Writing a cover letter for a job as an insurance compliance analyst can be an intimidating task. This guide aims to provide helpful advice and tips on how to craft a compelling cover letter that will make you stand out from the rest of the competition. It also includes an example of a completed cover letter that you can use as a reference when creating your own. With these resources in hand, you will have the confidence to confidently and successfully apply for the position of an insurance compliance analyst.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples.

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

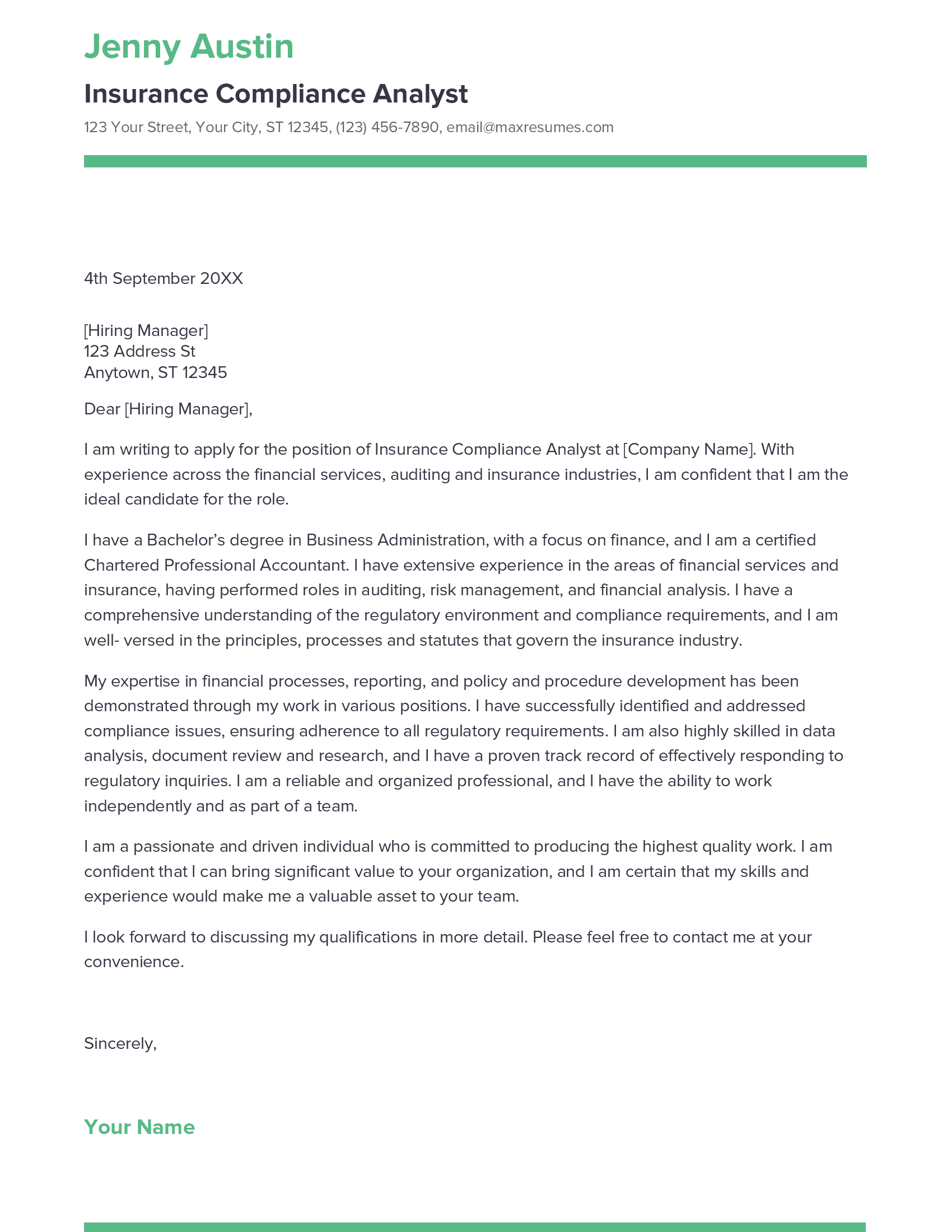

Insurance Compliance Analyst Cover Letter Sample

Dear [Employer Name],

I am writing to apply for the position of Insurance Compliance Analyst at [Company Name]. With experience across the financial services, auditing and insurance industries, I am confident that I am the ideal candidate for the role.

I have a Bachelor’s degree in Business Administration, with a focus on finance, and I am a certified Chartered Professional Accountant. I have extensive experience in the areas of financial services and insurance, having performed roles in auditing, risk management, and financial analysis. I have a comprehensive understanding of the regulatory environment and compliance requirements, and I am well- versed in the principles, processes and statutes that govern the insurance industry.

My expertise in financial processes, reporting, and policy and procedure development has been demonstrated through my work in various positions. I have successfully identified and addressed compliance issues, ensuring adherence to all regulatory requirements. I am also highly skilled in data analysis, document review and research, and I have a proven track record of effectively responding to regulatory inquiries. I am a reliable and organized professional, and I have the ability to work independently and as part of a team.

I am a passionate and driven individual who is committed to producing the highest quality work. I am confident that I can bring significant value to your organization, and I am certain that my skills and experience would make me a valuable asset to your team.

I look forward to discussing my qualifications in more detail. Please feel free to contact me at your convenience.

Sincerely,

[Your Name]

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Insurance Compliance Analyst cover letter include?

A Insurance Compliance Analyst cover letter should serve as an introduction to your resume, highlighting your professional qualifications and skills that make you an ideal candidate for the position. It should also demonstrate your understanding of the insurance industry and the specific requirements of the position.

In the cover letter, you should demonstrate your knowledge of insurance rules, regulations, and laws, as well as any experience you have with insurance compliance or risk management. Additionally, you should demonstrate your communication and organizational skills and ability to work independently and in teams.

You should also include any relevant certifications, such as Certified Insurance Compliance Professional (CICP) or Chartered Property Casualty Underwriter (CPCU), that equip you to be an effective Insurance Compliance Analyst. Additionally, you should include any project management, documentation, or auditing experience that will make you a strong fit for the position.

Finally, your cover letter should articulate your enthusiasm for the position, any personal qualities that make you a good candidate, and your commitment to being an effective Insurance Compliance Analyst.

Insurance Compliance Analyst Cover Letter Writing Tips

Writing a cover letter can be a daunting task, especially when applying for a position such as an insurance compliance analyst. A well- crafted cover letter can make all the difference in securing an interview and ultimately an offer, so it is important to make sure that yours is up to the mark. Here are some tips to help you write a strong cover letter for an insurance compliance analyst position:

- Keep it concise. Don’t try to include too much information – the cover letter should be no more than one page long. Focus on the most relevant aspects of your experience and qualifications that make you the ideal candidate for the position.

- Tailor your cover letter to the role. Research the position and the company that you are applying to and be sure to include details that relate to the job in your cover letter.

- Highlight your qualifications. Be sure to include details of any certifications or qualifications related to insurance compliance and be sure to explain how they make you the perfect candidate for the position.

- Show your personality. While a cover letter should mostly be professional, it can also be a great opportunity to show your personality and demonstrate your enthusiasm for the role.

- Proofread. This is an essential step in any job application process – make sure to read through your cover letter and make any necessary corrections before submitting your application.

Common mistakes to avoid when writing Insurance Compliance Analyst Cover letter

Writing a cover letter for an Insurance Compliance Analyst position can seem like a daunting task. However, understanding the basics of cover letter writing can make the process more manageable. To help you write a compelling cover letter, here are a few common mistakes to avoid:

- Not following the company’s guidelines: Insurance companies often have specific guidelines for cover letter submissions. Be sure to read and follow them carefully, as not doing so could lead to your application being rejected.

- Not emphasizing relevant skills: Too many cover letters focus on generic skills that could be applied to any job. When applying for an Insurance Compliance Analyst position, make sure to emphasize the skills and experience that make you a unique candidate for the role.

- Not demonstrating knowledge of the industry: A cover letter is a great opportunity to demonstrate your knowledge of the insurance industry. Show employers that you understand the complexities of insurance compliance and the risks associated with it.

- Using a generic template: While using a template can be a great starting point when writing a cover letter, make sure to customize it to fit the needs of the position you’re applying for. Generic cover letters can make your application appear uninspired.

- Failing to proofread: Make sure to take the time to proofread your cover letter before submitting it. Errors in grammar, spelling, or formatting can be a red flag to employers and could lead to your application being ignored.

By avoiding these common mistakes when writing an Insurance Compliance Analyst cover letter, you can ensure your application has the best chance of standing out among the competition.

Key takeaways

Cover letters are key components of any job application and should not be overlooked when applying for an Insurance Compliance Analyst role. An effective cover letter can demonstrate your qualifications, highlight key skills and provide insight into your personality and passion for the role.

Here are some key takeaways for writing an impressive Insurance Compliance Analyst cover letter:

- Start off with a strong introduction: Introduce yourself, explain why you are writing and how you heard about the position.

- Demonstrate your knowledge: Showcase your knowledge of the insurance industry, the role of an Insurance Compliance Analyst and the specific organization you are applying to. Explain how you are a great fit for the position.

- Highlight key skills: Explain your previous experience and any relevant skills that you can bring to the role. Use concrete examples to back your claims.

- Explain your motivation: Show your enthusiasm for the position and explain why you would be a great fit.

- Offer to provide references: Include the contact information of a few references who can vouch for your experience and qualifications.

- End with a call- to- action: Summarize why you are the best candidate for the role and express your desire to be invited for an interview.

By following these tips, you can craft an effective Insurance Compliance Analyst cover letter and increase your chances of being selected for an interview.

Frequently Asked Questions

1. How do I write a cover letter for an Insurance Compliance Analyst job with no experience?

Writing a cover letter for an Insurance Compliance Analyst job with no experience can be challenging, but it is possible. Start your cover letter by introducing yourself and explaining why you’re interested in the position. Next, highlight any relevant experience that you have, such as any previous work related to insurance or compliance. Then, point out any knowledge or qualifications that you possess that are relevant to the role. Finally, include a call to action and express your enthusiasm for the opportunity.

2. How do I write a cover letter for an Insurance Compliance Analyst job experience?

If you have experience working in insurance compliance, it is important to include this experience in your cover letter. Start by stating your relevant qualifications and years of experience. Then, provide examples of your accomplishments in the role. Finally, explain why you would be an asset to the company, and close by expressing your enthusiasm and interest in the job.

3. How can I highlight my accomplishments in Insurance Compliance Analyst cover letter?

When highlighting your accomplishments in an Insurance Compliance Analyst cover letter, it is important to provide specific examples. Think about the impact that your work had on the company and how it helped to improve processes and efficiency. Talk about any awards or certifications that you have earned and the successes you have achieved in previous roles.

4. What is a good cover letter for an Insurance Compliance Analyst?

A good cover letter for an Insurance Compliance Analyst will start by introducing yourself and explaining why you are interested in the role. Make sure to include any relevant experience and qualifications that you possess. Highlight any accomplishments that you have achieved in previous roles and explain why you would be an asset to the company. Finally, include a call to action and express your enthusiasm for the opportunity.

In addition to this, be sure to check out our cover letter templates, cover letter formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

Let us help you build

your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder