinate with loan originators and customers to ensure a smooth and successful loan closing.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Closer Resume Examples Resume with 7 Years of Experience

A highly organized and efficient Mortgage Closer with 7 years of experience in the banking industry. Proven ability to handle all aspects of mortgage closing process while providing outstanding customer service. Possesses excellent communication, organizational, and problem- solving skills. Possess a deep understanding of the lending requirements of various loan types and the jurisdictional requirements of closing documents.

Core Skills:

- Mortgage Closing Process

- Loan Types and Jurisdictional Requirements

- Outstanding Customer Service

- Communication and Organizational Skills

- Problem- Solving and Negotiation

- Attention to Detail

Responsibilities:

- Communicate with lenders, attorneys, and title companies to ensure accurate and timely closing of mortgages

- Review mortgage documents for accuracy and compliance with all applicable laws

- Verify mortgage closing documents for accuracy and completeness

- Arrange for the transfer of funds for the closing of mortgages

- Coordinate real estate closing services with other parties

- Develop and maintain relationships with lenders and other stakeholders

- Provide customer service to all parties involved in the closing process

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Closer Resume Examples Resume with 10 Years of Experience

A highly motivated, organized and experienced Mortgage Closer with 10 years in the mortgage banking industry. Skilled in determining customer needs, reviewing loan documents and preparing closing statements. Experienced in facilitating loan closings and providing customer service excellence. Adept at problem solving and working with customers to provide the best loan closing experience.

Core Skills:

- Document Preparation

- Closing Procedures

- Problem Solving

- Customer Service

- Loan Origination

- Mortgage Loan Guidelines

- Regulatory Compliance

- Title Clearance

- Recording and Closing Statements

Responsibilities:

- Review loan documents to ensure accuracy and completeness

- Verify customer income, assets and other financial qualifications

- Provide support and assistance to customers throughout the loan- closing process

- Ensure compliance with federal and state regulations

- Gather and review title documents to ensure clear title

- Close loans and record loan documents with county recorder

- Prepare closing statements, loan documents and other paperwork

- Answer customer inquiries and resolve customer complaints

- Coordinate loan closings with title companies, brokers and other lenders

- Analyze loan documents for changes or discrepancies

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Closer Resume Examples Resume with 15 Years of Experience

Highly organized and detail- oriented Mortgage Closer with 15+ years of experience in the mortgage banking industry. Experienced in providing detailed loan documentation and managing the closing process before closing. Possesses an in- depth knowledge of mortgage regulations and loan compliance, loan document preparation, loan closing and insurance requirements. Proven ability to develop and maintain positive relationships with clients, lenders, and title companies.

Core Skills:

- Document Preparation

- Compliance Knowledge

- Loan Closing

- Insurance Requirements

- Time Management

- Organizational Skills

- Negotiation

- Problem Solving

- Communication

- Interpersonal Skills

Responsibilities:

- Maintained the accuracy of loan closing packages and ensured all documents were complete, accurate and in compliance with applicable regulations

- Collaborated with lenders to resolve loan issues, negotiate terms and conditions, schedule loan closings and obtain proper loan documentation

- Reviewed loan closing packages and ensured all documents met established deadlines and standards

- Communicated with clients to obtain necessary loan documents and ensure loan documents were accurate for loan closing

- Reviewed title work for accuracy and cleared title issues prior to closing

- Coordinated loan closings with title companies and lenders to ensure loan documents were in order

- Assisted clients in understanding the loan documentation and answered questions

- Developed and maintained positive relationships with lenders, clients and title companies

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Closer Resume Examples resume?

A mortgage closer is a crucial part of the mortgage-lending process; they’re responsible for ensuring that all of the paperwork and regulations are properly taken care of before the loan closes. A strong mortgage closer resume should demonstrate a thorough understanding of mortgage documents, a detail-oriented work ethic, and the ability to collaborate with other departments.

When creating a resume for a mortgage closer position, here are some of the key points to include:

- Relevant experience with mortgage closing, loan processing, and title review

- Knowledge of mortgage documents (e.g., Note, Deed of Trust, Promissory Note, etc.)

- Ability to adhere to deadlines and work efficiently

- A strong understanding of closing documents and federal regulations

- Excellent interpersonal and communication skills

- Proven record of accuracy and attention to detail

- Ability to multitask and manage multiple loan files simultaneously

- Experience with automated loan origination systems (Loan Origination Software)

- Proficiency in Microsoft Office applications

- Familiarity with compliance regulations (RESPA, TILA, etc.)

- Bilingual in English and another language is a plus

Including this information in your resume will help you stand out to potential employers and demonstrate your suitability for the role. Good luck and happy job hunting!

What is a good summary for a Mortgage Closer Resume Examples resume?

A mortgage closer resume should be comprehensive and succinctly summarize a candidate’s qualifications for the role. It should start with a professional summary that emphasizes a candidate’s expertise in mortgage closing processes, related administrative tasks, and detailed knowledge of relevant laws and regulations. It should also highlight a candidate’s ability to efficiently review, process, and close mortgage loans, manage documents, and respond to requests from clients and lenders. Additionally, the resume should include experience with customer service, excellent communication skills, and up-to-date computer and software proficiency. A mortgage closer resume should also feature any certifications or education that is necessary for the job. Finally, the resume should focus on demonstrating how a candidate’s skills and qualifications can be effectively used to benefit the respective employer.

What is a good objective for a Mortgage Closer Resume Examples resume?

.A mortgage closer is a professional responsible for ensuring a mortgage loan transaction closes accurately and on time. When writing a resume for this position, it is important to include a clear and concise objective statement that conveys your experience, skills and qualifications to a potential employer. Here are some examples of good objectives for a Mortgage Closer Resume:

- To obtain a position as a Mortgage Closer where my 6+ years of experience in the mortgage industry, knowledge of loan processing and excellent organization skills can be utilized.

- Seeking a Mortgage Closing role to utilize my expertise in reviewing loan documents and ensuring accuracy, completeness and compliance with all regulatory standards.

- Dedicated and forward-thinking Mortgage Closing professional eager to apply 8+ years of experience, attention to detail and exceptional customer service skills to a new role.

- A highly motivated mortgage loan closer looking for an opportunity to put to use my 9+ years of experience with mortgage closing, loan review and loan origination.

- Experienced Mortgage Closer with a strong background in financial analysis and a commitment to delivering quality service in an efficient, organized manner.

- To leverage my 8+ years of mortgage closing experience and excellent organizational skills to secure a Mortgage Closer role.

How do you list Mortgage Closer Resume Examples skills on a resume?

Including your mortgage closer skills on your resume can help show potential employers that you have the right experience and qualifications for the job. Here are some examples of the types of skills you should include on your resume:

- Knowledge of loan processing, loan closing, and loan servicing

- Experience with loan origination systems such as Encompass, Calyx Point, and LendingQB

- Ability to review and analyze loan documents to ensure accuracy and completeness

- Proficiency in Microsoft Office Suite, particularly Excel

- Understanding of loan closing software and processes

- Excellent customer service and communication skills

- Strong problem solving and time management skills

- Highly organized with attention to detail

- Knowledge of banking and financial regulations

- Ability to manage multiple tasks simultaneously

- Expertise in document preparation and file management

What skills should I put on my resume for Mortgage Closer Resume Examples?

or bulletA mortgage closer resume should demonstrate a broad range of professional skills related to finance, customer service, and organization. As a mortgage closer, your resume should emphasize the skills required to secure the best mortgage terms for a customer. Here are some of the key skills to include on a mortgage closer resume:

-Financial Analysis: A mortgage closer must have strong financial analysis skills in order to accurately assess the financial eligibility of mortgage applicants. Skills in financial analysis include the ability to understand income statements, calculate loan-to-value ratios, and prepare loan applications.

-Customer Service: As a mortgage closer, you must be able to provide excellent customer service. This includes the ability to effectively communicate with customers, understand their needs and preferences, and ensure their satisfaction with the loan process.

-Organizational Skills: Mortgage closers must have excellent organizational skills in order to ensure the efficient and timely closure of mortgage loans. This includes the ability to manage multiple tasks simultaneously and prioritize them according to urgency.

-Risk Management: Mortgage closers need to have a strong understanding of risk management and be able to identify potential risks associated with mortgage loans. This includes the ability to analyze credit and loan documents, as well as the ability to assess a borrower’s ability to repay the loan.

These are just some of the key skills to include on a mortgage closer resume. By emphasizing these skills on your resume, you can demonstrate that you are a qualified and capable mortgage closer.

Key takeaways for an Mortgage Closer Resume Examples resume

If you’re looking to land a job as a mortgage closer, you’ll need to have an impressive resume. Here are some key takeaways for a mortgage closer resume example:

- Include your past experience: Showcase your past experience in a mortgage closing role, and highlight any certifications you have.

- Showcase your skills: List any relevant technical skills you have, such as Microsoft Office, mortgage processing software, or other programs you’ve used.

- Highlight your achievements: Showcase any specific accomplishments you’ve achieved in the mortgage closing role, such as closing a high-value loan or meeting a tight deadline.

- Demonstrate your organizational skills: Make sure to mention any organizational skills you’ve developed, such as being able to keep on top of paperwork or managing multiple tasks at once.

- Showcase your attention to detail: Highlight your ability to pay attention to detail and accuracy, as this is a key requirement for mortgage closers.

By following these key takeaways, your mortgage closer resume example will stand out from the competition and get you noticed by potential employers.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder