Starting a career as a bank loan officer requires a highly specialized skillset and education. Writing an effective resume is the first step in securing an interview and ultimately a job. Creating a resume that accurately represents your skills and qualifications is essential in the competitive banking industry. This guide will provide insight into the elements of a successful bank loan officer resume, and provide examples of the most commonly used resume formats. By following the tips and strategies discussed within this guide, you can create a resume that will stand out and help you secure the position you desire.

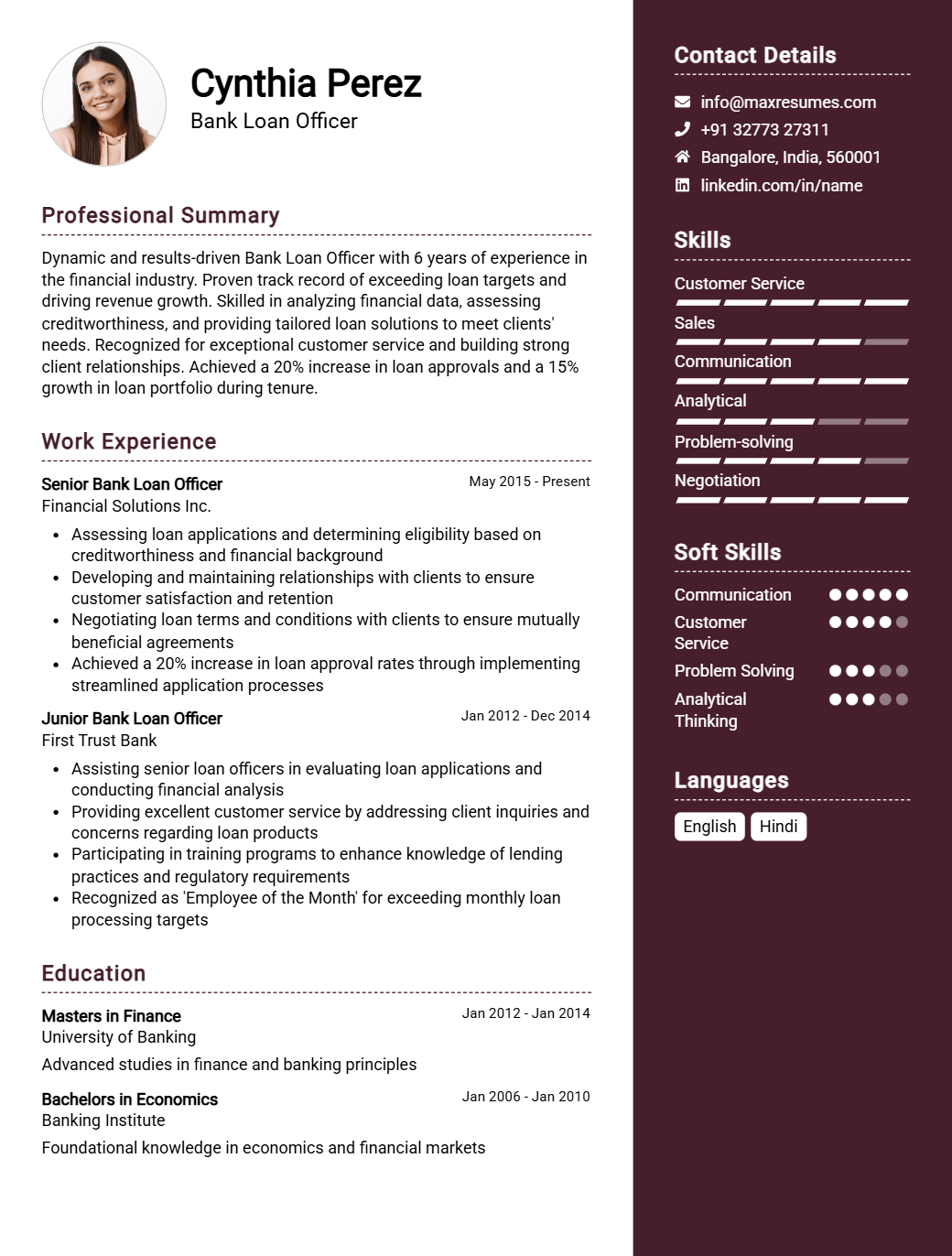

Bank Loan Officer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Bank Loan Officer Resume Examples

John Doe

Bank Loan Officer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly experienced Bank Loan Officer with over 5 years of experience in the banking industry. Demonstrated expertise in loan processing and loan origination, with a proven track record of facilitating successful loan transactions. Highly capable in evaluating and analyzing customer credit histories, as well as assessing customer income and financial statements. Adept at utilizing sound judgment to recommend loan products and services to meet customer needs.

Core Skills:

- Excellent knowledge of banking and lending regulations

- Ability to evaluate and analyze customer credit histories

- Excellent organizational, problem- solving, and communication skills

- Proficient in Microsoft Office Suite, loan origination and processing software

- Strong customer service and relationship building skills

Professional Experience:

Bank Loan Officer, ABC Bank, San Francisco, CA

- Performed credit analysis to evaluate and determine customer creditworthiness.

- Conducted loan interviews as well as managed customer loan applications.

- Reviewed customer financial statements and other documents for accuracy and completeness.

- Provided customer service and managed customer relationships to ensure customer satisfaction.

- Facilitated loan origination and processing to ensure loan transactions were completed timely and accurately.

- Coordinated with other departments to ensure compliance with banking regulations and laws.

Education:

Bachelor of Science in Business Administration, San Francisco State University, San Francisco, CA

Bank Loan Officer Resume Examples Resume with No Experience

Dynamic and motivated entry- level loan officer with excellent communication, customer service, and problem- solving skills. Extensive knowledge of banking and loan processes, policies, and regulations. Dedicated to delivering a high level of customer satisfaction and providing tailored loan solutions.

Skills:

- Knowledge of banking and loan policies and regulations

- Strong customer service and problem- solving skills

- Excellent verbal and written communication

- Proficient in utilizing loan processing software

- Ability to multitask and prioritize tasks

- Strong attention to detail

Responsibilities

- Greet customers and answer all inquiries regarding loan products and services

- Assist loan applicants in completing loan applications

- Review loan applications and financial information

- Verify creditworthiness of applicants

- Calculate loan payments and interest rates

- Assist loan applicants with contract signing and closing

- Process payments, including loan modifications and extensions

- Track loan documents and files

- Maintain confidentiality of loan records

- Provide customer service to loan applicants and borrowers

- Answer all inquiries regarding loan documents, terms and conditions

- Assist customers with resolving loan issues

- Assist in the development and implementation of loan policies and procedures

- Ensure compliance with banking regulations and laws

Experience

0 Years

Level

Junior

Education

Bachelor’s

Bank Loan Officer Resume Examples Resume with 2 Years of Experience

Highly motivated and organized Bank Loan Officer with 2 years of experience in the banking and financial services industry. Experienced in the review, analysis and processing of loan applications, maintaining and managing loan portfolios, and providing excellent customer service. Possesses excellent communication, interpersonal, problem- solving and time management skills.

Core Skills:

- Loan origination, processing and closing

- Credit analysis and risk assessment

- Loan portfolio review and management

- Regulatory and compliance

- Financial reporting

- Customer service

- Interpersonal skills

- Problem- solving

Responsibilities:

- Assessed customer creditworthiness and financial capabilities by analyzing customer credentials and other relevant information

- Reviewed loan applications and prepared documents for loan approval

- Obtained customer financial documents and verified accuracy of information

- Analyzed customer’s credit histories and prepared risk assessments

- Calculated and verified customer income to determine loan eligibility

- Assisted customer with loan application process and addressed customer inquiries

- Ensured compliance with all banking standards and regulatory requirements

- Monitored loan portfolios and provided monthly updates to management

- Provided excellent customer service to ensure customers satisfaction with loan process

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Bank Loan Officer Resume Examples Resume with 5 Years of Experience

I am an experienced Bank Loan Officer with five years of experience working with clients to evaluate their financial needs, determine the most appropriate loan type and provide guidance throughout the loan process. I have a comprehensive understanding of banking regulations, and am committed to providing excellent customer service to each and every individual who I work with. My interpersonal and communication skills enable me to effectively explain the loan process, while my attention to detail ensures that all relevant information is accurately documented.

Core Skills:

- Knowledgeable in loan procedures and banking regulations

- Exceptional customer service skills

- Strong communication and interpersonal abilities

- High attention to detail

- Flexible and able to adapt to changing needs

Responsibilities:

- Meet individually with clients to discuss loan options and eligibility

- Review prospective customers’ financial information to determine loan eligibility

- Analyze credit scores, employment history, and other factors

- Explain the loan process to clients and answer questions

- Submit approved loan applications to management for review and approval

- Stay up to date on industry standards and best practices

- Ensure all paperwork is accurate and up to date

- Maintain accurate records of loan information in accordance with banking regulations

- Monitor loan progress and observe repayment timeline

- Assist customers with loan modifications or refinancing options as needed

- Act as an ambassador for the bank and build positive relationships with customers

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Bank Loan Officer Resume Examples Resume with 7 Years of Experience

With more than 7 years of experience as a Bank Loan Officer, I am highly adept at assessing creditworthiness, analyzing financial information, and providing tailored loan solutions to meet customers’ unique financial needs. During my career, I have successfully written dozens of loans, managed and monitored loan activities, and provided superb customer service to ensure customer satisfaction. My ability to build strong relationships with customers and my extensive knowledge of banking products allow me to provide the best possible financial solutions for my clients.

Core Skills:

- Outstanding customer service skills

- Knowledge of banking products and services

- Knowledge of banking regulations

- Excellent written and verbal communication

- Proficient in Microsoft Office and other financial software

- Ability to manage multiple tasks and prioritize workloads

- Ability to build strong relationships with clients

- Analytical skills to assess creditworthiness and financial information

Responsibilities:

- Responding to customer inquiries regarding loan products and services

- Evaluating creditworthiness and financial information of customers

- Analyzing loan applications and making recommendations

- Providing guidance and advice to ensure customers make informed decisions

- Verifying income and assets to ensure compliance with loan requirements

- Negotiating loan terms and conditions with customers

- Assisting customers with loan applications, documents, and paperwork

- Monitoring loans and ensuring timely payments

- Developing and maintaining relationships with customers

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Bank Loan Officer Resume Examples Resume with 10 Years of Experience

Results- oriented Bank Loan Officer with 10 years of experience in helping clients to obtain the most favorable loan terms and conditions. Possesses a strong attention to detail to ensure accuracy and compliance with all banking regulations and laws. Proven success in creating an effective Bank Loan Officer strategy and budget. Experienced in working with a variety of borrowers, from individuals to large businesses.

Core Skills:

- Financial Analysis

- Financial Planning

- Loan Processing

- Credit Analysis

- Risk Assessment

- Customer Service

- Loan Documentation

- Regulatory Compliance

Responsibilities:

- Conducted financial analysis and loan evaluations to assess creditworthiness and loan eligibility.

- Reviewed financial records, credit score and other necessary documentation to determine loan terms and conditions.

- Provided advice and guidance to clients on loan programs and available options.

- Conducted due diligence, risk assessment and credit analysis prior to loan approval.

- Ensured all loan related documentation was complete and accurate.

- Provided support to customers during the loan process.

- Reviewed and verified loan information, ensuring compliance with applicable policies and procedures.

- Maintained accurate and updated loan files.

- Resolved customer inquiries and complaints in a timely and effective manner.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Bank Loan Officer Resume Examples Resume with 15 Years of Experience

I am an experienced Bank Loan Officer with 15 years of expertise in the financial services industry. I have a proven success record in originating and managing loan portfolios, managing portfolio risk, and negotiating loan terms and conditions. Utilizing my strong interpersonal and communication skills, I have effectively built and maintained relationships with clients, lenders, and other stakeholders. My experience also includes preparing financial statements, analyzing credit reports, and assessing loan applications. I am highly motivated, detail- oriented, and committed to providing the best customer experience.

Core Skills:

- Loan Origination

- Loan Portfolio Management

- Risk Assessment and Management

- Negotiation

- Financial Analysis

- Interpersonal and Communication Skills

Responsibilities:

- Originate and manage loan portfolios

- Analyze credit reports and financial statements

- Negotiate loan terms and conditions

- Assess loan applications

- Monitor and report on loan portfolio performance

- Ensure compliance with relevant regulations and guidelines

- Maintain strong relationships with clients, lenders, and other stakeholders

- Provide excellent customer service

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Bank Loan Officer Resume Examples resume?

A Bank Loan Officer Resume Examples should showcase the applicant’s skills and experience in the banking and finance industry. The following is a list of key features that should be included on a Bank Loan Officer Resume Examples:

- Professional Summary: Provide a brief summary of the applicant’s professional experience in the banking and finance industry, along with relevant skills, qualifications, and achievements.

- Education & Training: List any relevant educational qualifications and training programs the applicant has completed related to the banking and finance industry.

- Work History & Achievements: List any work experience the applicant has in the banking and finance field, along with any relevant achievements or awards.

- Job Skills & Responsibilities: List any job skills and responsibilities the applicant has in the banking and finance industry, such as customer service, loan processing, and financial analysis.

- Professional References: Include professional references from former employers or colleagues in the banking and finance industry.

By including these key features in a Bank Loan Officer Resume Examples, applicants can show employers they have the necessary skills and experience to fill the position.

What is a good summary for a Bank Loan Officer Resume Examples resume?

A Bank Loan Officer Resume Examples resume should concisely summarize a candidate’s experience, accomplishments, and qualifications in a professional, persuasive, and to-the-point fashion. A good summary should encompass the candidate’s knowledge of the banking industry, their ability to process and assess loan applications, their experience working with customers, and their ability to stay up-to-date with changing banking regulations. The summary should also highlight any special skills the candidate brings to the role, such as strong communication, problem-solving, and decision-making skills. By providing a clear and concise snapshot of the candidate’s qualifications and experience, the summary should help a potential employer make an informed decision about whether or not to move forward with the hiring process.

What is a good objective for a Bank Loan Officer Resume Examples resume?

/bulletA Bank Loan Officer’s primary objective is to support the organization’s financial goals and objectives by providing excellent customer service and ensuring loan and credit applications are processed in a timely and accurate manner. When writing your resume, it’s important to highlight your qualifications and any relevant experience you have in the banking industry. Here are some examples of good objectives for a Bank Loan Officer Resume:

- To utilize my extensive experience in the banking industry to provide high quality customer service and loan processing to ensure the organization meets its financial objectives

- To use my strong interpersonal and communication skills in order to build trust with customers and increase loan and credit applications

- To utilize my knowledge of banking regulations and procedures to ensure the accuracy and integrity of applications

- To leverage my organizational and problem-solving skills to manage multiple tasks and meet tight deadlines

- To employ my leadership skills to supervise junior loan officers and ensure the accuracy of their work

How do you list Bank Loan Officer Resume Examples skills on a resume?

for bulletsWriting a resume for a Bank Loan Officer position can be challenging. It’s important to showcase your skills and experience in an effective way that will highlight your qualifications and make you stand out from other applicants. When it comes to listing your skills on a resume, it’s important to be specific and focus on what you can bring to the position. Here are some tips on how to list Bank Loan Officer resume examples skills on a resume.

- Financial Analysis and Reporting: Being able to evaluate financial information and present it in a way that is understandable and accurate is an essential skill for a Bank Loan Officer. When listing this skill, provide examples of financial analysis reports or presentations that you have conducted in the past.

- Professional Customer Service: You will be interacting with the customers on a daily basis, so you must be able to provide excellent customer service. Detail your experience with customer service, from how you handle difficult customers to how you respond to customer inquiries.

- Knowledge of Banking Regulations: A Bank Loan Officer must be aware of the various regulations and laws that govern the banking industry. Be sure to list any courses or certifications that you have taken in the banking industry, as well as your experience with related banking regulations.

- Risk Assessment: As a Bank Loan Officer, you must be able to assess the risk of a loan and make informed decisions. Showcase your ability to assess risk by detailing your experience in making loan decisions.

- Negotiation: A Bank Loan Officer must be able to negotiate loan terms that are satisfactory to all parties involved. List any experience you have with negotiations, such as successful loan settlements or client agreement.

What skills should I put on my resume for Bank Loan Officer Resume Examples?

or bulletWriting a resume for a bank loan officer position can be a daunting task. You want to showcase your skills and experience in a way that will stand out to potential employers. To ensure your resume stands out, you must include the right skills for the job. Here are some of the top skills for a bank loan officer resume:

- Knowledge of Banking Regulations and Procedures: Bank loan officers must have knowledge of banking regulations and procedures, including the ability to interpret and apply them. They must also understand the requirements for loan applications, processing, and closing.

- Understanding of Credit Analysis: Bank loan officers must have an understanding of credit analysis, including the ability to assess creditworthiness, analyze financial statements, and determine the risk associated with each loan.

- Interpersonal and Communication Skills: Bank loan officers must possess strong interpersonal and communication skills, as they must interact with clients, other bank employees, and loan applicants. They must also be comfortable working with a variety of people, from executives to loan applicants.

- Time Management and Problem-Solving Skills: Bank loan officers must be able to manage their time effectively and solve complex problems. They must also have the ability to quickly analyze data and identify potential problems.

- Customer Service Skills: Bank loan officers must have excellent customer service skills, as they must be able to handle customer inquiries and provide assistance when needed. They must also be able to effectively explain the loan process and answer questions.

These are just a few of the skills that should be included on your bank loan officer resume examples. Including these skills on your resume will help you stand out and make sure you are considered for the position.

Key takeaways for an Bank Loan Officer Resume Examples resume

As a bank loan officer, your resume should demonstrate your ability to assist customers in meeting their financial goals by offering sound advice and providing exceptional customer service. With that in mind, here are some key takeaways for writing an effective bank loan officer resume.

- Focus on Your Experience: An effective bank loan officer resume should highlight key skills and experiences that showcase your ability to succeed in the role. Make sure to include any past banking experience, such as customer service, loan application processing, and risk management.

- Highlight Your Achievements: Be sure to highlight any achievements you’ve had in the banking industry. This can include awards for customer service or for successful loan processing.

- Emphasize Your Communication Skills: Bank loan officers must have strong communication skills to be successful. Your resume should demonstrate your ability to communicate clearly and effectively with customers, as well as your ability to listen to customer needs and provide solutions.

- Demonstrate Your Technical Expertise: A successful bank loan officer must also have strong technical skills. Make sure to list any technological experience you have, such as software proficiency or experience with financial databases.

- Showcase Your People Skills: Bank loan officers must be able to build trust with customers. Make sure to emphasize any customer service experience or interpersonal skills that demonstrate your ability to develop relationships and provide exceptional service.

With these key takeaways in mind, you can craft an effective bank loan officer resume that will help you stand out from the competition.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder

Write here introduction….

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

[Job Title] Resume Examples

John Doe

Job Title

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Write summary…

Write Resume…

Experience

0 Years

Level

Junior

Education

Bachelor’s

Write Resume…

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Write Resume…

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Write Resume…

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Write Resume…

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Write Resume…

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder