A resume is an important part of any job application, and loan officers are no exception. Crafting a strong, compelling loan officer resume can help you stand out from the competition and increase your chances of getting hired. This guide will provide you with the essential information and tips you need to create an eye-catching loan officer resume. With our resume writing examples, you’ll learn the best practices for highlighting your experience, skills, and qualifications, as well as how to format and structure your resume for maximum impact. With a few simple strategies, you can be on your way to crafting a winning loan officer resume that will help you land the job of your dreams.

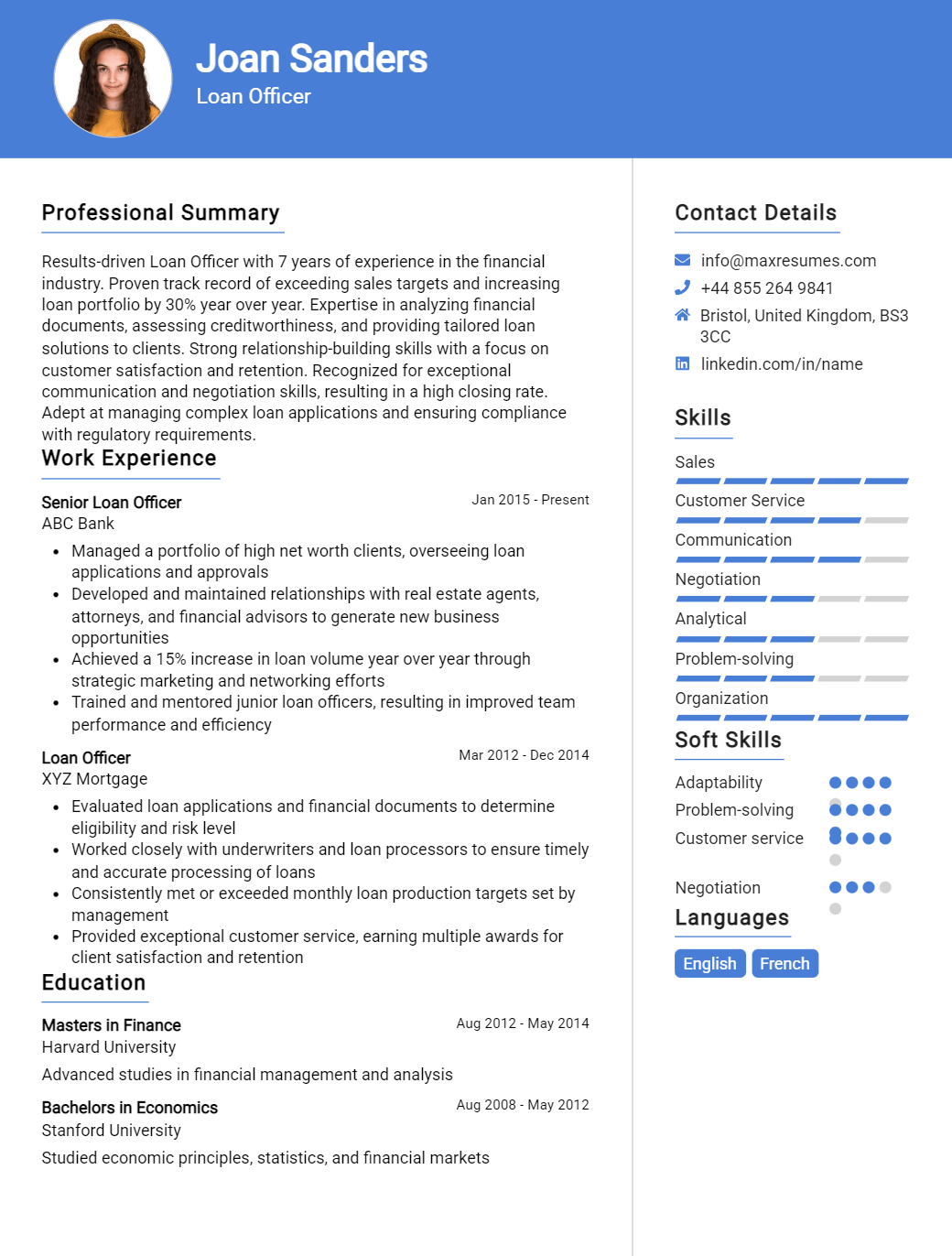

Loan Officer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Officer Resume Examples

John Doe

Loan Officer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Loan Officer with over 10 years of experience in the financial services industry specializing in loan origination, underwriting, and mortgage processing. During this time, I have provided exceptional service to clients, ensuring they are secure in the information they are provided and are kept abreast of changes in the industry. My ability to develop successful lending relationships has been vital to the success of my clients’ businesses. Through my knowledge of the mortgage industry, I have developed a dedication to helping homeowners and buyers get the best loan terms possible while maintaining the highest standards of integrity and confidentiality.

Core Skills:

- Loan origination

- Underwriting

- Mortgage processing

- Customer service

- Financial analysis

- Compliance

- Problem- solving

- Communication

- Negotiation

- Time management

Professional Experience:

- Loan Officer, XYZ Financial Services, 2015- Present

- Originate and process mortgage loans for clients, meeting with them to discuss loan options and answer any questions they may have

- Analyze client credit information, income and assets to determine best loan options

- Negotiate with loan applicants to obtain the best terms and conditions available

- Review and verify loan application documents to ensure authenticity and accuracy

- Oversee loan transactions from origination to closing

- Keep clients informed of their loan status and changes in the mortgage industry

Education:

- Bachelor of Science in Business Administration, ABC University, 2010- 2014

- Diploma of Finance and Mortgage Brokerage, DEF College, 2014- 2015

Loan Officer Resume Examples Resume with No Experience

Recent college graduate with excellent communications, problem- solving and team- work skills seeking to serve as a Loan Officer. Equipped with a Bachelor’s degree in Business Administration and a passion for finance, I am eager to provide excellent customer service and to help bridge the gap between lenders and borrowers.

Skills and Abilities :

- Proficient in Microsoft Office Suite and customer service software

- Strong analytical skills

- Excellent written/verbal communication

- Attention to detail

- Organizational and multi- tasking ability

- Strong knowledge of banking regulations

- Ability to manage multiple loan applications

Responsibilities

- Assisting customers with loan applications, including collecting customer information and providing guidance

- Maintaining accurate customer records and loan documentation

- Analyzing loan applications and credit reports to determine risk levels

- Making loan decisions in compliance with banking regulations

- Negotiate loan terms and interest rates

- Coordinating with other loan officers and loan processors

- Ensure loan payments are made on time

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Officer Resume Examples Resume with 2 Years of Experience

I am a motivated and experienced Loan Officer with two years of experience in the banking industry. I have strong qualifications in customer service, sales and marketing, and loan origination and processing. I have a proven ability to work with both commercial and residential loan customers, and I have a track record of success in both sales and customer service. I am a team player who is passionate about helping people achieve their financial goals.

Core Skills:

- Customer Service

- Sales & Marketing

- Loan Origination

- Processing

- Commercial & Residential Loan Customers

- Relationship Building

- Problem Solving

- Financial Analysis

Responsibilities:

- Developed comprehensive financial plans for loan customers to meet their goals

- Analyzed financial data to determine eligibility and appropriate loan products

- Assessed creditworthiness of potential loan customers

- Originated, processed, and closed loans in compliance with regulatory requirements

- Negotiated loan terms and conditions with customers

- Maintained good relationships with customers by providing excellent customer service

- Participated in loan presentations and marketing activities to attract and retain loan customers

- Developed strategies to increase loan volume and profits

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Officer Resume Examples Resume with 5 Years of Experience

An experienced loan officer with over 5 years of experience in the financial sector. Possessing strong knowledge in the areas of loan processing, credit analysis and loan origination. Fully knowledgeable with the lending and banking regulations and regulations, and proven track record of success in assessing clients financial needs and providing solutions. Possessing excellent communication and interpersonal skills, able to build strong relationships with clients and ensure a quick and efficient loan process.

Core Skills:

- Financial Analysis

- Loan Origination

- Loan Processing

- Credit Analysis

- Banking Regulations

- Problem- Solving

- Interpersonal Communication

- Customer Service

- Negotiation

- Time Management

Responsibilities:

- Analyzing clients’ financial information to determine the best possible loan options available.

- Managing the loan process from start to finish, including loan application, loan approval, and funding.

- Collecting and verifying all necessary documents from clients and supporting their loan application process.

- Liaising with relevant parties such as banks, credit institutions, and clients to ensure the smooth processing of loan applications.

- Negotiating terms and conditions of a loan with clients and lenders.

- Ensuring compliance with federal and state laws in the loan process.

- Working closely with clients to determine their needs and provide solutions through loans.

- Keeping up- to- date with the changing banking regulations and industry trends.

- Providing excellent customer service to ensure a satisfactory experience for clients.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Officer Resume Examples Resume with 7 Years of Experience

An experienced Loan Officer with 7+ years of experience in underwriting, evaluating, and processing loans for financial institutions. Possessing a comprehensive understanding of loan products and regulations, including FHA, VA, and conventional mortgage loans. Adept at managing large loan portfolios, meeting deadlines, and effectively communicating with clients. Committed to providing excellent customer service and a high level of quality control.

Core Skills:

- Underwriting & Evaluation

- Portfolio Management

- Financial Analysis

- Regulatory Compliance

- Document Preparation

- Customer Service

- Loan Origination

- Risk Assessment

Responsibilities:

- Conduct detailed financial analysis and reviews of loan applicants

- Analyze credit reports and financial data to ensure accuracy and integrity

- Make decisions on loan approvals and denials based on credit and ability to repay

- Monitor loan portfolios for loan quality, delinquencies, and trends

- Ensure compliance with applicable regulations and guidelines

- Provide outstanding customer service in order to build relationships and increase loan production

- Assist in training and development of new loan officers

- Maintain up- to- date knowledge of loan regulations, products, and best practices

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Officer Resume Examples Resume with 10 Years of Experience

Dynamic and driven loan officer with 10 years of experience in providing customers with sound financial advice and assistance to facilitate the loan process. A record of success in meeting customer needs and target goals, combined with a comprehensive understanding of lending systems, procedures, and policies. Expert in credit analysis, loan structuring, and the ability to effectively negotiate loan terms. Highly organized and able to manage multiple projects simultaneously.

Core Skills:

- Credit Analysis

- Loan Structuring

- Negotiating Loan Terms

- Financial Advising

- Loan Processing

- Problem Solving

- Risk Assessment

- Regulatory Compliance

- Team Building

- Customer Service

Responsibilities:

- Assisted customers with financial decisions

- Analyzed credit history, capacity and collateral to determine loan eligibility

- Reviewed customer application information, loan documents, income and asset documents and credit reports

- Identified and evaluated customer risk and provided advice to protect customers

- Developed loan structures to meet customer needs

- Negotiated loan terms with customers

- Ensured accurate and timely processing of loan documents

- Ensured compliance with regulations and industry best practices

- Developed and maintained relationships with borrowers, professionals, and other stakeholders

- Ensured customer satisfaction throughout the loan process

- Built and maintained a positive team environment

- Trained and mentored junior loan officers

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Officer Resume Examples Resume with 15 Years of Experience

A highly experienced Loan Officer with 15+ years of experience in onboarding new customers, analyzing loan applications, and managing client accounts. Adept at utilizing risk management strategies and delivering exceptional customer service. Possesses a strong attention to detail and solid communication and problem- solving skills.

Core Skills:

- Loan origination

- Credit analysis

- Risk management

- Mortgage underwriting

- Financial analysis

- Client relations

- Regulatory compliance

- Microsoft Office

- Sales and marketing

Responsibilities:

- Interview and onboard new customers for loan applications.

- Accurately review and assess customer loan applications for accuracy and completeness.

- Analyze credit reports, income statements and other financial records to determine the customer’s ability to repay the loan.

- Ensure loan applications comply with all relevant regulatory requirements.

- Prepare loan documents and coordinate closing process.

- Monitor customer accounts to identify and resolve any delinquencies or defaults.

- Interact with customers to provide professional guidance throughout the loan process.

- Keep all loan records up to date and in compliance with company, industry, and government regulations.

- Develop and maintain relationships with business partners, lenders, investors, and other financial institutions.

- Assist with the preparation of marketing materials and promotional campaigns.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Officer Resume Examples resume?

bullet- A loan officer resume should begin with a summary or objective statement that outlines the candidate’s qualifications and experience working as a loan officer.

- The resume should then list the candidate’s professional experience, beginning with their most recent job. For each job, include the company name, job title, and dates of employment.

- Detail the duties and responsibilities associated with each job, such as interviewing loan applicants, analyzing credit histories and financial data, and approving or rejecting loan applications.

- List the educational qualifications and certifications the candidate holds, such as a degree in finance or banking, or a real estate license.

- Include any special skills or qualifications, such as knowledge of specific loan software systems or proficiency in foreign languages.

- Detail any extracurricular activities or volunteer experiences that demonstrate the candidate’s ability to work with people.

- Provide references from previous employers, clients, or colleagues.

What is a good summary for a Loan Officer Resume Examples resume?

A Loan Officer Resume Examples resume should be a concise summary of a candidate’s professional qualifications, skills, and accomplishments. It should provide an overview of the candidate’s experience and qualifications, highlighting the key strengths and capabilities that make the candidate a great fit for the role of a Loan Officer. It should also include any applicable education, training, and certifications that the candidate holds. The resume should demonstrate the candidate’s ability to accurately assess and evaluate loan applications and make sound decisions on loan approvals and rejections. Additionally, the resume should demonstrate the candidate’s ability to maintain current knowledge of loan regulations, industry trends, and financial products. Finally, the resume should showcase the candidate’s excellent customer service and communication skills, as well as their ability to foster positive and productive relationships with applicants, lenders, and other stakeholders.

What is a good objective for a Loan Officer Resume Examples resume?

A Loan Officer is responsible for managing a lending portfolio, reviewing loan applications, and approving funding. Writing an effective resume objective is an important part of creating a strong resume that will help you to stand out from other applicants. Here are some examples of good objectives for a Loan Officer Resume:

- Experienced Loan Officer with 5+ years of experience in the banking industry, seeking a position in a well-established organization to utilize skills in loan processing and customer service.

- Driven and organized Loan Officer offering proven experience in assessing loan applications, reviewing existing loan portfolios, and developing cooperative relationships with customers.

- Detail-oriented Loan Officer seeking position to leverage in-depth understanding of loan process and procedures as well as experience in loan origination, underwriting, and closing.

- Proactive Loan Officer with expertise in lending compliance and risk management, looking to leverage skill set and knowledge to foster growth in an established organization.

- Results-driven Loan Officer with extensive customer service and loan origination experience, seeking a position to provide innovative solutions and expertise that will promote the growth of the organization.

How do you list Loan Officer Resume Examples skills on a resume?

When you are applying for a job as a loan officer, it is important to list your relevant skills on your resume. This will help employers see that you possess the skills needed to successfully fulfill the role. Here are some of the key skills to include on your resume when you apply for a loan officer position:

- Financial Analysis: As a loan officer, you will need to have a strong understanding of how to analyze a person’s financial situation in order to determine if they qualify for a loan.

- Risk Assessment: You will also need to be able to assess the risk of a loan, and analyze any potential risks a borrower may pose.

- Negotiation: You will also need to be able to negotiate with potential borrowers to ensure that the terms of the loan are fair and beneficial for both parties.

- Financial Documentation: You will need to be familiar with all of the financial documentation that is involved in a loan, and be able to properly explain it to borrowers.

- Regulatory Compliance: In addition, you will need to be familiar with all of the regulations related to loans in your area, and be able to ensure that all loans are compliant with those regulations.

- Relationship Management: You will also need to be able to manage relationships with borrowers, lenders, and other stakeholders in order to ensure that the loan process runs smoothly.

By including these key skills on your resume, you will be better equipped to find a job as a loan officer. Make sure to emphasize any relevant experience you have that demonstrates your ability to use these skills. Good luck!

What skills should I put on my resume for Loan Officer Resume Examples?

A Loan Officer Resume is an important tool that provides potential employers with a comprehensive overview of your experience, qualifications, and skills. It also tells them about your ability to handle the responsibilities associated with being a Loan Officer. In order to create an effective Loan Officer Resume, it is important to highlight the skills and experiences that will be relevant for the job.

When creating a Loan Officer Resume, there are several skills that you should include to demonstrate your qualifications. These skills include:

-Financial Management: Loan Officers must be able to manage finances and accounts, including auditing and reconciling accounts, preparing financial reports, and creating budgets.

-Risk Management: Loan Officers must be able to take into account the risk associated with lending decisions and accounts. They must be able to identify, evaluate, and mitigate risks in order to make sound lending decisions.

-Customer Relations: Loan Officers must be able to build relationships with customers and be able to communicate effectively. This includes being able to identify customer needs, answer their questions, and provide solutions to their problems.

-Regulatory Compliance: Loan Officers must be familiar with the laws and regulations associated with lending, including the Fair Housing Act, the Equal Credit Opportunity Act, and the Truth in Lending Act.

-Problem Solving: Loan Officers must be able to think critically and solve problems quickly and efficiently in order to make sound lending decisions.

-Attention to Detail: Loan Officers must be able to pay close attention to detail to ensure accuracy and compliance.

Including these skills and experiences on your Loan Officer Resume is important for demonstrating your qualifications and capabilities. Be sure to include any additional skills and experiences that you may have that are relevant for the job to make your resume stand out.

Key takeaways for an Loan Officer Resume Examples resume

When you are applying for a loan officer job, it is essential to include the right information in your resume so that you can stand out from the competition. Loan officer resumes should be tailored to each job description you apply to and the skills and experience you possess. Here are some key takeaways for a loan officer resume examples resume:

Include relevant job experience: When creating your resume, it is important to make sure to include any relevant job experience you have. This could be anything from customer service experience to loan processing or collections. Focus on the skills that are specific to loan officers and demonstrate how you have used them in prior positions.

Highlight your technical skills: Many loan officers rely heavily on technology and automation in their day-to-day duties. Make sure to highlight any technical skills you have related to loan processing, such as working with loan origination software, automated underwriting systems, or other loan processing tools.

Demonstrate your problem-solving skills: As a loan officer, you will often have to find solutions to challenging issues. Demonstrate the problem-solving skills you have used in past positions and how you have been able to come up with innovative solutions to solve problems.

Include other relevant information: Loan officers often have to work closely with other departments, and you should include any other relevant experience you may have had in your resume. This could be anything from working with borrowers to understanding different loan products or working with compliance departments.

By following these key takeaways for creating a loan officer resume, you will be able to create an effective resume that showcases your skills and experience and help you stand out from the competition.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder