Securing a job as a business banker requires a great resume. When you apply for a job as a business banker, you bring your professional experience and education to the table. A well-crafted resume that highlights your qualifications and experience can make all the difference in landing the job of your dreams. This resume writing guide provides step-by-step instructions and examples to help you create the perfect business banker resume. With the right resume, you can make sure to stand out from the competition and leave a lasting impression with the hiring manager.

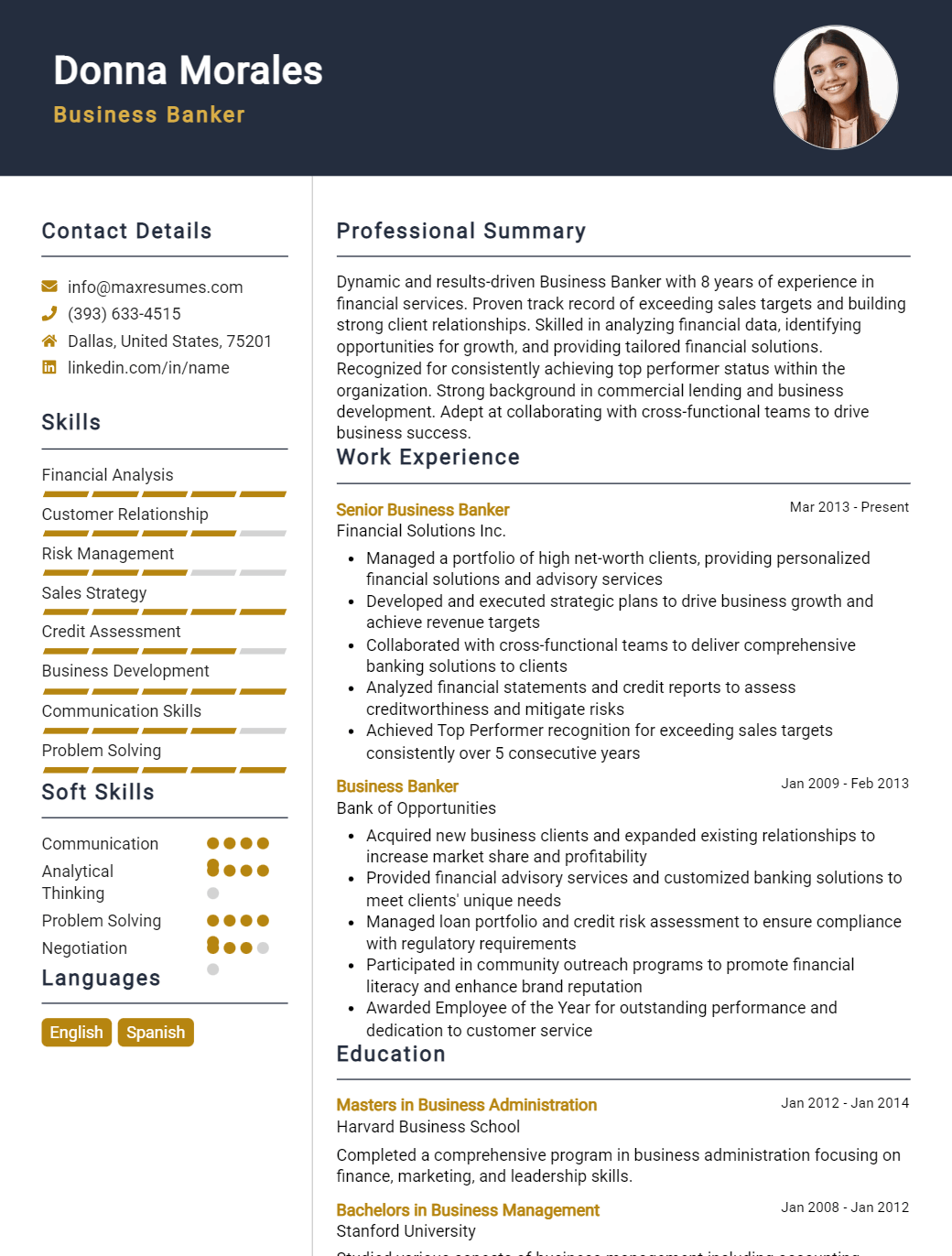

Business Banker Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Business Banker Resume Examples

John Doe

Business Banker

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Dynamic and results- oriented finance professional with 8+ years of combined experience in investment banking, corporate banking and financial management. A creative problem solver with a proven ability to develop strong relationships with clients and colleagues. Adept at analyzing financial data and developing strategic plans that improve performance and drive revenue.

Core Skills:

- Investment Banking

- Corporate Banking

- Financial Management

- Credit Analysis

- Financial Modeling

- Compliance

- Risk Management

- Banking Regulations

- Capital Markets

- Fundraising

- Business Development

Professional Experience:

Business Banker | ABC Bank | Washington, DC | 2018- Present

- Work in partnership with sales, credit and other internal teams to develop banking strategies that increase clients’ portfolio volume and revenue.

- Lead team of 5 in identifying and assessing customers’ banking needs and providing customized solutions.

- Develop and implement strategies to expand customer base and meet loan and deposit portfolio objectives.

- Analyze and review credit applications, financial statements, and collateral assessments.

- Provide guidance to clients on various banking products and services to increase revenue.

Senior Investment Banker | XYZ Investment Bank | New York, NY | 2012- 2018

- Led teams of 10 in providing strategic advice to clients on capital markets, investments, mergers and acquisitions.

- Developed and executed innovative strategies to secure new business and expand client base.

- Prepared and presented financial models to clients to demonstrate the impact of investment decisions.

- Participated in investor relations, fundraising, and equity and debt issuance activities.

Education:

MBA in Finance | Columbia University | New York, NY | 2010- 2012

B.S. in Finance | XYZ University | New York, NY | 2006- 2010

Recent college graduate with a strong desire to work in the banking sector. Possesses excellent communication and customer service skills, as well as a natural ability to build strong relationships with customers. Committed to providing the highest level of customer service and satisfaction.

Skills:

- Knowledge of banking and financial services

- Excellent customer service skills

- Strong communication skills

- Ability to develop relationships with customers

- Attention to detail

- Sales and marketing experience

- Problem- solving skills

- Ability to work independently

Responsibilities

- Handling customer banking transactions

- Ensuring customer satisfaction throughout all interactions

- Developing and maintaining strong customer relationships

- Selling banking products and services

- Cross- selling banking products

- Keeping accurate records of customer accounts

- Resolving customer complaints and inquiries

- Following established policies and procedures

Experience

0 Years

Level

Junior

Education

Bachelor’s

Business Banker Resume Examples Resume with 2 Years of Experience

Motivated and experienced Business Banker with two years of experience in financial consulting, banking, and sales. Adept in interacting with a wide range of clients and customers and providing them with comprehensive financial advice and solutions. Experienced in developing and maintaining relationships with clients and partners. Proven ability to work independently and collaboratively to achieve results.

Core Skills:

- Financial Consulting

- Banking

- Sales

- Relationship Building

- Interpersonal Communication

- Strategic Planning

- Problem- Solving

- Negotiation

Responsibilities:

- Advised clients and customers on matters related to banking and financial services

- Developed and nurtured relationships with clients, customers, and partners

- Provided tailored advice on banking products to meet needs and goals

- Analyzed financial records and prepared customized financial plans

- Negotiated terms and conditions of banking contracts

- Developed and implemented strategic plans to increase sales and revenue

- Submitted loan applications to appropriate processing unit

- Ensured compliance with banking regulations and guidelines

- Monitored market trends and changes in regulations to best serve customers

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Business Banker Resume Examples Resume with 5 Years of Experience

Dynamic and results- oriented Business Banker with 5 years of experience in the banking industry. Proven track record of success in achieving long- term growth of loan and deposit portfolios as well as building relationships with clients. Skilled in developing strategies and marketing plans to generate leads and drive business.

Core Skills:

- Banking & Financial Services

- Relationship Building & Management

- Business Development & Marketing

- Analytical & Problem Solving

- Strategic Planning & Execution

Responsibilities:

- Developed strategies and marketing plans to generate leads and drive business for the loan and deposit portfolios.

- Managed and maintained relationships with existing clients and developed relationships with new customers.

- Assisted in the development of business plans to ensure long- term growth of the portfolio.

- Generated sales and marketing reports to analyze customer trends, identify opportunities and make informed decisions.

- Analyzed customer needs and developed customized loan and deposit plans to meet their financial needs.

- Negotiated loan and deposit terms and conditions with customers to ensure mutually beneficial agreements.

- Conducted financial analysis on loan and deposit applications to determine risk and make credit decisions.

- Upheld regulations, policies, and procedures to ensure compliance with banking and financial laws.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Business Banker Resume Examples Resume with 7 Years of Experience

An experienced Business Banker with 7 years of extensive experience in customer service, loan processing, and relationship management. Skilled in evaluating credit requests and developing financial solutions for customers. Proven ability to build and maintain customer relationships, resolve customer inquiries, and identify business opportunities. Committed to providing excellent customer service and delivering superior quality banking products.

Core Skills:

- Business Banking

- Credit Analysis

- Relationship Management

- Financial Solutions

- Customer Service

- Problem Solving

- Loan Processing

Responsibilities:

- Develop and nurture strong customer relationships with a focus on customer service and satisfaction

- Analyze customer credit requests and make sound financial recommendations

- Evaluate customer profiles and assess risk exposures

- Manage loan processing and ensure accurate and timely customer service

- Identify and pursue business opportunities to grow customer base

- Conduct customer interviews to understand customer needs and develop appropriate solutions

- Provide expertise on banking products and services to ensure customer satisfaction

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Business Banker Resume Examples Resume with 10 Years of Experience

I am an experienced Business Banker with 10+ years in the industry. I have a strong background in financial management, customer relations, and credit analysis. I am also knowledgeable on all aspects of commercial loan origination and underwriting. I have a proven ability to interpret customer needs and develop tailored solutions to their banking needs. I have a customer- first mindset, with a focus on building long- term relationships and helping clients to achieve their financial goals.

Core Skills:

- Financial Management

- Customer Relations

- Credit Analysis

- Commercial Loan Origination

- Loan Underwriting

- Relationship Management

- Banking Product Knowledge

- Negotiation

- Compliance

Responsibilities:

- Advising clients on financial products and services

- Analyzing customer creditworthiness and recommending appropriate loan products

- Understanding customer needs and providing tailored solutions

- Negotiating terms of loan packages

- Overseeing loan origination and underwriting processes

- Monitoring loan portfolios and ensuring compliance with regulations

- Building and maintaining client relationships

- Assisting with bank marketing efforts

- Identifying new business opportunities and cross- selling products and services

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Business Banker Resume Examples Resume with 15 Years of Experience

Highly experienced and organized Business Banker with 15 years of experience in providing financial services such as advising clients on investments, opening new accounts, and providing expert financial advice. Possesses in- depth knowledge of banking regulations, commercial banking processes, and customer service. Skilled in analyzing financial data and developing long- term commercial banking strategies. Expert communicator and negotiator with the ability to effectively collaborate with colleagues and build relationships with clients.

Core Skills:

- In- depth understanding of banking regulations, procedures, and processes

- Advanced financial analysis and long- term strategy development

- Ability to analyze financial data and develop comprehensive reports

- Excellent customer service and communication skills

- Proven track record of securing new clients and maintaining relationships

- Highly organized with strong attention to detail

- Expert negotiator and problem solver

Responsibilities:

- Develop and implement financial strategies for corporate clients

- Analyze financial data, develop risk profiles and create comprehensive financial reports

- Advise clients on investments and financial products

- Negotiate terms of financial contracts and agreements

- Open new accounts and process customer transactions

- Ensure compliance with banking regulations and policies

- Provide excellent customer service to clients and build relationships

- Train and mentor junior banking team members

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Business Banker Resume Examples resume?

A business banker is generally responsible for facilitating a company’s financial transactions, as well as offering advice on important banking matters. They must have extensive knowledge of the banking industry, so it is important that a business banker’s resume is comprehensive and well-crafted. Below are some key components to include on a business banker resume.

- Education: A business banker should have a degree in finance, accounting, or a related field. The resume should specify the school name and degree earned.

- Professional Experience: Demonstrate your experience and expertise in the banking field by including a section detailing your prior work experience. This should include the dates of employment, the name of the bank or financial institution, and the job title.

- Specialized Skills: Bankers need to demonstrate that they understand the banking industry and possess the necessary skills to effectively serve customers. Include a section describing any specialized skills related to customer service, investments, loans, and other banking-related activities.

- Personal Skills: Bankers must also possess excellent communication and interpersonal skills. Include a section on your resume that details any relevant personal skills, such as the ability to handle stressful situations, problem-solving skills, and the capacity to provide effective customer service.

By including all of these key components on your resume, you can demonstrate that you have the qualifications and experience necessary to be a successful business banker. This will help you stand out from the competition and secure your dream job.

What is a good summary for a Business Banker Resume Examples resume?

A good summary for a Business Banker Resume Examples resume should provide an overview of your qualifications and experience as a business banker. It should express your ability to manage complex financial transactions, analyze and interpret financial data, identify potential business opportunities, and build strong working relationships with clients. It should also highlight your knowledge of banking regulations, your experience working in a customer-oriented environment, and your ability to provide sound financial advice. Finally, the summary should emphasize your commitment to providing excellent customer service and your willingness to continue to learn and grow in the banking industry. With a well-crafted summary, you can demonstrate to potential employers why you’re the right candidate for the job.

What is a good objective for a Business Banker Resume Examples resume?

A business banker is responsible for facilitating financial transactions between business clients and financial institutions. As such, a good objective for a business banker resume must demonstrate the applicant’s ability to effectively manage and complete banking tasks, as well as to create strong, long-lasting relationships with clients.

- To leverage my 5 years of experience in banking to manage financial transactions and provide exceptional customer service to clients.

- To effectively interact with business clients and financial institutions to create successful banking solutions.

- To utilize superior communication skills to effectively manage and grow client relationships.

- To apply my expertise in banking regulations and compliance to ensure the highest levels of security.

- To utilize my knowledge of financial instruments and investments to provide sound financial advice and guidance to clients.

- To collaborate effectively with other banking professionals to ensure client satisfaction and compliance with banking regulations.

How do you list Business Banker Resume Examples skills on a resume?

When writing a resume for a business banker position, it’s important to include the skills and experience most relevant to the job. Here’s a few examples of the skills you can list on your resume:

- Financial Expertise: As a business banker, you should have in-depth knowledge of financial and banking operations, as well as be able to interpret financial statements and analyze risk.

- Problem-Solving: To be a successful business banker, you must be able to identify and solve complex financial problems.

- Client Management: As a banker, you’ll be working directly with clients, so it’s important to have strong people management and customer service skills.

- Negotiation Skills: You’ll be dealing with clients, vendors, and other stakeholders, all of which require strong negotiation skills.

- Leadership: As a business banker, you’ll likely have to manage teams and lead projects. It’s important to have a proven track record of successful Leadership.

- Accounting/Bookkeeping: Business banking requires a sharp eye for detail, so you should be able to keep accurate records and be proficient in accounting.

- Risk Management: A major part of your job is assessing risk and making decisions accordingly. You should be able to identify and mitigate risks.

By including these skills on your resume, you’ll be better able to demonstrate to employers why you’re the perfect choice for the job. Good luck!

What skills should I put on my resume for Business Banker Resume Examples?

When crafting a resume as a Business Banker, you will want to highlight the skills and qualifications that make you stand out as a professional in the banking industry. In addition to your banking background and experience, you should include qualifications related to data analysis, financial literacy, customer service, problem-solving, and communication. Here are some of the key skills to consider including on your Business Banker Resume Examples:

- Data Analysis: Your ability to analyze and interpret financial data is critical in the banking industry. Be sure to include your experience with financial analysis, bookkeeping, and market research.

- Financial Literacy: Demonstrate your knowledge of banking products and services, along with recent changes in the industry. Show that you are a trusted source for accurate banking information.

- Customer Service: As a Business Banker, you are the face of the bank and need to be able to provide excellent customer service. Showcase your ability to provide professional and courteous service in a timely manner.

- Problem-Solving: Demonstrate your ability to solve complex banking problems and think on your feet. Show that you can take initiative and take immediate action to resolve issues.

- Communication: Include any experience you have with written and verbal communication. Demonstrate your ability to confidently explain complicated banking concepts to customers.

Key takeaways for an Business Banker Resume Examples resume

A business banker resume can be a powerful tool for demonstrating your skills and experiences in the banking industry. Writing a successful resume is essential for job seekers in the banking industry, as employers often require specific qualifications for the position. Therefore, when writing a business banker resume, it is important to ensure that your qualifications are clearly stated, and that your experience is detailed and relevant to the job.

Here are some key takeaways for an effective business banker resume:

1) Include a summary of your qualifications. When writing a business banker resume, it’s important to include a summary of your qualifications that highlights your areas of expertise. Be sure to include any education or certifications you may have, as well as a list of competencies that demonstrate your ability to work in the banking industry.

2) Demonstrate your knowledge and skills. When writing a business banker resume, it’s important to highlight the skills and knowledge that you have acquired throughout your career. Showcase any relevant experience in the banking industry, such as customer service, loan servicing, and investments.

3) Tailor your experience to the job. It’s important to tailor your experience to the job you’re applying for. Pay close attention to the job description and highlight any experiences that are applicable to the position.

4) Highlight any relevant awards or recognition. If you have received any awards or recognition for your work in the banking industry, be sure to include them on your business banker resume. This demonstrates that you are a standout candidate and will be a valuable asset to the bank.

5) Follow standard formatting guidelines. When writing a business banker resume, it is important to follow standard formatting guidelines. Be sure to include clear headings and use a professional font to ensure that your resume is easy to read.

By following these key takeaways, you will be able to create an effective business banker resume that will stand out to hiring managers and help you secure the job of

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder