Writing a cover letter for an insurance loss control specialist position can be an intimidating task. It’s important to craft effective and compelling content that will help you stand out from other candidates and secure a job interview. In this guide, you’ll find helpful tips on writing an effective cover letter for an insurance loss control specialist job as well as a sample cover letter to help you get started.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples.

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

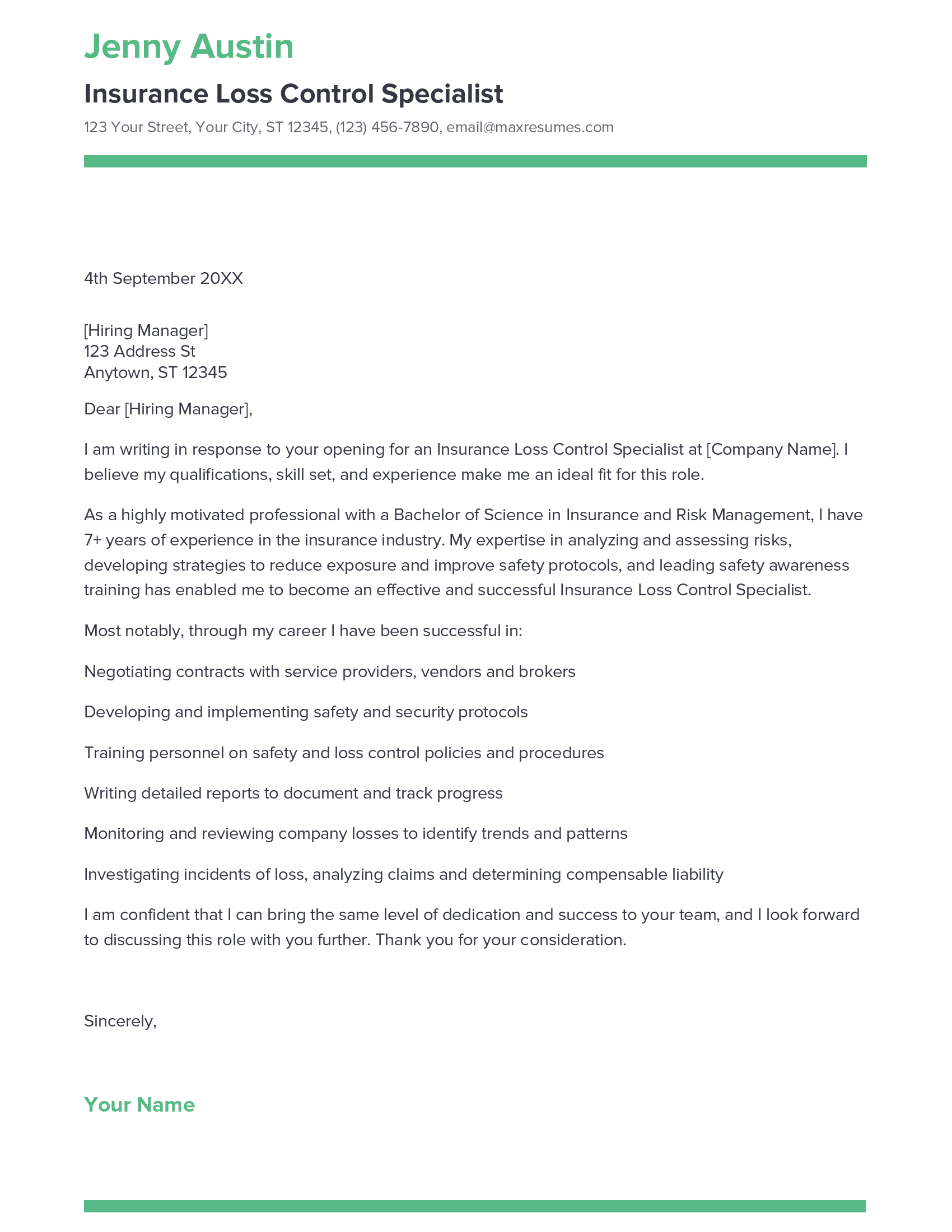

Insurance Loss Control Specialist Cover Letter Sample

Dear [Hiring Manager],

I am writing in response to your opening for an Insurance Loss Control Specialist at [Company Name]. I believe my qualifications, skill set, and experience make me an ideal fit for this role.

As a highly motivated professional with a Bachelor of Science in Insurance and Risk Management, I have 7+ years of experience in the insurance industry. I have a deep understanding of the insurance policies and procedures, pricing models, and risk control measures. My expertise in analyzing and assessing risks, developing strategies to reduce exposure and improve safety protocols, and leading safety awareness training has enabled me to become an effective and successful Insurance Loss Control Specialist.

Most notably, through my career I have been successful in:

- Negotiating contracts with service providers, vendors and brokers

- Developing and implementing safety and security protocols

- Training personnel on safety and loss control policies and procedures

- Writing detailed reports to document and track progress

- Monitoring and reviewing company losses to identify trends and patterns

- Investigating incidents of loss, analyzing claims and determining compensable liability

I am confident that I can bring the same level of dedication and success to your team, and I look forward to discussing this role with you further. Thank you for your consideration.

Sincerely,

[Your Name]

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Insurance Loss Control Specialist cover letter include?

A Insurance Loss Control Specialist cover letter should succinctly highlight a candidate’s qualifications and relevant experience. It should open with a strong introduction that will make the hiring manager want to read more. Next, the cover letter should include a description of the candidate’s experience in the insurance industry, their knowledge of loss control best practices, and any areas of expertise relevant to the position. It should also mention any certifications or licenses held, such as those related to risk management or safety. The body of the letter should also include details on the candidate’s communication and problem- solving skills, as well as their willingness to work in a team environment. Finally, the letter should end with a call to action, politely encouraging the hiring manager to contact the candidate for an interview.

Insurance Loss Control Specialist Cover Letter Writing Tips

A well- written cover letter can be the key to securing an interview for an Insurance Loss Control Specialist position. In order to ensure that your cover letter stands out to prospective employers, here are a few tips to consider:

- Research the company: Thoroughly research the company to which you’re sending your cover letter. Utilize the company’s website, social media, public news, and other resources to gain an understanding of the company’s operations, mission, and goals. Use this information to craft a cover letter that speaks to the company’s values and how you can be an asset to the organization.

- Explicitly state your qualifications: Be sure to include relevant qualifications and experience in your cover letter. Highlight the education, certifications, and experience that make you a qualified candidate for the Insurance Loss Control Specialist position.

- Include tangible results: Use real- life examples to show how you’ve worked to decrease losses or otherwise benefited previous employers. This will provide the hiring manager with tangible evidence of your potential as a future employee.

- Personalize it: Make sure to address the cover letter to the correct person and customize the content to the company’s needs. Show the employer that you have taken the time to understand their organization and how you can be an asset.

- Proofread: Don’t forget to thoroughly proofread your cover letter before submitting. Make sure there are no typos, grammar errors, or other mistakes that could be detrimental to your chances of being hired.

By following these tips, you can craft a successful cover letter that will help you stand out from the competition and get your foot in the door for an Insurance Loss Control Specialist position.

Common mistakes to avoid when writing Insurance Loss Control Specialist Cover letter

Cover letters are the first thing that potential employers look at when considering a candidate for an Insurance Loss Control Specialist role. A great cover letter can make all the difference in helping you land an interview and ultimately the job. Here are some common mistakes to avoid when writing your Insurance Loss Control Specialist cover letter:

- Not Customizing the Letter: It is important to tailor your cover letter to the specific Insurance Loss Control Specialist position you are applying for. They should reflect the qualifications and experience as it relates to the job you’re applying for.

- Being Too Generic: Generic cover letters don’t stand out and don’t show employers how you are the best fit for the job. Be sure to highlight your skills, experiences, and qualifications that are relevant to the Insurance Loss Control Specialist position.

- Not Knowing the Company: Employers want to know that you have researched their company and understand the position you’re applying for. Do your research and be sure to highlight what you’ve learned about the company and why you’d be a great fit.

- Not Including Contact Details: Make sure to include your contact information in your cover letter. This includes your full name, address, phone number, and email.

- Not Proofreading: A cover letter filled with typos and grammatical errors will not leave a good impression with potential employers. Take the time to proofread and edit your cover letter before submitting it.

Following these tips can help you create an Insurance Loss Control Specialist cover letter that stands out from the competition and helps you land the job. Good luck!

Key takeaways

- Start your cover letter by introducing yourself and the position you are applying for, and mentioning why you are interested in the position.

- Highlight your relevant qualifications and experience, including any certifications and specialized training you have related to insurance loss control.

- Focus on how you are the perfect fit for the job and how you can help the company with your skills and expertise.

- Use concrete examples of your successes and accomplishments in your previous roles to make your cover letter stand out.

- Demonstrate your knowledge of the company’s operations, objectives and goals by emphasizing how you can help them achieve those.

- Use language that is tailored to the job, such as insurance- specific terms and phrases.

- Show enthusiasm for the position and make sure to thank the employer for their time and consideration.

- End your cover letter by stating your interest in meeting with the hiring manager in person to discuss the job opportunity further.

Frequently Asked Questions

1. How do I write a cover letter for an Insurance Loss Control Specialist job with no experience?

When applying for an Insurance Loss Control Specialist job with no experience, it is important to focus on the skills and qualities you have acquired that make you a strong candidate for the position. Your cover letter should emphasize your knowledge of insurance, risk management, and safety protocols, as well as your ability to work with a team and maintain a professional attitude. Incorporate any relevant volunteer experience or educational opportunities you have taken part in, such as specialized training or job shadowing. Additionally, mention any certifications or licenses you may hold that could be beneficial to the job.

2. How do I write a cover letter for an Insurance Loss Control Specialist job experience?

When applying for an Insurance Loss Control Specialist job with experience, it is important to highlight your accomplishments in previous roles. Be sure to emphasize any successes you have had in developing and implementing safety protocols, reducing workplace accidents, and managing losses. Discuss any professional certifications or licenses you have obtained, and mention any awards or recognition you have received for your work in the insurance industry. Additionally, emphasize your ability to collaborate with a team and provide exceptional customer service.

3. How can I highlight my accomplishments in Insurance Loss Control Specialist cover letter?

To highlight your accomplishments in an Insurance Loss Control Specialist cover letter, focus on any successes you have had in previous roles. For example, discuss any safety protocols you have developed, any workplace accidents you have successfully avoided, or any losses you have managed. Additionally, emphasize any professional certifications or licenses you have obtained in the field, as well as any awards or recognition you have received.

4. What is a good cover letter for an Insurance Loss Control Specialist job?

A good cover letter for an Insurance Loss Control Specialist job should emphasize your knowledge of the insurance industry, your ability to manage risks and losses, and your experience in developing and implementing safety protocols. Additionally, make sure to mention any professional certifications or licenses you may have obtained, as well as any awards or recognition you have received. Finally, emphasize your experience working with a team, providing exceptional customer service, and any volunteer work or educational opportunities you have partaken in.

In addition to this, be sure to check out our cover letter templates, cover letter formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

Let us help you build

your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder