Finding a job as a payment processor requires a resume that showcases your technical knowledge and experience in the industry. Writing a resume for this role can be tricky and it’s important to ensure that you include all the relevant information in order to stand out from other applicants. This guide provides advice on how to craft an effective payment processor resume, including key sections to include, formatting tips, and resume examples.

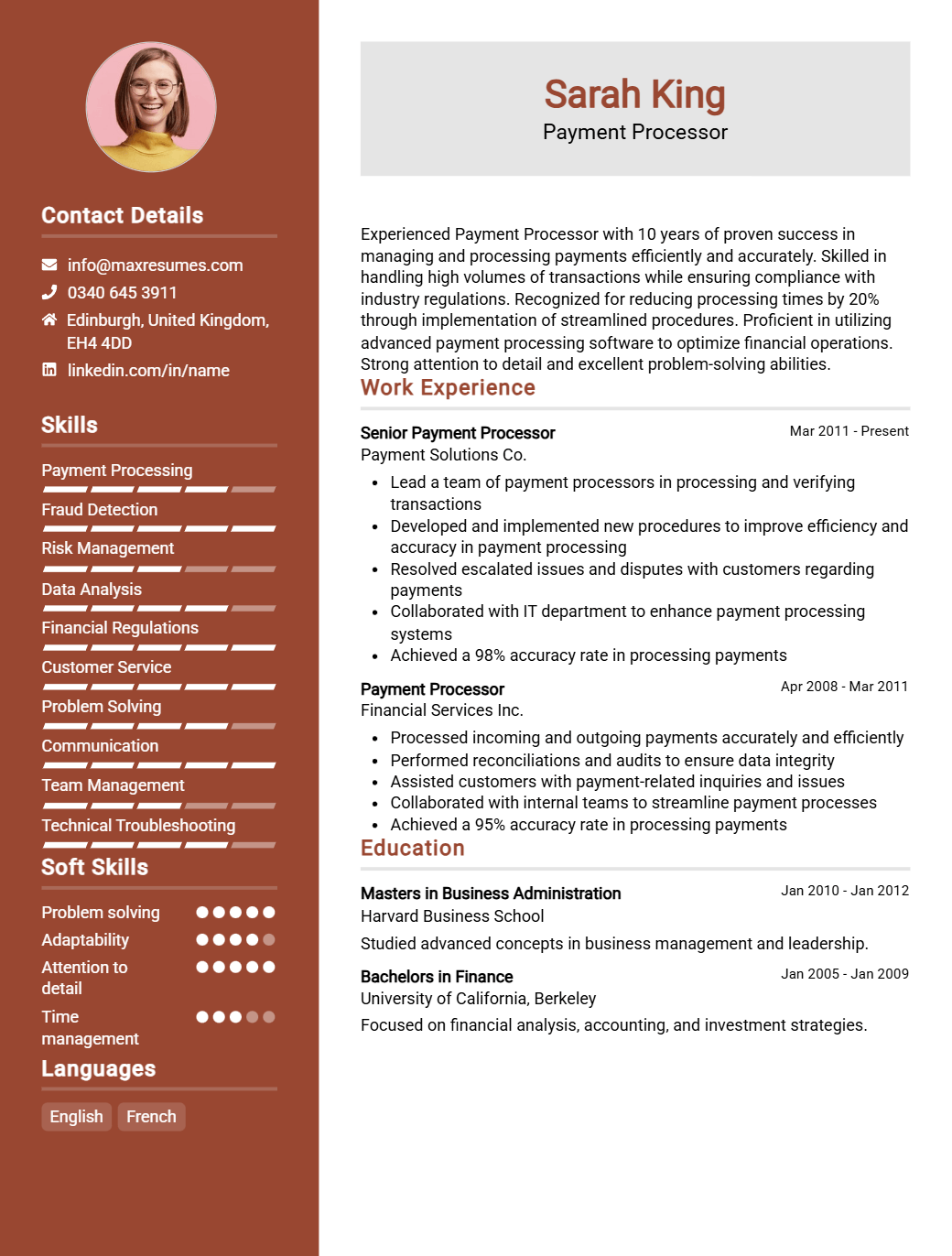

Payment Processor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Payment Processor Resume Examples

John Doe

Payment Processor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly self-motivated and organized Payment Processor with 5+ years of experience in payment processing, data entry, customer service, and financial analysis. Possesses excellent interpersonal skills and the ability to transfer data quickly, accurately and efficiently. Experienced in problem solving, customer service and communication.

Core Skills:

Payment Processing, Data Entry, Financial Analysis, Customer Service, Problem Solving, Communication

Professional Experience:

Payment Processor, XYZ Corporation, 2017-Present

- Processed and reconciled customer payments and invoices using proprietary software

- Analyzed and reviewed customer accounts to ensure accuracy in payments and invoices

- Resolved customer inquiries and complaints in a timely manner

- Maintained customer files and records

- Worked with other departments to ensure customer satisfaction

- Coded and entered payment information into the system

- Reconciled customer accounts and maintained accurate records

- Assisted in the implementation of new payment protocols

Data Entry Specialist, ABC Company, 2015-2017

- Entered customer information into the system

- Verified customer information for accuracy

- Maintained customer files and records

- Resolved customer inquiries and complaints in a timely manner

- Processed payments and invoices

- Assisted with the development and implementation of payment protocols

Education:

Bachelor of Science in Business Administration, ABC University, 2015

Payment Processor Resume with No Experience

Recent college graduate with a passion for customer service, problem solving and payment processing. Adept at building relationships with customers and colleagues. Eager to bring excellent communication skills and knowledge of financial processes to a payment processor role.

Skills

- Experienced in customer service and financial processes

- Adept at building relationships with customers

- Proven ability to solve and address customer inquiries

- Excellent communication and problem solving skills

- Knowledgeable in financial regulations and procedures

- Proficient in Microsoft Office Suite

Responsibilities

- Process payments in a timely manner according to established financial procedures.

- Monitor and reconcile customer accounts.

- Respond to customer inquiries and handle any customer issues.

- Update customer account information.

- Follow up with customers on overdue payments.

- Ensure compliance with payment processing regulations.

- Assist with training new payments processors.

- Generate reports on payment processing activity.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Payment Processor Resume with 2 Years of Experience

Payment Processor Resume with 2 Years of Experience

Results-driven Payment Processor with 2 years of experience in the banking and finance industry. Adept in analyzing customer accounts, reconciling financial statements and processing payments. Proven success in establishing and maintaining positive customer relationships. Motivated to continue learning and building on existing knowledge.

Core Skills:

- Payment Processing

- Reconciliation

- Financial Analysis

- Customer Service

- Risk Management

- Compliance

- Process Improvement

- Microsoft Office Suite

Responsibilities:

- Processed payments for customers in a timely manner.

- Reconciled financial records and accounts for customers.

- Monitored customer accounts to identify suspicious activity.

- Ensured compliance with internal regulations and industry standards.

- Assisted customers with financial queries.

- Evaluated customer accounts for risk and fraud prevention.

- Compiled financial reports for management.

- Developed and implemented process improvements to increase efficiency.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Payment Processor Resume with 5 Years of Experience

Experienced Payment Processor with 5+ years of experience working in the financial services industry. Skilled in financial analysis, records management and customer service. Possess a comprehensive understanding of banking regulations and payment processing systems. Demonstrated ability to work in a fast-paced environment while maintaining accuracy and efficiency.

Core Skills:

- Financial Analysis

- Payment Processing

- Records Management

- Banking Regulations

- Customer Service

- Attention to Detail

- Problem Solving

- Data Entry

- Time Management

Responsibilities:

- Processed various types of payments such as credit cards, debit cards, e-checks and ACH payments.

- Verified accuracy of customer transactions and transactions against established financial guidelines and regulations.

- Maintained customer confidence and protected operations by keeping information confidential.

- Monitored customer accounts and ensured customer satisfaction.

- Resolved customer inquiries and complaints in a timely manner.

- Assisted in the implementation of new payment processing systems.

- Monitored and updated reports and payment logs on a daily basis.

- Ensured compliance with banking regulations and industry standards.

- Performed data entry and maintained customer records.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Payment Processor Resume with 7 Years of Experience

Seasoned Payment Processor with 7+ years of experience in effectively processing and managing financial transactions. Adept at ensuring accuracy and compliance with contractual documents and regulatory requirements. Possess excellent interpersonal, communication, and problem solving skills. Track record of building strong rapport with clients and consistently delivering timely and accurate services.

Core Skills:

- Payment Processing

- Accounting

- Regulatory Requirements

- Client Relations

- Analytical Skills

- Problem Solving

- Documentation

- Interpersonal

- Communication

Responsibilities:

- Process and reconcile payments from various sources such as credit cards, checks, wire transfers, and ACH fees for customers.

- Ensure accuracy and compliance with contractual documents and regulatory requirements.

- Provide customer service and address inquiries, complaints, and disputes related to payments.

- Update customer accounts and other financial records in the company’s database.

- Assist in developing and implementing payment processing procedures and policies.

- Provide oversight in the resolution of payment processing issues and discrepancies.

- Liaise with internal and external stakeholders to ensure timely and accurate payment processing.

- Monitor and analyze payment processing activities to identify areas of improvement.

- Maintain a high level of confidentiality of customer information and payments.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Payment Processor Resume with 10 Years of Experience

Highly experienced Payment Processor with 10+ years in the finance industry managing financial transactions and providing customer service. Proven track record of accurate data entry and exceptional customer service. Skilled in utilizing modern payment processing tools and technologies to ensure the efficiency of all banking processes. Possesses excellent problem-solving and communication skills.

Core Skills:

- Payment processing

- Data entry

- Financial transactions

- Customer service

- Problem-solving

- MS Office Suite

- Excellent communication

- Banking systems

- Account reconciliation

- Knowledge of banking regulations

- Time management

Responsibilities:

- Manage payment processing tasks and transactions

- Handle customer inquiries regarding payment processing

- Ensure accurate data entry of financial information

- Ensure compliance with banking regulations

- Manage customer accounts and transactions

- Process financial transactions in a timely manner

- Reconcile account information and balance records

- Resolve customer issues and disputes

- Assist customers with payment inquiries

- Troubleshoot basic payment processing issues

- Prepare monthly reports on payment processing tasks and activities

- Identify and escalate discrepancies or suspicious transactions

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Payment Processor Resume with 15 Years of Experience

Highly experienced Payment Processor with 15 years of expertise in payment processing, account reconciliation, and data entry. Highly motivated professional with a proven track record of accuracy and efficiency. Able to manage multiple tasks, remain organized and meet deadlines.

Core Skills:

- Payment Processing & Reconciliation

- Data Entry & Record Keeping

- Computer Proficiency

- Cash Handling & Bank Deposits

- Customer Service & Problem Solving

- Financial Reporting

- Auditing & Compliance

- Risk Management

Responsibilities:

- Processed payments and reconciled accounts accurately and efficiently.

- Entered data into the system to ensure accurate record keeping.

- Handled cash and ensured proper documentation of bank deposits.

- Audited and verified data for accuracy and compliance with laws and regulations.

- Assisted customers with payment processing issues and provided solutions.

- Maintained financial records and generated reports on a regular basis.

- Implemented risk management strategies and monitored daily activities.

- Trained new staff on payment processing policies and procedures.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Payment Processor resume?

When it comes to creating a resume for a Payment Processor position, it is important to include the key skills and qualifications that employers are looking for. A Payment Processor resume should present your qualifications, experience, and skills in a way that is easy to read and understand.

In a Payment Processor resume, your job title and experience should be front and center. Your work history should include specific details of the payment processing systems and software you’ve used, and any additional experience or knowledge you possess. You should also include any special training or certifications you have relevant to payment processing.

Skills-wise, you should include any knowledge of computers and programming, as well as an understanding of banking regulations and compliance. It is important to include any experience you have with customer service, problem-solving, and processing transactions.

Payment processing is a highly technical position, so it is important to include any experience you have with developing, managing, and troubleshooting payment processing systems. You should also highlight your attention to detail, as accuracy and data security are essential components of payment processing.

Finally, make sure to include any additional qualifications or certifications that are relevant to the position, such as knowledge of PCI Compliance or experience with fraud prevention. This is essential for employers to know that you can handle the job’s requirements with ease.

By including the right information, you can make a Payment Processor resume that will stand out to employers and give them confidence in your abilities. With the right qualifications, experience, and skills, you can make yourself an attractive candidate for the job.

What is a good summary for a Payment Processor resume?

A Payment Processor resume summary should highlight the individual’s experience in processing payments and financial transactions. It should include information about the applicant’s ability to handle multiple payment methods, process payments quickly and accurately, and maintain customer confidentiality. The summary should also showcase the applicant’s knowledge of financial regulations, as well as their customer service skills. Finally, the summary should mention the individual’s ability to identify and solve any payment processing issues.

What is a good objective for a Payment Processor resume?

A payment processor resume should focus on the candidate’s ability to process payments quickly and accurately. The objective should demonstrate the candidate’s knowledge of payment processing systems and the ability to analyze and resolve problems. The objective should also highlight the candidate’s customer service experience, as payment processors often interact directly with customers.

An effective objective for a payment processor resume should read something like: “Seeking a position as a payment processor utilizing strong customer service skills, comprehensive knowledge of payment processing systems, and the ability to accurately process payments quickly.”

In addition to the objective, the resume should focus on the candidate’s experience processing payments. This could include years of experience processing payments, specific payment processing systems the candidate is familiar with, and any prior customer service roles. The candidate should also list any certifications, such as a payment processor certification, they may have.

Properly highlighting all of these qualifications can help a payment processor stand out from the crowd and land the job. With a clearly defined objective, the candidate can clearly demonstrate their abilities and make a strong impression on potential employers.

How do you list Payment Processor skills on a resume?

A Payment Processor is an important occupation in any business requiring transactions to be completed electronically. To be successful in this job, it is essential to have a thorough understanding of the payment processing systems, software and procedures. If you are applying for a job that requires Payment Processor skills, it is important to include these skills on your resume.

One way to make sure your Payment Processor skills stand out on your resume is to list them under a dedicated “Payment Processor Skills” section. This section should be placed near the top of your resume, after your contact information and career objective. Under this heading, list each Payment Processor skill you have developed. Consider listing any certifications you possess, such as Certified Payment Processor (CPP) or Payment Card Industry (PCI) certification.

When composing your list of Payment Processor skills, it is important to detail the specific skills you have developed. For example, instead of writing “Proficient with payment processing software”, you should list the specific software you are familiar with. Similarly, instead of writing “Thorough understanding of payment processing systems and procedures”, you should detail the exact procedures and systems you are knowledgeable of.

It is also important to include any relevant experience you have that relates to Payment Processor skills. Consider mentioning any experience working with customers to process payments, any experience training other employees on payment processing, or any experience troubleshooting payment processing hardware or software.

By listing your Payment Processor skills in a dedicated section on your resume, you can ensure that your qualifications are clear and concise to the employer.

What skills should I put on my resume for Payment Processor?

If you are applying for a job as a Payment Processor, it’s important to highlight the right skills on your resume. Payment Processors are responsible for processing payments for companies, so employers are looking for job applicants who have key skills and knowledge in this area.

When crafting your resume, consider adding the following skills to demonstrate that you have the qualifications to be a successful Payment Processor:

- Knowledge of Payment Processing Systems: Payment Processors need to have a good understanding of different payment processing systems, including the process of securely running credit card payments and other online payment methods.

- Attention to Detail: Payment Processors must pay close attention to detail in order to ensure that all transactions are accurate and properly recorded.

- Proficiency with Technology: Payment Processors must be able to understand and use different software programs and systems that are used to process payments.

- Strong Math Skills: Payment Processors must be able to calculate payments accurately and quickly.

- Analytical Skills: Payment Processors must be able to analyze data and spot any errors or inconsistencies.

- Interpersonal Skills: Payment Processors must be able to communicate effectively and work well with others.

- Problem-Solving Skills: Payment Processors must be able to address any issues that arise during the payment process.

- Organizational Skills: Payment Processors must be able to organize and prioritize tasks in order to meet deadlines.

By highlighting these skills on your resume, you can demonstrate to employers that you have the skills and knowledge necessary to excel in the role of Payment Processor.

Key takeaways for an Payment Processor resume

When creating a resume for a position as a payment processor, there are several key takeaways that can help you stand out from the competition. Here are some of the most important things to include and highlight on your resume:

- Demonstrate a knowledge of payments: Show that you are familiar with payment processing and the various methods involved in processing payments, from credit cards and debit cards to online payments and invoices.

- Have experience with various payment systems: Demonstrate that you have knowledge of the various payment systems and can use them to process payments efficiently.

- Demonstrate your customer service skills: Include any customer service experience you have and how you were able to help customers successfully complete payments.

- Highlight organizational skills: Include any experiences or training you have in staying organized, especially when dealing with large numbers of payments and other tasks.

- Have a basic knowledge of accounting: Demonstrate that you understand the basics of accounting, such as how to record payments and process refunds or credits.

By demonstrating these skills and experiences on your resume, you can give employers the confidence that you are the right fit for the job. Make sure to keep these key takeaways in mind when writing your payment processor resume.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder