A Chief Credit Officer is a key position that is responsible for overseeing the credit operations of a company or organization. They must ensure that the company’s credit policies are enforced and that credit is extended in a responsible manner. A well-crafted resume is essential for any candidate seeking to land a job as a Chief Credit Officer. This blog post will provide an overview of the resume writing process and provide samples of Chief Credit Officer Resume Examples for guidance. By following the tips and examples provided, you will be able to create a well-written resume that will make you stand out from the competition.

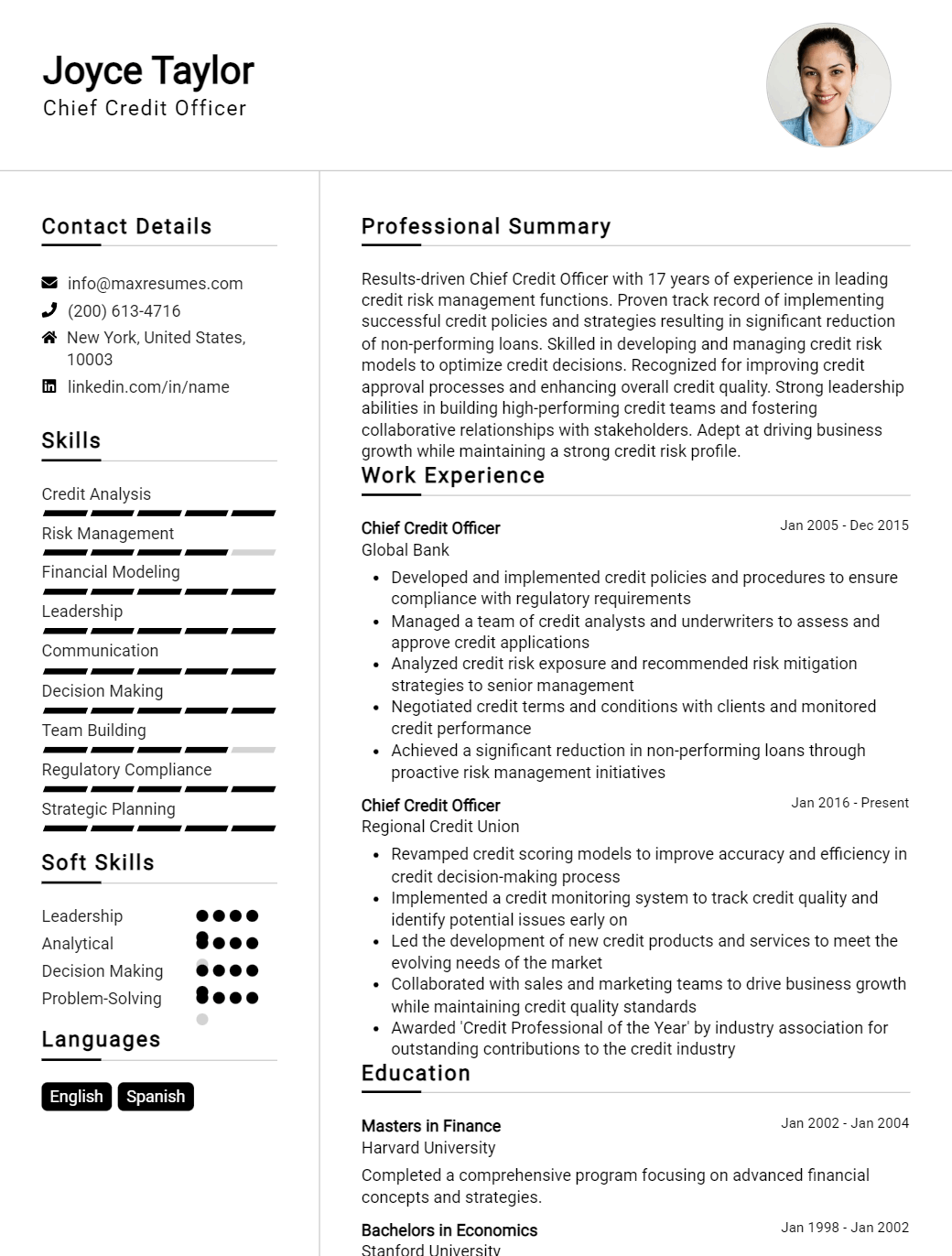

Chief Credit Officer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Chief Credit Officer Resume Examples

John Doe

Chief Credit Officer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced and results- driven Chief Credit Officer with a proven track record of leading and developing effective credit strategies. My background in both commercial and consumer credit management positions me to excel as a Chief Credit Officer, leading a team to success. I possess a keen eye for risk management, due diligence and portfolio optimization, along with the ability to evaluate potential borrowers and develop loan policies. I am committed to creating a positive work environment, engaging employees, and achieving the highest levels of customer service and satisfaction.

Core Skills:

- Leadership & Management

- Credit Analysis

- Portfolio Management

- Financial Modeling & Forecasting

- Risk Management

- Compliance & Regulatory

- Loan Processing

- Loan Origination

- Strategic Planning

- Strong Communication Skills

- Problem- Solving

Professional Experience:

Chief Credit Officer – ABC Credit Union, January 2016 – Present

- Develop and enforce credit policies, procedures, and processes to ensure compliance with regulatory and statutory requirements.

- Analyze creditworthiness of borrowers to determine their ability to repay loans and ensure that proper loan terms and conditions have been met.

- Prepare detailed financial statements and analyze financial performance of borrowers to determine the creditworthiness of the company.

- Manage the credit portfolio and optimize loan performance.

- Negotiate loan agreements with customers, assess loan applications, and review financial and credit documents.

- Establish and maintain relationships with external credit rating agencies to ensure accurate ratings.

- Develop credit strategies and recommend loan terms, repayment plans, and credit limits.

- Oversee, review, and approve all loan requests.

Education:

Master of Business Administration (MBA), ABC University, October 2013 – June 2016

Bachelor of Science in Business Administration, XYZ College, August 2009 – May 2013

Chief Credit Officer Resume Examples Resume with No Experience

- Highly motivated Chief Credit Officer with a background in financial analysis, credit risk management, and loan origination.

- Extensive experience in financial services, credit risk management, and loan origination.

- Excellent track record of developing and implementing credit policies and procedures that meet regulatory requirements and corporate objectives.

- Strong ability to analyze financial statements and credit histories to assess creditworthiness and formulate accurate credit decisions.

Skills:

- Advanced knowledge of financial analysis and credit risk management

- Strong problem- solving and analytical skills

- Excellent communication and negotiation skills

- Proficient with Microsoft Office Suite (Word, Excel, PowerPoint)

- Strong leadership and organizational abilities

Responsibilities

- Develop and implement credit policies and procedures in accordance with corporate and regulatory requirements

- Analyze financial statements and credit histories to assess creditworthiness

- Review and approve loan applications and credit inquiries

- Monitor and manage credit risk exposure

- Oversee and manage loan disbursement and collection processes

- Provide guidance and training to loan officers and other staff on credit procedures and policies

- Ensure all credit decisions are in accordance with corporate, legal, and regulatory requirements

Experience

0 Years

Level

Junior

Education

Bachelor’s

Chief Credit Officer Resume Examples Resume with 2 Years of Experience

Dynamic Chief Credit Officer with two years of experience overseeing commercial lending operations and credit risk management. Proven track record of supporting profitable portfolio growth and mitigating credit risks. Highly organized and detail- oriented with a keen eye for credit analysis and risk assessment. Possesses excellent communication and interpersonal skills, excelling in cultivating relationships with internal and external stakeholders.

Core Skills:

- Credit Risk Management

- Analytical Thinking & Problem Solving

- Regulatory Compliance

- Credit Analysis & Portfolio Reviews

- Budget Management & Financial Reporting

- Risk Mitigation Strategies

- Loan Origination & Underwriting

- Commercial Lending Operations

Responsibilities:

- Analyzed and assessed the credit worthiness of borrowers and the impact on loan portfolio

- Developed and implemented credit risk management strategies to mitigate potential losses

- Monitored loan portfolio performance and identified credit risk issues

- Coordinated the review of credit applications and loan origination processes

- Ensured compliance with all applicable laws, regulations and credit policies

- Participated in the development of loan policies and procedures

- Prepared financial statements and reports as necessary

- Liaised with external auditors and regulators on credit compliance matters

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Chief Credit Officer Resume Examples Resume with 5 Years of Experience

A Chief Credit Officer with 5+ years of experience in financial institutions, with expertise in credit underwriting, analysis and risk management. Proven success in providing credit and loan origination services to a variety of customers, while maintaining compliance with banking regulations. Possesses excellent problem solving, organizational and leadership skills, combined with a thorough knowledge of financial products, banking policies and credit standards.

Core Skills:

- Credit Underwriting & Analysis

- Risk Management

- Loan Origination

- Compliance with Banking Regulations

- Financial Product Knowledge

- Credit Standards & Banking Policies

- Problem Solving & Leadership

- Strategic Planning & Decision Making

Responsibilities:

- Overseeing the credit decision process and loan origination services to customers

- Analyzing loan applications for financial soundness and creditworthiness

- Developing credit policies, procedures and standards for credit risk management

- Establishing credit limits and setting risk parameters for credit decisions

- Monitoring loan portfolios to ensure compliance with credit policies and regulations

- Assisting in the development of credit strategies to maximize the value of loan portfolios

- Working with the executive team to develop and implement strategic plans for credit operations

- Coordinating with external auditors and regulators to ensure compliance with banking regulations.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Chief Credit Officer Resume Examples Resume with 7 Years of Experience

A highly experienced Chief Credit Officer with over 7 years of experience in managing credit risk and leading credit analysis teams. Strong analytical, problem solving and decision- making skills, and a track record of success in identifying and mitigating credit risks. Experienced in developing credit policies and procedures, conducting credit training and maintaining relationships with key stakeholders. Proven ability to lead and motivate a credit team, and ensure the timely and accurate completion of credit activities.

Core Skills:

- Risk Management

- Credit Analysis

- Credit Policies & Procedures

- Credit Training & Development

- Team Leadership & Motivation

- Banking Regulations & Compliance

- Negotiations & Relationship Management

- Performance & Quality Assurance

- Financial Analysis & Reporting

Responsibilities:

- Develop and implement credit policies and procedures to meet organizational needs and adhere to banking regulations.

- Identify, assess and manage credit risk in order to minimize potential losses.

- Lead a team of credit analysts in the efficient and accurate completion of credit activities.

- Monitor the progress and quality of credit activities, and take corrective action when needed.

- Analyze financial statements and credit applications in order to assess potential risks and make credit decisions.

- Ensure compliance with all banking regulations and laws.

- Negotiate and maintain relationships with key stakeholders, such as customers, suppliers, and bankers.

- Conduct regular credit training sessions for staff.

- Prepare credit reports and other financial analysis documents.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Chief Credit Officer Resume Examples Resume with 10 Years of Experience

Highly experienced Chief Credit Officer with 10+ years in the banking industry. Adept in providing strategic advice and guidance to senior level management and staff on credit- related matters. Skilled in designing and developing policies, procedures, and loan products. Proven track record of successfully managing the entire credit cycle, including credit risk assessment, loan origination and portfolio management.

Core Skills:

- Credit Risk Management

- Loan Origination

- Portfolio Risk Analysis

- Loan Portfolio Management

- Credit Analysis

- Regulatory Compliance

- Strategic Planning

- Leadership

- Risk Mitigation

Responsibilities:

- Develop and implement credit policies, procedures and loan products.

- Monitor and review credit reports, financial statements and credit history.

- Review and analyze loan applications and creditworthiness of borrowers.

- Monitor and review credit reports, financial statements and credit history.

- Assess and report on credit risk exposures and prepare credit risk reports.

- Monitor and manage loan portfolios and identify problem loans.

- Negotiate loan terms and conditions with borrowers.

- Ensure compliance with banking laws and regulations.

- Develop and maintain strong relationships with customers and other stakeholders.

- Supervise and mentor credit staff.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Chief Credit Officer Resume Examples Resume with 15 Years of Experience

A highly accomplished professional with 15 years of experience in the banking and financial services industry, I am well- versed in developing and assessing credit policies, credit risk management, and financial performance. Through my career, I have been successful in driving the credit analysis process, management of credit risks, compliance to regulations and legislation, and creating and implementing credit strategies to minimize risk and maximize returns on investments. My core strengths include relationship management, problem- solving, decision making, and negotiation.

Core Skills:

- Credit Risk Management

- Credit Analysis

- Financial Performance Analysis

- Credit Strategy Development

- Relationship Management

- Problem- Solving

- Decision Making

- Negotiation

Responsibilities:

- Design and implement credit policies in compliance with regulations and legislation

- Develop and maintain relationships with internal and external stakeholders

- Monitor and analyze credit performance and risk factors

- Analyze financial data and market conditions to identify and manage risks

- Provide guidance and advice on credit decisions

- Oversee the credit portfolio and make recommendations for improvement

- Ensure proper documentation of credit files and loan applications

- Negotiate and manage loan terms and conditions

- Monitor and resolve customer complaints

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Chief Credit Officer Resume Examples resume?

or star A resume for a Chief Credit Officer should provide a comprehensive overview of the individual’s qualifications, education, and professional experience. This resume should be tailored to the specific job and industry the individual is applying for. Below are some of the key elements that should be included in a Chief Credit Officer resume:

- Professional Summary: A brief summary of the individual’s professional experience and qualifications that are applicable to the job.

- Education: List the individual’s formal education and any applicable certifications.

- Work Experience: A comprehensive list of the individual’s professional experience, including job titles, dates of employment, and a brief description of each role.

- Skills: A comprehensive list of the individual’s key skills, both technical and soft, that are applicable to the job.

- Professional Achievements: A list of key accomplishments achieved during the individual’s professional experience.

- Certifications: A list of any applicable certifications that are relevant to the job.

- Professional Memberships: A list of applicable professional memberships or associations that the individual is a part of.

What is a good summary for a Chief Credit Officer Resume Examples resume?

A Chief Credit Officer resume should emphasize the individual’s education, experience, and qualifications in the banking and financial services industry. It should highlight the individual’s leadership, communication, and decision-making skills, as well as their ability to develop and execute successful credit strategies. The resume should also demonstrate knowledge of all applicable laws, regulations, and practices related to credit, banking, and financial services. It should also demonstrate an understanding of complex financial analysis and risk management, and the ability to build relationships with banks, creditors, and customers. Finally, the resume should demonstrate the candidate’s ability to work collaboratively with other executives and staff to maximize profitability and meet organizational goals.

What is a good objective for a Chief Credit Officer Resume Examples resume?

bulletA Chief Credit Officer is responsible for developing and implementing credit policies and procedures that ensure a business’s financial stability, safety and liquidity. This is a high-level position that requires a combination of technical knowledge, financial expertise and executive leadership. As such, a Chief Credit Officer’s resume should reflect these qualities.

When writing a resume for a Chief Credit Officer position, it’s important to tailor the objective to the job you’re applying for. The objective should emphasize the areas of expertise and experience you possess that will make you an ideal candidate for the role. Here are some examples of objectives that you can use to tailor your resume for a Chief Credit Officer role:

- To leverage my 10+ years of financial expertise and proven track record of developing and implementing credit policies and procedures to ensure a company’s financial stability and liquidity.

- To use my extensive experience in commercial lending and credit risk management to guide a company’s financial health and profitability.

- To utilize my extensive knowledge of risk management, financial regulations, and banking compliance to ensure a company’s ability to manage and protect its assets.

- To employ my strong financial acumen and ability to analyze and manage risk to help a business stay compliant with legal and regulatory requirements.

- To implement innovative credit policies and procedures that maximize a company’s financial wellbeing.

By writing a concise and tailored objective for your resume, you’ll be able to show potential employers the skills and experience you possess that make you the best candidate for the job.

How do you list Chief Credit Officer Resume Examples skills on a resume?

When you are applying for a position as a Chief Credit Officer, it’s important that your resume reflects the skills and expertise necessary to be successful in the role. To list your skills effectively, you should include specific examples of how you’ve applied them in previous roles. Here are some examples of skills that you may want to consider adding to your resume when applying for a Chief Credit Officer position:

- Experience in developing and executing credit policies and procedures: Showcase your ability to develop and execute credit policies and procedures that are in line with company objectives.

- Strategic credit analysis and portfolio management: Demonstrate your experience in analyzing credit data and making strategic decisions to manage and optimize the credit portfolio.

- Risk assessment, monitoring and management: Highlight your ability to identify, assess and manage credit risk.

- Regulatory compliance: Showcase your experience with credit regulation processing and compliance.

- Relationship management: Detail your experience in managing relationships with banks, suppliers and other stakeholders.

- Financial reporting: Showcase your ability to analyze financial statements and provide detailed reports to senior management.

- Credit scoring and data mining: Detail your experience in credit scoring models and mining data from various sources.

- Leadership: Showcase your ability to lead teams and effectively manage projects.

By highlighting these key skills, you can demonstrate your qualifications for a Chief Credit Officer role and ensure that your resume stands out.

What skills should I put on my resume for Chief Credit Officer Resume Examples?

Writing a resume for a Chief Credit Officer position can be a daunting task. You want to showcase your experience and skills to potential employers, but how do you know what to include? Here are some suggestions for skills that you should include in your Chief Credit Officer resume to demonstrate your capabilities in this role:

- Knowledge of credit risk management systems: As a Chief Credit Officer, you will be responsible for managing the credit risk of your organization. You should have a deep understanding of credit risk management systems, as well as the ability to analyze and interpret data to make informed decisions.

- Expertise in financial analysis: You should have a comprehensive understanding of financial models and be able to assess risk and make decisions based on the analysis. This could include advanced knowledge of portfolio analysis, stress testing, and evaluating credit exposure.

- Leadership and team management: Chief Credit Officers need to be able to lead teams and direct the credit and risk policies of the organization. You should showcase your experience with managing teams, developing and executing strategies, and leading projects.

- Regulatory compliance and reporting: A Chief Credit Officer must also be familiar with applicable regulations and be able to ensure that all policies and procedures are compliant. You should have experience with financial reporting, compliance management, and risk assessment.

By including these skills in your Chief Credit Officer resume, you will be able to demonstrate your knowledge and experience to potential employers. With these credentials, you can show that you are the right person for the job.

Key takeaways for an Chief Credit Officer Resume Examples resume

When you are writing your Chief Credit Officer resume, it is important to include key takeaways to make it stand out. Here are some key takeaways to include on your resume:

• Knowledge of credit risk management: As a Chief Credit Officer, you must demonstrate a clear understanding of credit risk management and have the experience to back it up. Showcase your technical skills and knowledge of the credit risk management process, applicable regulations and industry best practices.

• Strong communication skills: Highlighting your ability to communicate effectively with executive-level stakeholders and customers is important. Demonstrate your excellence in oral and written communication, as well as your ability to present complex information in a clear and concise manner.

• Proven leadership capabilities: Showcase your leadership capabilities and how you have successfully led teams and projects throughout your career. Provide evidence of your ability to build and lead effective teams and inspire others to drive results.

• Analytical mindset: Demonstrate your ability to make sound decisions by highlighting your analytical and problem-solving skills. Showcase how you can use financial and business data to identify opportunities and develop strategies to maximize returns.

• Thorough understanding of regulations: A Chief Credit Officer needs to have a thorough understanding of the relevant regulations and best practices in the industry. Highlight your experience with the latest regulations and how you have successfully implemented them in the past.

By including these key takeaways in your Chief Credit Officer resume, you will be able to showcase your impressive credentials and demonstrate why you are the ideal candidate for the job.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder