If you’re looking to become a bank examiner, you’ll need a resume that stands out. The highest-ranking banking positions require a well-crafted resume that details your qualifications and experience. To help you create the perfect resume, this guide provides several bank examiner resume examples and tips for writing the perfect resume. With this guide in hand, you can create a resume that shows you’re the ideal candidate for the job.

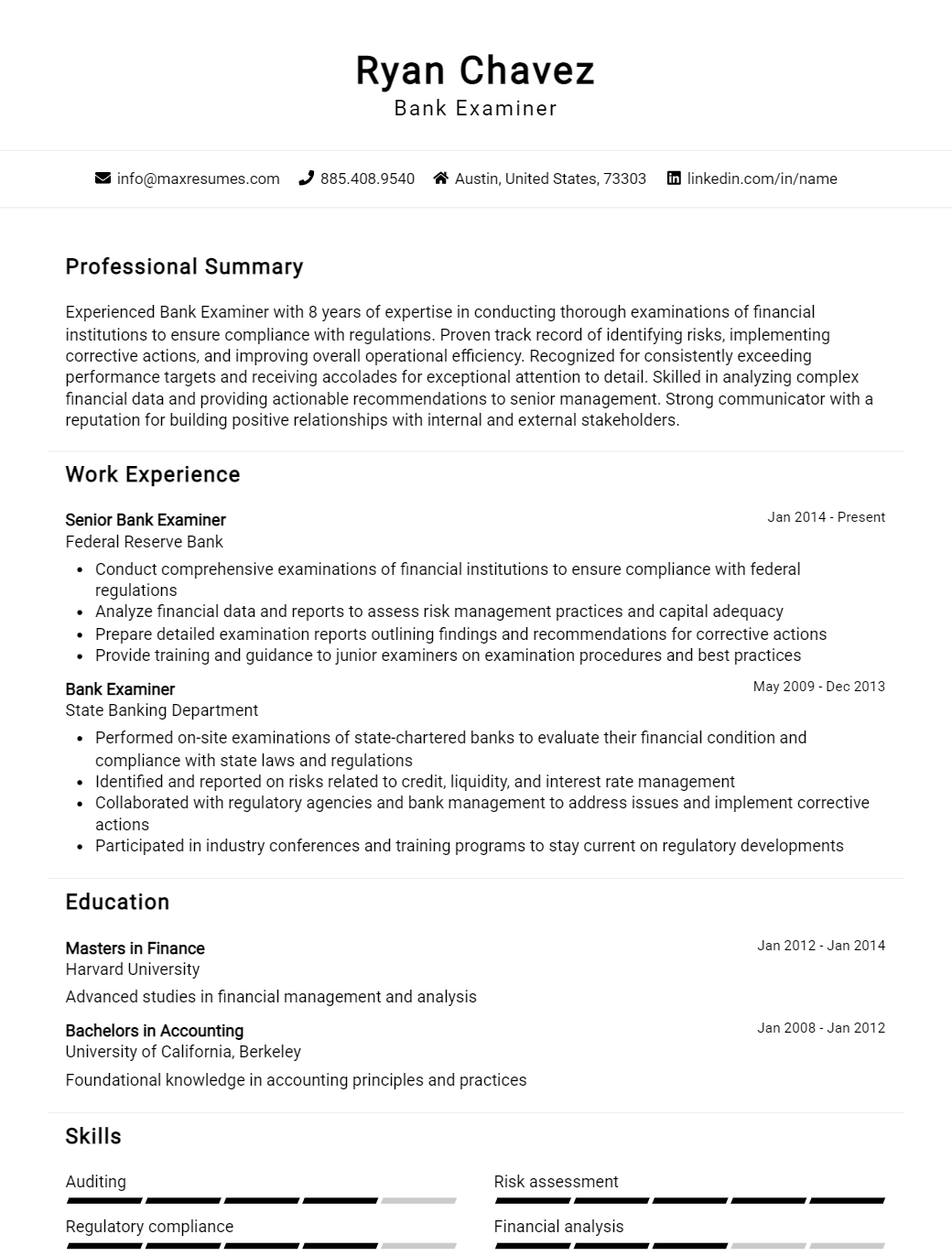

Bank Examiner Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Bank Examiner Resume Examples

John Doe

Bank Examiner

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly organized and detail- oriented professional with 10 years of experience as a Bank Examiner. I have an in- depth understanding of banking regulations and compliance standards, as well as excellent analytical, problem solving, and written and verbal communication skills. I am proficient in Microsoft Office applications and have experience with automated banking systems. I am committed to providing exceptional financial regulation services to the banking industry.

Core Skills:

- Knowledge of banking regulations and compliance standards

- Demonstrated ability to analyze financial data

- Expertise in Microsoft Office suite

- Highly organized and detail- oriented

- Strong written and verbal communication skills

- Excellent problem solving and decision- making skills

- Proficient in automated banking systems

Professional Experience:

Bank Examiner, ABC Bank | 2017- Present

- Evaluate financial data to identify compliance with regulations

- Prepare reports on examination findings, recommendations, and corrective action plans

- Review internal control and operational efficiency of financial institutions

- Analyze financial statements and provide guidance to ensure compliance with regulations

- Monitor changes in banking laws and regulations

- Provide advice on banking practices and procedures

Education:

Masters of Science, Banking and Financial Services | ABC University | 2017

Bank Examiner Resume Examples Resume with No Experience

A highly motivated and experienced individual with a desire to become a Bank Examiner. Possesses exceptional analytical and communication skills and has a strong understanding of the banking industry. Highly organized and detail- oriented with a passion for helping people.

Skills:

- Strong analytical and problem- solving skills

- Excellent written and verbal communication

- Proficient in Microsoft Office applications

- Strong interpersonal and customer service skills

- Detailed- oriented

Responsibilities:

- Analyze financial data from banks and other financial institutions

- Analyze bank transactions, documents and records to assess compliance with applicable laws and regulations

- Conduct on- site examinations of financial institutions

- Identify and report suspicious activities to law enforcement

- Conduct reviews of banks and financial institutions to ensure compliance

- Provide training and guidance to financial institutions on compliance and regulatory matters

Experience

0 Years

Level

Junior

Education

Bachelor’s

Bank Examiner Resume Examples Resume with 2 Years of Experience

An experienced bank examiner with two years of experience in conducting financial reviews, auditing processes, and evaluating compliance reports. Possess a strong understanding of financial regulations, banking processes and procedures, as well as an in- depth knowledge of the banking industry. Proven ability to identify and address potential issues with bank operations and implement corrective measures when appropriate. Excellent communication and problem- solving skills, with a commitment to developing strong relationships with clients.

Core Skills:

- Financial regulation knowledge

- Auditing processes and compliance review

- Strong analytical and problem- solving skills

- Excellent communication and interpersonal skills

- Excellent presentation and report writing skills

- Ability to work independently and in a team environment

Responsibilities:

- Conduct regular financial reviews of banks and other financial institutions

- Audit processes to identify any potential discrepancies

- Evaluate compliance reports to ensure compliance with regulations

- Identify areas that need improvement in processes and procedures

- Develop corrective measures based on audit and review findings

- Provide recommendations to improve banking operations

- Prepare and present reports to senior management

- Maintain relationships with clients and provide assistance as needed

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Bank Examiner Resume Examples Resume with 5 Years of Experience

Highly experienced Bank Examiner with 5 years of experience in completing comprehensive financial examinations of banking institutions to ensure compliance with laws, regulations, and other applicable standards. Adept at identifying discrepancies, formulating corrective action plans, and providing thorough and timely reports. Possesses an in- depth knowledge of accounting and auditing, banking and finance, economic analysis, and risk management. Committed to providing the highest level of professionalism and customer service.

Core Skills:

- Banking and Financial Institution Regulations

- Accounting and Auditing

- Risk Management

- Data Analysis

- Report Writing

- Problem- Solving

- Relationship Building

- Customer Service

Responsibilities:

- Conducted financial examinations of banking institutions to ensure compliance with laws, regulations, and other applicable standards

- Analyzed financial reports, identified discrepancies, and provided recommendations for corrective action

- Identified and assessed potential risk areas such as internal processes and control systems

- Developed and implemented testing plans to ensure accuracy and reliability of banking institution financial reporting

- Prepared detailed reports based on findings and communicated results to management

- Monitored banking institution financial health and performance

- Developed strategies and strategies to mitigate risk and improve audit processes and procedures

- Provided guidance and assistance to banking institutions in areas of accounting and auditing, banking and finance, economic analysis, and risk management

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Bank Examiner Resume Examples Resume with 7 Years of Experience

Highly experienced Bank Examiner with 7 years of expertise in banking, finance and compliance. Possess excellent knowledge of banking regulations and procedures, federal and state laws. Combined with strong organizational and analytical skills, able to effectively address problems, identify risks and ensure compliance in a timely and accurate manner.

Core Skills:

- Regulatory Compliance

- Risk Analysis

- Bank Examination

- Financial Analysis

- Banking Regulations

- Problem Resolution

- Auditing

- Documentation

- Financial Reporting

Responsibilities:

- Plan, coordinate and conduct examinations and investigations of depository institutions and other financial institutions to ensure compliance with banking laws and regulations.

- Evaluate and analyze the financial condition of the institution, the quality of its management, the adequacy of its internal controls and the accuracy of its financial reports.

- Review loan documents, creditworthiness, security documents, compliance documents and other banking documents.

- Monitor changes in the banking industry and ensure compliance with new regulations and laws.

- Identify deficiencies in the banks operations and provide recommendations to reduce risk.

- Prepare detailed reports of examinations and investigations for use by bank officials and regulators.

- Develop, implement and monitor action plans to address problems or concerns.

- Assist in the development and implementation of policies and procedures that ensure the safety and soundness of the financial institution.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Bank Examiner Resume Examples Resume with 10 Years of Experience

Highly organized and detail- oriented professional with over 10 years of experience as a Bank Examiner. Skilled in risk analysis and financial reviews, with expertise in verifying financial data, making sure that regulations are followed and that organizations are compliant with applicable laws and standards. Adept at working with Bank stakeholders and providing critical reports to management.

Core Skills:

- Risk Assessment & Analysis

- Auditing & Reporting

- Financial Data Verification

- Regulation Compliance

- Leadership & Teamwork

- Organizational & Time Management

- Problem Solving & Decision Making

Responsibilities:

- Conducted detailed reviews and examinations of financial statements and records

- Developed and maintained relationships with lenders, borrowers, and other stakeholders

- Identified, analyzed, and reported on financial risks and compliance issues

- Inspected bank branches and operational processes to ensure compliance with banking regulations

- Prepared reports with recommendations for improved bank operations

- Provided guidance to bank directors and senior management on how to improve compliance and risk management

- Evaluated new business strategies and proposed changes to bank operations and performance standards

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Bank Examiner Resume Examples Resume with 15 Years of Experience

Highly experienced Bank Examiner with 15 years of experience in the field of banking and financial services, with a strong commitment to customer protection and satisfaction. A proven record of success in performing audits, monitoring and enforcing banking laws, and managing financial examinations for local, state, and federal banking institutions. Possesses excellent communication, analytical, and problem- solving skills.

Core Skills:

- Compliance Auditing

- Risk Assessment

- Financial Analysis

- Regulatory Guidance

- Record Keeping

- Report Writing

- Financial Forecasting

- Technical Expertise

- Interpersonal Communication

Responsibilities:

- Monitor and evaluate the performance of financial institution and their compliance with applicable laws and regulations.

- Prepare detailed reports on the institution’s financial condition, risk assessment, and compliance with federal and state banking laws.

- Develop and maintain relationships with banking personnel to ensure full disclosure of information.

- Identify and assess financial institution risks, and provide appropriate recommendations.

- Develop and implement examination plans, analyze records, and prepare written reports.

- Monitor and evaluate financial institution operations and management systems.

- Evaluate and review loan portfolios, customer accounts, and any other related banking activities.

- Provide technical assistance to regulatory agencies and other authorities.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Bank Examiner Resume Examples resume?

A bank examiner resume should include a few key elements to help you stand out from other applicants. Bank examiners must have a solid understanding of banking regulations, audit practices, and financial analysis. With the right resume, you can demonstrate these qualifications to potential employers. Here are some tips to help you create an effective bank examiner resume:

-Highlight Your Education: Most bank examiners have at least a Bachelor’s degree, so be sure to list any degrees you have in the education section. Include the name of the school, the degree earned, and the year you graduated.

-Include Professional Experience: If you have experience in the banking industry, such as working in a bank, listing this as professional experience is beneficial. List the name of the company, the position you held, and the duties you were responsible for.

-Showcase Your Skillset: Bank examiners must have an understanding of banking regulations and financial analysis, so include skills that demonstrate this. Examples include accounting principles, financial statement analysis, audit practices, and risk management.

-List Relevant Certifications: Bank examiners must have certain certifications to do their job, so be sure to include any relevant certifications. Examples include the Certified Bank Examiner (CBE) certification, Certified Internal Auditor (CIA), and Certified Public Accountant (CPA).

-Describe Your Accomplishments: Employers want to know the results you achieved in past positions, so be sure to include any noteworthy accomplishments in your resume. Examples include uncovering fraud or increasing profitability.

By including these elements in a bank examiner resume, you can ensure that you stand out from other applicants. Be sure to include any relevant experience, certifications, and accomplishments to show potential employers that you are qualified for the position.

What is a good summary for a Bank Examiner Resume Examples resume?

A Bank Examiner Resume Examples resume should be concise and to the point with key facts about a candidate’s experience and abilities. The summary should include a brief overview of the candidate’s professional qualifications and background, their key skills, and a few examples of their experience. The summary should also emphasize the candidate’s certifications and any awards they have received. It should also mention any associations or affiliations the candidate is a member of, as well as any additional training or certifications they may have received. Finally, the summary should highlight the candidate’s ability to work as part of a team and their commitment to compliance with all banking regulations.

What is a good objective for a Bank Examiner Resume Examples resume?

Blog:

Are you looking for examples of effective objectives for a Bank Examiner Resume? A good resume objective can help you stand out from the competition and make a strong first impression with potential employers. In this blog post, we’ll provide examples of successful objectives for a Bank Examiner Resume, along with tips on how to craft the perfect objective.

What is a Bank Examiner Resume Objective?

A Bank Examiner Resume objective is a short statement of your professional goals and aspirations. It should be tailored to the specific Bank Examiner position you are applying for. It should focus on the skills, qualifications, and experience you have that make you an ideal candidate.

Examples of Good Bank Examiner Resume Objectives

- To leverage my 5 years of experience in finance and banking to become a successful Bank Examiner.

- To utilize my knowledge of financial regulations and banking procedures to become a top-performing Bank Examiner.

- To obtain a Bank Examiner position at ABC Bank and utilize my strong problem-solving skills and attention to detail.

- Seeks to join XYZ Bank as a Bank Examiner and contribute my knowledge of banking compliance and audit systems.

- To secure a Bank Examiner role with ABC Bank and use my understanding of federal banking regulations to help ensure regulatory compliance.

Tips for Writing a Bank Examiner Resume Objective

When writing a Bank Examiner Resume Objective, be sure to include your relevant experience and qualifications. Focus on the skills and attributes that make you an ideal candidate for the position. Tailor your objective to the specific Bank Examiner position you are applying for. Use strong, action-oriented words and phrases to describe yourself. Finally, keep your objective brief and to the point.

By following the tips and examples provided in this blog post, you can craft the perfect Bank Examiner Resume objective. Good luck with your job search!

How do you list Bank Examiner Resume Examples skills on a resume?

When writing a resume for a Bank Examiner position, it is important to emphasize your skills related to the job. Bank Examiners are responsible for assessing financial institutions for compliance with relevant rules and regulations. To be successful in this role, you must demonstrate a strong background in banking, financial analysis, and the ability to identify and report on possible violations.

When listing your skills on a resume, it is wise to use specific examples that demonstrate your proficiency in areas such as financial analysis, banking regulations, and other relevant topics. Here are some Bank Examiner resume examples:

- Expert knowledge of banking regulations and compliance standards.

- Proficient in financial analysis and reporting, including risk assessment.

- Ability to identify irregularities, discrepancies, or potential violations.

- Strong research and investigative skills.

- Proven ability to work collaboratively with financial institutions.

- Excellent written and verbal communication skills.

- Exceptional critical thinking skills to accurately interpret financial data.

- Ability to quickly and accurately process large amounts of data.

What skills should I put on my resume for Bank Examiner Resume Examples?

When writing a resume for a bank examiner position, it is important to include the right skills to stand out to potential employers. Bank examiners are responsible for assessing the safety and soundness of financial institutions and ensuring they are in compliance with laws and regulations. To be successful in this role, you must have an extensive background in finance and banking, as well as a keen eye for detail.

When writing your resume, you should include the following skills to highlight your qualifications:

- Thorough knowledge of banking regulations and laws: As a bank examiner, it is essential to have a deep understanding of banking laws and regulations in order to ensure financial institutions comply with them.

- Excellent problem solving skills: Bank examiners must be able to identify issues and develop solutions to correct them.

- Strong communication skills: Bank examiners must be able to clearly explain complex financial topics to others in order to provide guidance and advice.

- Attention to detail: Bank examiners must be able to review financial statements and documents for accuracy.

- Analytical skills: Bank examiners must be able to analyze financial data and draw meaningful conclusions from it.

- Computer skills: Bank examiners must be comfortable using computers to track and analyze financial data.

By including these skills on your resume, you will be able to demonstrate your qualifications for the position and stand out to potential employers.

Key takeaways for an Bank Examiner Resume Examples resume

In order to craft an effective Bank Examiner Resume, there are certain key takeaways to keep in mind.

For starters, it is important to focus on your experience in the banking industry. Bank Examining is a specialized field and potential employers will be looking for resumes that showcase the applicant’s background in the banking sector. Highlight any past positions held in a bank setting, any special certifications you may have, and any experience that you possess that you feel would be beneficial for the position.

In addition, be sure to showcase any technical skills that you have that pertain to the role of a Bank Examiner. These skills could include experience with auditing processes, financial regulations, or compliance standards. Any additional skills that you possess that could be helpful to the role should also be included, such as customer service, problem solving, or communication skills.

Finally, it is important to include a list of references with your Bank Examiner Resume. While your resume should showcase your experience and qualifications, having a few references can help demonstrate to potential employers that you have the right skills and background for the position. Make sure to include reliable and professional references that can speak to your work ethic and qualifications in the banking industry.

By following these key takeaways, you can craft an effective Bank Examiner Resume that will help you stand out from the competition and get you one step closer to securing your dream job.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder