Writing a strong resume for a position as a consumer loan officer is essential for any job seeker hoping to land a position in the banking industry. This guide will provide tips on how to create an effective and winning resume that will stand out from the competition and give you the best chance at being noticed by potential employers. It will provide detailed examples of how to format your resume, what information to include, and what to leave out. Additionally, this guide will also provide advice on how to best highlight your key qualifications and experience as a loan officer. Ultimately, a well-crafted resume can be the difference between landing an interview or your resume being passed over.

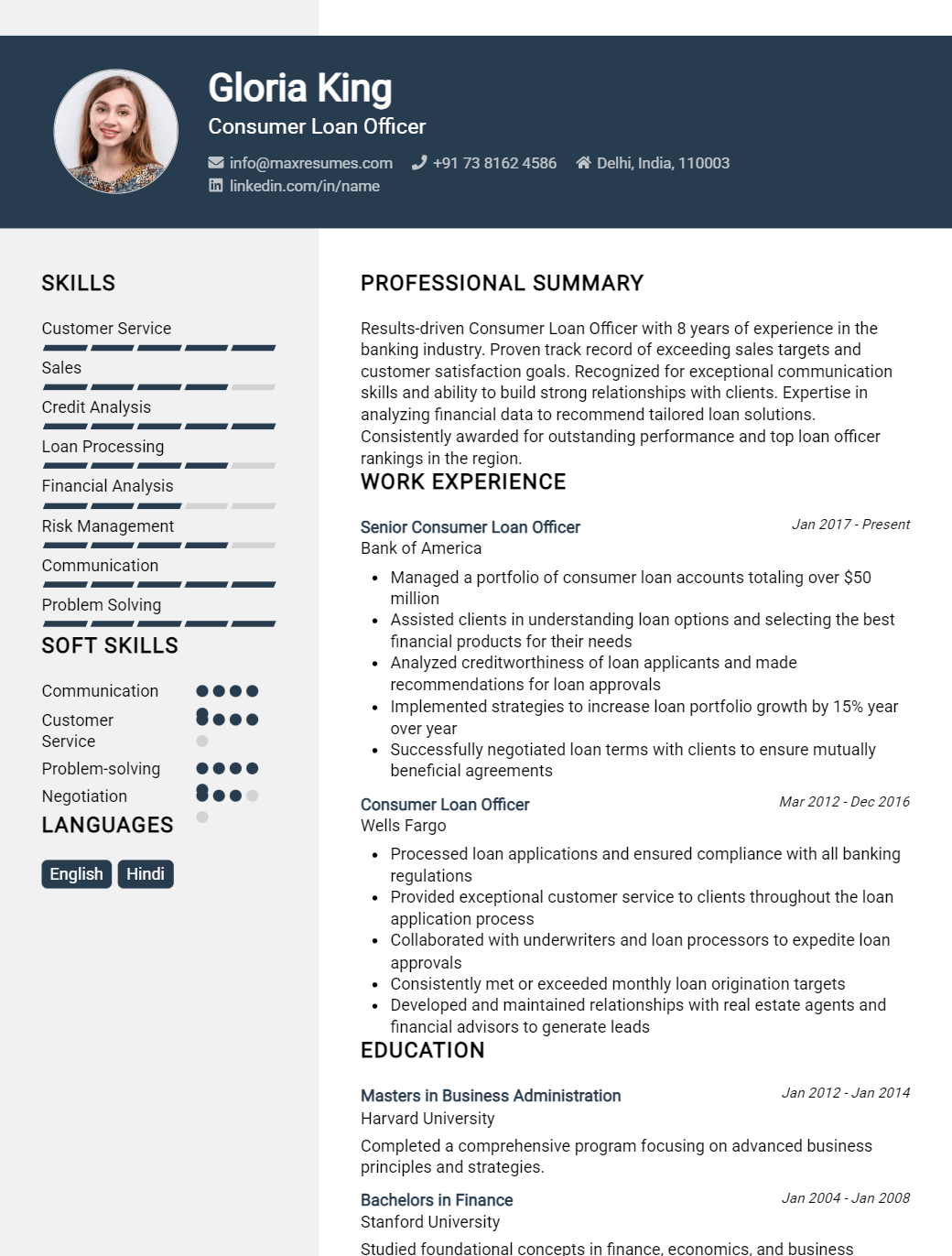

Consumer Loan Officer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Consumer Loan Officer Resume Examples

John Doe

Consumer Loan Officer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced consumer loan officer with over 10 years of banking experience. I specialize in providing loan application services and helping customers secure the best loan options for their financial needs. I have a deep understanding of the loan process and I am confident in my ability to assess financial information and provide guidance to customers. My experience in the banking industry has given me the skills to build strong relationships with customers, successfully close loan deals and provide excellent customer service.

Core Skills:

- Loan Process Management

- Risk Management & Analysis

- Financial Record Keeping

- Compliance & Regulations

- Customer Relations

- Negotiation & Closing

- Loan Documentation

Professional Experience:

Consumer Loan Officer, ABC Bank – 2021- Present

- Evaluate loan applications, assess creditworthiness and recommend loan products to customers.

- Analyze customer financial information to assess loan eligibility and recommend loan options.

- Develop strategies to improve loan operations and ensure compliance with regulations.

- Negotiate loan terms with customers, close deals and provide excellent customer service.

Consumer Loan Officer, XYZ Bank – 2017- 2021

- Received and assessed loan applications, recommended loan products and ensured compliance with regulations.

- Negotiated loan terms with customers, closed deals and provided excellent customer service.

- Analyzed customer financial information to assess loan eligibility and recommend loan options.

Education:

Bachelor of Business Administration (BBA), XYZ University – 2014

Consumer Loan Officer Resume with No Experience

Energetic, organized, and reliable individual with excellent communication and interpersonal skills, looking to secure a position as a Consumer Loan Officer.

SKILLS:

- Knowledge of basic loan principles, loan processing and underwriting

- Ability to make independent decisions while working on a team

- Excellent written and verbal communication skills

- Proficient in Microsoft Office Suite, including Word, Excel and PowerPoint

- Strong numerical and analytical skills

Responsibilities

- Analyze financial statements and credit reports for loan applicants

- Evaluate loan applications and determine eligibility for approval

- Analyze credit risks and develop loan terms to minimize risk

- Negotiate terms and conditions of loan agreement with customers

- Monitor loan compliance and ensure adherence to all state and federal regulations

- Maintain accurate records of all loan activity and correspondence with customers

- Develop and implement strategies to increase loan portfolio growth

Experience

0 Years

Level

Junior

Education

Bachelor’s

Consumer Loan Officer Resume with 2 Years of Experience

A highly motivated and experienced Consumer Loan Officer with 2 years of experience in the financial services sector. Skilled in performing FICO credit analysis, leveraging customer relationship management (CRM) systems, and providing excellent customer service. Proven ability to build strong relationships with clients, demonstrate loan products, and effectively negotiate loan terms. Track record of maintaining high standards of customer satisfaction with a focus on accuracy and attention to detail.

Core Skills:

- FICO credit analysis

- Loan origination

- Underwriting

- Customer relationship management

- Sales and negotiation

- Customer service

- Loan documentation

- Time management

Responsibilities:

- Performed FICO credit analysis for consumer loan applications and underwrote loan decisions.

- Leveraged customer relationship management (CRM) systems and loan origination software to process loan applications.

- Presented loan products to clients and negotiated loan terms.

- Reviewed and determined loan eligibility based on customer creditworthiness.

- Ensured accuracy in loan documentation and customer information.

- Maintained customer satisfaction by providing clear communication and timely responses to customer queries.

- Developed strategies to increase loan application volume and meet business objectives.

- Maintained up- to- date knowledge of loan policies and procedures.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Consumer Loan Officer Resume with 5 Years of Experience

Dynamic and detail- oriented Consumer Loan Officer with 5 years of experience in loan origination, processing, and servicing. Proven ability to quickly understand customer needs and develop secure and efficient loan solutions. Experienced in mortgage, consumer banking, and auto loan origination and servicing. Skilled in delivering exceptional customer service and problem- solving.

Core Skills:

- Loan Origination

- Customer Service

- Processing & Servicing

- Problem- Solving

- Mortgage & Auto Loans

- Banking Operations

- Underwriting & Risk Analysis

- Financial Statement Analysis

- Credit Analysis

- Loan Documentation

Responsibilities:

- Originated mortgage, consumer banking and auto loans.

- Verified, analyzed and evaluated income, credit, collateral, and other information submitted by loan applicants.

- Performed financial statement analysis and credit analysis.

- Reviewed loan documentation and underwrote loan requests.

- Assessed risk levels and determined loan eligibility.

- Completed loan setup and closing.

- Processed loan applications, renewals and modifications.

- Performed loan servicing activities and maintained records.

- Responded to customer inquiries, provided exceptional customer service, and solved customer issues.

- Negotiated loan terms and conditions.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Consumer Loan Officer Resume with 7 Years of Experience

Highly motivated and customer- focused professional with over 7 years of experience in the banking and finance industry. Proficient in customer service, financial operations, customer loan origination, and loan portfolio management. A proven track record of meeting customer needs and effectively managing loan operations. Possess excellent problem- solving, communication, and negotiation abilities.

Core Skills:

- Customer Service

- Financial Operations

- Loan Origination

- Loan Portfolio Management

- Problem- Solving

- Communication

- Negotiation

Responsibilities:

- Interviewed customers to assess financial needs and determine the best loan product to meet those needs.

- Gathered and analyzed customer information, such as credit history and employment records, to assess the risk of loan defaults.

- Advised customers on available loan products and terms, and prepared loan agreements.

- Maintained loan portfolio records, including customer payments and loan renewals.

- Developed and implemented strategies to increase loan origination and approval rates.

- Researched and evaluated customer loan applications and provided credit approval.

- Analyzed financial statements and other records to ensure accuracy of reported customer information.

- Resolved customer issues and complaints in a timely and professional manner.

- Participated in training sessions and seminars to remain up to date on banking regulations and industry trends.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Consumer Loan Officer Resume with 10 Years of Experience

I am an experienced Consumer Loan Officer with 10 years of experience providing top- notch customer service to a diverse client base. I specialize in managing loan portfolios, exceeding sales goals, and providing financial guidance to meet customers’ individual needs. Through my precise attention to detail, exceptional problem solving skills, and ability to build relationships with clients, I am able to create loan solutions that satisfy individual goals. I am dedicated to providing customers with a personalized loan experience and committed to helping them reach their financial objectives.

Core Skills:

- Financial Analysis

- Financial Modeling

- Loan Underwriting

- Credit Analysis

- Sales and Customer Service

- Relationship Management

- Problem Solving

- Time Management

- Negotiation

Responsibilities:

- Process loan applications, verify credit history, and review financial documentation

- Analyze credit reports and scores to determine loan eligibility

- Provide quality customer service to borrowers throughout the loan process

- Negotiate loan terms and conditions with borrowers

- Develop and maintain relationships with potential and existing customers

- Prepare and present loan proposals to credit committee

- Monitor loan performance and provide regular updates to borrowers

- Perform financial analysis to assess risk and assess loan affordability

- Maintain accurate loan records and track loan payments

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Consumer Loan Officer Resume with 15 Years of Experience

A highly experienced and motivated Consumer Loan Officer with 15 years of expertise in banking, loan processing, underwriting and customer relations. Proven track record of successfully evaluating loan applications and managing loan portfolios. Possesses deep knowledge of credit analysis, risk assessment and financial regulations. Adept at identifying customer needs, informing them of loan terms and conditions and providing exceptional customer service.

Core Skills:

- Deep knowledge of banking, loan processing and underwriting

- Proficient at credit analysis, risk assessment and financial regulations

- Exceptional customer service and communication skills

- Highly organized and detail- oriented

- Skilled at problem- solving and decision- making

Responsibilities:

- Evaluate loan applications and ensure accuracy of documents

- Analyze credit risk and financial standing of loan applicants

- Ensure loan compliance with the federal, state and local laws

- Provide customers with financial advice and guidance

- Manage loan portfolios and maintain records of loan transactions

- Investigate discrepancies related to loan applications and documents

- Monitor loan performance and assist customers with financial issues

- Respond to customer inquiries in a professional manner

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Consumer Loan Officer resume?

A Consumer Loan Officer Resume should include the essential skills and qualifications required to be successful in the position. It should also include any relevant experience that could demonstrate the candidate’s ability to perform in the role.

Below is a list of key points that should be included in a Consumer Loan Officer Resume:

- Strong working knowledge of consumer loan products and services

- Excellent communication and interpersonal skills

- Ability to work with customers to assess financial needs

- Proven ability to assess creditworthiness and risk factors

- Ability to negotiate and close deals

- Proficient with loan origination systems, underwriting, and other processes

- Understanding of loan regulations and compliance

- Ability to identify potential revenue opportunities

- Highly organized with the ability to multitask

- Strong problem-solving and decision-making skills

- Proficient in Microsoft Office applications

- Ability to work in a team environment as well as independently

- Previous experience in banking and/or financial services

- Relevant certifications, such as those for loan officers

- Bilingual capabilities

What is a good summary for a Consumer Loan Officer resume?

A good summary for a Consumer Loan Officer resume should show a prospective employer that you are adept in obtaining and assessing information from clients, evaluating creditworthiness, and providing tailored loan solutions for a variety of customer needs. Your summary should also highlight your strong communication, customer service, and problem-solving skills, which will be essential in your role as a loan officer. Additionally, you should mention any certifications, training, or experience that make you a competitive candidate for the position. Lastly, if you have a record of success in loan origination and sales, be sure to include that in your summary. A well-crafted summary can make all the difference when it comes to standing out to employers in the competitive field of consumer loan officers.

What is a good objective for a Consumer Loan Officer resume?

Writing a resume can be a daunting task, but it doesn’t have to be. When it comes to writing a resume for a consumer loan officer position, having a clear and concise objective is an essential part of the document. A good objective should give a brief overview of your experience and desired position, and it should also indicate the value you have to offer the company.

Here are some tips for writing a standout consumer loan officer resume objective:

- Be Specific: Your objective should clearly state what type of consumer loan officer position you are looking for. This will help the reader quickly understand the type of experience you have and what you are looking for.

- Highlight Your Skills and Experience: If you have relevant experience in consumer loan officer roles, make sure to highlight the skills and experience you have that would make you an ideal candidate for the position.

- Include Your Unique Assets: Your resume objective should also include any unique assets you bring to the table, such as your ability to work with a diverse clientele or your knowledge of the loan process.

- Give Yourself a Goal: Finally, it’s important to give yourself a goal in your objective. For example, you might state that you are looking to bring your skills and expertise to a consumer loan officer role and provide outstanding customer service.

By including all of the above tips in your resume objective, you can ensure that your resume stands out from the competition and positions you as an attractive candidate for the position.

How do you list Consumer Loan Officer skills on a resume?

.Writing a resume for a consumer loan officer position can be challenging, especially if you’re not sure which skills to highlight. After all, the success of your resume will determine whether you’re invited to the interview. To ensure you have the best chance of getting hired, make sure to list your consumer loan officer skills accurately and in an organized way. Here are some of the skills you should include on your resume:

- Knowledge of Loan Processes: A consumer loan officer should have a solid understanding of the loan process and be able to explain it to consumers in a clear and concise manner.

- Analytical Thinking: As a consumer loan officer, you need to be able to analyze a consumer’s financial situation and assess their creditworthiness.

- Communication Skills: As a consumer loan officer, it is important to be able to communicate effectively with clients and other professionals.

- Negotiation Skills: You should be able to negotiate deals and find loan solutions for consumers.

- Attention to Detail: You should be able to pay close attention to detail and documents to ensure accuracy.

- Time Management Skills: You should be able to manage your time effectively so that you can meet the demands of the job.

- Customer Service Skills: As a consumer loan officer, you should know how to handle customer inquiries and provide excellent customer service.

- Compliance Knowledge: You should possess a strong understanding of laws and regulations related to consumer loan processes.

What skills should I put on my resume for Consumer Loan Officer?

When applying for a consumer loan officer role, having the right skills on your resume is essential. These skills will show potential employers that you are able to handle the responsibilities of the job, as well as make you stand out from the competition. Below is a list of skills to include on your resume when applying for a consumer loan officer role.

- Knowledge of banking regulations: Having a thorough knowledge of banking regulations is an essential skill for a consumer loan officer. This includes an understanding of mortgage and lending regulations, as well as compliance requirements.

- Analytical skills: As a consumer loan officer, you need to be able to review loan applications, analyze financial statements, and assess risk in order to determine if a loan should be approved or denied. Therefore, having strong analytical skills is important.

- Attention to detail: Consumer loan officers must be able to pay close attention to detail in order to accurately assess loan applications and make sure all necessary documents have been included.

- Communication skills: As a consumer loan officer, you need to be able to explain loan terms and conditions clearly to applicants. Therefore, strong communication skills are necessary for this position.

- Negotiation skills: You need to be able to negotiate with applicants in order to get the best terms for both parties. Therefore, having strong negotiation skills is an important skill to have for this role.

- Customer service: Having excellent customer service skills is an important skill for a consumer loan officer. You need to be able to address customer concerns and provide excellent customer service in order to maintain a good reputation for the company.

Key takeaways for an Consumer Loan Officer resume

When searching for a job as a consumer loan officer, it is important that your resume stands out from the competition. When crafting your resume, it is important to highlight your experience, skills, and strengths that make you the ideal candidate for the position. Here are some key takeaways to help you create an effective consumer loan officer resume.

• Demonstrate your financial expertise: Make sure to highlight any experience or certifications you have in finance, banking, or loan origination. You should also discuss any relevant knowledge you have in consumer loan regulations, rules, and procedures.

• Showcase your customer service skills: As a consumer loan officer, you will be responsible for providing excellent customer service. Be sure to emphasize any customer service experience you have in your resume, and include any awards or recognition you have received for your service.

• Detail your problem-solving and analytical skills: As a loan officer, you must be able to analyze data, make decisions quickly, and solve complex problems. Include any successes you have had in these areas, as well as any courses or training you have taken that have helped you develop these skills.

• Highlight your soft skills: As a loan officer, you must often work in a team environment, so it is important to demonstrate your communication, negotiation, and conflict resolution skills. Include any experience you have in these areas, as well as any awards or recognition you have received for them.

By following these key takeaways, you can craft an effective resume that will make you stand out from the competition and help you get the job you want as a consumer loan officer.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder