Having a great resume is essential to landing the job you have always wanted. Knowing how to write an effective resume is key to presenting yourself in the best light possible and winning the job. In this blog post, we will provide a loan originator resume example and a step-by-step guide on how to write a winning loan originator resume. With our tips, you will be able to craft a resume that highlights your skills and experience and increases your chances of getting hired.

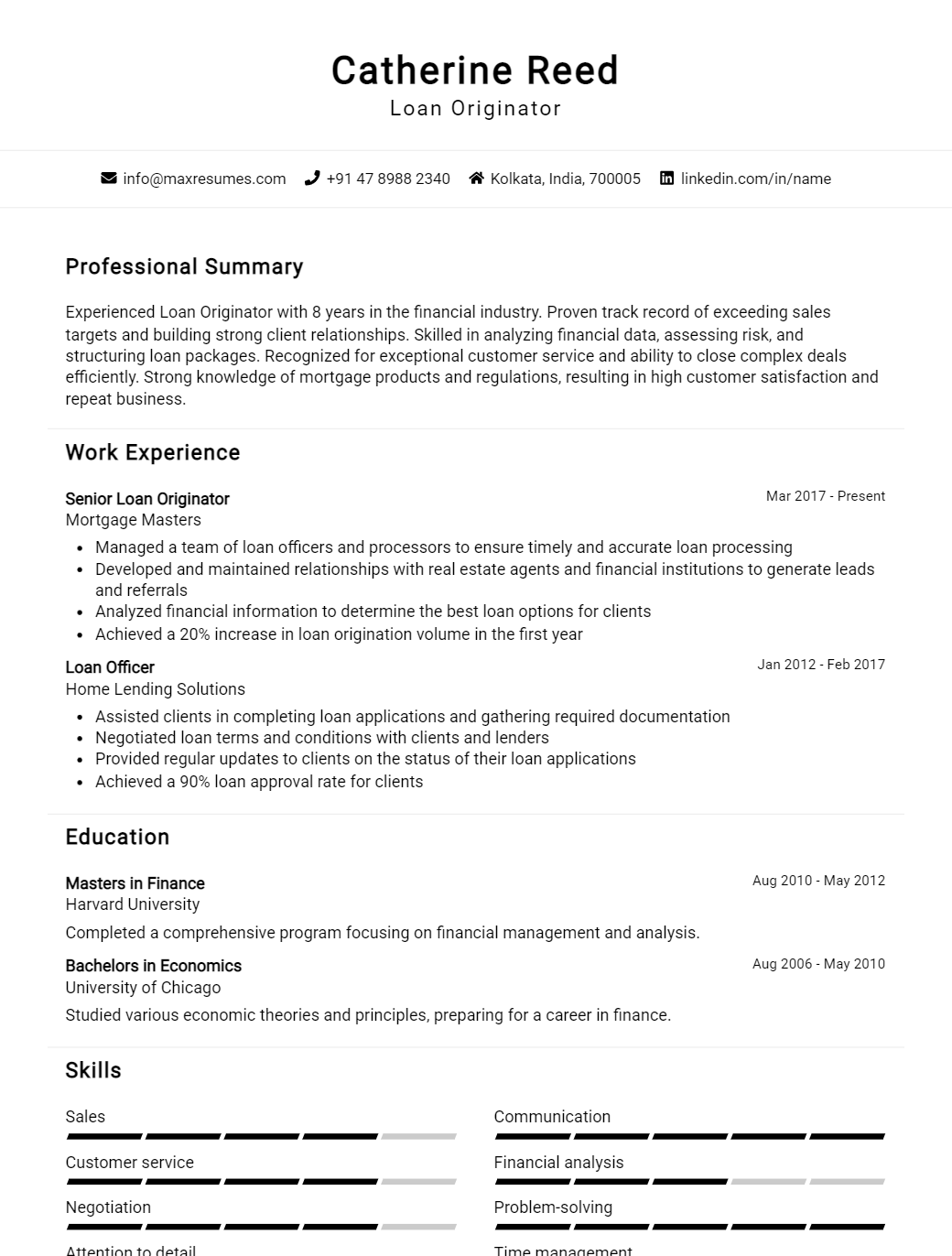

Loan Originator Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Originator Resume Examples

John Doe

Loan Originator

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly experienced Loan Originator with more than 10 years of experience in the mortgage industry. I have a passion for helping my customers find the best loan option for their individual situation. My ability to stay abreast of changing industry rules and regulations allows me to provide my clients with the most up- to- date information and advice. I am an effective communicator, problem solver and team player and have consistently achieved high levels of customer satisfaction.

Core Skills:

- Mortgage Loan Originations

- Processing, Underwriting and Closing

- Strong Knowledge of Mortgage Regulations

- Proficient in Mortgage Software Systems

- Exceptional Communication Skills

- Team Player

Professional Experience:

Loan Originator, ABC Mortgage, 2016 – Present

- Provide customers with loan options that best meet their needs while ensuring compliance with guidelines.

- Process and review loan applications, review and analyze documents, conduct credit checks, order appraisals and verify income.

- Communicate with customers to ensure all documents are accurate and submitted in a timely manner.

- Maintain records of loan activity and monitor loan status throughout the process.

Loan Originator, XYZ Mortgage, 2012 – 2016

- Provided customers with loan options that best met their needs while ensuring compliance with guidelines.

- Processed and reviewed loan applications, reviewed and analyzed documents, conducted credit checks, ordered appraisals and verified income.

- Regularly communicated with customers to ensure all documents were accurate and submitted in a timely manner.

- Kept records of loan activity and monitored loan status throughout the process.

Education:

Bachelor of Science in Business Administration, ABC University, 2010

Loan Originator Resume Examples Resume with No Experience

Recent college graduate with a degree in Business Administration and a strong interest in Loan Originator. Possesses excellent interpersonal and communication skills, advanced research and analytical abilities, and a strong work ethic. Highly organized, detail- oriented, and capable of multitasking in a fast- paced environment.

Skills:

- Proficient in Microsoft Office Suite

- Strong problem- solving and decision- making skills

- Good understanding of financial principles

- Strong interpersonal, communication, and customer service skills

- Excellent research and analytical abilities

- Ability to work independently and as part of a team

Responsibilities

- Review loan applications and documents to determine eligibility

- Gather and verify customers’ financial information such as income, employment, and credit history

- Calculate loan payments and interest rates

- Advise customers on the loan terms, fees, and benefits

- Provide support with loan application completion and follow- up

- Maintain accurate records and update customer profiles

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Originator Resume Examples Resume with 2 Years of Experience

I am a seasoned loan originator with 2 years of experience in the banking and finance industry. I am adept at identifying customer needs and negotiating loan terms to ensure customer satisfaction. I have extensive customer service experience, enabling me to build strong relationships with clients and lenders. I am highly organized and have the ability to track and manage multiple loans at once. I am confident in my ability to evaluate and process loan applications and to ensure compliance with all applicable laws and regulations.

Core Skills:

- Loan Origination

- Customer Service

- Banking and Finance

- Negotiation

- Compliance

- Organization

- Conflict Resolution

Responsibilities:

- Originate loan applications based on customer needs and qualification.

- Analyze credit reports and financial statements for accuracy and to determine loan eligibility.

- Communicate loan options to customers and negotiate loan terms.

- Prepare loan documents and ensure compliance with applicable laws and regulations.

- Monitor loan progress and coordinate with lenders on loan terms and conditions.

- Track and manage multiple loan files simultaneously.

- Resolve customer inquiries and complaints in a timely and professional manner.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Originator Resume Examples Resume with 5 Years of Experience

I am a Loan Originator with 5 years of experience in the mortgage industry. I specialize in helping customers purchase or refinance their homes by providing them with the best loan options tailored to their individual needs. I am meticulous in reviewing credit, assets and income documents to ensure accuracy and compliance with underwriting guidelines. I am also adept at utilizing technology to streamline the loan origination process. I have excellent relationships with brokers, lenders, and realtors to provide customers with the best options available in the marketplace.

Core Skills:

- Loan Origination

- Credit Analysis

- Mortgage Underwriting

- Technology Utilization

- Client Relations

- Market Knowledge

Responsibilities:

- Meet with customers to understand their financial needs and goals

- Analyze credit, asset, and income documents to determine loan eligibility

- Facilitate communication between brokers, lenders, and realtors

- Utilize technology to streamline the loan origination process

- Negotiate terms with lenders and ensure compliance with regulations

- Provide recommendations to customers on loan products that best meet their needs

- Monitor market trends and provide guidance to customers on loan options

- Follow up with customers after loans are closed to ensure satisfaction.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Originator Resume Examples Resume with 7 Years of Experience

Dynamic and experienced Loan Originator with 7 years of experience in customer service and sales, as well as strong knowledge of mortgage products, loan origination processes and industry regulations. Proven track record of successfully originating, processing and closing residential mortgages in a timely and accurate manner. Demonstrated ability to develop and maintain relationships with customers, loan officers and third- party providers. Highly organized, detail- oriented and goal- oriented individual with excellent problem solving and customer service skills.

Core Skills:

- Mortgage origination experience

- Loan applications

- Sales and customer service

- Loan origination processes

- Regulatory compliance

- Problem solving

- Relationship building

- Time management

- Data entry

Responsibilities:

- Analyzed and verified loan applications for accuracy and completeness

- Developed customer relationships and provided customer service to ensure customer satisfaction

- Processed loan applications and verified documents

- Developed and maintained data files and records

- Monitored loan origination processes, procedures and regulations

- Provided feedback and guidance to loan officers

- Educated customers on types of loan products available in the market

- Reviewed and processed loan closing documents

- Followed up on requests for documents and information from customers and lenders

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Originator Resume Examples Resume with 10 Years of Experience

I am a loan originator with 10 years of experience in the field. I excel in facilitating the loan process for clients, building relationships with lenders, and understanding and complying with current regulations. I am an excellent communicator who is able to effectively explain loan options to clients and solicit feedback and approval. I am highly organized and use my attention to detail and problem- solving skills to ensure that all documents and paperwork are accurate and up to date.

Core Skills:

- Loan Documentation and Underwriting

- Regulatory and Compliance

- Credit Analysis

- Relationship Building

- Negotiation and Problem Solving

- Client Communications

- Attention to Detail

- Time Management

Responsibilities:

- Assisted prospective borrowers in completing loan applications.

- Maintained knowledge of current loan programs and underwriting requirements.

- Processed loan papers and documentation to ensure accuracy and compliance.

- Evaluated creditworthiness of potential borrowers and counseled them on their options.

- Negotiated terms and conditions of loans with lenders.

- Communicated with clients throughout the loan process to provide updates and seek necessary approvals.

- Researched and resolved any discrepancies in loan documents.

- Developed strong relationships with lenders, realtors, and other third parties.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Originator Resume Examples Resume with 15 Years of Experience

Loan originator with 15 years of experience in mortgage and loan services. Experienced in helping customers obtain financing for a variety of needs. Skilled in managing loan origination processes, customer relations, and financial analysis. Proficient in utilizing loan origination software and has a strong knowledge of relevant regulations and guidelines. Committed to providing customer service excellence and creating win- win solutions.

Core Skills:

- Loan Origination

- Customer Service

- Financial Analysis

- Regulatory Compliance

- Loan Processing

- Relationship Management

- Problem Solving

- Negotiation

- Communication

- Time Management

Responsibilities:

- Assisted customers with loan applications, collected credit information and analyzed financial documents

- Advised customers on loan products, rates, and terms

- Verified application and credit documentation for accuracy and completeness

- Negotiated loan terms with customers as well as with other loan originators

- Managed loan origination processes, including pre- qualification, pre- approval, and approval

- Assisted customers in understanding mortgage policies and procedures

- Ensured compliance with all federal, state, and local regulations and guidelines

- Developed effective relationships with customers, lenders and brokers

- Maintained accurate records of customer loan applications and documents

- Analyzed financial information, such as income, assets, and credit scores, to determine customer eligibility for loan

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Originator Resume Examples resume?

A loan originator resume is an important tool for anyone looking to secure a job in the lending industry. It should include all the necessary information about your education, experience, and skills as it relates to loan origination.

Here are some tips for crafting an effective loan originator resume:

- Highlight Your Qualifications: Make sure to highlight your qualifications and certifications, such as the NMLS certification and any other lending certifications or licenses. Include information about your years of experience in the field and any specialized training you have received.

- Demonstrate Your Expertise: Loan originators should be able to demonstrate their expertise in loan origination. Provide examples of successful loan originations you have completed in the past, as well as any other accomplishments you can list.

- Detail Your Responsibilities: Be sure to include information about your loan origination responsibilities. This should include any duties you have performed, such as loan processing, underwriting, and closing.

- List Your Professional Skills: Showcase your professional skills, such as financial analysis, customer service, and problem-solving. Also, include any other relevant skills you have, such as knowledge of regulatory standards and lending procedures.

- Include Your Education: Make sure to include your credentials and education, such as any degrees or certifications you have received. This can include any specialized training or continuing education courses you have completed.

By following these tips, you will be able to create an effective loan originator resume that will help you stand out in the competitive job market. Good luck!

What is a good summary for a Loan Originator Resume Examples resume?

A Loan Originator resume should convey a candidate’s knowledge and experience in the role. A great resume should feature the candidate’s understanding of loan origination principles and regulations, as well as their ability to successfully close loans. The summary should highlight the candidate’s years of experience in the loan origination field, as well as any special skills or qualifications that make them a good fit for the position. Additionally, it should identify the candidate’s ability to build relationships with clients, lenders, and other parties involved in the loan origination process. This summary should also demonstrate the candidate’s dedication to customer service, as well as their ability to stay organized and handle multiple tasks at once. It should also emphasize the candidate’s knowledge of relevant federal, state, and local regulations. Finally, the summary should showcase the candidate’s strong communication and negotiation skills.

What is a good objective for a Loan Originator Resume Examples resume?

.Writing a strong objective for a Loan Originator Resume Examples resume is an essential part of creating an effective job application. Your objective is a statement of your goal as a job applicant, and should communicate your key skills, qualifications and experience to prospective employers. Here are some tips for creating an effective objective for a Loan Originator Resume Examples resume:

- Demonstrate your understanding of the roles and responsibilities of a Loan Originator with a strong, specific objective.

- Highlight your knowledge of loan origination, credit analysis and financial regulations.

- Showcase your ability to develop and manage relationships with clients, lenders and other stakeholders.

- Emphasise your excellent communication and customer service skills.

- Highlight any qualifications or certifications you have related to the role.

- Make your objective concise and to the point.

By writing a strong, focused objective, you can make a great impression on prospective employers and increase your chances of being selected for an interview.

How do you list Loan Originator Resume Examples skills on a resume?

symbolWhen trying to stand out among other loan originator candidates, showcasing relevant skills on your resume can be a big help. Developing a targeted resume that emphasizes the skills needed for the job you’re applying for can give you an edge over the competition. Here are some tips for listing your loan originator resume examples skills on your resume.

- Focus on the skills that set you apart. When you’re writing your resume, think about the skills that make you an ideal candidate for the job. Focus on the most relevant skills you possess that are related to loan origination or that are specific to the job you’re applying for.

- Provide examples of your skills. Instead of simply listing your skills on your resume, provide examples of how you’ve used them. For example, if you have experience in loan origination, include a few specific examples to highlight your experience. This can help employers understand the depth of your knowledge and experience.

- Group related skills together. When you’re listing your skills on your resume, list related skills together. For example, you could list your customer service and communication skills together, or your technical and analytical skills together. This helps employers quickly and easily see the skills you possess.

- Highlight transferable skills. If you’ve gained skills from previous jobs that are also applicable to loan origination, include them as well. This can help demonstrate to employers that you have the aptitude and capabilities for the job.

By focusing on the skills that are most applicable to the job you’re applying for and providing examples to demonstrate your experience, you can make sure your loan originator resume examples skills stand out on your resume.

What skills should I put on my resume for Loan Originator Resume Examples?

When writing a resume for a Loan Originator position, there are certain skills you should include to make sure you stand out from the competition. Here are some skills to include in your resume to show you have the experience and qualifications necessary to take on the role of a Loan Originator:

- Knowledge of mortgage loan origination process: You should have a clear understanding of the mortgage loan origination process, including the different types of loan products, underwriting guidelines and loan origination software.

- Communication skills: As a Loan Originator, you will be working with both customers and banks, so having strong communication skills is essential. You should be able to clearly explain the loan process, answer their questions and negotiate terms.

- Analytical skills: You will need to be able to quickly analyze financial data and interpret credit reports to determine a customer’s eligibility for a loan.

- Detail-oriented: You should be able to pay attention to details to make sure all the paperwork is accurate and up-to-date.

- Time-management skills: You should be able to manage your time efficiently in order to meet deadlines.

- Computer skills: You should have a working knowledge of computer software, such as loan origination systems and Microsoft Office programs.

By including these skills in your resume, you can demonstrate to employers that you have the qualifications necessary to succeed in the Loan Originator position.

Key takeaways for an Loan Originator Resume Examples resume

When constructing a resume as a Loan Originator, it is important to highlight your customer service skills and your ability to communicate effectively with customers. Additionally, you should include any experience you have in the banking or financial services industry, as this will give employers a better idea of your understanding of the job. Here are a few key takeaways for an Loan Originator Resume Examples resume:

• Highlight your customer service skills: Emphasize the customer service skills you possess that make you an effective Loan Originator, such as your ability to address customer concerns, explain loan products, and work with customers to find solutions to their financial needs.

• Explain your knowledge of the banking and financial services industry: Loan Originators must have a strong understanding of banking and financial services. Show employers your expertise in this area by including any relevant education, certifications, or prior experience.

• Include metrics and results: It is important to demonstrate the success of your prior experience as a Loan Originator. Include metrics or results that showcase your performance, such as the number of loans approved or customer satisfaction ratings.

• Showcase your communication skills: As a Loan Originator, you must be able to communicate with customers and other financial professionals. Make sure to demonstrate your communication skills on your resume with examples of how you have effectively communicated in the past.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder