Writing a resume as a Credit Officer can be daunting. You want to make sure you showcase your knowledge and skills, while also demonstrating that you are the perfect fit for the job. At the same time, you want to make sure that your resume stands out among the competition. This guide will provide you with tips and examples of how to create the perfect Credit Officer resume. Here, we will discuss how to structure your resume, what information to include, and how to craft an effective resume that will set you apart from the rest.

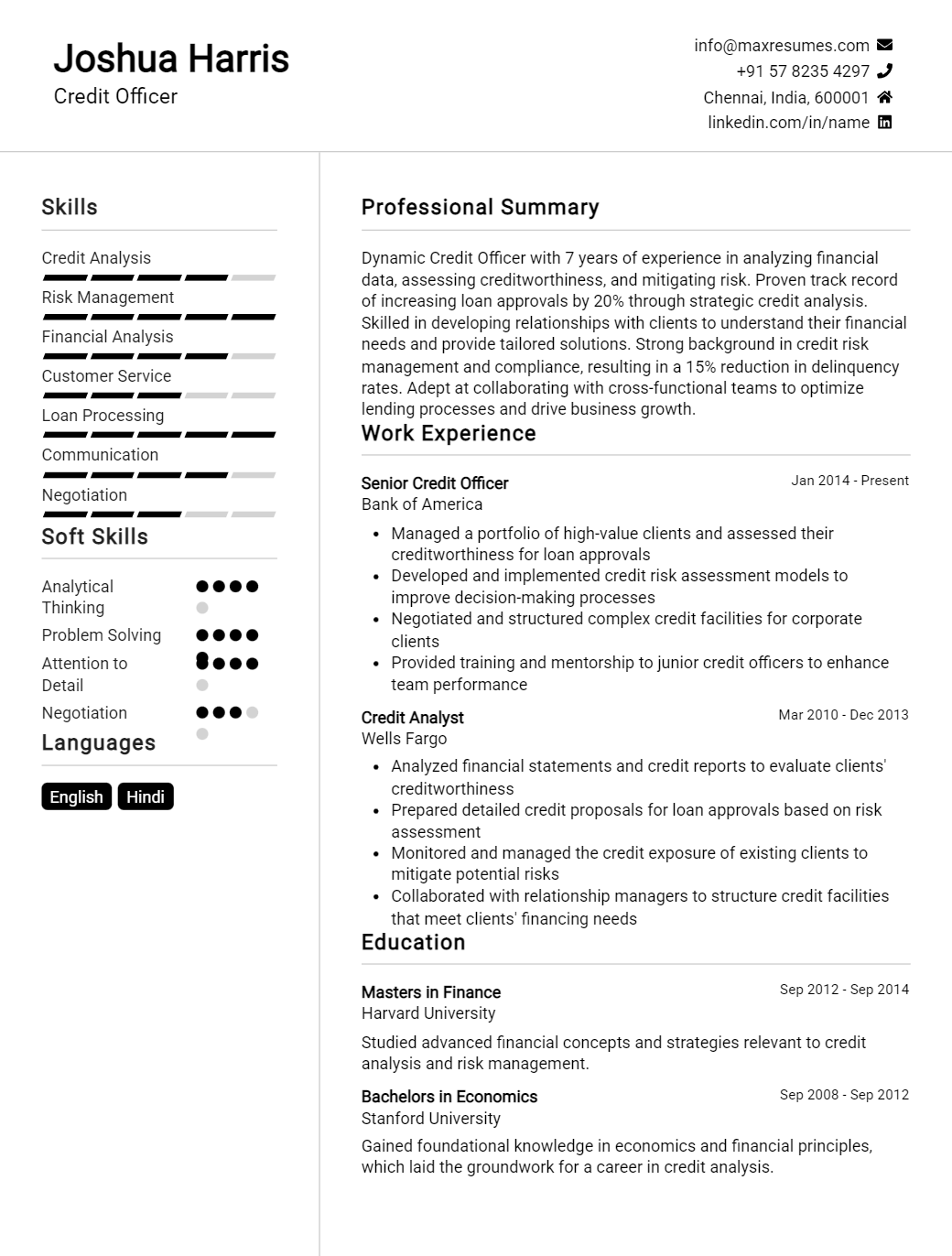

Credit Officer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Officer Resume Examples

John Doe

Credit Officer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced and highly competent Credit Officer with excellent analytical abilities, problem- solving skills, and communication skills. I have a solid understanding of the regulations and laws that govern the credit industry, as well as a proven track record of success in creating and implementing innovative strategies and policies. Additionally, I have a strong background in financial analysis, customer service, and risk management. I am confident that I can provide the highest level of service to any organization looking to secure new customers.

Core Skills:

- Excellent knowledge of regulations and laws governing the credit industry

- Strong understanding of financial analysis and risk management

- Proficient in customer relations, problem solving and communication

- Ability to create and implement innovative strategies and policies

- Excellent analytical and organizational skills

- Computer literacy in all standard software

Professional Experience:

Credit Officer, XYZ Credit Union, North Carolina

- Reviewed and processed all credit applications

- Conducted financial analysis of applicants’ credit histories to assess credit worthiness

- Negotiated terms and conditions of credit agreements

- Determined the amount and type of credit to extend

- Provided analysis and recommendations for credit decisions

- Ensured compliance to all laws and regulations governing the credit industry

- Assisted in the collection of delinquent accounts

- Developed and implemented risk management strategies

Education:

Bachelor of Science in Business Administration, ABC University, North Carolina

- Completed with Honors

- Major in Financial Management

Credit Officer Resume Examples Resume with No Experience

Highly motivated and organized recent graduate looking to leverage excellent communication and organization skills as a Credit Officer. Possesses knowledge of entry- level credit analysis and a desire to contribute to a positive working environment.

Skills:

- Data analysis

- Accounting

- Risk assessment

- Financial reporting

- Credit policies

- Computer competency

- Time management

- Excellent communication

- Strong relationship building

Responsibilities

- Analyze customer creditworthiness and assess risk

- Conduct financial and background checks of potential customers

- Provide timely and accurate credit reports

- Ensure compliance with credit policies and procedures

- Monitor customer accounts and review payment histories

- Handle customer disputes and negotiate payment arrangements

- Maintain accurate records of all customer transactions and documentation

- Assist in the development and implementation of policies and procedures

- Provide customer service and support

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Officer Resume Examples Resume with 2 Years of Experience

A highly motivated and dedicated Credit Officer with 2 years of experience in providing a range of financial services, including loan assessment, risk management and customer service. Experienced in assessing creditworthiness, monitoring credit performance and making sound business decisions in accordance with internal policies and procedures. Possesses a strong attention to detail and excellent problem solving skills, as well as excellent interpersonal and communication skills.

Core Skills:

- Risk assessment

- Loan application processing

- Credit report analysis

- Credit portfolio management

- Account servicing

- Credit review and monitoring

- Knowledge of banking regulations

- Strong communication and interpersonal skills

Responsibilities:

- Assessed creditworthiness of loan applications in accordance with bank policies and procedures

- Analyzed credit reports to ensure accuracy and compliance with regulations

- Monitored credit performance of existing customers to ensure compliance with contractual agreement

- Serviced customer accounts and managed customer inquiries in a timely and efficient manner

- Provided guidance in making sound credit decisions and recommendations

- Maintained up- to- date records of customer accounts, including credit limits and financial transactions

- Participated in internal audits and compliance reviews

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Officer Resume Examples Resume with 5 Years of Experience

Dynamic and motivated Credit Officer with 5+ years of experience in the financial services industry. Proven ability to lead credit risk and control teams to achieve organizational objectives. Expert in regulatory compliance and credit risk management. Skilled communicator with excellent interpersonal and analytical skills.

Core Skills:

- Credit Risk Analysis

- Credit Risk Management

- Regulatory Compliance

- Financial Planning

- Business Analysis

- Risk Mitigation

- Report Writing

- Problem Solving

- Decision Making

- Process Improvement

Responsibilities:

- Analyze credit risk of loan applicants and formulate risk assessment strategies

- Develop and implement effective credit risk control policies and procedures

- Monitor and analyze financial statements, credit reports and other documentation to ensure compliance

- Prepare credit reports and process credit requests in a timely manner

- Identify areas of risk and suggest risk mitigation measures

- Research and analyze current industry trends and economic climates to inform credit risk management decisions

- Facilitate the process of collecting delinquent payments

- Negotiate payment agreements and assess creditworthiness of loan applicants

- Provide regular reports on credit risk management activities to senior management

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Officer Resume Examples Resume with 7 Years of Experience

A highly accomplished Credit Officer with seven years of extensive experience in financial and credit management using a variety of tools and techniques. Adept at understanding customer requirements, managing customer databases and utilizing credit scoring models, analyzing credit worthiness and developing appropriate credit limits. Skilled in monitoring customer accounts and identifying any potential risks. Proven ability to work with internal and external stakeholders, to effectively manage customer credit risk.

Core Skills:

- Financial Management

- Credit Management

- Credit Scoring Techniques

- Customer Requirements Analysis

- Credit Risk Management

- Account Monitoring

- Communication and Interpersonal Skills

- Database Management

Responsibilities:

- Developed customer credit profiles and credit limits by analyzing customer financial statements.

- Evaluated customer’s credit worthiness by utilizing various credit scoring methods.

- Monitored customer accounts for any changes in financial status.

- Recommended customer credit limits and payment terms to the concerned authorities.

- Developed a scorecard to evaluate the credit worthiness of customers.

- Processed customer requests for credit line increases or decreases.

- Developed customer credit reports and identified any potential risks.

- Liaised with internal and external stakeholders regarding customer credit matters.

- Assisted in the development and implementation of credit management policies.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Officer Resume Examples Resume with 10 Years of Experience

Highly motivated, customer- focused and results- oriented Credit Officer with 10 years of experience in credit risk management, loan processing and collections. Proven track record of helping financial institutions maximize profit and reduce delinquency. Experienced in developing and implementing collections strategies and working with customers to ensure successful repayment of loans. Possesses excellent communication and problem- solving skills.

Core Skills:

- Credit Risk Management

- Loan Processing

- Collection Strategies

- Legal Compliance

- Customer Service

- Problem Solving

- Attention to Detail

- Relationship Building

- Time Management

- Communication

Responsibilities:

- Developed and implemented loan collection strategies to reduce delinquency and improve loan repayment rates.

- Evaluate credit data and financial statements to determine the degree of risk involved in extending credit.

- Advised and counseled customers on repayment plans and methods to avoid further delinquency.

- Maintained records of customer accounts, payments, and other related documents.

- Negotiated repayment plans with customers to maximize collections.

- Monitored customer accounts, identified and resolved issues.

- Assessed customer creditworthiness, established credit lines and limits.

- Adhered to legal, ethical and regulatory guidelines for credit collections.

- Facilitated and coordinated the release of loan payments.

- Investigated and resolved customer complaints.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Officer Resume Examples Resume with 15 Years of Experience

A highly skilled Credit Officer with 15 years of experience in financial services, loan processing, and customer relations. Dedicated to providing personalized customer service and maintaining strong relationships with loan customers. Skilled in assessing loan requests and approving credit applications in a timely manner. Proven record of properly managing multiple portfolios and reducing bad debt.

Core Skills:

- Loan Processing

- Credit Analysis

- Regulatory Compliance

- Risk Management

- Customer Relations

- Problem Solving

- Data Analysis

- Financial Reporting

- Credit Policies

Responsibilities:

- Reviewed customer loan applications and credit histories to assess credit worthiness and make decisions regarding loan approvals.

- Developed and implemented credit policies and procedures to ensure regulatory compliance.

- Monitored credit portfolios and customer accounts to identify potential risks and recommend corrective action.

- Analyzed customer financial information to determine repayment capacity.

- Researched and responded to customer inquiries and complaints in a timely and professional manner.

- Prepared credit reports and financial statements for management review.

- Coordinated with other departments to ensure timely and accurate processing of loan requests.

- Recommended solutions to reduce bad debt and improve customer satisfaction.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Officer Resume Examples resume?

A credit officer resume should be tailored to the specific job and organization for which the individual is applying. To ensure that the resume is effective, it should include the following:

- Professional Summary: A concise statement summarizing the individual’s professional qualifications, experience and key competencies related to the credit officer role.

- Education: Any relevant college/university degrees, licences, certificates and/or professional development courses completed.

- Work Experience: A summary of the individual’s professional experience and job history in the credit field, including years with each employer, job titles and responsibilities.

- Skills: A comprehensive list of technical and soft skills relevant to the credit officer role.

- Relevant Projects: Any special projects the individual has worked on related to the credit officer position.

- Awards and Achievements: Any awards or recognition achieved related to credit and/or finance.

- Languages: A summary of any foreign language skills the individual may possess.

- Membership in Professional Organizations: A list of any professional organizations the individual is a member of.

- Additional Details: A summary of any additional details that could be of use to a potential employer, such as volunteering or community involvement.

What is a good summary for a Credit Officer Resume Examples resume?

A good summary for a Credit Officer Resume Examples resume should showcase a candidate’s ability to manage the credit risk of a financial institution. It should highlight their experience working with clients, their knowledge of credit-related regulations, and their ability to identify and minimize risk. The summary should also demonstrate their excellent communication skills, problem-solving aptitude, and organizational abilities. Additionally, the summary should demonstrate the candidate’s understanding of financial and economic trends, as well as their ability to interpret and accurately report on financial data. Ultimately, the summary should highlight the candidate’s ability to effectively manage the credit risk of an institution.

What is a good objective for a Credit Officer Resume Examples resume?

A Credit Officer Resume should be organized and concise, detailing the skills and experiences that make you an ideal candidate for the role. To help you get started, here are some suggested objectives for a Credit Officer Resume Examples:

- Demonstrate strong commitment to credit management and financial reporting, with a track record of successfully managing risk.

- Develop and maintain strong relationships with customers, while ensuring credit policies and procedures are adhered to.

- Utilize analytical and problem-solving skills to review and analyze credit applications and financial statements.

- Leverage excellent communication skills to communicate with customers and other departments.

- Utilize strong organizational skills to manage and process credit requests.

- Create and implement effective credit policies and procedures to ensure sound credit decisions.

- Monitor and report on credit exposure to ensure risk is managed effectively.

How do you list Credit Officer Resume Examples skills on a resume?

When listing Credit Officer Resume Examples skills on a resume, it’s important to highlight the key abilities relevant to the job. The most sought-after skills for this role include strong financial analysis and management, communication, problem-solving, and decision-making.

To help you get started, here are some skills that should be included in a Credit Officer Resume Examples:

- Financial Analysis: An in-depth understanding of financial analysis techniques, such as ratio analysis and cash flow analysis.

- Management: Experience in managing the credit risk, processes, and portfolios for organizations.

- Communication: Excellent verbal and written communication skills. Able to explain complex financial concepts and present them in a clear and concise manner.

- Problem-Solving: Proven ability to identify and resolve complex financial problems.

- Decision-Making: Strong critical thinking skills and the ability to make strategic decisions in a timely manner.

- Business Acumen: A comprehensive understanding of the business landscape and how different factors can impact an organization’s financial performance.

- Customer Service: High level of customer service and an understanding of customer satisfaction.

- Interpersonal Skills: Ability to work well with customers, coworkers, and other stakeholders.

- Time Management: Proficiency in managing tasks and deadlines.

What skills should I put on my resume for Credit Officer Resume Examples?

When writing your resume for the role of a Credit Officer, it is important to include a list of skills you possess that are relevant to the position. As a Credit Officer, you need to be well-versed in financial principles such as credit analysis, risk assessment, and financial modeling. You must also be knowledgeable of relevant regulations and compliance laws. Here are some skills to consider including on your resume when applying for a Credit Officer position:

- Credit analysis: Ability to analyze credit reports and financial statements, understanding of financial ratios and creditworthiness.

- Risk assessment: Ability to identify and assess potential risks related to lending decisions.

- Financial modeling: Knowledge of financial models and ability to modify models for different scenarios.

- Regulations & compliance: Knowledge and understanding of relevant regulations and laws related to credit.

- Communication & negotiation: Excellent communication and negotiation skills in order to interact with customers, build relationships, and resolve disputes.

- Problem-solving: Ability to analyze and solve complex financial problems in order to make appropriate decisions.

- Time management: Ability to prioritize tasks and manage time efficiently in order to meet deadlines.

- Interpersonal skills: Excellent interpersonal skills in order to work collaboratively with colleagues, customers, and other stakeholders.

Key takeaways for an Credit Officer Resume Examples resume

In order to make your resume stand out from other applicants, here are some key takeaways for a Credit Officer Resume Examples resume:

- Highlight your experience in the credit industry. This could include any prior experience as a credit officer, as well as any other related positions. Make sure to include your job duties, successes, and any other relevant information.

- Showcase your knowledge of credit policies and procedures. It is important to show that you understand the credit process and how to handle difficult situations.

- Demonstrate your ability to handle customer complaints. Credit officers must be able to handle customer complaints and resolve them in a professional manner.

- Showcase your problem-solving skills. Credit officers must be able to think critically and come up with solutions to difficult credit problems.

- Demonstrate your communication skills. Credit officers must be able to communicate effectively with customers and other stakeholders.

- Highlight your familiarity with relevant software. If you are familiar with credit-related software, make sure to mention it in your resume.

By following these key takeaways for a Credit Officer Resume Examples resume, you can ensure that your resume stands out from other applicants.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder