If you are looking to become a Loan Document Specialist, then you are in luck. Writing a resume can be a daunting task but with the right guidance, you can craft a resume that is sure to stand out. This guide will provide you with tips, tricks, and examples to help you create a professional and convincing Loan Document Specialist resume. The guide will cover topics such as formatting, language, and proofreading, and will provide sample Loan Document Specialist resumes to help you get started. With the information provided in this guide, you will be able to create a powerful and effective resume that will help you secure the job of your dreams.

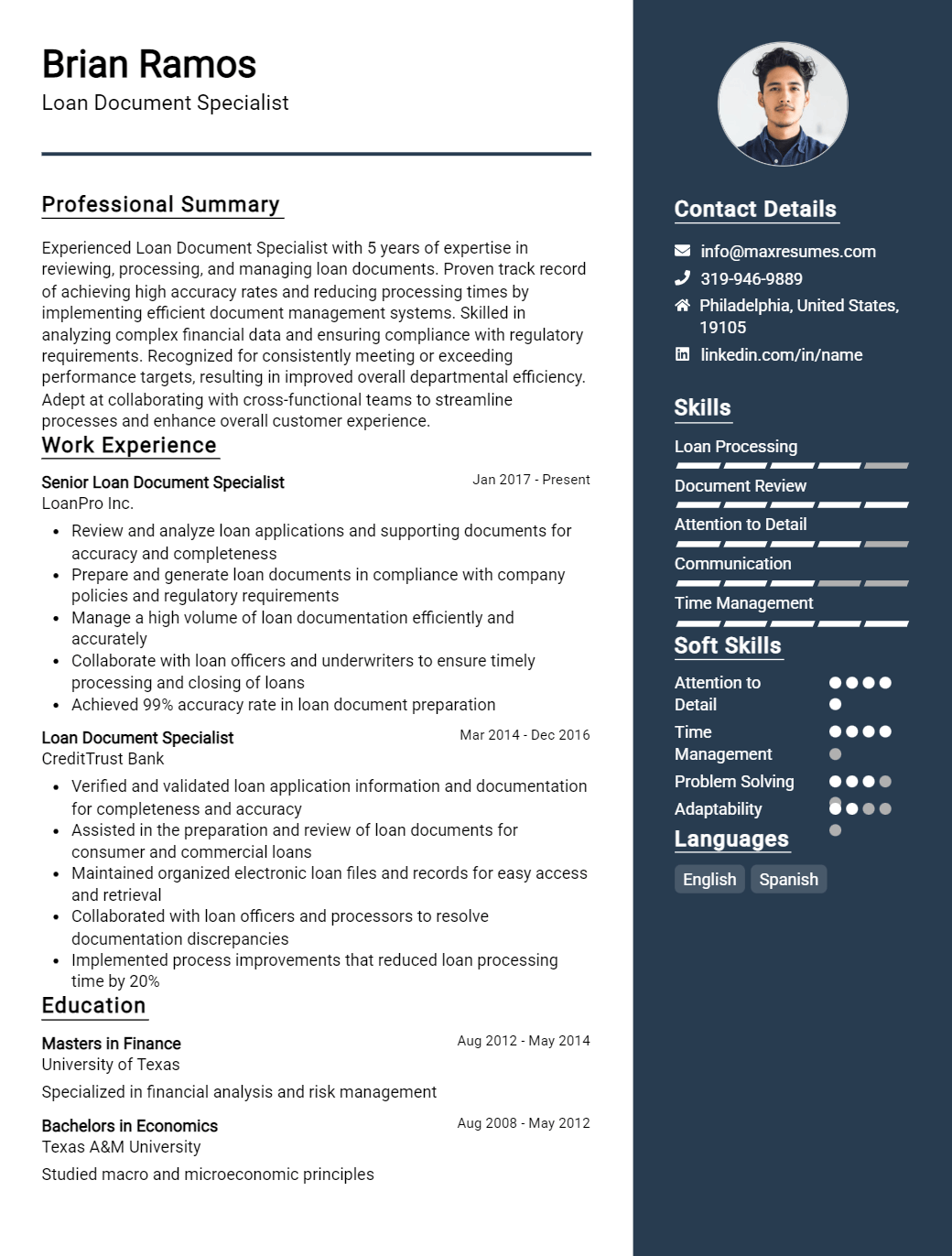

Loan Document Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Document Specialist Resume Examples

John Doe

Loan Document Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A dedicated and organized Loan Document Specialist with 5+ years of experience in the financial services industry. Skilled in processing loan documents accurately and efficiently, as well as delivering excellent customer service. Adept at using loan document software to create and manage loan documents and possess an in- depth knowledge of the loan document process. Highly organized, communicative, and detail- oriented with a commitment to meeting deadlines.

Core Skills:

- Loan Document Processing

- Loan Document Software

- Customer Service

- Data Entry

- Attention to Detail

- Time Management

- Problem Solving

- Organizational Skills

Professional Experience:

Loan Document Specialist, ABC Bank – Anytown, US

May 2019 – Present

- Review loan documents for accuracy and completeness prior to processing

- Create and manage loan documents using loan document software

- Monitor loan document status and review documents for compliance

- Respond to customer inquiries and provide excellent customer service

- Ensure documents are processed in a timely manner and meet deadlines

- Verify loan information and documents to ensure accuracy

- Assist with loan document preparation and filing

Loan Document Processor, XYZ Bank – Anytown, US

April 2017 – April 2019

- Processed loan documents accurately and efficiently

- Responded to customer inquiries regarding loan documents

- Performed data entry for loan documents

- Ensured accuracy of loan documents and compliance with regulations

- Updated loan information as needed

- Verified loan documents for accuracy and completeness

- Managed loan document processing and filing

Education:

Bachelor of Science in Accounting, Anytown University – Anytown, US

Graduated May 2017

GPA: 3.5

Loan Document Specialist Resume Examples Resume with No Experience

- Recent college graduate with experience in customer service, banking, and a strong desire to work in the field of finance.

- Demonstrated passion for data entry and record keeping, with a keen eye for detail.

- Excellent multitasking abilities, ability to prioritize tasks, and dedication to meeting deadlines.

Skills:

- Proficient in Microsoft Office Suite, particularly Excel

- Excellent customer service and communication skills

- Strong problem- solving skills

- Ability to quickly learn new software and systems

- Strong organizational and time- management skills

Responsibilities:

- Verify accuracy of loan documents

- Organize and store loan documents in an organized manner

- Enter loan information into computer databases

- Maintain loan records and databases

- Monitor and update loan accounts

- Communicate with customers regarding loan status and documents

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Document Specialist Resume Examples Resume with 2 Years of Experience

Highly organized and detail- oriented Loan Document Specialist with over two years of experience in the mortgage industry. Specializing in loan closing and document preparation, with a strong knowledge of loan compliance and regulations. Excelling in the completion of loan application packages, and proficient in the use of multiple loan processing software. Passionate about providing accurate and quality loan documents that meet the needs of lenders and borrowers.

Core Skills:

- Loan Closing & Document Preparation

- Loan Compliance & Regulations

- Loan Application Packages

- Loan Processing Software

- Quality Assurance & Quality Control

- Problem Solving & Analytical Thinking

- Time Management & Organization

Responsibilities:

- Preparing loan documents in accordance with loan requirements and lender guidelines

- Obtaining and reviewing required documents from borrowers, lenders, and other third parties

- Ensuring data accuracy in loan documents and loan packages

- Completing loan packages with appropriate signatures and notarizations

- Liaising with lenders, borrowers, and other third parties to answer questions and provide document updates

- Performing quality assurance and quality control on loan documents and packages

- Conducting loan reviews to ensure compliance with lender regulations and standards

- Staying up- to- date on federal, state, and local regulations as they relate to loan documents

- Implementing process improvements to ensure efficient document preparation and review.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Document Specialist Resume Examples Resume with 5 Years of Experience

Dedicated Loan Document Specialist with 5 years of experience in the banking and financial services industry. Experienced in all aspects of loan document preparation and verification, client servicing, and loan closing. Proficient in Microsoft Office Suite and loan origination systems. Committed to delivering excellent customer service and providing quality work to meet all customer needs.

Core Skills:

- Knowledge of banking and financial services

- Proficient in Microsoft office suite

- Ability to analyze and process loan documents

- Client servicing and loan closing experience

- Strong customer service skills

Responsibilities:

- Verified documents for accuracy and completeness prior to loan closing

- Monitored changes in loan documentation to ensure compliance with regulations

- Ensured customer satisfaction by responding to inquiries and resolving customer disputes

- Executed loan closing process, including preparation of loan documents and disbursement of funds

- Utilized loan origination systems to process and track loan applications

- Updated loan documents to ensure accuracy and compliance with regulations

- Handled customer calls and inquiries related to loan documents

- Assisted customers in understanding and filling out loan application forms

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Document Specialist Resume Examples Resume with 7 Years of Experience

A highly organized and efficient Loan Document Specialist with 7 years of experience in the financial industry. Adept at evaluating loan applications, analyzing financial information and coordinating loan agreements. Proven track record of managing loan operations and ensuring compliance with governmental regulations. Possess good communication, time management and multitasking abilities.

Core Skills:

- Loan Document Preparation

- Regulatory Compliance

- Credit Underwriting

- Loan Processing

- Risk Analysis

- Financial Record Keeping

- Conflict Resolution

- Loan Origination

Responsibilities:

- Analyzed loan applications to ensure all required documents were provided, verified accuracy and completeness of information and determined credit worthiness of applicants.

- Ensured loan documents were prepared correctly and adhered to federal, state and local regulations.

- Reviewed financial statements, credit reports, tax returns and other related documents to accurately evaluate loan applications.

- Prepared loan documents such as promissory notes, loan agreements, collateral mortgages and disclosure statements.

- Updated and maintained accurate loan records and performed periodic audits to ensure compliance with regulations.

- Researched customer accounts for discrepancies and assisted with resolution of discrepancies.

- Collaborated with loan officers and external customers to verify accuracy and completeness of documentation.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Document Specialist Resume Examples Resume with 10 Years of Experience

Experienced Loan Document Specialist with 10+ years of experience in the mortgage industry. Proven ability to accurately process loan documents while meeting strict deadlines. Skilled in loan underwriting, preparing closing documents, and researching title documents. Thorough understanding of appraisal reviews, regulations, and loan processing policies. Excellent problem- solving, customer service and interpersonal skills.

Core Skills:

- Loan Document Preparation

- Loan Underwriting

- Title Research

- Appraisal Reviews

- Loan Processing Policies

- Problem- solving

- Customer Service

- Interpersonal Skills

Responsibilities:

- Prepare and process all loan documents in accordance with company and regulatory guidelines

- Perform loan underwriting to assess borrowers’ creditworthiness and financial stability

- Research, review and audit title documents to ensure accuracy and completeness

- Monitor and evaluate appraisal reviews for accuracy and completeness

- Review loan documents for accuracy and compliance with company and regulatory policies

- Independently resolve customer service inquiries and complaints

- Maintain up- to- date knowledge of mortgage industry regulations and standards

- Create and maintain detailed loan files for future reference

- Train and mentor new loan document specialists

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Document Specialist Resume Examples Resume with 15 Years of Experience

Experienced Loan Document Specialist with 15 years of hands- on experience in preparing loan documents and closing loan transactions. Expert in analyzing credit and financial information, reviewing contracts and agreements, and updating loan records. Highly organized and detail- oriented in meeting deadlines and exceeding customer expectations.

Core Skills

- Loan Processing

- Credit Analysis

- Loan Documentation

- Contract Review

- Loan Closing

- Customer Service

- Data Entry

- Problem Resolution

Responsibilities

- Verified loan documents for accuracy and completeness

- Analyzed credit, income, and asset information when underwriting loans

- Reviewed loan contracts and agreements for accuracy, completeness, and compliance with all relevant laws and regulations

- Ensured all loan documents met necessary legal requirements for signing

- Served as a liaison between customers, lenders and other financial institutions

- Assisted in loan closing and post- closing tasks

- Processed loan modifications and extensions

- Updated loan records and databases with applicable information

- Resolved customer inquiries related to loan processing and closing

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Document Specialist Resume Examples resume?

A Loan Document Specialist Resume should be tailored to the specific position and company. It should showcase the candidate’s qualifications and expertise in loan document preparation, and emphasize their experience and knowledge in the industry. Here are a few tips to help you create a comprehensive Loan Document Specialist Resume:

- Include a well-written summary that highlights your professional career and expertise.

- List all relevant job experience and accomplishments in reverse-chronological order. Include job titles, dates of employment, and a brief description of each position.

- Include any special certifications or training related to loan document preparation that you’ve completed.

- Include a list of technical skills related to loan document preparation, such as data entry, filing, and formatting documents.

- Include any relevant awards and recognition you’ve received related to loan document preparation.

- Demonstrate your mastery of any software programs or databases related to loan document preparation.

- List any professional organizations or associations you’re a member of related to loan document preparation.

- Include any volunteer experience related to loan document preparation that you have.

- Include a list of any publications or presentations related to loan document preparation that you’ve made.

- Demonstrate your commitment to professional development by listing any continuing education classes related to loan document preparation that you’ve taken.

- Include any additional qualifications or special skills related to loan document preparation that you have.

What is a good summary for a Loan Document Specialist Resume Examples resume?

A Loan Document Specialist resume should highlight a candidate’s ability to prepare, review, and process loan documents for accuracy and compliance. The ideal resume will showcase a candidate’s strong understanding of the banking industry, excellent organizational skills and attention to detail, and a working knowledge of loan processing software and other financial tools. An effective resume should also include a summary of qualifications that demonstrate the applicant’s expertise in banking regulations and compliance, as well as their ability to work effectively with other team members.

What is a good objective for a Loan Document Specialist Resume Examples resume?

A good objective for a Loan Document Specialist Resume Examples resume should focus on the applicant’s experience and qualifications. The objective should demonstrate the applicant’s knowledge of loan document processing and their ability to manage all related tasks. A Loan Document Specialist should be knowledgeable, organized and efficient.

A good objective for a Loan Document Specialist Resume Examples resume should include:

-Demonstrate knowledge of loan document processing and related tasks

-Showcase ability to manage loan document processing in an efficient and organized manner

-Highlight experience in the loan document processing industry

-Display a commitment to accuracy and timely completion of tasks

-Prove ability to successfully communicate with loan document representatives, customers and other stakeholders

-Ability to represent the team professionally and positively

How do you list Loan Document Specialist Resume Examples skills on a resume?

.

A loan document specialist resume should showcase a wide range of abilities that demonstrate the candidate’s familiarity with loan documents and related financial services. To ensure your resume stands out among other candidates, be sure to include the following skills:

- Knowledge of loan documents and services: A loan document specialist should have a comprehensive understanding of loan documents, including but not limited to, promissory notes, security agreements, and other related documents.

- Accounting and bookkeeping: A loan document specialist is often required to work with financial data, so it is important to include any accounting and bookkeeping experience in a resume.

- Computer software: Most loan document specialists need to work with computer software, such as Microsoft Office, in order to access and review loan documents.

- Attention to detail: Because loan documents can have major financial implications, it is important for loan document specialists to pay close attention to detail when reviewing loan documents.

- Customer service: A loan document specialist should have strong customer service skills. This means being able to handle customer inquiries and complaints in a professional manner.

- Communication: Finally, loan document specialists need to be able to communicate clearly and effectively with clients and colleagues. This means having excellent written and verbal communication skills.

What skills should I put on my resume for Loan Document Specialist Resume Examples?

A loan document specialist is a financial professional who is responsible for making sure that loan contracts and documents are completed accurately and properly. A successful loan document specialist resume should demonstrate a candidate’s ability to review and understand complex financial documents, as well as their ability to adhere to all regulations and laws regarding loan documents. When crafting your resume, it’s important to showcase the skills that make you successful in this field. Here are some skills to consider including in a loan document specialist resume:

-Experience with loan documents: A strong loan document specialist should be highly knowledgeable and experienced with loan documents and should be able to explain the details and significance of each document.

-Attention to detail: A loan document specialist must pay close attention to detail and must be able to spot any potential errors or discrepancies.

-Organization: A loan document specialist must be highly organized to ensure that loan documents are completed accurately and on time.

-Research: A loan document specialist must have strong research skills to ensure that documents are accurate and compliant with all applicable laws and regulations.

-Communication: A loan document specialist must have strong communication skills in order to effectively interact with other professionals and team members.

-Computer proficiency: A loan document specialist must be proficient in using various computer programs and software to manage loan documents.

By making sure to include these skills on your resume, you can be sure that potential employers will have the information they need to evaluate your qualifications for the loan document specialist position.

Key takeaways for an Loan Document Specialist Resume Examples resume

When you are putting together your resume as a loan document specialist, there are a few key takeaways that you need to keep in mind.

First, make sure you list any specialized skills or experience that you have that are relevant to the job. This could include experience with loan document processing software, a strong understanding of banking regulations, or any other related skills that you possess.

Next, make sure that you highlight any relevant achievements that you have had in the past. Any awards or accolades that you have earned in the past can be great additions to your resume, as they demonstrate that you are capable of providing top-notch customer service and meeting deadlines.

Finally, make sure that you include any contact details that you may have. This could include your email, phone number, and address. This information can be very helpful for potential employers, as it allows them to contact you easily if they have any further questions.

By following these key takeaways, you can make sure that your resume as a loan document specialist stands out from the competition. With a well-crafted resume, you can improve your chances of getting the job you want.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder