If you are a loan administrator looking to make a career move, you know how important it is to have a resume that stands out from the crowd. Writing a resume that accurately represents your skills, qualifications and experience can be challenging, but with the right guidance and examples, it can be a breeze. In this blog post, we provide a comprehensive guide to writing an effective loan administrator resume, along with examples and tips to help you get the most out of your job search.

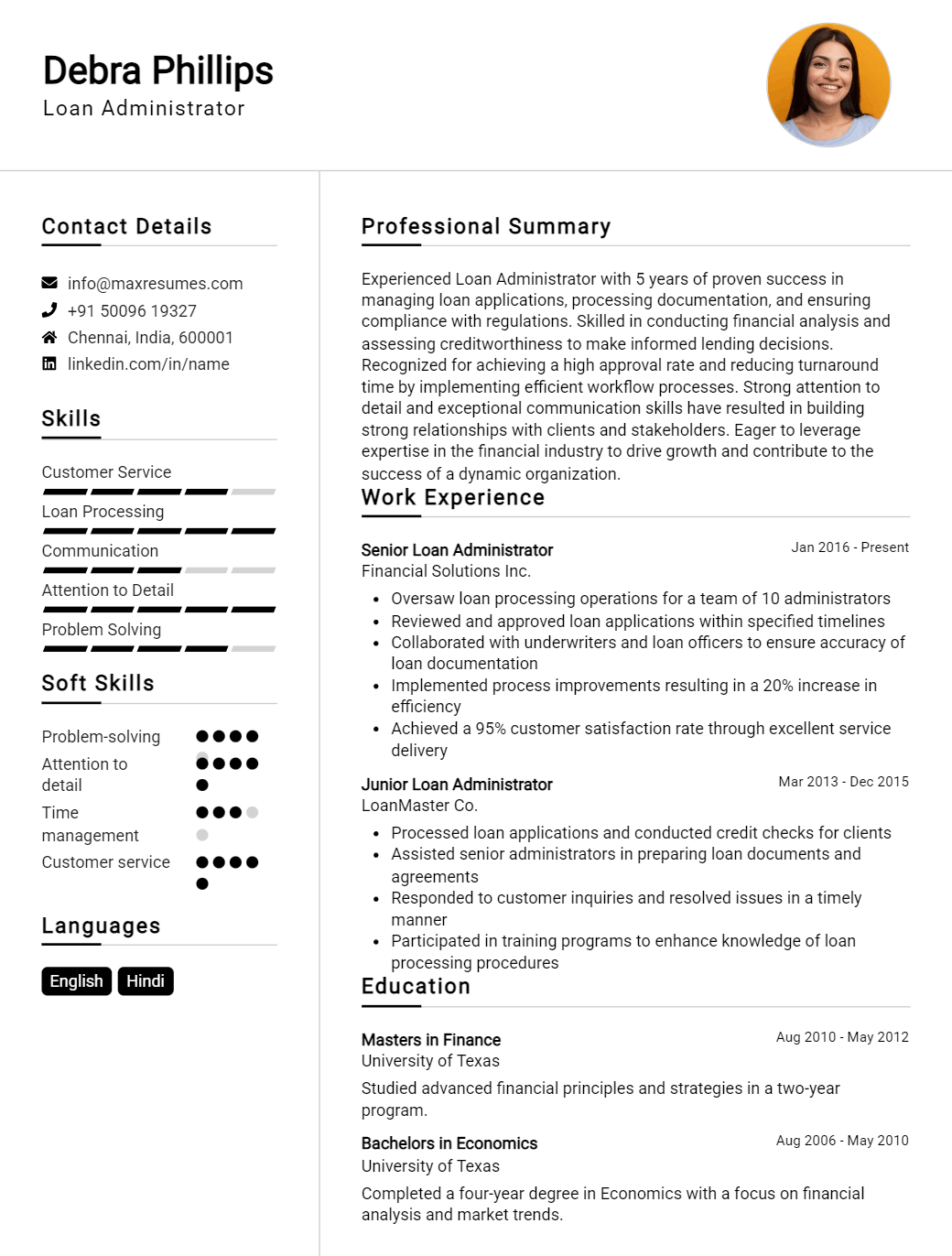

Loan Administrator Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loan Administrator Resume Examples

John Doe

Loan Administrator

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly experienced Loan Administrator with over 10 years of experience managing loan files and closing loan packages. I have an in- depth understanding of all aspects of loan processing, from pre- qualification to loan closing. My expertise includes loan origination, loan documentation, residential and commercial loan underwriting and data entry. I am organized, detail- oriented, and able to work effectively both independently and within a team environment.

Core Skills:

- Loan Origination

- Loan Documentation

- Residential and Commercial Loan Underwriting

- Regulatory Compliance

- Data Entry

- Microsoft Office Suite

- Customer Service

Professional Experience:

Loan Administrator, ABC Mortgage, Lansing, MI – 2019 to Present

- Process loan applications, including verifying credit and income, ordering title reports and appraisals, and preparing loan documents

- Manage and track loan files throughout the loan process

- Review and analyze loan documentation for accuracy

- Ensure loan documents meet all applicable federal, state, and local laws and regulations

- Prepare weekly loan status reports

- Provide customer service to loan applicants

Education:

Bachelor of Science in Business Administration, Michigan State University, Lansing, MI – 2017

Loan Administrator Resume Examples Resume with No Experience

Recent college graduate with an interest in Loan Administration. Adept at following organizational guidelines, taking initiative, and using effective interpersonal skills. Seeking to leverage my education and enthusiasm to effectively contribute to the Loan Administration team.

Skills:

- Excellent verbal and written communication skills

- Attention to detail

- Knowledge of financial products, services and banking regulations

- Proficient in Microsoft Word and Excel

- Strong problem solving and analytical skills

Responsibilities

- Gather, review and organize loan documentation

- Process loan applications and ensure accuracy of data

- Perform financial calculations and analysis

- Ensure compliance with banking regulations and internal policies

- Coordinate loan closings, verify accuracy of loan documentation, and prepare loan closing statement

- Provide customer service to loan applicants and lenders

- Prepare reports and perform administrative duties as needed

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loan Administrator Resume Examples Resume with 2 Years of Experience

Dynamic Loan Administrator with two years of extensive experience and expertise in the banking industry. Demonstrated track record of success in granting, servicing, and collecting loans. Adept in understanding and monitoring loan compliance, processing documents, and data entry. Committed to providing outstanding customer service and diligence in verifying information. Always striving to improve existing processes and procedures with the company’s best interests in mind.

Core Skills:

- Loan Processing

- Data Entry

- Customer Service

- Loan Compliance

- Document Verification

- Risk Management

- Problem- Solving

- Time Management

Responsibilities:

- Received and reviewed loan applications for accuracy and completeness.

- Processed applications, prepared documents, and entered data into loan tracking system.

- Developed and maintained loan accounts and verified loan information.

- Ensured loan compliance with federal and state regulations.

- Assisted borrowers with questions and concerns regarding loan status.

- Collected loan payments and monitored delinquency.

- Analyzed submitted documents, credit reports, and appraisals.

- Researched and resolved customer inquiries and complaints in a timely and efficient manner.

- Prepared monthly reports to upper management.

- Established and maintained solid relationships with clients.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loan Administrator Resume Examples Resume with 5 Years of Experience

I am a motivated and experienced Loan Administrator with over 5 years of experience in the banking industry. My experience includes loan processing, loan originations, loan modifications, loan servicing, and customer service. I have a strong knowledge of banking regulations and a great attention to detail. My strength lies in my ability to identify and resolve customer issues quickly, while also meeting tight deadlines. I pride myself in providing excellent customer service and ensuring that all customer needs are met in a timely fashion.

Core Skills:

- Loan Originations

- Loan Processing

- Loan Servicing

- Loan Modifications

- Banking Regulations

- Customer Service

- Attention to Detail

- Problem Solving

Responsibilities:

- Processed loan applications and financial documents

- Ensured accuracy and integrity of loan data

- Originated and serviced loans according to customer needs

- Assessed creditworthiness of potential borrowers

- Developed and managed loan modifications

- Maintained documents and customer data

- Researched and addressed customer complaints

- Performed required customer service duties

- Monitored loan accounts for delinquency and default

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loan Administrator Resume Examples Resume with 7 Years of Experience

I am an experienced Loan Administrator with 7 years of experience working in the financial services industry. I have worked in various positions, all focused on providing superior customer service and accurate loan processing. I am highly organized, analytical, and have excellent communication skills. I am able to work under pressure and meet tight deadlines. I am skilled in all aspects of loan processing, including making sure all documents are complete and accurate, approving loan applications, and assisting customers in understanding the loan process.

Core Skills:

- Loan processing

- Data entry

- Customer service

- Microsoft Office Suite

- File management

- Attention to detail

Responsibilities:

- Processing loan applications according to company policy

- Verifying customer information and documents

- Answering customer inquiries regarding loan application status

- Ensuring all documents are accurate and complete

- Assisting customers in understanding the loan process

- Updating customer databases with loan information

- Maintaining accurate records of loan documents

- Addressing customer complaints in a professional manner

- Generating loan documents for customers

- Communicating with customers throughout the loan process

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loan Administrator Resume Examples Resume with 10 Years of Experience

Highly- experienced Loan Administrator with over 10 years of experience in the banking industry. Proven ability to handle complex loan applications and loan disbursement processes. Experienced in loan origination, loan servicing, and loan document preparation. Possesses strong customer service, communication, and time management skills.

Core Skills:

- Loan Origination

- Loan Administration

- Loan Servicing

- Loan Document Preparation

- Risk Management

- Customer Service

- Time Management

- Communication

Responsibilities:

- Managed multiple loan applications in all phases of the loan origination process.

- Monitored loan status and communicated with customers to ensure proper documentation was submitted.

- Prepared loan documents in accordance with financial regulations and laws.

- Reviewed loan applications for accuracy and completeness.

- Ensured that all loans were in compliance with state and federal regulations.

- Developed loan policies and procedures to ensure timely disbursement and repayment.

- Assisted in resolving customer inquiries concerning loan status, loan payments, and other loan matters.

- Assisted in conducting credit checks and analyzing financial information.

- Established and maintained relationships with financial institutions and other lending partners.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loan Administrator Resume Examples Resume with 15 Years of Experience

Highly experienced Loan Administrator with 15 years of experience in mortgages, consumer and commercial loans. Experienced in loan origination, document preparation and loan processing. Adept at accurately assessing collateral values, managing loan files and providing excellent customer service. Skilled in maintaining loan documents and files in accordance with statutory regulations.

Core Skills:

- Loan Origination

- Document Preparation

- Loan Processing

- Loan File Management

- Customer Service

- Collateral Value Assessments

- Problem Solving

- Risk Management

- Regulatory Compliance

- Loan Documentation

Responsibilities:

- Originated and approved consumer and commercial loan applications.

- Processed assigned loans and ensured they met all regulatory requirements.

- Analyzed and assessed collateral values.

- Monitored changes in loan terms and ensured compliance with applicable regulations.

- Ensured compliance with all applicable laws, regulations, and procedures.

- Verified accuracy and completeness of loan documents.

- Supervised loan processing staff and provided guidance and instructions.

- Processed loan payments and maintained up to date records.

- Resolved customer inquiries and complaints in a timely manner.

- Collaborated with loan officers, underwriters, and other personnel.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loan Administrator Resume Examples resume?

A Loan Administrator Resume Examples resume should be a comprehensive summary of a candidate’s experience and qualifications. A strong resume should highlight an individual’s knowledge of lending concepts, federal and state laws, and banking compliance regulations. It should also show a well-rounded set of skills and the ability to manage loan portfolios.

Here are a few elements to include in a Loan Administrator Resume Examples resume:

- Loan Processing: Knowledge of the loan lifecycle process, including loan origination, underwriting, documentation, and closing.

- Regulatory Compliance: Understanding of banking regulations, including the Bank Secrecy Act, Fair Credit Reporting Act, and the Equal Credit Opportunity Act.

- Portfolio Management: Proficiency in loan servicing, portfolio management, and risk assessment.

- Financial Analysis: Ability to analyze loan documents and customer financials, with an understanding of credit policies, procedures, and practices.

- Computer Skills: Proficiency in Microsoft Office and related loan software programs.

- Communication: Clear and effective communication skills, with the ability to interact with customers, colleagues, and regulatory agencies.

- Customer Service: Experience in resolving customer inquiries and complaints.

- Leadership: Strong leadership and organizational skills, with experience in managing a team of loan officers.

What is a good summary for a Loan Administrator Resume Examples resume?

A good summary for a Loan Administrator Resume Examples resume should highlight the applicant’s experience and skills in the loan industry. It should emphasize their knowledge of loan processing, underwriting and analysis, as well as their ability to manage loan portfolios and client relationships. The summary should also outline the applicant’s ability to work with loan documentation, regulatory and legal requirements, loan systems and software, as well as their commitment to providing excellent customer service. Finally, the summary should demonstrate the applicant’s ability to provide effective loan administration and support to the organization.

What is a good objective for a Loan Administrator Resume Examples resume?

A Loan Administrator plays a vital role in an organization’s financial operations. Employers look for a Loan Administrator with a strong understanding of the loan process and management skills. When writing a resume for this position, it’s important to have an objective that reflects your qualifications and goals.

Here are some examples of objectives for a Loan Administrator resume that may help you get started:

- To obtain a Loan Administrator position with an established financial institution, utilizing excellent loan management and processing skills.

- Seeking a Loan Administrator role at a bank, utilizing knowledge of loan origination, processing and management.

- To gain a Loan Administrator position at a reputable financial institution, utilizing expertise in loan administration, underwriting, and processing.

- To secure a Loan Administrator role at a dynamic financial institution, leveraging exceptional organizational and communication skills.

- To obtain a Loan Administrator position at a top-tier financial firm, with a focus on loan origination and processing.

- Seeking a Loan Administrator role at a prestigious bank, leveraging knowledge of loan management, servicing, and regulations.

- To secure a Loan Administrator position at a leading financial institution, utilizing expertise in loan origination, processing and underwriting.

When crafting an objective for your Loan Administrator resume, remember to focus on your qualifications and goals. The objective should be concise, yet provide enough information to grab the reader’s attention. By including the right details, you can create a winning resume objective that will help you stand out from the competition.

How do you list Loan Administrator Resume Examples skills on a resume?

Writing a resume can be overwhelming, especially if you’re lacking job experience. To make the task easier, consider the following tips on how to list Loan Administrator Resume Examples skills on a resume:

- Highlight Your Loan Administration Experience: When writing a resume for a Loan Administrator position, it’s important to highlight your experience in the field. Include key responsibilities you’ve held in previous positions, such as credit analysis, regulatory compliance, financial statement analysis, and loan administration.

- Showcase Your Technical Skills: A Loan Administrator is expected to possess technical skills and knowledge in the areas of banking and finance. Showcase the technical skills you have, such as mortgage loan origination, in-depth knowledge of banking regulations, and financial statement analysis.

- Demonstrate Your Management Qualities: Loan Administrators often have to make decisions that affect the entire loan process. List any management qualities you have, such as your ability to manage multiple loan portfolios, lead a team, or effectively handle customer inquiries.

- Highlight Your Interpersonal Skills: Loan Administrators must have strong interpersonal skills to be successful in the field. List any communication skills you have, such as public speaking, active listening, customer service, and problem-solving.

By using these tips, you can ensure that your Loan Administrator resume examples skills make a positive impression on employers and showcase your abilities in the field.

What skills should I put on my resume for Loan Administrator Resume Examples?

When creating a resume for a Loan Administrator position, it is important to showcase the skills most relevant to the job. Loan Administrators manage loan portfolios, evaluate credit applications, and assist customers in the loan process.

To be successful in the role, Loan Administrators should be organized and have excellent customer service and communication skills. They should also be familiar with financial regulations and have a good understanding of loan products.

Here are some of the top skills to include on a Loan Administrator resume:

- Computer proficiency: Loan Administrators should have strong computer skills and be familiar with loan origination, servicing, and processing software.

- Attention to detail: Loan Administrators must be detail-oriented to accurately evaluate loan applications and ensure the accuracy of loan documentation.

- Customer service: Loan Administrators should have outstanding customer service skills to help customers through the loan process. They should also be patient and be able to explain complex financial concepts.

- Analytical skills: Loan Administrators must be able to review financial documents and assess credit risk. They should also be able to identify trends in loan data and generate reports.

- Regulatory knowledge: Loan Administrators should have a good understanding of financial regulations and be familiar with industry compliance rules.

By demonstrating these skills on your resume, you can demonstrate to potential employers that you have the necessary qualifications to perform the job duties of a Loan Administrator.

Key takeaways for an Loan Administrator Resume Examples resume

When writing a resume for a loan administrator role, it is important to highlight your technical and financial knowledge, as well as your ability to communicate well with clients. Here are some key takeaways to include in your loan administrator resume examples:

• Ability to analyze loan applications and make informed decisions. Demonstrate your ability to review and assess creditworthiness and present accurate loan information to potential borrowers.

• Knowledge of loan regulations and underwriting standards. Demonstrate your understanding of both federal and state loan regulations and the ability to adhere to them.

• Excellent communication skills. Showcase your ability to communicate with clients, lenders, and other stakeholders in a clear and concise manner.

• Financial and mathematical acumen. Showcase your strong analytical and mathematical skills, including your ability to calculate interest rates, payment amounts, and other financial information.

• Problem-solving skills. Demonstrate your ability to identify and resolve issues related to loan applications.

• Time management and organizational skills. Showcase your ability to manage multiple projects and tasks and stay organized.

By emphasizing these key takeaways, you can create a powerful and well-rounded resume that will help you stand out from the competition.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder