Writing a cover letter as an Insurance Underwriting Manager can be a challenging yet rewarding process. It’s an opportunity to demonstrate your skills and achievements in a concise and professional manner. This guide provides you with a comprehensive overview of how to craft a successful cover letter and includes a helpful example of an Insurance Underwriting Manager cover letter. By following these guidelines, you can make sure your cover letter stands out and gives you the best chance of taking the next steps in your career.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples.

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

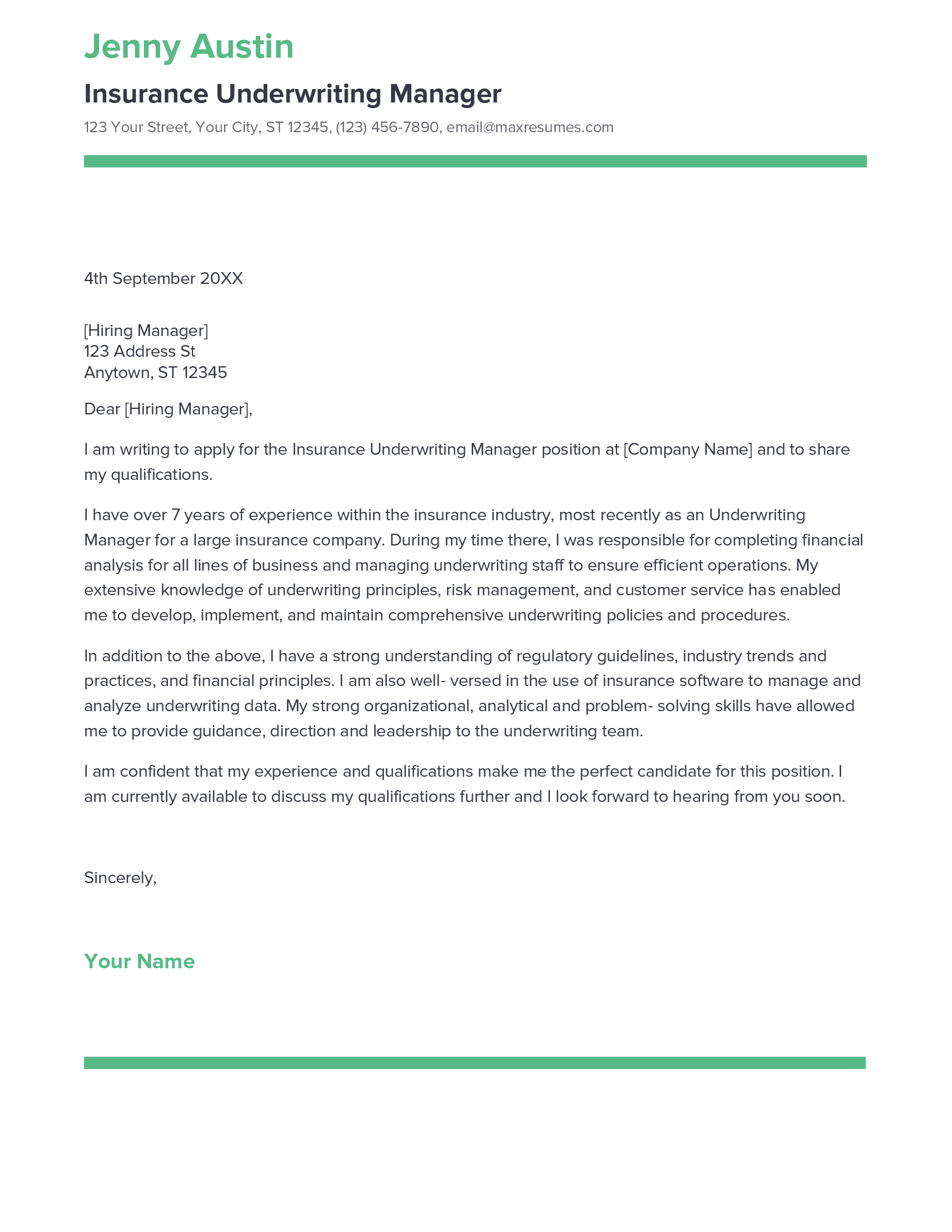

Insurance Underwriting Manager Cover Letter Sample

Dear [Hiring Manager],

I am writing to apply for the Insurance Underwriting Manager position at [Company Name] and to share my qualifications.

I have over 7 years of experience within the insurance industry, most recently as an Underwriting Manager for a large insurance company. During my time there, I was responsible for completing financial analysis for all lines of business and managing underwriting staff to ensure efficient operations. My extensive knowledge of underwriting principles, risk management, and customer service has enabled me to develop, implement, and maintain comprehensive underwriting policies and procedures.

In addition to the above, I have a strong understanding of regulatory guidelines, industry trends and practices, and financial principles. I am also well- versed in the use of insurance software to manage and analyze underwriting data. My strong organizational, analytical and problem- solving skills have allowed me to provide guidance, direction and leadership to the underwriting team.

I am confident that my experience and qualifications make me the perfect candidate for this position. I am currently available to discuss my qualifications further and I look forward to hearing from you soon.

Sincerely,

[Your Name]

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Insurance Underwriting Manager cover letter include?

A Insurance Underwriting Manager cover letter should highlight the candidate’s professional experience and qualifications in the insurance industry, as well as their ability to manage underwriting operations and lead a team. The cover letter should explain why the candidate is the best fit for the job and why they are passionate about this role. Specifically, the cover letter should focus on the candidate’s:

- Extensive knowledge of insurance underwriting regulations and standards

- Proven ability to analyze and interpret risk assessment data

- Excellent problem- solving and decision- making skills

- Skilled negotiation techniques for successful underwriting outcomes

- Track record of managing underwriting teams and meeting business objectives

- Experience in developing, executing, and evaluating underwriting strategies

- Proficiency in the use of computer hardware and software applications

- History of working collaboratively with internal and external stakeholders

- Strong written and verbal communication skills.

The cover letter should also emphasize the candidate’s enthusiasm for the job, as well as their commitment to helping the organization reach new heights of success. Additionally, the candidate should express their motivation to take on a leadership role in the insurance underwriting department. Finally, the candidate should provide examples of their ability to work with colleagues in a professional and productive manner.

Insurance Underwriting Manager Cover Letter Writing Tips

Writing a cover letter for an insurance underwriting manager position requires an eye for detail and the ability to demonstrate your qualifications. Here are some tips to help you craft a successful cover letter:

- Start with an attention- grabbing introduction. Use a professional tone and dive right into the details of your qualifications and why you think you’re the right fit for this position.

- Highlight your experience. Focus on the experiences that you have in insurance underwriting, such as your ability to assess risk and make sound decisions.

- Demonstrate your knowledge of the insurance industry. Show that you are familiar with the industry and mention any certifications or awards that you have achieved.

- Make sure to express your passion for the position. Your enthusiasm for the job should shine through in your writing.

- Emphasize your communication skills. The job of an insurance underwriting manager involves a lot of communication with clients and other stakeholders, so make sure you show that you are capable of communicating effectively.

- Close your letter with a call to action. Make sure to let the hiring manager know that you’re eager to speak further about the position and why you are the best choice for the job.

Common mistakes to avoid when writing Insurance Underwriting Manager Cover letter

Writing a cover letter for an Insurance Underwriting Manager position can be a daunting task if you don’t know the basics of the job and the qualifications the employer is looking for. A strong cover letter should make a clear connection between your qualifications and the position’s requirements. Here are some common mistakes to avoid when writing your cover letter:

- Not doing your research on the job and employer: Before you begin writing your cover letter, be sure to research the company and position you are applying for. This will give you an understanding of what the employer is looking for in a candidate and help you tailor your letter to the position.

- Not using industry keywords: Utilizing industry keywords and terminology in your cover letter will demonstrate that you understand the job you are applying for and make a good impression on the employer.

- Not highlighting your relevant qualifications: Make sure to include information about your qualifications and work experience that are relevant to the position you are applying for. Don’t forget to include any relevant professional certifications or training you have gone through as well.

- Not personalizing your letter: Your cover letter should always be personalized to the position you are applying for. Do not use generic phrases or statements and make sure to include specific qualifications and experiences that the employer is looking for.

- Failing to proofread: The last thing you want to do is submit a cover letter with spelling and grammar errors. Take the time to proofread your letter and make sure it is free of any mistakes before sending it off.

By avoiding these common mistakes, your cover letter will be more likely to stand out from the competition and get you one step closer to landing the Insurance Underwriting Manager position you want.

Key takeaways

Writing an impressive cover letter can be daunting, especially if you’re applying to be an Insurance Underwriting Manager. However, if you follow these simple steps and focus on why you are the best candidate for the position, you can create an impressive letter that will help you land the job.

Here are the key takeaways for writing a great Insurance Underwriting Manager cover letter:

- Highlight your qualifications: Make sure to highlight the qualifications and experience that make you the ideal candidate for the position. Focus on relevant skills, such as financial analysis, risk assessment, and decision- making abilities.

- Discuss your successes: Showcase your successes in the field, such as successful cases you have managed or awards you have received.

- Create a positive impression: Make sure that the letter is well- written, free from typos and grammatical errors, and professional in tone. A positive impression will go a long way in helping you stand out from other applicants.

- Connect with the company: Show that you’ve done your research and mention why you want to join the company and how you believe you can contribute to its success.

- Close the letter professionally: Make sure to end the letter on a professional note, and thank them for considering you for the position.

By following these tips, you can create an impressive cover letter that will help you stand out and make a great first impression with a potential employer.

Frequently Asked Questions

1.How do I write a cover letter for an Insurance Underwriting Manager job with no experience?

Writing a cover letter for an Insurance Underwriting Manager job with no experience can be challenging. However, the key is to showcase your strengths and abilities that are relevant to the job. Start by researching the company and the position, and use this information to tailor your cover letter to the role. Demonstrate your enthusiasm for the job and explain why you are the perfect fit for it. Highlight your skills and experiences that are related to the job and tie them to the company’s values and mission. Show that you are up to date with industry trends and willing to learn. Finally, express your appreciation for the opportunity and include a call to action.

2.How do I write a cover letter for an Insurance Underwriting Manager job experience?

Writing a cover letter for an Insurance Underwriting Manager job with experience is much easier than with no experience. Start by introducing yourself and expressing your enthusiasm for the position. Showcase the skills and experience you have that are relevant to the role, such as analyzing data, problem- solving, and risk assessment. Highlight any successes you achieved in your previous job and explain how they are particularly relevant to this job. Show that you are familiar with the company and its mission and values. Show that you are up to date with industry trends and willing to learn. Finally, express your appreciation for the opportunity and include a call to action.

3.How can I highlight my accomplishments in Insurance Underwriting Manager cover letter?

Highlighting your accomplishments in an Insurance Underwriting Manager cover letter is essential to getting the job. Showcase any successes and awards you achieved in your past experiences that are relevant to the role. Explain the specific challenges you faced and the solutions you proposed that led to the success. If you have any certifications or special training, be sure to mention them as well. Finally, explain how your accomplishments are particularly relevant to this job and how they can help you achieve success in the role.

4.What is a good cover letter for an Insurance Underwriting Manager job?

A good cover letter for an Insurance Underwriting Manager job should be tailored to the company and the job. Start by introducing yourself and expressing your enthusiasm for the position. Showcase the skills and experience you have that are relevant to the role, such as analyzing data, problem- solving, and risk assessment. Highlight any successes you achieved in your previous job, and explain how they are particularly relevant to this job. Show that you are familiar with the company and its mission and values. Show that you are up to date with industry trends and willing to learn. Finally, express your appreciation for the opportunity and include a call to action.

In addition to this, be sure to check out our cover letter templates, cover letter formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

Let us help you build

your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder