Creating a resume can be an overwhelming task, but with the right guidance and resources, you can craft a resume that will get you noticed. If you’re a loan consultant looking for work, you will need to put together an effective and professional resume that highlights your skills and qualifications. This guide will provide you with resume examples and tips to make sure your resume stands out from the competition. With the right information, you will be able to create a resume that reflects your unique experience as a loan consultant, increases your chances of landing an interview, and helps you reach your career goals.

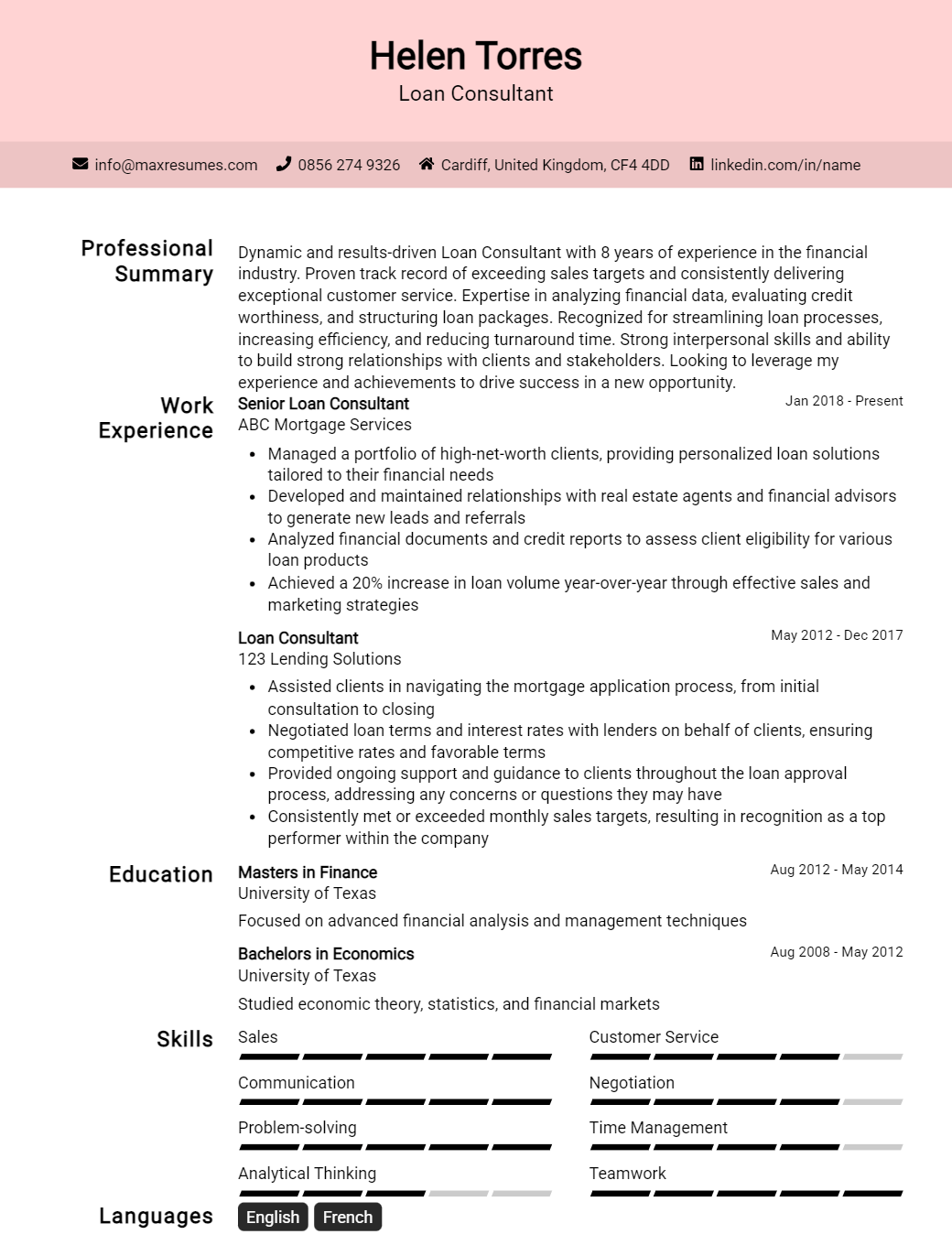

Loan Consultant Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Consultant Resume Examples

John Doe

Loan Consultant

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a Loan Consultant with 12 years of experience in the banking and financial industry. I specialize in providing clients with tailored loan advice and facilitating smooth loan processing and approval. I have extensive knowledge of the banking system, loan procedures and regulations. I am also well- versed in customer service and assessment of financial history and credit worthiness. I am a team player, highly organized, and have the ability to handle multiple tasks at the same time.

Core Skills:

- Loan Processing and Approval

- Banking and Financial Industry

- Credit Assessment

- Client Relationship Management

- Customer Service

- Regulatory Procedures and Compliance

- Loan Analysis and Advice

Professional Experience:

Loan Consultant, ABC Bank, 2012- Present

- Analyze and assess credit worthiness of clients

- Create tailored loan advice for clients

- Negotiate loan terms and repayment plans

- Facilitate loan approval and processing

- Monitor loan progress and resolve customer inquiries

- Maintain knowledge of banking systems and regulations

Education:

Bachelor of Science in Business Administration, University of X, 2010

Loan Consultant Resume Examples Resume with No Experience

Recent college graduate with a Bachelor’s in Business Administration and a passion for helping people achieve their financial goals. Possess excellent interpersonal and communication skills, and a willingness to learn and grow in the loan consultant field.

Skills:

- Knowledgeable in loan origination, underwriting, and servicing

- Experience with loan programs such as FHA, VA, and conventional loans

- Proficient in mortgage loan origination software, including Encompass, Calyx Point and Microsoft Office Suite

- Excellent interpersonal and communication skills

- Strong organizational and time- management abilities

Responsibilities:

- Maintaining accurate loan documents and files

- Updating loan documents and records

- Assisting with loan origination, underwriting, and servicing

- Communicating with clients regarding loan options and procedures

- Explaining loan documents and terms to customers

- Assisting customers with completing loan applications and documentation

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Consultant Resume Examples Resume with 2 Years of Experience

I am a loan consultant with 2 years of experience in the mortgage industry. I specialize in providing customers with personalized loan advice and assistance in finding the best loan option to meet their unique needs. My core skills include detailed analysis of loan programs, mortgage calculations and analysis, loan origination, and loan servicing. I also have experience in regulatory compliance, loan document preparation, and loan closing. I am highly organized, detail- oriented and always focus on customer service.

Core Skills:

- Loan Program Analysis

- Mortgage Calculations and Analysis

- Loan Origination

- Loan Servicing

- Regulatory Compliance

- Loan Document Preparation

- Loan Closing

- Customer Service

Responsibilities:

- Assess customers’ financial conditions and advise them on the best loan option for their needs.

- Analyze loan programs and services to determine the best fit for the customer.

- Research and verify customers’ credit scores to determine the loan eligibility.

- Prepare loan documents and review for accuracy.

- Comply with all applicable regulatory requirements.

- Negotiate with lenders to secure the best terms and conditions for the loan.

- Review customer loan applications for completeness and accuracy.

- Follow up with customers to ensure smooth processing and closing of the loan.

- Ensure customer satisfaction with the loan process.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Consultant Resume Examples Resume with 5 Years of Experience

Motivated and results- focused loan consultant with 5+ years of experience in the financial industry. Possesses a solid understanding of banking and lending policies, excellent customer service and communication skills, and a knack for problem- solving. Possesses a high degree of accuracy and attention to detail when analyzing loan applications, providing loan documentation, and administering loan closings.

Core Skills:

- Strong knowledge of banking and lending policies

- Excellent customer service and communication skills

- Ability to troubleshoot and solve problems

- Highly accurate and detail- oriented

- Proficient in Microsoft Office Suite

- Ability to manage multiple projects/tasks at once

- Thorough understanding of loan and credit process

Responsibilities:

- Review loan applications to ensure accuracy and completeness

- Gather and review credit history and financial documents

- Provide loan documentation and consult customers on loan products

- Administer loan closings, including title searches and credit reports

- Analyze loan data and financial underwriting criteria

- Maintain and update loan files in accordance with policies and regulations

- Assist customers throughout the loan process by providing guidance and support

- Keep up to date with applicable laws and regulations regarding lending

- Provide excellent customer service to ensure customer satisfaction.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Consultant Resume Examples Resume with 7 Years of Experience

A highly experienced loan consultant with 7 years of experience, ready to join an organization to help them manage their loan applications and ensure the best possible outcome for their clients. My core skills include excellent customer service, strong communication and negotiation skills, attention to detail, and the ability to remain organized and meet deadlines. I am confident in my ability to provide customers with all the necessary information and assistance to help them make the best decision for their loan.

Core Skills:

- Excellent customer service

- Strong verbal and written communication skills

- Attention to detail

- Negotiation and problem- solving skills

- Organizational skills

- Ability to meet deadlines

Responsibilities:

- Review loan applications and assess risk factors

- Negotiate terms and conditions of loans

- Identify and propose solutions to improve the loan approval process

- Provide customers with detailed information regarding loan options

- Update loan documents and ensure accuracy of information

- Monitor loan activity and provide timely updates to customers

- Handle customer concerns and respond to inquiries in a timely manner

- Keep up to date on changes in the loan industry and regulations

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Consultant Resume Examples Resume with 10 Years of Experience

Highly experienced and motivated Loan Consultant with over 10 years of experience in the financial industry. Proven ability to provide excellent customer service while developing loan products that meet the needs of clients. A strong communicator and problem solver with an in- depth knowledge of loan criteria and industry regulations. Driven to create tailored loan strategies and tailor repayment plans that ensure customer satisfaction.

Core Skills:

- Loan Origination

- Customer Service

- Financial Analysis

- Regulatory Compliance

- Problem Solving

- Negotiation

- Relationship Management

- Process Improvement

Responsibilities:

- Originated and maintained a portfolio of mortgage loan products for clients.

- Evaluated applications, credit reports and income documents to determine client eligibility for loan products.

- Monitored loan product trends and industry regulations to assess customer needs and tailor loan products.

- Created repayment plans to fit within customer budget and financial goals.

- Negotiated with lenders to secure the best interest rates and fees for customers.

- Answered customer inquiries, managed customer accounts and provided guidance on loan products.

- Developed and implemented process improvements for loan product origination and customer service.

- Maintained records of customer accounts and loan documents in accordance with regulations.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Consultant Resume Examples Resume with 15 Years of Experience

Professional Loan Consultant with 15+ years of expertise in providing loan advice and direction to clients. Extensive experience in evaluating loan applications, recommending loan products and negotiating loan terms and conditions. Demonstrated ability to analyze credit information, identify qualifying factors, and guide borrowers to appropriate loan options. Proven track record of maintaining accuracy and compliance in loan management and operations.

Core Skills:

- Loan processing and analysis

- Credit evaluation

- Loan application management

- Loan origination and approval

- Risk assessment

- Regulatory compliance

- Contract negotiations

- Collection strategies

- Customer service

- Problem solving

Responsibilities:

- Analyzing and evaluating loan applications to identify and make recommendations on loan eligibility

- Providing guidance to customers on loan products, terms and conditions

- Negotiating loan terms and conditions with customers to ensure legal standards are met

- Developing and implementing processes and procedures to comply with loan regulations and industry standards

- Monitoring loan portfolios and collecting overdue loan payments

- Identifying potential risks and developing strategies to mitigate them

- Assisting customers with loan processing and documentation

- Communicating with sales and customer service personnel to ensure quality service to customers

- Maintaining accurate records and documents related to lending activities

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Consultant Resume Examples resume?

A Loan Consultant’s resume should be tailored to the job they are applying for and should include the following:

- Professional Summary: A brief, one to two sentence summary of your professional experience and qualifications.

- Education: List of any degrees earned, relevant courses, or certifications.

- Experience: Outline of your experience in loan consulting and other relevant positions.

- Professional Skills: Include any special technical or analysis skills you possess.

- Areas of Expertise: List your experience in different areas of loan consulting such as loan origination, underwriting, or closing.

- Computer Skills: Highlight any computer programs you are proficient with such as Microsoft Office Suite, loan origination software, etc.

- Languages: Include any languages you are fluent in, such as Spanish, French, or Chinese.

- Personal Attributes: Describe any positive traits or characteristics you possess such as excellent communication or problem solving skills.

- Awards and Achievements: List any awards or accomplishments earned in the loan consulting field.

- Professional References: Include contact information for references from your professional contacts.

What is a good summary for a Loan Consultant Resume Examples resume?

A Loan Consultant resume should highlight a candidate’s expertise in helping people make the best financial decisions for their situation. An effective resume should include the Loan Consultant’s educational background, relevant work experience, and any certifications or licenses they may have. It should also demonstrate the Loan Consultant’s ability to provide excellent customer service, stay organized and efficient with paperwork, and have a thorough understanding of loan products and services. In addition, the resume should also emphasize any technical and problem-solving skills the Loan Consultant has acquired. Ultimately, a successful Loan Consultant resume should demonstrate the applicant’s ability to be a reliable, knowledgeable, and dependable loan consultant.

What is a good objective for a Loan Consultant Resume Examples resume?

Having a good objective on your resume is important if you are looking for a job as a loan consultant. A well-crafted objective statement should reflect your knowledge, skills, and experience in the loan industry and demonstrate to employers why you are the best candidate for the role. Here are some examples of good objectives for loan consultant resumes:

- To leverage my knowledge of the loan industry and financial regulations to help clients secure the best loan terms and conditions.

- To utilize my strong problem solving skills to help customers navigate the loan process, find creative solutions and negotiate the best loan outcomes.

- Seeking to use my excellent interpersonal skills to build and maintain trusting relationships with customers while providing them with the highest level of customer service.

- To utilize my expertise in loan processing to assist customers in meeting their financial goals.

- Seeking to bring my expertise in loan origination and underwriting to ensure customers get the best loan products for their individual needs.

- To apply my knowledge of mortgage laws and regulations to help facilitate the loan process and ensure compliance with all applicable laws.

How do you list Loan Consultant Resume Examples skills on a resume?

A Loan Consultant resume should include a comprehensive list of skills that demonstrate the applicant’s aptitude in the finance industry. Loan Consultants should be detail-oriented, organized and possess a thorough understanding of the loan process. The following are some of the skills that can be included in a Loan Consultant resume:

- Strong knowledge of the loan process

- Proficient in the use of financial software

- Skilled in evaluating loan applications

- Experienced in establishing loan documents

- Ability to review and analyze financial information

- Proficient in verifying credit reports

- Excellent customer service and communication skills

- Ability to identify areas of risk and propose solutions

- Ability to explain complex financial concepts in simple terms

- Excellent time management and organizational skills

- Ability to work on multiple projects simultaneously

- Experienced in dealing with a variety of clients

What skills should I put on my resume for Loan Consultant Resume Examples?

When crafting your loan consultant resume, it is important to make sure that you highlight the skills and qualifications that are most important for a successful loan consultant. Fortunately, there are many transferable skills that can be included on a loan consultant resume that can help you to stand out from the competition. Some of the most important skills to include on your resume are:-

- Customer Service: Loan consultants must have outstanding customer service skills to be able to effectively communicate with potential borrowers and assess their needs.

- Financial Knowledge: Loan consultants must have a thorough understanding of financial services and markets to be able to effectively recommend loan products.

- Organizational Skills: Loan consultants must have strong organizational skills to track loan applications, paperwork and other important documents.

- Attention to Detail: Loan consultants must have an eye for detail in order to ensure accuracy in the loan documents and financial calculations.

- Problem-Solving: Loan consultants must be able to think on their feet to evaluate potential loan applicants and to devise creative solutions to complicated repayments.

- Negotiation: Loan consultants must be able to negotiate loan conditions and rates with potential clients.

By highlighting these skills on your loan consultant resume, you will be able to effectively demonstrate your suitability for the position.

Key takeaways for an Loan Consultant Resume Examples resume

When creating a resume for a Loan Consultant role, it is important to focus on showcasing your experience and skills in the loan and banking industry. Your resume should highlight any experience you have in loan origination, loan servicing, and loan operations, as well as any experience you have in other related roles such as collections and customer service. Additionally, you should be sure to include your education and certifications, as they are important in the loan consulting field. Finally, here are some key takeaways to keep in mind when creating a resume for a Loan Consultant role:

- Highlight your experience and skills in the loan and banking industry. Be sure to list any experience you have in loan origination, loan servicing, and loan operations, as well as other related roles such as collections and customer service.

- Include your education and certifications. It is important to demonstrate to potential employers that you have the necessary qualifications and training to be a successful Loan Consultant.

- Showcase your problem-solving skills. Loan Consultants are expected to be able to identify and resolve problems, so it is important to highlight any experience you have in this area.

- Demonstrate your ability to provide excellent customer service. Loan Consultants must be able to provide clients with a high level of customer service, so be sure to include any experience you have in this area.

- Include any relevant volunteer or community service. Demonstrating an interest in the community is an important part of being a successful Loan Consultant, so it is important to showcase any volunteer or community service experience you have.

By following these key takeaways, you can ensure that your resume is impressive and effective when applying for a Loan Consultant role. Be sure to highlight your experience and skills, include your education and certifications, and showcase your problem-solving abilities and customer service skills. Additionally, don’t forget to include any

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder