Writing a resume for a loan processor position is a challenging task if you’re not sure what to include or how to format it. It’s important to make sure your loan processor resume stands out from other candidates, which is why it’s best to use a resume writing guide with examples. This guide will provide a detailed overview of how to create a winning loan processor resume, from choosing the best format and writing the perfect summary statement to adding the right keywords and showcasing your skills and experience. By the end of this guide, you’ll have a loan processor resume that will get you noticed by employers.

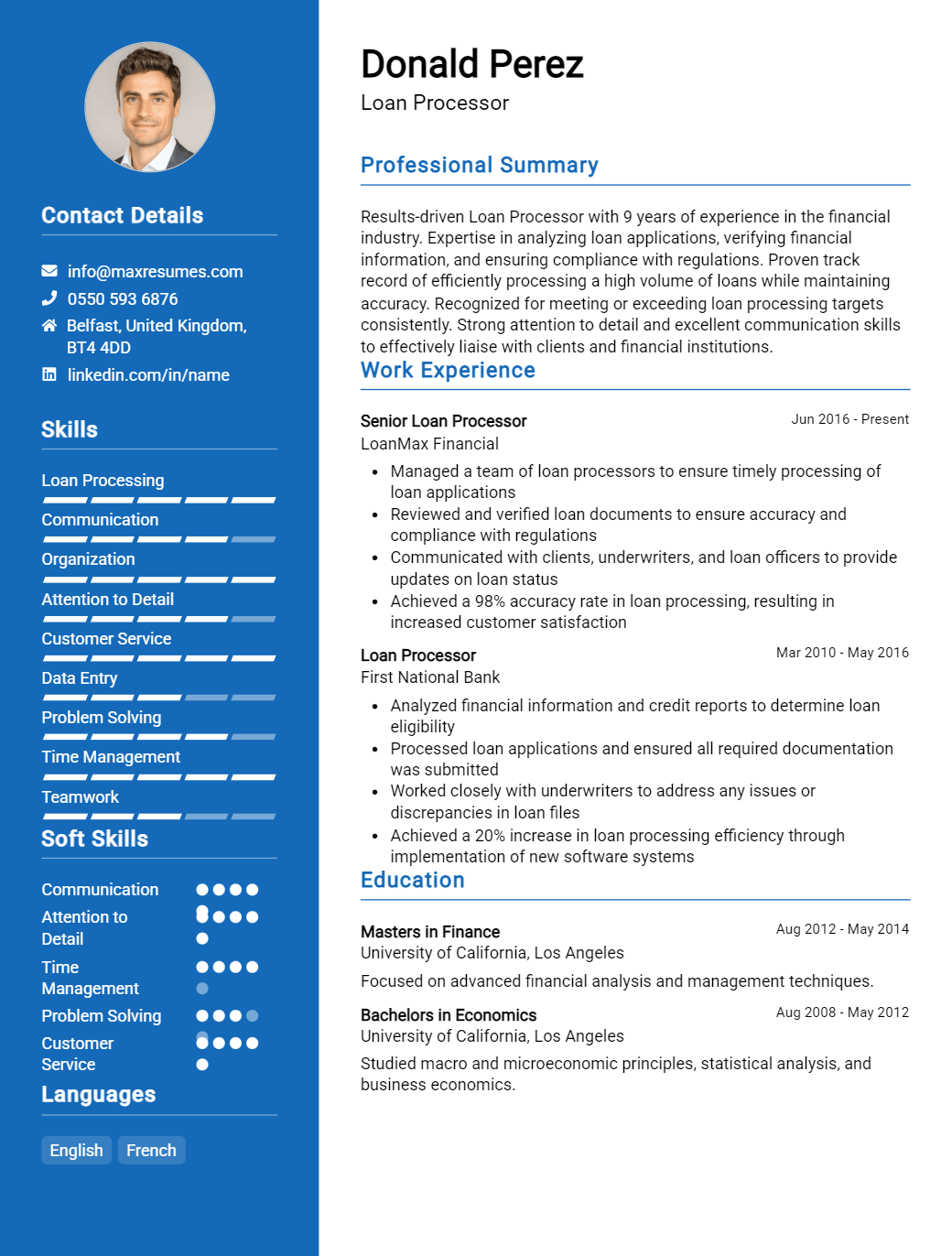

Loan Processor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Processor Resume Examples

John Doe

Loan Processor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly skilled Loan Processor with 8 years of experience in managing and processing loan applications, and analyzing financial data to provide efficient and effective solutions to customers. My educational background in finance and business has provided a great foundation to succeed in this role, while my expertise in financial analysis, customer service and problem solving have enabled me to facilitate smooth loan processing operations. I am looking for a challenging role in a dynamic environment, where I can utilize my skills to ensure the highest quality customer service.

Core Skills:

- Loan Processing and Management

- Financial Analysis

- Credit and Risk Assessment

- Documentation and Verification

- Regulatory Compliance

- Customer Service

- Problem Solving

Professional Experience:

Loan Processor, ABC Bank, New York, NY

- Processed loan applications and verified customer documents

- Evaluated customers’ credit histories and provided risk assessments

- Analyzed customers’ financial data and made recommendations for best loan solutions

- Ensured compliance with all regulatory guidelines

- Maintained detailed records of loan processing operations

- Provided guidance to customers throughout the loan process

- Responded to customer questions and inquiries in a timely manner

Education:

Bachelor of Science in Finance, New York University, New York, NY

Loan Processor Resume Examples Resume with No Experience

Recent college graduate with a passion for finance and loan processing. Highly organized and self- motivated with excellent problem- solving and communication skills. Ready to apply technical knowledge to a loan processor position and provide excellent customer service.

Skills:

- Written and verbal communication

- Customer service

- Data entry

- Problem solving

- Organizational skills

Responsibilities

- Data entry for loan applications and related documents

- Maintaining accurate records of loan documents

- Verifying accuracy and completeness of loan applications

- Follow- up with customers and lenders to obtain necessary information

- Assist in the preparation of loan documents

- Provide customer service for loan applicants

- Resolve complaints and answer inquiries regarding loan processing

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Processor Resume Examples Resume with 2 Years of Experience

A highly organized and detail- oriented Loan Processor with 2 years’ experience working in the financial services industry. Possesses excellent time management skills and a deep understanding of loan documentation and customer service. Experienced in a wide range of loan types and credit reporting requirements. Committed to providing outstanding customer service and accuracy in all tasks.

Core Skills:

- Loan Processing

- Documentation Preparation

- Credit Reporting

- Financial Analysis

- Time Management

- Customer Service

- Regulatory Compliance

Responsibilities:

- Review loan applications and documents for accuracy, completeness and compliance with loan regulations.

- Analyze credit reports and bank statements to ensure customer eligibility.

- Coordinate with borrowers and loan officers to resolve discrepancies and questions.

- Liaise with lenders to ensure timely and accurate loan processing.

- Communicate with customers to provide updates on loan status.

- Prepare and maintain loan files for review.

- Ensure compliance with all applicable laws, regulations, and policies.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Processor Resume Examples Resume with 5 Years of Experience

Loan processor with over 5 years of experience in the banking and finance industry, I have a proven track record of accurately assessing loan applications and ensuring that all loans are processed quickly, efficiently, and in accordance with legal regulations and requirements. My core skills include problem solving and decision- making, strong communication and interpersonal skills, and excellent organizational skills. I possess a comprehensive knowledge of banking and financial regulations and am adept at staying on top of changes as well as promoting loan products. My knowledge of credit and financial assessment, along with my accuracy and attention to detail, have enabled me to remain successful in my career.

Core Skills:

- Problem solving and decision- making

- Strong communication and interpersonal skills

- Excellent organizational skills

- Knowledge of banking and financial regulations

- Credit and financial assessment

- Accuracy and attention to detail

Responsibilities:

- Evaluate loan applications to ensure accuracy and completeness

- Verify and analyze financial details of loan applications

- Oversee administrative tasks associated with loan processing

- Oversee loan documents, such as credit reports and income documents

- Communicate with lenders, borrowers, and other stakeholders

- Inspect loan documents for accuracy and completeness

- Monitor loan processing performance and metrics

- Assist with loan closings

- Address and resolve customer inquiries or complaints

- Maintain loan processing database

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Processor Resume Examples Resume with 7 Years of Experience

Highly organized and motivated Loan Processor with 7 years of experience in the finance and banking industry. Adept at efficiently managing multiple loan applications, preparing loan documents, and communicating with borrowers, lenders and third- party vendors. Skilled at monitoring and verifying credit reports, financial statements, and other loan documents in order to ensure compliance with federal and state regulations. Proven capability in providing excellent customer service throughout the loan application process.

Core Skills:

- Loan Origination

- Credit Management

- Federal and State Regulations

- Loan Application Processing

- Documentation and Records Management

- Mortgage and Real Estate Knowledge

- Customer Service

- Risk Management

- Problem- Solving

Responsibilities:

- Process loan applications from start to finish including obtaining credit reports, verifying financial documents, and preparing loan documents

- Verify accuracy of loan applications before submitting to underwriters for review

- Analyze credit reports and financial statements to assess risk and communicate with borrowers and lenders

- Negotiate loan terms with borrowers and lenders to ensure compliance with federal and state regulations

- Monitor loan processing stages to ensure timely completion

- Act as a liaison between borrowers, lenders, and third- party vendors

- Provide excellent customer service and respond to borrower concerns in a timely manner

- Research and recommend loan products that best meet customer needs

- Assist in the development of policies and procedures to ensure compliance with state and federal regulations

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Processor Resume Examples Resume with 10 Years of Experience

A results- oriented Loan Processor with 10 years of experience in the financial industry. Demonstrated expertise in analyzing financial data and determining the eligibility of borrowers to receive loans. Adept at communicating with clients, customers, and loan officers. Assisted in managing loan portfolio and setting up appropriate loan payment plans. Possesses excellent customer service, communication, and problem- solving skills.

Core Skills:

- Financial Data Analysis

- Loan Processing

- Loan Documentation

- Risk Assessment

- Customer Service

- Communication

- Problem Solving

Responsibilities:

- Examined loan applications to determine whether they meet specific lending criteria

- Verified accuracy of loan documents and collected relevant information from applicants

- Interviewed clients to obtain additional information needed to process loan applications

- Processed loan applications and ensured that all documents were complete and accurate

- Maintained and updated loan records on a daily basis

- Reviewed credit reports and appraisals to determine loan eligibility

- Determined loan structure and terms based on risk assessment

- Provided customer service and resolved customer issues in a timely manner

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Processor Resume Examples Resume with 15 Years of Experience

An experienced loan processor with 15 years of experience in financial services, I have a solid understanding of mortgage and loan processing procedures, document preparation, customer service, and multitasking. I am an organized and motivated individual with a proven track record for meeting deadlines and providing accurate loan processing transactions. I possess excellent critical thinking skills and strive to ensure customer satisfaction.

Core Skills:

- Loan processing

- Documentation preparation

- Customer service

- Multi- tasking

- Critical thinking

- Time management

- Attention to detail

- Communication

- Problem solving

Responsibilities:

- Handle loan applications, evaluate information, and make decisions on loan approvals

- Prepare and submit documents to underwriters and other departments

- Analyze credit reports, tax returns, and other financial documents

- Ensure accuracy of all documentation and data entry

- Review loan files for compliance with all applicable laws and regulations

- Contact customers to provide updates and progress reports

- Work with loan officers and other stakeholders to facilitate loan origination process

- Resolve customer inquiries and complaints in a timely manner

- Generate reports for analysis of loan delinquencies and other metrics

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Processor Resume Examples resume?

A loan processor resume is a critical document when applying for a loan processor role. It can be the key to securing an interview and getting your foot in the door.

When preparing your resume, there are several important elements that should be included to ensure you present yourself as the best candidate. Here are some of the essential components that should be included in a loan processor resume:

- Professional Summary: A concise and tailored professional summary that outlines your experience as a loan processor and your qualifications.

- Key Skills and Qualifications: Highlight the key skills and qualifications you possess that make you an ideal candidate for the role.

- Education and Certifications: List your educational background, any certifications you may have, and any other relevant professional development.

- Experience: Provide details of your past professional experience, such as the roles you have had as a loan processor and any related job titles.

- References: Include references from previous employers or colleagues who can attest to your professional skills and experience.

With these elements included in your resume, you can demonstrate your qualifications and experience to potential employers. This will give them a better understanding of your capabilities and make you stand out from the competition.

What is a good summary for a Loan Processor Resume Examples resume?

A loan processor resume example should provide an accurate summary of the job seeker’s experience, qualifications, and skills. It should highlight their ability to quickly and accurately review and process loan applications, as well as their understanding of loan documentation and financial regulations. In addition, the summary should emphasize the candidate’s customer service and communication skills, which are essential when working with clients and other loan officers. Finally, the summary should demonstrate their ability to stay organized and work on multiple tasks simultaneously, as loan processors often handle a variety of loan applications at one time. By creating an effective summary, a loan processor resume example will stand out and give the job seeker a better chance of getting the job.

What is a good objective for a Loan Processor Resume Examples resume?

A loan processor is an integral part of the mortgage lending process, responsible for managing customer information, verifying customer documents and processing loan applications. To stand out from other applicants and secure a job as a loan processor, it is important to craft a resume that emphasizes one’s skills and experience.

The following is an example of a good objective for a loan processor resume:

- To utilize my customer service and administrative skills to ensure accurate and timely loan processing and customer satisfaction.

- To leverage my expertise in loan and mortgage regulations, along with my knowledge of software and financial analysis, to deliver precise and efficient loan processing services.

- To apply my attention to detail, problem-solving and organizational skills to ensure successful loan applications.

- To foster positive relationships with customers and colleagues while striving to exceed expectations in loan processing activities.

How do you list Loan Processor Resume Examples skills on a resume?

When crafting a loan processor resume, it is essential to list your skills in a way that highlights your expertise and qualifications. Loan processors are responsible for managing the loan application process and making sure all paperwork is in order so that the loan can be approved in a timely manner. To demonstrate that you are the right candidate for the job, you must be able to show that you possess the necessary skills and abilities.

In order to effectively list your loan processor resume examples skills on a resume, consider the following:

- Familiarity with the loan application process: A loan processor should be knowledgeable about the steps of the loan application process, including how to collect and verify documents, calculate debt-to-income ratio, and follow up with lenders.

- Strong communication skills: Loan processors must communicate effectively with borrowers, lenders, and other parties involved in the loan process. They need to be able to explain the application process clearly and answer any questions that borrowers may have.

- Attention to detail: Loan processors must review applications and paperwork for accuracy and completeness. It is essential that loan processors have strong attention to detail in order to ensure that all documents are accurate and up-to-date.

- Problem solving abilities: Loan processors must be able to problem solve when issues arise. They should have the ability to think critically and come up with creative solutions to any problems that may be encountered during the loan application process.

- Time management: Loan processors must be able to manage their time effectively in order to keep up with the demands of the loan application process. They must be able to prioritize tasks and complete them within the specified timeframe.

By listing these skills prominently on your resume, you will demonstrate to potential employers that you possess the necessary qualifications to be an effective loan processor. With these essential skills in your arsenal, you will be able to make a lasting impression and show that you are the right candidate for

What skills should I put on my resume for Loan Processor Resume Examples?

When writing a resume for a Loan Processor, it is important to include the right skills that demonstrate your qualifications and experience. As a Loan Processor, you will be responsible for managing and processing loan applications, so having strong technical and organizational skills is essential. Here is a list of the key skills you should include on your resume:

- Loan Processing: Knowledge of the loan processing process, including credit checks, document verification, and financial analysis.

- Organization: Ability to maintain accurate and organized records, and track and manage loan applications.

- Attention to Detail: Ability to analyze and process financial documents accurately and thoroughly.

- Communication: Excellent verbal and written communication skills for communicating with lenders, borrowers and other financial professionals.

- Computer Proficiency: Knowledge of loan processing software and other computer programs used in the loan processing industry.

- Time Management: Ability to manage time and prioritize tasks to meet deadlines.

- Problem-solving: Ability to analyze and troubleshoot problems in order to come up with solutions.

- Customer Service: Ability to provide excellent customer service to both lenders and borrowers.

Key takeaways for an Loan Processor Resume Examples resume

When crafting a resume for a loan processor role, there are several key takeaways that can help you create a strong resume. A loan processor is responsible for evaluating and verifying a loan applicant’s creditworthiness and making sure they meet all the loan requirements. The job requires excellent organizational, communication, and problem-solving skills. It is important to highlight these skills on your resume to demonstrate your suitability for the position.

- Highlight Your Skills: Loan processors must have the ability to problem-solve, remain organized, and communicate effectively. Make sure to highlight these skills on your resume and emphasize how you have used them in previous roles.

- List Relevant Experience: Loan processors are expected to have experience in evaluating and verifying financial documents, as well as managing customer relationships. Make sure to include any relevant experience you have in these areas, as well as any other experiences that might be useful for the role.

- Be Specific: Make sure to tailor your resume to the specific job you are applying for. Be as detailed as possible about your qualifications, so that the hiring manager can see that you are a good fit for the position.

- Include Certifications: If you have any certifications that may be applicable to the loan processor role, make sure to include them on your resume. This will show the hiring manager that you have the qualifications and knowledge to succeed in the role.

By following these key takeaways, you can create a strong and effective resume that will demonstrate your suitability for the loan processor position. Make sure to include your relevant experience, skills, and certifications to help you stand out from other candidates.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder