Resume writing can be a daunting task, especially if you’re in the market for a new job as a mortgage banker. Mortgage bankers are responsible for originating and closing mortgage loans, so they must be able to demonstrate a variety of skills on their resume in order to stand out from the competition. To help you get started on your own resume, we’ve created a guide of mortgage banker resume examples, complete with tips and advice on what to include. Read on to learn how to craft an impressive mortgage banker resume that will help you land your dream job.

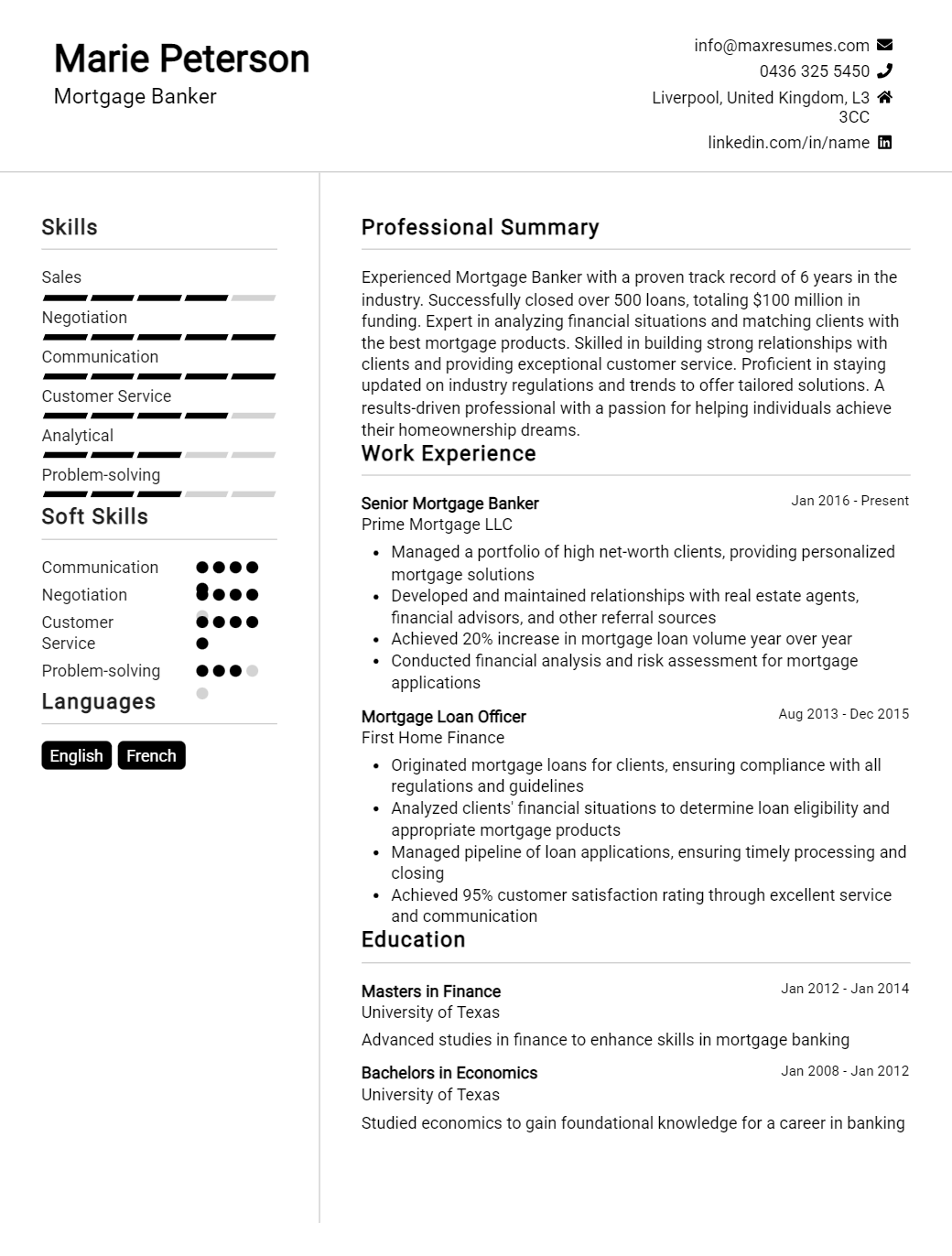

Mortgage Banker Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Banker Resume Examples

John Doe

Mortgage Banker

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly motivated and driven Mortgage Banker with over 8 years of experience in finance, loan origination and banking. Experienced in providing financial counseling to clients and assessing their credit history, income, and other factors. Possesses exceptional interpersonal skills and is able to effectively communicate and build relationships to increase customer satisfaction. Committed to delivering superior customer service and providing guidance and assistance to clients.

Core Skills:

- Loan Origination

- Credit Assessments

- Financial Counseling

- Mortgage Banking

- Relationship Building

- Communication

- Customer Service

- Regulatory Compliance

Professional Experience:

Mortgage Banker

ABC Bank, San Diego, CA

Sept 2019 – Present

- Consult with customers to assess their financial and credit history and gather required information.

- Originate, process and close residential mortgage loans.

- Conduct necessary due diligence to ensure accuracy and compliance with legal and regulatory requirements.

- Communicate with clients throughout loan process and provide guidance and assistance.

- Develop relationships with customers to increase customer satisfaction.

- Evaluate financial data to recommend and provide appropriate loan products.

Mortgage Loan Officer

XYZ Bank, San Diego, CA

Jan 2016 – Sep 2019

- Processed mortgage applications and worked with customers to acquire and process necessary documents.

- Discussed and addressed customer inquiries and complaints in a timely manner and within acceptable service standards.

- Liaised with third- party vendors and other banking representatives to facilitate loan applications.

- Developed relationships with customers to increase customer satisfaction and maintain a professional relationship.

- Ensured all loan documents were accurately completed and followed up with clients to ensure timely completion.

Education:

Bachelor of Science, Finance

University of California, San Diego

2013 – 2016

Mortgage Banker Resume Examples Resume with No Experience

Recent graduate with a degree in finance looking to use my knowledge of the mortgage banking industry to enter the field as a Mortgage Banker. My strong organizational, analytical and communication skills will enable me to help customers find the best mortgage solutions.

Skills:

- Knowledge of the mortgage banking industry

- Organizational skills

- Analytical skills

- Effective communication

- Professionalism

Responsibilities

- Providing detailed information to customers on mortgage products and services

- Assessing customer needs and recommending the best mortgage solutions

- Organizing and preparing mortgage documents

- Reviewing credit reports and loan applications

- Negotiating with lenders to secure favorable terms

- Maintaining accurate records of customer transactions

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Banker Resume Examples Resume with 2 Years of Experience

Highly motivated and experienced Mortgage Banker with 2 years of expertise in the financial services industry. Proven track record of successfully assisting clients in obtaining home loans and managing their financial portfolios. Expert in market trends and strategic financial planning, with strong technical and analytical skills and natural problem- solving abilities. Committed to providing clients with superior customer service and an informative and stress- free loan process.

Core Skills:

- Mortgage Knowledge

- Loan Origination

- Data Analysis

- Financial Planning

- Client Service

- Market Research

- Regulatory Compliance

Responsibilities:

- Developed and maintained a comprehensive database of clients, including loan applications, credit histories, and other pertinent information.

- Analyzed financial and market data to identify potential opportunities for clients.

- Assisted clients with loan applications and collected required documents.

- Negotiated loan terms and conditions with clients.

- Processed loan applications and reviewed credit reports to ensure accuracy.

- Developed relationships with potential clients and made recommendations for loan products.

- Monitored market trends and regulatory changes to ensure compliance.

- Educated clients on loan products, interest rates, and other financial opportunities.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Banker Resume Examples Resume with 5 Years of Experience

A highly- motivated Mortgage Banker with 5 years of experience in providing financial advice to potential and current clients, assessing their financial circumstances and tailoring loan options to suit their individual needs. A proven track record of success in closing deals and ensuring clients are making informed decisions. Possesses a knowledge of various loan products and programs, including FHA, VA, and conventional mortgages. Possesses excellent communication and interpersonal skills, with the ability to build trust and rapport with clients.

Core Skills:

- Excellent communication and interpersonal skills

- Proficiency in financial analysis

- Knowledge of loan products and programs

- Ability to assess and analyze financial circumstances

- Excellent sales and negotiation abilities

- Ability to manage and prioritize multiple tasks

- Ability to build trust and rapport with clients

- Highly organized and detail oriented

Responsibilities:

- Counseling clients on loan products and programs

- Analyzing financial circumstances to recommend loan options

- Analyzing credit information and preparing loan applications

- Processing loan applications, including collecting financial documents

- Negotiating loan terms with lenders and other financial institutions

- Negotiating interest rates and loan terms with clients

- Coordinating with lenders, underwriters, and other financial institutions

- Generating loan documents and completing loan closings

- Managing a portfolio of clients and providing ongoing communication

- Generating leads, networking, and developing new business opportunities

- Staying up to date on industry trends and regulatory changes

- Maintaining client records and managing account updates.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Banker Resume Examples Resume with 7 Years of Experience

Highly motivated and creative mortgage banker with seven years of experience originating and managing loan portfolios. Proven background in providing comprehensive customer service, loan processing and closing, and financial analysis. Expertise in developing long- term relationships with clients, lenders, and real estate agents. Excellent reputation for problem solving, communication, and collaboration.

Core Skills:

- Mortgage Loan Origination

- Loan Processing and Closing

- Financial Analysis

- Relationship Building

- Problem- Solving

- Communication

- Collaboration

Responsibilities:

- Originating and managing mortgage loan portfolios

- Interacting with clients, lenders, and real estate agents

- Analyzing clients’ financial and credit data to determine eligibility

- Assessing loan applications and completing necessary paperwork

- Developing and maintaining an in- depth knowledge of applicable regulations

- Obtaining necessary documents and verifying accuracy

- Negotiating loan terms and closing loans on behalf of clients

- Keeping up- to- date on market trends, loan products, and client needs

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Banker Resume Examples Resume with 10 Years of Experience

Hardworking and motivated Mortgage Banker with 10 years of experience in the industry. Skilled in evaluating loan applications and guiding customers through the mortgage process. Proven ability to maintain strong relationships with clients, identify financial needs and provide clear and accurate advice. Experienced in developing marketing and sales strategies to grow the business.

Core Skills:

- Financial analysis and risk assessment

- Mortgage loan origination

- Customer service orientation

- Knowledge of banking and lending regulations

- Business development and sales

- Negotiation and problem solving

Responsibilities:

- Analyzed financial records and credit profiles of loan applicants

- Evaluated loan applications and conducted interviews to verify information

- Provided detailed advice on loan products and assisted customers in selecting the best option

- Developed and maintained strong relationships with clients

- Monitored market trends and identified new business opportunities

- Researched and developed marketing and sales strategies to grow the business

- Ensured compliance with lending regulations and provided guidance on loan applications

- Negotiated terms and conditions on behalf of the customer

- Resolved customer issues and ensured customer satisfaction.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Banker Resume Examples Resume with 15 Years of Experience

Energetic and accomplished Mortgage Banker with over 15 years of experience in the banking and mortgage industry. Possesses a deep understanding of mortgage financing and the home loan process. Skilled negotiator and communicator with a track record of successfully closing loan packages and maintaining long- term relationships with clients. Committed to providing excellent customer service and delivering exceptional results.

Core Skills:

- Mortgage Financing

- Loan Packages

- Risk Management

- Negotiation

- Client Services

- Regulatory Compliance

- Loan Origination

- Process Improvement

- Loan Underwriting

Responsibilities:

- Develop and maintain positive relationships with clients and referral sources.

- Identify and analyze client needs and provide appropriate mortgage solutions.

- Prepare complete loan packages and ensure compliance with banking regulations.

- Analyze financial and credit data for potential borrowers.

- Monitor loan origination, underwriting and closing processes.

- Negotiate loan terms and conditions with customers.

- Review and verify all loan documents for accuracy and completeness.

- Provide knowledgeable advice on products and services.

- Evaluate risks associated with loan packages and suggest mitigation plans.

- Maintain accurate records and document all customer interactions.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Banker Resume Examples resume?

A mortgage banker resume should be tailored to the employer’s needs, clearly outlining the qualifications, experience, and abilities that make the applicant a good fit. When writing a mortgage banker resume, here are some things to include:

- Professional Summary: This should be a brief, one- to two-sentence overview of your qualifications, experience, and areas of expertise. It should be tailored to the specific job to which you’re applying.

- Education: Be sure to include the highest degree earned, as well as any other relevant training or certifications.

- Experience: Highlight any relevant job experience, including the name of the companies you’ve worked for and your job title.

- Skills: List any relevant skills you have, such as knowledge of specific mortgage types, software programs, or other banking related abilities.

- Interests: Include any relevant interests or hobbies that may be of interest to the employer.

- References: Include the contact information of three professional references.

By including all of these components, a mortgage banker resume will be complete and demonstrate suitability for the job. Make sure to tailor your resume to the employer’s requirements to increase your chances of being hired.

What is a good summary for a Mortgage Banker Resume Examples resume?

A great summary for a Mortgage Banker Resume Examples resume includes a brief overview of the job seeker’s professional experience, specializations, and qualifications. It should highlight their key accomplishments, such as successfully managing a portfolio of mortgages or meeting specific financial goals. Additionally, it should showcase their knowledge of the mortgage banking industry and various lending regulations and policies. The summary should also include any certifications or credentials that the job seeker has obtained, as well as any awards, recognitions, or other professional achievements. Finally, it should close with a statement of the job seeker’s commitment to providing exceptional customer service and delivering quality results.

What is a good objective for a Mortgage Banker Resume Examples resume?

A mortgage banker resume objective should be concise and tailored to the job you’re applying for. The objective should communicate your skills, experience, and goals to the employer and provide them with an understanding of how you can be an asset to their team. A good objective should be no longer than one or two sentences. Here are some examples of good objectives for a mortgage banker resume:

- Experienced mortgage banker with 5+ years in the industry, looking to leverage my customer service skills, knowledge of the loan process, and sales experience to help a growing organization succeed.

- Driven mortgage banker with a commitment to providing clients with excellent service and advice. Seeking to join an established team and contribute to the development of new business opportunities.

- Seeking a mortgage banker position to utilize my customer service, loan processing, and sales experience to help promote financial literacy and advise clients on the best loan options for their needs.

- Detail-oriented mortgage banker with 8+ years of experience in the industry, looking to join a team where I can use my knowledge of the loan process and financial analysis to provide clients with the best services possible.

How do you list Mortgage Banker Resume Examples skills on a resume?

A mortgage banker is a key player in the real estate market, and having the right skills for this type of job is essential if you want to stand out from the competition. When you are writing your resume, it is important to list the mortgage banker resume examples skills that are relevant to the job you are applying for. Here are some tips on what to include:

- Detailed Knowledge of Mortgage Processes: Mortgage bankers should have a good understanding of all the different aspects of the mortgage process, from loan origination to closing and beyond.

- Strong Negotiation Skills: Being able to successfully negotiate terms with customers and lenders is a must for any mortgage banker.

- Excellent Communication Abilities: Mortgage bankers must be able to communicate with customers, lenders, and other professionals in the industry in an effective and professional manner.

- Knowledge of Compliance Regulations: Mortgage bankers must have a good understanding of the laws and regulations that govern the mortgage industry in order to ensure they are in compliance.

- Advanced Computer Proficiency: A mortgage banker should have excellent computer and technological skills in order to carry out the various tasks associated with the job.

By including these mortgage banker resume examples skills on your resume, you will be able to demonstrate to potential employers that you are the perfect candidate for the job.

What skills should I put on my resume for Mortgage Banker Resume Examples?

.A mortgage banker is responsible for managing and developing a portfolio of clients and providing them with the best mortgage loan options. To be successful in this role, you should have strong communication and negotiating skills, be able to research information, and be knowledgeable about the mortgage loan industry. Here are some of the skills employers look for in mortgage bankers:

- Analytical Thinking: Ability to analyze and interpret financial data, including credit reports, loan applications, and financial statements.

- Communication Skills: Ability to explain complex financial concepts to clients in a clear and concise manner.

- Knowledge of Mortgage Laws: Understanding of the laws and regulations that govern the mortgage industry.

- Negotiating Skills: Ability to negotiate favorable mortgage terms and conditions with lenders.

- Problem-Solving: Ability to identify and resolve potential roadblocks and issues.

- Research Skills: Ability to research current market trends, property values, and other relevant data.

- Time Management: Ability to prioritize tasks, manage multiple projects at once, and meet deadlines.

By including these skills on your resume, you will demonstrate to potential employers that you have the knowledge and skills necessary to excel in this role.

Key takeaways for an Mortgage Banker Resume Examples resume

Mortgage Banker resumes need to stand out from the competition in order to land the job you want. A well-crafted resume will show potential employers that you have the skills and experience necessary to succeed in the role. Here are some key takeaways for crafting a standout Mortgage Banker resume:

- Highlight Your Education: As a Mortgage Banker, your educational background will be highly relevant to the job. Include details of any relevant degree programs and certifications you have completed. This will give employers a great indication of your experience and knowledge within the field.

- Showcase Your Experience: Your experience in the Mortgage Banking industry will be one of the biggest factors employers consider when hiring. Detail any previous roles you have held in the industry, showcasing the specific responsibilities and successes you achieved in each role.

- Demonstrate Your Skills: Mortgage Bankers need to have a wide range of skills in order to succeed in their role. Be sure to emphasize the specific skills and knowledge you possess, such as customer service, sales, and financial analysis.

- Use Action-Oriented Language: Use powerful, action-based language throughout your resume in order to make it stand out and prove you are the right person for the job. Use phrases such as “Increased profits by…” and “Achieved successful outcomes in…” to demonstrate your achievements.

By following these key takeaways, you can create a standout Mortgage Banker resume that will help you land the job you want.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder