If you’re applying for a mortgage analyst position, you’ll need an impressive resume to stand out from the competition. This guide will provide you with details regarding what to include in your resume, as well as mortgage analyst resume examples to give you an idea of how to put together an effective and attractive resume. With the help of these tips and examples, you’ll be able to craft a resume that will make you a strong candidate for the job.

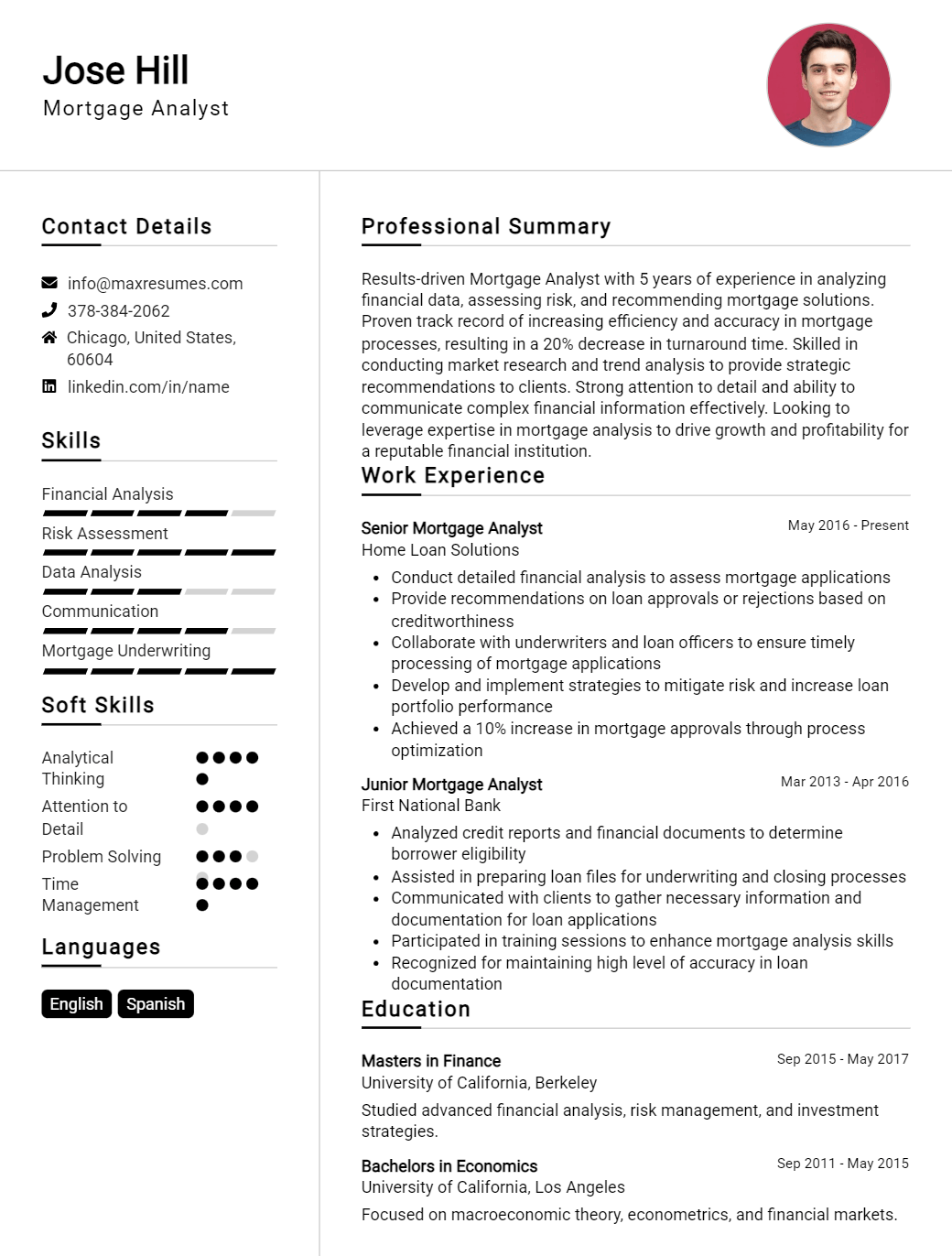

Mortgage Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Analyst Resume Examples

John Doe

Mortgage Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A mortgage analyst with 3+ years of experience in analyzing financial data and providing mortgage solutions. Possess an in- depth knowledge of various financial markets, capital structures, and risk management strategies. A strategic thinker with a proven track record of providing mortgage solutions that maximize return on investment and minimize financial risks. Possess excellent problem- solving and analytical skills, with the ability to develop and implement creative and effective solutions to meet customer needs.

Core Skills:

- Financial analysis and modeling

- Capital markets analysis

- Risk management strategies

- Data analysis and interpretation

- Business strategy

- Portfolio management

- Credit analysis and modeling

- Investment analysis

- Regulatory and compliance

Professional Experience:

Mortgage Analyst, XYZ Bank, Los Angeles, CA

- Analyzed financial data, including credit scores and loan- to- value ratios, to assess loan eligibility and creditworthiness of mortgage applicants

- Compiled financial reports and conducted financial analysis to develop and recommend mortgage solutions

- Developed and implemented strategies to optimize returns on mortgage investments

- Provided advice and support to customers on the best mortgage options available

- Participated in meetings with clients, lenders, and other stakeholders to be involved in the decision- making process

- Researched current trends in the financial industry and the mortgage markets and devised strategies to capitalize on opportunities

Education:

BS in Finance, ABC University, Los Angeles, CA

Mortgage Analyst Resume Examples Resume with No Experience

- Recent college graduate with a degree in Finance and a keen interest in mortgages.

- Excellent analytical and problem- solving skills with a strong background in financial modeling and quantitative analysis.

- Highly motivated, organized and detail- oriented individual with a passion for helping customers, finding solutions and driving results.

Skills:

- Strong financial analysis and modeling abilities.

- Excellent communication and customer service skills.

- Proficient in Microsoft Excel, including pivot tables and VBA.

- Ability to identify and evaluate financial risk.

- Proficient in creating mortgage loan documents and disclosures.

- Familiarity with loan origination and processing procedures.

Responsibilities

- Analyzed financial information such as income, assets and liabilities to determine eligibility of individuals for mortgage loans.

- Reviewed loan applications and supporting documents for accuracy and completeness.

- Performed calculations to determine the maximum loan amount for which an individual could qualify.

- Provided customers with loan information, such as rates and terms, in order to assist them in making informed decisions.

- Developed and maintained relationships with loan officers, underwriters and other mortgage professionals.

- Prepared loan documents and disclosures.

- Ensured compliance with all applicable federal and state laws and regulations.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Analyst Resume Examples Resume with 2 Years of Experience

Dynamic and results- oriented Mortgage Analyst with 2+ years of experience in analyzing loan requirements and financial analysis. Possessing excellent skills in determining creditworthiness and mitigating credit risks. Experience with conducting data analysis, financial and risk analysis, and bank loan processing. Possessing strong communication and interpersonal skills to work with a wide variety of customers.

Core Skills:

- Data Analysis

- Financial Analysis

- Banking

- Loan Processing

- Credit Risk Analysis

- Creditworthiness

- Interpersonal Skills

- Communication

Responsibilities:

- Perform financial analysis of loan requirements and determine the risk associated with each loan.

- Analyze customer credit profiles to determine creditworthiness and to assess risks associated with loan applications.

- Conduct data analysis and review of loan applications to ensure accuracy.

- Process loan applications and prepare loan documents.

- Monitor loan performance and review customer credit records to identify potential delinquencies and fraud.

- Collaborate with underwriters and lenders to ensure compliance with banking regulations.

- Provide expertise and consultation on banking and loan related issues.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Analyst Resume Examples Resume with 5 Years of Experience

A highly experienced Mortgage Analyst with 5 years of experience in the financial services industry. Proven ability to analyze financial data, develop sound financial models, assess customer credit worthiness and suggest appropriate loan structures. Experienced in assessing and approving residential and commercial loan applications, ensuring compliance with state and federal regulations. Highly knowledgeable of credit policies and guidelines. Possesses excellent interpersonal and communication skills that strengthen client relationships.

Core Skills:

- Financial data analysis

- Loan application assessment

- Credit analysis

- Financial modeling

- Regulatory compliance

- Interpersonal communication

- Customer relationship building

Responsibilities:

- Analyze financial data of applicants to verify customer credit worthiness

- Assess and approve residential and commercial loan applications

- Prepare financial models to assess customer financial history

- Develop and suggest appropriate loan structures based on customer needs

- Ensure compliance with state and federal regulations

- Manage customer relationships and communicate resolutions

- Handle customer complaints and address customer inquiries

- Monitor and review loan portfolio to identify potential risks

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Analyst Resume Examples Resume with 7 Years of Experience

I am an experienced Mortgage Analyst with more than seven years of experience in residential and commercial mortgage origination. I have a comprehensive understanding of loan origination processes, with the ability to effectively analyze credit reports, appraisals, and financial documents. I am skilled in working with clients to develop comprehensive mortgage loan solutions tailored to the needs of the borrower. I am an effective communicator, able to work with lenders, underwriters and appraisers to ensure timely loan processing.

Core Skills:

- Mortgage Analysis

- Loan Origination

- Credit Report Analysis

- Financial Document Analysis

- Loan Processing

- Appraisal Evaluation

- Client Communication

- Mortgage Solutions

- Loan Administration

Responsibilities:

- Analyzing credit reports, income documents, appraisals, and other financial documents for loan origination.

- Developing loan solutions tailored to the needs of the borrower.

- Working with both lenders and underwriters to quickly and accurately process loans.

- Evaluating appraisals to ensure accuracy.

- Developing relationships with clients and ensuring their satisfaction.

- Monitoring loan processing to ensure timely completion.

- Maintaining regulatory compliance with loan origination and processing activities.

- Generating reports and updates for clients on loan status and origination process.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Analyst Resume Examples Resume with 10 Years of Experience

A Mortgage Analyst with 10+ years of experience in the financial services industry. I have expertise in the analysis and evaluation of mortgage loans for the purpose of loan underwriting. I am organized, detail- oriented, and thorough in all aspects of loan analysis, with the ability to quickly review complex financial information and accurately determine the risk level of a loan. On top of my experience in the financial services industry, I am knowledgeable in banking regulations and able to use this knowledge to help make sound underwriting decisions.

Core Skills:

- Advanced knowledge of mortgage loan underwriting

- Proficient in loan analysis and evaluation

- Ability to quickly and accurately review complex financial information

- Extensive understanding of banking regulations

- Strong interpersonal and communication skills

- Ability to work in a team environment

Responsibilities:

- Review loan applications, financials documents and appraisals

- Analyze financial data to determine the risk level of a loan

- Underwrite mortgage loans according to established guidelines

- Ensure loans are compliant with banking regulations

- Communicate with loan officers and other stakeholders

- Provide loan approval and denial notices

- Update and maintain loan tracking systems

- Assist with loan processing and closing activities

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Analyst Resume Examples Resume with 15 Years of Experience

Seasoned mortgage analyst with 15 years of experience in servicing, underwriting, and analysis to help clients achieve their financial goals. Proven track record of excellent customer service and attention to detail, resulting in high client satisfaction. Core skills include analysis and interpretation of credit reports, financial statements, legal documents and loan contracts. Adept at asset, income, and debt analysis to determine eligibility for loan products and programs. Highly organized and highly motivated professional with excellent communication skills, problem- solving skills, and a passion for helping others.

Core Skills:

- Financial analysis

- Credit analysis

- Loan servicing

- Financial statement analysis

- Asset analysis

- Legal documentation

- Loan structuring

- Regulatory compliance

- Relationship management

- Microsoft Office suite

Responsibilities:

- Assisted clients in understanding their financial position and helping them to achieve their financial goals.

- Analyzed credit reports, financial statements, and loan contracts to determine eligibility for loan products and programs.

- Performed asset, income, and debt analysis to calculate loan- to- value ratios and other factors.

- Prepared loan documents and communicated loan terms, conditions, and structures with clients.

- Reviewed mortgage loan applications and underwrote loan documents to ensure compliance with applicable regulations.

- Processed loan payments, maintained records, and updated loan and mortgage information in databases.

- Responded to client inquiries and provided excellent customer service.

- Worked closely with other mortgage professionals to ensure the smooth completion of loan processes.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Analyst Resume Examples resume?

A mortgage analyst resume should include all relevant experience and qualifications that have been obtained in the past. By including this information, potential employers will be able to get a better understanding of your work experience and education level. Below are some of the key aspects that should be included in a mortgage analyst resume.

- Education: List any degrees that have been earned, such as a bachelor’s degree in finance, accounting, or a related field.

- Professional Experience: Describe any past positions that have been held in the mortgage industry. Include the length of time in each position as well as any relevant accomplishments.

- Technical Skills: Include a list of any software programs or tools that are used in the mortgage industry.

- Analytical Skills: Describe any experience working with financial data or numerical information.

- Communication Skills: Showcase any experience working with clients, providing customer service, or interacting with colleagues.

- Problem-Solving Skills: Explain how you have handled challenging mortgage cases or how you have navigated complex processes.

- Industry Knowledge: Describe any knowledge of relevant laws, regulations, or industry trends.

What is a good summary for a Mortgage Analyst Resume Examples resume?

A Mortgage Analyst Resume Example should highlight the individual’s expertise in the banking and mortgage industries, as well as their ability to analyze loan options and documents. The summary should also demonstrate the individual’s knowledge of the mortgage process, from origination and underwriting to loan modifications and foreclosure proceedings. The summary should also demonstrate the individual’s interpersonal skills and ability to work well with clients, lenders and colleagues. Additionally, the summary should mention any certifications or awards related to the mortgage industry, as well as any specialized technology and software experience. Finally, the summary should provide a brief overview of the individual’s past and current job duties, emphasizing their experience in the field.

What is a good objective for a Mortgage Analyst Resume Examples resume?

with numberWriting a resume for a mortgage analyst position can be daunting. It’s important to craft an objective that accurately reflects your skills and experience while making it clear why you’re the best fit for the job. Here are some examples of good objectives to include on a mortgage analyst resume:

- To leverage my experience in financial analysis, credit underwriting, and customer service to ensure the highest level of customer satisfaction and successful loan origination.

- To utilize my knowledge of finance, risk management, and portfolio management to develop long-term relationships with lenders and borrowers.

- To apply my understanding of data analysis, quantitative analysis, and financial modeling to assess loan applications and develop sound credit decisions.

- To provide exceptional customer service and utilize my problem-solving skills to quickly and efficiently process loan originations.

- To contribute my experience in loan processing and regulatory compliance to ensure a seamless and compliant loan origination process.

By clearly articulating the skills and experience you bring to the table in your objective, you can demonstrate to employers why you’re the best fit for the job.

How do you list Mortgage Analyst Resume Examples skills on a resume?

When creating a resume for a job as a Mortgage Analyst, it is important to highlight your skills to make your resume stand out from the competition. Including a list of skills on your resume can show employers that you have the specific abilities needed for the job. Here are some of the most important Mortgage Analyst skills to consider listing on your resume:

- Financial Analysis: Mortgage Analysts are required to analyze financial data to determine the best course of action for mortgage clients. This requires knowledge of financial models, market trends, and other data to provide reliable advice.

- Credit Assessments: Mortgage Analysts must be able to assess creditworthiness of potential mortgage customers. They should be able to evaluate income, debt, and other financial factors to make informed decisions.

- Negotiation: In order to get the best terms for clients, Mortgage Analysts must be able to negotiate with lenders. They must be able to negotiate rates, loan terms, and other financial considerations.

- Risk Management: Mortgage Analysts must be able to identify and manage risks associated with lending money. They should have a deep understanding of the legal, financial, and regulatory issues associated with mortgage lending.

- Client Relations: Mortgage Analysts must be able to build relationships with clients to establish trust and ensure repeat business. They should be able to provide personalized advice and demonstrate excellent customer service.

By including these skills on your resume, you can show employers that you are the right candidate for the job. Be sure to tailor your skills section to the job you are applying for and include any relevant certifications or education to further demonstrate your qualifications.

What skills should I put on my resume for Mortgage Analyst Resume Examples?

When writing a resume for a Mortgage Analyst position, there are certain key skills that employers look for. Below are some of the most important skills that you should consider including on your resume.

-Financial Analysis: Mortgage Analysts must have a strong understanding of financial analysis and be able to evaluate financial data to make sound decisions. They must be skilled in analyzing financial portfolios and trends to make informed decisions.

-Mortgage Knowledge: Mortgage Analysts must be knowledgeable about the mortgage process, loan products, and regulations. They must understand the different types of mortgages, interest rates, and credit standards to ensure the best possible loan products for their clients.

-Interpersonal Skills: Mortgage Analysts must have excellent interpersonal skills to build relationships with clients and other professionals in the industry. They should be able to communicate complex information in an approachable way and be comfortable working with clients from different backgrounds.

-Organizational Skills: Mortgage Analysts must be organized and able to multi-task. They should be able to effectively manage their time and prioritize tasks to meet deadlines.

-Problem Solving: Mortgage Analysts must be able to think outside the box and come up with creative solutions to complex problems. They should have a good understanding of the mortgage industry and be able to come up with solutions to potential issues that may arise.

By including these skills on your resume, you can demonstrate to employers that you possess the necessary skills and knowledge to be a successful Mortgage Analyst.

Key takeaways for an Mortgage Analyst Resume Examples resume

When writing a resume for a Mortgage Analyst position, there are a few key takeaways that you should keep in mind.

- Highlight Your Experience: Make sure to highlight any relevant experience that you may have. This could include prior mortgage analysis experience, as well as any related financial services experience. You should also include any specialized skills or certifications that you may possess.

- Detail Your Achievements: In addition to detailing your work experience, be sure to include any tangible achievements that you have made during your time in the mortgage analysis field. This could include any successful refinancing deals that you have completed or any innovative strategies that you have implemented.

- Showcase Your Knowledge: Demonstrate your knowledge of the mortgage and financial services fields by including any related courses, certifications, or seminars that you have completed. If you have any publications or presentations on the subject, include them as well.

- Include Your Education: Make sure to include any educational background that might be relevant to the mortgage analyst position. This includes any specialized degrees or diplomas that you may have earned.

Following these key takeaways will help you craft an effective resume for a Mortgage Analyst position. Make sure to tailor the resume for each job opportunity that you apply for, as this will help you stand out from the competition.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder