A loan underwriter plays an important role in the loan origination process. They are responsible for analyzing a borrower’s financial information and credit history to determine if the loan should be approved. Crafting a resume for a loan underwriter job may feel like a daunting task, but with the right guidance and resources, you can create an effective document that highlights your background and qualifications. This guide will provide resume writing tips and examples to help you create a compelling resume for a loan underwriter job.

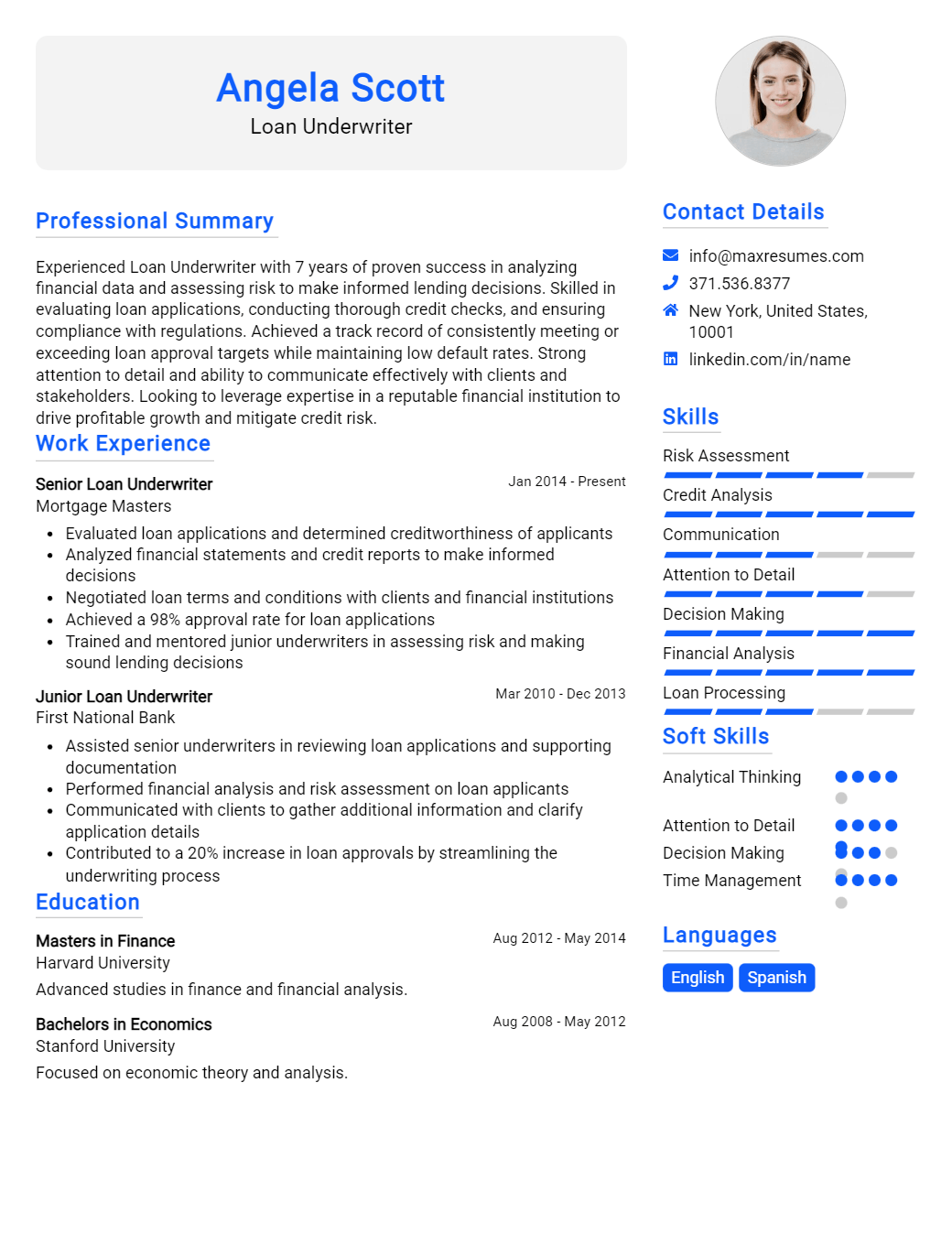

Loan Underwriter Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Underwriter Resume Examples

John Doe

Loan Underwriter

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced loan underwriter with over 10 years of experience in the banking and financial services industry. I have a proven track record of analyzing loan applications, conducting credit assessments, and performing loan underwriting. I am proficient in evaluating financial data, verifying credit histories, and assessing risk factors to ensure loans meet the necessary standards and guidelines. I have great attention to detail and an aptitude for working with numbers. I am a team player, have strong interpersonal and communication skills, and enjoy working with people from all walks of life.

Core Skills:

- Loan underwriting

- Credit analysis

- Risk assessment

- Financial data analysis

- Credit history verification

- Policies and procedures

- Attention to detail

- Interpersonal and communication skills

- Teamwork

Professional Experience:

Loan Underwriter, Bank of America, 2020- present

- Responsible for analyzing loan applications and conducting credit assessments to determine loan eligibility

- Analyzed borrowers’ financial data and verified credit histories to ensure accuracy

- Assessed risk factors and evaluated loans in accordance with policies, procedures, and guidelines

- Monitored loans to ensure repayment

- Maintained up- to- date records and reported any suspicious activities

Loan Underwriter, Wells Fargo, 2017- 2020

- Analyzed credit applications including gathering all required documents and analyzing financial data

- Ensured compliance with all policies and procedures in the loan underwriting process

- Performed credit checks and analyzed loan data to assess risk factors

- Reviewed loan files for completeness prior to submitting for loan approval

- Monitored account activity and reported delinquent accounts to management

Education:

Bachelor of Science in Business Administration, University of Central Florida, 2012

Loan Underwriter Resume Examples Resume with No Experience

Recent college graduate with a Bachelor’s in Finance seeks to leverage analytical and communication skills to become a Loan Underwriter. Possesses excellent problem- solving, interpersonal, and organizational abilities.

Skills:

- Strong mathematical and analytical skills

- Excellent organizational abilities

- Proficient in MS Office Suite

- Ability to communicate effectively

- Ability to effectively analyze and evaluate creditworthiness of borrowers

- Ability to make well- informed decisions

- Knowledge of banking regulations

- Ability to work effectively in a team

Responsibilities

- Review loan applications and credit reports to determine creditworthiness of applicants

- Analyze financial information such as income, assets and liabilities

- Verify employment and obtain credit references

- Assess loan applications for rating, pricing and risk analysis

- Evaluate loan proposals for accuracy and approve or deny loan applications

- Manage customer inquiries, disputes and complaints

- Ensure compliance with applicable banking regulations

- Maintain accurate records of loan decisions and documentation

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Underwriter Resume Examples Resume with 2 Years of Experience

An experienced Loan Underwriter with 2 years of experience in underwriting residential mortgage loans, reviewing credit reports, and calculating debt- to- income ratios to determine credit worthiness. Highly organized and detail- oriented with excellent written and verbal communication skills. Proven ability to assess and determine risk factors for potential borrowers.

Core Skills

- Credit Analysis

- Risk Assessment

- Financial Statement Analysis

- Regulatory Compliance

- Loan Documentation

- Mortgage Loan Processing

- Customer Service

Responsibilities

- Reviewed and analyzed residential loan applications for accuracy and completeness.

- Evaluated credit profiles to determine loan eligibility.

- Analyzed financial statements, tax returns, and other supporting documentation to determine creditworthiness.

- Calculated debt- to- income ratios and estimated loan repayment abilities.

- Ensured documentation met regulatory compliance requirements.

- Investigated discrepancies and requested additional documents when necessary.

- Communicated with borrowers to resolve questions and obtain missing documents.

- Maintained customer loan files and records in accordance with company policies.

- Provided customer service to borrowers throughout the loan process.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Underwriter Resume Examples Resume with 5 Years of Experience

A highly motivated and detail- oriented Loan Underwriter with 5 years of experience in analyzing and interpreting complex personal financial reports to assess creditworthiness and facilitate loan approval. Expert in collecting, analyzing and interpreting financial data, calculating loan repayment amounts, and pricing. Strong communication and negotiation skills, able to effectively interact with customers and all levels of management.

Core Skills:

- Financial Analysis

- Credit Underwriting

- Loan Processing

- Risk Evaluation

- Risk Management

- Compliance

- Regulatory Requirements

- Portfolio Management

- Data Processing

- Document Verification

- Customer Service

- Negotiation

Responsibilities:

- Analyze borrowers’ financial information to determine credit worthiness and loan eligibility

- Evaluate credit risk and calculate loan repayment amounts, pricing, and related costs

- Verify accuracy of loan documents, including credit reports and income statements

- Ensure compliance with all applicable regulations and laws

- Monitor portfolio performance and generate regular reports

- Provide superior customer service and respond to customer inquiries

- Negotiate loan terms and conditions with customers

- Assist with loan origination, closing and funding processes

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Underwriter Resume Examples Resume with 7 Years of Experience

A dedicated Loan Underwriter with seven years’ experience in the financial services industry. Proven track record of success by ensuring the accuracy and approval of multiple loan applications and meeting deadlines while adhering to underwriting guidelines. Experienced in all loan types, including Commercial, Consumer, Reverse Mortgage and VA loans. Possesses strong organizational, problem- solving and communication skills.

Core Skills:

- Loan Underwriting

- Credit Analysis

- Credit Risk Assessment

- Regulatory Compliance

- Documentation

- Problem- solving

- Communication

- Organization

Responsibilities:

- Review and analyze loan documents for accuracy and completeness.

- Utilize credit scoring systems, credit reports and automated underwriting system (AUS) to assess credit risk.

- Analyze and verify information on loan applications to ensure compliance with underwriting guidelines.

- Provide guidance to loan officers on loan approval, loan modifications and loan denial decisions.

- Ensure compliance with all applicable laws and regulations.

- Prepare loan documentation for approval and funding.

- Monitor loan pipelines and loan portfolios.

- Maintain updated knowledge of changing loan underwriting regulations.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Underwriter Resume Examples Resume with 10 Years of Experience

Highly experienced Loan Underwriter with 10 years of experience in the banking and mortgage industry. Exceptional ability to analyze and interpret financial statements, credit scores and loan applications. Adept at underwriting all types of mortgage loans and developing strategies to meet customer needs. Skilled at working with a variety of customers, loan officers and other professionals in the mortgage and banking industry.

Core Skills:

- Loan Underwriting

- Financial Statement Analysis & Interpretation

- Credit Score Analyzing

- Mortgage Loan Processing

- Credit Assessment

- Risk Analysis & Management

- Loan Documentation & Closing

- Loan Origination

- Compliance & Regulatory Guidelines

Responsibilities:

- Review loan applications for accuracy and completeness

- Analyze borrower’s credit score, financial statements and loan application

- Verify mortgage loan documents for compliance with Federal and State regulations

- Communicate with customers and loan officers in order to facilitate loan application process

- Process loan applications and prepare records that meet loan approval guidelines

- Generate loan underwriting report based on criteria and review of documents

- Monitor closing process to ensure accurate and timely closing of loans

- Develop and implement guidelines and procedures to ensure compliance with all regulatory requirements.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Underwriter Resume Examples Resume with 15 Years of Experience

Highly experienced Loan Underwriter with 15 years of experience in underwriting residential and commercial mortgage loans in accordance with investor guidelines. Possess an in- depth knowledge of policies, regulations, and procedures of loan underwriting and credit analysis. Skilled in financial and legal documentation, credit analysis, loan structuring, and closing. Demonstrated ability to spot potential risks, identify potential solutions, and provide effective feedback to staff and management.

Core Skills:

- Financial and Legal Documentation

- Credit Analysis

- Loan Structuring

- Loan Closing

- Risk Identification

- Regulatory Knowledge

- Investor Guidelines

Responsibilities:

- Evaluating and underwriting residential and commercial mortgage loan applications

- Analyzing borrower credit history and financial information

- Reviewing appraisals and reports to ensure accuracy

- Ensuring all loan documents are in accordance with investor guidelines

- Negotiating terms of loan packages and making recommendations to management

- Providing training to loan officers and support staff on loan underwriting

- Maintaining updated knowledge of industry trends and regulations

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Underwriter Resume Examples resume?

- A loan underwriter resume should highlight experience in loan processing, credit analysis, and financial risk assessment.

- The resume should also include a summary of qualifications, listing the candidate’s related educational background, skills, and any certifications or qualifications that may be relevant to the position.

- The resume should also list any previous work history related to the field, including any internships or volunteer work.

- The candidate should also include any experience in data analysis, problem solving, and financial analysis, as well as any customer service experience.

- It is important for the candidate to include a section outlining any relevant technical skills, such as knowledge of loan origination systems and financial software.

- Finally, the resume should include any professional references, such as colleagues and previous employers.

What is a good summary for a Loan Underwriter Resume Examples resume?

A loan underwriter resume should highlight a candidate’s experience in assessing and evaluating loan applications, making risk-based decisions, and analyzing financial statements. It should also mention any specialized training or certifications the applicant may have in regards to evaluating loan applications. Additionally, the summary should include any customer service experience the candidate may have. Finally, the resume should showcase the candidate’s ability to understand and follow all government regulations pertaining to loan underwriting. The summary should be concise, yet highlight the candidate’s qualifications and experience.

What is a good objective for a Loan Underwriter Resume Examples resume?

A loan underwriter handles the job of reviewing loan applications to ensure that they meet the lender’s standards. They analyze financial data, assess creditworthiness, and determine the borrower’s ability to repay the loan. Writing a resume for a loan underwriter position requires an objective that accurately reflects the job seeker’s qualifications and experience. Here are some examples of good objectives for a loan underwriter resume:

- Experienced loan underwriter with five years of experience in financial analysis, risk assessment, and loan approvals. Skilled in using data to develop effective strategies for approving loan applications.

- Dedicated loan underwriter with knowledge of financial regulations, credit risk analysis, and loan processing. Proven record of delivering quality output and meeting underwriting deadlines.

- Talented loan underwriter with strong background in financial industry. Skilled in utilizing data to analyze credit risk, assess loan applications, and make loan decisions.

- Detail-oriented loan underwriter with excellent communication, problem-solving, and critical thinking skills. Highly efficient in evaluating loan applications and ensuring compliance with regulatory standards.

- Professional loan underwriter with a deep understanding of banking products and procedures. Determined to use data to evaluate borrowers’ creditworthiness and make informed decisions.

How do you list Loan Underwriter Resume Examples skills on a resume?

If you are applying for the role of loan underwriter, you need to make sure that your resume clearly shows that you possess the skills needed to be successful in the role. To effectively list loan underwriter resume examples skills on your resume, you should highlight the following skill sets:

- Financial Analysis: Loan underwriters need to have the ability to analyze financial information and use it to make sound decisions. This includes being able to analyze credit reports, income statements, and other financial documents.

- Risk Assessment: Loan underwriters need to be able to assess the risk associated with a loan request. They must be able to determine if the loan applicant is likely to default on their loan.

- Knowledge of Regulations: Loan underwriters need to be familiar with regulations and laws related to loan underwriting. This includes understanding fair-lending laws, bankruptcy laws, and state and federal regulations.

- Written and Verbal Communication: Loan underwriters need to be able to communicate effectively both in writing and verbally. They need to be able to explain loan terms and conditions to both the loan applicant and other lenders.

- Problem-Solving: Loan underwriters need to have the ability to identify and address any issues that arise during the loan underwriting process. This includes being able to identify potential issues and come up with solutions.

By showcasing your relevant expertise in finance, risk assessment, regulations, communication, and problem-solving, you can demonstrate to employers that you have the skills needed to be a successful loan underwriter.

What skills should I put on my resume for Loan Underwriter Resume Examples?

or numbersWhen creating a resume for a Loan Underwriter position, highlighting the right skills is essential for demonstrating your qualifications for the job. Loan Underwriters review loan applications for accuracy and completeness, assess creditworthiness and approve loans within established risk parameters. Therefore, the most important skills for this position include:

- Knowledge of banking regulations: Loan Underwriters need to have an understanding of banking regulations and laws to ensure loan applications are compliant.

- Attention to detail: A Loan Underwriter must have strong attention to detail and be able to detect any errors in loan documents.

- Analytical skills: Loan Underwriters must be able to review and analyze loan applications and credit reports to assess risk and make decisions.

- Communication skills: Loan Underwriters must have excellent communication skills for dealing with customers and other financial professionals.

- Decision-making: Loan Underwriters must be able to make sound decisions quickly and accurately.

- Computer skills: Loan Underwriters must have a good understanding of computer software and database programs to manage loan information.

Including these skills on your resume will help you stand out and demonstrate your abilities as a Loan Underwriter. With the right skills, you can make a great first impression and show employers that you are the right person for the job.

Key takeaways for an Loan Underwriter Resume Examples resume

When it comes to crafting a strong loan underwriter resume, there are several key takeaways to keep in mind. Your resume should reflect your qualifications, experience, and abilities that highlight why you’re the best candidate for the job.

For starters, start off your resume with a strong summary that outlines your experience and qualifications. Highlight any relevant industry certifications, such as a Certified Mortgage Underwriter or Certified Consumer Loan Underwriter designation. This indicates to potential employers that you’re well-versed in the field and understand the complexity of the job.

In the work experience section, be sure to provide detail about the roles and responsibilities you’ve had within the loan underwriter role. Showcase any notable accomplishments where you went above and beyond in order to exceed expectations.

In the skills section, list technical, analytical, and interpersonal skills that set you apart from other candidates. This is an opportunity to showcase your proficiency and qualifications in the field.

Finally, be sure to include any additional certifications and awards that demonstrate your commitment to professional development. This will demonstrate to employers that you’re serious about your career as a loan underwriter.

By following these key takeaways, you can craft a resume that stands out amongst other applicants and shows off your impressive qualifications for the loan underwriter role.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder