Writing a resume can be a daunting task, especially if you want to stand out from the other applicants. A loan modification specialist resume should highlight your knowledge of loan modification processes as well as your communication, negotiation and analytical skills. To help you create a standout resume, this guide will provide you with resume writing tips and loan modification specialist resume examples. With these examples and tips, you can create a resume that will help you stand out to potential employers.

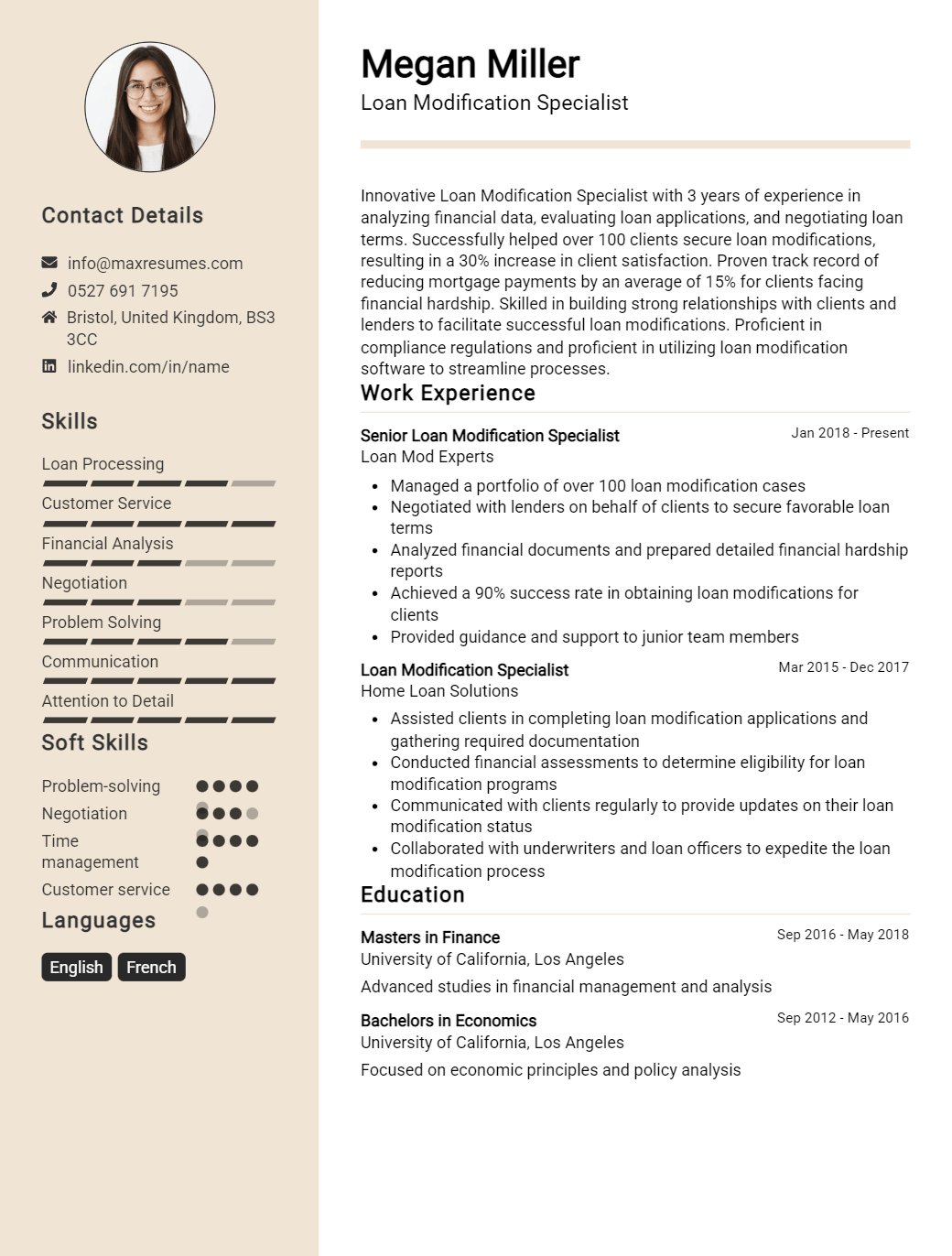

Loan Modification Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Modification Specialist Resume Examples

John Doe

Loan Modification Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly organized, analytical professional with more than six years of experience within the banking and loan modification industry. Possessing an in- depth knowledge of loan modification processes and procedures, together with an impressive ability to build strong relationships with clients. Experienced in providing in- depth guidance and support to clients in order to assist them in making informed decisions and achieve their financial goals.

Core Skills:

- Loan Modification Expertise

- Financial Analysis and Forecasting

- Problem Solving and Decision Making

- Excellent Communication and Interpersonal Skills

- Documentation and Record Keeping

- Knowledge of Compliance Regulations

- Process Improvement Techniques

Professional Experience:

Loan Modification Specialist, ABC Bank, 2016 – Present

- Offer professional consultation services to customers regarding loan modification processes, including options to refinance, modify or cancel loans.

- Analyze loan applications and determine eligibility requirements.

- Accurately calculate potential monthly payments based on individual circumstances.

- Assist customers in submitting complete and accurate loan modification paperwork.

- Provide assistance in negotiating loan modification terms with creditors.

- Ensure compliance with all applicable laws, regulations and policies.

- Monitor loan modification programs to ensure accuracy and timeliness.

Education:

Bachelor of Business Administration, ABC University, 2012 – 2016

Minor in Finance

Loan Modification Specialist Resume Examples Resume with No Experience

Loan Modification Specialist with no experience seeking an entry- level position to begin a career in the lending industry. Possesses strong knowledge of financial regulations and customer service skills, capable of adapting quickly to new processes and technologies.

Skills & Abilities:

- Proficient in customer service, including responding to phone and email inquiries

- Knowledgeable in financial regulations and policies related to loan modification

- Organized and detail- oriented approach to customer relations

- Excellent problem solving and analytical skills

- Ability to multi- task and prioritize tasks

- Strong verbal and written communication skills

- Proficient in Microsoft Office products

Responsibilities

- Assist customers through the loan modification process

- Provide clear and concise customer service

- Review financial documents to ensure accuracy and compliance with all regulations

- Provide timely and accurate customer updates throughout the loan modification process

- Answer customer inquiries in a timely and professional manner

- Maintain up- to- date records of customer interactions and loan modification status

- Collaborate with other departments to ensure a successful loan modification process

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Modification Specialist Resume Examples Resume with 2 Years of Experience

I am a Loan Modification Specialist with 2 years of experience in the banking industry. I am passionate about helping people and making a difference in their financial lives. I have great problem- solving skills, excellent customer service and communication abilities, strong attention to detail, and the ability to analyze and interpret financial documents. I am also proficient in using Microsoft Office programs.

Core Skills:

- Analyzing and interpreting financial documents

- Customer service and communication

- Microsoft Office programs

- Problem- solving skills

- Attention to detail

Responsibilities:

- Reviewing client’s financial situation and determining eligibility for loan modification

- Negotiating loan terms and repayment plans with lenders

- Explaining loan modification options to clients

- Assisting clients with the loan modification paperwork

- Keeping up to date with changes in the loan modification process and regulations

- Providing guidance and support to clients throughout the loan modification process

- Maintaining accurate records and documentation

- Resolving customer queries and complaints in a timely manner.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Modification Specialist Resume Examples Resume with 5 Years of Experience

To use my 5 years of customer service and loan modification experience in a customer- oriented Loan Modification Specialist role.

A results- oriented customer service professional with 5 years of experience in Loan Modification. Expertise in loss mitigation, financial analysis, and customer service. Possesses exceptional problem solving and multitasking skills. Proven ability to develop and maintain positive working relationships with customers, colleagues, and other stakeholders.

Core Skills:

- Loss Mitigation

- Financial Analysis

- Customer Service

- Problem Solving

- Multitasking

- Record Keeping

- Strong Attention to Detail

Responsibilities:

- Provided custom tailored solutions to customers’ loan modification inquiries

- Reviewed customer financial information and evaluated suitability for the program

- Performed detailed analysis of loan applications to ensure compliance with investor, state, and federal regulations

- Reviewed customer loan documents to verify accuracy and completeness

- Managed a high volume of customer inquiries in a timely and professional manner

- Maintained detailed customer records to ensure accuracy and compliance

- Identified areas of potential customer risk and provided customer solutions to address customer issues.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Modification Specialist Resume Examples Resume with 7 Years of Experience

Highly motivated and experienced Loan Modification Specialist with 7 years of experience working in the financial services sector. Experienced in providing customer service, restructuring loan documents, and analyzing financial data to provide solutions to customers. Possess excellent analytical, problem solving, and customer service skills. Effectively prepare and evaluate loan applications ensuring customer satisfaction and company compliance.

Core Skills:

- Organizational Skills

- Financial Analysis

- Customer Service

- MS Office

- Direct Loan Restructuring

- Loan Modifications

- Loan Negotiation

- Loan Documentation

Responsibilities:

- Analyze loan applications for accuracy and completeness.

- Conduct customer interviews to determine customer needs and loan requirements.

- Restructure loan documents to ensure customer satisfaction and company compliance.

- Negotiate loan terms and conditions with customers.

- Prepare and review loan documents.

- Provide customer service and follow up on loan applications.

- Conduct financial analysis on loan applications to determine the most feasible loan terms.

- Monitor customer accounts and track customer payments.

- Review customer credit reports and assess loan eligibility.

- Track loan modifications and ensure timely submission of documents.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Modification Specialist Resume Examples Resume with 10 Years of Experience

Loan Modification Specialist with 10 years’ experience in the mortgage loan industry. Expertise in loan modification services, delinquency management and debt resolution. Proven success in developing and executing strategies to reduce delinquency, increase payment collections and maximize delinquency reduction. A strong background in loan modification and debt resolution, backed by a commitment to providing excellent customer service.

Core Skills:

- Loan Modification

- Delinquency Management

- Strategic Planning

- Debt Resolution

- Loan Processing

- Customer Service

- Negotiations

- Data Analysis

- Risk Assessment

Responsibilities:

- Provide loan modification services to borrowers in need of assistance in addressing their delinquent mortgages.

- Negotiate payment plans and debt resolution strategies with borrowers to reduce delinquency and improve their chances of loan modification.

- Analyze loan data to identify borrowers that can benefit from loan modification.

- Develop and execute strategies to reduce delinquency, increase payment collections and maximize delinquency reduction.

- Review loan documents to ensure accuracy and compliance with regulations.

- Assist borrowers in completing loan modification applications and submitting required paperwork.

- Provide excellent customer service to borrowers and answer any questions regarding loan modification process.

- Conduct risk assessments to ensure loan modification strategies are successful.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Modification Specialist Resume Examples Resume with 15 Years of Experience

Highly experienced Loan Modification Specialist with over 15 years of experience in the field. Very knowledgeable in the process of loan modification, including the evaluation and processing of customer loan applications. Possesses strong financial and analytical skills, as well as great customer service skills. Capable of working in a fast- paced environment, and able to manage and prioritize multiple tasks at once.

Core Skills:

- Loan Modification Analysis

- Financial and Analytical Skills

- Customer Service

- Time Management

- Process Management

- Documentation

- Negotiation

Responsibilities:

- Evaluate loan modification requests and applications to determine customer eligibility for loan modification.

- Analyze customer’s financial documents to determine a payment plan or loan modification that best fits the customer’s needs.

- Communicate regularly with customers to ensure paperwork is completed accurately and on time.

- Negotiate with lenders to obtain loan modifications.

- Create and update customer profiles to keep track of the loan modification process.

- Respond to customer inquiries regarding loan modification processes.

- Process loan modification paperwork to completion.

- Prepare and present reports and financial statements on loan modification activity to management.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Modification Specialist Resume Examples resume?

When it comes to loan modification specialist positions, having a well-crafted resume is essential in standing out from the competition. In order to make sure your resume is up to par, here are some important items to include when creating a loan modification specialist resume:

- Professional Summary: In a few sentences, clearly convey your experience and skills related to the loan modification industry. It’s important to highlight your main qualifications and how your past work has prepared you for this job.

- Education: Include any degree or certifications you have related to loan modification.

- Experience: List out all of your past positions related to the field of loan modification. Include the company name, job title, start and end dates, and a brief description of your job duties.

- Skills: Include key skills that would be beneficial to a loan modification specialist. Some examples include knowledge of loan modification regulations, familiarity with loan modification software, and strong written and verbal communication skills.

- Achievements: If you have any notable achievements in the loan modification industry, list them here. This could include successfully negotiating loan modifications for clients, creating efficient loan modification processes, etc.

By including these items in your loan modification specialist resume, you will be able to present your credentials and make a strong impression on potential employers.

What is a good summary for a Loan Modification Specialist Resume Examples resume?

A Loan Modification Specialist Resume Examples resume should provide a comprehensive summary of one’s professional experience and qualifications that demonstrate the individual’s ability to work in the loan modification industry. It should include information on the individual’s experience in loan modification and foreclosure prevention, their familiarity with different loan products, their knowledge of the related legal and regulatory environment, and their ability to effectively negotiate with lenders. Additionally, it should feature an inventory of any relevant certifications, licenses, or coursework that may be beneficial to potential employers. Together, these elements should create a comprehensive picture of one’s abilities and experience, and be tailored to clearly and concisely showcase the individual’s strengths and contributions to the loan modification field.

What is a good objective for a Loan Modification Specialist Resume Examples resume?

A good objective for a Loan Modification Specialist Resume Examples resume is to demonstrate a commitment to helping clients in obtaining loan modification solutions that are within their financial means.

To accomplish this, an effective objective should include the following:

- Experienced in reviewing and analyzing loan modification requests

- Skilled in utilizing industry-specific software programs

- Proven ability to negotiate and secure loan modifications

- Ability to explain the complex loan modification process in a clear, concise manner

- Track record of helping clients meet their goals while staying within their budget

- Working knowledge of federal and state regulations regarding loan modifications

- Excellent communication skills and a commitment to customer service

- Ability to work in a fast-paced environment and manage multiple projects at once

How do you list Loan Modification Specialist Resume Examples skills on a resume?

bulletsWhen writing a resume as a loan modification specialist, it is important to emphasize the skills and qualities that will make you a successful professional. Your resume should be targeted toward the specific job you are applying for and should highlight the areas of expertise and qualifications that would be most beneficial to the position. While it can be difficult to know exactly what skills to include on your resume, here are some examples of skills that are beneficial for a loan modification specialist.

- Knowledge in Mortgage and Loan Processes: A loan modification specialist should have an in-depth knowledge of the mortgage and loan processes, including the ability to work with both lenders and borrowers.

- Attention to Detail: When working in the loan modification industry, attention to detail is key. Loan modification specialists must be able to review loan documents and make changes in a timely and accurate manner.

- Negotiation Skills: A loan modification specialist must have strong negotiation skills in order to reach agreements between lenders and borrowers. This includes being able to identify points of contention, present solutions, and effectively manage negotiations.

- Analytical Skills: Loan modification specialists must be able to analyze loan data and documents in order to identify potential solutions and make informed decisions.

- Communication Skills: A loan modification specialist must have excellent communication skills in order to be successful. This includes the ability to communicate effectively with lenders, borrowers, and other professionals in order to negotiate the best outcome for both parties.

By including these skills on your resume, you demonstrate to employers that you are a qualified and experienced loan modification specialist. It is important to remember to tailor your resume to the specific job you are applying for in order to make sure that your skills and qualifications are highlighted in the best possible way.

What skills should I put on my resume for Loan Modification Specialist Resume Examples?

or numberA Loan Modification Specialist handles requests from homeowners and lenders to modify a home loan to make repayment easier for the borrower. To work in this capacity, you will need to have a thorough understanding of the loan modification process, excellent customer service skills, and interpersonal skills. When writing your resume for a Loan Modification Specialist position, be sure to include the following skills:

- Knowledge of loan modification process: You should be able to explain the entire loan modification process to clients in an easy to understand manner, including the various types of loan modification programs and the steps involved in achieving a successful loan modification.

- Customer service skills: You need to have strong customer service skills to successfully handle inquiries from homeowners and lenders. Your ability to listen to their requests, provide accurate information, and help resolve issues is essential.

- Interpersonal skills: You must be able to communicate with clients and lenders in a professional manner. You should also be able to effectively manage relationships with clients and lenders to ensure a successful loan modification.

- Analytical skills: You should be able to analyze financial information and identify potential areas of improvement in the loan modification process.

- Negotiation skills: You must be able to negotiate with lenders to create a loan modification package that meets the needs of both parties.

- Computer skills: You should be comfortable using computers to access information and enter data. Knowledge of loan software programs is also useful for this position.

By highlighting these skills on your resume, you will demonstrate to potential employers that you are a qualified candidate for a Loan Modification Specialist role.

Key takeaways for an Loan Modification Specialist Resume Examples resume

When creating a resume as a Loan Modification Specialist, there are certain key takeaways that you should focus on. The goal is to create a resume that showcases your knowledge, skills, and experience in this field, as well as providing potential employers with a brief look at how you can help them. Here are some key takeaways for a Loan Modification Specialist Resume.

First and foremost, be sure to clearly highlight your relevant experience in the field. The more specific and detailed you can be, the better. List any previous positions you have held in loan modification, as well as any related job duties you have performed. Indicate any certifications or certifications you may have such as Fannie Mae/Freddie Mac Loan Modification Certification, or any other relevant certifications.

Be sure to draw attention to your strong communication and interpersonal skills. Working with clients in the loan modification field requires excellent communication and interpersonal skills. Showcase your ability to build relationships and liaise with clients, as well as your ability to listen and understand their needs.

Finally, highlight any technical skills you may have. Loan modification specialists need to be familiar with different software programs and platforms. Demonstrate your knowledge of these programs and platforms, as well as any other related software and technology.

By focusing on these key takeaways, you can create an effective resume that will put you in the best position to land a job as a loan modification specialist. Make sure to showcase your unique skills and experience to stand out from the competition.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder