Having a well-crafted resume is essential to landing the perfect job, especially if you are applying for a position as a Mortgage Advisor. As a Mortgage Advisor, you will be responsible for providing advice and expertise to clients on various mortgages, loan products, and other banking services. As a result, it is important to create a strong resume that highlights your qualifications, experience, and banking knowledge. To help you get started, this guide will provide you with some Mortgage Advisor resume examples and tips to help you create a successful resume.

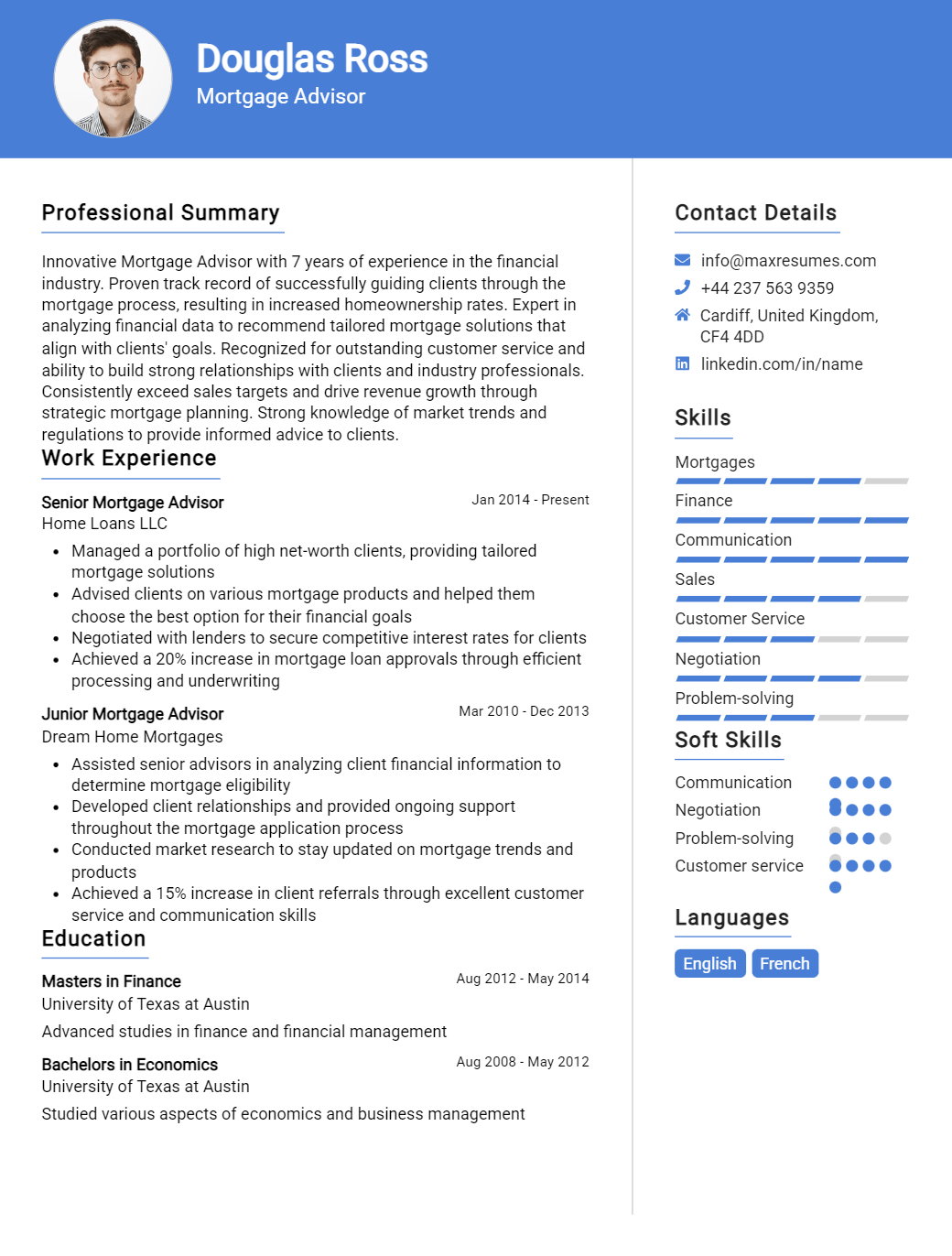

Mortgage Advisor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Mortgage Advisor Resume Examples

John Doe

Mortgage Advisor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced mortgage advisor with over 5 years of experience in the industry. My expertise lies in helping clients find the best mortgage for their financial situation. I have an excellent track record of helping clients save money and achieve their financial goals. I am well versed in mortgage regulations and can provide reliable advice to clients. My strong interpersonal skills allow me to build strong relationships with clients and ensure that I meet their needs in a timely and efficient manner.

Core Skills:

- Mortgage knowledge

- Financial analysis

- Financial advising

- Interpersonal skills

- Customer service

- Regulatory compliance

- Research and analysis

Professional Experience:

- Senior Mortgage Advisor, ABC Bank, San Francisco, CA (2018- Present)

- Advise clients on mortgage options and strategies to meet their needs

- Perform financial analysis and research to determine the best mortgage product

- Provide guidance on loan terms, interest rates, and other financial aspects of the mortgage

- Maintain up- to- date knowledge of local, state, and federal regulations

- Manage client relationships and ensure customer satisfaction

- Mortgage Advisor, XYZ Bank, San Francisco, CA (2017- 2018)

- Provided financial advice and guidance to clients

- Assisted clients with loan applications and ensured all documents were complete

- Conducted research on mortgage products and regulations

- Resolved customer inquiries and issues promptly and professionally

Education:

- Bachelor of Business Administration, ABC University, San Francisco, CA (2013- 2017)

Mortgage Advisor Resume Examples Resume with No Experience

Recent college graduate with a Bachelor of Science in Business Administration and a passion for helping others find the best mortgage loan. Highly organized and detail- oriented, with a proven ability to work independently to research and vet loan options. Looking to apply my knowledge and skills to make a positive impact in the mortgage advisor sector.

Skills:

- Strong financial and numerical skills

- Analytical and problem- solving abilities

- Excellent communication and customer service skills

- Proficient in Microsoft Office Suite

- Ability to work cross- functionally with a team

- Knowledge of loan processing and relevant regulations

Responsibilities

- Researching and determining the best loan options for clients

- Explaining loan terms and conditions to clients

- Creating loan applications and collecting relevant documents

- Verifying financial and personal information

- Managing the loan application process from start to finish

- Building and maintaining positive client relationships

- Assisting clients with inquiries and addressing their concerns

- Ensuring compliance with legal and regulatory guidelines

Experience

0 Years

Level

Junior

Education

Bachelor’s

Mortgage Advisor Resume Examples Resume with 2 Years of Experience

A highly motivated and professional mortgage advisor with two years of experience in providing financial advice. Possess a keen understanding of the financial industry and adept at managing a variety of mortgage products. Skilled at evaluating and analyzing financial data to ensure the best possible outcome for clients. Excellent communication skills with the ability to build strong, trusted relationships.

Core Skills:

- Mortgage advice

- Financial analysis

- Relationship building

- Problem solving

- Negotiation

- Data collection

- Time management

- Risk management

- Regulatory compliance

Responsibilities:

- Advising customers on mortgage options tailored to their individual needs

- Researching and providing information on available mortgage products and services

- Analyzing financial data and conducting risk assessment to determine the best course of action

- Assessing the client’s financial situation and making recommendations accordingly

- Negotiating mortgage terms with lenders on behalf of the client

- Liaising with lenders to ensure timely processing of loan applications

- Maintaining records of customer interactions and updating customer information in the database

- Ensuring compliance with legal and regulatory requirements

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Mortgage Advisor Resume Examples Resume with 5 Years of Experience

Proactive Mortgage Advisor with 5 years of experience in helping individuals and companies secure mortgages. Proven ability to identify customer needs, develop and negotiate loan terms, and manage loan portfolios. Possesses excellent interpersonal and communication skills, as well as a passion for helping clients.

Core Skills:

- Mortgage Portfolio Management

- Loan Origination and Negotiation

- Financial Analysis

- Risk Assessment and Management

- Customer Service

- Loan Documentation

Responsibilities:

- Analyze client financial documents and evaluate creditworthiness

- Develop and negotiate loan terms with potential clients

- Provide advice and guidance on loan options and the loan process

- Manage the loan portfolio, ensuring accuracy and compliance with regulations

- Maintain records of customer interactions and loan activity

- Provide excellent customer service to ensure customer satisfaction and repeat business

- Keep up to date with the latest developments in loan regulations and procedures

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Mortgage Advisor Resume Examples Resume with 7 Years of Experience

A highly motivated and determined Mortgage Advisor with 7 years of experience in providing financial advice and guidance to customers seeking mortgages and other loan products. Skilled in analyzing and evaluating customer needs to determine the best loan packages. Experienced in keeping up to date with mortgage market trends, economic climate and industry regulations. Excellent communication and customer service skills, ensuring customers are provided with high- quality advice and assistance.

Core Skills:

- Knowledge of mortgage products, banking regulations and lending guidelines

- Comprehensive understanding of financial and credit analysis

- Ability to evaluate customer financial data

- Excellent interpersonal, communication and problem- solving skills

- Highly organized and able to meet deadlines

- Proficient in MS Office, financial software and internet applications

Responsibilities:

- Advise customers on the best loan products and packages to meet their needs

- Analyze customer financial details and evaluate creditworthiness

- Provide detailed explanations of the loan process, terms, and conditions

- Monitor changes in the mortgage market, industry and economy

- Act as a liaison between the customer and the mortgage lender/broker

- Prepare and submit loan applications to lenders

- Negotiate with lenders on behalf of customers

- Develop and maintain strong customer relationships

- Ensure customer satisfaction throughout the loan process.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Mortgage Advisor Resume Examples Resume with 10 Years of Experience

Dynamic and highly qualified Mortgage Advisor with 10 years of experience providing outstanding customer service and high- quality mortgage advice. Proven track record in meeting and exceeding sales targets, devising strategies to increase client acquisition, and building long- term relationships with clients. Adept at quickly understanding and adapting to the needs of clients while leveraging my knowledge of the mortgage market to develop tailored solutions.

Core Skills:

- Client Relationship Management

- Customer Service

- Mortgage Advisory

- Sales Strategies

- Financial Analysis

- Problem- solving

- Negotiation

- Risk Assessment

Responsibilities:

- Provided specialized advice on mortgages and related financial products

- Led meetings with customers to gather information and assess their financial situation

- Analyzed financial data to identify potential problems and develop tailored solutions

- Analyzed credit reports, property appraisals and title documents to assess risk

- Developed sales strategies to generate leads, increase customer acquisition and build long- term relationships

- Assisted clients with the completion of mortgage application forms

- Negotiated with lenders to secure the best rates and terms for clients

- Provided ongoing support to customers throughout the mortgage process

- Updated clients on changing mortgage policies, regulations and market conditions

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Mortgage Advisor Resume Examples Resume with 15 Years of Experience

A highly experienced Mortgage Advisor with 15 years of expertise in ensuring clients make informed decisions when purchasing a property. Skilled in handling multiple tasks and meeting tight deadlines, while adhering to mortgage regulations and providing superior customer service. Possessing excellent interpersonal and communication skills, a good understanding of the mortgage market, and the ability to effectively manage a large portfolio of clients.

Core Skills:

- Mortgage advising and consultation

- Financial forecasting and analysis

- Client relationship management

- Negotiating and contracting

- Regulatory compliance

- Risk management

- Loan structuring

- Research and data analysis

- Mortgage documentation

Responsibilities:

- Advising clients on the process and requirements of obtaining a mortgage loan

- Analyzing and evaluating financial documents to determine clients’ eligibility for mortgage loans

- Assessing clients’ financial capabilities and liquidity

- Staying abreast of changes in the mortgage market to ensure compliance with regulations

- Providing detailed advice on loan options and terms and preparing loan applications

- Negotiating and contracting mortgage terms with lenders and closing loans on behalf of clients

- Developing and maintaining a large portfolio of clients

- Educating clients on the latest mortgage products and services

- Conducting research and gathering data to assess loan strategies and financial trends.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Mortgage Advisor Resume Examples resume?

A mortgage advisor resume should include the following:

- Education – Include any relevant degrees or certifications related to mortgages, such as a bachelor’s degree in finance, a master’s degree in banking, or a certified mortgage advisor certification.

- Experience – Highlight any previous mortgage advisor experience, such as working in the mortgage department of a bank, working as a loan officer in a mortgage company, or providing independent mortgage advice.

- Skills – Describe any skills that would be beneficial in a mortgage advisor position, such as market analysis, financial analysis, loan origination, problem-solving, customer service, and computer proficiency.

- Achievements – Highlight any awards or recognitions you have earned in your mortgage advisor career.

- Professional affiliations – List any professional organizations you are a member of, such as the National Association of Mortgage Brokers or the Mortgage Bankers Association.

- Additional information – Include any additional information you think could be beneficial to your potential employer. This may include volunteer work, continuing education, or extracurricular activities.

What is a good summary for a Mortgage Advisor Resume Examples resume?

A mortgage advisor resume example should highlight the candidate’s knowledge and experience in the banking and financial sector. The summary should focus on the candidate’s ability to work with clients and help them understand the process of obtaining a mortgage. It should demonstrate the candidate’s understanding of the loan origination process, their ability to analyze financial information, and their ability to analyze market trends. The summary should demonstrate strong interpersonal and problem-solving skills and the ability to take initiative and provide excellent customer service. The summary should also showcase the candidate’s knowledge of relevant laws, regulations, and compliance requirements.

What is a good objective for a Mortgage Advisor Resume Examples resume?

A mortgage advisor resume should have a clear, concise, and achievable objective that outlines the candidate’s value proposition for the hiring organization. Here are some tips for creating a good objective for a mortgage advisor resume:

- Summarize your experience in the mortgage industry and highlight relevant accomplishments by using measurable figures and examples.

- Demonstrate your understanding of the mortgage industry by listing any certifications or qualifications you may have.

- Showcase your commitment to the organization and its goals by emphasizing your eagerness to help the company grow.

- Express enthusiasm for the company by highlighting relevant characteristics and skills you possess that would make you an excellent fit for the role.

- Showcase your ability to handle financial documents and transactions with accuracy and precision.

- Highlight any other skills, such as customer service or sales, that you possess that may be beneficial to the organization.

These tips should help you to craft an effective and memorable objective for your mortgage advisor resume, and help you stand out to potential employers.

How do you list Mortgage Advisor Resume Examples skills on a resume?

bulletsWhen listing Mortgage Advisor Resume Examples skills on a resume, it is important to emphasis the skills that are specifically related to the role of a mortgage advisor. While a variety of skills may be useful, focusing on those that are most relevant will help to make your resume stand out. Here are some of the most important skills to consider including on your resume:

- Loan Origination: Mortgage advisors must have a thorough understanding of the loan origination process, including the ability to analyze and compare loan products and develop loan packages for clients.

- Financial Analysis: Mortgage advisors need to be able to analyze financial information, such as credit statements and income statements, in order to determine the best home loan or refinancing option for a client.

- Regulatory Compliance: Mortgage advisors need to understand the complex web of regulations that govern the mortgage industry in order to provide clients with accurate and up-to-date advice.

- Customer Service: Mortgage advisors need to provide excellent customer service to ensure that clients are satisfied with the services they receive. This includes the ability to handle customer inquiries and questions as well as providing timely responses.

- Negotiation: Mortgage advisors need to be able to negotiate effectively with lenders in order to secure the best possible loan terms for their clients.

By listing these skills on your resume, you will be able to demonstrate that you have the experience and knowledge necessary to succeed in the role of a mortgage advisor.

What skills should I put on my resume for Mortgage Advisor Resume Examples?

The mortgage advisor sector is a competitive one, so it is important to create a resume that stands out from the crowd. Here are some essential skills to include in your mortgage advisor resume examples:

- Financial Analysis: Successful mortgage advisors must be able to analyze financial documents such as loan applications, credit reports, and income statements. Showcase your ability to interpret such documents and understand their implications for the loan process.

- Regulatory Knowledge: Mortgage advisors must stay up to date on the ever-changing regulations that govern the mortgage industry. Demonstrate your knowledge of these regulations and your ability to follow them diligently.

- Negotiating Skills: Good negotiation skills are essential in the mortgage advisor field. Emphasize your ability to negotiate favorable terms for clients and to build relationships with lenders.

- Relationship Management: The success of a mortgage advisor often relies on their relationships with lenders. Showcase your communication and interpersonal skills that have allowed you to develop strong and lasting relationships.

- Time Management: The mortgage process is often a long and complicated one, so mortgage advisors must manage their time efficiently and meet deadlines. Demonstrate your ability to do this in your resume examples.

These are just some of the essential skills to include in your mortgage advisor resume examples. By showcasing these skills, you will be sure to make a great impression in the competitive mortgage advisor sector.

Key takeaways for an Mortgage Advisor Resume Examples resume

When writing a resume for a mortgage advisor role, there are some key points to keep in mind. First, you should highlight any experience or qualifications that make you uniquely qualified for the role. This can include education and certifications such as the Certified Mortgage Planning Specialist or the Mortgage Loan Originator designation. Additionally, your resume should include a list of the services you offer and detail your knowledge of industry regulations and best practices. Finally, make sure to include information on your achievements and any relevant awards or recognitions you have earned. These key takeaways can help you create an effective resume that will stand out to potential employers.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder