Writing the perfect commercial lender resume can be a daunting task. With the right resume writing guide, though, the process can be much easier. This guide will provide you with step-by-step instructions on how to craft an effective and impactful commercial lender resume with examples to help you along the way. With the right resume, you can confidently apply for any commercial lender position and stand out among the competition.

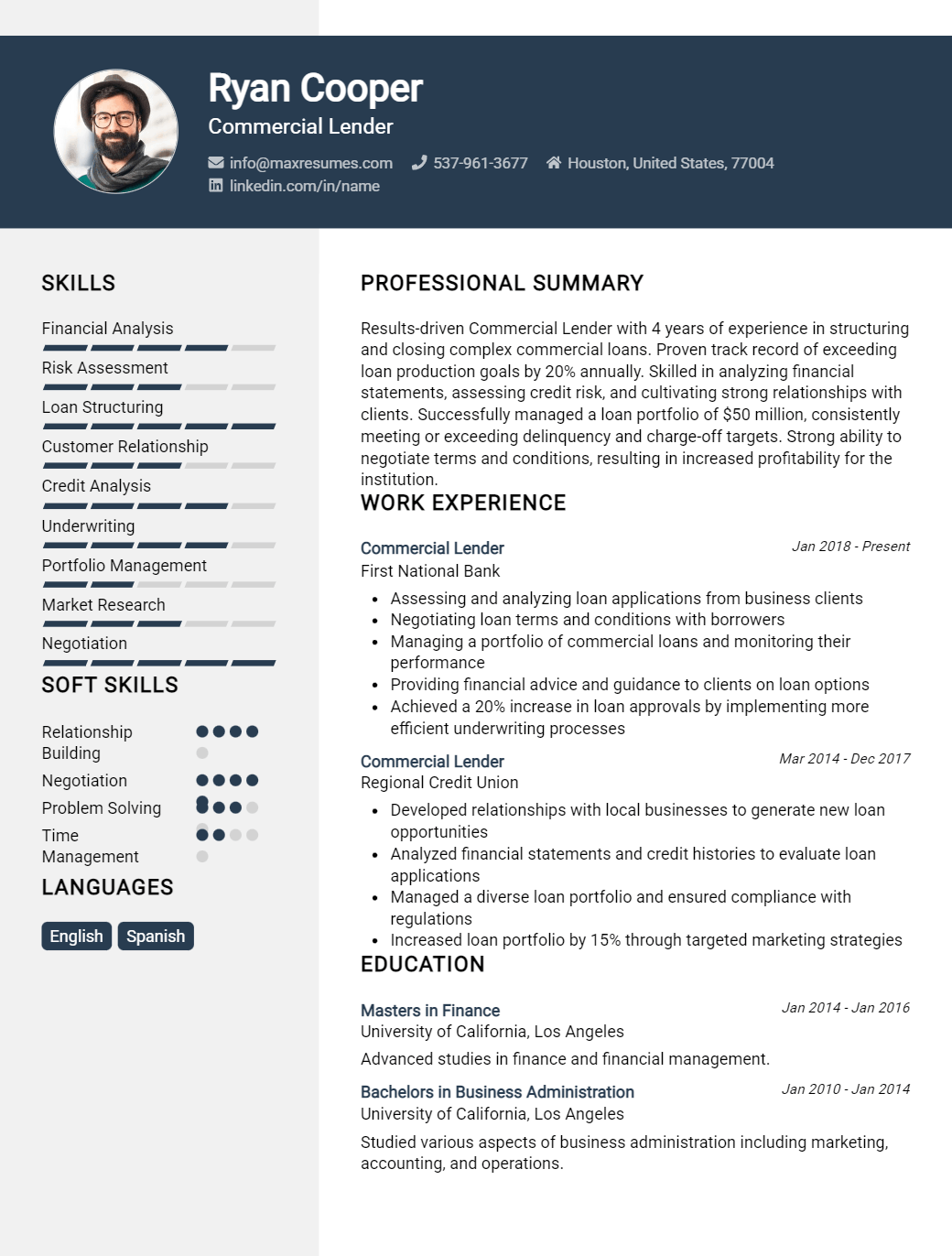

Commercial Lender Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Commercial Lender Resume Examples

John Doe

Commercial Lender

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly motivated and well- rounded commercial lender with over ten years of experience providing finance and lending solutions to business clients. Skilled in analyzing financial statements, developing lending strategies, and managing customer relations. Demonstrated success in identifying and executing profitable banking deals while maintaining regulatory and compliance requirements. Possesses strong interpersonal and communication skills and works well in a diverse environment.

Core Skills:

- Financial analysis

- Loan structuring

- Risk management

- Customer relations

- Regulatory compliance

- Deal negotiation

- Problem solving

- Business development

Professional Experience:

Commercial Lender, XYZ Bank – City, State

- Evaluated and assessed loan applications including analyzing financial statements and credit worthiness.

- Developed lending strategies such as loan terms, rates, and security requirements.

- Established and maintained relationships with business clients and other financial institutions.

- Negotiated deals and loan structures to match clients’ needs and financial capabilities.

- Managed a portfolio of commercial real estate loans and portfolios.

- Ensured compliance with all banking regulations and policies.

Commercial Loan Officer, ABC Bank – City, State

- Reviewed and approved new loan requests including analyzing financial statements and credit worthiness.

- Structured and maintained loan terms, rates, and security requirements.

- Cultivated and managed relationships with clients, vendors, and other financial institutions.

- Negotiated deals and loan structures to meet clients’ needs and financial capabilities.

- Monitored a portfolio of commercial real estate loans and portfolios.

- Ensured compliance with all banking regulations and policies.

Education:

Bachelor of Science in Business Administration, XYZ University – City, State

Commercial Lender Resume Examples Resume with No Experience

Recent college graduate with a Bachelor of Business Administration degree, eager to begin a career as a commercial lender. Possesses a strong work ethic and a desire to learn and grow in the field.

Skills:

- Financial Analysis: Ability to analyze, interpret and evaluate financial information.

- Customer Service: Professionalism and experience in dealing with customers.

- Negotiation & Problem Solving: Ability to negotiate loan terms and resolve customer complaints.

- Business Knowledge: Understanding of banking and commercial lending principles.

Responsibilities:

- Analyzing potential borrowers’ financial information and creditworthiness.

- Evaluating loan requests and making recommendations to senior management.

- Negotiating loan terms with borrowers and communicating loan decisions.

- Ensuring all loan documents are accurate and compliant with relevant laws and regulations.

- Developing and maintaining relationships with clients and other financial institutions.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Commercial Lender Resume Examples Resume with 2 Years of Experience

Highly motivated Commercial Lender with over 2 years of experience in financial services. Experienced in developing, implementing, and managing commercial lending programs. Skilled in creating and monitoring loan documents and strategies to ensure compliance with industry regulations. Well- versed in risk management, client relations, and loan review. Dedicated to providing efficient, reliable, and professional services to businesses and individuals.

Core Skills:

- Financial Analysis

- Credit Analysis

- Loan Structuring

- Risk Management

- Client Relations

- Regulatory Compliance

- Loan Review

- Business Development

Responsibilities:

- Identified and pursued potential business opportunities to increase loan portfolio.

- Developed and implemented loan policies, procedures, and processes.

- Conducted financial analysis, credit analysis, and loan structuring.

- Managed loan portfolio and monitored loan documents to ensure accuracy and compliance with industry and company regulations.

- Evaluated loan applications and determined creditworthiness of applicants.

- Negotiated loan terms, conditions, and repayment schedules.

- Established and maintained relationships with clients.

- Assisted in the collection of loan payments and performed loan review.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Commercial Lender Resume Examples Resume with 5 Years of Experience

I am a highly experienced Commercial Lender with 5 years of experience in financial analysis and credit review. My proven track record of successful lending transactions and solid customer relationships makes me a valuable asset to any financial institution. Through my knowledge of banking regulations and credit risk management, I ensure the accuracy of client data and create loan structures that meet both their needs and the bank’s goals. In addition, I possess excellent communication and negotiation skills, enabling my clients to achieve their desired outcomes.

Core Skills:

- Financial Analysis

- Credit Review

- Banking Regulations

- Credit Risk Management

- Communication

- Negotiation

Responsibilities:

- Analyze financial information and creditworthiness of clients

- Create loan structures that meet the bank’s goals and the client’s needs

- Review credit applications and determine credit limits

- Ensure compliance with banking regulations

- Negotiate loan agreements with clients

- Establish relationships with clients to ensure repeat business

- Provide regular credit reviews to ensure accuracy of client data

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Commercial Lender Resume Examples Resume with 7 Years of Experience

Highly experienced Commercial Lender with seven years in the banking industry. Outstanding interpersonal and problem- solving skills, along with a strong interest in financial analysis. Proven ability to build and maintain relationships with customers, grow a portfolio of clients, and identify suitable loan options for commercial customers. Experienced in financial analysis techniques, assessing creditworthiness, loan structuring, and working with commercial clients.

Core Skills:

- Asset and Liability Management

- Commercial Lending

- Risk Analysis

- Credit Risk Management

- Loan Structuring

- Interpersonal Skills

- Financial Analysis

- Relationship Management

- Regulatory Compliance

Responsibilities:

- Originated and structured commercial loans

- Analyzed and evaluated clients’ financial histories, credit ratings and other information in order to determine loan eligibility

- Developed and maintained relationships with clients, partners and referral sources

- Monitored the loan portfolio to identify potential defaults and took action to mitigate related risks

- Assisted in the underwriting of various commercial loan products

- Negotiated loan terms and rates with clients

- Ensured compliance with all applicable banking regulations and lending policies

- Provided ongoing customer support and assistance with loan applications, repayment and other related activities

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Commercial Lender Resume Examples Resume with 10 Years of Experience

Seasoned Commercial Lender with 10 years of experience in the banking and finance industry. Expertise in analyzing clients’ financial data, creating loan proposals and evaluating creditworthiness. Proven track record of successful client relationships and developing creative financing solutions. Strong communication and interpersonal skills and well- versed in financial analysis and reporting.

Core Skills:

- Financial Analysis

- Credit Risk Assessment

- Loan Proposal Writing

- Financing Solutions

- Client Relationship Management

- Commercial Lending

- Regulatory Compliance

- Financial Reporting

Responsibilities:

- Evaluate creditworthiness of potential customers

- Analyze financial documents, such as tax returns and credit score

- Prepare customized loan proposals for client’s specific needs

- Manage and maintain relationships with existing clients

- Proactively identify and develop new business opportunities

- Monitor compliance with banking regulations and policies

- Provide financial advice and support to clients

- Generate financial reports, such as loan performance and risk exposure

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Commercial Lender Resume Examples Resume with 15 Years of Experience

With 15 years of experience in commercial lending, I am an experienced professional in the field. My expertise includes providing customer service in relation to loan applications and meeting their needs, as well as developing relationships with lenders and clients. I have a keen eye for detail and a strong ability to assess credit worthiness of a customer or loan request. I am also knowledgeable of bank policies and procedures.

Core Skills:

- Analyzing customer financials and credit histories

- Assessing credit worthiness

- Developing relationships with lenders

- Knowledge of bank policies

- Excellent customer service

- Effective problem- solving skills

- Comfortable working with tight deadlines

Responsibilities:

- Reviewing customer loan applications and ensuring accuracy of all documents

- Negotiating loan terms and interest rates with lenders

- Processing loan applications and managing loan closings

- Analyzing customer financial statements and credit reports

- Keeping track of customer loan documents and monitoring repayment progress

- Developing relationships with lenders to ensure best terms possible

- Working with customers to ensure they understand the loan process and their rights and responsibilities

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Commercial Lender Resume Examples resume?

A commercial lender resume should include certain key elements that demonstrate your experience and qualifications for the job. Here are a few of the essential elements to include on your resume:

- Professional Summary: A well-crafted professional summary should be on the top of your resume. It should communicate your skills and experience in a succinct, yet powerful manner.

- Education and Qualifications: A commercial lender needs a strong educational background. Include your schooling, certifications, and any other qualifications related to banking and finance.

- Professional Experience: Provide a detailed list of the professional experience you have in the lending industry. Include the job title, company name, and brief job description.

- Skills and Competencies: Include a list of the skills and competencies required for the job. Highlight your areas of expertise and any special training or experience you have.

- Professional References: Professional references are necessary to include on a commercial lender resume. Provide names, contact information, and brief descriptions of your relationship with the persons listed.

Including these key elements on your resume will help you create a comprehensive and effective resume that will stand out from the competition.

What is a good summary for a Commercial Lender Resume Examples resume?

A commercial lender resume should present an individual’s qualifications and experience in the banking industry. It should focus on the ability to evaluate credit worthiness, manage loan portfolios, and analyze financial statements. It should also highlight interpersonal skills, specialized knowledge of lending policies and procedures, and a proven track record of successfully closing loans. A good summary should include a few sentences summarizing the individual’s relevant qualifications and expertise. It should also provide a brief overview of their experience in the field, such as the number of years they have been employed in the banking industry. Finally, the summary should be tailored to the specific position they are applying for, highlighting the relevant skills and qualifications that make the individual the perfect fit for the job.

What is a good objective for a Commercial Lender Resume Examples resume?

A good objective for a Commercial Lender Resume Examples resume should be well-crafted and centered around the job for which you are applying. It should be clear, concise and tailored to the company. Here are some examples of objectives for a Commercial Lender resume:

- To obtain a Commercial Lender position in a dynamic financial institution that provides opportunities for growth and customer service excellence.

- Seeking to leverage extensive lending experience and customer-focused approach to secure a Commercial Lender position with a reputable banking organization.

- Aiming to secure a Commercial Lender role with a financial institution focused on delivering superior customer service and best-in-class lending practices.

- Utilizing a customer-oriented approach and extensive financial knowledge to secure a Commercial Lender role with an established banking organization.

- To contribute to a financial organization as a Commercial Lender by utilizing strong customer service skills and extensive lending experience.

How do you list Commercial Lender Resume Examples skills on a resume?

bulletsA commercial lender resume should include a comprehensive list of the skills and qualifications that are necessary for a successful job in this field. Prospective employers will be looking for evidence of experience, knowledge, and technical capabilities.

When listing skills on a commercial lender resume, it is important to be as specific as possible. It is also important to make sure that your skills are well-aligned with the job you are applying for.

Commercial lender resume examples may include the following skills:

- Familiarity with commercial loan products, such as SBA loans, lines of credit, and industry-specific funding

- Experience with loan origination and underwriting

- Knowledge of credit and risk analysis

- Proficiency in financial modeling and analysis

- Ability to manage deadlines and prioritize tasks

- Excellent interpersonal and communication skills

- Strong problem-solving skills

- Proficiency with industry standard software

- Knowledge of legal and regulatory compliance

- Ability to develop and maintain strong customer relationships

- Attention to detail and accuracy

By highlighting these types of commercial lending skills on your resume, you can demonstrate your capabilities and qualifications for the job. This will give you a better chance of making a positive impression and landing an interview.

What skills should I put on my resume for Commercial Lender Resume Examples?

When applying for a job as a commercial lender, your resume should demonstrate your knowledge and experience in areas important to lenders. Here are some examples of the types of skills employers will be looking for:

- Financial Analysis: A commercial lender must be able to analyze a potential borrower’s financial information in order to make an informed lending decision. This includes an understanding of financial statements, cash flow forecasts and credit reports.

- Risk Evaluation: A commercial lender must be able to assess the risks associated with a potential borrower in order to make the best lending decision. This requires the ability to analyze a company’s financials and look for red flags that could indicate a higher risk loan.

- Relationship Management: Commercial lenders must be able to develop and maintain relationships with their clients. This includes being able to understand the needs of a potential borrower and helping them meet them. The ability to develop relationships with clients is essential to success in this field.

- Negotiation: Commercial lenders must also be able to negotiate terms of a loan with a borrower. This requires being able to negotiate loan terms that are beneficial to both parties.

These are just some of the skills employers are looking for in a commercial lender. With these skills, you will be better positioned to succeed in the field.

Key takeaways for an Commercial Lender Resume Examples resume

A Commercial Lender resume is a resume that highlights the skills, qualifications, and experience of a person who has held a position as a Commercial Lender. The commercial lending sector is a rapidly growing and competitive industry with lenders offering a variety of products and services to businesses. A good resume should reflect your professional qualifications, experience, and expertise in commercial lending. Here are some key takeaways for an effective Commercial Lender resume:

- Highlight your experience in commercial lending. The commercial lending sector is highly specialized, so it is important to showcase your knowledge of the subject and your experience in the field. Showcase any past positions you have held in commercial lending, such as loan officer positions, or any other related experience you may have.

- Include detail of your qualifications and certifications. For many positions, a candidate must have certain certifications or qualifications in order to be considered. Be sure to list any relevant qualifications or certifications you have that are related to commercial lending.

- Demonstrate your ability to assess and analyze risk. Commercial lending requires an understanding of risk and an ability to assess the risk associated with a loan. Showcase any experience you have assessing and analyzing risk in the commercial lending sector.

- Showcase your customer service skills. Commercial Lenders must be able to build relationships with potential clients and provide excellent customer service. Showcase any experiences you have in customer service and working with clients.

- Ensure accuracy in your resume. Make sure that your resume is accurate and free of errors. Double check all information listed to make sure that it is up-to-date and correct.

By following these key takeaways, you can create an effective Commercial Lender resume that will help you stand out from the competition.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder