When you are applying for a loan manager position, having a well-crafted resume is essential to stand out from the competition. As a loan manager, you are responsible for managing lending services, working with credit analysis, evaluating loans, and dealing with customers. Crafting the perfect resume can help you get the job you want, so it’s important to focus on the important aspects of your experience and qualifications. In this blog post, you will find a complete guide to writing a loan manager resume along with some examples. With the help of this guide, you can create a resume that will make a positive impression on the hiring manager and increase your chances of getting the job.

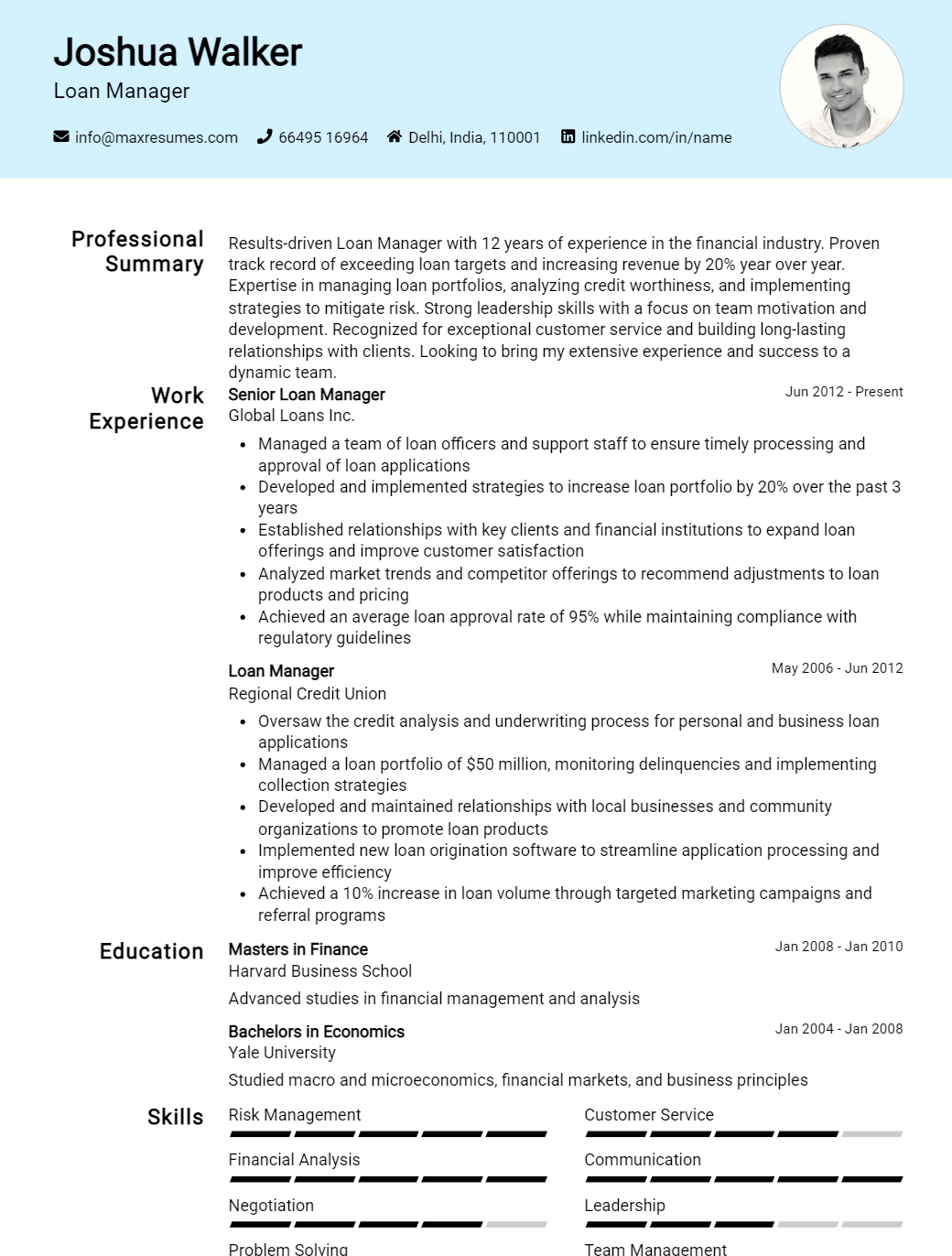

Loan Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Manager Resume Examples

John Doe

Loan Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a Loan Manager with over 5 years of experience in financial services. My expertise includes loan origination, loan processing, underwriting and closing, as well as my ability to develop and maintain a strong rapport with customers. I am a highly organized and detail- oriented individual who possesses strong communication and interpersonal skills. I am confident in my ability to drive loan volume, quality, and customer satisfaction.

Core Skills:

- Loan Origination & Processing

- Underwriting & Closing

- Risk & Compliance Management

- Customer Relationship Building

- Financial Analysis & Reporting

- Loan Portfolio Management

- Loan Documentation

- Credit Analysis & Approval

Professional Experience:

Loan Manager, ABC Bank – New York, NY

- Managed and monitored loan origination, processing, underwriting and closing activities.

- Identified opportunities for loan portfolio growth and risk mitigation.

- Developed and maintained strong relationships with customers, providing them with tailored loan solutions.

- Analyzed financial statements, credit reports and other documents to evaluate customer creditworthiness.

- Ensured compliance with relevant banking regulations, policies and procedures.

Loan Officer, XYZ Financial – New York, NY

- Originated and processed mortgage, business and consumer loans.

- Developed marketing strategies and tactics to engage potential customers.

- Conducted credit reviews and analyzed personal financial statements.

- Monitored loan closing activities and approved loan documents.

Education:

Bachelor of Science in Finance, New York University – New York, NY

Loan Manager Resume Examples Resume with No Experience

Highly motivated and experienced Loan Manager with a proven track record of successfully working with clients to effectively manage financial needs. Expert in loan origination, underwriting, and troubleshooting. Strong financial analysis and problem- solving skills.

Skills:

- Loan Origination

- Underwriting

- Financial Analysis

- Problem- Solving

- Client Relations

- Time Management

- Loan Processing

Responsibilities:

- Originating and underwriting loans for customers

- Reviewing loan applications for accuracy and completeness

- Processing loan documents, such as title documents and loan applications

- Analyzing credit reports and evaluating credit applications

- Verifying financial information and ensuring compliance with laws and regulations

- Reviewing loan agreements and ensuring they meet applicable laws and regulations

- Contacting clients to discuss payments and payment plans

- Maintaining records of loan activities and updates

- Handling customer inquiries and complaints

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Manager Resume Examples Resume with 2 Years of Experience

Professional Loan Manager with 2 years of experience in providing financial services to members of the community. Experienced in loan processing, risk analysis, and portfolio management. Skilled in helping clients secure the best loan options. Committed to providing excellent customer service and maintaining optimal loan profitability.

Core Skills:

- Loan processing

- Risk management

- Credit analysis

- Portfolio management

- Financial modeling

- Customer service

- Communication

Responsibilities:

- Reviewed applications, credit reports, and other financial documents to determine loan eligibility

- Analyzed credit history, debt- to- income ratio, and other financial information to assess risk

- Processed loan applications, including verifying all necessary documentation

- Negotiated loan terms to ensure profitable loan portfolio

- Evaluated loan applications and proposed financing solutions for clients

- Developed and maintained relationships with borrowers and lenders

- Monitored loan performance and worked with borrowers to ensure timely payments

- Ensured compliance with state and federal regulations and laws.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Manager Resume Examples Resume with 5 Years of Experience

A highly organized and efficient Loan Manager with five years of experience in providing financial services and loan/credit services. Skilled in conducting loan/credit evaluations, risk analysis, and loan/credit processing. Utilizes excellent customer service and communication skills to build strong relationships with customers and stakeholders. Possesses a strong knowledge of lending policies, financial regulations and compliance requirements.

Core Skills:

- Risk Analysis

- Loan/Credit Processing

- Regulatory Compliance

- Financial Services

- Customer Service

- Document Preparation

- Relationship Building

- Loan/Credit Evaluation

- Negotiation

- Problem Solving

Responsibilities:

- Conducted loan/credit evaluations and risk analysis.

- Developed and executed loan/credit processing plans.

- Developed and maintained relationships with customers and stakeholders.

- Ensured compliance with internal policies, external regulations and guidelines.

- Evaluated loan/credit applications and made decisions accordingly.

- Prepared and maintained loan/credit documents.

- Negotiated loan/credit terms and conditions.

- Reviewed and updated loan/credit policies and procedures.

- Resolved customer complaints and disputes in a timely and efficient manner.

- Provided advice and recommendations to customers on loan/credit options and strategies.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Manager Resume Examples Resume with 7 Years of Experience

Highly accomplished Loan Manager with seven years of experience in the financial services industry. Expert in loan origination, underwriting, and portfolio management with in- depth knowledge of banking regulations. Proven success in developing and overseeing processes to ensure quality standards, compliance with regulations, and customer satisfaction. Skilled in building and maintaining relationships with clients, managing accounts and resolving customer issues.

Core Skills:

- Loan Origination

- Underwriting

- Portfolio Management

- Banking Regulations

- Process Development and Oversight

- Quality Assurance

- Client Relationship Building and Maintenance

- Account Management

- Problem Resolution

Responsibilities:

- Developed loan origination and underwriting policies and procedures to maintain compliance with all applicable regulations

- Reviewed and approved or denied loan applications based on evaluation of credit, collateral, and other criteria

- Managed a portfolio of loans to ensure that all accounts were current and in compliance with regulations

- Monitored customer accounts to identify any changes in credit risk or collateral value

- Developed customer relationships to generate referrals and new business

- Resolved customer inquiries and worked to resolve any conflicts or issues

- Ensured quality standards and customer satisfaction through efficient and effective service

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Manager Resume Examples Resume with 10 Years of Experience

Dynamic and versatile Loan Manager with 10 years of experience in the mortgage and banking industry. Experienced in all aspects of the loan process, from loan origination, credit analysis and underwriting, to loan servicing and collections. Proven track record developing best practices, strategies and procedures to ensure compliance. Demonstrated expertise in building relationships with customers, lenders and other stakeholders.

Core Skills:

- Mortgage & banking industry experience

- Loan origination, credit analysis & underwriting

- Loan servicing & collections

- Compliance best practices

- Relationship building & customer service

- Strong communication & organizational skills

- Strategic problem- solving & decision- making

Responsibilities:

- Managed the loan process from origination to closing, including loan servicing and collections.

- Analyzed loan applications, credit reports and other financial documents for completeness, accuracy, and compliance with lending regulations.

- Reviewed loan documentation for quality control and regulatory compliance.

- Developed and implemented procedures to ensure compliance with federal and state laws.

- Conducted customer interviews to obtain information required for loan applications.

- Reviewed loan applications for accuracy and completeness and processed loan modifications.

- Reviewed closed files for accuracy and completeness and managed loan portfolio.

- Responded to customer inquiries and escalated complex inquiries to higher levels.

- Negotiated repayment terms and loan modifications to reduce delinquency.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Manager Resume Examples Resume with 15 Years of Experience

A highly skilled and experienced Loan Manager with 15 years of experience in the financial services industry. Proven track record of success in developing loan portfolios and leveraging complex financial analysis to assess credit worthiness of applicants. Possesses excellent customer service and negotiation skills, with the ability to assess risk and develop effective loan terms. Has a comprehensive understanding of market trends and regulations, and the ability to provide sound financial advice.

Core Skills:

- Loan Portfolio Management

- Financial Analysis

- Credit Risk Assessment

- Negotiation

- Risk Analysis

- Regulatory Compliance

- Financial Advice

- Market Trends

- Customer Service

- Data Entry

Responsibilities:

- Develop and manage loan portfolios for customers based on individual financial needs and risk assessment.

- Perform financial analysis and credit risk assessment to assess creditworthiness of loan applicants.

- Negotiate loan terms and advise customers on loan products.

- Analyze risk associated with loan products and propose strategies to mitigate risk.

- Ensure compliance with federal and state laws, as well as internal policies and procedures.

- Provide sound financial advice to customers regarding loan products and market trends.

- Maintain customer relationships and provide excellent customer service.

- Input customer information into loan system and review loan documents.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Manager Resume Examples resume?

A Loan Manager is responsible for managing loan portfolios and overseeing the loan process. A Loan Manager Resume should highlight qualifications such as salesmanship, financial expertise, strong communication, problem-solving, and organization skills. Here are some examples of what to include in a Loan Manager Resume:- Education: Include any bachelor’s or master’s degree in finance, economics, accounting, or management.

- Relevant Experience: Include any past experience in sales, loan underwriting, loan processing, loan origination, loan servicing, or loan management.

- Technical Skills: Include any technical skills related to loan management such as loan systems, loan origination software, and database management.

- Personal Skills: Include any personal skills related to loan management such as customer service, communication, organization, and problem-solving.

- Professional Certifications: Include any certifications that are relevant to loan management such as Certified Mortgage Banker (CMB) or Certified Credit Professional (CCP).

By showcasing your qualifications and relevant experience, you can create a Loan Manager Resume that will make you stand out to employers.

What is a good summary for a Loan Manager Resume Examples resume?

A loan manager resume should highlight an individual’s experience and qualifications in handling loan applications, processing customer loan requests, approving loans, and developing and implementing loan policies. A loan manager should demonstrate an understanding of financial products, credit risk management, and customer service. In addition, the loan manager must have strong communication and interpersonal skills.

The resume should begin with a strong summary that provides an overview of the individual’s qualifications and experience. This summary should include the loan manager’s qualifications such as any degrees or certifications they may possess as well as relevant experience in the loan industry. It should also include any special skills such as knowledge of financial analysis or credit risk analysis.

The summary should also include relevant accomplishments such as successful loan applications, customer satisfaction, any awards or recognition received, or any innovative solutions implemented. It should also provide the loan manager’s commitment to customer service and their ability to work well under pressure.

Overall, a loan manager’s resume should provide a comprehensive summary of the individual’s qualifications, experience, and accomplishments. It should demonstrate their ability to handle loan applications, process customer requests, approve loans, and develop and implement loan policies. It should also highlight any special skills and accomplishments that make the loan manager an ideal candidate for the position.

What is a good objective for a Loan Manager Resume Examples resume?

A Loan Manager is responsible for overseeing, approving and processing loan applications for individuals or businesses. An effective Loan Manager should have a solid understanding of all loan types, as well as a thorough knowledge of the financial industry. Crafting a well-written and informative Loan Manager resume is key to landing a job in this fast-paced and competitive field.

When creating an objective statement for your Loan Manager resume, it is important to consider the needs of the company you are applying to. Here are some examples of good objectives for a Loan Manager resume:

- To use my expertise in loan processing and financial industry knowledge to help grow the business and ensure quality service to customers.

- Seeking a Loan Manager position where I can use my strong financial analysis and management skills to maximize profits.

- Looking to leverage my expertise in loan processing and risk assessment to ensure the successful approval of loan applications.

- Seeking a Loan Manager role where I can utilize my experience in customer service and loan operations to help the company reach its goals.

- To acquire a Loan Manager role where I can use my knowledge of loan procedures and policy to lead a team of loan officers.

- Seeking a Loan Manager position where I can apply my experience in financial management to streamline operations and optimize customer service.

How do you list Loan Manager Resume Examples skills on a resume?

When writing a loan manager resume, it is important to list key skills that are relevant to the job. Loan managers must possess a wide range of skills in order to be successful, so employers are looking for resumes that demonstrate these skills. Here are some of the top skills to include on a loan manager resume:

- Regulatory Compliance: Loan managers must understand and adhere to all regulatory compliance laws. This includes being up-to-date on all federal, state, and local regulations related to loan management.

- Accounting and Financial Analysis: Loan managers must be able to analyze financial reports and interpret loan documents. They must also be able to develop and implement financial strategies for the organization.

- Loan Administration: Loan managers must understand how to structure loans to meet the needs of the borrowers, as well as address any problems with loan administration.

- Risk Management: Loan managers must be able to assess and identify potential risks associated with loan transactions and develop appropriate strategies to limit potential losses.

- Customer Service: Loan managers must be able to build relationships with customers and handle customer complaints in a professional manner.

- Negotiation: Loan managers must be able to negotiate loan terms with customers and lenders in order to ensure the best outcomes for their organization.

- Problem-Solving: Loan managers must be able to think critically and come up with solutions to complex problems related to loan transactions.

By including these skills on your resume, you can demonstrate that you have the qualifications and experience needed to excel as a loan manager.

What skills should I put on my resume for Loan Manager Resume Examples?

A Loan Manager is responsible for managing loan processes and providing financial advice to loan applicants. As such, a well-written Loan Manager resume should include mention of certain key skills and qualifications. Here are some skills and qualifications that should be included on a Loan Manager resume:

- Extensive knowledge of loan products and lending regulations: Loan Managers must have a thorough understanding of loan products, lending regulations, and credit analysis techniques.

- Financial analysis and problem-solving skills: Loan Managers must be able to analyze financial statements and make informed decisions. Additionally, they must have strong problem-solving skills to address any issues that arise during the loan process.

- Excellent communication skills: Loan Managers must have excellent written and verbal communication skills in order to effectively communicate with loan applicants, lenders, and other stakeholders.

- Time management and organizational skills: Loan Managers must be able to manage their time efficiently and keep organized records throughout the loan process.

- Knowledge of financial software: Loan Managers should have knowledge of financial software and be comfortable using it to analyze loan requests.

By including each of these skills and qualifications on your Loan Manager resume, you will be able to show potential employers that you are the right candidate for the job.

Key takeaways for an Loan Manager Resume Examples resume

A Loan Manager resume should include a few key takeaways that demonstrate your ability to manage the loan process. Here are a few points to consider when crafting your resume:

- Highlight your experience in managing loan processes. Include details such as the number of loans you have managed, the amount of money you have managed, and the types of loans you have managed. When possible, provide examples of successful loans you have managed.

- Demonstrate your knowledge of lending laws and regulations. Employers want to know you are well-versed in the applicable regulations and laws that regulate the loan process.

- Showcase your ability to develop relationships with clients. Many times, loan managers must be able to build trust and rapport with potential borrowers to successfully assist them with a loan.

- Stress your excellent communication and organizational skills. Loan managers often help customers throughout the loan process and must be organized and able to effectively communicate.

- Highlight your success in managing loan closings. Loan managers must be able to manage the loan closing process from start to finish.

These key takeaways can help you craft an effective Loan Manager resume that showcases your qualifications and experience in this field.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder