A Loan Analyst is an important position for any financial institution because they are responsible for ensuring that a loan is properly assessed and managed. Loan Analysts are expected to have strong communication and analytical skills, as well as the ability to effectively assess and manage risk associated with loan applicants and portfolios. Crafting a resume that accurately represents your qualifications and experiences is essential in order to stand out to potential employers. To help you create the perfect resume, this guide provides examples of successful Loan Analyst resumes and resume writing tips.

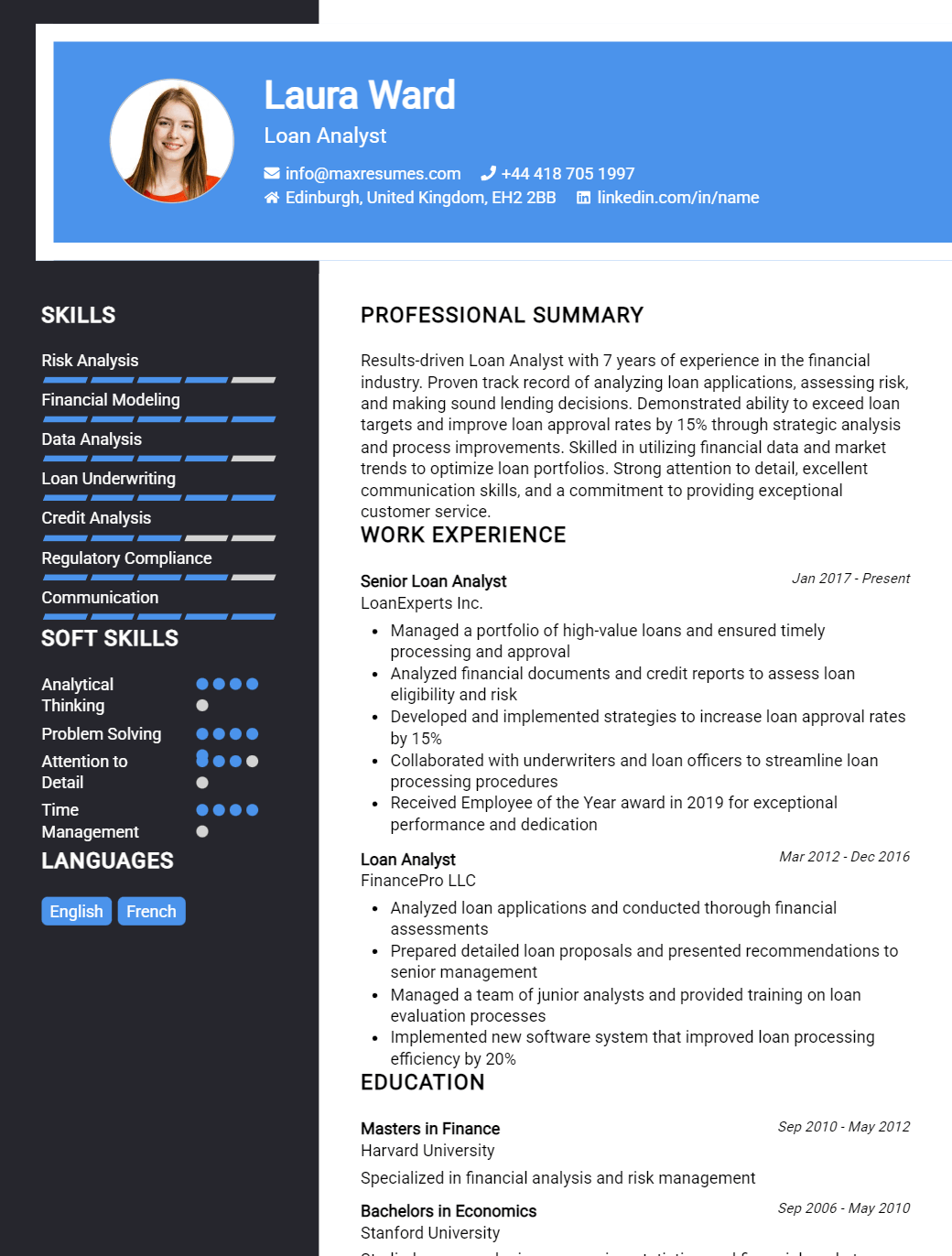

Loan Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Analyst Resume Examples

John Doe

Loan Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Loan Analyst with extensive experience in all facets of loan processing, customer service, and financial analysis. I have a passion for working in the financial industry and a strong background in customer service, data analysis and problem- solving. I am highly organized and detail- oriented, and I have a proven track record of successfully navigating the loan process. I am confident that I can bring my experience and skills to your organization and make a positive contribution.

Core Skills:

- Loan Processing

- Financial Analysis

- Credit Analysis

- Account Reconciliation

- Mortgage Underwriting

- Risk Management

- Documentation Review

- Problem Solving

- Customer Service

- Data Analysis

Professional Experience:

Loan Analyst, ABC Financial Services, October 2018 – Present

- Analyze customer financial and credit information to prepare loan applications

- Review loan applications for accuracy and completeness

- Process loan applications according to company procedures

- Reconcile customer accounts and resolve discrepancies

- Develop credit recommendations for loan approval

- Develop strategies to manage loan risks

- Monitor loan portfolios to ensure compliance with regulations

- Provide customer service and respond to customer inquiries

- Prepare financial statements and analyses for review

Loan Processor, XYZ Financial Services, May 2016 – October 2018

- Reviewed loan applications for accuracy and completeness

- Processed loan applications according to company procedures

- Analyzed customer financial and credit information to prepare loan applications

- Reconciled customer accounts and resolved discrepancies

- Developed credit recommendations for loan approval

- Monitored loan portfolios to ensure compliance with regulations

- Provided customer service and responded to customer inquiries

- Developed strategies to manage loan risks

Education:

Bachelor of Science in Business Administration, University of XYZ, 2016

Loan Analyst Resume Examples Resume with No Experience

Recent Finance graduate with a Bachelor’s in Business Administration and a focus in Finance, looking to transition into Loan Analyst role. Possess a deep knowledge of the finance industry, banking regulations, and documentation requirements. Adept multitasker with strong organizational and problem solving skills.

Skills:

- MS Office Proficiency

- Financial Analysis

- Bank Regulations

- Documentation Review

- Risk Management

- Database Management

- Problem Solving

- Time Management

- Analytical Thinking

- Math Skills

Responsibilities

- Gather financial and credit information for loan applicants

- Analyze financial and credit data to determine loan eligibility

- Research and analyze loan terms and requests

- Prepare reports and documents for loan applications

- Monitor loan status and document changes

- Collaborate with other departments to resolve loan issues

- Conduct risk assessment to determine loan delinquency

- Maintain accurate records and database of loan activities

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Analyst Resume Examples Resume with 2 Years of Experience

I am a Loan Analyst with over 2 years of experience in financial services. I have an extensive knowledge of the financial markets and banking regulations, as well as excellent problem- solving and communication skills. I have a proven track record of making sound business decisions while following lending standards and regulations. I am confident in my ability to assess loan applications, analyze financial statements, and make sound decisions to ensure successful loan transactions.

Core Skills:

- Financial services experience

- Financial markets knowledge

- Banking regulations

- Problem- solving skills

- Excellent communication skills

- Sound business decisions

- Lending standards and regulations

- Ability to assess loan applications

- Ability to analyze financial statements

- Making sound decisions

Responsibilities:

- Evaluate credit risk for potential loan applicants

- Prepare loan packages for underwriting

- Perform loan reviews and recommend improvements

- Analyze loan applications and financial statements

- Review loan documents and secure collateral

- Monitor loan performance and identify default risk

- Ensure compliance with banking regulations

- Conduct risk assessment of loan portfolio

- Prepare monthly reports on loan portfolio performance

- Maintain updated records of loan applications and repayment status

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Analyst Resume Examples Resume with 5 Years of Experience

I am a results- oriented Loan Analyst with 5 years of experience in analyzing new loan applications, assessing creditworthiness of potential borrowers, and managing loan portfolios. I have a good grasp of global financial trends and market conditions. I am an excellent communicator with strong problem- solving capabilities and great attention to detail. My expertise includes loan underwriting, credit analysis, and portfolio management. I am adept at understanding and interpreting complex financial documentation, analyzing economic trends, and assessing the risk associated with loans.

Core Skills:

- Analytical Thinking

- Credit Analysis

- Risk Management

- Financial Documentation

- Loan Underwriting

- Portfolio Management

- Communication

- Problem Solving

- Attention to Detail

Responsibilities:

- Process loan applications and review required documentation to evaluate creditworthiness

- Analyze credit reports, financial statements, and other financial documents to assess borrowers’ creditworthiness

- Analyze economic trends and financial market conditions to assess the risk of loan default

- Verify accuracy of loan files and ensure compliance with state and federal laws and regulations

- Approve loans that meet financial institution criteria and reject those that do not

- Monitor loan portfolio and take necessary steps to ensure compliance

- Develop strategies to minimize loan losses and mitigate credit risk

- Resolve customer disputes and respond to inquiries regarding loan terms and conditions

- Prepare and present loan reports to upper management

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Analyst Resume Examples Resume with 7 Years of Experience

A highly motivated and dedicated Loan Analyst with 7 years of experience in loan assessment and processing. Skilled at analyzing credit scores, financial data and identifying potential risks. Proficient in evaluating loan applications, documents and making assessments. Experienced in providing advice on loan products, services and repayment options. Possesses excellent interpersonal, communication and problem- solving skills.

Core Skills:

- Credit Analysis

- Risk Management

- Loan Assessment

- Financial Data Analysis

- Loan Processing

- Document Evaluation

- Loan Product Advice

- Problem- Solving

- Interpersonal Skills

- Communication Skills

Responsibilities:

- Analyzing credit scores and financial data to assess loan applications

- Evaluating loan documents and making assessments

- Identifying potential risks and providing advice on loan products, services and repayment options

- Identifying and understanding customer needs

- Negotiating loan agreements

- Assisting with loan origination processes

- Investigating loan files for discrepancies

- Developing and maintaining relationships with customers

- Meeting loan processing deadlines

- Ensuring compliance with relevant regulations

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Analyst Resume Examples Resume with 10 Years of Experience

Dynamic loan analyst with 10+ years of experience in credit risk management, loan portfolio management, and loan processing. Proven track record of developing successful strategies for higher loan approval rates and increasing profitability. Adept in analyzing financial statements, loan documents, and credit histories to determine creditworthiness. Skilled in working with clients to ensure their credit needs are met efficiently and effectively.

Core Skills:

- Credit Risk Management

- Loan Portfolio Management

- Loan Processing

- Financial Statement Analysis

- Credit History Analysis

- Problem Solving

- Attention to Detail

- Negotiation

- Communication

- Interpersonal Skills

Responsibilities:

- Analyzing loan applications to determine credit worthiness

- Reviewing financial statements and credit histories to identify potential risks

- Interacting with clients to understand and assess their credit needs

- Developing strategies to increase loan approval rates and profitability

- Analyzing loan terms and conditions to ensure they are compliant with legal and regulatory requirements

- Negotiating with banks and financial institutions to secure the best loan terms

- Coordinating with internal departments to ensure timely loan processing

- Monitoring loan portfolio performance to identify potential risks and losses

- Staying up to date with industry developments and best practices

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Analyst Resume Examples Resume with 15 Years of Experience

Dynamic Loan Analyst with 15 years of experience in providing financial advice and guidance to customers regarding loan options. Skilled in assessing customer creditworthiness, loan applications, and accurately analyzing and interpreting financial data. Proven track record of meeting deadlines and delivering results in a timely manner. Committed to providing high- quality customer service and delivering excellent results.

Core Skills:

- Financial Analysis

- Creditworthiness Assessment

- Loan Applications

- Customer Service

- Data Interpretation

- Deadline Management

- Risk Management

- Communication

Responsibilities:

- Analyzed customer creditworthiness, financial data, and loan applications to determine loan eligibility and provide financial advice

- Provided customers with accurate and up- to- date information on loan options

- Maintained up- to- date records of loan transactions

- Managed customer portfolios and assessed loan risk

- Researched and monitored current loan market trends

- Developed and maintained relationships with customers, vendors, and partners

- Resolved customer complaints in a timely and professional manner

- Prepared and submitted loan reports to management

- Assisted in developing, implementing, and enforcing loan policies and procedures

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Analyst Resume Examples resume?

A Loan Analyst Resume Examples resume should include a variety of information that showcases the candidate’s skills and qualifications related to the position. This resume should be tailored to the job description and highlight the candidate’s most relevant experience and qualifications. Here are some of the most important elements an ideal loan analyst resume should include:

- Professional Summary: This should provide a brief statement about the applicant’s experience and what makes them well-suited for the job.

- Qualifications: A list of the applicant’s qualifications and skills related to the loan analyst position.

- Work History: A list of the candidate’s past work experience related to the loan analyst position.

- Education: A list of the applicant’s educational background.

- Certifications: Any certifications or licenses related to the loan analyst position.

- Professional Training: Any relevant professional training or courses the applicant has taken.

- Contact Information: The applicant’s contact information, including their address, phone number, and email.

- References: A list of references who can vouch for the applicant’s qualifications and experience.

By including all of these elements, a loan analyst resume examples can provide employers with a comprehensive overview of the applicant’s qualifications and experience. This can help employers understand why the applicant is the ideal candidate for the job.

What is a good summary for a Loan Analyst Resume Examples resume?

A Loan Analyst resume should be concise and concisely summarize a candidate’s work history, skills, education, and other qualifications. It should include a summary of relevant experience as a Loan Analyst, as well as any specialized knowledge or skills. It should also include any relevant certifications or licenses, as well as any additional experience that may be beneficial to the position. Additionally, the resume should clearly state the candidate’s qualifications and accomplishments, including any awards or special achievements. Finally, the resume should include the candidate’s contact information, such as an email address and a telephone number.

What is a good objective for a Loan Analyst Resume Examples resume?

A Loan Analyst resume should include a clear and concise objective that highlights the candidate’s strengths and experience relevant to the position.

Here are some examples of good objectives for a Loan Analyst resume:

- To secure a Loan Analyst position utilizing a background in banking, financial analysis, and customer service to provide expert guidance and assistance to clients in the loan process.

- Looking to leverage a proven background in banking, financial analysis, and customer service to provide quality assistance and advice to loan applicants and customers in a Loan Analyst role.

- To gain a Loan Analyst position where analytical and communication skills can be used to help clients achieve their financial goals and fulfill their loan needs.

- To obtain a Loan Analyst position where exceptional customer service and financial analysis skills can be utilized to assist clients in managing their loan applications.

- Seeking a Loan Analyst position to use extensive knowledge and experience of banking, financial services, and customer service to help clients get the best deals on their loans.

- To acquire a Loan Analyst role that leverages financial analysis, customer service, and banking expertise to help clients with the loan application process.

How do you list Loan Analyst Resume Examples skills on a resume?

When applying for a loan analyst position, you must include a resume that outlines your education, experience, and skills. You should highlight the most important skills that are relevant to the job you are applying for, and give examples of how you have used those skills.

When listing your skills on your loan analyst resume, make sure to showcase the following:

- Knowledge of Financial Analysis: Loan analysts must have a strong understanding of financial analysis, including analyzing loan trends and predicting credit risk. Showcase any experience you have conducting financial analysis, such as creating financial models or evaluating loan applications.

- Risk Management: Loan analysts must be able to manage risk and make decisions on which loans should be approved or denied. Demonstrate how you have managed risk in the past, such as using data to determine risk and developing strategies to minimize risk.

- Communication and Interpersonal Skills: Loan analysts must be able to effectively communicate with clients and work with colleagues to make decisions. Showcase your communication skills by highlighting any experience you have in providing feedback, negotiating, and presenting loan decisions.

- Problem-Solving Skills: Loan analysts must be able to think critically and solve problems quickly. Demonstrate how you have used logic and data to solve problems in the past, such as analyzing financial data and developing strategies to reduce loan delinquencies.

- Technical Skills: Loan analysts must be comfortable working with loan software and other financial management programs. List any technical skills you have, such as experience with loan databases and financial reporting software.

By showcasing the right skills in your loan analyst resume, you can demonstrate that you are a qualified candidate for the job. Make sure to highlight your skills in a way that shows how you have used them in the past, and give examples of how you have successfully applied them to the loan analyst role.

What skills should I put on my resume for Loan Analyst Resume Examples?

When applying for a loan analyst position, a resume should be tailored to the specific job and highlight your most relevant skills and experience. Your resume should show that you have the necessary qualifications and abilities to be an effective loan analyst.

Here are some skills and qualifications to consider including on your resume:

- Analytical Skills: Loan analysts need to be able to analyze financial data, identify trends, and make decisions based on their findings.

- Math Proficiency: Loan analysts must understand and use math skills such as algebra, geometry, and statistics to interpret data and draw meaningful conclusions.

- Computer Knowledge: Loan analysts must be able to use computer software and applications to compile and analyze financial data.

- Negotiation Skills: Loan analysts must be able to negotiate terms with clients and lenders in order to reach mutually beneficial agreements.

- Problem Solving: Loan analysts must possess the ability to identify, analyze, and solve problems related to loan applications and financial data.

- Attention to Detail: Loan analysts must have a keen eye for detail and the ability to spot discrepancies and errors in financial data.

- Communication Skills: Loan analysts must be able to communicate effectively and professionally with clients, lenders, and colleagues.

By including these skills on your resume, you will be able to demonstrate your qualifications for the loan analyst position and give prospective employers an insight into your capabilities.

Key takeaways for an Loan Analyst Resume Examples resume

When crafting the perfect loan analyst resume, there are key takeaways you should keep in mind. First, you should focus on listing skills that are relevant to the job, such as financial analysis, problem solving, and communication. Additionally, you should highlight your experience and any certifications you possess that are directly related to loan analysis. Finally, make sure to include any special projects or accomplishments that demonstrate your expertise in the field.

When it comes to the resume design, make sure to stick with a traditional format, including headers for each section of your resume. Additionally, prioritize the content so that the most relevant information is at the top of the page. Finally, proofread your resume for accuracy and conciseness.

Overall, a loan analyst resume should be tailored to the specific job you are applying for and should include the skills, experience, and qualifications that you can bring to the table. By following these key takeaways, you can create a resume that effectively highlights your strengths and sets you apart as a qualified candidate.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder